Professional Documents

Culture Documents

NPA Booklet

Uploaded by

BaideheeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPA Booklet

Uploaded by

BaideheeCopyright:

Available Formats

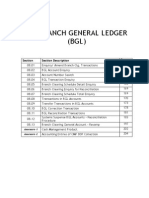

BOOKLET ON

NPA FUNCTIONALITY

IN B@NCS24

By

Loans Team,

State Bank of India,

Core Banking Project,

CBD Belapur, Navi Mumbai

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

2

INDEX

FOREWORD........................................................................................................................................... 3

EXPLANATION OF THE TERMS USED IN THIS BOOKLET....................................................... 5

CHAPTER 1............................................................................................................................................. 6

CLASSIFICATION OF NPA IN B@NCS24.......................................................................................... 6

CHAPTER 2............................................................................................................................................. 7

ARREAR CONDITIONS ....................................................................................................................... 7

CHAPTER 3........................................................................................................................................... 11

ARREAR ACTION............................................................................................................................... 11

CHAPTER 4........................................................................................................................................... 12

NPA PROCESSING IN B@NCS24..................................................................................................... 12

CHAPTER 5........................................................................................................................................... 14

MENU NAVIGATION FOR NPA IN B@NCS24 ................................................................................ 14

CHAPTER 6........................................................................................................................................... 25

AMEND NPA STATUS ....................................................................................................................... 25

CHAPTER 7........................................................................................................................................... 32

GRANTING OF HOLIDAYS IN NPA TRACKING............................................................................. 32

CHAPTER 8........................................................................................................................................... 36

INCA / UIPY CALCULATION & ACCOUNTING IN B@NCS24 ...................................................... 36

CHAPTER 9........................................................................................................................................... 37

PROVISIONING IN B@ncs24............................................................................................................ 37

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

3

CHAPTER 10......................................................................................................................................... 39

OTHER ASPECTS OF NPA................................................................................................................ 39

TRACKING OF NPA FOR DDP CHEQUES TRANSACTIONS......................................................... 39

TRACKING OF NPA FOR BILLS TRANSACTIONS.......................................................................... 40

TREATMENT OF NPA FOR ALL THE ACCOUNTS OF A CUSTOMER.......................................... 40

IN CASE ONE OF HIS ACCOUNTS IS NPA ..................................................................................... 40

PROTESTED BILLS AND RECALLED DEBTS ACCOUNTS............................................................ 40

STEPS FOR TRANSFER OF CC/OD ACCOUNTS TO PB/RD.......................................................... 42

STEPS FOR TRANSFER OF DL / TL TO PB / RD .......................................................................... 45

LEGAL CASE TRACKING.................................................................................................................. 49

DICGC / ECGC CLAIMS, SETTLEMENT AND APPROPRIATION................................................. 52

ECGC CLAIMS PROCESSING.......................................................................................................... 62

WRITE OFF........................................................................................................................................ 64

WRITE OFF WITH TRANSFER OF BALANCE TO AUC ACCOUNT .............................................. 69

REPORTS IN B@NCS24 FOR NPA................................................................................................... 73

FAQs ON NPA TRACKING................................................................................................................ 74

CHAPTER 11...................................................................................................................................... 78

NPA DATE.......................................................................................................................................... 78

CHAPTER 12...................................................................................................................................... 81

NPA CALCULATOR........................................................................................................................... 81

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

4

FOREWORD

NPA Management has assumed greater significance due to stringent norms getting

introduced from time to time. Role of technology in helping the operating staff to

identify the NPA accounts and probable NPA accounts will go a long way in planning

proper strategy for addressing credit risks.

B@ncs24 supports the entire functionality of NPA. In our maiden attempt in making

available the entire gamut of NPA functionality through the system, B@ncs24 has

been customized to handle this complex functionality. All the conditions, which

trigger the NPA status of a particular loan account, have been built in the system, so

that each and every account is tracked on an on-going basis. NPA module in

B@ncs24 is designed to track on a daily basis and enable an up-to-date IRAC status

of Banks loan accounts to be obtained at any point.

B@ncs24 is designed to handle all the connected functionalities of NPA such as

passing of INCA / UIPY accounting entries, making Provision, stopping of interest

application in NPA accounts, maintaining DICGC/CGA Claims received for

appropriation, recovery in respect of NPA and finally write off / AUCA/ Compromise

of NPA.

In this booklet an attempt has been made to explain the above-mentioned features in

order to familiarize the users with this functionality. This compilation aims to equip

the Branch users with suitable tools to handle one of the most vital areas of asset

management through B@ncs24. I commend the efforts made by

Shri R. Lakshminarasimhan, Asstt. General Manager and members of the Core

Banking Project in bringing out this booklet which, I am sure will be found very

useful by the operating functionaries. Any suggestions for its improvement may

please be sent to the Development Team at Core Banking Project (E-mail Id

lakshminarasimhan.r@sbi.co.in).

STATE BANK OF INDIA U.S. ROY

CORE BANKING PROJECT CHIEF GENERAL MANAGER

CBD BELAPUR

25.11.2004

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

5

EXPLANATION OF THE TERMS USED IN THIS BOOKLET

TERMINOLOGY USED

MEANING

Risk Grade IRAC Status

Bad Debt Indicator IRAC Status

Arrears Overdues / Irregularity

Loans CC / OD / DL / TL

Old IRAC Status Confirmed NPA Status of the account

New IRAC Status Indicative NPA Status of the account

INCA Interest Not Collected Account

UIPY Unrealised Interest of Previous Years

SCR NO. Screen Number

Prompt Screen

Screen for inputting account number /

CIF number and action

Return Screen

The screen that is displayed by B@ncs24

after transmitting Prompt Screen

System (as shown in many of

the screens of B@ncs24)

Various modules in B@ncs24

DEP CC / OD accounts (Deposit Module)

LON DL / TL accounts (Loans Module)

CRA Credit Risk Assessment

Old Bad Debt Indicator Old IRAC Status

New Bad Debt Indicator New IRAC Status

AUCA Advances Under Collection Account

(Bad Debt Indicator, IRAC Status and Risk Grade have the same meaning and are used interchangeably in the system)

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

6

CHAPTER 1

CLASSIFICATION OF NPA IN B@NCS24

Non-Performing Assets in B@ncs24 have been classified into 7 categories, which are

called as RISK GRADES as per details below:-

RISK

GRADE

DESCRIPTION

00 Standard Asset

01 Standard But Temporarily Irregular Asset

02 Standard But Irregular for Over 60 Days

04 Sub-Standard Asset

05 Doubtful Asset Less than 1 Year

06 Doubtful Asset = > 1 Year but < 3 Years

07 Doubtful Asset = > 3 Years

08 Loss Asset

(Please note that risk grade numbers 03 and 09 are not used presently)

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

7

CHAPTER 2

ARREAR CONDITIONS

Various conditions that make a loan account to slip from the status of Standard Asset are

getting tracked in B@ncs24. These are called ARREAR CONDITIONS. In other

words all the NPA business rules are defined in the system at every RISKGRADE of the

CC/OD/DL/TL accounts. For example, Cash Credit or Overdraft account running

continuously irregular for over 90 days has to be classified as Sub-standard Asset. In the

given example, Account running irregular for 90 days is referred as an Arrear

Condition. To explain this further, when an account is in Sub-Standard asset for Over 1

year, the same has to be classified as Doubtful Asset Category I. Here Account staying

in a particular category of asset for over 1 year is the Arrear Condition. These Arrear

conditions are defined in the system for various RISKGRADES and are assigned with

specific numbers. Therefore, whenever the system has categorized an asset to a

particular NPA status, user can find out which arrear condition has triggered the

deterioration so that he can initiate remedial measures. We furnish below the details of

the Arrear Conditions defined for CC/OD accounts and DL/TL accounts. Since system

will refer these Arrears Conditions only by the number, user is expected to use this

booklet for finding the details. If continuous irregularity in the account has triggered the

NPA status, user can take up for regularizing the account. In case non-submission of

stock statement has triggered the NPA status, user can approach the borrower for

submission of stock statement. Always, the user has to relate the arrear condition to a

given Risk Grade of the account.

