Professional Documents

Culture Documents

Description: Tags: Fed

Uploaded by

anon-232641Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description: Tags: Fed

Uploaded by

anon-232641Copyright:

Available Formats

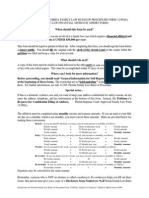

STATEMENT OF FINANCIAL STATUS – FEDERAL EMPLOYEE SALARY OFFSET PROGRAM

YOUR NAME ______________________________ YOUR SSN ______________________

1.AMOUNT YOU ARE PROPOSING TO PAY EACH MONTH: $__________

***************** HOUSEHOLD AND EMPLOYMENT INFORMATION ****************

2.YOUR ADDRESS _____________________________________________________

_____________________________________________________

_____________________________________________________

3.COUNTY IN WHICH YOU LIVE:____________________ HOME PHONE _____________

4.EMPLOYER’S NAME _____________________________________________________

5.EMPLOYER’S _____________________________________________________

ADDRESS

_____________________________________________________

6.EMPLOYER’S PHONE ________________ YOUR JOB TITLE _____________________

7.NUMBER OF DEPENDENTS (AS DEFINED BY IRS) INCLUDING SELF: _____________

8.MARITAL STATUS (MARRIED, SINGLE, DIVORCED): _____________

9.SPOUSE’S NAME AND SSN: _______________________________________________

**************************** MONTHLY INCOME **************************

NOTE: GROSS INCOME IS INCOME BEFORE ANY DEDUCTIONS SUCH AS TAXES. NET

INCOME IS YOUR TAKE-HOME PAY. INCLUDE RECENT PAY STUBS AND TAX RETURNS.

10.YOUR AVERAGE MONTHLY INCOME GROSS $__________ NET $__________

11.YOUR SPOUSE’S AVG MONTHLY INCOME GROSS $__________ NET $__________

12.OTHER CONTRIBUTING RESIDENT(S) AVG MONTHLY INCOME NET $__________

13.OTHER(ALIMONY, ETC. DESCRIBE_________________________)NET $__________

************************** MONTHLY EXPENSES ***************************

14.RENT/MORTGAGE (TO WHOM:_________________________________)$__________

15.PROPERTY TAX $__________

16.HOME/RENTER’S INSURANCE $__________

17.FOOD $__________

18.CLOTHING $__________

19.ELECTRICITY $__________

20.NATURAL GAS/HEATING OIL/PROPANE $__________

21.WATER/SEWER/TRASH DISPOSAL $__________

- CONTINUED ON PAGE 2 –

- STATEMENT OF FINANCIAL STATUS PAGE 2 – MONTHLY EXPENSES CONTINUED

22.BASIC PHONE SERVICE $__________

23.CAR PAYMENT (FIRST CAR) $__________

24.CAR PAYMENT (SECOND CAR) $__________

25.AUTO FUEL AND MAINTENANCE $__________

26.PUBLIC TRANSPORTATION $__________

27.AUTO INSURANCE $__________

28.MEDICAL INSURANCE PAYMENTS NOT DEDUCTED FROM PAYCHECK $__________

29.MEDICAL CO-PAYMENTS AND EXPENSES NOT COVERED BY INSURANCE $__________

30.CHILD CARE EXPENSES(NUMBER OF CHILDREN:_______) $__________

31.CHILD SUPPORT (NUMBER OF CHILDREN:_______) $__________

LIST ANY OTHER MONTHLY EXPENSES BELOW:

32._________________________________________________________ $__________

33._________________________________________________________ $__________

34._________________________________________________________ $__________

******************************** ASSETS ********************************

35.BANK ACCOUNT 1(BANK NAME:_______________________________) $__________

36.BANK ACCOUNT 2(BANK NAME:_______________________________) $__________

37.BANK ACCOUNT 3(BANK NAME:_______________________________) $__________

38.STOCKS/BONDS (BANK NAME:_______________________________) $__________

39.HOME VALUE:$__________ OWED:$__________

40.OTHER REAL ESTATE VALUE:$__________ OWED:$__________

41.CAR 1(YR,MAKE,MODEL:______________)VALUE:$__________ OWED:$__________

42.CAR 2(YR,MAKE,MODEL:______________)VALUE:$__________ OWED:$__________

*************************** SWORN STATEMENT ****************************

I DECLARE UNDER PENALTIES PROVIDED BY 18 U.S.C. SECTION 1001, THAT THE

ANSWERS AND STATEMENTS CONTAINED HEREIN ARE TO THE BEST OF MY KNOWLEDGE

AND BELIEF TRUE, CORRECT AND COMPLETE.

