Professional Documents

Culture Documents

Difference between agreement to sell and agreement for sale

Uploaded by

Jatin KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference between agreement to sell and agreement for sale

Uploaded by

Jatin KumarCopyright:

Available Formats

Difference between Agreement to SELL and Agreement for SALE

There is a bit of bewilderment and confusion which takes a silent birth in ones mind, when he/she is asked to distinguish between Agreement to sell and Agreement for Sale. The SALE OF GOODS ACT, 1930, groups both under a single generic name of contracts of sale. However, taking in consideration the scheme followed in English Sale of Goods Act, 1893, it is treated differently in Indian Jurisdictions. The fundamental point of distinction between remains that of the transfer of the concerned goods. In an Agreement for Sale (henceforth referred as Sale), there is a transfer of property from the goods from seller to buyer, but there is none, in case of Agreement to Sell. Section 77 of the Contract Act defined sale as follows: Sale is the exchange of property for a price. It involves the transfer of the ownership of the thing sold from the seller to the buyer. In order to form Sale, as stated by Benjamin on Sale1, following conditions must be satisfied: 1) An agreement to sale by which alone the property does not pass; 2) An actual sale by which the property passes. By this, we may infer that, when compared, Sale is a more comprehensive and wider term just because of the fact that it contains agreement to sell within itself. A sale, in an ordinary course, takes place, when by general and mutual agreement goods are transferred and respectively appropriated towards the contract2. While on the other hand, an agreement to sell, is only a promise to sell, which of course, is enforceable by law3 For a sale, to be established at a legal platform, there must be an agreement amidst the parties for the sale of the goods in which eventually property passes4. If an agreement contemplates that some particular goods or property would pass on a future date or on the happening of some eventuality, it would become sale when that particular eventuality occurs or whenever that future date comes, till then the sale is deemed as an agreement to sell.

1 2

Section 1 of the English Act. Eighth Edition, 1950 Anwar Khan Mahboob Co. Vs. Commissioner of Sales tax 1970(2) SCC 294 3 Ram Narain Mahtovs Vs. State of Madhya Pradesh (1970) 2 SCJ 367 4 State of Gujarat Vs. Variety Body Builders 1976 (3) SCC 500

Tabular and Descriptive distinction between Agreement to Sell and Sale S.No Agreement to Sell 1. An agreement to sell is an executory contract. 2. An agreement to sell creates a jus in personam. 3. In an agreement to sell in case of breach of contract by the buyer, the seller is entitled only to damages since ownership has not passed to the buyer. 4. Since ownership has not passed to the buyer, the seller is at liberty to sell the goods to third parties and the buyer can only claim damages from the seller 5. Since ownership does not pass to the buyer, if goods are destroyed by an accident, the loss will be sellers, even though the goods happen to be in the buyers possession. Where a buyer who has paid for the goods in which ownership has not passed to him, finds that the seller has become bankrupt, his only right would be to claim a rateable dividend. Where the buyer becomes a bankrupt, without paying for the goods, since ownership has not passed to the buyer, the seller may refuse to deliver the goods unless paid for. Sale A sale is an executed contract. A sale creates a jus in rem5. In a sale since ownership has passed to the buyer, the seller is entitled to sue for the price of the goods sold, even though the goods may still remain in his possession. Since the ownership has transferred, the seller will be guilty of conversion, if he sells the goods to third parties and the buyer can sue and recover the identical goods as owner, even from third persons6. Since ownership has passed to the buyer even if the goods are lost buy an accident, while in the sellers possession, the loss will be the buyers. Since ownership has passed to the buyer, if the seller becomes bankrupt, the buyer would be entitled to recover the goods from the assignee in insolvency. Since ownership has passed to the buyer if the buyer becomes an insolvent, without having paid for the goods, the seller if he is not entitled to a lien over the goods, just deliver them and will be entitled only to a rateable dividend for the price due.

6.

7.

5 6

Sales Tax Officer Vs. Budh Prakash Jai Prakash AIR 1954 SC 459 Union of India Vs. Tarachand Ramprasad Agarwal AIR 1976 MP 101

You might also like

- (Case Brief) GVK Industries Ltd. & Another V/s The Income Tax Officer & AnotheDocument9 pages(Case Brief) GVK Industries Ltd. & Another V/s The Income Tax Officer & AnotheAnonymous 8GvuZyB5VwNo ratings yet

- Rights and Powers of TrusteeDocument5 pagesRights and Powers of TrusteeSabNo ratings yet

- Compiled Case Summary Corporate Basics 1-2Document13 pagesCompiled Case Summary Corporate Basics 1-2Priya KulkarniNo ratings yet

- North Eastern Hill University Shillong: Assignment On Family Law (I) TOPIC: Void and Voidable MarriageDocument15 pagesNorth Eastern Hill University Shillong: Assignment On Family Law (I) TOPIC: Void and Voidable MarriageChakseng chmominNo ratings yet

- SR Bommai CaseDocument2 pagesSR Bommai CaseKeshav AggarwalNo ratings yet

- Timber Tree As Movable or Immovable PropertyDocument6 pagesTimber Tree As Movable or Immovable PropertyAditya ShahNo ratings yet

- The Essentials of Priviledged Will Under Indian Succession ActDocument8 pagesThe Essentials of Priviledged Will Under Indian Succession ActShivani TelangeNo ratings yet

- What Is Hindu Joint Family and KartaDocument9 pagesWhat Is Hindu Joint Family and KartaRishabh KumarNo ratings yet

- Restitution of Conjugal Rights PetitionDocument30 pagesRestitution of Conjugal Rights PetitionruhiNo ratings yet

- Offence of Cheating Case ExplainedDocument3 pagesOffence of Cheating Case ExplainedNaman KumarNo ratings yet

- Prakash V MST SahaniDocument8 pagesPrakash V MST SahaniAditi IndraniNo ratings yet

- Property Law Research PaperDocument12 pagesProperty Law Research PaperSanjith CNo ratings yet

- Muslim LawDocument27 pagesMuslim LawSuchi PatelNo ratings yet

- Maneka Gandhi Vs UOIDocument4 pagesManeka Gandhi Vs UOIBiju Prasad100% (1)

- Registration as NoticeDocument8 pagesRegistration as NoticedhatriksNo ratings yet

- CIT Calcutta v. Burlop Dealers Ltd.Document3 pagesCIT Calcutta v. Burlop Dealers Ltd.anilaumesh100% (1)

- Trust Laws in India: An Overview of Key ConceptsDocument7 pagesTrust Laws in India: An Overview of Key ConceptsSaurabh Krishna SinghNo ratings yet

- Law Relating To Suspension and Revocation of Gift TP ProjectDocument12 pagesLaw Relating To Suspension and Revocation of Gift TP Projectanon_909832531No ratings yet

- Hukumchand Insurance Company LimitedDocument2 pagesHukumchand Insurance Company LimitedBrena GalaNo ratings yet

- Chanakya National Law University, Patna: Project Topic: Morgan Stanley Mutual Fund Vs Kartick DasDocument4 pagesChanakya National Law University, Patna: Project Topic: Morgan Stanley Mutual Fund Vs Kartick Dashuma gousNo ratings yet

- Table of Contents Appeal SummaryDocument11 pagesTable of Contents Appeal SummaryPriyanshu gopaNo ratings yet

- T V Somanathan Administrative and Regulatory State - Oxford HandbooksDocument26 pagesT V Somanathan Administrative and Regulatory State - Oxford HandbooksDebabrataNo ratings yet

- Contract Project PDFDocument8 pagesContract Project PDFmirza ahrazNo ratings yet

- The Transfer of Property Act 1882Document83 pagesThe Transfer of Property Act 1882CA Sairam BalasubramaniamNo ratings yet

- Caste Disabilities Removal Act ReportDocument7 pagesCaste Disabilities Removal Act ReportraattaiNo ratings yet

- R.K. GARG VS UNION OF INDIA CASE ANALYSISDocument10 pagesR.K. GARG VS UNION OF INDIA CASE ANALYSISPrachi Tripathi 42No ratings yet

- Pure Theory of Law Hans Kelson-Ltp..Document45 pagesPure Theory of Law Hans Kelson-Ltp..ShabnamNo ratings yet

- Cancellation of InstrumentsDocument3 pagesCancellation of InstrumentsnandinivermaNo ratings yet

- Brief Note Fulham CaseDocument2 pagesBrief Note Fulham CaseAyush JohriNo ratings yet

- Chennammal V1Document19 pagesChennammal V1Aditi Soni100% (1)

- Assignment ON NEGOTIABLE INSTRUMENTS ACT AravindDocument7 pagesAssignment ON NEGOTIABLE INSTRUMENTS ACT AravindAravind KumarNo ratings yet

- Rief Facts OF THE Case: Bala Debi vs. MajumdarDocument4 pagesRief Facts OF THE Case: Bala Debi vs. MajumdarAssassin AgentNo ratings yet

- Divisible Profit: DividendDocument10 pagesDivisible Profit: Dividendsameerkhan855No ratings yet

- Collector of Madura Vs Mootoo RamalingaDocument22 pagesCollector of Madura Vs Mootoo RamalingaSahal ShajahanNo ratings yet

- Gift TOPADocument43 pagesGift TOPAvishal moreNo ratings yet

- Will and CodicilDocument16 pagesWill and CodicilHarshit MalviyaNo ratings yet

- Performance of Contracts Under The Sale of Goods ActDocument7 pagesPerformance of Contracts Under The Sale of Goods ActThomas JosephNo ratings yet

- Hotel Association Vs MaharashtraDocument26 pagesHotel Association Vs MaharashtraAshutosh Masgonde100% (1)

- Malvika's GPC ProjectDocument23 pagesMalvika's GPC ProjectMalvika BishtNo ratings yet

- Discharge of TrusteeDocument3 pagesDischarge of TrusteeAzad SamiNo ratings yet

- Devolution of Immovable Property During Life TimeDocument11 pagesDevolution of Immovable Property During Life TimeAshitaNo ratings yet

- Legality of Object and ConsiderationDocument21 pagesLegality of Object and Considerationjjmaini130% (1)

- Ms Jorden CaseDocument18 pagesMs Jorden CaseKishan PatelNo ratings yet

- Real Estate Sale Agreement Confirming Party DraftDocument10 pagesReal Estate Sale Agreement Confirming Party DraftSravya0% (1)

- 114 ADocument13 pages114 ARvi MahayNo ratings yet

- Cheran Properties LTD vs. Kasturi and SonsDocument3 pagesCheran Properties LTD vs. Kasturi and SonsDiptimaan KumarNo ratings yet

- TP 2Document36 pagesTP 2Dolly Singh OberoiNo ratings yet

- 18BBL036 Case Brief - (Asgarali Pradhania V Emperor)Document2 pages18BBL036 Case Brief - (Asgarali Pradhania V Emperor)Rishabh Khandelwal0% (3)

- Cy pres doctrine in charitable trustsDocument14 pagesCy pres doctrine in charitable trustsprashansha kumudNo ratings yet

- Analyse The Case of Jumma Masjid V K. Deviah (AIR 1962 SC 847)Document3 pagesAnalyse The Case of Jumma Masjid V K. Deviah (AIR 1962 SC 847)Shweta SharmaNo ratings yet

- LEGAL RULES AND PRINCIPLESDocument2 pagesLEGAL RULES AND PRINCIPLESGhina ShaikhNo ratings yet

- TOPIC: Analyze The Changing Trends On Guardianship in IndiaDocument17 pagesTOPIC: Analyze The Changing Trends On Guardianship in Indiashubhangi dixitNo ratings yet

- Restitution of Conjugal RightsDocument9 pagesRestitution of Conjugal RightspriyankaNo ratings yet

- TOPA Questions and AnswerDocument14 pagesTOPA Questions and AnswerSamiksha PawarNo ratings yet

- Nopany Investments PVT LTD V Santokh SinghDocument2 pagesNopany Investments PVT LTD V Santokh SinghajkNo ratings yet

- Share Capital: Classification of Company Securities A. Shares B. Debentures A. SharesDocument10 pagesShare Capital: Classification of Company Securities A. Shares B. Debentures A. SharesAnonymousNo ratings yet

- Law of Contract 1Document31 pagesLaw of Contract 1a99984085No ratings yet

- Sem 10 Registration Act NotesDocument23 pagesSem 10 Registration Act Notesdebjit bhowmickNo ratings yet

- Distinguish Sale vs Agreement to SaleDocument45 pagesDistinguish Sale vs Agreement to Saleraorajneesh7No ratings yet

- ForecastingDocument27 pagesForecastingJatin KumarNo ratings yet

- 239Document78 pages239Jatin KumarNo ratings yet

- Hire Purchase ExplainedDocument28 pagesHire Purchase Explaineddhuvad2004100% (1)

- Acc FinalDocument32 pagesAcc FinalJatin KumarNo ratings yet

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities November 2, 2020Document3 pagesPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities November 2, 2020Nope Nope NopeNo ratings yet

- Business Law Module No. 2Document10 pagesBusiness Law Module No. 2Yolly DiazNo ratings yet

- Heidegger - Nietzsches Word God Is DeadDocument31 pagesHeidegger - Nietzsches Word God Is DeadSoumyadeepNo ratings yet

- Art 1780280905 PDFDocument8 pagesArt 1780280905 PDFIesna NaNo ratings yet

- The Future of Indian Economy Past Reforms and Challenges AheadDocument281 pagesThe Future of Indian Economy Past Reforms and Challenges AheadANJALINo ratings yet

- Consent 1095 1107Document3 pagesConsent 1095 1107Pervil BolanteNo ratings yet

- York Product Listing 2011Document49 pagesYork Product Listing 2011designsolutionsallNo ratings yet

- Architectural PlateDocument3 pagesArchitectural PlateRiza CorpuzNo ratings yet

- HERMAgreenGuide EN 01Document4 pagesHERMAgreenGuide EN 01PaulNo ratings yet

- Tes 1 KunciDocument5 pagesTes 1 Kuncieko riyadiNo ratings yet

- EAPP Q2 Module 2Document24 pagesEAPP Q2 Module 2archiviansfilesNo ratings yet

- Belonging Through A Psychoanalytic LensDocument237 pagesBelonging Through A Psychoanalytic LensFelicity Spyder100% (1)

- Bpoc Creation Ex-OrderDocument4 pagesBpoc Creation Ex-OrderGalileo Tampus Roma Jr.100% (7)

- Group 9 - LLIR ProjectDocument8 pagesGroup 9 - LLIR ProjectRahul RaoNo ratings yet

- Lesson 2 Globalization of World EconomicsDocument17 pagesLesson 2 Globalization of World EconomicsKent Aron Lazona Doromal57% (7)

- 2013 Gerber CatalogDocument84 pages2013 Gerber CatalogMario LopezNo ratings yet

- Ejercicio 1.4. Passion Into ProfitDocument4 pagesEjercicio 1.4. Passion Into ProfitsrsuaveeeNo ratings yet

- The Highest Form of Yoga - Sant Kirpal SinghDocument9 pagesThe Highest Form of Yoga - Sant Kirpal SinghKirpal Singh Disciple100% (2)

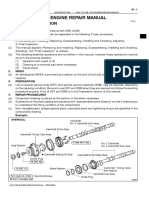

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Ultramat 2 instructions for useDocument2 pagesUltramat 2 instructions for useBalaji BalasubramanianNo ratings yet

- 4AD15ME053Document25 pages4AD15ME053Yàshánk GøwdàNo ratings yet

- Lost Temple of Forgotten Evil - Adventure v3 PDFDocument36 pagesLost Temple of Forgotten Evil - Adventure v3 PDFВячеслав100% (2)

- Supply Chain AssignmentDocument29 pagesSupply Chain AssignmentHisham JackNo ratings yet

- Md. Raju Ahmed RonyDocument13 pagesMd. Raju Ahmed RonyCar UseNo ratings yet

- Wonder at The Edge of The WorldDocument3 pagesWonder at The Edge of The WorldLittle, Brown Books for Young Readers0% (1)

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaNo ratings yet

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Page 17 - Word Connection, LiaisonsDocument2 pagesPage 17 - Word Connection, Liaisonsstarskyhutch0% (1)

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- Food Product Development - SurveyDocument4 pagesFood Product Development - SurveyJoan Soliven33% (3)