Professional Documents

Culture Documents

TRIF Constructions Notes

Uploaded by

cmakuldeep0 ratings0% found this document useful (0 votes)

7 views7 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views7 pagesTRIF Constructions Notes

Uploaded by

cmakuldeepCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

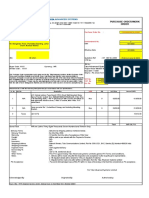

TRIF Constructions Private Limited

Schedules to the financial statements

for the period from 29 October 2008 to 31 March 2009

(Currency: Indian Rupees)

1.

(a)

(b)

©

@

Statement of significant accounting policies

Basis of preparat of financial statements:

‘The financial statements are prepared under the historical cost convention, on the accrual

basis of accounting in accordance with the accounting principles generally accepted in

India (‘Indian GAAP") and comply with the Companies (Accounting Standards)

Rules, 2006 issued by the Central Government, in consultation with National Advisory

Committee on Accounting Standards (‘NACAS") and relevant provisions of Companies

Act, 1956 (‘the Act’) to the extent applicable.

Use of estimates

The preparation of financial statements in conformity with Indian GAAP requires the

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the disclosure of contingent liabilities on the date of the

financial statements and the reported amounts of revenues and expenses during the

reported period. Management believes that the estimates made in the preparation of the

financial statements are prudent and reasonable. Actual results could differ from those

estimates. Any revision to accounting estimates is recognised prospectively in current

‘and future periods.

Income taxes

Income tax expense comprises current income tax, fringe benefit tax (i.e. amount of tax

for the period determined in accordance with the income tax law) and deferred tax

charge or credit (reflecting the tax effects of timing differences between accounting

income and taxable income for the period). The deferred tax charge or credit and the

corresponding deferred tax liabilities or assets are recognized using the tax rates that

hhave been enacted or substantively enacted by the balance sheet date. Deferred tax

assets are recognized only to the extent there is reasonable certainty that the assets can

be realized in future; however; where there is unabsorbed depreciation or carried

forward loss under taxation laws, deferred tax assets are recognized only if there is a

virtual certainty of realization of such assets. Deferred tax assets are reviewed at each

balance sheet date and written down or written up to reflect the amount that is

reasonably/virtually certain (as the case may be) to be realized.

Provision for Fringe Benefit Tax (FBT) is made on the basis of applicable FBT on the

taxable value of specified expenses of the Company as prescribed under

the Income Tax Act 1961.

Earning per share

Basic caming per share is calculated by dividing the net profivloss for the period

attributable to the equity share holders by the weighted average number of equity shares

‘outstanding during the period.

For the purpose of calculating diluted earnings per share, the net profitloss for the

period attributable to the equity shareholders and the weighted average number of shares

Ryistanding during the period are adjusted for the effects of all dilutive potential equity

TRIF Constructions Private Limited

Schedules to the financial statements

for the period from 29 October 2008 to 31 March 2009

(Currency: Indian Rupees)

©

o

shares outstanding during the period, except where the results would be anti-dilutive.

Foreign currency translation

Foreign exchange transactions are recorded at the spot rates on the date of the respective

transactions. Exchange differences arising on foreign exchange transactions settled

during the period are recognized in the profit and loss account of the period.

‘Monetary assets and liabilities denominated in foreign currencies as at the balance sheet

date are translated at the closing exchange rates on that date; the resultant exchange

differences are recognized in the profit and loss account.

Provisions and contingencies

‘The Company creates a provision where there is present obligation as a result of a past

event that probably requires an outflow of resources and a reliable estimate can be made

of the amount of the obligation. A disclosure for a contingent liability is made when

there is a possible or a present obligation that may, but probably will not require an

outflow of resources. When there is a possible obligation in respect of which the

likelihood of outflow of resources is remote, no provision or disclosure is made.

TRIF Constructions Private Limited

Schedules to the financial statements

Jar the period from 29 October 2008 to 31 March 2009

(Currency: Indian Rupees)

6

Micro, Small and Medium Enterprises

Under the Micro, Small and Medium Enterprises Development Act, 2006 MSMED')

which came into force from 2 October 2006, certain disclosures are required to be made

relating to Micro, Small and Medium enterprises. On the basis of the information and

records available with the management, there are no outstanding dues to the Micro and

Small enterprises as defined in the Micro, Small and Medium Enterprises Development

‘Act, 2006 as set out in the following disclosures:

2009,

Principal amount remaining unpaid to any supplier as at the period

end 2

Interest due thereon

Amount of interest paid by the Company in terms of section 16 of

the MSMED, along with the amount of the payment made to the

supplier beyond the appointed day during the accounting period.

Amount of interest due and payable for the period of delay in

making payment (which have been paid but beyond the appointed

day during the period) but without adding the interest specified

under the MSMED =

Amount of interest accrued and remaining unpaid at the end of the

accounting period .

Earning per share

Profit / (Loss) attributable to equity shareholders (A) (57,370)

Weighted average number of equity shares outstanding during the 10,000

period (B)

Basic and diluted earnings per equity share (Face value of Rs.10/- per (5.74)

share) (A /B)

Related Party Disclosure

Names of related parties

Holding Company (w.e.f 11 December 2008)

Tata Realty and Infrastructure Limited

Ultimate Holding Company(w.e.f 11 December 2008)

‘Tata Sons Limited

Fellow subsidiaries (w.e.f 11December 2008)

TRIF Gandhinagar Projects Private Limited

Navinya Buildcon Private Limited

TRIF Constructions Private Limited

Schedules to the financial statements

for the period from 29 October 2008 to 31 March 2009

(Currency: Indian Rupees)

Pioneer Infratech Private Limited

‘TRIF Hyderabad Projects Private Limited

Abinsa Realtors Private Limi

TRIF Kochi Projects Private Limited

TRIF Kolkata Projects Private Limited

TRIF Property Development Private Limited

TRIF Infrastructure Private Limited

TRIF Real Estate And Development Private Limited

TRIF Realty Projects Private Limited

TRIF Trivandrum Projects Private Limited

TRIL Airport Developers Limited

‘TRIL Constructions Limited

TRIL Developers Limited

TRIF Erectors Private Limited (w.e.f. 30 December 2008)

‘TRIF Mega Projects Private Limited (w.e.f. 30 December 2008)

‘TRIF Modern Superstructures Private Limited (w.e.£. 30 December 2008)

TRIF Structures and Builders Pi i 30 December 2008)

Acme Living Solutions Private Limited (w.e.f. 27 February 2009)

Ardent Properties Private Limited (w.e.f. 19 December 2008)

Arrow Infra Estates Private Limited

Landscape Structures Private Limited (w.e.f. 19 December 2008)

Gurgaon Construct Well Private Limited (Formerly Unitech Construct Well Private

Limited)

Gurgaon Infratech Private Limited (Formerly Unitech Infratech Private Limited)

Gurgaon Realtech Limited (Formerly Unitech Real Tech Limited)

Pune Solapur Expressways Private Limited (w.e.f. 24 March 2009)

2st Century Infra Tele Limited )

Computational Research Laboratories Limited

Concept Marketing and Advertising Limited

‘e-Nxt Financials Limited

Ewart Investment Private Limited

Ewart Investments Limited

Good Health TPA Services Limited

Infiniti Retail Limited (formerly Value Electronics Limited)

Nova Integrated Systems Limited

Panatone Finvest Limited

‘Tara Aerospace Systems Limited

Tata Advanced Systems Limited

Tata AG, Zug

Tata AIG General Insurance Company Limited

Tata AIG Life Insurance Company Limited

‘Tata Asset Management (Mauritius) Pvt Limited

Tata Asset Management Limited

‘Tata Business Support Services Limited (formerly E2E SerWiz Solutions Limited)

Tata Capital Advisors Pte. Limited

Tata Capital Housing Finance Limited

‘Tata Capital Limited (formerly Primal Investment and Finance Limited)

‘Tata Capital Markets Limited

Tata Capital Markets Pte. Limited

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hindustan Junction Boxes.Document1 pageHindustan Junction Boxes.cmakuldeepNo ratings yet

- Magnetic Control Rev1Document2 pagesMagnetic Control Rev1cmakuldeepNo ratings yet

- Honeywell Secunty Amedment 2Document1 pageHoneywell Secunty Amedment 2cmakuldeepNo ratings yet

- Honeywell USD Rev1Document1 pageHoneywell USD Rev1cmakuldeepNo ratings yet

- Honeywell Secunty Ameded PO'sDocument3 pagesHoneywell Secunty Ameded PO'scmakuldeepNo ratings yet

- Cardscan Info DriveDocument2 pagesCardscan Info DrivecmakuldeepNo ratings yet

- Cardscan Overdrive Systems.Document1 pageCardscan Overdrive Systems.cmakuldeepNo ratings yet

- Hindustan Junction Boxes.Document1 pageHindustan Junction Boxes.cmakuldeepNo ratings yet

- Asmacs Netgear SwitchesDocument1 pageAsmacs Netgear SwitchescmakuldeepNo ratings yet

- TRIF Constructions ARDocument1 pageTRIF Constructions ARcmakuldeepNo ratings yet

- TRIF26Q4Document1 pageTRIF26Q4cmakuldeepNo ratings yet

- Audited - TRIF Constructions PVT LTD Financials As of 31 Mar 10Document9 pagesAudited - TRIF Constructions PVT LTD Financials As of 31 Mar 10cmakuldeepNo ratings yet

- TRIF Constructions FinancialsDocument6 pagesTRIF Constructions FinancialscmakuldeepNo ratings yet

- TRIF Constructions DRDocument3 pagesTRIF Constructions DRcmakuldeepNo ratings yet

- Notes To Accounts TRIF Constructions 31 Mar 10 - Cut 1Document6 pagesNotes To Accounts TRIF Constructions 31 Mar 10 - Cut 1cmakuldeepNo ratings yet

- LOR TRIF ConstructionsDocument4 pagesLOR TRIF ConstructionscmakuldeepNo ratings yet

