Professional Documents

Culture Documents

Government Accounting Theories

Uploaded by

Hazel JumaquioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Accounting Theories

Uploaded by

Hazel JumaquioCopyright:

Available Formats

Bulacan State University City of Malolos, Bulacan Graduate School

GOVERNMENT ACCOUNTING IN THE PHILIPPINES: Concepts, Theories and Practices

Part 2 of 2

A report submitted to:

Dr. Luis M. Lansang Professor

In partial fulfilment of the requirements for the course Fiscal Management in Education

Submitted by: Hazel S. Jumaquio Master of Arts in Education

August 2012 Date Submitted

1st Trimester, SY 2012-2013

Table of Contents Page Introduction 1

I.

II.

III. IV. V.

Government Accounting

The Accounting Theory.... Accounting Practices.. Recommendation..

1

2-3 3 4

VI.

The Accounting Process

I.

Introduction

It is said that accounting is the language of business. It is a means of reporting the financial facts of a business life, whether in government or in the private sector. It is for this reason that the users of the information must understand the financial reports, which the accounting system produces. Government accounting is important because it involves recording, analysing, classifying, and communicating of all government transactions involving government funds and properties. Having a report thereof, the people can have a clearer view on how the government have been spending the funds from the taxes that weve been paying. In this report, the discussant will tackle about the Government accounting system, its theories and practices

.

II. GOVERNMENT ACCOUNTING Government accounting encompasses the processes of analysing, recording, classifying, summarizing and communicating all transactions involving the receipt and disposition of government funds and property, and interpreting the results thereof. The New Government Accounting System (NGAS) The objectives of the NGAS are: (1) simplify government accounting; (2) conform to international accounting standards; and (3) generate periodic and relevant financial reports for better monitoring of performance. CONTENT OF THE NGAS MANUAL Volume I- The Accounting Policies It shows the basic features and policies of the NGAS, the government accounting plan, discussions on the financial reports and statements and other related records required and the illustrative journal entries. Volume II- The Accounting Books, Records, Forms, and Reports It contains the various formats of the book of accounts, registries, records, forms, and reports including instructions on their use. Volume III- The Chart Accounts It includes the chart of accounts and the defenitions/descriptions of each account: cash, receivables, marketable securities, inventories, expenses, assets, investments, property, plant and equipment, liabilities, equity, revenue, taxes. GOVERNMENT ACCOUNTING SYSTEMS There are three systems of state accounting: 1. National Government Accounting that which is used by the different departments, bureaus, offices, and the field offices and operating units of these agencies. 2. Local Government Accounting- used by provinces, cities and municipalities. 3. Commercial Accounting- used by the private sector but applied by government owned and/or controlled corporations with propriety functions.

III. Accounting Theories Accounting theory is the broad conceptual framework of specific accounting rules and practices. The term could apply to all forms of accounting, although most often it is used with reference to financial accounting -- financial by corporate entities to owners of equity and other investors.

Accounting theory chiefly revolves around two documents: the balance sheet and the income statement.

1

The balance sheet measures the state of an entity at a particular moment in time. Balance sheets are designed to embody the equation Assets = Liabilities + Equity. An asset is anything that the corporation owns. This includes cash, office furniture, accounts receivable and so forth. It also includes intangible property such as patents and goodwill.If an entity has $1,000 of assets at a given moment, those assets, minus the claims that creditors may make upon them, equal the value remaining to the owners. Assets Future economic benefits controlled by the entity as a result of past transactions or other past events. Future economic benefits (capable to render services) expected to flow to the entity. Control by reporting entity where the capacity of the entity to benefit from the asset. Must be owned by the entity. Have agreement to use the asset and the item is separable from the entity. Recognition criteria Reliance on the law- legal right to the future benefit. Control is used to determine the existence of assets. Determination of economic substance of the transaction or event- if the event is economically significant, it is important enough to record and report. Use of the conservatism principle: anticipate losses, but not gains- report on asset when we are certain. Ability to measure the value of the asset- if cant measure reliably, the asset is not recorded.

