Professional Documents

Culture Documents

Relationship Between Inflation and Interest Rates in Pakistan

Uploaded by

Trang Bùi HàOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relationship Between Inflation and Interest Rates in Pakistan

Uploaded by

Trang Bùi HàCopyright:

Available Formats

Research Journal of Recent Sciences _________________________________________________ ISSN 2277-2502

Vol. 3(4), 51-55, April (2014)

Res.J.Recent Sci.

Relationship between Inflation and Interest Rate: Evidence from Pakistan

Ayub G.1, Rehman N.U.2, Iqbal M.3, Zaman Q.3 and Atif M.3

1

University of Swat, Khyber Pakhtonkhawa, PAKISTAN

Economics Department, University of Peshawar, Khyber Pakhtonkhawa, PAKISTAN

3

Statistics Department, University of Peshawar, Khyber Pakhtonkhawa, PAKISTAN

Available online at: www.isca.in, www.isca.me

Received 6th November 2013, revised 16th December 2013, accepted 3rd January 2014

Abstract

This study focuses on the study of the causal relation of inflation rate with that of nominal interest rate in Pakistan. This is

also known as Fisher hypothesis, which is used to study the equilibrium relation for long run between the inflation rate and

the nominal interest rate in the time series data from 1973-2010. In this study, the Stationarity and non-Stationarity of the

data is checked empirically using both ADF and PP test of unit root. Co-integration techniques like Johansen and EngleGranger (Residual Based) co-integration test are used to study the long run relationship between the nominal interest rate

and inflation. It is found that there exist a long run equilibrium relationship between the nominal interest rate and the

inflation of Pakistan for the period of 1973-2010.

Keywords: Inflation, nominal interest rate, unit root, Co-integration.

Introduction

One of the vast areas of the econometric is the time series

econometric. It has verity of application in engineering,

medical, signal processing, and agriculture and especially in

economics. In econometrics, time series analysis has significant

role because most of the variables are observed over the period

of time. In time series analysis the collected series of

observation can be arranged in continues time point or it can be

observed at discreet set of point. But in most of the time series,

the series are observed at equal interval of time.

The term inflation is used to indicate an increase in domestic

prices of the commodities relatively more than increase in the

prices of the commodities globally. It indicates the increase in

the prices of goods and service over the time while nominal

interest rate refers to those interest rates which are considered

before taking inflation into consideration or before adjusting the

interest rate for inflation and when nominal rates adjusted for

the inflation are called real interest rate1. This relation

commonly refers as the Fisher equation. Fisher equation can be

defined as one-to-one relationship between the expected

inflation and the nominal interest rate, assuming the real interest

rate is stationary2.

Fisher equation is also known as Fisher hypothesis which

suggests that there exist a positive relationship between rate of

interest and expected inflation. Fisher equation or hypothesis

provides theoretical basis for studying the relationship between

the interest rate and expected inflation. The implication of the

Fisher equation affects the debtors and creditors and also

important for the effectiveness of the monetary policy and

efficiency in banking sectors. The Fisher hypothesis supports

International Science Congress Association

strongly the US economy in particular and for the industrial

countries in general3.

Suppose I is the nominal interest rate and r is the real interest

rate and P is the inflation rate then Fisher equation can be

defined as

I=r+P

Or

r =I P

The Fisher equation states that a unit increase in P causes a unit

increase in the nominal interest rate, this one to one relation

between inflation and nominal interest rate is known as Fisher

effect. Hassan, states that Fisher hypothesis as the theoretical

framework for studying the relationship between the nominal

interest rate and the rate of inflation for Pakistan. He tested the

validity of the Fisher hypothesis using quarterly data from 1957

q1 to 1991 q2 by applying co-integration technique for Pakistan.

The study concluded that there exists a long run relationship

between the nominal interest rate and inflation for Pakistan3.

Berument and Mehdi studied relationship between interest rate

and inflation and test the Fisher hypothesis for 26 countries of

world and concluded that there exists a positive relationship

between the inflation rate and nominal interest rate. The study

supports the Fisher hypothesis for more than half of the

countries of the world under consideration4.

Jayasinghe and Udayaseelan studied the Fisher equation by

using co-integration technique of econometrics for Sri Lank.

They considered the data set of the three frequencies i.e.

monthly data from 1978 to 2008, quarterly from 1978 to 2008

and yearly from 1953-1977. They found that there are

differences exist in the relationship of the nominal interest rate

and expected inflation for the different data set collected

51

Research Journal of Recent Sciences ______________________________________________________________ ISSN 2277-2502

Vol. 3(4), 51-55, April (2014)

Res. J. Recent Sci.

monthly, quarterly and yearly. The study finally concluded that

there hardly exist a long run relationship in the nominal interest

rate and inflation5.