43.SIGNATURE:____________________________________DATE:_________________

SOCIAL SECURITY NUMBER: ______________________

WARNING:18 U.S.C. 1001 PROVIDES THAT "WHOEVER...KNOWINGLY AND WILLFULLY

FALSIFIES, CONCEALS OR COVERS UP BY ANY TRICK, SCHEME, OR DEVICE A

MATERIAL FACT, OR MAKES ANY FALSE, FICTITIOUS OR FRAUDULENT STATEMENTS

OR REPRESENTATION.., SHALL BE FINED NOT MORE THAN $10,000.00, OR

IMPRISONED NOT MORE THAN FIVE YEARS, OR BOTH".

RETURN THIS FORM AND ALL REQUIRED DOCUMENTATION TO:

U.S. DEPARTMENT OF EDUCATION

ATTN: HEARINGS UNIT

PO BOX 4227

IOWA CITY, IA 52244-4222

STATEMENT OF FINANCIAL STATUS

INSTRUCTIONS

THIS STATEMENT OF FINANCIAL STATUS FORM HAS BEEN SENT IN RESPONSE TO YOUR

REQUEST TO ESTABLISH A MONTHLY PAYMENT PLAN. IN ORDER TO DETERMINE A

PAYMENT AMOUNT THAT IS BOTH AFFORDABLE FOR YOU AND REASONABLE BASED ON

THE AMOUNT YOU OWE, YOU MUST COMPLETE AND RETURN IT.

1. IMMEDIATELY BEGIN SENDING THE AMOUNT YOU PROPOSE TO PAY EACH MONTH TO:

U.S. DEPARTMENT OF EDUCATION

PO BOX 4169

GREENVILLE, TX 75403-4169

INCLUDE YOUR NAME AND SOCIAL SECURITY NUMBER ON YOUR CHECK OR MONEY

ORDER. TO MAKE PAYMENT BY CREDIT CARD CALL 800-621-3115. DO NOT SEND

CASH.

2. COMPLETE EVERY FIELD ON THIS FORM. IF AN ANSWER IS ZERO, WRITE ZERO.

3. INCLUDE PROOF OF YOUR HOUSEHOLD INCOME FOR BOTH YOU AND YOUR SPOUSE

(FOUR MOST RECENT LEAVE AND EARNINGS STATEMENTS AND TWO MOST RECENT

FEDERAL INCOME TAX RETURNS), AND PROOF OF YOUR EXPENSES (SUCH AS COPIES

OF MONTHLY BILLS AND/OR CANCELLED CHECKS).

4. DO NOT INCLUDE MONTHLY PAYMENTS ON CREDIT CARDS IF THE ITEMS PURCHASED

BY THAT CREDIT CARD FIT UNDER AN EXPENSE CATEGORY LISTED. INCLUDE

THOSE COSTS UNDER THAT EXPENSE CATEGORY. FOR EXAMPLE, PAYMENTS ON CREDIT

CARDS USED TO PURCHASE CLOTHING SHOULD BE LISTED UNDER CLOTHING EXPENSES.

5. IF YOU ARE PAYING SOME EXPENSES QUARTERLY OR ANNUALLY, SUCH AS

AUTOMOBILE INSURANCE, CALCULATE THE AMOUNT THAT WOULD BE DUE IF THESE

EXPENSES WERE PAID MONTHLY AND PUT THAT AMOUNT IN THE SPACE PROVIDED.

6. RETURN THE COMPLETED FORM TO: U.S. DEPARTMENT OF EDUCATION

ATTN: HEARINGS UNIT

PO BOX 4227

IOWA CITY, IA 52244-4222

7. WE WILL NOTIFY YOU IN WRITING ONCE WE DETERMINE AN ACCEPTABLE MONTHLY

PAYMENT AMOUNT. YOU MAY CONTACT US AT 800-621-3115 FOR FURTHER

ASSISTANCE.

PRIVACY ACT NOTICE

THIS REQUEST IS AUTHORIZED UNDER 31 U.S.C. 3711,20 U.S.C. 1078-6, AND 20 U.S.C. 1095A.

