Professional Documents

Culture Documents

Cash Flow For DCF

Uploaded by

Santanu ShyamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow For DCF

Uploaded by

Santanu ShyamCopyright:

Available Formats

The following pertains to a project being considered by Yerevan Technologies Ltd.

(YTL)

Year

0

1

2

3

1. Initial Investment

300.00

2. Revenues

3. Variable costs

4. Depreciation

5. Deferred revenue expenses written off

300.00

75.00

75.00

10.00

325.00

81.25

75.00

10.00

350.00

87.50

75.00

10.00

500.00

125.00

75.00

10.00

6. Administration and general expenses 3

20.00

20.00

20.00

20.00

7. Short Term Interest 4

8. Long Term Interest

9. Profit before Tax

10. Tax (40%)

11. Net Income

12. Addition to Net Working Capital

13. Salvage Value (after tax)

24.00

10.00

86.00

34.40

51.60

50.00

26.00

10.00

102.75

41.10

61.65

100.00

28.00

10.00

119.50

47.80

71.70

40.00

10.00

220.00

88.00

132.00

-150.00

25.00

Cost of capital :

10%

Tax Rate:

40%

All figures are in Rupees crores

Notes

1

Initial investment includes Rs.

The project is expected to reduce cash flow in an existing product because of overlapping market, as follows:

50.00

(this amount was incurred for a different project that was subsequently abandoned)

Year

1

-10

-15

-20

-20

Administrative and general expenditure includes alloction of head office expenses of:

Short term interest partains bank loan which is expected reduce to zero each year

a Assess the cash flow relevant for DCF analysis

b Compute the NPV of the project

Page 1 of 3

t that was subsequently abandoned)

Page 2 of 3

Year

2

1

1. Initial Investment

300.00

2. Revenues

3. Variable costs

4. Depreciation

5. Deferred revenue expenses written off

6. Administration and general expenses

7. Short Term Interest

8. Long Term Interest

9. Profit before Tax

10. Tax (40%)

11. Net Income

12. Addition required to Net Working Capital

13. Salvage Value (after tax)

Cost of capital :

Tax

Cash flow

Capital Expenditure

300.00

75.00

75.00

10.00

20.00

24.00

10.00

86.00

34.40

51.60

50.00

325.00

81.25

75.00

10.00

20.00

26.00

10.00

102.75

41.10

61.65

100.00

350.00

87.50

75.00

10.00

20.00

28.00

10.00

119.50

47.80

71.70

500.00

125.00

75.00

10.00

20.00

40.00

10.00

220.00

88.00

132.00

-150.00

25.00

10%

40%

-250.00

Net Income

Add

Depreciation

Def.Rev Exp w/o

After tax L.T.Interest

H.O.Allocation

Less

Project externality

Working Capital

51.60

61.65

71.70

132.00

75.00

10.00

6.00

4

75.00

10.00

6.00

4

75.00

10.00

6.00

4

75.00

10.00

6.00

4

-10

-15

-20

-20

-50.00

-100.00

150.00

Salvage Value (after tax)

25.00

Net

-250.00

NPV

234.28

86.60

41.65

146.70

382.00

You might also like

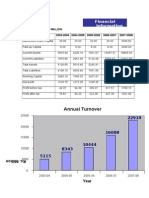

- Financial Information MAR 08Document1 pageFinancial Information MAR 08Sandeep SolankiNo ratings yet

- Eva ProblemsDocument10 pagesEva Problemsazam4989% (9)

- Achieving Service-Oriented Architecture: Applying an Enterprise Architecture ApproachFrom EverandAchieving Service-Oriented Architecture: Applying an Enterprise Architecture ApproachNo ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Review of Financial Statement Preparation Analysis and Interpretation Pt.8Document6 pagesReview of Financial Statement Preparation Analysis and Interpretation Pt.8ADRIANO, Glecy C.No ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- FAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESDocument36 pagesFAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESPrince McBossmanNo ratings yet

- Amdocs LTDDocument4 pagesAmdocs LTDsommer_ronald5741No ratings yet

- Proforma Profit and Loss StatementDocument6 pagesProforma Profit and Loss Statementgirishjain2000No ratings yet

- Topic:-Evaluate The Financial Performance of Marks &spencer PLCDocument27 pagesTopic:-Evaluate The Financial Performance of Marks &spencer PLCAnonymous ohYFoO4No ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanRizaldi DjamilNo ratings yet