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

8

ARREAR CONDITIONS FOR CASH CREDIT AND OVERDRAFT ACCOUNTS

A

r

r

e

a

r

C

o

n

d

i

t

i

o

n

N

u

m

b

e

r

I

n

R

i

s

k

G

r

a

d

e

o

f

C

C

/

O

D

a

c

c

o

u

n

t

Description

N

u

m

b

e

r

o

f

D

a

y

s

/

P

e

r

c

e

n

t

a

g

e

o

f

e

r

o

s

i

o

n

N

e

w

N

P

A

S

t

a

t

u

s

o

f

t

h

a

t

a

c

c

o

u

n

t

201 00 Excess Drawings / Irregularity 30 Days 01

202 01 Excess Drawings / Irregularity 30 Days 02

203 02 Excess Drawings / Irregularity 30 Days 04

204 00 Interest not Serviced 30 Days 01

205 01 Interest not Serviced 30 Days 02

206 02 Interest not Serviced 30 Days 04

207 00 Non submission of Stock Statement 90 Days 04

208 01 Non submission of Stock Statement 90 Days 04

209 02 Non submission of Stock Statement 90 Days 04

210 00 Non submission of Renewal Data 180 Days 04

211 01 Non submission of Renewal Data 180 Days 04

212 02 Non submission of Renewal Data 180 Days 04

213 00 Erosion in Security Value 90.10% 08

214 01 Erosion in Security Value 90.10% 08

215 02 Erosion in Security Value 90.10% 08

216 04 Erosion in Security Value 90.10% 08

217 05 Erosion in Security Value 90.10% 08

218 06 Erosion in Security Value 90.10% 08

219 07 Erosion in Security Value 90.10% 08

220 04 Erosion in Security Value 50.10% 05

221 01 Auto Upgrade -- 00

222 02 Auto Upgrade -- 00

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

9

In the given example, Arrear Condition 201 is operational only when the Cash

Credit or Overdraft account is in Risk Grade 00. This arrear condition indicates that if

the account is irregular that is over and above DP for 30 days, then the NPA status of that

account will be converted to Risk Grade 01, which is Standard but irregular for over 30

days. The other arrear conditions need to be understood in the same manner. Arrear

Condition No. 221 and 222 are covered in a separate chapter.

ARREAR CONDITIONS FOR DEMAND / TERM LOAN ACCOUNTS

A

r

r

e

a

r

C

o

n

d

i

t

i

o

n

N

u

m

b

e

r

I

n

R

i

s

k

G

r

a

d

e

o

f

T

L

/

D

L

a

c

c

o

u

n

t

Description

N

u

m

b

e

r

o

f

D

a

y

s

/

P

e

r

c

e

n

t

a

g

e

o

f

e

r

o

s

i

o

n

N

e

w

N

P

A

S

t

a

t

u

s

o

f

t

h

a

t

a

c

c

o

u

n

t

101 00 Excess Drawings / Irregularity 30 Days 01

102 01 Excess Drawings / Irregularity 30 Days 02

103 02 Excess Drawings / Irregularity 30 Days 04

104 00 Erosion in Security Value 90.10% 08

105 01 Erosion in Security Value 90.10% 08

106 02 Erosion in Security Value 90.10% 08

107 04 Erosion in Security Value 90.10% 08

108 05 Erosion in Security Value 90.10% 08

109 06 Erosion in Security Value 90.10% 08

110 07 Erosion in Security Value 90.10% 08

111 04 Erosion in Security Value 50.10% 05

112 01 Auto Upgrade -- 00

113 02 Auto Upgrade -- 00

There are certain Arrears Conditions, which are common to both CC/OD and

DL/TL accounts. These Arrears Conditions are called as Common Conditions, details

of which are furnished below:

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

10

COMMON ARREAR CONDITIONS

A

r

r

e

a

r

C

o

n

d

i

t

i

o

n

N

u

m

b

e

r

I

n

R

i

s

k

G

r

a

d

e

o

f

C

C

/

O

D

o

r

D

L

/

T

L

a

c

c

o

u

n

t

Description

N

u

m

b

e

r

o

f

D

a

y

s

i

n

t

h

e

g

i

v

e

n

r

i

s

k

g

r

a

d

e

N

e

w

N

P

A

S

t

a

t

u

s

o

f

t

h

a

t

a

c

c

o

u

n

t

151 04 Risk Grade (4) 365 days 05

152 05 Risk Grade (5) 365 days 06

153 06 Risk Grade (6) 730 days 07

Common arrear conditions are based on time factor. If an account is classified as

Substandard and is remaining in the same stage for 1 year, then the IRAC status of that

account need to be reclassified as Doubtful Asset-Category 1. This business rule is

getting addressed through Arrear Condition Number 151.

In all, we have seen 38 Arrear Conditions defined in B@ncs24 as at present.

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

11

CHAPTER 3

ARREAR ACTION

In the earlier Chapter, we have seen the Arrear Conditions defined in the system. All

these Arrear Conditions trigger what is called the ARREAR ACTION. Arrear actions

are detailed below:-

ACTION

NO.

DESCRIPTION

100 CHANGE TO RISK GRADE 0

101 CHANGE TO RISK GRADE 1

102 CHANGE TO RISK GRADE 2

104 CHANGE TO RISK GRADE 4

105 CHANGE TO RISK GRADE 5

106 CHANGE TO RISK GRADE 6

107 CHANGE TO RISK GRADE 7

108 CHANGE TO RISK GRADE 8

For example, Arrear Condition No. 153 is attached with Action No. 107. Arrear

Condition 153 indicates the continuous stay of an Account in IRAC Status Doubtful

Assets Category 2 (Risk Grade 06 in B@ncs24) will initiate Arrear Action No. 107

which is nothing but changing the status of that account to Doubtful Asset Category 3

(Risk Grade 07 in B@ncs24).

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

12

CHAPTER 4

NPA PROCESSING IN B@NCS24

Each and every loan account is processed by the system during End of Day process

(EOD) for deciding the NPA status. The Arrear Condition and the Arrear Action

explained in the previous chapters are used by the system in determining the Risk Grade

of an account. The Risk Grade thus decided by the system is shown as NEW IRAC

STATUS. Every loan account in B@ncs24 has two risk grades as detailed below

1. NEW IRAC STATUS

This is an indicative status of a loan account as processed by the system. It is

purely system generated based on the Arrears Conditions. NPA processes

such as stopping of interest application, segregation of INCA / UIPY, etc. will

not happen based on the Risk Grade shown under New IRAC Status. This

requires a confirmation from the operating staff. The confirmed status

happens both by manual intervention and End of Year (EOY) process.

2. OLD IRAC STATUS

This is the actual IRAC status of a loan account. The New IRAC status is

confirmed by the operating staff during year-end or any time during the year.

The confirmed status is reflected under the column OLD IRAC STATUS.

Therefore, for all purposes of finding the NPA status of an account, the user

has to refer only this column. The system starts the NPA processes such as

non-application of interest and segregation of INCA / UIPY automatically.

Rate of Interest in the loan account is not going to be zeroised upon the status

change to 04 or above. Interest accruals will continue in the loan account

but the same will not be applied to the account. The user thus can ascertain

the interest accruals (on simple interest basis) in respect of NPA accounts at

any point of time.