Liabilities A present obligation of the entity arising from past events, the settlement of which is expected to results in an outflow from the entity of resources embodying economic benefits. Has future economic sacrifice and how it arise might due to some other events. Obligation must be the result of a past event ensures that only present liabilities are recorded and not the future ones. Recognition criteria- if it is probable that economic benefits will be sacrificed in the future and the liability is measurable. SAME AS ASSET. Owners equity Residual interest in the assets of the entity after deducting all its liabilities. It is a residual claim. Difference with creditors Rights of the parties- creditors have rights to settlement by a given date and rank priority over owners in the settlement of the events of liquidation. Owners have rights to participate in profits and use the asset of the entity. Economic substance of the arrangement- right of owners to use the assets, interest and profits. The income statement, also sometimes called the "profit and loss" statement, abbreviated as the P&L, is a document designed to show the change in the company's condition through a given period -- month, quarter, or year. Revenue accounts may include sales, interest, rental income and service fees. Expense accounts may include cost of goods sold, salaries/wages, rent paid, utilities and office administration expenses.

II. Accounting Practices Double- Entry System. State accounting uses double-entry bookkeeping. Under this system, three basic elements define the financial position of an agency, namely: a) Resourcesof agency b) Claims of creditor c) Government equity is assets less liabilities Negative Entries. State accounting uses negative entries. when errors are commited, erroneous entries are recorded again but in the negative so that when totals are derived, the amounts erroneously entered are automatically removed. Recording Procedures. Transactions are usually recorded in the books of original entry or journals. For transactions which are very common and routine, special journals are used to facilitate and simplify recording. The special journals used in each system in each system of state accounting are as follows: a. National Government (1) Journal and Analysis of Obligation (2) Journal of Disbursement (3) Journal of Checks Issued (4) Journal of Bills Rendered (5) Journal of Collections and Deposits b. Local Government (1) Journal and Analysis and Obligations (2) Journal of Collections and Deposits (3) Journal of Disbursements by Treasurers/ Disbursing officers (4) Journals of Checks Issued (5) Journals of Bills Rendered c. Government Corporations (1)Sales Register (2) Cash Receipts Book/ Register (3) Cash Disbursement Book/ Register (4) Check Register Documentation. State accounting rules and regulations require that all transactions are to be supported by sufficient, formal written documents, with complete and accurate description of the transactions, its peso amount authorization and other substantiating information. Use of Standard Chart of accounts. The three systems of State accounting use a common Standard Government Chart of Accounts (SGCA) to effect uniformity in accounting and reporting, facility in consolidation of financial reports, and adaptability to computerization. The Accounting Process These are the series of operations that are carries out systematically in each accounting period. These operations are as follows: a. Selection of Events. Only financial transactions of the business entity are being analyzed. b. Analysis of Business Transactions. Each transaction is being analysed to determine its effects on assets, liabilities, owners equity, revenues and expenses. c. Measuring the Effects. The effect of transactions on the financial position of the enterprise are measured and represented by money amounts. d. Classifying the Measured Effects. The effects are classified according to the individual assets, liabilities, owners equity items, revenues, or expenses affected.

e.

Journalizing. This refers to the systematic and chronological recording of the effects of financial transactions on the elements of financial statements in the general and special journals. Posting. After the transactions have been recorded in the journals, entries are posted or entered in the general ledgers.

f.

g. Taking an Unadjusted Trial Balance. After posting on the general ledgers, balances of debits and credits are determined by adding all debits and the credits of every account. h. Preparation of Worksheet. To facilitate the preparation of adjusting journal entries and financial statements, a worksheet is prepared with columns for unadjusted trial balance, adjustments, adjusted trial balance, income statement, and balance sheet, all with debit and credit columns. i. Preparing Financial Statements. After the worksheet is accomplished, income statement and balance sheet are now ready for preparation. j. Journalizing and Posting Adjusting Journal Entries. At this point, adjusting journal entries can be recorded in the general journal and posted in the general ledgers

k. . Journalizing and Posting Closing Journal Entries. To reflect changes brought about by transactions affecting the operations, in the capital account, all revenue and expense accounts are closed to capital account. l. Taking a Post-Closing Trial Balance. After posting all the closing entries, preparation of post-closing trial balance is next. The trial balance shows only the real accounts. m. Communicating the Processed Information. The information is relayed to users in the form of financial statements. n. Journalizing and Posting Reversing Entries. These entries are made to reverse some of the adjusting journal entries.

Recommendation: Government accounting is a key in preventing corruption in our government, if and only if the officials will report with complete honesty the funds that theyve been spending for the development of our country. Funds are given to implement projects and programs that will aim to improve the state of our country and to solve problems in our society but unfortunately some officials were implementing programs and projects just to get more funds that they will be using for their personal interests. To avoid such things there must be transparency in the report of the government officials and agencies on the way budgets were used. Agencies assigned to evaluate the government expenditures must perform their task honestly and avoiding conspiracy between them. References: Leonor Briones, Philippine Public Fiscal Administration, (Mandaluyong: FAFI, Inc, 1196)

http://www.scribd.com/doc/19010247/Accounting-theories-and-practices : Date of Retrieval July 29, 2012 http://www.ehow.com/info_7749226_principles-accounting-theory.html#ixzz22Flw42VZ : Date of Retrieval- July 29, 2012

You might also like

- Manuals of Government Accounting in the Philippines: Old and New Systems ComparedDocument2 pagesManuals of Government Accounting in the Philippines: Old and New Systems ComparedAndyGonzalesAlagar60% (10)

- Module 1 - Introduction To Government AccountingDocument11 pagesModule 1 - Introduction To Government AccountingRiviera MehsNo ratings yet

- Government Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityDocument36 pagesGovernment Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityErika MonisNo ratings yet

- Introduction to Government Accounting and the Philippine Budget ProcessDocument20 pagesIntroduction to Government Accounting and the Philippine Budget ProcessLaong laan100% (1)

- Pa 111 Public Accounting and Budgeting Module IDocument23 pagesPa 111 Public Accounting and Budgeting Module IAbdul Hakim Mambuay100% (10)

- New Government Accounting System in The PhilippinesDocument5 pagesNew Government Accounting System in The PhilippinesCristalNo ratings yet

- Government Accounting PunzalanDocument5 pagesGovernment Accounting PunzalanN Jo88% (17)

- Understanding the National Budget ProcessDocument47 pagesUnderstanding the National Budget Processenaportillo13100% (9)

- Draft of Briones Lecture On Manuel RoxasDocument36 pagesDraft of Briones Lecture On Manuel RoxasManuel L. Quezon III100% (5)

- Overview of Government AccountingDocument26 pagesOverview of Government Accountingkimberly100% (9)

- The Philippine Budget SystemDocument3 pagesThe Philippine Budget Systemeathan27100% (2)

- Public Borrowing 4Document14 pagesPublic Borrowing 4Corpuz Tyrone0% (1)

- Presentation of Financial Statements Standard for Philippine Public SectorDocument18 pagesPresentation of Financial Statements Standard for Philippine Public SectorAnonymous bEDr3JhGNo ratings yet

- History of Public Fiscal AdministrationDocument13 pagesHistory of Public Fiscal AdministrationRonna Faith Monzon100% (1)

- Budget Process of The Philippine National GovernmentDocument3 pagesBudget Process of The Philippine National GovernmentMary Ann Tan100% (1)

- PS 103 Philippine Public Administration Fiscal AdministrationDocument8 pagesPS 103 Philippine Public Administration Fiscal AdministrationTristan Jade Corpuz Valdez100% (4)

- New Government Accounting System ManualDocument37 pagesNew Government Accounting System ManualArahbellsNo ratings yet

- Public Fiscal Administration Part 1-1Document10 pagesPublic Fiscal Administration Part 1-1phoebeNo ratings yet

- The New Government Accounting System of The PhilippinesDocument6 pagesThe New Government Accounting System of The PhilippinesGlaiza Gigante100% (1)

- Ngas Module Government AccountingDocument11 pagesNgas Module Government AccountingAnn Kristine Trinidad50% (2)

- Fetalver ABPA3 (PA 317 Public Accounting and Budgeting) PDFDocument38 pagesFetalver ABPA3 (PA 317 Public Accounting and Budgeting) PDFEMMANUELNo ratings yet

- Dealing With Fiscal AdministrationDocument19 pagesDealing With Fiscal AdministrationJaylyn Joya Ammang100% (1)

- The New Government Accounting System ManualDocument37 pagesThe New Government Accounting System ManualJane Delos Santos100% (11)

- Module 2 Accounting For Budgetary AccountsDocument30 pagesModule 2 Accounting For Budgetary Accountscha11No ratings yet

- Pre-1. Introduction To Government AccountingDocument24 pagesPre-1. Introduction To Government AccountingPaupauNo ratings yet

- GOVERNMENT ACCOUNTING - Accounting Responsibilities.Document19 pagesGOVERNMENT ACCOUNTING - Accounting Responsibilities.Hannah Verano86% (7)

- The Philippine Public Sector Accounting StandardsDocument8 pagesThe Philippine Public Sector Accounting StandardsRichel ArmayanNo ratings yet

- MODULE 1 Overview of Public Fiscal AdministrationDocument8 pagesMODULE 1 Overview of Public Fiscal AdministrationRica GalvezNo ratings yet

- Government AccountingDocument5 pagesGovernment AccountingPrincessa Lopez Masangkay100% (1)

- Reaction Paper Public Fiscal AdministrationDocument25 pagesReaction Paper Public Fiscal AdministrationLeigh LynNo ratings yet

- The Budgeting Process and Budget Trends in The National Government of The PhilippinesDocument60 pagesThe Budgeting Process and Budget Trends in The National Government of The PhilippinestentenNo ratings yet

- State Audit in The PhilippinesDocument49 pagesState Audit in The PhilippinesArlyn Drance100% (12)

- Budgetary Accounts and Systems ExplainedDocument4 pagesBudgetary Accounts and Systems ExplainedMoises A. Almendares0% (1)

- Philippine Budget ProcessDocument6 pagesPhilippine Budget Processdara100% (1)

- Philippine Public DebtDocument20 pagesPhilippine Public Debtmark genove100% (3)

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocument98 pagesThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanNo ratings yet

- General Principles of Public Fiscal Administration: Submitted By: Jonathan A. RiveraDocument14 pagesGeneral Principles of Public Fiscal Administration: Submitted By: Jonathan A. RiveraRomel Torres100% (5)

- Government Accounting Manual For National Government AgenciesDocument14 pagesGovernment Accounting Manual For National Government AgenciesKenneth CalzadoNo ratings yet

- 5 Disbursements 1Document199 pages5 Disbursements 1John Karl Mabini100% (1)

- This Study Resource Was: Quiz 1: Public Accounting and BudgetingDocument6 pagesThis Study Resource Was: Quiz 1: Public Accounting and BudgetingReggie AlisNo ratings yet

- Government AuditingDocument19 pagesGovernment AuditingGherine Joy Serrano Tayag100% (2)

- Government Auditing and Accounting SystemDocument22 pagesGovernment Auditing and Accounting SystemKenneth Delos Santos100% (2)

- Public Financial ManagementDocument41 pagesPublic Financial ManagementDenalynn100% (1)

- Government Accounting System Ref 2Document15 pagesGovernment Accounting System Ref 2Romeo AnacanNo ratings yet

- Revenues and Other ReceiptsDocument28 pagesRevenues and Other ReceiptsJV100% (1)

- Local Fiscal Administration ReportDocument18 pagesLocal Fiscal Administration ReportOliver Santos100% (3)

- Theory of The BudgetDocument23 pagesTheory of The BudgetClemen John TualaNo ratings yet

