Professional Documents

Culture Documents

Engineering Economics Review Questions

Uploaded by

pganoel0 ratings0% found this document useful (0 votes)

71 views18 pagesEngineering Economics

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEngineering Economics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views18 pagesEngineering Economics Review Questions

Uploaded by

pganoelEngineering Economics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 18

Engineering Economics—Practice Problems 267

Practice Problems

f you attempt only a few, select those with an asterisk.)

54 Which of the following would be most difficult to monetize?

4) maintenance cost b) selling price) fuel cost) prestige

*5.2 If $1,000 is deposited in a savings account that pays 6% annual interest and Value and Interest

all the interest is let in the account, what is the account balance after three

years?

a) $640 b) $1,000 ©) $1,180 ) $1,191

°5.3 Your perfectly reliable friend, Merle, asks for a Joan and promises to pay

back $150 two years from now. If the minimum interest rate you will ac-

cept is 8%, what is the maximum amount you will loan him?

a)sti9——_b) $126 9 si29 4) $139

54 $12,000 is borrowed now at 12% interest. The first payment is $4000 and is

made 3 years from now. The balance of the debt immediately after the

payment is

a) $4000) $8000 )$12,000 ad) $12,860

55 An alumnus establishes a perpetual endowment fund to help Saint Louis

University. What amount must be invested now to produce income of

$100,000 one year from now and at one-year intervals forever? Interest rate

is 8%,

a) $8000 _b)$100,000-—) $1,250,000) $10,000,000

*5.6 The annual amount of a series of payments to be made at the end ofeach of Equivalence of Cash

the next twelve years is $500. What is the present worth of the payments at Flow Patterns

8% interest compounded annually?

a) $500) $3,768, +) $6,000 ) $6480

“57 Consider a prospective investment in a project having a first cost of

$300,000, operating and maintenance costs of $35,000 per year, and an es-

timated net disposal value of $50,000 at the end of thirty years. Assume an

interest rate of 8%

What is the present equivalent cost of the investment if the planning hori-

zon is thirty years?

a) $670,000 b) $689,000 «) $720,000) $791,000

If the project replacement will have the same first cost, life, salvage value,

and operating and maintenance costs as the original, what is the capital~

ized cost of perpetual service?

a) $670,000 b) $689,000) $720,000) $765,000

Eres

268 Chapter 5—Engineering Economics

+58 Maintenance expenditures for a structure with a twenty-year life will come

as periodic outlays of $1,000 at the end of the fifth year, $2,000 atthe end of

the tenth year, and $3,500 at the end of the fifteenth year. With interest at

10%, what is the equivalent uniform annual cost of maintenance for the

‘twenty-year period?

a) $200 ) $262 ) $300 4) $925

59 An alumnus has given Michigan State University ten million dollars to

build and operate a laboratory. Annual operating cost is estimated to be

one hundred thousand dollars. The endowment will earn 6% interest.

‘Assume an infinite life for the laboratory and determine how much money

may be used for its construction.

2) $5.00%10% b) $8.83x10% ) $8,72%10" d) $9. 90108

5.10 An investment pays $6000 at the end of the first year, $4000 at the end of

the second yeat, and $2000 at the end of the third year. Compute the pre-

cont value of the investment if a 10% rate-of-returm is required. \

a) $8333 —_—b) $9667 $10,300 4) $12,000

5,1 An amount F is accumulated by investing a single amount P for n come

pounding periods with intrest rate of. Select the formula that relates P to

a) P= F(t4i)™ b) P=F(+i)" ) P= P(r)" 4) P=F(L+ni)

5.12. At the end of each of the next ten years, a payment of $200 is due. At an

interest rate of 6%, what is the present worth of the payments?

a) $27 b) $200 gga 4) $2000

5.13. The purchase price of an instrument is $12,000 and its estimated mainte-

nance costs are $500 for the first year, $1500 for the second and $2500 for

the third year. After three years of use the instrument is replaced it has no

salvage value, Compute the present equivalent cost ofthe instrument using

10% interest.

a)$14,070 b)S15570 «$15,730 4) $16,500

{fan amount invested five years ago has doubled, what is the annual inter-

est rate?

a) 15% b) 12% 10% d) 6%

515 After a factory has been built near a stream, itis learned that the stream oc

casionally overflows its banks. A hydrologic study indicates that the prob-

ability of flooding is about 1 in 8 in any one year, A flood would cause

about $20,000 in damage to the factory. A levee can be constructed to pre-

‘vent flood damage. Its cost will be $54,000 and its useful life is thirty years.

Money can be borrowed at 8% interest, If the annual equivalent cost of the

levee is less than the annual expectation of flood damage, the levee should

cnr

a

268 Chapter 5—Engineering Economics

38

59

5.0

sat

5.2

5.13

544

5a5

Maintenance expenditures for a structure with a twenty-year life will come

as periodic outlays of $1,000 at the end of the fifth year, $2,000 at the end of

the tenth year, and $3,500 at the end of the fifteenth year. With interest at

10%, what is the equivalent uniform annual cost of maintenance for the

twenty-year period?

a)$200—_b) $262 9 $300 a) $525

An alumnus has given Michigan State University ten million dollars to

build and operate a laboratory. Annual operating cost is estimated to be

one hundred thousand dollars. The endowment will earn 6% interest.

Assume an infinite life for the laboratory and determine how much money

may be used for its construction.

a) $5.00%10° b) $8.33%10°

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Design of Structural MembersDocument12 pagesDesign of Structural Membersrco548No ratings yet

- Word Problems Involving Decimals: AdditionDocument2 pagesWord Problems Involving Decimals: Additionrco548No ratings yet

- Sample Hydro WaterDocument7 pagesSample Hydro Waterrco548No ratings yet

- Development of Sources of Water For Rural/Urban Residences: Leonardo C. Sawal, MSSEDocument22 pagesDevelopment of Sources of Water For Rural/Urban Residences: Leonardo C. Sawal, MSSErco548No ratings yet

- Engineering EconomicsDocument18 pagesEngineering Economicsrco548No ratings yet

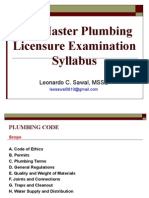

- The Master Plumbing Licensure Examination Syllabus: Leonardo C. Sawal, MSSEDocument16 pagesThe Master Plumbing Licensure Examination Syllabus: Leonardo C. Sawal, MSSErco548No ratings yet

- CabinetDocument1 pageCabinetrco548No ratings yet

- Formula For Engineering EconomyDocument1 pageFormula For Engineering Economyrco548No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)