BOOKLET ON NPA FUNCTIONALITY IN B@NCS24

State Bank of India, Core Banking Project, Corporate Centre, CBD Belapur.

For internal circulation only

13

Both the NEW IRAC STATUS and the OLD IRAC STATUS can be changed by the

user. While doing so, the user is expected to verify the arrear condition, which has

triggered the NEW IRAC STATUS, and take appropriate action before manually

changing it.

AUTO UPGRADATION

Risk Grades 00, 01 and 02 are Standard Assets. In order to help the users to initiate

remedial action, standard assets, which are irregular for over 30 days and over 60 days

have been, classified under 01 and 02 respectively. In any of these stages if the account

becomes regular, the system automatically upgrades that particular account to Risk Grade

00 and continues the monitoring once again. Thus, an account, which is in 01 and 02

category, upon regularization, will be classified as 00 (Standard) by the system.

However, when an account slips to any other category such as Risk Grade 04 or 08, the

system will not automatically upgrade it to 00 Standard even if the irregularity is

rectified. Manual intervention is required in this case.

You might also like

- NEFT Message FormatsDocument16 pagesNEFT Message Formatsmukeshkpatidar100% (1)

- SFMS - GuidelinesDocument116 pagesSFMS - GuidelinesRajnish ShastriNo ratings yet

- Terminal Operators LiabilityDocument30 pagesTerminal Operators LiabilityMurat YilmazNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- CBS Navigation MenuDocument34 pagesCBS Navigation MenuShailaja Thakur67% (6)

- Finnacle & Bancs Commands Bank Audit PDFDocument22 pagesFinnacle & Bancs Commands Bank Audit PDFAang Shaw50% (2)

- 01.19 Safe CustodyDocument9 pages01.19 Safe Custodymevrick_guyNo ratings yet

- Sfms-Neft 2011Document56 pagesSfms-Neft 2011VivekNo ratings yet

- All Finacle CommandsDocument39 pagesAll Finacle Commandssindhukotaru100% (2)

- Study On Implementation of KCC Scheme - WBDocument92 pagesStudy On Implementation of KCC Scheme - WBR K ThanviNo ratings yet

- Accounting Concept of Currency Chest TransactionDocument1 pageAccounting Concept of Currency Chest TransactionAjoydeep DasNo ratings yet

- Niraj-LSB CatalogueDocument8 pagesNiraj-LSB CataloguenirajNo ratings yet

- Chapter 2 Management Accounting Hansen Mowen PDFDocument28 pagesChapter 2 Management Accounting Hansen Mowen PDFidka100% (1)

- Chapter - 11: Npa DateDocument9 pagesChapter - 11: Npa DateBaideheeNo ratings yet

- Npa Status Through Short Enquiry: Menu Navigation For Npa inDocument11 pagesNpa Status Through Short Enquiry: Menu Navigation For Npa inBaidehee0% (3)

- 8 To 8 Functionality: Section Section DescriptionDocument7 pages8 To 8 Functionality: Section Section Descriptionmevrick_guyNo ratings yet

- 01.09-User System ManagementDocument12 pages01.09-User System Managementmevrick_guyNo ratings yet

- Core Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalDocument8 pagesCore Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalleenardniNo ratings yet

- 01 07-VpisDocument19 pages01 07-Vpishell_hello11No ratings yet

- GLIFDocument38 pagesGLIFTigmarashmi MahantaNo ratings yet

- 01.01 IntroductionDocument16 pages01.01 Introductionmevrick_guyNo ratings yet

- 01.04-DepositAccounts Other FunctionalitiesDocument30 pages01.04-DepositAccounts Other Functionalitiesmevrick_guyNo ratings yet

- 01.03-Deposit Accounts OpeningDocument38 pages01.03-Deposit Accounts Openingmevrick_guy0% (1)

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- 01.05 Transaction ProcessingDocument23 pages01.05 Transaction Processingmevrick_guyNo ratings yet