- Singtel 2007 - 2008 Financial Report AnalysisDocument23 pagesSingtel 2007 - 2008 Financial Report Analysisthanhha19850% (1)

- Idea InnovationDocument14 pagesIdea Innovationnilufar nourinNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Value-Based ManagementDocument21 pagesValue-Based ManagementPrathamesh411No ratings yet

- BS-2015 IIDocument2 pagesBS-2015 IIMohammad AdnanNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- Bajaj Bal SheetDocument3 pagesBajaj Bal SheetSukshith ShettyNo ratings yet

- Maruti Suzuki (Latest)Document44 pagesMaruti Suzuki (Latest)utskjdfsjkghfndbhdfnNo ratings yet

- A Project On "Economic Value Added" in Kirloskar Oil Engines LTDDocument19 pagesA Project On "Economic Value Added" in Kirloskar Oil Engines LTDPrayag GokhaleNo ratings yet

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- Cost of Equity Cost of DebtDocument5 pagesCost of Equity Cost of DebtKamalakar ReddyNo ratings yet

- Common Size Analysis 2009-2011: Balance Sheet Indexed (%)Document1 pageCommon Size Analysis 2009-2011: Balance Sheet Indexed (%)Ahsan ShahidNo ratings yet

- Common Size Balance Sheet AnalysisDocument7 pagesCommon Size Balance Sheet AnalysisMuhammad AdnanNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- Name Enrollment Number Project On Section Submitted To DateDocument14 pagesName Enrollment Number Project On Section Submitted To DateL1588AshishNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- Loan Amortization Schedule AnalysisDocument15 pagesLoan Amortization Schedule AnalysisSanchit TaksaliNo ratings yet

- 6 Financial Statements ReviewDocument21 pages6 Financial Statements Reviewsanu sayedNo ratings yet

- CHAPTER 4 Financials Velas Encendida Candles 3 12 19Document18 pagesCHAPTER 4 Financials Velas Encendida Candles 3 12 19JenilynNo ratings yet

- Assets: Analisis Vertical 2011 %Document11 pagesAssets: Analisis Vertical 2011 %Christian CoronelNo ratings yet

- InfosysDocument9 pagesInfosysvibhach1No ratings yet

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Financial analysis and cash flow statement of Celerity Technology Company (CTCDocument4 pagesFinancial analysis and cash flow statement of Celerity Technology Company (CTCJack JacintoNo ratings yet

- Hungry PediaDocument19 pagesHungry PediaPrashannaNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Biz Plan - FinancialsDocument28 pagesBiz Plan - FinancialsGuvi EmmaNo ratings yet

- Investment Analysis and Depreciation CalculationsDocument9 pagesInvestment Analysis and Depreciation CalculationsdebojyotiNo ratings yet

- Macro Perspective: Pakistan Leasing Year Book 2009Document7 pagesMacro Perspective: Pakistan Leasing Year Book 2009atifch88No ratings yet

- Calculate startup costs and projected financesDocument8 pagesCalculate startup costs and projected financesInder KeswaniNo ratings yet

- Siemens Balance SheetDocument4 pagesSiemens Balance SheetRutvik HNo ratings yet

- ASghar Ali OD Final ProjectDocument10 pagesASghar Ali OD Final ProjectAbdul HadiNo ratings yet

- Dhairya Accnts PRJCTDocument19 pagesDhairya Accnts PRJCTNafees AliNo ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- CH 3-11Document18 pagesCH 3-11api-281685551100% (1)

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Capital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallyDocument14 pagesCapital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallybhaskkarNo ratings yet

- Abb 1Q Cy 2013Document11 pagesAbb 1Q Cy 2013Angel BrokingNo ratings yet

- Naztech - 27.01.2021 - IrrDocument81 pagesNaztech - 27.01.2021 - IrrRashan Jida ReshanNo ratings yet

- From The Following Information, Calculate The DCF Value of The Firm: Financial Forecasts (Rs in Millions) 1 2 3 4 5 6Document2 pagesFrom The Following Information, Calculate The DCF Value of The Firm: Financial Forecasts (Rs in Millions) 1 2 3 4 5 6ShubhamNo ratings yet