- The PPSAS and The Revised Chart of AccountsDocument98 pagesThe PPSAS and The Revised Chart of AccountsDaniel Salmorin87% (15)

- Reflection The Budget Cycle of Fiscal Administration in The PhilippinesDocument3 pagesReflection The Budget Cycle of Fiscal Administration in The PhilippinesBernadette Ruth MasuliNo ratings yet

- IM Public Accounting and Budgeting 1Document47 pagesIM Public Accounting and Budgeting 1Briones FLo Ri Ane100% (1)

- Philippines Fiscal Policy GuideDocument21 pagesPhilippines Fiscal Policy GuideOliver Santos100% (2)

- Constitutional Bases of Public Finance in The Philippines (Taxation)Document23 pagesConstitutional Bases of Public Finance in The Philippines (Taxation)DARLENE100% (1)

- Public Fiscal Administration AssignmentDocument14 pagesPublic Fiscal Administration AssignmentJonathan Rivera100% (6)

- The Development of Public Finance InstitutionsDocument49 pagesThe Development of Public Finance InstitutionsPeo Batangasph100% (3)

- Philippine Public Fiscal AdministrationDocument51 pagesPhilippine Public Fiscal Administrationjeffrey catacutan flores89% (47)

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- Analysing and Interpreting Financial StatementsDocument28 pagesAnalysing and Interpreting Financial StatementsBhodzaNo ratings yet

- Accounting and Financial Management Study NotesDocument72 pagesAccounting and Financial Management Study NotesShani BitonNo ratings yet

- Part 1 - Acc - 2016Document10 pagesPart 1 - Acc - 2016Sheikh Mass JahNo ratings yet

- Acctng1 Lesson 1-4Document28 pagesAcctng1 Lesson 1-4Icel EstoqueNo ratings yet

- 2019 School Intervention Plan in Cip Project SUMA (Solving and Understanding Mathematical Analysis)Document2 pages2019 School Intervention Plan in Cip Project SUMA (Solving and Understanding Mathematical Analysis)Hazel JumaquioNo ratings yet

- The Electronic Class Record User Manual For Grades 4-6 (From DepEd)Document4 pagesThe Electronic Class Record User Manual For Grades 4-6 (From DepEd)UɐƃnqnlUoɹNo ratings yet

- Quarter 1 Week 6 English 6Document30 pagesQuarter 1 Week 6 English 6Hazel JumaquioNo ratings yet

- Continuous Improvement Program Project SUMADocument97 pagesContinuous Improvement Program Project SUMAHazel Jumaquio100% (2)

- 2019 School Action Plan in Cip Project SUMA (Solving and Understanding Mathematical Analysis)Document2 pages2019 School Action Plan in Cip Project SUMA (Solving and Understanding Mathematical Analysis)Hazel Jumaquio100% (6)

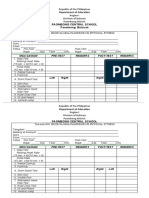

- Philippine school physical fitness test resultsDocument2 pagesPhilippine school physical fitness test resultsHazel JumaquioNo ratings yet

- School Development Plan Reviewed by StakeholdersDocument19 pagesSchool Development Plan Reviewed by StakeholdersHazel Jumaquio100% (2)

- Copy Reading ExerciseDocument4 pagesCopy Reading ExerciseHazel JumaquioNo ratings yet

- Continuous Improvement Program Project SUMADocument97 pagesContinuous Improvement Program Project SUMAHazel Jumaquio100% (2)

- Magna Carta for Public School Teachers ActDocument23 pagesMagna Carta for Public School Teachers ActHazel JumaquioNo ratings yet

- Annual Implementation PlanDocument9 pagesAnnual Implementation PlanHazel Jumaquio100% (16)

- Situation Analysis 2Document38 pagesSituation Analysis 2Hazel JumaquioNo ratings yet

- Situation AnalysisDocument37 pagesSituation AnalysisHazel Jumaquio100% (1)

- HBO - Change Process, Managing ConflictDocument12 pagesHBO - Change Process, Managing ConflictHazel JumaquioNo ratings yet