- 01.13 ClearingDocument38 pages01.13 Clearingmevrick_guy0% (1)

- Branch InterfaceDocument81 pagesBranch Interfacemevrick_guy100% (1)

- 00.02-List of ChaptersDocument2 pages00.02-List of Chaptersashi9812No ratings yet

- Procedural Guidelines1Document69 pagesProcedural Guidelines1sburugulaNo ratings yet

- BANCS@24Document27 pagesBANCS@24Arihant Pawariya80% (5)

- What Is An Account Aggregator?Document7 pagesWhat Is An Account Aggregator?Francis NeyyanNo ratings yet

- B@Ncs24 Software Solution: ArihantDocument27 pagesB@Ncs24 Software Solution: Arihantsanchit_hNo ratings yet

- 01 06-CashDocument21 pages01 06-Cashmevrick_guyNo ratings yet

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- Sbi Core BankingDocument28 pagesSbi Core Bankingsarthak_ganguly100% (1)

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyNo ratings yet

- LogicDocument712 pagesLogicsuresh vedpathiNo ratings yet

- 01.17 Currency ChestDocument10 pages01.17 Currency Chestmevrick_guyNo ratings yet

- Cif CircularDocument196 pagesCif CircularLalit Yadav67% (3)

- CBS FaqDocument138 pagesCBS FaqKallol DasNo ratings yet

- Cbi BankDocument81 pagesCbi BankVaibhavKamble100% (1)

- e-KYC and New Investor Process FlowDocument32 pagese-KYC and New Investor Process FlowSneha Abhash SinghNo ratings yet

- Cash System and Procedure Part 1Document8 pagesCash System and Procedure Part 1Rohit BhaduNo ratings yet

- 01 02-CifDocument25 pages01 02-Cifmevrick_guyNo ratings yet

- NachDocument8 pagesNachS GanesanNo ratings yet

- IMPS FAQsBankers PDFDocument5 pagesIMPS FAQsBankers PDFAccounting & TaxationNo ratings yet

- UPI GuidelinesDocument31 pagesUPI Guidelinespradyumna sisodiaNo ratings yet

- Bank Management System in VB 6Document30 pagesBank Management System in VB 6yusuf habibNo ratings yet

- IRAC Norms & NPA ManagementDocument29 pagesIRAC Norms & NPA ManagementSarvar PathanNo ratings yet

- UPI For Businesses BrochureDocument8 pagesUPI For Businesses BrochuretyagigaNo ratings yet

- Bcsbi PDFDocument284 pagesBcsbi PDFsimerjotkaur100% (3)

- Sr. No. Particulars AnnexureDocument18 pagesSr. No. Particulars AnnexureSrinivasan IyerNo ratings yet

- Rtgs-Neft 10xDocument13 pagesRtgs-Neft 10xDharmavir Singh GautamNo ratings yet

- PGC FINACLEDocument95 pagesPGC FINACLEBavya MohanNo ratings yet

- AEPS Interface Specification v2.7 PDFDocument55 pagesAEPS Interface Specification v2.7 PDFSanjeev PaulNo ratings yet

- Finacle SettingDocument2 pagesFinacle Settingersukhdevchd2836No ratings yet

- SBI Core BankingDocument47 pagesSBI Core Bankingsarthak_ganguly78% (9)

- Interbank Mobile Payment ServiceDocument10 pagesInterbank Mobile Payment ServiceRitesh KumarNo ratings yet

- Npa Management SbiDocument104 pagesNpa Management Sbiparth jani100% (1)

- NPA & Income RecognitionDocument56 pagesNPA & Income RecognitionDrashti Raichura100% (1)

- Manual 1044 31mar19 Revised PDFDocument232 pagesManual 1044 31mar19 Revised PDFRanjeet kumarNo ratings yet

- Promotion Study Material Clerk To OfficerDocument315 pagesPromotion Study Material Clerk To OfficerAbhishek KumarNo ratings yet

- A HandBook On Finacle Work Flow Process 1st EditionDocument79 pagesA HandBook On Finacle Work Flow Process 1st EditionSpos Udupi100% (2)

- Ccs (Conduct) RulesDocument3 pagesCcs (Conduct) RulesKawaljeetNo ratings yet

- VT - DUNS - Human Services 03.06.17 PDFDocument5 pagesVT - DUNS - Human Services 03.06.17 PDFann vom EigenNo ratings yet

- Section 114-118Document8 pagesSection 114-118ReiZen UelmanNo ratings yet

- 1st Quarterly Exam Questions - TLE 9Document28 pages1st Quarterly Exam Questions - TLE 9Ronald Maxilom AtibagosNo ratings yet

- Planning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityDocument24 pagesPlanning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityAsma ShoaibNo ratings yet

- Haryana MGMTDocument28 pagesHaryana MGMTVinay KumarNo ratings yet

- Resolution No 003 2020 LoanDocument4 pagesResolution No 003 2020 LoanDexter Bernardo Calanoga TignoNo ratings yet

- Anubrat ProjectDocument80 pagesAnubrat ProjectManpreet S BhownNo ratings yet

- Selecting ERP Consulting PartnerDocument7 pagesSelecting ERP Consulting PartnerAyushmn SikkaNo ratings yet

- Coin Sort ReportDocument40 pagesCoin Sort ReportvishnuNo ratings yet

- Company Profile of Tradexcel Graphics LTDDocument19 pagesCompany Profile of Tradexcel Graphics LTDDewan ShuvoNo ratings yet

- Idx Monthly StatsticsDocument113 pagesIdx Monthly StatsticsemmaryanaNo ratings yet

- Best Practice Guidelines For Concrete Placement Planning, Field Testing, and Sample Collection PDFDocument48 pagesBest Practice Guidelines For Concrete Placement Planning, Field Testing, and Sample Collection PDFandriessebastia9395No ratings yet

- Chandelier Exit 26 Jun 2016Document4 pagesChandelier Exit 26 Jun 2016Rajan ChaudhariNo ratings yet

- GADocument72 pagesGABang OchimNo ratings yet

- Know Your BSNLDocument96 pagesKnow Your BSNLFarhanAkramNo ratings yet

- Customer Loyalty AttributesDocument25 pagesCustomer Loyalty Attributesmr_gelda6183No ratings yet

- Cross TAB in Crystal ReportsDocument15 pagesCross TAB in Crystal ReportsMarcelo Damasceno ValeNo ratings yet

- Memphis in May Damage Repair Invoice - 080223Document54 pagesMemphis in May Damage Repair Invoice - 080223Jacob Gallant0% (1)

- Talk About ImbalancesDocument1 pageTalk About ImbalancesforbesadminNo ratings yet

- G2 Group5 FMCG Products Fair & Lovely - Ver1.1Document20 pagesG2 Group5 FMCG Products Fair & Lovely - Ver1.1intesharmemonNo ratings yet

- Break Even Point (Bep) Analysis of Tomato Farming Business in Taraitak I Village, Langowan District, Minahasa DistrictDocument8 pagesBreak Even Point (Bep) Analysis of Tomato Farming Business in Taraitak I Village, Langowan District, Minahasa Districtrenita lishandiNo ratings yet

- Group 13 Excel AssignmentDocument6 pagesGroup 13 Excel AssignmentNimmy MathewNo ratings yet

- FRANCHISEDocument2 pagesFRANCHISEadieNo ratings yet

- Hanan 07 C.V.-aucDocument6 pagesHanan 07 C.V.-aucAhmed NabilNo ratings yet

- Ecoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot CanadaDocument4 pagesEcoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot Canadaming_zhu10No ratings yet

- HPM 207Document7 pagesHPM 207Navnit Kumar KUSHWAHANo ratings yet