Alexander studied the relationship between the expected

inflation and nominal interest rate for South Africa by using cointegration technique of econometrics and concluded that the

Fisher Equation for South Africa for the period of 2000 to

2005, with objective of testing the relationship between the

nominal interest rate and inflation i.e., Fisher hypothesis. The

study concluded that the short run relationship did not verify

empirically whereas in the long run relationship the data verify

the Fisher Equation for South Africa6.

Saeidi and Valian studied the relationship between currency

rates, interest rate and inflation based on Fisher effect theory for

the economy of Iran. They test the Fisher effect for the annual

data for economy of Iran ranging from 1991-2009, by using

econometric methods. They divide the annual interest rate into

three parts, one year short term, 3-year midterm and 5-years

long term and dividing the exchange rates into two groups i.e.,

official currency rates and nonofficial currency rates. They

studied relationship between official and nonofficial currency

with all three types of interest rate i.e. long, midterm, and short

term and then studied the relationship between inflation rate and

interest rate and found a direct and positive relation i.e., validity

of the Fisher effect for Iran economy7.

Nicolas Million examined the Fisher hypothesis in application

to US data. He used the data as monthly average of daily closing

bids of 3 months treasury bills rate secondary market from

1951.1 to 1999.12 for the interest rate while the data of the

inflation rate were computed from the monthly data of CPI of

Urban. The empirical analysis showed a strong evidence for the

threshold behavior in real interest rate. He concluded that Fisher

effect appeared stronger in some periods of data and not in other

periods. The Fisher effect was strong in a situation where there

exist stochastic trend in the inflation and the nominal interest

rate and in such situation he found strong correlation between

the inflation and nominal interest rate. He also obtain the strong

Fisher effect evidence when he considered the nonlinear feature

of the relationship into account8.

Macri J found in his research with the objective of studying the

Fisher hypothesis for Australia. He studies the Fisher hypothesis

for Australia using quarterly short term data from first quarter of

1979 to second quarter of 2005 i.e. 1979 Q1 to 2005 Q2 by

using Johansen technique of cointegration. He used the

consumer price index (CPI) for the computation of inflation and

the 90 days bank Accepted Bill rates as nominal interest rate

from the Reserve Bank of Australia. He observed the nominal

interest rate is positively related with inflation and concluded

that there exists a long run cointegration relationship between

the nominal interest rate and inflation for Australia9.

International Science Congress Association

Helmut herwartz and Hans-EggertReimers investigated the

cointegrationlink between the inflation and nominal interest rate

for around monthly time series data of 43 years of 114 countries

included Pakistan obtained from international financial statistics

of the International Monetary Fund (IMF) for period of 1960:1

to 2004:6. They used cointegration test for testing the validity of

Fisher hypothesis for different economies of world. They

concluded that there exists a long run relationship between

nominal interest rates and inflation for number of the countries

of the world under consideration. They also concluded that few

of the countries of the world where there were high inflation or

high interest rate, the long run relationship not exists as

mentioned by Fisher10.

Sundqvistemil studied the empirical investigation of the

international Fisher effect and test the long run validity of Fisher

effect for quarterly data of nominal interest rate for six countries

and quarterly exchange rates between the US dollars and five

other currencies between years 1993-2000. He considered the

data for Germany only for period of 1993-1998. The data was

obtained from the International Monterey Funds. He studied the

international Fisher effect in country pairs and concluded that

Fisher effect hold for some of the country pairs like US-Japan

and for some time period while it does not hold for others11.

Phylaktis and Blake studied the Fisher effect for different

countries of the World. They considerthree countries of the

world having highly inflation including Argentina, Brazil and

Mexico. They examined Fisher hypothesis using yearly data and

observed the validity of the Fisher hypothesis i.e. there exists a

long run equilibrium relationship among the nominal interest

rate and inflation12.

Paleologos. J and Georgantelis did a cointegration analysis of

Fisher hypothesis for Greece. They studied the validity of Fisher

hypothesis for economy of Greece from the period of 1980 Q-I

to 1996 Q-II using Johnsons technique of cointegration. They

concluded that there is no one to one movement in nominal

interest rate and inflation rate in long run for Greece economy

i.e. the data showed no validity of the Fisher hypothesis for

Greece and found that there is no long run equilibrium

relationship between the nominal interest rate and inflation13.

Makku. L investigated the Fisher effect using unit root and

cointegration. He studied Fisher hypothesis for monthly US data

for period of 1953:1 to 1990:12. He studies the unit root in time

series using ADF and studies a long run relationship between

the nominal interest rate and the inflation foe the monthly data

of the US and concluded that there Fisher effect showed the

validity over the period of 1953:1 to 1079:12. Whereas the over

the other time laps i.e. from 1979:11 to 1990:12 the data showed

no validity of the Fisher hypothesis14.

Beyer.A and Hug. A studied Fisher hypothesis after adjusting

the structural breaks for 15 countries of OECD. They consider

the different data set for different countries of OECD. Quarterly

52

Research Journal of Recent Sciences ______________________________________________________________ ISSN 2277-2502

Vol. 3(4), 51-55, April (2014)

Res. J. Recent Sci.

data was used to study Fisher hypothesis by using cointegration

techniques like ARDL and Johansen cointegration test. For

different countries of OECD, data collected over the different

period of time and make structural break adjustment. They used

improved approach of unit root and observed unit root in

nominal interest rate and inflation for all countries except the

Netherland. Similarly they found the Fisher cointegration

relationship but it does not support the evidence of the more of

the countries of OECD in both pre and post break adjustment15.

Westerlund studied Fisher effect for the 20 countries of OECD.

The panel quarterly data form 1980 to 2004 collected and using

co-integration techniques, the validity of Fisher hypothesis

found in data16.

The level of real interest rates is critical for standard evaluations

of government debt sustainability. Ball, Elmendorf and Mankiw

suggest the emergence of a virtuous cycle in which low real

rates and rapid growth reduce fiscal debt burden. If the return on

government debt is sufficiently below the output growth rate for

a sufficiently long period, the government can roll over the debt

and accumulated interest without raising taxes because output

will likely grow faster than the debt will accumulate17.

Material and Methods

In this research paper secondary data is considered for analysis.

Data for 1973 to 2010 regarding the nominal interest rate and

inflation acquired from the State Bank of Pakistan. Eviews and

SPSS are used for econometric analysis of data.

Test

Augmented Ducky-Fuller

Phillip-Perron

Augmented Ducky-Fuller

Phillip-Perron

Test

Augmented Ducky-Fuller

Phillip-Perron

Augmented Ducky-Fuller

Phillip-Perron

Results and Discussion

Econometric analysis begins by checking the Stationarity and

non-Stationarity of data graphically. For co-integration

relationship, its one of the assumptions that data must be

integrated of either same order or different order. Unit root

testing procedures like ADF and PP tests are then applied to

discuss the Stationarity and non-Stationarity empirically. After

this co-integration techniques are used to find out long run

relationship between the nominal interest rate and inflation rate

for Pakistan.

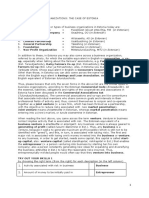

To test the Stationarity in yearly time series data for Pakistan

from 1973-2010, both ADF and PP test are performed. The

table-1, contains the output of the both test for the both variables

i.e., nominal interest rate and inflation at levels. The output

indicates that the variable nominal interest rate is non-stationary

at both 1% and 5% significance level using both ADF and PP

test whereas the variable inflation also is non-stationary as well.

After taking the first difference of nominal interest rate and

inflation, both variables become stationary that can be verified

from the table-2, which confirms that both variables are

stationary using ADF and PP test. For the both variables i.e.

inflation and nominal interest rate the null hypothesis of the unit

root is not rejected at both 1% and 5% of significance level and

concluded that both series are stationary or both series are

integrated at order 1.

Table-1

Unit Root Test for Stationarity

Nominal Interest Rate

Test statistics

1%

5%

-3.255788 (0.0910)

-4.252879

-3.547490

-2.462832 (0.3435)

-4.226815

-3.536601

Inflation

-3.210628 (0.0980)

-4.226815

-3.536601

-3.210628 (0.0980)

-4.226815

-3.536601

Table-2

Unit Root Stationarity after First Difference

Nominal Interest Rate

Test statistics

1%

5%

-4.315442 (0.0082)

-4.234972

-3.540328

-4.201279 (0.0109)

-4.234972

-3.540328

Inflation

-8.400166 (0.0000)

-4.234972

-3.540328

-8.893679 (0.0000)

-4.234972

-3.540328

International Science Congress Association

Null Hypothesis

Fail to Reject H0

Fail to Reject H0

Status

Non-stationary

Non-stationary

Fail to Reject H0

Fail to Reject H0

Non-stationary

Non-stationary

Null Hypothesis

Reject H0

Reject H0

Status

Stationary

Stationary

Reject H0

Reject H0

Stationary

Stationary

53

Research Journal of Recent Sciences ______________________________________________________________ ISSN 2277-2502

Vol. 3(4), 51-55, April (2014)

Res. J. Recent Sci.

Test of cointegration: One of the conditions for testing cointegration for time based data is that time series must be nonstationary in nature and both series must be integrated at same

order for Stationarity. As using PDF and PP test, it is verified

from previous results that both series are non-Stationary and

become stationary at first order difference.