- NetscapeDocument6 pagesNetscapeAnuj BhattNo ratings yet

- Airthread WorksheetDocument21 pagesAirthread Worksheetabhikothari3085% (13)

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- The CAPM: A Brief IntroductionDocument8 pagesThe CAPM: A Brief IntroductionSantanu ShyamNo ratings yet

- Pride of Kalina Co-Op. HSG Soc. LTDDocument2 pagesPride of Kalina Co-Op. HSG Soc. LTDSantanu ShyamNo ratings yet

- CTCDocument4 pagesCTCSantanu ShyamNo ratings yet

- Evaluation Sheets - Term-WiseDocument3 pagesEvaluation Sheets - Term-WiseSantanu ShyamNo ratings yet

- S M L XL Sales Rate Freestock WIP 014DI 014DI 014DI 014DI Size SKU Code ColorDocument3 pagesS M L XL Sales Rate Freestock WIP 014DI 014DI 014DI 014DI Size SKU Code ColorSantanu ShyamNo ratings yet

- Alibaba IPO Financial Model WallstreetMojoDocument62 pagesAlibaba IPO Financial Model WallstreetMojoSantanu ShyamNo ratings yet

- Book 1Document9 pagesBook 1Santanu ShyamNo ratings yet

- Credit Card WorkingDocument4 pagesCredit Card WorkingSantanu ShyamNo ratings yet

- Article CategoryDocument63 pagesArticle CategorySantanu ShyamNo ratings yet

- CTCDocument4 pagesCTCSantanu ShyamNo ratings yet

- Reg No. and Name ListDocument114 pagesReg No. and Name ListSantanu ShyamNo ratings yet

- Finals PrepDocument8 pagesFinals PrepSantanu ShyamNo ratings yet

- MK 212 SVarshney Term VDocument1 pageMK 212 SVarshney Term VSantanu ShyamNo ratings yet

- MK - Sales and Distribution ManagementDocument4 pagesMK - Sales and Distribution ManagementSantanu ShyamNo ratings yet

- Brands Face CreamDocument2 pagesBrands Face CreamSantanu ShyamNo ratings yet

- LIME 6 Rule Book For B-Schools 2014Document8 pagesLIME 6 Rule Book For B-Schools 2014Santanu ShyamNo ratings yet

- LIME 6 Rule Book For B-Schools 2014Document8 pagesLIME 6 Rule Book For B-Schools 2014Santanu ShyamNo ratings yet

- Class Schedule Term-V 2014-15-5020 Batch 2Document2 pagesClass Schedule Term-V 2014-15-5020 Batch 2Santanu ShyamNo ratings yet

- BtE Toolbox 2014Document37 pagesBtE Toolbox 2014Santanu ShyamNo ratings yet

- Capital Budgeting ExamplesDocument26 pagesCapital Budgeting ExamplesSantanu ShyamNo ratings yet

- Project Financing - Sample ProblemDocument1 pageProject Financing - Sample ProblemSantanu ShyamNo ratings yet

- SANTANU SHYAM (0311/50) : Academic QualificationsDocument2 pagesSANTANU SHYAM (0311/50) : Academic QualificationsSantanu ShyamNo ratings yet

- Class Schedule (Term III) - 5020 - Pre Mid Term and Post Mid Term 2013 14Document4 pagesClass Schedule (Term III) - 5020 - Pre Mid Term and Post Mid Term 2013 14Santanu ShyamNo ratings yet

- SANTANU SHYAM (0311/50) : Academic QualificationsDocument2 pagesSANTANU SHYAM (0311/50) : Academic QualificationsSantanu ShyamNo ratings yet

- Aerospace Industry Overview and Update - Stout Risius Ross (2011)Document7 pagesAerospace Industry Overview and Update - Stout Risius Ross (2011)Ashish PateriaNo ratings yet

- Blackberry Java Application Development Guide 741609 1109114520 001 5.0 Beta USDocument127 pagesBlackberry Java Application Development Guide 741609 1109114520 001 5.0 Beta USSantanu ShyamNo ratings yet

- SANTANU SHYAM (0311/50) : Academic QualificationsDocument2 pagesSANTANU SHYAM (0311/50) : Academic QualificationsSantanu ShyamNo ratings yet

- Course List 2014-15Document18 pagesCourse List 2014-15Santanu ShyamNo ratings yet

- Spring NotesDocument1 pageSpring NotesSantanu ShyamNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet