Professional Documents

Culture Documents

RMC No 10-2015

Uploaded by

Karla MirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No 10-2015

Uploaded by

Karla MirCopyright:

Available Formats

E#i

r.Eilei

.\ffii/

gU-J

..v

REPUBLIC OF THE P}]ILIPPINES

DEPARTN{ENT OF FIN-AN CE

BUREAU OF INTERNAL REYENUE

)r

,l.,

.-".'-lrl,i

NSg#

v

lv4arch

23.2015

REVENUE MEMORANDUM CIRCULAR NO. IC_

SUBJECT

N{

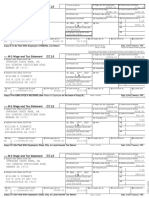

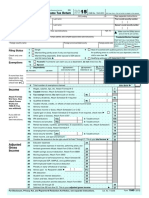

F|LTNG OF TNCOME TAX RETURNS (BtR FORM NO. 1700) OF EMPLOYEES

BELONGING TO THE EMPLOYER IDENTIFIED AS LARGE TAXPAYER

TO

All Revenue Officials, Employees and Others Concerned

\Uhile the Large Taxpayei'Ofiices of the Bui'eau has limiied accessrbilitv in processrng

ti-ansactions of employees of Large Taxpayer (LT) and the existing regisrration recorcs

of employeei

are still wiih the Revenue Distrrct office (RDo) where the LT is physically, iocated/situatec, ali RDos

are hereby directed to accepilreceive BIR Form 1700 filed by empioyees employed by LT

The lncome

Tax Returns (lTR) with no tax payment shall be'manuall5z filed using eBlRForms. in triplicate

copies.

iviih the RDC where the LT employer is physically situated/located. Cn the oil-rer hand

i-R witn

payment shall be filed/paid in any Authorized Agent Banks (AABs)/Revenue Collection

Ofiicers

(RCOs)' Special Coliecting Officers (SCOs) and other authorized Coltection Offrcers (COs)

v,,iihin tne

concerned RDO. Also, fortaxpayers'convenience,they are encouraged to e-frle and/oi-e-pav

using

er 15.

For example:

Emcloyee of SM Ncrlh Edsa (main employer is a Large Taxpaye) musi ftie at RDO C3g - iyofih,euezcr,

Citl' va1"r" S/i.4 ls physicaliy situated/iocaled. inCicating also RDa Code O3g in the jTR.

However, new employees of LT regtstered where the LT emplcyer is registerec

foiicwing

Revenue Regulations (RR) 7-2012 and using eTlS1, shall file their no pa5rment ITR with

ihe

concerned Large Taxpayer office or pay in any AABs (lrR with payment) of LT.

Only employees not qualified for the substituted filing pursuant to RR 3-2002, sr.,ch

as

employees deriving compensation income from'iwo or more employers, concurrently or

successively

at any time during the taxable year; employees deriving compensation income and the income .rax

of

ia,'hich has not been withheld corr-ectly (i.e. tax due is not equal to the tax r,,riihheld)

are requrrec to fiie

BiR Form 1700: or those employees qualified for substituted filing but opted to file for an ITR

for

purposes of fromotion (PNP/AFP), loans, foreign travel requiremenis,

etc.

AII internal revenue officers, employees and others concerned are hereby enjoined

to give this

Circular as wide a pubiicity as possible.

H-2

KIM S. JACIN:TO-HENARES

Commissioner of lnierna Re,renue

03i3?0

You might also like

- Pals - Pol Law 2015Document32 pagesPals - Pol Law 2015MaricelBaguinonOchate-NaragaNo ratings yet

- Articles of Partnership (FORM)Document5 pagesArticles of Partnership (FORM)Karla MirNo ratings yet

- Pals - Pol Law 2015Document32 pagesPals - Pol Law 2015MaricelBaguinonOchate-NaragaNo ratings yet

- Tax CasesDocument49 pagesTax CasesKarla MirNo ratings yet

- Criminal Procedure Midterms ReviewerDocument8 pagesCriminal Procedure Midterms ReviewerSuiNo ratings yet

- Evidence CasesDocument87 pagesEvidence CasesKarla MirNo ratings yet

- Bank vs Heirs, Partition of EstateDocument36 pagesBank vs Heirs, Partition of EstateKarla MirNo ratings yet

- De Ocampo Vs GatchalianDocument7 pagesDe Ocampo Vs GatchalianKarla MirNo ratings yet

- Dilg MC 2013-139Document8 pagesDilg MC 2013-139Karla MirNo ratings yet

- Alcantara Vs CADocument22 pagesAlcantara Vs CAKarla MirNo ratings yet

- Duties and Functions of Barangay TanodDocument18 pagesDuties and Functions of Barangay TanodKarla Mir81% (37)

- Anti Red Tape MaterialsDocument2 pagesAnti Red Tape MaterialsKarla MirNo ratings yet

- Traders Insurance Vs Dy Eng GiokDocument5 pagesTraders Insurance Vs Dy Eng GiokKarla MirNo ratings yet

- Anti Red Tape MaterialsDocument2 pagesAnti Red Tape MaterialsKarla MirNo ratings yet

- Criminal Procedure Midterms ReviewerDocument8 pagesCriminal Procedure Midterms ReviewerSuiNo ratings yet

- Grassroots Budgeting Guidelines For 2015Document27 pagesGrassroots Budgeting Guidelines For 2015Karla MirNo ratings yet

- Civil Procedure Flow ChartDocument8 pagesCivil Procedure Flow ChartCharles Cornel93% (14)

- Civil Procedure Flow ChartDocument8 pagesCivil Procedure Flow ChartCharles Cornel93% (14)

- Property Law ReviewerDocument48 pagesProperty Law Reviewerpinkbucket96% (24)

- Barangay Tanods and The Barangay Peace and OrderDocument25 pagesBarangay Tanods and The Barangay Peace and OrderKarla Mir74% (42)

- Criminal Procedure Midterms ReviewerDocument8 pagesCriminal Procedure Midterms ReviewerSuiNo ratings yet

- Annotated Rules of Court: Rules of Criminal ProcedureDocument106 pagesAnnotated Rules of Court: Rules of Criminal Procedureviktor samuel fontanilla100% (14)

- Third Division GDocument16 pagesThird Division GKarla MirNo ratings yet

- Katarungang Pambarangay: A HandbookDocument134 pagesKatarungang Pambarangay: A HandbookCarl92% (101)

- Property Law ReviewerDocument48 pagesProperty Law Reviewerpinkbucket96% (24)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- United States TIN PDFDocument2 pagesUnited States TIN PDFAldo Rodrigo AlgandonaNo ratings yet

- Form 944 Employer Tax ReturnDocument4 pagesForm 944 Employer Tax ReturnRafael PolancoNo ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- Revenue Collection for One-Time Tax PaymentsDocument2 pagesRevenue Collection for One-Time Tax PaymentsFloisNo ratings yet

- US Internal Revenue Service: I1040 - 2004Document128 pagesUS Internal Revenue Service: I1040 - 2004IRS100% (1)

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- SUTA and FUTA CalculationsDocument2 pagesSUTA and FUTA CalculationsMary83% (12)

- EntitlementsDocument4 pagesEntitlementsRichard HortonNo ratings yet

- How To File Federal Tax ReturnDocument4 pagesHow To File Federal Tax ReturnDiana Bumbaru100% (1)

- IRSDoc6209 2003Document665 pagesIRSDoc6209 2003EheyehAsherEheyehNo ratings yet

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocument1 pageW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- EIN and Biz RegistrationDocument2 pagesEIN and Biz RegistrationmaufunctNo ratings yet

- US Internal Revenue Service: I1040 - 1998Document112 pagesUS Internal Revenue Service: I1040 - 1998IRSNo ratings yet

- LeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberDocument12 pagesLeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberghostgripNo ratings yet

- Information For The Press - Press Office - SSADocument4 pagesInformation For The Press - Press Office - SSATony DiazNo ratings yet

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- Michigan Individual Income Tax Return form guideDocument2 pagesMichigan Individual Income Tax Return form guideyaposiNo ratings yet

- 2011 Tax TableDocument2 pages2011 Tax TablefrankvanhasteNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- CGC Food Corp employee payroll reportDocument6 pagesCGC Food Corp employee payroll reportacctg2012No ratings yet

- Top Federal Tax Rates Since 1916Document1 pageTop Federal Tax Rates Since 1916Ephraim DavisNo ratings yet

- SF-181 Ethnicity and Race Identification Standard Form 181Document26 pagesSF-181 Ethnicity and Race Identification Standard Form 181Sistar Makkah94% (16)

- Fiscal Responsibility ActDocument99 pagesFiscal Responsibility ActRyan KingNo ratings yet

- Form 940 for 2019: Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument1 pageForm 940 for 2019: Employer's Annual Federal Unemployment (FUTA) Tax Returnfortha loveofNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- FPSC Exam Fee Payment ChalanDocument1 pageFPSC Exam Fee Payment ChalanDaniyal ArifNo ratings yet

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet