Professional Documents

Culture Documents

PA1 Mock Exam

Uploaded by

yciamyr67%(3)67% found this document useful (3 votes)

6K views18 pagespractical accounting 1 mock exam

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpractical accounting 1 mock exam

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

67%(3)67% found this document useful (3 votes)

6K views18 pagesPA1 Mock Exam

Uploaded by

yciamyrpractical accounting 1 mock exam

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

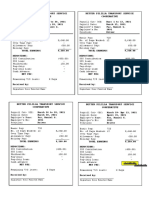

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

1

1. Seattle Company is part of a major industrial group and is known to accurately disclose related

party transactions in its financial statements. Remuneration and other payments made to the

entitys chief executive officer during 2012 were:

Annual salary 2,000,000

Share options and other share-based payments 1,000,000

Contributions to retirement benefit plan 500,000

Reimbursement of travel expenses for business trips 1,200,000

What is the total amount that should be disclosed as compensation to key management

personnel to conform to related party disclosures required by the standard?

a. 3,500,000 c. 3,000,000

b. 4,700,000 d. 2,500,000

2. Martha Company reported the following selected balances on its financial statements for each of

the three years 2010 2012:

2010 2011 2012

Market adjustment Trading securities 5,500,000 3,750,000 (1,200,000)

Market adjustment Available-for-sale securities (1,300,000) 900,000 1,350,0000

How much net unrealized loss should be shown in the 2012 income statement?

a. 1,200,000

b. 4,500,000

c. 4,950,000

d. 3,600,000

Mills Company completed leasehold improvements costing P480,000 on December 31, 2008. The

improvements had an estimated useful life of 10 years. The related lease, which would have

terminated on December 31, 2016, was renewable for an additional four-year term. On March 10,

2012 Mills exercised the renewal option.

3. The accumulated amortization at December 31, 2011 should be

a. 145,000

b. 120,000

c. 144,000

d. 180,000

4. The amortization expense for 2012 should be (rounded)

a. 34,286

b. 40,000

c. 48,000

d. 42,857

5. The accumulated amortization at December 31, 2012 should be

a. 213,333

b. 222,857

c. 160,000

d. 192,000

6. The following information relate to Merck Company. Company Mercks balance sheet date is

December 31, 2012. Assume that company Mercks financial statements are authorized for issue

on March 31, 2013.

a. An amount of P350,000 owing to Company Z for services rendered during

December, 2012.

b. Long-service leave, estimated to be P5,000,000, owing to employees in respect

of past services.

c. Costs of P2,300,000 estimated to be incurred for relocating an employee from

Mercks head office location to another city. The staff member will physically

relocate during January 2013.

d. Provision of P200,000 for the overhaul of a machine. The overhaul is needed

every five years and the machine was five years old as at December 31, 2012.

e. Damages awarded against Merck Company resulting from a court case decided

on December 20, 2012. The judge has announced that the amount of damages

will be set at a future date, expected to be in April 2015. Merck Company has

received advice from its lawyers that the amount of the damages could be

anything between P4,000,000 and P5,000,000

How much is Merck Companys provision in its December 31, 2012 balance sheet?

a. 4,500,000

b. 9,500,000

c. 9,850,000

d. 12,000,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

2

7. During 2012, Garber Corporation, which uses the allowance method of accounting for doubtful

accounts, recorded a provision for bad debt expense of 10,000 and in addition it wrote off, as

uncollectible, accounts receivable of 4,000. As a result of these transactions, net cash flows

from operating activities would be calculated (indirect method) by adjusting net income with a

a. 10,000 increase.

b. 4,000 increase.

c. 6,000 increase.

d. 6,000 decrease.

On January 1, 2011, Manning Company, established a stock appreciation rights plan for its executives.

It entitled them to receive cash at any time during the next four years for the difference between the

market price of its common stock and a pre-established price of 20 on 50,000 SARs. Current market

prices of the stock are as follows:

January 1, 2011 35 per share

December 31, 2011 38 per share

December 31, 2012 30 per share

December 31, 2013 33 per share

Compensation expense relating to the plan is to be recorded over a four-year period beginning

January 1, 2011.

8. What amount of compensation expense should Manning recognize for the year ended

December 31, 2011?

a. 150,000.

b. 225,000.

c. 187,500.

d. 900,000.

9. What amount of compensation expense should Manning recognize for the year ended

December 31, 2012?

a. 0.

b. 25,000.

c. 250,000.

d. 125,000.

10. On December 31, 2013, 8,000 SARs are exercised by executives. What amount of

compensation expense should Manning recognize for the year ended December 31, 2013?

a. 237,500.

b. 162,500.

c. 487,500.

d. 65,000.

Sloan Company, a wholesaler, budgeted the following sales for the indicated months:

June July August

Sales on account 2,790,000 2,860,000 2,980,000

Cash sales 180,000 200,000 260,000

Total sales 2,970,000 3,060,000 3,240,000

All merchandise is marked up to sell at its invoice cost plus 20%. Merchandise inventories at the

beginning of each month are at 30% of that month's projected cost of goods sold.

11. The cost of goods sold for the month of June is anticipated to be

a. 2,232,000.

b. 2,325,000.

c. 2,356,000.

d. 2,475,000.

12. Merchandise purchases for July are anticipated to be

a. 2,448,000.

b. 3,114,000.

c. 2,550,000.

d. 2,595,000.

13. Holler Company uses the straight-line depreciation for its property plant and equipment. The

related balances were:

December 31, 2012 December 31, 2011

Property, plant and equipment 60,000,000 65,000,000

Accumulated depreciation 19,000,000 15,000,000

Holler purchased land during 2012 for P5,000,000 and sold machinery for P7,000,000 at a gain of

P500,000. Depreciation expense for 2012 is

a. 6,500,000 c. 6,000,000

b. 7,500,000 d. 7,000,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

3

14. RAPC Company employs 5 people. Each employee is entitled to two weeks paid vacation every

year the employee works for the company. The conditions of the paid vacation are (a) for each

full year of work, an employee will receive two weeks of paid vacation (no vacation accrues for a

portion of a year), (b) each employee will receive the same pay for vacation time as the regular

pay in the year taken, and (c) unused vacation pay can be carried forward.

Employee Starting

date

Cumulative vacations taken

As of December 31, 2012

Weekly

salary

Brianna Lim December 1, 2012 2 weeks 3,500

Tricia Lopez August 1, 2010 1 week 3,000

Crissy German December 1, 2005 10 weeks 5,000

Jackielou De Vera March 31, 2011 None 2,500

Paula De Jesus March 1, 2012 3 weeks 4,000

What is the liability for vacation pay of RAPC Company on December 31, 2012?

a. 60,000 c. 58,500

b. 65,000 d. 63,000

Pinson Company is considering acquiring Gagne Company. The following information relates to Gagne

Company:

Net tangible assets at cost 5,000,000

Net tangible assets at fair market value 5,500,000

Average net income for the past four years 475,000

Normal rate of return for the industry 8%

____ 15. What is the amount of goodwill if average excess earnings for the past four years are to

be capitalized at the normal rate of return for the industry?

a. 400,000.

b. 437,500.

c. 440,000.

d. 500,000.

____ 16. What is the total amount that Pinson should be willing to pay for Gagne if average excess

earnings for the past four years are to be capitalized at 14%?

a. 5,750,000.

b. 5,700,000.

c. 4,600,000.

d. 5,250,000.

Crosby Corporation sold one of its high-rise buildings on January 1, 2010 for P10,000,000. Crosby

received a cash down payment of P2,000,000 and a 5-year, interest bearing promissory note for the

balance. The note states that the balance is payable in equal annual payments of principal and

interest of P2,219,278, to be paid on December 31 of each year starting December 31, 2010 and

every December 31 thereafter. The payments where received as scheduled on December 31, 2010

and December 31, 2011.

17. What was the stated interest rate on the promissory note?

a. 10%

b. 11%

c. 12%

d. 14%

18. What is the balance of the note payable in the December 31, 2011 statement of financial position?

a. 3,561,444

b. 7,839,131

c. 5,330,331

d. 5,481,444

Gott Company was organized on January 1, 2012, with 300,000 shares of common stock with a 6 par

value authorized. During 2012, Gott had the following stock transactions:

Jan. 4 Issued 120,000 shares at 10 per share.

Mar. 8 Issued 40,000 shares at 11 per share.

May 17 Purchased 15,000 shares at 12 per share.

July 6 Issued 30,000 shares at 13 per share.

Aug. 27 Sold 10,000 treasury shares at 14 per share.

Gott uses the FIFO method for purchase-sale purposes.

19. If Gott uses the par value method to record treasury stock transactions, the total amount of

additional paid-in capital at December 31, 2012 is

a. 890,000.

b. 910,000.

c. 930,000.

d. 970,000.

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

4

20. If Gott uses the cost method to record treasury stock transactions, the total amount of

additional paid-in capital at December 31, 2012 is

a. 890,000.

b. 910,000.

c. 930,000.

d. 970,000.

21. Ponce Company sells merchandise on a consignment basis to dealers. The selling price of the

merchandise averages 25% above cost of the merchandise. The dealer is paid a 10% commission

of the sales price for all sales made. All dealer sales are made on a cash basis. The following

consignment sales activities occurred during 2012:

Manufacturing cost of goods shipped on consignment 8,800,000

Sale price of merchandise sold by dealers 9,600,000

Payments remitted by dealers after deducting commission 6,300,000

How much is the gross profit on sales?

a. 2,400,000

b. 1,920,000

c. 1,700,000

d. 1,220,000

22.Sommet, Inc. disclosed the following information as of and for the year ended December 31, 2012:

Net cash sales 200,000

Net credit sales 300,000

Inventory at beginning 100,000

Inventory at end 150,000

Net income 30,000

Accounts receivable at beginning of year 110,000

Accounts receivable at end of year 130,000

Sommets receivables turnover is

a. 2.4 to 1.

b. 2.5 to 1.

c. 4.17 to 1.

d. 4.0 to 1.

23. A reconciliation of Reagan Companys bank account at November 30, 2012 revealed the following

items:

Balance per bank statement 2,600,000

Deposits in transit 300,000

Checks outstanding ( 100,000)

Correct cash balance 2,800,000

Balance per books 2,810,000

Bank service charge ( 10,000)

Correct cash balance 2,800,000

December data are as follows:

Bank Book

Deposits recorded 1,600,000 1,800,000

Checks recorded 2,200,000 2,500,000

Service charges recorded 50,000 -

Collection by the bank, P500,000 note

plus interest

550,000

-

NSF check returned with December 31

statement

100,000

-

Balances 2,400,000 2,110,000

What is the amount of outstanding checks on December 31, 2012?

a. 540,000

b. 400,000

c. 340,000

d. 390,000

On January 1, 2012, Garnett Company (as lessor) entered into a noncancelable lease agreement with

Rush Company for machinery which was carried on the accounting records of Garnett at 2,265,000

and had a market value of 2,400,000. Minimum lease payments under the lease agreement which

expires on December 31, 2021, total 3,550,000. Payments of 355,000 are due each January 1. The

first payment was made on January 1, 2012 when the lease agreement was finalized. The interest

rate of 10% which was stipulated in the lease agreement is the implicit rate set by the lessor. The

effective interest method of amortization is being used. Rush expects the machine to have a ten-year

life with no salvage value, and be depreciated on a straight-line basis. Collectibility of the rentals is

reasonably predictable, and there are no important uncertainties surrounding the costs yet to be

incurred by the lessor.

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

5

24. What should be the income before income taxes derived by Garnett from the lease for the year

ended December 31, 2012?

a. 375,000

b. 339,500

c. 204,500

d. 240,000

25. Ignoring income taxes, what should be the expenses incurred by Rush from this lease for the year

ended December 31, 2012?

a. 240,000

b. 204,500

c. 444,500

d. 375,000

26. What is the finance lease liability in the balance sheet of Rush Company on December 31, 2012?

a. 2,400,000

b. 2,285,000

c. 1,894,500

d. 2,045,000

27. What is the carrying amount of the lease receivable on the balance sheet of Garnett Company on

January 1, 2012?

a. 3,195,000

b. 2,045,000

c. 2,249,500

d. 2,400,000

28. Dalton Companys accounting records provided the following information for the year 2012:

January 1 December 31

Current assets 800,000

Property, plant and equipment 3,200,000 3,000,000

Current liabilities 600,000

Long-term liabilities 900,000

Working capital of P300,000 remained unchanged from January 1 to December 31, 2012. Net

income for 2012 was P500,000. No dividends were declared during 2012 and there were no other

changes in equity. What is amount of long-term liabilities on December 31, 2012?

a. 200,000

b. 300,000

c. 500,000

d. 900,000

29. Denny Company sells major household appliance service contracts for cash. The service

contracts are for a one-year, two-year, or three-year period. Cash receipts from contracts are

credited to Unearned Service Revenues. This account had a balance of 900,000 at December

31, 2012 before year-end adjustment. Service contract costs are charged as incurred to the

Service Contract Expense account, which had a balance of 225,000 at December 31, 2012.

Service contracts still outstanding at December 31, 2012 expire as follows:

During 2013 190,000

During 2014 285,000

During 2015 125,000

What amount should be reported as Unearned Service Revenues in Denny's December 31,

2012 balance sheet?

a. 675,000.

b. 600,000.

c. 375,000.

d. 300,000.

30. On July 1, Wanda Company sold to Winn Company a new computer software system. The

contract price for both the system and the after-sales service for updates and eliminating viruses

for a period of 12 months was P2,000,000. Wanda estimates the cost of the after-sales service

at P400,000 and it normally marks up such costs by 50% when tendering for after-sales contracts.

What amount of revenue shall Wanda recognize in its statement of comprehensive income for the

year ended December 31, 2012?

a. 1,700,000

b. 2,000,000

c. 1,600,000

d. 2,600,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

6

31. The inventory control account balance of Emmy Company at December 31, 2012 was P2,780,000

using the perpetual inventory system. A physical count conducted on that day found inventory on

hand worth P2,300,000. Net realizable value for each inventory item held for sale exceeded cost.

An investigation of the discrepancy revealed the following:

a. Goods worth P60,000 held on consignment for Genie Accessories had been

included in the physical count.

b. Goods costing P120,000 were purchased on credit from Romano Company on

December 27, 2012 on FOB shipping terms. The goods were shipped on

December 28, 2012 but, as they had not arrived by December 31, 2012, were

not included in the physical count. The purchase invoice was received and

processed on December 31, 2012.

c. Goods costing P240,000 were sold on credit to Alfonso Company for P300,000

on December 28, 2012 on FOB destination terms. The goods were still in

transit on December 31, 2012. The sales invoice was raised and processed on

December 31, 2012.

d. Goods costing P270,000 were purchased on credit (FOB destination) from

Melissa Company on December 29, 2012. The goods were received on

December 30, 2012 and included in the physical count. The purchase invoice

was received on January 2, 2013.

e. On December 31, 2012, Emmys Company sold goods costing P650,000 on

credit (FOB shipping) terms to Hamiltons Boutique for P900,000. The goods

were dispatched from the warehouse on December 31, 2012 but the sales

invoice had not been raised at that date.

f. Damaged inventory items valued P40,000 were discovered during the physical

count. These items were still recorded on December 31, 2012 but were

omitted from the physical count records pending their writeoff.

What is Emmy Companys adjusted inventory amount?

a. 2,360,000

b. 2,600,000

c. 2,660,000

d. 3,000,000

____ 32. Certain information relative to the 2012 operations of Thomas Company follows:

Accounts receivable, January 1, 2012 34,000

Accounts receivable collected during 2012 46,000

Cash sales during 2012 12,000

Inventory, January 1, 2012 18,000

Inventory, December 31, 2012 16,500

Purchases of inventory during 2012 40,000

Gross margin on sales 13,500

What is Thomas's accounts receivable balance at December 31, 2012?

a. 28,000.

b. 31,000.

c. 34,000.

d. 43,000.

33. On December 31, 2010, Marsh Company entered into a debt restructuring agreement with Saxe

Company which was experiencing financial difficulties. Marsh restructured a P1,000,000 note

receivable as follows:

* Reduced the principal obligation to P700,000

* Forgave P120,000 of accrued interest

* Extended the maturity date from December 31, 2010 to December 31, 2012

* Reduced the interest rate from 12% to 8%. Interest was payable annually

on December 31, 2011 and 2012.

In accordance with the agreement, Saxe made payments to Marsh on December 31, 2011 and

2012. How much interest income should Marsh report for the year ended December 31, 2012?

a. 112,000 c. 56,000

b. 84,000 d. 0 (US GAAP)

34. Altis Company had 100,000 ordinary shares outstanding on January 1. In addition, as of January

1, the company had issued share options that allowed employees to purchase 40,000 ordinary

shares. The option exercise price is P10 per share. The options were exercised on April 1. The

average share price for the year was P20. The share price on the option exercise date on April 1

was P16. The company has no other potentially dilutive securities. Net income for the year was

P2,000,000. What is the amount of basic earnings per share?

a. 20.00

b. 15.38

c. 14.95

d. 16.67

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

7

35. The cash account of Maria Company disclosed a balance of P3,450,000 on December 31, 2012.

The bank statement as of December 31, showed a balance of P2,735,000. Upon comparing the

statement with the cash records, the following facts were developed.

a. Marias account was charged on December 27 for a customers uncollectible check

amounting to P150,000.

b. A 4-month, 10% P300,000 customers note dated August 20, 2012, discounted on

September 30, 2012, was dishonored December 21 and the bank charged Maria

P315,000, which include a protest fee of P5,000.

c. A customers check for P150,000 was entered as P105,000 by Maria Company.

d. Check no. 777 for P210,000 was entered in the cash disbursements journal at

P120,000 and check No. 780 for P33,000 was entered as P3,300.

e. Bank service charges of P4,300 for December were not yet recorded on the books.

f. A bank memo stated that Ana Companys note for P200,000 and interest of

P20,000 had been collected on December 29, and the bank charged P6,000. (no

entry has been made on the books)

g. Receipts on December 29, 2012 for P880,000 were deposited January 2, 2013.

h. Maria issued a total of P1,200,000 checks in December. The following canceled

checks were included in the December bank statement:

No. 777 P 210,000 No. 782 P 50,000

No. 778 120,000 No. 785 77,000

No. 780 33,000 No. 786 90,000

No. 781 80,000 No. 790 45,000

What is the correct amount of cash to be shown in Marias December 31, 2012 balance sheet?

a. 3,120,000

b. 2,910,000

c. 2,240,000

d. 3,435,000

36. Information concerning the debt of Cannell Company is as follows:

Short-term borrowings:

Balance at December 31, 2012 1,050,000

Proceeds from borrowings in 2013 650,000

Payments made in 2013 (900,000)

Balance at December 31, 2013 800,000

Current portion of long-term debt:

Balance at December 31, 2012 3,250,000

Transfers from caption "Long-Term Debt" 1,000,000

Payments made in 2013 (2,450,000)

Balance at December 31, 2013 1,800,000

Long-term debt:

Balance at December 31, 2012 18,000,000

Proceeds from borrowings in 2013 4,500,000

Transfers to caption "Current Portion of Long-Term Debt" (1,000,000)

Payments made in 2013 (3,000,000)

Balance at December 31, 2013 18,500,000

In preparing a statement of cash flows for the year ended December 31, 2013, for Cannell

Company, cash flows from financing activities would reflect

Inflow Outflow

a. 4,000,000 4,000,000

b. 4,500,000 4,500,000

c. 5,300,000 5,150,000

d. 5,150,000 6,350,000

On December 31, 2011 Long Corporation sold some of its product to Doane Company, accepting a

3%, four-year promissory note having a maturity value of 400,000 (interest payable annually on

December 31). Long Corporation pays 6% for its borrowed funds. Doane Company, however, pays

8% for its borrowed funds. The product sold is carried on the books of Long at a manufactured cost of

255,000. Long uses a perpetual inventory system.

____ 37. What is the amount of sales to be recorded in 2011?

a. 400,000.

b. 333,758.

c. 294,012.

d. 358,317.

____ 38. What is the total amount of interest revenue to be recorded in 2013?

a. 27,877.

b. 26,701.

c. 22,069.

d. 39,877.

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

8

39. Angola Company was organized on January 1, 2012, 25,000 shares of P100 par value common

stock being issued in exchange for property, plant and equipment valued at P3,000,000 and cash

of P1,000,000. The following data summarize activities for 2012:

Net income for the period ending December 31, 2012 was P1,000,000.

Raw materials on hand on December 31, were equal to 25% of raw materials purchased.

Manufacturing costs were distributed as follows:

Materials used 50%

Direct labor 30%

Factory overhead 20% (includes depreciation of 200,000)

Goods in process remaining in the factory on December 31 were equal to 33 1/3% of the

goods finished and transferred to stock.

Finished goods remaining in stock were equal to 25% of the cost of goods sold.

Operating expenses were 30% of sales

Cost of goods sold was 150% of total operating expenses.

Ninety percent of sales were collected. The balance was considered to be collectible.

Seventy five percent of the raw materials purchased were paid for. There were no

expense accruals or prepayments at the end of the year.

Raw materials purchases for the year amounted to

a. 1,500,000

b. 1,750,000

c. 2,000,000

d. 2,250,000

40. Robin Company has an incentive compensation plan under which the sales manager receives a

bonus equal to 10 percent of the company's income after deductions for bonus and income taxes.

Income before bonus and income taxes is P8,520,000. The effective income tax rate is 35

percent. How much is the bonus (rounded)?

a. 852,000

b. 630,000

c. 553,800

d. 520,000

41. Weston Company purchased a tooling machine on January 3, 2005 for 600,000. The machine was

being depreciated on the straight-line method over an estimated useful life of 10 years, with no

salvage value. At the beginning of 2012, the company paid 150,000 to overhaul the machine. As

a result of this improvement, the company estimated that the useful life of the machine would be

extended an additional 5 years (15 years total). What should be the depreciation expense

recorded for the machine in 2012?

a. 41,250

b. 50,000

c. 60,000

d. 66,000

42. On April 13, 2012, Foley Co. purchased machinery for 240,000. Salvage value was estimated to be

10,000. The machinery will be depreciated over ten years using the double-declining balance

method. If depreciation is computed on the basis of the nearest full month, Foley should record

depreciation expense for 2013 on this machinery of

a. 41,600.

b. 40,800.

c. 41,100.

d. 41,866.

On January 1, 2010, Freetown Company granted to an employee the right to choose either shares or

a cash payment. The choices are as follows:

* Share alternative equal to 20,000 shares with a par value of P30.

* Cash alternative cash payment equal to the market value of 25,000 phantom shares.

The grant is conditional upon the completion of three years service. On grant date, on January 1,

2010, the share price is P35. After taking into account the effect of vesting restrictions, Freetown

Company has estimated that the fair value of the share alternative to be P55.

43. What is the total fair value of the equity component on January 1, 2010 as a result of the

share and cash alternative?

a. 225,000 c. 200,000

b. 125,000 d. 220,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

9

44. What is the compensation expense for the year 2010 if the share price on December 31, 2010

is P42?

a. 1,050,000 c. 350,000

b. 425,000 d. 405,000

45. What is the compensation expense for the year 2011 if the share price on December 31, 2011

is P57?

a. 950,000 c. 600,000

b. 675,000 d. 525,000

46. What is the compensation expense for the year 2012 if the share price on December 31, 2012

is P65?

a. 525,000 c. 675,000

b. 600,000 d. 750,000

47. If the employees choose the cash alternative, what is the cash payment to be made on

December 31, 2012?

a. 1,625,000 c. 1,500,000

b. 1,350,000 d. 1,325,000

48. If the employees choose the share alternative, what is the amount of share premium to be

credited from the issuance of shares?

a. 1,250,000 c. 1,100,000

b. 1,025,000 d. 325,000

49. Nolte Corp.'s 2012 income statement had pretax financial income of 100,000 in its first year of

operations. Nolte uses an accelerated cost recovery method on its tax return and straight-line

depreciation for financial reporting. The differences between the book and tax deductions for

depreciation over the five-year life of the assets acquired in 2012, and the enacted tax rates

for 2012 to 2016 are as follows:

Book Over (Under) Tax Tax Rates

2012 (20,000) 35%

2013 (26,000) 30%

2014 (6,000) 30%

2015 24,000 30%

2016 28,000 30%

There are no other temporary differences. In Nolte's December 31, 2012 balance sheet, the

noncurrent deferred income tax liability and the income taxes currently payable should be

Noncurrent Deferred Income Taxes

Income Tax Liability Currently Payable

a. 15,600 20,000

b. 15,600 28,000

c. 6,000 24,000

d. 6,000 28,000

50. Manchester Company provided the following information for the year ended December 31, 2012:

Net income 2,000,000

Total assets 14,950,000

Share capital 5,600,000

Share premium 2,400,000

Dividends declared 1,200,000

Prior period adjustment for 2011 overdepreciation 500,000

The debt to equity ratio is 30% at December 31, 2012. What was the retained earnings balance

on January 1, 2012?

a. 1,165,000

b. 2,165,000

c. 3,200,000

d. 2,200,000

51.At a lump-sum cost of 36,000, Sealy Company recently purchased the following items for resale:

Item No. of Items Purchased Resale Price Per Unit

M 4,000 2.50

N 2,000 8.00

O 6,000 4.00

The appropriate cost per unit of inventory is:

M N O

a. 2.50 8.00 4.00

b. 1.55 9.93 1.66

c. 1.80 5.76 2.88

d. 3.00 3.00 3.00

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

10

Assume that the following data relate to Bass, Inc. for the year 2012:

Net income (30% tax rate) 3,500,000

Average common shares outstanding 2012 1,000,000 shares

10% cumulative convertible preferred stock:

Convertible into 80,000 shares of common 1,600,000

8% convertible bonds; convertible into 75,000

shares of common 2,500,000

Stock options:

Exercisable at the option price of 25 per share;

average market price in 2012, 30 90,000 shares

____ 52. What is the amount of basic earnings per share?

a. 3.34.

b. 3.50.

c. 2.29.

d. 3.20.

____ 53. What is the amount of diluted earnings per share?

a. 2.92.

b. 3.11.

c. 3.16.

d. 2.97.

54. At December 31, 2012, Mayes stockholders equity was P4,500,000, while total assets was

P500,000 larger than at the beginning of the year. Total liabilities on January 1, 2012 and

December 31, 2012 were P1,400,000 and P1,200,000 respectively. If the dividend declaration

during 2012 exceeded the proceeds from the issuance of ordinary shares by P250,000, how much

is the net income or loss for 2012?

a. 950,000 net income

b. 50,000 net loss

c. 550,000 net income

d. 450,000 net income

55.Baker Corp.'s liability account balances at June 30, 2013 included a 10% note payable in the

amount of 1,500,000. The note is dated October 1, 2011 and is payable in three equal annual

payments of 500,000 plus interest. The first interest and principal payment was made on

October 1, 2012. In Baker's June 30, 2013 balance sheet, what amount should be reported as

accrued interest payable for this note?

a. 112,500.

b. 75,000.

c. 37,500.

d. 25,000.

56. Sachi Corporation is considering the purchase of Adorable Company, whose balance sheet as of

December 31, 2012 is summarized as follows:

Current assets 800,000 Current liabilities 600,000

Fixed assets (net) 1,100,000 Long-term liabilities 700,000

Other assets 700,000 Common stock 850,000

Retained earnings 450,000

Total 2,600,000 Total 2,600,000

The fair market value of the current assets is P1,100,000 because of the undervaluation of

inventory. The normal rate of return on the net assets for the industry is 15% and the average

expected annual earnings for Adorable Company is P300,000. Assuming that the excess earnings

continue for the next five years and Sachi follows the years multiple of excess earnings

approach of computing goodwill, how much would Sachi be willing to pay for the net assets of

Adorable?

a. 2,125,000

b. 1,900,000

c. 2,000,000

d. 2,300,000

57. On December 31, 2012 Bobby Company had 50,000 shares of P100 par value ordinary share capital

outstanding and 30,000 shares of P100 par value 10% noncumulative preference shares. The total

shareholders equity on December 31, 2012 amounted to P12,000,000. The preference shareholders

have a liquidation value of P120 per share and preference dividends have been paid up to December

31, 2012. The book value per share of ordinary share capital on December 31, 2012 should be

a. 168

b. 180

c. 162

d. 240

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

11

Lange Company books and records disclosed following information:

a. Prior to any adjustments, the Retained Earnings account is reproduced below:

RETAINED EARNINGS

Date Particulars Debit Credit Balance

2010

Jan. 1 Balance P580,000

Dec. 31 Net income for the year 310,000 890,000

2011

Jan. 31 Dividends paid 140,000 750,000

Apr. 3 Paid in capital in excess of par 90,000 840,000

Aug. 30 Gain on retirement of preferred stock at

less than issue price

64,500

904,500

Dec. 31 Net loss for the year 205,000 699,500

2012

Jan. 31 Dividends paid 100,000 599,500

Dec. 31 Net loss for the year 165,500 P434,000

b. The company failed to properly recognize accruals and prepayments. Selected accounts

revealed the following information:

2009 2010 2011 2012

1.

Prepaid expenses

P8,500 P6,200 P7,400 P9,500

2.

Accrued expenses

5,400 7,300 8,700 9,000

3.

Unearned income

6,900 7,800 8,900 9,600

4.

Accrued income

4,700 5,600 6,200 7,800

c. Dividends had been declared on December 31 in 2010 and 2011 but had not been

entered in the books until paid.

d. The company purchased a machine worth P270,000 on April 30, 2009. The company

charged the purchase to expense. The machine has an estimated useful life of 3 years.

The company uses the straight-line method and residual values are deemed immaterial.

e. The company received transportation equipment as donation from one of its stockholders

on September 30, 2011. The equipment was used to deliver goods to customers. The

equipment costs P750,000 and has a remaining life of 3 years on the date of donation.

The equipment has a fair value of P240,000 and P30,000 was incurred for registering the

transfer of ownership. The company did not record the donation on its books. The

expenses paid related to the donated equipment were charged to expense.

f. The physical inventory of merchandise had been understated by P64,000 and by P44,500

at the end of 2010 and 2012, respectively.

g. The merchandise inventories at the end of 2011 and 2012 did not include merchandise

that was then in transit shipped FOB shipping point. These shipments of P43,400 and

P32,600 were recorded as purchases in January 2012 and 2013, respectively.

Determine the corrected balances of the following:

58. Retained earnings, 12/31/09

a. 580,900

b. 850,900

c. 790,900

d. 760,900

59. Retained earnings, 12/31/10

a. 976,700

b. 860,700

c. 930,700

d. 720,700

60. Retained earnings, 12/31/11

a. 481,000

b. 411,000

c. 341,000

d. 241,000

61. Retained earnings, 12/31/12

a. 302,700

b. 362,700

c. 252,700

d. 332,700

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

12

62. Lane Corporation has an incentive commission plan for its salesmen, entitling them to an

additional sales commission when actual quarterly sales exceed budgeted estimates. An analysis

of the account "incentive commission expense" for the year ended December 31, 2012, follows:

Amount For Quarter Ended Date Paid

42,000 December 31, 2011 January 23, 2012

36,000 March 31, 2012 April 24, 2012

39,000 June 30, 2012 July 19, 2012

43,000 September 30, 2012 October 22, 2012

The incentive commission for the quarter ended December 31, 2012, was 35,000. This amount

was recorded and paid in January 2013. What amount should Lane report as incentive commission

expense for 2012?

a. 160,000.

b. 118,000.

c. 153,000.

d. 195,000.

In 2012, the initial year of its existence, Hyland Company's accountant, in preparing both the income

statement and the tax return, developed the following list of items causing differences between

accounting and taxable income:

1. The company sells its merchandise on an installment contract basis. In 2012, Hyland elected,

for tax purposes, to report the gross profit from these sales in the years the receivables are

collected. However, for financial statement purposes, the company recognized all the gross

profit in 2012. These procedures created a 240,000 difference between book and taxable

incomes. The future collection of the installment contracts receivables are expected to result

in taxable amounts of 120,000 in each of the next two years. (Note: the company treats

installment contracts receivable as a current asset on its balance sheet.)

2. The company has also chosen to depreciate all of its depreciable assets on an accelerated

basis for tax purposes but on a straight-line basis for accounting purposes. These procedures

resulted in 42,000 excess depreciation for tax purposes over accounting depreciation. The

temporary difference due to excess tax depreciation will reverse equally over the three year

period from 2013-2015.

3. Hyland leased some of its property to Simms Company on July 1, 2012. The lease was to

expire on July 1, 2014 and the monthly rentals were to be 30,000. Simms, however, paid the

first year's rent in advance and Hyland reported this entire amount on its tax return. These

procedures resulted in a 180,000 difference between book and taxable incomes. (Note: this

lease was an operating lease and Hyland classified the unearned rent as a current liability on

its balance sheet.)

4. Hyland owns 150,000 of bonds issued by the DOT upon which 6% interest is paid annually. In

2012, Hyland showed 9,000 of income from the bonds on its income statement but did not

show any of this amount on its tax return. (Note: these bonds are classified as long-term

investments on Hyland's balance sheet.)

5. In 2012, Hyland insured the lives of its chief executives. The premiums paid amounted to

12,000 and this amount was shown as an expense on the income statement. However, this

amount was not deducted on the tax return. The company is the beneficiary.

Hyland Company showed income before income taxes of 900,000. The enacted tax rates are

40% for all years; and that no other differences between book and taxable incomes existed,

except for those mentioned above:

63. What is the income tax payable?

a. 176,400

b. 319,200

c. 361,200

d. 320,400

64. What is the deferred tax liability at the end of 2012?

a. 72,000

b. 112,800

c. 116,400

d. 40,800

65. What is the net deferred tax expense (benefit) for 2012?

a. 72,000

b. 112,800

c. 116,400

d. 40,800

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

13

66. Authentic Book Company obtained the copyright to a textbook written by renowned author Atty.

Jack De Vera, on June 1, 2010. This textbook is one of the most popular and effective reviewers

used by CPA board exam candidates in taxation. The royalty agreement with between Authentic

and Atty. Jack De Vera stipulates for payments of royalties at 20% of future sales of the book, to

be paid twice a year on April 1 for sales in May to October of the preceding year, and on

November 1 for sales in November from the previous year to April of the same year. Authentic

made royalty payments of P500,000 and P700,000 on April 1, 2011 and November 1, 2011,

respectively; and P600,000 and P800,000 on April 1, 2012 and November 1, 2012, respectively.

Atty. Jack De Veras book registered sales for the months of May to October 2012 of P3,000,000

and for November to December 2012, of P800,000. It was also determined that 50% of the

books sold occur in the first two months of the 6-month period. What is the royalty expense of

Authentic Books for the year ended December 31, 2012?

a. 1,400,000

b. 760,000

c. 1,160,000

d. 1,560,000

____ 67. A company has been using the FIFO cost method of inventory valuation since it was

started 10 years ago. Its 2012 ending inventory was 90,000, but it would have been

70,000 if LIFO had been used. Thus, if LIFO had been used, this company's income

before taxes would have been

a. 20,000 less in 2012.

b. 20,000 less over the 10-year period.

c. 20,000 greater over the 10-year period.

d. 20,000 greater in 2012.

68. Kirsten Company purchased machinery that cost P1,200,000 on January 4, 2009. The entire cost

was recorded as an expense. The machinery has a ten-year life and a P150,000 residual value.

The error was discovered on December 20, 2012. Ignoring income tax considerations and before

the correction was made and books were closed on December 31, 2012, Kirsten Companys

retained earnings was understated by

a. 885,000

b. 780,000

c. 1,200,000

d. 420,000

69. The following information was extracted from the accounts of Claw Corporation at December

31, 2012:

CR(DR)

Total reported income since incorporation 1,500,000

Total cash dividends paid (800,000)

Cumulative effect of changes in accounting principle (120,000)

Total stock dividends distributed (200,000)

Prior period adjustment, recorded January 1, 2012 66,000

What should be the balance of retained earnings at December 31, 2012?

a. 446,000.

b. 500,000.

c. 380,000.

d. 566,000.

70. Vera Company has a herd of 100 three year-old oxen on January 1, 2012. During 2012, 50 four-

year-old male oxen were purchased on July 1 for P150,000 each while 20 three and three

quarters year-old oxen were sold on October 1. The fair value less cost to sell regarding oxen for

2012 is as follows:

Three year old ox on January 1, 2012 120,000

Four year old ox on July 1, 2012 150,000

Three and three quarters year old ox on October 1, 2012 130,000

Three year old ox on December 31, 2012 135,000

Four year old ox on December 31, 2012 160,000

Four and a half year old ox on December 31, 2012 170,000

What is the gain from price and physical change that shall be recognized by Vera Company in the

2012 statement of comprehensive income?

a. 2,500,000 and 1,700,000

b. 1,700,000 and 2,500,000

c. 2,000,000 and 3,000,000

d. 3,000,000 and 2,000,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

14

71. On January 1, 2012, Olin Company borrows 2,000,000 from National Bank at 12% annual

interest. In addition, Olin is required to keep a compensatory balance of 200,000 on deposit

at National Bank which will earn interest at 4%. The effective interest that Olin pays on its

2,000,000 loan is

a. 10.0%.

b. 11.6%.

c. 12.0%.

d. 12.8%.

72. If a company purchases merchandise on terms of 2/10, n/30, the cash discount available is

equivalent to what effective annual rate of interest (assuming a 360-day year)?

a. 2%

b. 24%

c. 36%

d. 72%

73. The expenses other than interest expense of Regular Company for the current year is 40% of cost

of sales but only 20% of sales. Interest expense is 5% of sales. The amount of purchases equals

80% of cost of sales. Ending inventory is 120% as much as the beginning inventory. The income

after tax of 30% for the current year is P420,000. What is the amount of sales for the year?

a. 1,200,000

b. 2,400,000

c. 2,500,000

d. 1,680,000

74. Cole Co. pays all salaried employees on a biweekly basis. Overtime pay, however, is paid in the

next biweekly period. Cole accrues salaries expense only at its December 31 year-end. Data

relating to salaries earned in December 2012 are as follows:

Last payroll was paid on 12/26/12, for the 2-week period ended 12/26/12.

Overtime pay earned in the 2-week period ended 12/26/12 was 5,000.

Remaining work days in 2012 were December 29, 30, 31, on which days there was no overtime.

The recurring biweekly salaries total 80,000.

Assuming a five-day work week, Cole should record a liability at December 31, 2012 for accrued

salaries of

a. 24,000.

b. 29,000.

c. 48,000.

d. 53,000.

75. In 2010, Timmy Mining Company purchased property with natural resources for P50,000,000.

The property was relatively close to a large city and had an expected residual value of

P5,000,000. Development cost, tonnage mined and estimated remaining tons for the years 2010

to 2014 are as follows:

Year Development

Cost

Tons

Extracted

Estimated Tons

Remaining

2010 4,000,000 0 5,000,000

2011 6,000,000 1,000,000 4,000,000

2012 5,000,000 2,500,000 1,000,000

2013 2,000,000 1,700,000 300,000

2014 0 300,000 0

How much is the depletion in 2012?

a. 30,000,000

b. 27,500,000

c. 35,000,000

d. 34,375,000

76. Disney Company finished construction of its building on January 1, 2002 at a total cost of

P25,000,000. The building was depreciated over its estimated useful life of 20 years using the

straight-line method with no residual value. The building was subsequently revalued on January

1, 2010 and the revaluation report showed that the asset had a replacement cost of P32,000,000

and was determined to have no change in its useful life. On January 1, 2012 the building was

tested for recoverability and the fair value was ascertained to be P10,000,000 on this date, with

no change on its remaining useful life. What is the impairment loss to be recognized by Disney in

2012?

a. 1,800,000 c. 2,850,000

b. 6,000,000 d. 2,500,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

15

The following information relates to the pension plan for the employees of Mauro Company:

1/1/10 12/31/11 12/31/12

Accum. benefit obligation 2,200,000 2,300,000 3,000,000

Projected benefit obligation 2,325,000 2,490,000 3,335,000

Fair value of plan assets 2,125,000 2,600,000 2,870,000

Market-related value of assets 2,050,000 2,580,000 2,825,000

Unrecognized net (gain) or loss -0- (360,000) (400,000)

Settlement rate (for year) 11% 11%

Expected rate of return (for year) 8% 7%

Mauro estimates that the average remaining service life is 16 years. Mauro's contribution was 315,000

in 2012 and benefits paid were 235,000.

77. The interest cost for 2012 is

a. 224,100.

b. 253,000.

c. 273,900.

d. 366,850.

78. The actual return on plan assets in 2012 is

a. 170,000.

b. 190,000.

c. 245,000.

d. 270,000.

79. Yanina Corporation has the following equity accounts:

Accumulated profits 2,500,000

Asset revaluation reserve 1,000,000

Share capital 5,000,000

Contra equity reserve 500,000

Appropriation reserve 1,500,000

Share premium 3,000,000

Foreign translation reserve - credit 800,000

Treasury shares at cost 400,000

What is Yaninas shareholders equity?

a. 12,900,000

b. 13,900,000

c. 10,100,000

d. 13,300,000

80. At December 31, 2012, Anns Boutique had 1,000 gift certificates outstanding, which had been

sold to customers during 2012 for 50 each. Anns operates on a gross margin of 60% of its sales.

What amount of revenue pertaining to the 1,000 outstanding gift certificates should be deferred

at December 31, 2012?

a. 0.

b. 20,000.

c. 30,000.

d. 50,000.

81. What amount should an individual have in a bank account today before withdrawal if 10,000 is

needed each year for four years with the first withdrawal to be made today and each subsequent

withdrawal at one-year intervals based on 10% interest compounded annually? (The balance in

the bank account should be zero after the fourth withdrawal.)

a. 10,000 + (10,000 0.909) + (10,000 0.826) + (10,000 0.751)

b. 10,000 0.683 4

c. (10,000 0.909) + (10,000 0.826) + (10,000 0.751) + (10,000 0.683)

d. 10,000 0.909 4

82. Kelvin Company uses the composite method of depreciation on its property, plant and equipment

based on a composite rate of 20%. At the beginning of 2012, the total cost of Kelvins

depreciable assets was P5,000,000 and had accumulated depreciation of P2,000,000. Kelvin has

always maintained a 10% residual value for all depreciable assets. During 2012, Kelvin sold fixed

assets with an original cost of P800,000 for P500,000 and acquired assets as replacements with a

total cost of P1,500,000. What is the balance of the accumulated depreciation account of Kelvin

on December 31, 2012?

a. 2,726,000

b. 3,140,000

c. 2,840,000

d. 2,600,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

16

83. The following is the shareholders equity section of Benny Corporation at December 31, 2012:

12% fully participating, cumulative preference shares, P50 par;

authorized 100,000 shares: 15,000 shares issued

750,000

Ordinary shares, P20 par; 90,000 shares issued 1,800,000

Share premium 2,450,000

Total paid in capital 5,000,000

Retained earnings 4,000,000

Less: Cost of 3,000 preference treasury shares 1,000,000

Total shareholders equity 10,000,000

Dividends have not been paid since 2010. On December 31, 2012, Benny wants to pay a cash

dividend of P3.50 a share to ordinary shareholders. How much should be the total amount of

cash dividend to be declared?

a. 564,000 c. 600,000

b. 690,750 d. 615,250

Isaac Co. assigned 500,000 of accounts receivable to Dixon Finance Co. as security for a loan of

420,000. Dixon charged a 2% commission on the amount of the loan; the interest rate on the note

was 10%. During the first month, Isaac collected 110,000 on assigned accounts after deducting 380

of discounts. Isaac accepted returns worth 1,350 and wrote off assigned accounts totaling 3,700.

84. The amount of cash Isaac received from Dixon at the time of the transfer was

a. 378,000.

b. 410,000.

c. 411,600.

d. 420,000.

85. Entries during the first month would include a

a. debit to Cash of 110,380.

b. debit to Bad Debts Expense of 3,700.

c. debit to Allowance for Doubtful Accounts of 3,700.

d. debit to Accounts Receivable of 115,430.

86. On January 1, 2012 Carmelo Company purchased investment securities for P1,500,000. The

securities are classified as trading. By December 31, 2012, the securities had a fair value of

P2,100,000 but had not yet been sold. The company also recognized a P400,000 restructuring

charge during the year. The restructuring charge is composed of an impairment write-down on a

manufacturing facility. Tax rules do not allow a deduction for the write-down unless the facility is

actually sold; the facility was not sold by the end of the year. Excluding the trading securities and

the restructuring the charge, income before taxes for the year was P5,000,000. The income tax

rate for the current year and future years is 30%. What is Carmelos deferred tax expense?

a. 60,000 c. 120,000

b. 300,000 d. 180,000

87. On April 7, 2012, Kaiser Corporation sold a 2,000,000 twenty-year, 8 percent bond issue for

2,120,000. Each 1,000 bond has two detachable warrants, each of which permits the purchase of

one share of the corporation's common stock for 30. The stock has a par value of 25 per share.

Immediately after the sale of the bonds, the corporation's securities had the following market

values:

8% bond without warrants 1,008

Warrants 21

Common stock 28

What accounts should Kaiser credit to record the sale of the bonds?

a. Bonds Payable 2,000,000

Premium on Bonds Payable 77,600

Paid-in CapitalStock Warrants 42,400

b. Bonds Payable 2,000,000

Premium on Bonds Payable 16,000

Paid-in-CapitalStock Warrants 84,000

c. Bonds Payable 2,000,000

Premium on Bonds Payable 35,200

Paid-in CapitalStock Warrants 84,800

d. Bonds Payable 2,000,000

Premiums on Bonds Payable 120,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

17

88. Nevada Company has 40 employees who work 8-hour days and are paid hourly. On January 1,

2010, the company began a program of granting its employees 10 days' paid vacation each year.

Vacation days earned in 2010 may first be taken on January 1, 2011. Information relative to these

employees is as follows:

Hourly Vacation Days Earned Vacation Days Used

Year Wages by Each Employee by Each Employee

2010 P50.00 10 0

2011 55.00 10 8

2012 60.00 10 7

Nevada has chosen to accrue the liability for compensated absences at the current rates of pay in

effect when the compensated time is earned. What is the amount of the accrued liability for

compensated absences that should be reported at December 31, 2012?

a. 280,000

b. 288,000

c. 252,800

d. 276,800

89. Steven Company started its business on January 1, 2012. After considering the collection

experience of other companies in the industry, Steven established an allowance for doubtful

accounts estimated at 5% of credit sales. Outstanding accounts receivable recoded on December

31, 2012 totaled P460,000, while the allowance for doubtful accounts has a credit balance of

P50,000 after recording estimated doubtful accounts expense for December and after writing off

P10,000 of uncollectible accounts.

Further analysis of the companys accounts showed that merchandise purchased in 2012

amounted to P1,800,000 and ending merchandise inventory was P300,000. Goods were sold at

40% above cost. 80% of total sales were on account. Total collections from customers, on the

other hand, excluding proceeds from cash sales, amounted to P1,200,000. Considering the given

data, the accounts receivable and allowance for doubtful accounts are

Accounts Receivable Allowance for Doubtful Accounts

a. 10,000 understated 24,000 understated

b. 10,000 understated 34,000 understated

c. 20,000 understated 24,000 understated

d. 20,000 understated 34,000 understated

90.Oswald Corporation's partial income statement after its first year of operations is as follows:

Income before income taxes 1,750,000

Income tax expense

Current 483,000

Deferred 42,000 525,000

Net income 1,225,000

Oswald uses the straight-line method of depreciation for financial reporting purposes and

accelerated depreciation for tax purposes. The amount charged to depreciation expense on its

books this year was 700,000. No other differences existed between book income and taxable

income except for the amount of depreciation. Assuming a 30% tax rate, what amount was

deducted for depreciation on the corporation's tax return for the current year?

a. 560,000.

b. 665,000.

c. 700,000.

d. 840,000.

Mississippi Company decides to enter the leasing business. The company acquires a specialized

packaging machine for P3,000,000 cash and leases it for a period of six years, after which the

machine is to be returned to Mississippi Company for disposition. The expected guaranteed residual

value of the machine is P200,000. The lease terms are arranged so that Mississippi Company earns a

return of 12%. The present value of 1 at 12% for six periods is .51, and the present value of annuity

advance of 1 at 12% for six periods is 4.60.

91. What is the annual lease payment payable in advance required yielding the desired return?

a. 645,000

b. 630,000

c. 652,174

d. 732,000

92. What is the gross investment in the lease?

a. 3,780,000

b. 3,913,044

c. 3,580,000

d. 3,980,000

MOCK CPA EXAMINATION PRACTICAL ACCOUNTING PROBLEMS I

OCTOBER 2012 (100 ITEMS, 18 PAGES)

for review and practice purposes only

(Not to be assumed as actual examination)

18

93. What is the amount of interest revenue to be recorded in the first year of the lease?

a. 284,400

b. 360,000

c. 347,760

d. 402,000

94.Presented below is information related to Molson, Inc.:

December 31,

2012 2011

Common stock 75,000 60,000

6% Preferred stock 350,000 350,000

Retained earnings (includes net income for current year) 90,000 75,000

Net income for year 60,000 32,000

What is Molsons rate of return on common stock equity for 2012?

a. 48.8% c. 25%

b. 26% d. 22.4%

95. In 2010, Minton Company purchased a tract of land as a possible future plant site. In January,

2012, valuable sulfur deposits were discovered on adjoining property and Minton Company

immediately began explorations on its property. In December, 2012, after incurring 500,000 in

exploration costs, which were accumulated in an expense account, Minton discovered sulfur

deposits appraised at 2,500,000 more than the value of the land. To record the discovery of the

deposits, Minton should

a. Make no entry.

b. Debit 500,000 to an asset account.

c. Debit 2,500,000 to an asset account.

d. Debit 3,000,000 to an asset account.

96. Deltoid Company signed a three-month, zero-interest-bearing note on November 1, 2012 for the

purchase of 40,000 of inventory. The face value of the note was 40,588. Assuming Deltoid used a

Discount on Note Payable account to initially record the note and that the discount will be

amortized equally over the 3-month period, the adjusting entry made at December 31, 2012 will

include a

a. Debit to Discount on Note Payable for 196.

b. Debit to Interest Expense for 392.

c. Credit to Discount on Note Payable for 196.

d. Credit to Interest Expense for 392.

97. Edwards Corporation purchased a new machine on October 31, 2012. A 700 down payment was

made and three monthly installments of 2,100 each are to be made beginning on November 30,

2012. The cash price would have been 6,400. Edwards paid no installation charges under the

monthly payment plan but a 100 installation charge would have been incurred with a cash

purchase. The amount to be capitalized as the cost of the machine on October 31, 2012 would be

a. 7,100.

b. 7,000.

c. 6,500.

d. 6,400.

On January 1, 2012, Gregg Company purchased land for an office site by paying 80,000 cash. Gregg

began construction on the office building on January 1. The following expenditures were incurred for

construction:

Date Expenditures

January 1, 2012 120,000

April 1, 2012 50,000

May 1, 2012 90,000

July 1, 2012 111,000

The office was completed and ready for occupancy on December 31. To help pay for construction,

360,000 was borrowed on January 1, 2012 on a 9%, 3-year note payable. Other than the

construction note, the only debt outstanding during 2012 was a 150,000, 12%, 6-year note payable

dated January 1, 2011.

98. The weighted-average accumulated expenditures on the construction project during 2012

were

a. 192,000. c. 156,000.

b. 1,467,000. d. 348,000.

99. The actual interest cost incurred during 2012 was

a. 45,000. c. 25,200.

b. 50,400. d. 42,000.

100.Assume the weighted-average accumulated expenditures for the construction project are

435,000. The amount of interest cost to be capitalized during 2012 is

a. 39,150. c. 45,000.

b. 41,400. d. 50,400.

You might also like

- P1 AssessmentDocument26 pagesP1 AssessmentRay Jhon OrtizNo ratings yet

- Liabs 2Document3 pagesLiabs 2Iohc NedmiNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- Accounting 106 SeatworkDocument2 pagesAccounting 106 SeatworkLaizashi Carin50% (2)

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocument4 pagesCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNo ratings yet

- Cost Behavior AnalysisDocument18 pagesCost Behavior AnalysiskathleenNo ratings yet

- LecDocument12 pagesLecLorenaTuazonNo ratings yet

- Inventory LatojaDocument2 pagesInventory Latojalisa juganNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- 4 InventoriesDocument5 pages4 InventoriesandreamrieNo ratings yet

- AUDProb TEST BANKDocument28 pagesAUDProb TEST BANKFrancine HollerNo ratings yet

- Ia Test Bank 20 PGDocument20 pagesIa Test Bank 20 PGzee abadillaNo ratings yet

- Intermediate Accounting Prac Mock ExamsDocument72 pagesIntermediate Accounting Prac Mock ExamsIris Claire ClementeNo ratings yet

- Liabilities BSA 5-2sDocument7 pagesLiabilities BSA 5-2sJustine GuilingNo ratings yet

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Document34 pages#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Events After The Reporting Period NCA Held For Disposal Discontinued OperationsDocument2 pagesEvents After The Reporting Period NCA Held For Disposal Discontinued OperationsJeremiah DavidNo ratings yet

- CE On Book Value Per ShareDocument3 pagesCE On Book Value Per SharealyssaNo ratings yet

- Financial assets reclassification and measurementDocument5 pagesFinancial assets reclassification and measurementcourse heroNo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Calculating Investment Income from AssociatesDocument2 pagesCalculating Investment Income from Associatesmiss independent100% (1)

- Consolidated Balance Sheets and Income Statements of Pare and SubsidiaryDocument3 pagesConsolidated Balance Sheets and Income Statements of Pare and SubsidiaryRaymundo Eirah100% (1)

- K12 Philippines Whereabouts PDFDocument37 pagesK12 Philippines Whereabouts PDFsichhahaNo ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- ACTIVITY 3 - Operating Segments PDFDocument3 pagesACTIVITY 3 - Operating Segments PDFEstilo0% (2)

- P1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Document2 pagesP1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Patrick Kyle Agraviador0% (1)

- FAR.2845 Statement of Profit or Loss and OCI PDFDocument6 pagesFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- Accounts payable and accrued liabilities for multiple companiesDocument2 pagesAccounts payable and accrued liabilities for multiple companiesNah HamzaNo ratings yet

- FarDocument14 pagesFarKenneth Robledo100% (1)

- Operating Segment.Document14 pagesOperating Segment.Honey LimNo ratings yet

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconNo ratings yet

- Equity Investments 2019 RecapDocument10 pagesEquity Investments 2019 RecapAlmirah's iCPA ReviewNo ratings yet

- Auditing Problems AP 007 to 010 SolutionsDocument6 pagesAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenNo ratings yet

- Accounting 162 - Material 006: For The Next Few RequirementsDocument3 pagesAccounting 162 - Material 006: For The Next Few RequirementsAngelli LamiqueNo ratings yet

- Rmbe FarDocument15 pagesRmbe FarMiss Fermia0% (1)

- Act-6j03 Comp2 1stsem05-06Document12 pagesAct-6j03 Comp2 1stsem05-06RegenLudeveseNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- Measuring and assessing asset impairment under PAS 36Document15 pagesMeasuring and assessing asset impairment under PAS 36Aliah Jane PalomadoNo ratings yet

- Lanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsDocument22 pagesLanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsFeizhen MaeNo ratings yet

- TOA - Theory of Accounts ReviewDocument7 pagesTOA - Theory of Accounts ReviewAnne Lorrheine CasanosNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Morales, Jonalyn M.Document7 pagesMorales, Jonalyn M.Jonalyn MoralesNo ratings yet

- Junior Philippine Accounting Midterms ReviewDocument5 pagesJunior Philippine Accounting Midterms ReviewezraelydanNo ratings yet

- D8Document11 pagesD8neo14100% (1)

- Investment in Equity SecuritiesDocument11 pagesInvestment in Equity SecuritiesnikNo ratings yet

- Accounting 30 For SetDocument7 pagesAccounting 30 For SetJennywel CaputolanNo ratings yet

- QuestionsDocument16 pagesQuestionsRuby JaneNo ratings yet

- Shareholder's Equity ReviewerDocument16 pagesShareholder's Equity ReviewerJudelle Ibarrientos Garing100% (2)

- DWC Legazpi Practical Accounting One LiabilitiesDocument14 pagesDWC Legazpi Practical Accounting One Liabilitiesyukiro rineva0% (2)

- Investment in Equity - MCDocument5 pagesInvestment in Equity - MCLeisleiRago100% (1)

- Problems Audit of Investments PDFDocument17 pagesProblems Audit of Investments PDFLove alexchelle ducut0% (1)

- 19 - Revaluation and ImpairmentDocument3 pages19 - Revaluation and Impairmentjaymark canayaNo ratings yet

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- Midterm Winter 2013 With Final Winter 2013 For Posting FallDocument10 pagesMidterm Winter 2013 With Final Winter 2013 For Posting FallMiruna CiteaNo ratings yet

- 9.liability Questionnaire QUIZDocument10 pages9.liability Questionnaire QUIZMark GaerlanNo ratings yet

- Wrwftauditing Problems Watitiw: Page 1 of 7Document7 pagesWrwftauditing Problems Watitiw: Page 1 of 7Ronnel TagalogonNo ratings yet

- 2nd Yr Midterm (2nd Sem) ReviewerDocument19 pages2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- Audit of Shareholders EquityDocument6 pagesAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- Prelimx No AnswersDocument7 pagesPrelimx No Answerscarl fuerzasNo ratings yet

- Sharecropping Simulation ActivityDocument5 pagesSharecropping Simulation Activityapi-282568260100% (1)

- All Template Chapter 6 As of September 10 2019Document32 pagesAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Incorporating The Venture Backed LLCDocument30 pagesIncorporating The Venture Backed LLCRoger RoyseNo ratings yet

- Thrift BankDocument23 pagesThrift BankErl JohnNo ratings yet

- Research Grant GuidelinesDocument12 pagesResearch Grant GuidelinessckamoteNo ratings yet

- Solution Manual For Financial Acct2 2nd Edition by GodwinDocument11 pagesSolution Manual For Financial Acct2 2nd Edition by GodwinToni Johnston100% (36)

- Case Competition SummaryDocument3 pagesCase Competition SummaryRichard WangNo ratings yet

- Treasury Stock ENtriesDocument3 pagesTreasury Stock ENtrieseuphoria2No ratings yet

- WorldCom The Expense Recognition PrincipleDocument6 pagesWorldCom The Expense Recognition PrincipleSvetlana Svetlichnaya100% (1)

- 466 8Document9 pages466 8Prathap H GowdaNo ratings yet

- Letter To The Mayor (Sunshine City) FinalDocument2 pagesLetter To The Mayor (Sunshine City) Finalapi-288606068No ratings yet

- Iqta SystemDocument10 pagesIqta SystemAnurag Sindhal75% (4)

- About Warren BuffetDocument14 pagesAbout Warren BuffetPadregarcia Mps100% (1)

- Details of State Pension SchemesDocument30 pagesDetails of State Pension SchemesBoreda RahulNo ratings yet

- University of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsDocument29 pagesUniversity of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsBright Ikpang100% (2)

- Withholding Tax Guide - Japan PDFDocument45 pagesWithholding Tax Guide - Japan PDFSteven OhNo ratings yet

- Cost TB C02 CarterDocument23 pagesCost TB C02 CarterArya Stark100% (1)

- Forensic Auditing: Tech Tennis Case StudyDocument4 pagesForensic Auditing: Tech Tennis Case StudypthavNo ratings yet

- Taxsmile Notes On Income TaxDocument46 pagesTaxsmile Notes On Income Taxaman16755747No ratings yet

- 47 RP V Soriano PDFDocument12 pages47 RP V Soriano PDFBrenda de la GenteNo ratings yet

- NLC Payroll EtcDocument8 pagesNLC Payroll EtcJessica CrisostomoNo ratings yet

- An Introduction to Financial Management Principles and ConceptsDocument30 pagesAn Introduction to Financial Management Principles and ConceptsGautami JhingaranNo ratings yet

- LSW/ValuTeachers DeceitDocument6 pagesLSW/ValuTeachers DeceitScott DauenhauerNo ratings yet

- Better Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeDocument1 pageBetter Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeHellen DeaNo ratings yet

- Payslip November 2023Document2 pagesPayslip November 2023renukakaur533No ratings yet

- Calpine Corp. The Evolution From Project To Corporate FinanceDocument4 pagesCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Theoretical Framework of The StudyDocument16 pagesTheoretical Framework of The StudyKurt CaneroNo ratings yet

- Basics of Demand and SupplyDocument29 pagesBasics of Demand and SupplyNuahs Magahat100% (2)

- Madhya Pradesh Vision DocumentDocument44 pagesMadhya Pradesh Vision Documentsam_bhopNo ratings yet

- 03 AGS General Principles of Taxation VI C PDFDocument10 pages03 AGS General Principles of Taxation VI C PDFGabriel Jhick SaliwanNo ratings yet