Professional Documents

Culture Documents

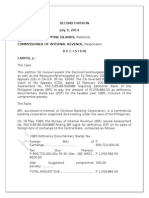

Phil Global Vs Cir

Uploaded by

totonagsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phil Global Vs Cir

Uploaded by

totonagsCopyright:

Available Formats

Taxation Tax Collection Prescriptive Period Reconsideration vs Reinvestigation

In April 1991, Philippine Global Communication, Inc. (PGCI) filed its annual income tax

return (ITR) for the taxable year 1990. A tax audit was subsequently conducted by the

Bureau of Internal Revenue(BIR) and eventually a final assessment notice (FAN) was timely

issued in April 1994. The FAN demanded PGCI to pay P118 million in deficiency taxes

inclusive of surcharge and interest. PGCI was able to file a protest within the reglementary

period. PGCI however refused to produce additional evidence. In October 2002, eight years

after the FAN was issued, the Commissioner of Internal Revenue(CIR) issued a final

decision denying the protest filed by PGCI. PGCI then filed a petition for review with the

Court of Tax Appeals (CTA). The CIR filed its answer in January 2003. The CTA ruled that

the CIR can no longer collect because it is already barred by prescription. The CIR argued

that the prescriptive period has been extended because PGCI asked for a reinvestigation.

ISSUE: Whether or not the CIR is barred by prescription.

HELD: Yes. Under the law, the CIR has 3 years from the issuance of the FAN to make its

collection. The FAN was issued in April 1994 and so the CIR has until April 1997 to make a

collection. Within that period, the CIR never issued a warrant of distraint/levy. Its earliest

collection effort was only when it filed an answer to the appeal filed by PGCI. CIRs answer

was filed in January 2003 which was way beyond the three year prescriptive period to

collect the assessed taxes.

The CIR cannot invoke that the protest filed by PGCI is in effect a request for

reinvestigation. Under the law, a request for reinvestigation shall toll the running of the

prescriptive period to collect. However in the case at bar, the protest filed by PGCI is not a

request for reinvestigation but rather it was a request for reconsideration. And in such case,

it did not suspend the prescriptive period. The protest is a request for reconsideration

because PGCI did not adduce additional evidence or documents. PGCI merely sought the

CIR to review the existing records on file.

You might also like

- FIRS Handbook on Reforms in the Tax System 2004-2011From EverandFIRS Handbook on Reforms in the Tax System 2004-2011No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- BPI vs. CIR Tax Prescription RulingDocument2 pagesBPI vs. CIR Tax Prescription RulingNikki AndradeNo ratings yet

- CIR vs. Philippine Global: Request for Reconsideration Does Not Toll PrescriptionDocument3 pagesCIR vs. Philippine Global: Request for Reconsideration Does Not Toll PrescriptionPiaNo ratings yet

- Bank of Philippine Islands Tax Collection CaseDocument1 pageBank of Philippine Islands Tax Collection CaseRaquel DoqueniaNo ratings yet

- CIR V PGCDocument3 pagesCIR V PGCMich LopezNo ratings yet

- CIR V Philippine Global CommunicationDocument2 pagesCIR V Philippine Global CommunicationGenevieve Kristine Manalac100% (1)

- 278-CIR v. Phil. Global Communications G.R. No. 167146 October 31, 2006Document9 pages278-CIR v. Phil. Global Communications G.R. No. 167146 October 31, 2006Jopan SJNo ratings yet

- Issue:: Com. vs. Metrostar SuperamaDocument2 pagesIssue:: Com. vs. Metrostar SuperamaEric CamposNo ratings yet

- CIR V Philippine Global Communication, Inc. (Basco)Document2 pagesCIR V Philippine Global Communication, Inc. (Basco)Erika FloresNo ratings yet

- Transpo Case Digest For MidtermDocument2 pagesTranspo Case Digest For MidtermgmcamaymayanNo ratings yet

- Prescription Has Set In: CIR's Right to Collect DST from CBC is Time-BarredDocument3 pagesPrescription Has Set In: CIR's Right to Collect DST from CBC is Time-BarredVINCENTREY BERNARDONo ratings yet

- CIR Vs Philippine Global CommunicationDocument3 pagesCIR Vs Philippine Global CommunicationMaria Raisa Helga YsaacNo ratings yet

- BPI vs. CIR, 2014 - DST - PrescriptionDocument9 pagesBPI vs. CIR, 2014 - DST - PrescriptionhenzencameroNo ratings yet

- Philippines Supreme Court Rules Tax Collection PrescribedDocument9 pagesPhilippines Supreme Court Rules Tax Collection PrescribedgiboNo ratings yet

- TAX 2 Case Digest Part 2Document31 pagesTAX 2 Case Digest Part 2Jenny OcabaNo ratings yet

- Cases 51-53Document4 pagesCases 51-53Soraya Salubo LautNo ratings yet

- China Banking Corporation Vs CIRDocument5 pagesChina Banking Corporation Vs CIRAnonymous VtsflLix1No ratings yet

- China Banking Corporation v. CIRDocument2 pagesChina Banking Corporation v. CIRRaymond Cheng80% (5)

- China Banking Corporation Vs CIRDocument3 pagesChina Banking Corporation Vs CIRMiaNo ratings yet

- CIR vs. Fitness by Design Case DigestDocument1 pageCIR vs. Fitness by Design Case DigestMaestro LazaroNo ratings yet

- CIR's Right to Assess PDI PrescribedDocument3 pagesCIR's Right to Assess PDI PrescribedJoshua Erik Madria100% (1)

- Philippines Bank Tax DisputeDocument2 pagesPhilippines Bank Tax Dispute09367766284No ratings yet

- Tax Cases For Submission PDFDocument22 pagesTax Cases For Submission PDFMarkNo ratings yet

- CIR vs. The Stanley Works Sales (Phils.), Inc., G.R. No. 187589. Dec 3, 2014Document10 pagesCIR vs. The Stanley Works Sales (Phils.), Inc., G.R. No. 187589. Dec 3, 2014raph basilioNo ratings yet

- CIR V BF. GoodrichDocument7 pagesCIR V BF. GoodrichMary Ann Celeste LeuterioNo ratings yet

- Taxation Review - CIR vs. Fitness by DesignDocument1 pageTaxation Review - CIR vs. Fitness by DesignMaestro LazaroNo ratings yet

- TUPAZ v. ULEP Prescriptive Period Criminal Case ReinstatementDocument4 pagesTUPAZ v. ULEP Prescriptive Period Criminal Case ReinstatementDenver GamlosenNo ratings yet

- 7 CIR V FMF Development CorpDocument2 pages7 CIR V FMF Development CorpKate AlagaoNo ratings yet

- Tax Cases For SubmissionDocument22 pagesTax Cases For SubmissionmikaeyapeshaNo ratings yet

- Tax Dispute Ruling on Deficiency AssessmentsDocument10 pagesTax Dispute Ruling on Deficiency AssessmentsBernadette Luces BeldadNo ratings yet

- CIR V BASF TAX CASE DIGESTDocument7 pagesCIR V BASF TAX CASE DIGESTRea Romero0% (1)

- 10-CIR v. B.F. Goodrich Phils., Inc. G.R. No. 104171 February 4, 1999Document5 pages10-CIR v. B.F. Goodrich Phils., Inc. G.R. No. 104171 February 4, 1999Jopan SJNo ratings yet

- BPI vs. CIRDocument2 pagesBPI vs. CIRAldrin TangNo ratings yet

- Philippine Journalists Inc. v CIR: Waiver of limitations invalid, assessment beyond 3-year periodDocument19 pagesPhilippine Journalists Inc. v CIR: Waiver of limitations invalid, assessment beyond 3-year periodCarolyn Clarin-BaternaNo ratings yet

- BPI vs. CIRDocument2 pagesBPI vs. CIRAnneNo ratings yet

- Bpi V Cir G.R No. 139786 October 17, 2005Document2 pagesBpi V Cir G.R No. 139786 October 17, 2005PJ HongNo ratings yet

- Rizal Commercial Banking Corporation V CIR (September 7 2011)Document63 pagesRizal Commercial Banking Corporation V CIR (September 7 2011)ybunNo ratings yet

- G.R. No. 213943 Cir Vs Philippine Daily Inquirer, Inc FactsDocument4 pagesG.R. No. 213943 Cir Vs Philippine Daily Inquirer, Inc FactsChiic-chiic SalamidaNo ratings yet

- Tax Case DigestsDocument21 pagesTax Case Digestsannamariepagtabunan100% (3)

- CIR Prescription RulingDocument1 pageCIR Prescription RulingHoreb FelixNo ratings yet

- G.R. No. 198677 November 26, 2014 Commissioner of Internal Revenue, Petitioner, BASF COATING + INKS PHILS., INC., RespondentDocument10 pagesG.R. No. 198677 November 26, 2014 Commissioner of Internal Revenue, Petitioner, BASF COATING + INKS PHILS., INC., RespondentMikkaEllaAnclaNo ratings yet

- GR No. 175410 SMI-Ed Philippines Technology, Inc. v. Commissioner of Internal RevenueDocument20 pagesGR No. 175410 SMI-Ed Philippines Technology, Inc. v. Commissioner of Internal RevenueRoxanne Daphne LapaanNo ratings yet

- RR No 21-2018Document45 pagesRR No 21-2018Jevi RuiizNo ratings yet

- Case#188 FEBTC Vs CIRDocument2 pagesCase#188 FEBTC Vs CIRBrent Christian Taeza TorresNo ratings yet

- Summary of Significant SC (Tax) Decisions (September - December 2013)Document3 pagesSummary of Significant SC (Tax) Decisions (September - December 2013)Paterno S. Brotamonte Jr.No ratings yet

- Basis of Prescribed Period To CollectDocument2 pagesBasis of Prescribed Period To CollectJCSNo ratings yet

- Tax Law Case DigestsDocument13 pagesTax Law Case DigestsOlive ElevenNo ratings yet

- BPI v. CIR Statute of Limitations Not SuspendedDocument2 pagesBPI v. CIR Statute of Limitations Not Suspendedshookt panboi100% (3)

- Summary of Significant SC Decisions (September-December 2013)Document3 pagesSummary of Significant SC Decisions (September-December 2013)anorith88No ratings yet

- 5 enronBASFDocument8 pages5 enronBASFmieai aparecioNo ratings yet

- CIR's Right to Collect Tax PrescribedDocument3 pagesCIR's Right to Collect Tax PrescribedDaLe AparejadoNo ratings yet

- 143.CIR Vs Stanley (Phils.)Document8 pages143.CIR Vs Stanley (Phils.)Clyde KitongNo ratings yet

- Republic V KerDocument3 pagesRepublic V KerCinNo ratings yet

- BIR Cannot Collect Deficiency After 5 YearsDocument2 pagesBIR Cannot Collect Deficiency After 5 YearsDiane Dee YaneeNo ratings yet

- Calamba Steel vs. CIR Tax Refund Case SummaryDocument8 pagesCalamba Steel vs. CIR Tax Refund Case SummaryHuntershinjiNo ratings yet

- CIR v. Wyeth Suaco Lab.Document3 pagesCIR v. Wyeth Suaco Lab.Angelique Padilla UgayNo ratings yet

- CIR Vs Phil. Global Communications, GR 167146, Oct. 31, 2006Document4 pagesCIR Vs Phil. Global Communications, GR 167146, Oct. 31, 2006katentom-1No ratings yet

- Tax 2 QADocument15 pagesTax 2 QAChaNo ratings yet

- Bir'S Right To Collect: When Does The Suspension of The Five (5) - Year Prescription Period To Collect Commence?Document2 pagesBir'S Right To Collect: When Does The Suspension of The Five (5) - Year Prescription Period To Collect Commence?Rollie ConteNo ratings yet

- Personnel ActionDocument2 pagesPersonnel ActiontotonagsNo ratings yet

- CIR V GoodrichDocument1 pageCIR V GoodrichtotonagsNo ratings yet

- Supreme Court Rules Boy Scouts of Philippines Subject to COA AuditDocument2 pagesSupreme Court Rules Boy Scouts of Philippines Subject to COA AudittotonagsNo ratings yet

- Biraogo vs. Philippine Truth CommissionDocument2 pagesBiraogo vs. Philippine Truth CommissiontotonagsNo ratings yet

- Cover Letter ResumeDocument3 pagesCover Letter ResumetotonagsNo ratings yet

- Personnel ActionDocument2 pagesPersonnel ActiontotonagsNo ratings yet

- Supreme Court Rules Boy Scouts of Philippines Subject to COA AuditDocument2 pagesSupreme Court Rules Boy Scouts of Philippines Subject to COA AudittotonagsNo ratings yet

- BSP Vs COADocument2 pagesBSP Vs COAtotonagsNo ratings yet

- Second DivisionDocument24 pagesSecond DivisiontotonagsNo ratings yet