Professional Documents

Culture Documents

Study Note 5.2 (353-378)

Uploaded by

s4sahithOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study Note 5.2 (353-378)

Uploaded by

s4sahithCopyright:

Available Formats

5.2.

DEPARTMENTAL ACCOUNTS

Introduction :

Departmental Accounts helps in identifying the performance of each department. Each

department is considered to be an Activity Centre. It is a tool which helps management in

decision-making.

Departmentation offers the following advantages —

a. Proper Allocation : Expenses that relate to a particular department are estimated on an

exact basis. Hence, cost and profits of each department is estimated more accurately.

b. Control : Availability of separate cost and profit figures for each department facilitates

control. Proper control and fixation of responsibility is easier.

c. Proper absorption : The processing times of different products in different departments

may vary. Specific cost analysis on a department-wise basis facilitates scientific cost

absorption and cost assignment. This provides the right platform for product- pricing

decisions also.

Bases of Appointment of Expenses :

Nature of Expense Treatment Examples

Specific Charge When a certain expense is • Depreciation of machinery on

specifically incurred for one value of machinery;

department, it should be charged • Insurance on stock on the value

in full to that department only. of stock.

Shared Common When benefits of certain expenses • Rent is apportioned based on

Expenses are expenses shared by all Floor Space occupied by each

departments and are capable of department.

precise allocation, they should • Lighting Expenses is

be apportioned to all depart- apportioned basis of on the

ments on an appropriate and number of light points (or) on the

equitable basis. basis of floor area.

• Canteen subsidy on the basis of

No. of workers.

General Expenses Common expenses which are not • Administration Expenses like

capable of accurate Office Salaries may be

apportionment to various apportioned equally among all

departments are dealt with departments or alternatively

judiciously, based on facts and debited to General P&L Account.

circumstances of each case. • Selling and Distribution

Expenses may be apportioned

based on Sales ratio.

Inter-Departmental Transfer :

1. Methods of Transfer Pricing : Transfers made by one department to another may be

recorded either at (a) Cost or (b) Market Price or (c) any other appropriate method e.g.

Cost + Agreed Profit Mark Up.

Financial Accounting 353

DEPARTMENTAL ACCOUNTS

2. Accounting : When transfers are made, their value should be credited as Income of the

Transferring Department and debited as cost of the Recipient Department. When profit is

added in the inter-departmental transfers, the loading (unrealised profit) included in the

Closing Stock should be reversed, by debiting the General P&L Account and crediting

Stock Reserve Account.

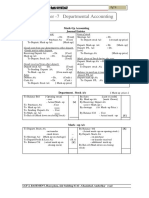

Illustrations 1 :

Snow White Ltd has two departments — Cloth and Readymade Clothes. Ready Made Clothes

are made by the Firm itself out of cloth supplied by the Cloth Department at its usual selling

price. From the following figures, prepare Departmental Trading and Profit and Loss Accounts

for the year ended 31st March :

Particulars Cloth Dept Readymade Clothes

st

Opening Stock on 1 April 3,00,000 50,000

Purchases 20,00,000 15,000

Sales 22,00,000 4,50,000

Transfer to Readymade Clothes Department 3,00,000 —

Expenses - Manufacturing — 60,000

Selling 20,000 6,000

Closing Stock on 31st March 2,00,000 60,000

The Stock in the Readymade Clothes Department may be considered as consisting of 75%

Cloth and 25% other expenses. The Cloth Department earned Gross Profit at the rate of 15%

during the year. General Expenses of the business as a whole came to Rs.1,10,000.

Solution :

Departmental Trading and Profit and Loss A/c for the year ending 31st March (Rs.)

Particulars Cloth RM Total Particulars Cloth RM Total

To Opg. Stock 3,00,000 50,000 3,50,000 By Sales 22,00,000 4,50,000 26,50,000

To Purchases 20,00,000 15,000 20,15,000 By Tfr. to 3,00,000 — 3,00,000

RM

To Tfr from — 3, 00,000 3,00,000 By Closing 2,00,000 60,000 2,60,000

Cloth Dept. Stock

To Mfg. Exps. 60,000 60,000

To Gross Profit 4, 00,000 85,000 4,85,000

Total 27,00,000 5,10,000 32,10,000 Total 27,00,000 5,10,000 32,10,000

To Selling Exp. 20,000 6,000 26,000 By Gross 4,00,000 85,000 4,85,000

Profit

To Profit c/d 3,80,000 79,000 4,59,000

Total 4,00,000 85,000 4,85,000 Total 4,00,000 85,000 4,85,000

To Gen. Exp. 1,10,000 By Profit b/d 4,59,000

To Stock Reserve 1,575

(See Note below)

To Net profit 3,47,425

Total 4,59,000 Total 4,59,000

Note 1 : Stock Reserve to be additionally provided is 7,200 – 5,625 = Rs. 1,575; calculated as

under :

354 Fianancial Accounting

Particulars On Opg Stock On Closing Stock

Rate of GP on Sales in Cloth Dept Given = 15% 4,00,000 ÷ 25,00,000 = 16%

Element of Cloth Stock in 75% of 50,000 = 37,500 75% of 60,000 = 45,000

Readymade Clothes

Stock Reserve required 37,500 × 15% = 5,625 45,000 × 16% = 7,200

to be maintained

Note 2: In this case, it is possible to ascertain the Reserve already created against Unrealised

Profit in the Opening Stock. In the absence of information, the Reserve should be calculated on

the difference in the Opening and Closing Stocks i.e. Rs. 10,000 in this question. Since the Closing

Stock has increased, the Reserve calculated would be debited to P&L A/c. In case of decrease

in Stocks, the Reserve would be credited to P&L A/c.

Illustration 2 :

The Trading and Profit & Loss Account of Bindas Ltd. for the year ending 31st March is as

under :

Purchases Rs. Sales Rs.

Transistors (A) 1,60,000 Transistors (A) 1,75,000

Tape Recorders (B) 1,25,000 Tape Recorders (B) 1,40,000

Spare parts for servicing and 80,000 Servicing and repair jobs (C) 35,000

repair job (C)

Salaries and wages 48,000 Stock on 31st March Transistors (A) 60,100

Rent 10,800 Tape Recorders (B) 20,300

Sundry Expenses 11,000 Spare parts for servicing & 44,600

repair jobs

Net Profit 40,200

Total 4,75,000 Total 4,75,000

Prepare Departmental Accounts for each of the three Departments A, B and C mentioned

above after taking into consideration the following :

(a) Transistors and Tape Recorders are sold at the Showroom. Servicing and Repairs are carried

out at the Workshop.

(b) Salaries and wages comprise as follows: Showroom 3/4th and Workshop 1/4th

It was decided to allocate the Showroom Salaries and Wages in ratio 1:2 between

Departments A and B.

(c) Workshop Rent is Rs.500 per month. Showroom Rent is to be divided equally between

Departments A and B.

(d) Sundry Expenses are to be allocated on the basis of the turnover of each Department.

Financial Accounting 355

DEPARTMENTAL ACCOUNTS

Solution :

Departmental P&L Accounts for the year ending 31st March (Amount in Rs.)

Particulars A B C Particulars A B C

To Purchases 1,60,000 1,25,000 By Sales 1,75,000 1,40,000

To Spares 80,000 By Services 35,000

To Sal. & Wages 12,000 24,000 12,000 By Closing Stock 60,100 20,300 44,600

To Rent 2,400 2,400 6,000 By Net Loss 19,500

To Sundry Exps.* 5,500 4,400 1,100

To Net Profit 55,200 4,500

Total 2,35,100 1,60,300 99,100 Total 2,35,100 1,60,300 99,100

Note : Sundry Expenses are apportioned in the ratio of Turnover (5: 4: 1) i.e. 1,75,000: 1,40,000:

35,000.

Illustration 3 :

Samudra & Co, a Partnership Firm has three departments viz. K, L, M which are under the

charge of the Partners B, C and D respectively. The following Consolidated P&L Account is

given below :

Particulars Rs. Particulars Rs.

To Opening Stocks (Notel) 81,890 By Sales (Note 7) 4,00,000

To Purchases (Note 2) 2,65,700 By Closing Stocks (Note 8) 89,000

To Salaries and Wages (Note 3) 48,000 By Discounts Received (Note10) 600

To Rent Expenses (Note 4) 10,800

To Selling Expenses (Note 5) 14,400

To Discount Allowed (Note 5) 1,200

To Depreciation (Note 6) 750

To Net Profit for the year 67,060

Total 4,89,800 Total 4,89,800

From the above Account and the following additional information, prepare the Departmental

P&L Accounts for the year ended 31st March -

1. Break up of Opening Stock Department wise is: K - Rs.37,890; L - Rs.24,000 and M - Rs.20,000.

2. Total Purchases were as under: K - Rs.1,40,700; L - Rs.80,600; M - Rs.44,400.

3. Salaries and Wages include Rs. 12,000 wages of Department M. The balance Salaries should

be apportioned to the three departments as 4:4:1.