- Agents of Socialization: Discussant: Hazel S. Jumaquio Mae-EmDocument18 pagesAgents of Socialization: Discussant: Hazel S. Jumaquio Mae-EmHazel JumaquioNo ratings yet

- A2 Advanced Investment Appraisal Technique新Document63 pagesA2 Advanced Investment Appraisal Technique新louisNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- QUIZ 5 MidtermsDocument9 pagesQUIZ 5 MidtermsMa. Clovel MosasoNo ratings yet

- WAGE RATES OnlyDocument1 pageWAGE RATES OnlyMiguel Anas Jr.No ratings yet

- FIN - Cash ManagementDocument24 pagesFIN - Cash Management29_ramesh170No ratings yet

- Household BudgetDocument1 pageHousehold Budgetmehta.deepeshNo ratings yet

- Travel Expense Reimbursement Form-1Document1 pageTravel Expense Reimbursement Form-1naveen kumarNo ratings yet

- Advanced FA I - Chapter 02, BranchesDocument137 pagesAdvanced FA I - Chapter 02, BranchesUtban AshabNo ratings yet

- Presentation of Financial StatementsDocument7 pagesPresentation of Financial StatementsAngel RosalesNo ratings yet

- Suvigya: Details Furnished by You WereDocument1 pageSuvigya: Details Furnished by You WereMKMK JilaniNo ratings yet

- Wooden Furniture Manufacturing Project ReportDocument62 pagesWooden Furniture Manufacturing Project Reporttanuja 3cc100% (2)

- 3.5 SK MC - Annex C - Sample SK AabDocument3 pages3.5 SK MC - Annex C - Sample SK AabLoyd GarridoNo ratings yet

- Understanding LiabilitiesDocument19 pagesUnderstanding LiabilitiesVictor Maruli Marpaung100% (2)

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- Chapter 3 - Chapter 3: Financial Forecasting and PlanningDocument35 pagesChapter 3 - Chapter 3: Financial Forecasting and PlanningAhmad Ridhuwan AbdullahNo ratings yet

- Chapter 22 NotesDocument5 pagesChapter 22 NotesQuintin Jerome BellNo ratings yet

- Operations Operations Operations Operations Manual Manual Manual ManualDocument2 pagesOperations Operations Operations Operations Manual Manual Manual ManualGlen JavellanaNo ratings yet

- Unit 1. Introduction: Computerised AccountingDocument27 pagesUnit 1. Introduction: Computerised Accountingdrtomy100% (1)

- Vertical StatementDocument7 pagesVertical StatementHardik Shah0% (1)

- Techno - Economic Feasibility Study To Establish Gelatin & Glue Production PlantDocument53 pagesTechno - Economic Feasibility Study To Establish Gelatin & Glue Production PlantMohammed Abbas100% (1)

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Acct 201 - Chapter 3Document31 pagesAcct 201 - Chapter 3Huy TranNo ratings yet

- Qio BD PaintsDocument222 pagesQio BD Paintsasif_powerplay9915No ratings yet

- Lecture 4-Business Planning & Basics in Accounting Jan 2024Document86 pagesLecture 4-Business Planning & Basics in Accounting Jan 2024WILFRED PERESO SEMENo ratings yet

- Aisha Steel Mills 2017 balance sheet and income statementDocument33 pagesAisha Steel Mills 2017 balance sheet and income statementqamber18No ratings yet

- MIA GuidanceDocument10 pagesMIA GuidancejasonlingNo ratings yet

- Homework Financial Statements AnalysisDocument13 pagesHomework Financial Statements AnalysisJay DomingoNo ratings yet

- Portfolio BagDocument5 pagesPortfolio Bagpradip_kumarNo ratings yet

- Cash ManagementDocument16 pagesCash Managementjayu91No ratings yet

- Fire Rescue Payroll - Final - 1-29-19Document3 pagesFire Rescue Payroll - Final - 1-29-19ABC15 NewsNo ratings yet