Professional Documents

Culture Documents

Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart Levels

Uploaded by

Miir ViirCopyright:

Available Formats

Mizuho Corporate Bank

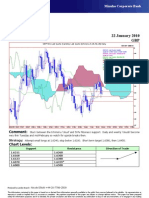

Technical Analysis 05 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

15Sep09 - 10Feb10

Pr

EUR=EBS , Last Quote, Candle 1.515

05Jan10 1.4413 1.4485 1.4406 1.4475

EUR= , Bid, Tenkan Sen 9

1.51

05Jan10 1.4369

EUR= , Bid, Kijun Sen 26

05Jan10 1.4679 1.505

EUR= , Bid, Senkou Span(a) 52

09Feb10 1.4524 1.5

EUR= , Bid, Senkou Span(b) 52

09Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

01Dec09 1.4475

1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

1.42

21Sep09 28Sep 05Oct 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb

Comment: Unwinding some of the nonsense of the last two weeks with room for more of the same. The

Euro is no longer oversold and momentum has yet to turn bullish, so room for a variety of different views.

Strategy: Attempt longs at 1.4470; stop below 1.4200. Short term target 1.4600, then 1.4800.

Chart Levels:

Support Resistance Direction of Trade

1.4400 1.4485

1.4350 1.4535

1.4300 1.4600

1.4257 1.4685*

1.4218/1.4200* 1.4765

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

You might also like

- Application For A US PassportDocument6 pagesApplication For A US PassportAbu Hamza SidNo ratings yet

- ISO 50001 Audit Planning MatrixDocument4 pagesISO 50001 Audit Planning MatrixHerik RenaldoNo ratings yet

- Vitiating Factors in ContractsDocument20 pagesVitiating Factors in ContractsDiana Wangamati100% (6)

- Demand To Vacate - Januario MendozaDocument1 pageDemand To Vacate - Januario Mendozaclaudenson18No ratings yet

- The Rocky Mountain WestDocument202 pagesThe Rocky Mountain WestYered Canchola100% (1)

- Carlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Document200 pagesCarlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Marko Grbic100% (2)

- Pilot Exam FormDocument2 pagesPilot Exam Formtiger402092900% (1)

- Plano Arquitectónico Casa 1 PlantaDocument1 pagePlano Arquitectónico Casa 1 PlantaKaren BustosNo ratings yet

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNo ratings yet

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirNo ratings yet

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337No ratings yet

- Balcon B equipment layout and dimensionsDocument1 pageBalcon B equipment layout and dimensionsOana RusuNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337No ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNo ratings yet

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337No ratings yet

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337No ratings yet

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNo ratings yet

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337No ratings yet

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337No ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEENo ratings yet

- DWG'S Site Office EngDocument26 pagesDWG'S Site Office Engpenyuka tembalangNo ratings yet

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirNo ratings yet

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Document1 pageArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UNo ratings yet

- EF Emergency Part 2 - 083919Document1 pageEF Emergency Part 2 - 083919adelnagehxiiiNo ratings yet

- My LATESTFXForecastsfor APRIL23Document2 pagesMy LATESTFXForecastsfor APRIL23api-26441337No ratings yet

- Plan Trotuare Denis v2Document1 pagePlan Trotuare Denis v2Mihai TataruNo ratings yet

- Plan Parter Bloc de LocuitDocument1 pagePlan Parter Bloc de LocuitRoxana CiobanuNo ratings yet

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsNo ratings yet

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirNo ratings yet

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337No ratings yet

- Arquitectonico PBDocument1 pageArquitectonico PBPedro MárquezNo ratings yet

- MyFXForecastsforMONDAY August23rdDocument2 pagesMyFXForecastsforMONDAY August23rdapi-26441337No ratings yet

- NSPT Cross LT 15 BH 2 +desainDocument1 pageNSPT Cross LT 15 BH 2 +desainSyarifudin BahriNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananNo ratings yet

- CPK CalculatorDocument6 pagesCPK CalculatorMarcinNo ratings yet

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

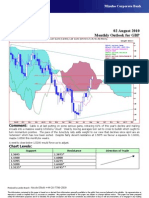

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- Esp 7 Q4M18Document13 pagesEsp 7 Q4M18Ellecarg Cenaon CruzNo ratings yet

- Perception of People Towards MetroDocument3 pagesPerception of People Towards MetrolakshaymeenaNo ratings yet

- Network Design Decisions FrameworkDocument26 pagesNetwork Design Decisions Frameworkaditya nemaNo ratings yet

- Pub. 127 East Coast of Australia and New Zealand 10ed 2010Document323 pagesPub. 127 East Coast of Australia and New Zealand 10ed 2010joop12No ratings yet

- Adw Ethical Stewardship of Artifacts For New Museum ProfessionalsDocument15 pagesAdw Ethical Stewardship of Artifacts For New Museum Professionalsapi-517778833No ratings yet

- Online Applicaiton Regulations Under CQ (MBBS&BDS) ChangedDocument23 pagesOnline Applicaiton Regulations Under CQ (MBBS&BDS) Changedyamini susmitha PNo ratings yet

- Sweetlines v. TevesDocument6 pagesSweetlines v. TevesSar FifthNo ratings yet

- Addis Ababa University-1Document18 pagesAddis Ababa University-1ASMINO MULUGETA100% (1)

- 1Document1 page1MariaMagubatNo ratings yet

- Debut Sample Script PDFDocument9 pagesDebut Sample Script PDFmaika cabralNo ratings yet

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDocument1 pageIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNo ratings yet

- DEALCO FARMS vs. NLRCDocument14 pagesDEALCO FARMS vs. NLRCGave ArcillaNo ratings yet

- SimpleDocument3 pagesSimpleSinghTarunNo ratings yet

- Class Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseDocument17 pagesClass Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseNidhi ShahNo ratings yet

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocument40 pagesPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNo ratings yet

- Week 1 and 2 Literature LessonsDocument8 pagesWeek 1 and 2 Literature LessonsSalve Maria CardenasNo ratings yet

- тест юніт 1Document3 pagesтест юніт 1Alina BurdyuhNo ratings yet

- Customer Engagement & Commerce: Because The Journey & The Outcome MattersDocument23 pagesCustomer Engagement & Commerce: Because The Journey & The Outcome MattersZhamrooNo ratings yet

- Day 16. The 10th ScoringDocument8 pagesDay 16. The 10th ScoringWahyu SaputraNo ratings yet

- Revision FinalDocument6 pagesRevision Finalnermeen mosaNo ratings yet

- Sana Engineering CollegeDocument2 pagesSana Engineering CollegeandhracollegesNo ratings yet

- International HR Management at Buro HappoldDocument10 pagesInternational HR Management at Buro HappoldNishan ShettyNo ratings yet