YOU ARE NOT REQUIRED TO PROVIDE THIS INFORMATION. IF YOU DO NOT, WE CANNOT DETERMINE

YOUR FINANCIAL ABILITY TO REPAY YOUR STUDENT AID DEBT. THE INFORMATION YOU PROVIDE WILL

BE USED TO EVALUATE YOUR ABILITY TO PAY. IT MAY BE DISCLOSED TO GOVERNMENT AGENCIES AND

THEIR CONTRACTORS, TO EMPLOYERS, LENDERS, AND OTHERS TO ENFORCE THIS DEBT; TO THIRD

PARTIES IN AUDIT, RESEARCH, OR DISPUTE ABOUT THE MANAGEMENT OF THIS DEBT; AND TO PARTIES

WITH A RIGHT TO THIS INFORMATION UNDER THE FREEDOM OF INFORMATION ACT OR OTHER FEDERAL

LAW OR WITH YOUR CONSENT. THESE USES ARE EXPLAINED IN NOTICE IN THE STUDENT FINANCIAL

ASSISTANCE COLLECTION FILES, NO 18-11-07; WE WILL SEND A COPY AT YOUR REQUEST.

You might also like

- Description: Tags: FsDocument3 pagesDescription: Tags: Fsanon-5551No ratings yet

- Instructions For Florida Family Law Rule of Procedure Form 12.902 (C), Family Law Financial Affidavit (Long Form) (09/12)Document13 pagesInstructions For Florida Family Law Rule of Procedure Form 12.902 (C), Family Law Financial Affidavit (Long Form) (09/12)vskywokervsNo ratings yet

- ECVSP12Document4 pagesECVSP12ballNo ratings yet

- ClerkDocument9 pagesClerkPando DailyNo ratings yet

- Finance New G YorkDocument1 pageFinance New G York健康生活園Healthy Life GardenNo ratings yet

- Andre FladellDocument26 pagesAndre FladellMy-Acts Of-SeditionNo ratings yet

- Yasp Financial Assistance Application 2018Document4 pagesYasp Financial Assistance Application 2018Daniel CarrilloNo ratings yet

- Complete Credit AppDocument2 pagesComplete Credit Appnghiemta18No ratings yet

- Blues Late Rental AppDocument2 pagesBlues Late Rental AppGuido Porto PortoNo ratings yet

- Credit Application Form 18Document3 pagesCredit Application Form 18Patricia GonsalesNo ratings yet

- Finance New G YorkDocument1 pageFinance New G York健康生活園Healthy Life GardenNo ratings yet

- Issue of Duplicate Share CertificatesDocument5 pagesIssue of Duplicate Share CertificatesMurali KrishnaNo ratings yet

- Entire Packet 10Document7 pagesEntire Packet 10JohnnyLarsonNo ratings yet

- Application for Legal AidDocument2 pagesApplication for Legal AidJim SteeleNo ratings yet

- State of Georgia Rental Assistance Program Income Documentation Waiver FormDocument2 pagesState of Georgia Rental Assistance Program Income Documentation Waiver FormSandra BenjaminNo ratings yet

- 2011-2012 Verification Form For Federal Student Aid ProgramsDocument3 pages2011-2012 Verification Form For Federal Student Aid ProgramsKyle FalconerNo ratings yet

- Request Restitution FormDocument2 pagesRequest Restitution Formjlori82No ratings yet

- Graduate Financial StatementDocument3 pagesGraduate Financial StatementthakreyNo ratings yet

- Court Financial AffidavitDocument6 pagesCourt Financial AffidavitJonathan PerezNo ratings yet

- Installment Payment Plan Request: No PO Box NumberDocument4 pagesInstallment Payment Plan Request: No PO Box NumberjackNo ratings yet

- Order For SupportDocument6 pagesOrder For SupportJoniTay802No ratings yet

- 3a05935618e0a1c97fceeb106b0d105223d301e75d1091d9d5be02aac2368789Document11 pages3a05935618e0a1c97fceeb106b0d105223d301e75d1091d9d5be02aac2368789cory.mccooeyeNo ratings yet

- Application For Waiver or Deferral of FeesDocument5 pagesApplication For Waiver or Deferral of Feessbf20112011No ratings yet

- Rental App - PrimaryDocument3 pagesRental App - Primaryapi-335836813No ratings yet