4. Rent is to be apportioned in the ratio of floor space which is as 2:2:5.

5. Selling Expenses and Discount Allowed are to be apportioned in the ratio of Turnover.

6. Depreciation on assets should be equally charged to the three departments.

7. Sales made by the three departments were: K - Rs.1,80,000; L - Rs.1,30,000 and M - Rs.90,000.

8. Break up of Closing Stock Department wise is: K - 45,100; L - Rs.22,300 and M - Rs.21,600.

The Closing Stock of Department M includes Rs.5,700 goods transferred from Department

K. However, Opening Stock does not include any goods transferred from other departments.

9. Departments K and L sold goods worth Rs.10,700 and Rs.600 respectively to Department

M.

356 Fianancial Accounting

10. Discounts received are traceable to Departments K, L and M as Rs.400; Rs.250 and

Rs.150 respectively.

11. Partners are to share the profits as under: (a) 75% of the Profits of Departments K, L and M

to the respective Partner in Charge, (b) Balance Profits to be credited as 2:1:1.

Solution :

1. Departmental P&L Accounts for the year ending 31st March (Amount in Rs.)

Particulars K L M Particulars K L M

To Opening Stock 37,890 24,000 20,000 By Sales 1,80,000 1,30,000 90,000

To Purchases 1,40,700 80,600 44,400 By Transfer 10,700 600 —

To Inter-Dept Trf — — 11,300 By Closing Stock 45,100 22,300 21,600

To Wages — — 12,000

To Gross Profit c/d 57,210 48,300 23,900

Total 235,800 1,52,900 1,11,600 Total 2,35,800 1,52,900 1,11,600

To Salaries (4:4:1) 16,000 16,000 4,000 By Gross 57,210 48,300 23,900

Profit b/d

To Rent (2:2:5) 2,400 2,400 6,000 By Discounts reed 400 250 150

To Selling Exp 6,480 4,680 3,240

To Disc. (18:13:9) 540 390 270

To Depreciation 250 250 250.

To Net Profit c/d 31,940 24,830 10,290

Total 57,610 48,550 24,050 Total 57,610 48,550 24,050

2. Computation of Stock Reserve

From the above profits, Stock Reserve should be eliminated on the Closing Stock.

• GP Rate in Department K = 57,210 - 1,90,700 = 30%.

• Stock Reserve = 30% on Rs.5,700 = Rs.1,710.

3. Profit and Loss Appropriation Account (Rs.)

Particulars Rs. Particulars Rs.

To Stock Reserve 1,710 By Profit b/d 67,060

To Profits transferred to Capital: (31940 + 24830 + 10290)

B : 75% of 31,940 = 23,955

C : 75% of 24,830 = 18,623

D : 75% of 10,290 = 7,718 50,296

To balance profits trfd in 2: 1: 1

B : 50% of 15,054 = 7,527

C : 25% of 15,054 = 3,764

D : 25% of 15,054= 3,764 (bal.fig) 15,054

Total 67,060 Total 67,060

Financial Accounting 357

DEPARTMENTAL ACCOUNTS

Illustration 4 :

Anand Ltd, has 3 departments X, Y and Z The following information is provided:

Particulars X Y Z

Opening Stock 3,000 4,000 6,000

Consumption of direct materials 8,000 12,000 —

Wages 5,000 10,000 —

Closing Stock 4,000 14,000 8,000

Sales — — 34,000

Stocks of each Department are valued at cost to the Department concerned. Stocks of X are

transferred to Y at a margin of 50% above Department cost. Stocks of Y are transferred to Z at a

margin of 10% above departmental cost.

Other expenses were :

Salaries 2,000

Printing and Stationery 1,000

Rent 6,000

Interest paid 4,000

Depreciation 3,000

Allocate expenses in the ratio of Departmental Gross Profits. Opening figures of reserves for

unrealised profits on departmental stocks were: Department Y-Rs.1,000; Department Z-Rs.2,000.

Prepare Departmental Trading and Profit and Loss Account for the year.

Solution :

1. Departmental Trading Account for the year (Rs.)

Particulars X Y Z Total Particulars X Y Z Total

To Opening Stock 3,000 4,000 6,000 13,000 By Internal 18,000 33,000 — 51,000

Transfer

To Direct Material 8,000 12,000 — 20,000 By Sales — — 34,000 34,000

To Wages 5,000 10,000 — 15,000 By Closing 4,000 14,000 8,000 26,000

Stock

To Intl. Transfer —8,000 33,000 51,000

To Gross Profit 6,000 3,000 3,000 12,000

Total 22,000 47,000 42,000 1,11,000 Total 22,000 47,000 42,000 1,11,000

2. Departmental Profit and Loss Account for the year (Rs.)

Particulars X Y Z Total Particulars X Y Z Total

To Salaries 1,000 500 500 2,000 By Gross 6,000 3,000 3,000 12,000

Profit b/d

To Prntg. & Stnry. 500 250 250 1,000 By Net loss 2,000 1,000 1,000 4,000

To Rent 3,000 1,500 1,500 6,000

To Interest paid 2,000 1,000 1,000 4,000

To Depreciation 1,500 750 750 3,000

Total 8,000 4,000 4,000 16,000 Total 8,000 4,000 4,000 16,000

358 Fianancial Accounting

3. Calculation of Unrealised Profit on Closing Stock of Dept Y

Particulars Department Y

Value of Closing Stock as given above 14,000

Total Cost of the Department 12,000 + 10,000 + 18,000 = 40,000

Cost of Internal Transfer in above 18,000

Value of Transferred in Material in Closing Stock 14,000 x 18,000 / 40,000 = 6,300

Unrealised Profit of Dept X included in above 6,300 x 50/150 = 2,100

4. Calculation of Unrealised Profit on Closing Stock of Dept Z

Particulars Department Z

Value of Closing Stock as given above 8,000

Profits of Department Y included in above 10% Margin = 8,000 x 10/110 =727

Profits of Department X included in above (8,000 – 727)×18.000/40,000×50/150 = 1,091

Total Unrealised Profit included in Dept Z Stock 1,818

5. Adjustment of Reserves on Opening and Closing Stocks

Particulars Rs. Particulars Rs.

To Net Loss b/d 4,000 By Reserve on Opening Stock (1000 + 2000)3,000

To Reserve on Closing Stock 3,918 By Net Loss after adjustment of Reserves 4,918

Total 7,918 Total 7 918

Illustration 5 :

Pooma Ltd. has 2 departments M & S. From the following particulars, prepare

Departmental Trading Account & Consolidated Trading Account for the year ending 31st

March.

Particulars M S

Opening Stock 20,000 12,000

Purchases 92,000 68,000

Carriage Inwards 2,000 2,000

Wages 12,000 8,000

Sales (excluding inter departmental transfers) 140,000 112,000

Purchased Goods transferred

By S to M 10,000 —

By M to S — 8,000

Finished Goods transferred

By S to M 35,000 —

By M to S — 40,000

Return of Finished Goods

By S to M 10,000 —

By M to S — 7,000

Closing Stock

Purchased Goods 4,500 6,000

Finished Goods 24,000 14,000

Purchased Goods have been transferred at their respective departmental Purchase Cost &

Finished Goods at Departmental Market Price. 20% of Finished Stock (Closing) at each

Department represented Finished Goods received from the other Department.