Engle-Granger test for cointegration (Residual based): Since

both series are stationary after 1st order difference at 1% and 5%

of significance level, so to investigate equilibrium relationship

for long run between nominal interest rate and inflation, run a

regression of interest rate on inflation and then inflation on

interest rate separately and save the residual for both

regressions. The both residual series of regression equations are

found stationary of same order difference by applying ADF and

PP tests.

The following table-3, shows that residual series of regression

of nominal interest rate on inflation (Residual 1) are nonstationary at 1 % and 5 % significancelevel.

Whereas the table-4 represents the Stationarity of the residual of

regression of inflation on nominal interest rate and indicates that

residual series are non-Stationarity at 1% and 5 % significance

level using ADF and PP test of Stationarity.

After taking the first difference of the both residual series, again

the Stationarity is being checked and it is found that both series

of residual of the regressions are stationary at same order of

integration i.e., (1, 1) at 1% and 5% significance level by using

ADF and PP test of stationary. The following table shows the

Stationarity of the residual after first difference.

After applying the Residual based test of co-integration i.e.,

Engle-Granger test for co-integration, it is concluded that the

both residual series have unit root and after taking first

difference of residual series of both regressions, they become

stationary and show an equilibrium relation for long run

between inflation and nominal interest rate for time series data

of Pakistan21.

Johansen Test of Co-integration: The Johansen test of cointegration used two different approaches for deciding the cointegrational relationship between nominal interest and inflation

rate i.e., trace statistic and max-Eigen statistic. The following is

the output of the Johansen co-integration test for time based data

for Pakistan.

Table-3

Stationarity of the Residual of Regression of nominal interest rate on inflation

Residual 1

C.V

Test

Statistic

C.V 5%

Null Hypothesis

1%

Augmented Ducky-Fuller -3.211007 (0.0979)

-4.226815

-3.536601

Fail to reject H0

Phillip-Perron

-3.211007 (0.0979)

-4.226815

-3.536601

Fail to reject H0

Status

Non-stationary

Non-stationary

Table-4

Residuals Stationarity of Regression Equation of inflation on Nominal interest Rate

Residual2

Test statistics

Critical Value

Critical Value

Test

Null Hypothesis

at 1%

at 5%

Augmented Ducky-Fuller

-3.25771 (0.0906)

-4.252879

-3.548490

Fail to reject H0

Non-stationary

Phillip-Perron

Non-stationary

-2.464017 (.3430)

-4.226815

-3.536601

Fail to reject H0

Status

Table-5

Stationarity of Both Residual Series of Regression after 1st Difference

Stationarity of Residual Series of Regression nominal interest rate on inflation after 1st Difference

Test

Test statistics

1%

5%

Null Hypothesis

Status

Augmented Ducky-Fuller

-8.399584 (0.0000)

-4.234972

-3.540328

Reject H0

Stationary

Phillip-Perron

-8.894523 (0.0000)

-4.234972

-3.540328

Reject H0

Stationary

Stationarity of Residual Series of Regression inflation on nominal interest rate after 1st Difference

Augmented Ducky-Fuller

-4.318898 (0.0081)

-4.234972

-3.540328

Reject H0

Stationary

Phillip-Perron

-4.204862 (0.0108)

-4.2345972

-3.540328

Reject H0

Stationary

International Science Congress Association

54

Research Journal of Recent Sciences ______________________________________________________________ ISSN 2277-2502

Vol. 3(4), 51-55, April (2014)

Res. J. Recent Sci.

Test Statistic

Trace-statistics

Max-Eigen

statistics

H 0:

H 1:

r=0

r=1

r=0

r=1

r>0

r>1

r>0

r>1

Table-6

Johansen Co-integration Test

Johansen Co-integration Statistics

Computed Value

Eigen Value

of Test statistics

0.408155

25.67113 (0.0011)

0.171863

6.788743 (0.0092)

0.408155

18.88239 (0.0087)

0.171863

6.788743 (0.0092)

It is clear from Table-6, that the computed value of the test

statistic, both approaches of Johansen co-integration test, is

more than the critical value at 5% level of significance so we

reject our hypothesis. It is concluded that there exists a cointegration or equilibrium relationship for long run between

nominal interest and inflation rate in Pakistan for period of

1973-2010.

Conclusion

The main objective of the study is to find out the causality

between nominal interest rate and inflation and equilibrium

relationship for long run between the said variables i.e., the

study of the validity of the Fisher Hypothesis for Pakistan. It is

found that both variables i.e. nominal interest rate and inflation

rate for Pakistan form 1973-2010 show non-Stationarity and

after taking first difference of their time series, The Stationarity

in both time series is checked using empirical approaches of unit

root. Both approached of unit root i.e. ADF and PP test were

used to test the Stationarity in both nominal interest rate and

inflation. Both variables are found non-stationary at 1 % and 5

% significance level and after 1st difference both were stationary

at 1 % and 5% significance level. Using co-integration

techniques likes Engle-Granger co-integration test (residual

based) and Johansen co-integration test, it is obtained that there

exists a relationship for long run or co-integration relationship

in nominal interest rate and inflation rate at 5% significance

level for period of 1973-2010.

References

1.

Shah I. and Waleed M., The Fisher Equation, Belgium

before and after Euro currency, Thesis, School of

Economics and Management, Lund Uni., Sweden (2010)

2.

Fisher I., The Theory of Interest, New York: Macmillan

(1930)

3.

Hassan H., Fisher Effect in Pakistan, The Pakistan Deve.

Review, 38(2), 153166 (1999)

4.

Berument H. and Mehdi M., The Fisher Hypothesis: a

multi-country analysis, J. App. Eco., 34, 1645-1655 (2002)

5.

Jayasinghe P., and Udayaseela T., Does Fisher effect hold

in Sri Lanka? An Analysis with bounds testing approach to

Cointegration, 76-82 (2010)

International Science Congress Association

Critical Value

5%

15.49471

3.841466

14.26460

3.841466

Decision

Reject H0:

Reject H0:

6.

Alexander H., The relationship between interest rates and

inflation in South Africa: Revisiting Fishers hypothesis,

Thesis, Rhodes University, South Africa, (2006)

7.

Saeidi P., and Vailan H., Studying the relationship

between currency rate, interest rate and inflation rate based

on Fisher international theory and Fisher international

effect in Iran economy, Aust. J. of Basic and App. Sci.

5(12), 1371-1378, (2011)

8.

Million N., Central Banks intervention and the Fisher

hypothesis: a threshold cointegration investigation,

Economic modelling, 21, 1051-1064 (2004)

9. Macri, J., Fisher Hypothesis: Further Evidence for

Australia, Department of Economics, Macquarie

University, Sydney, NSW 2109, Australia (2006)

10. Herwartz et al, Modelling the Fisher hypothesis:

worldwide

evidence,

Econstor

available

online

www.econstor.eu. (2006)

11. Sundqvist E., An empirical investigation of the

international Fisher effect, Bachelors Thesis, Lulea

University of Technology (2002)

12. Phylaktis K., and Blake D., The Fisher Hypothesis:

Evidence From Three High Inflation Economies,

Weltwirtschaftliches Archive 129, 591599 (1993)

13. Paleologos J. and Georgantelis S., Does the Fisher Effect

apply in Greece? A Cointegration Analysis, Spoudai,

University of Piraeus, 48, 1-4 (1996)

14. Lanne, M., Near Unit Root and the relationship between

inflation and interest rate: A reexamination of the Fisher

Effect, J. Emp. Eco., 26, 357-366 (2001)

15. Beyer A., and Haug A., Structural Breaks, cointegration

and the Fisher Effect. Working paper series No: 1013,

European Central Bank Germany (2009)

16. Westerlund J., Panel cointegration tests of the Fisher

eect, J. of App. Eco., 23, 193233 (2008)

17. Safdari Mehdi and Ramzan Gholami Avati, Investigating

the Asymmetric Effects of Government Spending on

Economic Growth, Res.J.Recent Sci., 1(5), 51-58(2012)

55

You might also like

- Relationshipbetween Inflationand Interest Rate Evidencefrom PakistanDocument6 pagesRelationshipbetween Inflationand Interest Rate Evidencefrom PakistanJuan Felipe SaavedraNo ratings yet

- Relationship Between Interest Rate and Inflation Rate: Research ReportDocument9 pagesRelationship Between Interest Rate and Inflation Rate: Research ReportMuqaddas IsrarNo ratings yet

- FEPP ModuleDocument6 pagesFEPP ModulePrateek SinghalNo ratings yet

- Fisher Effect in Pakistan: Testing Rational vs Adaptive ExpectationsDocument29 pagesFisher Effect in Pakistan: Testing Rational vs Adaptive ExpectationsdadmohammadNo ratings yet

- Economic Review Occasional Paper-No 13money Price RelationshipDocument16 pagesEconomic Review Occasional Paper-No 13money Price RelationshipJeevan RegmiNo ratings yet

- Issues of InflationDocument16 pagesIssues of Inflationfantastic worldNo ratings yet

- Financial Liberalization Asean and Fisher Hypothesis: in TheDocument22 pagesFinancial Liberalization Asean and Fisher Hypothesis: in TheMadu BiruNo ratings yet

- Interpreting The Relation of Money, Output AND PRICES IN INDIA (1991:2008)Document13 pagesInterpreting The Relation of Money, Output AND PRICES IN INDIA (1991:2008)Rahul AmrikNo ratings yet

- The Effect of Exchange Rate On Interest Rate and Stock ReturnsDocument12 pagesThe Effect of Exchange Rate On Interest Rate and Stock ReturnsMuhammad AteeqNo ratings yet

- An Analysis of The Indian Stock Market With GDP, Interest Rates and InflationDocument15 pagesAn Analysis of The Indian Stock Market With GDP, Interest Rates and InflationAadyaNo ratings yet

- Inflation, Interest Rate and Exchange Rate in Nigeria: An Examination of The Linkages and Implications For Monetary PolicyDocument18 pagesInflation, Interest Rate and Exchange Rate in Nigeria: An Examination of The Linkages and Implications For Monetary PolicyAJHSSR JournalNo ratings yet

- Ajem 2014 2 (2) 103 114Document12 pagesAjem 2014 2 (2) 103 114Bayo AdebayoNo ratings yet

- The Relationship Between Inflation and Economic GrowthDocument21 pagesThe Relationship Between Inflation and Economic Growthasmar farajovaNo ratings yet

- The Influence of Macroeconomic Variables on Stock Returns in IndonesiaDocument19 pagesThe Influence of Macroeconomic Variables on Stock Returns in IndonesiaMaria AlexandraNo ratings yet

- Synopsis 1Document20 pagesSynopsis 1Kalsoom AkhtarNo ratings yet

- Final - PJSS-31-1-05 (1) ADocument14 pagesFinal - PJSS-31-1-05 (1) AAsad MuhammadNo ratings yet

- Effect of Money Supply On Economic Growth in BangladeshDocument11 pagesEffect of Money Supply On Economic Growth in BangladeshImtiaz AminNo ratings yet

- MPRA Paper 92362Document9 pagesMPRA Paper 92362alhadipress3No ratings yet

- Aefr 341-354Document14 pagesAefr 341-354Yến Hằng TrầnNo ratings yet

- S U R J S S: Indh Niversity Esearch Ournal (Cience Eries)Document6 pagesS U R J S S: Indh Niversity Esearch Ournal (Cience Eries)leostarz05No ratings yet

- Stock Prices and Exchange Rates: Empirical Evidence From Kuwait's Financial MarketsDocument13 pagesStock Prices and Exchange Rates: Empirical Evidence From Kuwait's Financial Marketsfati159No ratings yet

- Root,+journal+manager,+15 IJEFI+5676+dritsaki+oke 1 20171201 V1Document10 pagesRoot,+journal+manager,+15 IJEFI+5676+dritsaki+oke 1 20171201 V1Youssouf ali bambaNo ratings yet

- Chapter-2: Review of LiteratureDocument15 pagesChapter-2: Review of LiteraturekavilankuttyNo ratings yet

- Banking Stock Returns and Their Relationship to Interest Rates and Exchange Rates: Australian EvidenceDocument35 pagesBanking Stock Returns and Their Relationship to Interest Rates and Exchange Rates: Australian Evidenceprabin ghimireNo ratings yet

- The Uncovered Interest Rate Parity-A Literature ReviewDocument14 pagesThe Uncovered Interest Rate Parity-A Literature ReviewTrader CatNo ratings yet

- Northamerjournal Vol4 Article1Document12 pagesNorthamerjournal Vol4 Article1Sriram KodamanchiliNo ratings yet

- Causal Correlation Between Exchange Rate and Stock PDFDocument13 pagesCausal Correlation Between Exchange Rate and Stock PDFAtaur Rahman HashmiNo ratings yet

- MexicoDocument12 pagesMexicogulatikash1603No ratings yet

- An Investigation of The Relationship Between Interest Rates and Economic Growth in Nigeria, 1970 - 2006Document6 pagesAn Investigation of The Relationship Between Interest Rates and Economic Growth in Nigeria, 1970 - 2006Jatin ParwaniNo ratings yet

- Research Methodology Cia 2Document10 pagesResearch Methodology Cia 2Tejaswini KateNo ratings yet

- Inflation Rate in Pakistan Research PaperDocument7 pagesInflation Rate in Pakistan Research Paperisvgmchkf100% (1)

- Literature Review On Inflation in TanzaniaDocument7 pagesLiterature Review On Inflation in Tanzaniac5eyjfnt100% (1)

- Assignment Fisher 1Document32 pagesAssignment Fisher 1Ranjit AulakNo ratings yet

- NSE-NYSE IntegrationDocument25 pagesNSE-NYSE IntegrationHaritika ChhatwalNo ratings yet

- Impact of Macroeconomic Variables On Indian Stock MarketDocument10 pagesImpact of Macroeconomic Variables On Indian Stock MarketAnindya MitraNo ratings yet

- Impact of Money Supply On Economic Growth of BangladeshDocument9 pagesImpact of Money Supply On Economic Growth of BangladeshSarabul Islam Sajbir100% (2)

- Final Term Paper 3Document21 pagesFinal Term Paper 3Stanley NgacheNo ratings yet

- Relationship Between Stock Market and Foreign Exchange Market in India: An Empirical StudyDocument7 pagesRelationship Between Stock Market and Foreign Exchange Market in India: An Empirical StudySudeep SureshNo ratings yet

- Relationship Between Inflation and Economic Growth in BangladeshDocument8 pagesRelationship Between Inflation and Economic Growth in BangladeshArif ShahriarNo ratings yet

- The Review of Stock Returns and Macroeconomic VariablesDocument28 pagesThe Review of Stock Returns and Macroeconomic VariablesfanycharesNo ratings yet

- Jurnal 2Document11 pagesJurnal 2devinaNo ratings yet

- Study On The Impact of Inflation On The Stock Market in ChinaDocument11 pagesStudy On The Impact of Inflation On The Stock Market in Chinaace rogerNo ratings yet

- Are Phillips Curves Useful for Forecasting InflationDocument10 pagesAre Phillips Curves Useful for Forecasting InflationTrinh DucNo ratings yet

- Modeling The Philips Curve: A Time-Varying Volatility ApproachDocument18 pagesModeling The Philips Curve: A Time-Varying Volatility ApproachOladipupo Mayowa PaulNo ratings yet

- Lje 2009Document23 pagesLje 2009Arshad HasanNo ratings yet

- 3 PDFDocument6 pages3 PDFFAHEEMNo ratings yet

- 7 Is It Really The Fisher EffectDocument7 pages7 Is It Really The Fisher EffectmartinbrindisNo ratings yet

- Impact of Money Supply and Inflation On Economic Growth in NepalDocument16 pagesImpact of Money Supply and Inflation On Economic Growth in NepalNikhil TandukarNo ratings yet

- The Relationship Between Stock Market Volatility and Macro Economic VolatilityDocument12 pagesThe Relationship Between Stock Market Volatility and Macro Economic VolatilitygodotwhocomesNo ratings yet

- Money Supply & Inflation in India: Phases and Relationship to Price LevelDocument33 pagesMoney Supply & Inflation in India: Phases and Relationship to Price LevelSyed M ShameelNo ratings yet

- The Money Supply Process in Bangladesh: An Error-Correction ApproachDocument22 pagesThe Money Supply Process in Bangladesh: An Error-Correction ApproachKhandaker Amir EntezamNo ratings yet

- Money, Inflation and Growth Relationship: The Turkish CaseDocument7 pagesMoney, Inflation and Growth Relationship: The Turkish CaseJennifer WijayaNo ratings yet

- Relationship between Treasury bill rate and NEPSE index in NepalDocument8 pagesRelationship between Treasury bill rate and NEPSE index in NepalDistro MusicNo ratings yet

- Noble GroupDocument2 pagesNoble GroupromanaNo ratings yet

- RELATIONSHIP BETWEEN OPENNESS, INFLATION AND GROWTHDocument12 pagesRELATIONSHIP BETWEEN OPENNESS, INFLATION AND GROWTHamal zahraNo ratings yet

- Alemu AdelaDocument11 pagesAlemu AdelaKaasahun Dangura KDNo ratings yet

- Dinero Precios y Produccion en IranDocument7 pagesDinero Precios y Produccion en IranRicardo123No ratings yet

- NBER Macroeconomics Annual 2017: Volume 32From EverandNBER Macroeconomics Annual 2017: Volume 32Martin EichenbaumNo ratings yet

- Lecture 6 - Profitability AnalysisDocument21 pagesLecture 6 - Profitability AnalysisTrang Bùi HàNo ratings yet

- Lecture 8 - Credit Analysis & Distress PredictionDocument22 pagesLecture 8 - Credit Analysis & Distress PredictionTrang Bùi Hà100% (1)

- Lecture 10 - Prospective Analysis - ForecastingDocument15 pagesLecture 10 - Prospective Analysis - ForecastingTrang Bùi Hà100% (1)

- Lecture 2 - Accounting Analysis 1Document21 pagesLecture 2 - Accounting Analysis 1Trang Bùi Hà100% (1)

- Annex 4Document4 pagesAnnex 4Trang Bùi HàNo ratings yet

- Lecture 1: Overview of Financial Statement AnalysisDocument17 pagesLecture 1: Overview of Financial Statement AnalysisTrang Bùi HàNo ratings yet

- Risk Analysis Liquidity and SolvencyDocument23 pagesRisk Analysis Liquidity and SolvencyTrang Bùi HàNo ratings yet

- Chapter 01Document17 pagesChapter 01Trang Bùi HàNo ratings yet

- Abcs ContractsDocument9 pagesAbcs ContractsTrang Bùi HàNo ratings yet

- 3 International Commercial Sale of GoodsDocument31 pages3 International Commercial Sale of GoodsPranav GhabrooNo ratings yet

- Practicetest Macro16Document9 pagesPracticetest Macro16Trang Bùi HàNo ratings yet

- Fdi Related Dispute Settlement and The Role of Icsid Striking Balance Between de 22Document15 pagesFdi Related Dispute Settlement and The Role of Icsid Striking Balance Between de 22Trang Bùi HàNo ratings yet

- MFCB Full Set 2Document9 pagesMFCB Full Set 2Tian Xiang100% (1)

- Cash and Cash Equivalents Basic ProblemsDocument6 pagesCash and Cash Equivalents Basic ProblemshellokittysaranghaeNo ratings yet

- GE Employee Layoff Benefits PackageDocument2 pagesGE Employee Layoff Benefits PackageIndiana Public Media NewsNo ratings yet

- N.L.S I.U: Rbi As The Custodian of Foreign ExchangeDocument13 pagesN.L.S I.U: Rbi As The Custodian of Foreign Exchangevishnu TiwariNo ratings yet

- Wachtell, Lipton, Rosen Katz: New - York, New York 10173Document11 pagesWachtell, Lipton, Rosen Katz: New - York, New York 10173Matthew Russell LeeNo ratings yet

- Financial InstrumentsDocument29 pagesFinancial InstrumentsayeshaNo ratings yet

- Brand Ambassadors 2021 by Ashish Gautam Ga Guru - OLD FORMATDocument65 pagesBrand Ambassadors 2021 by Ashish Gautam Ga Guru - OLD FORMATSushil 799 Pi 3No ratings yet

- Increase Market Share with New StrategiesDocument21 pagesIncrease Market Share with New StrategiesjilnaNo ratings yet

- Business Plan Powerpoint TemplateDocument14 pagesBusiness Plan Powerpoint TemplateTuyet PhamNo ratings yet

- Chapter Twenty-One: Managing Liquidity RiskDocument20 pagesChapter Twenty-One: Managing Liquidity RiskSagheer MuhammadNo ratings yet

- PRICING DECISION FACTORSDocument25 pagesPRICING DECISION FACTORSJulianne Lopez EusebioNo ratings yet

- Venture Capital Module Sem 3Document15 pagesVenture Capital Module Sem 3Sadhna GaurrNo ratings yet

- Government Budgeting Indian Budget For BeginnersDocument4 pagesGovernment Budgeting Indian Budget For BeginnersBankatesh ChoudharyNo ratings yet

- Swan Global Funds LTD - Foreign Equity FundDocument1 pageSwan Global Funds LTD - Foreign Equity FundinoxrocksNo ratings yet

- BISD District Final ReportDocument24 pagesBISD District Final ReportbeaumontenterpriseNo ratings yet

- Marketing Plan PPT MBDocument27 pagesMarketing Plan PPT MBFawwad AfridiNo ratings yet

- ZSE Listing Guide Mar 2022Document14 pagesZSE Listing Guide Mar 2022JonathanNo ratings yet

- Nhmfc-Waiver 2017 BlankDocument1 pageNhmfc-Waiver 2017 BlankSterling SamNo ratings yet

- PropertyGuru Prospectus 2019Document264 pagesPropertyGuru Prospectus 2019Terence LeeNo ratings yet

- CH 17 Payout PolicyDocument111 pagesCH 17 Payout PolicyDiego TriviñoNo ratings yet

- First StepDocument5 pagesFirst StepBhupendra Nagesh67% (3)

- Because Natalie Has Had Such A Successful First Few MonthsDocument3 pagesBecause Natalie Has Had Such A Successful First Few MonthsDoreenNo ratings yet

- TYPES OF BUSINESS ORGANIZATION Training MaterialDocument19 pagesTYPES OF BUSINESS ORGANIZATION Training MaterialAugustė MačiulytėNo ratings yet

- Exercise Receivables 1Document8 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- Module 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Document52 pagesModule 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Anna CharlotteNo ratings yet

- Company Introduction of Punjab Sind BankDocument9 pagesCompany Introduction of Punjab Sind BankHarsh GogiaNo ratings yet

- IL&FS CrisisDocument12 pagesIL&FS Crisisabid hussain0% (2)

- Baron Coburg - 2003Document7 pagesBaron Coburg - 2003magicshine100% (1)

- Chapter 13 MF Model QuestionsDocument12 pagesChapter 13 MF Model QuestionsMichelle HsuNo ratings yet

- Advantages of Capital Gains Tax Over Wealth TaxDocument8 pagesAdvantages of Capital Gains Tax Over Wealth TaxAnorld MunapoNo ratings yet