Professional Documents

Culture Documents

Robert Haines Legal Opinion

Uploaded by

dailyprincetonian0 ratings0% found this document useful (0 votes)

13K views1 pageOpinion provided by Robert Haines '61 to the Cap and Gown club.

Original Title

Robert Haines legal opinion

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOpinion provided by Robert Haines '61 to the Cap and Gown club.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13K views1 pageRobert Haines Legal Opinion

Uploaded by

dailyprincetonianOpinion provided by Robert Haines '61 to the Cap and Gown club.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

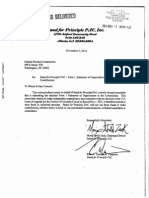

horwonce Bouse Te, 8-647

We, ew ese OTE 6747 Fax 908-647 «77

1002

HEROLD AND HAINES

Tel Ext 114

thaines@heroldhaines.com

May 15, 2006

George W.C. MeCarter, Esq,

McCarter & Higgins

48 Drs. James Parker Boulevard

Red Bank, NJ 07701

Re: Princeton Prospect Foundation - Dining Facilities

Dear Bill:

As you know, as a result of an IRS tax audit of Princeton Prospect Foundation

(the “Foundation”) during 1997-1998, a “Collateral Agreement” was included as part of

the settlement with the IRS. The Collateral Agreement set forth certain conditions and

procedures to be followed by the Foundation.

This provision does not bar the funding of

dining facilities provided that the work on the dining facilities is at least 50%

“educational;” in other words, if the dining facilities include a bar area or other social

area, the 50% test would be applied and then, if the “educational” component was at least

50% but less than 100%, only the educational percentage could be funded by the

Foundation. 1 specifically raised this issue with the IRS and, based on my analysis of the

then existing law, including Rev. Ruling 67-291, the Collateral A,

funding “f

“Drink facilities” (ie., tap rooms) are “social

limitations in the Collateral Agreement.

Itis, therefore, our opinion that the Foundation can fund dining room facilities.

Very truly yours,

Robert B. Haines

ce: Princeton Prospect Foundation

Attn.: Gordon Harrison

hAtemplsbites-igippfemeearter do

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Police Report On Tiger Inn BouncersDocument6 pagesPolice Report On Tiger Inn BouncersdailyprincetonianNo ratings yet

- New Mental Health Re-Enrollment FormDocument2 pagesNew Mental Health Re-Enrollment FormdailyprincetonianNo ratings yet

- Stand For PrinciplesDocument6 pagesStand For PrinciplesdailyprincetonianNo ratings yet

- Complaints Raised by PETA Against PrincetonDocument12 pagesComplaints Raised by PETA Against PrincetondailyprincetonianNo ratings yet

- John Doe Vs Columbia UniversityDocument54 pagesJohn Doe Vs Columbia UniversitydailyprincetonianNo ratings yet