Financial Accounting 359

DEPARTMENTAL ACCOUNTS

Solution :

1. Departmental Trading, Profit & Loss Account for the year ended 31st March

Particulars M S Particulars M S

To Opening Stock 20,000 12,000 By Sales 140,000 112,000

To Purchases 92,000 68,000 By Transfer:

Purchased Goods 8,000 10,000

Finished Goods 35,000 40,000

To Transfer : By Closing Stock

Purchased Goods 10,000 8,000 Purchased Goods 4,500 6,000

Finished Goods 40,000 35,000 Finished Goods 24,000 14,000

To Wages 12,000 8,000 By Return of 10,000 7,000

To Carriage Inwards 2,000 2,000 Finished Goods

To Return of Finished Goods 7,000 10,000

To Gross Profit 38,500 46,000

Total 221,500 189,000 Total 221,500 189,000

2. Calculation of Gross Profit Ratio

Particulars Mohan Sohan

Sales 140,000 112,000

Add: Transfer of Finished Goods 35,000 40,000

Less: Return of Finished Goods (7,000) (10,000)

Net Sales [A] 168,000 142,000

Gross Profit [B] as calculated below 38,500 46,000

Gross Profit Ratio [B ÷ A] 22.9% 32.4%

3. Consolidated Trading Account for the year ended 31st March

Particulars Amount Particulars Amount

To Opening Stock 32,000 By Sales (1,40,000+1,12,000) 2,52,000

To Purchases 160,000 By Closing Stock

To Wages 20,000 By Purchase Goods 10,500

To Carriage Inwards 4,000 By Finished Goods 38,000 48,500

To Stock Reserve

[24,000×20%] × 32.4% 1,555

[14,000×20%] × 22.9% 641

To Net Profit 82,304

Total 300,500 Total 300,500

Illustration 6 :

Khushi & Co has 2 departments A & B. Department A sells goods to Department B at normal

selling prices. From the following particulars prepare Departmental Trading & Profit & Loss

Account for the year ended 31st March & also ascertain the Net Profit to be transferred to

Balance Sheet.

360 Fianancial Accounting

Particulars A B

Opening stock NIL 1,00,000

Purchases 2,00,000 23,00,000

Goods from Department B 7,00,000 —

Wages 1,60,000 1,00,000

Travelling Expenses 1,40,000 10,000

Closing stock at cost to the Department 1,80,000 5,00,000

Sales 15,00,000 23,00,000

Printing & Stationery 16,000 20,000

The following expenses incurred for the both departments were not apportioned between

the departments :

Particulars Amount

Salaries 2,70,000

Advertisement Expenses 90,000

General Expenses 8,00,000

Depreciation should be charged at 25% on the machinery value of Rs.48,000. Advertisement

Expenses are to be apportioned in the turnover ratio, Salaries in 1:2 ratio & Depreciation in 1:3

ratio between Departments A & B. General Expenses are to be apportioned in 1:3 ratio.

Solution :

1. Departmental Trading, P&L Account of Khushi & Co for the year ended 31st March

(Rs.)

Particulars A B Particulars A B

To Opening Stock 1,00,000 By Sales 15,00,000 23,00,000

To Purchases 2,00,000 23,00,000 By Internal Transfer 7,00,000

To Wages 1,60,000 1,00,000 By Closing Stock 1,80,000 5,00,000

To Internal Transfer 7,00,000

To Gross Profit 6,20,000 10,00,000

Total 16,80,000 35,00,000 Total 16,80,000 35,00,000

To Traveling Expenses 1,40,000 10,000 By Gross Profit b/d 6,20,000 10,00,000

To Printing & Stationery 16,000 20,000

To Salaries 90,000 1,80,000

To Advertisement 35,526 54,474

Expenses

To General Expenses 2,00,000 6,00,000

To Depreciation (1:3) 3,000 9,000

To Net Profit 1,35,474 1,26,526

Total 6,20,000 10,00,000 Total 6,20,000 10,00,000

Note :

1. GP Ratio of Department B = Gross Profit * Total Sales = 10,00,000 + (23,00,000 + 7,00,000)

= 33.33%

2. Advertisement Expenses are apportioned in the ratio of External Sales i.e. 15 : 23.

Financial Accounting 361

DEPARTMENTAL ACCOUNTS

2. Computation of Unrealised Profit on Closing Stock :

Particulars Department A

Value of Closing Stock as given above 1,80,000

Total Material Cost of Department a 2,00,000 + 7,00,000 = 9,00,000

Material Cost of Internal Transfer in above 7,00,000

Value of Transferred in Material in Closing Stock 1,80,000×7,00,000/9,00,000 = 1,40,000

Unrealised Profit of Dept B included in above 1,40,000×1/3 = 46,667

(GP Ratio of Department B = 33.33% or l/3rd)

3. Profit after adjustment of Unrealised Profit

To Stock Reserve (as calculated above) 46,667 By Net Profit b/d 2,62,000

To Net Profit c/d to Balance Sheet 2,15,333 [1,26,526+1,35,474]

Total 2,62,000 Total 2,62,000

Illustration 7 :

Department X sells goods to Department Y at a profit of 25% on cost & to Department Z at a

profit of 10% on cost. Department Y sells goods to X & Z at a profit of 15% & 20% sales,

respectively. Department Z charges 20% & 25% profit on cost to Department X & Y, respectively.

Department Managers are entitled to 10% Commission on Net Profit subject to Unrealised

Profits on Departmental sales being eliminated.

Departmental profits after charging manager’s commission, bur before adjustment of

unrealised profits are : X = Rs. 36,000; Y = Rs. 27,000; Z = Rs. 18,000

Stocks lying at different departments at the year end are as under :

Particulars X Y Z

Transfer from Department X — 15,000 11,000

Transfer from Department Y 14,000 — 12,000

Transfer from Department Z 6,000 5,000 —

Find out the correct Departmental Profits after charging Managers’ Commission.

Solution :

1. Computation of Unrealised Profits

Particulars of transfer to Department X Department Y Department Z Total

From Department X to Y and Z 15,000 × 25/125 11,000 × 10/110

at 25% and 10% of Cost Nil =3,000 =1,000 4,000

From Department Y to X and Z 14,000 × 15/100 12,000 × 20/100

at 15% and 20% of Sales =2,100 Nil =2,400 4,500

From Department Z to X and Y 6,000×20/120 5,000×25/125

at 20% and 25% of Cost =1,000 =1,000 Nil 2,000

362 Fianancial Accounting

2. Computation of Correct Departmental Profits after charging

Manager’s Commission correctly

Particulars Department X Department Y Department Z

Profits after charging Mgr Commission 36,000 27,000 18,000

Add : Wrong Commission = 10% of Profits = 1/9 x 36,000 1/9 x 27,000 1/9x18,000

1/10 on Profits before charging commission =4,000 =3,000 =2,000

= 1/9 on Profits after charging commission

Profits before charging commission 40,000 30,000 20,000

Less : Unrealised Profits i.e. Stock Reserve 4,000 4,500 2,000

Profits qualifying for commission 36,000 25,500 18,000

Less : Commission at 10% of above 3,600 2,550 1,800

Correct Profits after charging commission 32,400 22,950 16,200

Illustration 8 :

The following details are available in respect of a business for a year.

Department Opening Stock Purchase Sales

X 120 units 1,000 units 1,020 units at Rs.20.00 each

Y 80 units 2,000 units 1,920 units at Rs.22.50 each

Z 152 units 2,400 units 2,496 units at Rs.25.00 each

The total value of purchases is Rs.1,00,000. It is observed that the rate of Gross Profit is the

same in each department. Prepare Departmental Trading Account for the above year.

Solution :

1. Computation of Closing Stock Quantity (in units)

Particulars X Y Z

Opening Stock 120 80 152

Add: Purchases 1,000 2,000 2,400

Less : Units Sold (1,020) (1,920) (2,496)

Closing Stock 100 160 56

2. Computation of Gross Profit Ratio

We are informed that the GP Ratio is the same for all departments. Selling Price is given for

each department’s products but the Sale Quantity is different from that of Purchase Quantity.

To find the Uniform GP Rate, the sale value of Purchase Quantity should be compared with the

Total Cost of Purchase, as under:

Assuming all purchases are sold, the sale proceeds would be

Particulars Sale Value of Purchase Quantity Amount

Department X 1,000 units at Rs.20.00 20,000

Department Y 2,000 units at Rs.22.50 45,000

Department Z 2,400 units at Rs.25.00 60,000

Total Sale Value of Purchase Quantity 125,000

Less : Cost of Purchase 1,00,000

Gross Profit Amount 25,000

Gross Profit Ratio 25,000 ÷ 1,25,000 20% of Selling Price

Financial Accounting 363

DEPARTMENTAL ACCOUNTS

3. Computation of Profit and Cost for each article

Department Selling Price Profit at 1/5 of SP Cost = Sales – Profit

Department X Rs.20.00 1/5 of Rs.20.00 = 4.00 Rs. 16.00

Department Y Rs.22.50 1/5 of Rs.22.50 = 4.50 Rs.18.00

Department Z Rs.25.00 1/5 of Rs.25.00 = 5.00 Rs.20.00

4. Departmental Trading Account for the year

Particulars X Y Z Total Particulars X Y Z Total

To Opg. stock 1,920 1,440 3,040 6,400 By Sales 20,400 43,200 62,400 126,000

To Purchase 16,000 36,000 48,000 100,000 By Clg. stock 1,600 2,880 1,120 5,600

To Gross Profit 4,080 8,640 12,480 25,200

Total 22,000 46,080 63,520 131,600 Total 22,000 46,080 63,520 131,600

Opening and Closing Stocks are valued at Cost as indicated in WN 3 above. Sale Amount in

the Trading Account is computed for the Sale Quantity only. Gross Profit is calculated at 20%

of Sale Value.

Illustration 9 :

Anumod Ltd. is a retail store having 2 Departments P and Q. The Company maintains at

Memorandum Stock Account & Memorandum Mark Up Account for each of the Departments.

Supplies issued to the Departments are debited to the Memorandum Stock Account of the

Department at Cost plus Mark Up, and Departmental Sales are credited to this Account. The

Mark Up on supplies issued to the Departments is credited to the Mark Up Account for the

Department. When it is necessary to reduce the Selling Price below the Normal Selling Price,

i.e. Cost plus Mark Up, the reduction (Mark Down) is entered in the Memorandum Stock

Account & Mark Up Account. Department P has a mark up of 33-1/3% on Cost, and Department

Q has a mark-up of 50% on cost.

The following information has been extracted from the records of the Company for a year

ending 31st December.

Particulars P Q

Opening Stock (at Cost) 24,000 36,000

Purchases 162,000 190,000

Sales 210,000 285,000

1. Opening Stock of Department P includes goods on which the Selling Price has been marked

down by Rs.510. These goods were sold in January at the reduced Selling Price.

2. Certain goods purchased during the year for Rs.2,700 for Department P, were transferred

during the year to Department Q & sold for Rs.4,500. Purchases & Sales are recorded in the

Purchases of Department P & the Sales of Department Q respectively, but no entries have

been made in respect of the transfer.

364 Fianancial Accounting

3. Goods purchased during the year were marked down as follows:

Particulars P Q

Cost 8,000 21,000

Mark down 800 4,100

At the end of the year there were some items in the stock of Department Q, which had

been marked down to Rs.2,300. With this exception, all goods marked down during the

year were sold during the year at reduced prices.

4. During stock-taking at the end of the year, goods which had cost Rs.240 were found to be

missing in Department P. It was determined that loss should be regarded as irrecoverable.

5. The Closing Stock in both Departments are to be valued at Cost for the purpose of the

annual accounts.

Prepare for the year ended 31st December the following accounts - (a) Trading Account; (b)

Memorandum Stock Account and (c) Memorandum Mark Up Account.

Solution :

1. Memorandum Stock Account (in Rs.)

Particulars P Q Particulars P Q

To balance b/d (givgn cost 32,000 54,000 By balance b/d (mark 510

+ 33-1/3% & 50% m-up) down - given)

To Purchases (given) 162,000 190,000 By Sales (given) 210,000 285,000

To Memorandum Mark Up 54,000 95,000 By Internal 2,700 —

(33-1/3% & 50% on pure.) Transfer -per contra

To Internal Transfer - per — 2,700 By Memorandum Mark 900

contra Up (M-up on Transfer)

To Memorandum Mark Up — 1,350 By Memorandum Mark 800 4,100

(50% on Internal Tfr) Up (Mark Down - given)

To Memorandum Mark Up — 344 By Abnormal Loss-Cost 240 —

(on Marked Down Goods transferred to P & L A/c

still in stock - See Note 1)

By Memorandum Mark 80

Up ( M-up on Stock Lost)

By balance c/d (Closing 32,770 54,294

Stock - balancing figure)

Total 248,000 343,394 Total 248.000 343,394

Note 1 : Mark Down in Unsold Stock of Department Q

Total Mark down × Value of Stock 4.100×2.300

— — — — — — — — — — — — — — — = — — — — — = Rs.344

Value of Mark down goods 27,400*

* Value of Mark Down Goods = Cost Add: Normal Mark Up 50% Less: Amount Marked

Down

= Rs.21,000 Add: Rs. 10,500 Less: Rs.4,100 (given) = Rs.27,400

Financial Accounting 365

DEPARTMENTAL ACCOUNTS

Note 2 : Valuation of Closing Stack at cost;

Department P Q

Closing Stock at Invoice Price as per Memorandum 32,770 54,294

Stock A/c

Closing Stock at Cost after reducing 1/3 and 1/2 32,770 – 1/4 54,294 - 1/3

on cost = 1/4 and 1/3 on the Invoice Price respectively thereon = 24,578 thereon = 36,196

2. Trading Account for the year ended 31st December (in Rs.)

Particulars P Q Particulars P Q

To Opening Stock 24,000 36,000 By Sales 210,000 285,000

To Purchases 162,000 190,000 By Internal Transfer 2,700 —

To Internal Transfer — 2,700 By Abnormal Loss 240 —

To Gross Profit 51,518 92,496 By Closing Stock (Note 2) 24,578 36,196

Total 237,518 321,196 Total 237,518 321,196

3. Memorandum Mark Up Account (in Rs.)

Particulars P Q Particulars P Q

To balance b/d (Mark 510 — By balance b/d (33-1/3% 8,000 18,000

Down-given - per contra) and 50% on cost given)

To Memorandum Stock 900 By Memorandum Stock 54,000 95,000

A/c (M-up on Transfer) (Mark Up on Purchase)

To Memorandum Stock 800 4,100 By Memorandum Stock 1,350

A/c (Mark Down - given) (Mark Up on Int. transfer)

To Memorandum Stock 80 — By Memorandum Stock 344

A/c (M-up on Goods Lost) A/c (marked down goods

still in stock)

To Gross Profit (as above) 51,518 92,496

To balance c/d (bal. fig.) 8,192 18,098

Total 62,000 114,694 Total 62,000 114,694

4. Confirmation / Verification of Gross Profit

Department P Q

Sales (given) 210,000 285,000

Add back : Reduction/Mark down 510 + 800= 1,310 4,100-344 = 3,756

Total 211,310 288,756

Normal Gross Profit at 1/4 and (1/4) = 52,828 (1/3) = 96,252

1/3 of above

Less : Reduction / Mark down 1,310 3,756

Gross Profit (as per Memo Mark Up a/c) 51,518 92,496

366 Fianancial Accounting

Illustration 10 :

Z Ltd., has 3 departments, X, Y, Z. The following information is provided :

X Y Z

Rs. Rs. Rs.

Opening Stock 3,000 4,000 6,000

Consumption of direct materials 8,000 12,000 —

Wages 5,000 10,000 —

Closing Stock 4,000 14,000 8,000

Sales — — 34,000

Stock of each department is valued at cost to the department connected. Stocks of X

department are transferred to Y at a margin of 50% above departmental cost. Stocks of Y

department are transferred to Z department at a margin of 10% above departmental cost. Other

expenses were : Salaries Rs. 2,000, Pringing & Stationery Rs. 1,000, Rent Rs. 6,000, Interest paid

Rs. 4,000, Depreciation Rs. 3,000, Allocate expenses in the ratio of departmental gross profit.

Opening figures of reserve for unrealised profits on departmental stocks were : Department Y

Rs. 1,000 ; Department Z Rs. 2,000.

Required : Prepare Departmental Trading and Profit & Loss Accounts for the year ended

March 31, 2008.

Departmental Trading and Profit & Loss Acconts

Dr. for the year ended 31st March, 2008 Cr.

Particulars X Y Z Total Particulars X Y Z Total

Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs

To Opening Stock : 3,000 4,000 6,000 13,000 By Internal b/d 18,000 33,000 — 51,000

To Direct Material By Sales — — 34,000 34,000

considered 8,000 12,000 — 20,000 By Closing Stock 4,000 14,000 8,000 26,000

To Wages 5,000 10,000 — 15,000

To Internal Transfer — 18,000 33,000 51,000

To Gross Profit c/d 6,000 3,000 3,000 12,000

22,000 47,000 42,0001,11,000 22,000 47,000 42,000 1,11,000

To Salaries 1,000 500 500 2,000 By Gross Profit b/d 6,000 3,000 3,000 12,000

To Printing & Stationery 500 250 250 1,000 By Net Loss c/d 2,000 1,000 1,000 4,000

To Rent 3,000 1,500 1,500 6,000

To Depreciation 1,500 750 750 3,000

To Interest paid 2,000 1,000 1,000 4,000

8,000 4,000 4,000 16,000 8,000 4,000 4,000 16,000

To Net Loss b/d 4,000 By Provision for

To Provision for unrealised profit

unrealised profit on Opening Stock 3,000

on Closing Stock 3,918 By Balance transferred to

Profit & Loss A/c 4,918

7,918 7,918

Working Notes :

(i) FIFO method for stock issue has been assumed. Alternatively this question could have

been solved by assuming other methods for stock issue like LIFO Basis, Weighted

Average basis, etc.