- Rental Application Royal CourtDocument2 pagesRental Application Royal CourtIv TulipsNo ratings yet

- Utah Rental ApplicationDocument2 pagesUtah Rental Applicationjbscribd123321No ratings yet

- NHA Form and RequirementsDocument2 pagesNHA Form and RequirementsPrincess Manalo TafallaNo ratings yet

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDocument3 pagesApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramrichardNo ratings yet

- Charity Application SAMPLEDocument8 pagesCharity Application SAMPLEChanchalRajKhatriNo ratings yet

- Income Withholding For SupportDocument3 pagesIncome Withholding For SupportballNo ratings yet

- w-4 IN PDFDocument2 pagesw-4 IN PDFAnonymous rPkHXogyNo ratings yet

- 15 Day Notice Per AB832 Rev727201Document3 pages15 Day Notice Per AB832 Rev727201BrianNo ratings yet

- JDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Document2 pagesJDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Antoinette MoederNo ratings yet

- NHA - Application Form GEHP RevisedDocument2 pagesNHA - Application Form GEHP RevisedStephanie Anne Jocson100% (2)

- La Celia ApplicationDocument1 pageLa Celia ApplicationZhang JunNo ratings yet

- International Student Financial StatementDocument2 pagesInternational Student Financial StatementValeria GutiérrezNo ratings yet

- Financial SponsershipDocument2 pagesFinancial SponsershipHari Krishna Shah 21BCS0167No ratings yet

- Application To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramDocument2 pagesApplication To Purchase A House and Lot Package/Housing Unit Under The Government Employees Housing ProgramCrislyne ItaliaNo ratings yet

- Georgia Rental Assistance Income WaiverDocument2 pagesGeorgia Rental Assistance Income WaiverJAMIE SCHADELNo ratings yet

- NSLP App Attach BDocument2 pagesNSLP App Attach Bapi-248185821No ratings yet

- Family Law Financial Affidavit Short FormDocument9 pagesFamily Law Financial Affidavit Short Formscadam817No ratings yet

- Charity Care Application EnglishDocument7 pagesCharity Care Application EnglishDavidNo ratings yet

- Camp CREATE Financial Aid Application 2019Document3 pagesCamp CREATE Financial Aid Application 2019DanielNo ratings yet

- JDF 205 Motion To File Without Payment and Supporting Financial AffidavitDocument3 pagesJDF 205 Motion To File Without Payment and Supporting Financial Affidavitdaddyjohnson100% (1)

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMister Nobody0% (1)

- Chase Loan Modification PacketDocument11 pagesChase Loan Modification PacketSince 1990 BK AND MOTIONS AT YAHOO COM100% (1)

- Birth-Qvc1096203 Jose Covington Edownload Quick Vital CertificatesDocument3 pagesBirth-Qvc1096203 Jose Covington Edownload Quick Vital CertificatesZayy SmooveNo ratings yet

- NHA - Application Form GEHP RevisedDocument2 pagesNHA - Application Form GEHP RevisedStephanie Anne Jocson100% (4)

- SAL FormDocument4 pagesSAL FormMark Kevin Plasencia DobleNo ratings yet

- Affidavit of Substantial Hardship and OrderDocument3 pagesAffidavit of Substantial Hardship and Ordermoneysquad5412No ratings yet

- NHA Application Form 1Document1 pageNHA Application Form 1TindusNiobetoNo ratings yet

- 1033 EFX Claim Form For Extended Claims Period (7.20.2022)Document5 pages1033 EFX Claim Form For Extended Claims Period (7.20.2022)Marquita HunterNo ratings yet

- Hotel Berry Application FormDocument6 pagesHotel Berry Application Formmelissacorker100% (1)

- 2880-EL_EAP Rental VerificationDocument1 page2880-EL_EAP Rental VerificationkevinNo ratings yet

- Dma 5097 PDFDocument2 pagesDma 5097 PDFAnonymous GpfoR36pNo ratings yet

- Sav 1048Document6 pagesSav 1048Tanasha FlandersNo ratings yet

- Fha Gift LetterDocument1 pageFha Gift LetterAndy ReyNo ratings yet

- Indigency Application (Blank) PDFDocument3 pagesIndigency Application (Blank) PDFdcarson90No ratings yet

- IFLGenuine NeedsDocument5 pagesIFLGenuine NeedsiqbmubNo ratings yet

- Prince SmartFit CPVC Piping System Price ListDocument1 pagePrince SmartFit CPVC Piping System Price ListPrince Raja38% (8)

- Clem Amended ComplaintDocument26 pagesClem Amended ComplaintstprepsNo ratings yet

- Ordinary Use and Enjoyment " of LandDocument4 pagesOrdinary Use and Enjoyment " of LandlkndgknfskNo ratings yet

- Money Purse Telugu BookDocument3 pagesMoney Purse Telugu BookAsheervadam Suraboina0% (3)

- 0.US in Caribbean 1776 To 1870Document20 pages0.US in Caribbean 1776 To 1870Tj RobertsNo ratings yet

- Project Report JP MorganDocument41 pagesProject Report JP Morgantaslimr191No ratings yet

- AsfsadfasdDocument22 pagesAsfsadfasdJonathan BautistaNo ratings yet

- Accounting Calling ListDocument4 pagesAccounting Calling Listsatendra singhNo ratings yet

- Smart Mobs Blog Archive Habermas Blows Off Question About The Internet and The Public SphereDocument3 pagesSmart Mobs Blog Archive Habermas Blows Off Question About The Internet and The Public SpheremaikonchaiderNo ratings yet

- Education in The Face of Caste: The Indian CaseDocument13 pagesEducation in The Face of Caste: The Indian CaseParnasha Sankalpita BhowmickNo ratings yet

- 해커스토익 김진태선생님 2020년 7월 적중예상문제Document7 pages해커스토익 김진태선생님 2020년 7월 적중예상문제포도쨈오뚜기No ratings yet

- The Little Girl and The Cigarette by Benoit DuteurtreDocument15 pagesThe Little Girl and The Cigarette by Benoit DuteurtreMelville HouseNo ratings yet

- Sample Resignation LetterDocument15 pagesSample Resignation LetterJohnson Mallibago71% (7)

- Rolex Watch U.S.A. v. Leland Stanford Hoffman Trademark ComplaintDocument15 pagesRolex Watch U.S.A. v. Leland Stanford Hoffman Trademark ComplaintKenan FarrellNo ratings yet

- MELENDEZ Luis Sentencing MemoDocument9 pagesMELENDEZ Luis Sentencing MemoHelen BennettNo ratings yet

- Impact of Pop Culture On PoliticsDocument3 pagesImpact of Pop Culture On PoliticsPradip luitelNo ratings yet

- FM ReportDocument2 pagesFM Reportcaiden dumpNo ratings yet

- Imam Al-Qurtubi's Tafsir of The Ayah: He Then Established Himself Over The Throne'Document3 pagesImam Al-Qurtubi's Tafsir of The Ayah: He Then Established Himself Over The Throne'takwaniaNo ratings yet

- Tax Invoice for 100 Mbps Home InternetDocument1 pageTax Invoice for 100 Mbps Home Internetpriyank31No ratings yet

- Reset NVRAM or PRAM On Your Mac - Apple SupportDocument1 pageReset NVRAM or PRAM On Your Mac - Apple SupportRudy KurniawanNo ratings yet

- TDW Pipeline Pigging CatalogDocument135 pagesTDW Pipeline Pigging CatalogShaho Abdulqader Mohamedali100% (1)

- Partnership Liability for Debts IncurredDocument12 pagesPartnership Liability for Debts IncurredDennis VelasquezNo ratings yet

- Ramadan Lantern Geo V2Document4 pagesRamadan Lantern Geo V2Little MuslimsNo ratings yet

- Affidavit of ConsentDocument2 pagesAffidavit of ConsentRocketLawyer100% (1)

- MJ: The Genius of Michael JacksonDocument4 pagesMJ: The Genius of Michael Jacksonwamu8850% (1)

- Golden Tax - CloudDocument75 pagesGolden Tax - Cloudvarachartered283No ratings yet

- ZXSS10 Network Design Scheme (LLD) - Template - 361048Document16 pagesZXSS10 Network Design Scheme (LLD) - Template - 361048Mahmoud KarimiNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Criminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodeDocument27 pagesCriminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodePrabhash ChandNo ratings yet

- Business Law and Pil AssignmentDocument13 pagesBusiness Law and Pil Assignmentsurbhirajoria5No ratings yet