- Constructions - 0910 Sub-JV Annex 1-16Document62 pagesConstructions - 0910 Sub-JV Annex 1-16cmakuldeepNo ratings yet

- Tasl - TBDocument9 pagesTasl - TBcmakuldeepNo ratings yet

- Audited - TRIF Constructions PVT LTD Financials As of 31 Mar 10Document9 pagesAudited - TRIF Constructions PVT LTD Financials As of 31 Mar 10cmakuldeepNo ratings yet

- Audit Report Trif ConstDocument2 pagesAudit Report Trif ConstcmakuldeepNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hitachi Datasheet Thin Image SnapshotDocument2 pagesHitachi Datasheet Thin Image Snapshotemail7urangNo ratings yet

- Accomplishment Report - 1st and 2nd SemDocument41 pagesAccomplishment Report - 1st and 2nd Semshailean azulNo ratings yet

- Analysing Context CluesDocument2 pagesAnalysing Context CluesSwathiNo ratings yet

- Summary Basis For Regulatory Action TemplateDocument23 pagesSummary Basis For Regulatory Action TemplateAviseka AcharyaNo ratings yet

- New Text DocumentDocument8 pagesNew Text DocumentDhaniNo ratings yet

- Engineering Economy Course SyllabusDocument11 pagesEngineering Economy Course Syllabuschatter boxNo ratings yet

- Row 1Document122 pagesRow 1abraha gebruNo ratings yet

- Foundation of Special and Inclusive EducationDocument25 pagesFoundation of Special and Inclusive Educationmarjory empredoNo ratings yet

- Theo 5Document2 pagesTheo 5chingchongNo ratings yet

- DRF1301 1000V 15A 30MHz MOSFET Push-Pull Hybrid DriverDocument4 pagesDRF1301 1000V 15A 30MHz MOSFET Push-Pull Hybrid DriverAddy JayaNo ratings yet

- ASBMR 14 Onsite Program Book FINALDocument362 pagesASBMR 14 Onsite Program Book FINALm419703No ratings yet

- Narasimha EngDocument33 pagesNarasimha EngSachin SinghNo ratings yet

- Scent of Apples: Does The Author Make Us Think Seriously of Life? Why Do You Say So?Document2 pagesScent of Apples: Does The Author Make Us Think Seriously of Life? Why Do You Say So?carl tom BondiNo ratings yet

- Parashara'S Light 7.0.1 (C) Geovision Software, Inc., Licensed ToDocument5 pagesParashara'S Light 7.0.1 (C) Geovision Software, Inc., Licensed TobrajwasiNo ratings yet

- Word Formation - ExercisesDocument4 pagesWord Formation - ExercisesAna CiocanNo ratings yet

- Kurukshetra English August '17Document60 pagesKurukshetra English August '17amit2688No ratings yet

- A Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaDocument12 pagesA Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaOsama MazharNo ratings yet

- Twin-Field Quantum Key Distribution Without Optical Frequency DisseminationDocument8 pagesTwin-Field Quantum Key Distribution Without Optical Frequency DisseminationHareesh PanakkalNo ratings yet

- WORKSHOP ON ACCOUNTING OF IJARAHDocument12 pagesWORKSHOP ON ACCOUNTING OF IJARAHAkif ShaikhNo ratings yet

- Life and Works of Jose RizalDocument5 pagesLife and Works of Jose Rizalnjdc1402No ratings yet

- Design of Efficient Serial Divider Using HAN CARLSON AdderDocument3 pagesDesign of Efficient Serial Divider Using HAN CARLSON AdderInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ARCH1350 Solutions 6705Document16 pagesARCH1350 Solutions 6705Glecy AdrianoNo ratings yet

- Sustainability of A Beach Resort A Case Study-1Document6 pagesSustainability of A Beach Resort A Case Study-1abhinavsathishkumarNo ratings yet

- The Art of Woodworking Shaker FurnitureDocument147 pagesThe Art of Woodworking Shaker Furnituremalefikus100% (2)

- Connectors/Conjunctions: Intermediate English GrammarDocument9 pagesConnectors/Conjunctions: Intermediate English GrammarExe Nif EnsteinNo ratings yet

- H-1 Nationalism in Europe NotesDocument5 pagesH-1 Nationalism in Europe Noteskanishk kumarNo ratings yet

- Causes and Diagnosis of Iron Deficiency and Iron Deficiency Anemia in AdultsDocument88 pagesCauses and Diagnosis of Iron Deficiency and Iron Deficiency Anemia in AdultsGissell LópezNo ratings yet

- FunambolDocument48 pagesFunambolAmeliaNo ratings yet

- Historyofluthera01morg PDFDocument420 pagesHistoryofluthera01morg PDFJhonNo ratings yet

- Evelyn Nakano Glenn, "From Servitude To Service Work: Historical Continuities in The Racial Division of Paid Reproductive Labor"Document44 pagesEvelyn Nakano Glenn, "From Servitude To Service Work: Historical Continuities in The Racial Division of Paid Reproductive Labor"s0metim3sNo ratings yet