Financial Accounting 367

DEPARTMENTAL ACCOUNTS

(ii) Calculation of unrealised profit on Closing Stock of Deptt. Y Rs.

Current cost incurred by Dept. Y (Rs. 12,000 + Rs. 10,000 + Rs. 18,000) 40,000

Profit included in Above (Rs. 18,000 × 50/150) 6,000

Profit included in Closing Stock of Rs. 14,000

(Rs. 6,000 × Rs. 14,000/Rs. 40,000) 2,100

(iii) Calculation of unrealised profit on Closing Stock of Dept C Rs.

Current Cost incurred by Dept. Z 33,000

Profit of Dept. B included in above (Rs. 33,000 × 10/110) 3,000

Cost element of Dept. Y included in current cost (Rs. 33,000 – 3,000) 30,000

Profit of Dept. a included in above cost (Rs. 6,000 × Rs. 30,000/Rs. 40,000)

Total Profit included in current cost of Dept. Z (Rs. 3,000 + Rs. 4,500) 7,500

Unrealised profit included in closing stock of

Rs. 8,000 (Rs. 7,500×Rs. 8,000/Rs. 33,000) 1,818

(iv) Total unrealised profit (Rs. 2,1000 + Rs. 1,818) 3,918

Illustration 11 :

X Limited is a retail organisation with several departments. Goods supplied to each

department are debited to a Memorandum Departmental Stock Account at cost, plus fixed

percentage (make-up) to give the normal selling price. The mark up is credited to a Memorandum

Departmental “Mark-up Account”. Any reduction in selling prices (mark-down) will require

adjustment in the stock account and in mark-up account. The mark up for Department A for

the last three years has been 40%. Figures relevant to Department A for the ended 31st Dec.

2008 were as follows :

Stcok 1st January 2008 at Cost, Rs. 80,000, Purchases at Cost Rs. 1,80,000, Sales Rs. 3,20,000.

It is further ascertained that :

(a) Goods purchased in the period were marked down by Rs. 1,400 from a cost of Rs. 16,000.

Marked-down stock costing Rs. 4,000 remained unsold on 31st December 2008.

(b) Stock shortages at the year end, which had cost Rs. 1,200 were to be written off.

(c) Stock at 1st Jan. 2008 including goods costing Rs. 8,200 had been sold during the year

and has been mark down in the selling price by Rs. 740. The ramaining stock had been

sold during the year.

(d) The departmental closing stock is to be valued at cost subject to adjustments for mark-

up and mark-down.

Required : Prepare (i) A Departmental Trading Account (ii) A Memorandum Stock Account

(iii) A Memorandum Mark-up Account for the year 2008.

Solution :

(i) Departmental Trading Account

Dr. for the year ended 31st December, 2008 Cr.

Particulars Rs. Particulars Rs.

To Opening Stock 80,000 By Sales 3,20,000

To Purchases 1,80,000 By Sortage 1,200

To Gross Profit c/d 90,150 By Closing stock

(Rs. 40,180 – Rs. 11,230) 28,950

3,50,150 3,50,150

368 Fianancial Accounting

Dr. (ii) Memorandum Departmental Stock Account (At Selling Price) Cr.

Particulars Rs. Particulars Rs.

To Balance b/d By Profit & Loss A/c 1,200

(Rs. 80,000 + Rs. 32,000) 1,12,000 (Cost of Shortage)

To Purchases By Memorandum Departmantal

(Rs. 1,80,000 + Rs. 72,000) 2,52,000 Mark-up A/c 480

(Load on Shortage)

By Mark-up A/c 1,400

(Mark Down in Current

Purchases)

By Debtors A/c (Sales) 3,20,000

Mark-up A/c

(Mark Down on Opening

Stock)

By Balance c/d 40,180

3,64,000 3,64,000

Dr. (iii) Memorandum Departmental Mark up Account Cr.

Particulars Rs. Particulars Rs.

To Memorandum Departmental By Balance b/d

Stock A/c (Rs. 1,200×40/100) 480 (Rs. 1,12,000×40/140) 32,000

To Memorandum Departmental By Memorandum Departmental

Stock A/c 1,400 Stock A/c 72,000

To Memorandum Departmental (Rs. 2,52,000×40/140)

Stock A/c 740

To Gross Profit transferred to

Profit & Loss A/c 90,150

To Balance c/d

[(Rs. 40,180+Rs. 350)×40/140

– (Rs. 350) 11,230

1,04,000 1,04,000

Working Note :

(i) Calculation of Cost of sales Rs.

a.Sales as per Books 3,20,000

b.Add : Mark-down in opening stock (given) 740

c.Add : Mark-down in sales out of current Purchases

(Rs. 1,400×12,000/16,000) 1,050

d.Value of sales if there was no mark-down (a+b+c) 3,21,790

e.Less : Gross Profit (40/140 of Rs. 3,21,790) subject to Mark Down

(Rs. 740 + Rs. 1,050) 91,940

f.Cost of sales (d - e) 2,29,850

(ii) Calculation of Closing Stock Rs.

a.Opening Stock 80,000

b.Add : Purchases 1,80,000

Financial Accounting 369

DEPARTMENTAL ACCOUNTS

c. Less : Cost of Sales 2,29,850

d. Less : Shortage 1,200

e. Closing Stock (a+b–c–d) 28,950

Illustration 12 :

Southern Store Ltd. is a retail store operating two departments. The company maintains

Memorandum Stock account and Memorandum Mark-up account for each of the departments.

Supplies issued to the department are debited to the Memorandum Stock account of the

department at cost plus the Mark-up, and departmental sales are credited to this account. The

mark-up on supplies issued to the departments is credited to the Mark-up account for the

department. When it is necessary to reduce the selling price below the normal selling price, i.e.

cost plus Mark-up, the reduction (mark down) is entered in the Memorandum Stock account

and in the mark-up account. Department Y has Mark-up of 33-1/3% on cost, and Department

Z 50% on cost. The following information has been extracted from the records of Southern

Store Ltd. for the year ended 31st December, 2008.

Department Department

Y Z

Rs. Rs.

Stock, 1st January, 2008 at cost 24,000 36,000

Purchases 1,62,000 1,90,000

Sales 2,10,000 2,85,000

(a) The stock of Department Y on 1st january, 2008 included goods on which the selling

price has been marked down by Rs. 510. These goods were sold in January, 2008 at the

reduced price.

(b) Certain goods purchased in 2008 for Rs. 2,700 for Department Y, were transferred during

the year to Department Z, and sold for Rs. 4,050. Purchase and sale are recorded in the

purchases of Department Y and the sales of Department Z respectively, but no entries in

respect of the transfer have been made.

(c) Goods purchased in 2008 were marked down as follows :

Department Y Department Z

Rs. Rs.

Cost 8,000 21,000

Mark down 800 4,100

At the end of the year there were some items in the stock of Department Z, which had

been marked down to Rs. 2,300. With this exception all goods marked down in 2008,

were sold during the year at the reduced prices.

(d) During stock taking on 31st December 2008, goods which had cost Rs. 240 were found

to be missing in department Y. It was determined that the loss should be regarded as

irrecoverable.

(e) The closing stock in both departments are to be valued at cost for the purpose of the

annual accounts.

Required : Prepare for each department for the year ended 31st December, 2008 :

(i) a Trading Account, (ii) a Memorandum Stock Account, and (iii) a Memorandum Mark-

up Account.

370 Fianancial Accounting

Solution :

Southern Stores Ltd.

Dr. Trading Account for the year ended 31st December, 2008 Cr.

Particulars Dept. Y Dept. Z Particulars Dept. Y Dept. Z

Rs. Rs. Rs. Rs.

To Opening Stock 24,000 36,000 By Sales 2,10,000 2,85,000

To Purchases 1,62,0001,90,000 By Transfer to Dept. Z 2,700 —

To Transfer from Y Dept. — 2,700 By Goods Lost 240 —

To Gross Profit c/d 51,518 92,496 By Closing Stock

(at cost) 24,578 36,196

2,37,518 3,21,196 2,37,518 3,21,196

Dr. Memorandum Stock Account (At Selling Price) Cr.

Particulars Dept. Y Dept. Z Particulars Dept. Y Dept. Z

Rs. Rs. Rs. Rs.

To Balance b/d By Balance b/d 510

(Cost + Mark-up) 32,000 54,000 By Sales 2,10,000 2,85,000

To Purchases By Transfer 2,7000

(Cost) 1,62,000 1,90,000 By Memorandum

To Memorandum Mark-up A/c

mark-up A/c (on transfer) 900

(on purchases) 54,000 95,000 By Memorandum

To Transfer 2,700 Mark-up A/c 800 4,100

To Memorandum (Marked down on

Mark-up A/c (on t/f) 1,350 current purchasers)

By P & L A/c

(Cost & Shortage) 240

To Memorandum By Memorandum

Mark-up A/c Mark-up A/c

(on Marked down (on lost Stock) 80

goods still in Stock) 344 By Balance c/d

(Closing Stock) 32,770 54,294

2,48,000 3,43,394 2,48,000 3,43,394

Financial Accounting 371

DEPARTMENTAL ACCOUNTS

Dr. Memorandum Mark-up Account Cr.

Particulars Dept. Y Dept. Z Particulars Dept. Y Dept. Z

Rs. Rs. Rs. Rs.

To Balance b/d 510 By Balance b/d 8,000 18,000

To Memorandum By Memorandum

Stock A/c (Mark-up 900 Stock A/c

on Transfer) (purchase) 54,000 95,000

To Memorandum By Memorandum

Stock A/c (Mark down Stock A/c 1,350

on Current Purchases) 800 4,100 (Mark-up on transfer)

To Memorandum By Memorandum

Stock A/c Stock A/c

(Mark down on (Marked down on

goods lost) 80 goods still in Stock) 344

To Gross Profit

(Balancing Figure) 51,518 92,496

To Balance c/d 8,192 18,098

62,000 1,14,694 62,000 1,14,694

Working Notes :

(i) Calculation of Closing Stock at Cost Y Dept. (Rs.) Z Dept. (Rs.)

Calculation of Closing Stock at

Invoice price 32,770 54,294

Calculation of Closing

Stock at Cost 32,770×3/4 = Rs. 24,57854,294×2/3 = 36,196

(ii) Total Mark down × Value of Stock 4,100×2,300

— — — — — — — — — — — — — — — = — — — — — = Rs.344

Value of Mark down goods 27,400*

(iii) Verification of Gross Profit Y Dept. (Rs.) Z Dept. (Rs.)

Sales 2,10,000 2,85,000

Add : Reduction 510 —

Add : Mark down 800 3,756

2,11,310 2,88,756

Gross Profit (1/4) 52,828 (1/3) 96,252

Less : Mark down 1,310 3,756

Gross Profit as per Memorandum

Mark up Account 51,518 92,496

Illustration 13 :

X Ltd., has a factory with two manufacturing Departments ‘X’ and ‘Y’. Part of the output of

Department X is transferred to Department Y for further procesing and the balance is directly

transferred to selling Department. The entire production of Department Y is directly transferred

to the selling Department. Inter departmental stock transfers are made as follows :

X Department to Y Department at 33-1,3% over Departmental Cost.

X Department to selling department at 50% over Departmental Cost.

372 Fianancial Accounting

Y Department to selling department at 25% over Departmental Cost.

The following information is given for the year ended 31st March, 2008.

Particulars Detp. X Dept. Y Selling Dept.

Units Rs. Units Rs. Units Rs.

Opening Stock of Finished Goods 60 60,000 20 40,000 50 1,28,000

Opening Stock of Raw Materials — — — — —

Raw material Consumed — 1,82,000 — 20,000 — —

Labour Charges — 70,000 — 32,000 — —

Sales — — — — 120 4,80,000

Closing Stock of Finished Goods 40 — 50 — 60 —

Out of the total transfer by X Department, 30 units were transferred to selling department,

while the reamining to Department Y. The per unit material and labout consumption in X

Department on production to be transferred directly to selling department is 300 per cent of the

labour and material consumption on units transferred to Y Department. General Administration

expenses Rs. 80,000.

Required : Prepare Departmental Profit and Loss Account and General Profit and Loss

Account for the year ended 31.3.2008.

Solution :

Departmental Profit and Loss Account

Dr. for the year ended 31st March, 2008 Cr.

X Dept. Y Dept. Selling Dept. X Dept. Y Dept. Sell Dept.

Particulars Qty. Rs. Qty. Rs. Qty. Rs. Particulars Qty. Rs. Qty. Rs. Qty. Rs.

To Opening stock 6 0 60,000 2 0 40,000 5 0 1,28,000 By Stock

To Raw Material 160 3,70,000 100 2,50,000 — —

consumed 1,82,000 — 20,000 — — By Sales — — — — 120 4,80,000

To Units By Closing

produced 140 — — — — — Stock 40 48,000 50 1,00,000 60 1,80,000

To Labour

Charges 70,000 — 32,000 — —

To Stock

Transferred

From X Dept. 130 2,08,000 30 1,62,00

To Stock

Transferred

From Y Dept. 100 2,50,000

To Departmental

Profit t/f to

General

P & L A/C 1,06,000 — 50,000 — 1,20,000

200 4,18,000 150 3,50,000 180 6,60,000 200 4,18,000 150 3,50,000 180 6,60,000

Financial Accounting 373

DEPARTMENTAL ACCOUNTS

General Profit and Loss Account

Dr. for the year ended 31st March, 2008 Cr.

Particulars Rs. Particulars Rs.

To General Adm. Expenses 80,000 By Profit transferrd from :

To Stock Reserve for Closing Stock X Dept. 1,06,000

on Dept. Y 12,000 Y Dept. 50,000

on Selling Dept. 18,175 Selling Dept. 1,20,000

To Net profit 1,65,825

2,76,000 2,76,000

Working Notes :

(a) Selling Dept.

Particulars Units Particulars Units

Opening Stock 50 Sales 120

T/f from X Dept. 30 Closing Stock 60

T/f from Y Dept. (Balancing figure) 100

180 180

(b) Y Dept.

Particulars Units Particulars Units

Opening Stock 20 T/f to Selling Dept. 100

T/f from X Dept. 130 Closing Stock 50

150 150

(c) X Dept.

Particulars Units Particulars Units

Opening Stock 60 T/f to Selling Dept. 30

Production (Balancing figure) 140 T/f to Y Dept. 130

Closing Stock 40

200 200

(d) Total Equivalent units produced in X Dept. in terms of those t/f to Y Dept.

= Equivalent units of those t/f to Sell Dept. + t/f to Y Dept. + Closing Stock.

= (30 × 300/100) + 130 + 40 = 260

(e) Calculation of Transfer Prices and Closing Stock.

374 Fianancial Accounting

X Dept. Y Dept. Selling Dept.

Rs. Rs. Rs.

A Cost of Opening Stock 60,000 40,000 1,28,000

B Add : Cost of Raw Materials Consumed 1,82,000 20,000 —

C Add : Labour Charges 70,000 32,000 —

D Add : T/f from X Dept. — 2,08,000 1,62,000

E Add : T/f form Y Dept. — — 2,50,000

F Total Cost (A+B+C+D+E) 3,12,000 3,00,000 5,40,000

G Equivalant Units 260 150 180

H Average Cost per Equivalent Unit (F/G) 1,200 2,000 3,000

I Transfer Price of 130 Units t/f to Dept. Y

(a) Cost of 130 Units (130×Rs. 1,200) 1,56,000

(b) Add : Profit element @ 33-1/3% 52,000

2,08,000

J Transfer Price of Units t/f to Selling Dept.

(a) Cost of Units t/f 1,08,000

(b) Add : Profit element 54,000 50,000

1,62,000 2,50,000

K Closing Stock 48,000 1,00,000 1,80,000

(40×Rs. 1,200) (50×Rs. 2,000) (60×Rs. 3,000)

(f) Unrealised Profit on Increase in Closing Stock of Y Dept. (Rs. 1,00,000 – Rs. 40,000)

A Current Cost incurred by Dept. Y

= Rs. 20,000 + Rs. 32,000 + Rs. 2,08,000 = Rs. 2,60,000

B Profit charged by Dept. X included in above (Rs. 2,08,000 × 1/4) = Rs. 52,000

C Profit included in Increase in Closing Stock.

= (Rs. 52,000 × Rs. 60,000/Rs. 2,60,000) = Rs. 12,000

(g) Profit Included in output transferred by Y Deptt. to Selling Dept.

A Transfer Price = Rs. 2,50,000

B Profit of Dept. Y included in Above (Rs. 2,50,000 × 25/125) = Rs. 50,000

C Cost Element of Dept. X in Transfer Price (Rs. 2,50,000 – Rs. 50,000) = Rs. 2,00,000

D Profit of Dept. X included in above

(Rs. 2,00,000 × Rs. 52,000/Rs. 2,60,000) = Rs. 40,000

E Total Profit Included in Transfer price (Rs. 50,000 + Rs. 40,000) = Rs. 90,000

(h) Profit Included in output transferred by X Dept. to Selling Dept.

= (Rs. 1,62,000 × 50/150) = Rs. 54,000

(i) Total Profit included in output transferred to Selling Dept.

= Rs. 90,000 + Rs. 54,000 = Rs. 1,44,000

(j) Total Transfer Price for the Transfer made by X Dept. and Y Dept.

= Rs. 1,62,000 + Rs. 2,50,000 = Rs. 4,12,000

(k) Unrealised Profit included in increas in Closing Stock of Sell Dept.

= Rs. 1,44,000 × Rs. 52,000/Rs. 4,12,000 = Rs. 18,175

Financial Accounting 375

DEPARTMENTAL ACCOUNTS

EXERCISE

Problem 1 : X Ltd. provides you the following information.

Stock as on 1.1.2008 Purchase (for Rs. 4,00,000) Sales

Department A 120 units 1000 Units 1020 units @ Rs. 80.00

Department B 80 units 2000 Units 1920 units @ Rs. 90.50

Department C 152 units 2400 Units 2496 units @ Rs. 100.00

The rate of gross profit is the same in each case.

Required : Prepare Departmental Trading Account for the year 2008.

Problem 2 : Zeenat is earning uniform rate of gross profit in all three departmens he is

handing. Following are the relevant details :

Purchase : Dept. A 15,000 cartons

Dept. R 20,000 cartons

Dept. Z 15,000 cartons

The total cost of the purchase amounted to Rs. 6,00,000.

Sales : Dept. A 16,000 cartons at Rs. 20 per carton

Dept. R 22,000 cartons at Rs. 15 per carton

Dept. Z 17,000 cartons at Rs. 10 per carton

Details of opening stock : Dept. A 4,000 cartons

Dept. R 5,000 cartons

Dept. Z 4,000 cartons

Required : Prepare the trading account for three department :

Problem 3 : Messers D, B and R carried on a business of Drapers and Tailors in Delhi; D was

in charge of Department “A” dealing in cloth. B of Department “B” for selling garments and

R of Department “C” the tailoring section. It had been agreed that each of the three partners

would reveive 75% of the profits disclosed by accounts of the department of which he was in

charge and the balance of the profits would be shared in the proportion : D 1/2, B 1/4 and

R 1/4. The following is the Trading and Profit and Loss Account of the firm for the six

months ended 30th September, 2008.

Dr. Trading and Profit and Loss Account Cr.

for the year ended 30.09.08

Particulars Rs. Particulars Rs.

To Opening Stock : By Sales :

Cloth (A) 37,890 Cloth (A) 1,80,000

Ready-made Garments (B) 24,000 Ready-made Garments (B) 1,30,000

Tailoring Jobs (C) 20,000 Tailoring Jobs (C) 90,000

To Purchases : By Discount received 800

Cloth (A) 1,40,700 By Closing Stock :

Ready-made Garments (B) 80,600 Cloth (A) 45,100

Tailoring Goods (c) 44,400 Ready-made Garments (B) 22,300

To Salaries and Wages 48,000 Tailoring Jobs (C) including

To Advertising 2,400 Rs. 5,700 for goods transferred

To Rent 10,800 from department (A)] 21,600

376 Fianancial Accounting

To Discount Allowed 1,200

To Sundry Expenses 12,000

To Depreciation on Furniture

and Fittings 750

To Net Profit 67,060

4,89,800 4,89,800

After consideration of the following, prepare Departmental Accounts and Profit and Loss

Appropriation Account.

(i) Cloth of the value of Rs. 10,700 and other goods of the value of Rs. 600 were transferred

at selling price by Departments A and B respectively to Department C.

(ii) Cloth and garments are sold in the show-room. Tailoring work is carried out in the

workshop.

(iii) The details of salaries and wages were as follows :

(a) General Office 50%, show-room 25% and 25% for workshop 75% of which is for

tailoring alone.

(b) Allocate General Office Expenses, in the proportion of 3 : 2 : 1 among the Departments

A, B, C.

(c) Distribute show-room expenses in the proportion of 1 : 2 between Departments A and B.

(d) the workshop rent is Rs. 1,000 per month the rent of the General Office and Show-

room is to be divided equally between Department A and B

(e) Depreciation charges are to be allocated equally amongst the three Departments.

(f) All other expenses are to be allocated on the basis of turnover.

(g) Discounts received are to be credited to the three Departments as follows : A Rs. 400;

B Rs. 250; C Rs. 150.

(h) The opening stock of Department C does not include any goods transferred from

Department A.

Problem 4 : M/s Bright and Co, had four departments A, B, C and D. Each department

being managed by a departmental managar whose commission was 10% of the respective

departmental profit, subject to a minimum of Rs. 6,000 in each case. Interdepartmental

transfers took place at a ‘loaded’ price as follows :

From Department A to Department B 10% above cost

From Department A to Department D 20% above cost

From Department C to Department D 20% above cost

From Department C to Department B 20% above cost

For the year ending on 31st March, 2008 the firm had already prepared and closed the

departmental Trading and Profit and Loss Account. Subsequently, it was discovered that

the closing stocks of departments had included interdepartmentally transferred goods at

loaded price instead of cost price. From the following information, prepare a statement

recomputing the departmental profit or loss :

Dept. A Dept. B Dept. C Dept. D

Rs. Rs. Rs. Rs.

Final Profit (Loss) (38,000) 50,400 72,000 1,08,000

Inter departmental transfers included 70,000 — 4,800

at loaded price in the departmental stock (Rs. 22,000 from (Rs. 3,600 from

Dept. A and Dept. C and

Rs. 48,000 from Rs. 1,200 from

Dept. C Dept. A)

Financial Accounting 377

DEPARTMENTAL ACCOUNTS

Problem 5 : X Ltd., has two departments A and B. From the following particulars, prepare

the Consolidated Trading Account and Departmental Trading Account for the year ending

on 31st Dec., 2008.

A B

Rs. Rs.

Opening stock (at cost) 20,000 12,000

Purchases 92,000 12,000

Sales 1,40,000 1,12,000

Wages 12,000 8,000

Carriage 2,000 2,000

Closing Stock :

(i) Purchased goods 4,500 6,000

(ii) Finished goods 24,000 14,000

Purchased goods transferred :

by B to A 10,000

by A to B 8,000

Finished goods transferred :

by A to B 35,000

by B to A 40,000

Return of finished goods :

by A to B 10,000

by B to A 7,000

You are informed that purchased goods have been transferred mutually at their respective

departmental purchased cost and finished goods at departmental market price and that

20%of the finished stock (closing) at each department represented finished goods received

from the other department.

Problem 6 : Department X sells goods to Department Y at a profit of 25% on cost and to

Department Z at 10% profit on cost. Department Y sells goods to X and Z at a profit of 15%

and 20% on sales, respectively. Department Z charges 20% and 25% profit on cost to

Department X and Y, respectively.

Department Managers are entitled to 10% commission on net profit subject to unrealised

profit on departmental sales being eliminated. Departmental profits after charging Managers’

commission, but before adjustment of unrealised profit are as under :

Rs.

Department X 36,000

Deapartment Y 27,000

Department Z 18,000

Stock lying at different departments at the end of the year are as under :

Dept. X Dept. Y Dept. Z

Rs. Rs. Rs.

Transfer from Department X — 15,000 11,000

Transfer from Department Y 14,000 — 12,000

Transfer from Department Z 6,000 5,000 —

378 Fianancial Accounting

You might also like

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- DEPARTMENTAL ACCOUNTSDocument17 pagesDEPARTMENTAL ACCOUNTSAyush AcharyaNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- 2 Insurance F PDFDocument42 pages2 Insurance F PDFjashveer rekhi17% (6)

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- Partnership Dec 2020 UpdatedDocument46 pagesPartnership Dec 2020 Updatedbinu100% (4)

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Problems On Internal ReconstructionDocument24 pagesProblems On Internal ReconstructionYashodhan Mithare100% (4)

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Home Work Fire Insurance ClaimDocument21 pagesHome Work Fire Insurance ClaimHetvi Vora80% (5)

- Investment Accounts PDFDocument35 pagesInvestment Accounts PDFRam Iyer80% (10)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- 6.46 Accounting - Advanced Partnership AccountsDocument28 pages6.46 Accounting - Advanced Partnership AccountsDivakara ReddyNo ratings yet

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Branch AccountingDocument44 pagesBranch Accountingaruna2707100% (1)

- Operating CostingDocument34 pagesOperating Costinganon_672065362No ratings yet

- Chartered Accountancy Professional CAP-II TitleDocument104 pagesChartered Accountancy Professional CAP-II TitleBAZINGANo ratings yet

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- As 11 Question 12 SolutionDocument3 pagesAs 11 Question 12 SolutionDebjit Raha100% (1)

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Contract Costing: Practical ProblemsDocument28 pagesContract Costing: Practical ProblemsHarshit Aggarwal79% (14)

- Chapter 9 Accounting For Branches Including Foreign Branches PMDocument48 pagesChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- 47 Branch AccountsDocument53 pages47 Branch AccountsShivaram Krishnan70% (10)

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- PartnershipDocument28 pagesPartnershipAdi Murthy100% (2)

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- Pre-Incorporation Profits and LossesDocument37 pagesPre-Incorporation Profits and LossesGokarakonda Sandeep100% (1)

- Departmental Trading and Profit and Loss AccountDocument10 pagesDepartmental Trading and Profit and Loss AccountKulwant Singh29% (7)

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- Calculate earnings under different payment systemsDocument54 pagesCalculate earnings under different payment systemsSelvakumar ThangarajNo ratings yet

- Chapter 12 Service CostingDocument3 pagesChapter 12 Service CostingMS Raju100% (1)

- Capital Gains IllustrationDocument15 pagesCapital Gains IllustrationSarvar PathanNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- Branch: ? AccountingDocument36 pagesBranch: ? AccountingbinuNo ratings yet

- CG Extra SumsDocument19 pagesCG Extra SumsPruthil Monpariya0% (1)

- Hire Purchase Accounting MethodsDocument26 pagesHire Purchase Accounting MethodsULTIMATE FACTS HINDINo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Over Heads Additional Sums PDFDocument40 pagesOver Heads Additional Sums PDFShiva AP100% (1)

- Accounting Entries for Company AmalgamationDocument5 pagesAccounting Entries for Company AmalgamationBCS71% (7)

- Module 6Document50 pagesModule 6rohit saini100% (3)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Departmental Accounting ProblemsDocument12 pagesDepartmental Accounting ProblemsRajesh NangaliaNo ratings yet

- Departmental Accounting InsightsDocument12 pagesDepartmental Accounting InsightsAnu 2255No ratings yet

- Variable Costing, Cost Allocation and Master BudgetDocument17 pagesVariable Costing, Cost Allocation and Master BudgetUpendra Prasad SinghNo ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- Management Accounting Extends Cost AccountingDocument6 pagesManagement Accounting Extends Cost AccountingchitkarashellyNo ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- NewDocument2 pagesNews4sahithNo ratings yet

- Study Note 9.2, Page 673-680Document8 pagesStudy Note 9.2, Page 673-680s4sahithNo ratings yet

- Study Note 9.1, Page 647-672Document26 pagesStudy Note 9.1, Page 647-672s4sahithNo ratings yet

- Study Note 7.1, Page 470 508Document39 pagesStudy Note 7.1, Page 470 508s4sahithNo ratings yet

- Study Note 4.5, Page (290-327)Document38 pagesStudy Note 4.5, Page (290-327)s4sahith100% (1)

- Study Note 8, Page 565-646Document82 pagesStudy Note 8, Page 565-646s4sahithNo ratings yet

- Study Note - 7.4, Page 542-564Document23 pagesStudy Note - 7.4, Page 542-564s4sahithNo ratings yet

- Study Note 7.2, Page 523-534Document12 pagesStudy Note 7.2, Page 523-534s4sahithNo ratings yet

- Study Note - 7.3, Page 535-541Document7 pagesStudy Note - 7.3, Page 535-541s4sahith100% (1)

- Study Note - 7.2 Page (509-522)Document14 pagesStudy Note - 7.2 Page (509-522)s4sahithNo ratings yet

- Study Note 5.1 (328-352)Document25 pagesStudy Note 5.1 (328-352)s4sahithNo ratings yet

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- Study Note 2.1 Page (60-79)Document20 pagesStudy Note 2.1 Page (60-79)s4sahith88% (8)

- Study Note 4.2, Page 169-197Document29 pagesStudy Note 4.2, Page 169-197s4sahith0% (1)

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- Studdy Note 7Document42 pagesStuddy Note 7s4sahith100% (1)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Study Note 4.1, Page 143-168Document26 pagesStudy Note 4.1, Page 143-168s4sahith40% (5)

- Studdy Note 9Document19 pagesStuddy Note 9s4sahithNo ratings yet

- Study Note 2.2 Page (80-113)Document34 pagesStudy Note 2.2 Page (80-113)s4sahithNo ratings yet

- Study Note 1.4, Page 47 59Document13 pagesStudy Note 1.4, Page 47 59s4sahithNo ratings yet

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- Study Note-1.3, Page 33-46Document14 pagesStudy Note-1.3, Page 33-46s4sahithNo ratings yet

- Studdy Note 8Document59 pagesStuddy Note 8s4sahithNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Studdy Note 6Document54 pagesStuddy Note 6s4sahithNo ratings yet

- Study Bote-1.1, Page 1-11Document11 pagesStudy Bote-1.1, Page 1-11s4sahithNo ratings yet

- Studdy Note 5Document22 pagesStuddy Note 5s4sahithNo ratings yet

- Front PageDocument2 pagesFront Pages4sahithNo ratings yet

- Histstats Colonial 1970Document1,298 pagesHiststats Colonial 1970Gustavo Adolfo Moreno MartínezNo ratings yet

- Intro To Financial Accounting Horngen 11e Chapter2 SolutionsDocument41 pagesIntro To Financial Accounting Horngen 11e Chapter2 SolutionsArena Arena100% (7)

- Generate Profit Loss Statement BusinessDocument1 pageGenerate Profit Loss Statement BusinessAdi PutraNo ratings yet

- Cag QuestionsDocument24 pagesCag QuestionsJason Dave VidadNo ratings yet

- Comprehensive ActivityDocument2 pagesComprehensive ActivitySofia Lynn Rico RebancosNo ratings yet

- Blackwell Publishing The Scandinavian Journal of EconomicsDocument11 pagesBlackwell Publishing The Scandinavian Journal of EconomicsShriram NarakasseryNo ratings yet

- Financial Statement Analysis On BEXIMCO and SQUAREDocument33 pagesFinancial Statement Analysis On BEXIMCO and SQUAREYolowii XanaNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFanandNo ratings yet

- Related Review LiteratureDocument4 pagesRelated Review LiteratureCherry Anne AtilloNo ratings yet

- Chapter 3Document30 pagesChapter 3SultanNo ratings yet

- HOBA Special ProbDocument14 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Soal LatihanDocument15 pagesSoal LatihanRafi FarrasNo ratings yet

- PLDTDocument16 pagesPLDTPrince PerezNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- FBL September 2023Document88 pagesFBL September 2023syed abdul hamidNo ratings yet

- PT SIER Annual Report 2014Document186 pagesPT SIER Annual Report 2014Lu LublinNo ratings yet

- Baja PDFDocument3 pagesBaja PDFdindakharismaNo ratings yet

- Solution On MFRS 120Document5 pagesSolution On MFRS 120Anas Ajwad100% (1)

- p2 - Guerrero Ch15Document27 pagesp2 - Guerrero Ch15JerichoPedragosa82% (11)

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- Meeting 1Document9 pagesMeeting 1erlina nurliaNo ratings yet

- MCOM Direct Tax Laws 01 (1) - Merged-MinDocument464 pagesMCOM Direct Tax Laws 01 (1) - Merged-MinAlexis ParrisNo ratings yet

- Partnership Operations: Problem CDocument3 pagesPartnership Operations: Problem CJoeneil DamalerioNo ratings yet

- ED PPT Chapter 1Document22 pagesED PPT Chapter 1FuadNo ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- The Great Gatsby Economics GlossaryDocument2 pagesThe Great Gatsby Economics Glossaryapi-237430703No ratings yet

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)

- Sample FsDocument3 pagesSample FsLocel Maquiran LamosteNo ratings yet

- TAX01 Midterm Exam AY 2022 2023Document7 pagesTAX01 Midterm Exam AY 2022 2023robNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet