Professional Documents

Culture Documents

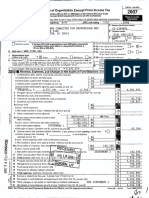

Cincinnati Arts Wave IRS Form 990 2009

Uploaded by

deanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cincinnati Arts Wave IRS Form 990 2009

Uploaded by

deanCopyright:

Available Formats

F'orm 990

OMS No 1545-0047

Department of the Treasury Internal Revenue Service

Return of Organization Exempt From Income Tax Under section SOl (c), 527, or 4947(a}(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

~ The orqarnzauon may have to use a copy of thrs return to satrsfy state reporting requirements

2008

I Open to Public lnspectiorr

I

F th 2008 d

t b 9/01 2008 d d' 8/31

2009

@

~

2: ~ UTI lO

» c: ~

c;:> ~ r-.,) C)

---.

C)

or e ca en ar year, or ax year egmnmg , , an en mg ,

B Check If applicable 0 Employer Identmcatron Number

,-- Please use Cincinnati Institute of Fine Arts

Address change IRS label 31-0537138

I- or pnnt dba Fine Arts Fund E

Name change or type. Telephone number

I- See 20 East Central Pkwy #200

lrutral return specrtic 513 871 2787

I- Instruc- Cincinnati, OH 45202

Termination lions.

I- 42,155,549.

Amended return G Gross receipts $

l- F Name and address of pnncipal officer Mary McCullough-Hudson

'-- Apphcauon pending H(a) Is thrs a group return for afnhates? t:1 Yes ~NO

Same As C Above H(b) Are all atnhates Included? Yes No

Tax-exempt status tx 1501 (c) (3 )... (Insert no ) I I 4947(a)(1) or I 1527 If 'No: attach a list (see instructrons)

I

J Website: ~ fineartsfund.orq H(c) Group exemption number ~

K Type of orqarnzatron Ix Corporauon I I Trust I I Association I I Other ~ I L Year of Forrnahon 1927 I M State of legal dormcile OH

I Part I Summary

1 Briefly describe the organization's mission or most significant activities Jn~J~n~hr~~E@9_~~£J~£Qes_~n9 ___

e _ cgt..a_l.Y~t_ gdv_jl..D~i_ng _t_h~_v_i.tg_l_i.ty _jl..Dd _viQr_jl..D~.Q{ _G~e.a_t..e!:. _Ciuc..i.Dua_U _c...o1!llllu_nit..i~.1;i _Qy __

u

c: ~hili~~_~_cr~atiya~na~_~_~_~i~~Ia~n~ _______________________

III

c:

a; ---------cr----------------------------------------------------

> 2 Check trus box ~ If the orqaruzanon discontinued ItS operations or disposed of more than 25% of ItS assets

0

e 3 Number of voting members of the governing body (Part VI, line 1 a) 3 48

ad

II) 4 Number of Independent voting members of the governing body (Part VI, line 1 b) 4 48

«> 5 Total number of employees (Part V, line 2a) 25

;:; 5

">

~ 6 Total number of volunteers (estimate If necessary) 6 1 760

« 7a Total gross unrelated business revenue from Part VIII, line 12, column (C) 7a O.

b Net unrelated busmess taxable Income from Form 990-T, line 34 7b O.

Prior Year Current Year

«> 8 Contributions and grants (Part VIII, line 1 h) 13,113,552. 12,436,071.

::J 9 Program service revenue (Part VIII, line 2g) 18,893. 22,592.

e

«> 10 Investment Income (Part VIII, column (A), lines 3, 4, and 7d) 1,413,708. -354,591.

>

«>

a: 11 Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) 27,750.

12 Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12) 15,414,270. 12,104,072.

13 Grants and Similar amounts paid (Part IX, column (A), lines 1-3) 11,378,895_ 10,332,904.

14 Benefits paid to or for members (Part IX, column (A), line 4)

II) 15 Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) 1,593,157. 1,918,868.

«> 16a Professional fundrarsmq fees (Part IX cclum, (A), line 11 e)

II)

c:

QI sing e~B EPv1E Bumn ( ), line 25) ~ I

a. b Total fundra 1,587,179. I

><

w

17 Other ex pen es ·dl II', coiumn (A), line 01 13-11 d, 11f-241) 1,494,009. 1,616,440.

CW) ~

18 Total expen ~ ~:~J~1;~c?~~~\ ~q Part IX, column (A), line 25) 14,466,061. 13,868,212.

19 Revenue les b ~~ line 12 948,209. -1,764,140.

b8 UJ I~ Beginning of Year End of Year

~j Total assets Part tl.eDeE N, UT

00 20 95,945 383. 83,608 933.

~'" 21 49,477,848. 43,155,892.

o'g Total habihn vall .une COO)

z,r 22 Net assets or fund balances Subtract line 21 from line 20 46,467,535. 40,453,041.

I Part II Signature Block

Under penalties of pe'lu:;'j" I declare that I have examined thrs return. Including accornpanymq schedules and statements. and to the best of my knowledge and belief, It IS

Sign :e. ~;cm~:[(yir([~rlth"ha~ o:e:s based on all InformatIon of wruch preparer has aiY ~edge.Q J -z Z 0 , 0

Here sl~na~~lr ~l ~ Date ~ \ ,

~ Mary c ullo h-Hudson President & CEO

Type or pront name and trtle

Date Check If Preparer's IdentIfyIng number

Paid self- ~D (see mstructions)

Preparer's employed

Pre- siqnature ~ Self-Prepared J

parer's - -

Form's name (or L __ J

Use yours If self- -- -- - -

Only employed), ~ L J EIN ~ l 1

- - -- - --

address, and

ZIP + 4 L _ -- .- Phone no ~ l -- -- - J May the IRS diSCUSS this return with the preparer shown above? (see mstructions)

[Xl Yes 0 No

BAA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

TEEA0112L

12122/08 Form 990 (2008)~

3/b-i.o

31-0537138

Pa e 2

see Instructions

'l- Briefly describe the organization's mission' See Schedule 0

2 Old the organization undertake any significant program services during the year which were not listed on the prior Form 990 or 990-EZ?

If 'Yes,' describe these new services on Schedule 0

3 Old the organization cease conducting, or make significant changes In how It conducts, any program services?

If 'Yes,' describe these changes on Schedule 0

4 Describe the exempt purpose achievements for each of the organization's three largest program services by expenses Section 501 (c) (3) and 501 (c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of grants and allocations to others, the total expenses, and revenue, If any, for each program service reported

DYes [R] No

DYes [R] No

4a(Code )(Expenses $ 10,386,160. mcludmq qrants of $ 10,313,850. ) (Revenue $ )

~~~J~~u~~~~Q~~~~e~yjf~e9_~~~~~~~~~PQ~~~~g~e3!~~~in~~~nE~~E~~ _

2~qa~~~~~~~_~~~n~~~~E5B~iv~~~E~~_~~!~~~~!~~~~n~~~n2~i~~~2~~b~B_~2~~ _

~252~u~~~_~®Eqe~~~~E~~£~nB~~~~~E~~~l~~~EyjQ~a~!~~Q~o~y~_~~!0~~02~21 __

_ sQ1~lJ-~~ P.!:<D~£~ g~a~!~ ~Q _s~QQ_o_f~ _eQ1~r_g~I}g_ ~~t.§ _~r2~~ _ ~n_9. _ ~~£ial_ ~!~ 3D'! ~~lt~~~ _

initiatives.

-----------------------------------------------------------------

4b(Code: I b(Expenses $ 712,627. includmq qrants of $ )(Revenue $ )

~2~0D~a~~~~!~2~@_~~_~~~~B~~~~~.!:~1~~B~~D~2[S~~e2~~~~n~_~O~~~!~ _

_ c2~v~.!:~a~~~n.§_~o_ ~e~~~mjD~ J~~u_f~ ~~~e~!~o~_~f_ Q~E~i_ZE~i2D _P_fQq_r2J.!!IIljQq. __ lh~_~u_f~~! __

2Qie~!~v~~J2~J2~~!~~_~mp~~~~~~~d~~~~g~~~!~~f~~~~~Y~B~~~U9~I}g_Q~bl~~ _

~~l~_~cB~~vl~~~~~cE02D~~~~c~l~Q~~~~~£~02£~!~~~q~!~~~~.§~~~~2~0~g~B~ _

~!~e~g~h~~in_g_'!_ D~aJ.!I.!Y_ E~t~_'!_n.9__~u1~us~ _s~£~o_f~ ~Q<.!,_ ~~r_y~Il5l. ~~ E_~hE~jQ'l2~<! _

sE~aJ.y~~K~~!~~~es!~~ _

4 c (Code I I) (Expenses $ 313, 11 7. Including grants of $ 19, 054 . ) (Revenue $ 9 897.)

~~~vj~~o~_~~~~cD~~cEl~~@2~~!Q~~~n~~~2.!:q_aB~~!~o~~~B.!:~u_gh~~~~p~a~!~~_~h2~~g __ 3Q<.!~~~~~~_~e!~oJ~~_g_~~h~B~~~~r~~tm~~~2f~~~eJ~~~Q'!_r.9__'!_n.9__~~~!~~~~~~~L __

~Q<.!p~~m2!~_g_~2~~_~n9_~~QY~~2f~~~1£~~~~lyJ!~2.!:qa~~~!0~~y~Q _

S2~~Q~~=~~~<!E~~_~e~!~r~~~~q~~~~~~~Q~2_~e~~e~g~J_tr~~yEID~l~'l~_~~y~~~~ _

~Q<.!p~~0.!:~~g~~~~E~~~l0Ql~~~n~~~E~~~~!h~~~~2~al_~o~®~~. _

4d Other program services (Oescnbe In Schedule 0 ) See Schedule 0

(Expenses $ 206,925. including grants of $ ) (Revenue $

12,695. )

4e Total program service expenses ~ $ 11,618,829. (Must equal Part IX, tine 25, column (8))

BAA

TEEAO 1 021. 12124/08

Form 990 (2008)

Form 990 (2008) Cincinnati Institute of Fine Arts

31-0537138

5 Section 501 (cX4), 501 (cX5), and 501 (cX6) organizations. Is the organization subject to the section 6033(e) notice and

reporting requirement and proxy tax? If 'Yes,' complete Schedule C, Part III 1-_5-+_-+ __

6 Did the organization maintain any donor advised funds or any accounts where donors have the right to provide advice on the distribution or Investment of amounts In such funds or accounts? If 'Yes,' complete Schedule D, Part I

12 Did the organization receive an audited financial statement for the year for which It IS completing this return that was

prepared In accordance with GAAp? If 'Yes,' complete Schedule D, Parts XI, XII, and XIII 12 X

13 Is the organization a school described In section 170(b)(1)(A)(II)? If 'Yes,' complete Schedule E 13 X

14a Did the organization maintain an office, employees, or agents outside of the US? 14a X

b Did the orqaruzatron have aggregate revenues or expenses of more than $10,000 from qrantrnakmq, fundrarsmq,

business, and program service activities outside the US? If 'Yes,' complete Schedule F, Part I 14b X

15 Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any organization

or entity located outside the United States? If 'Yes,' complete Schedule F, Part II 15 X

16 Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or assistance to

Individuals located outside the United States? If 'Yes,' complete Schedule F, Part III 16 X

17 Did the organization report more than $15,000 on Part IX, column (A), line 11e? If 'Yes,' complete Schedule G, Part I 17 X

18 Did the orqaruzatron report more than $15,000 total on Part VIII, lines 1c and 8a? If 'Yes,' complete Schedule G, Part II 18 X

I Part IV I Checklist of Required Schedules

1 Is the orqaruzatron descnbed In section 501 (c) (3) or 4947(a)(1) (other than a private foundation)? If 'Yes,' complete Schedule A

2 Is the orqarnzatron required to complete Schedule S, Schedule of Contributors?

3 Did the organization engage In direct or Indirect political campaign activrtres on behalf of or In oppositron to candidates for public office? If 'Yes,' complete Schedule C, Part I

4 Section 501 (cX3) organizations Did the orqaruzatron engage In lobbymq activities? If 'Yes,' complete Schedule C, Part II

7 Did the organization receive or hold a conservation easement, Including easements to preserve open space, the environment, histone land areas or histone structures? If 'Yes,' complete Schedule D, Part II

8 Did the organization maintain collections of works of art, hrstoncal treasures, or other Similar assets? If 'Yes,' complete Schedule D, Part III

9 Did the organization report an amount In Part X, line 21, serve as a custodian for amounts not listed In Part X, or provide credit counseling, debt management, credit repair, or debt negotiation services? If 'Yes,' complete Schedule D, Part IV

10 Did the organization hold assets In term, permanent, or quasi-endowments? If 'Yes,' complete Schedule D, Part V

11 Did the organization report an amount In Part X, lines 10, 12, 13, 15, or 25? If 'Yes,' complete Schedule D, Parts VI, VII, VIII, IX, or X as app/tcable

19 Did the orqaruzatron report more than $15,000 on Part VIII, line 9a? If 'Yes,' complete Schedule G, Part III 20 Did the orqaruzatron operate one or more hospitals? If 'Yes,' complete Schedule H

21 Did the organization report more than $5,000 on Part IX, column (A), line 1? If 'Yes,' complete Schedule I, Parts I and II

22 Did the organization report more than $5,000 on Part IX, column (A), line 2? If 'Yes,' complete Schedule I, Parts I and 11/

23 Did the orqaruzatron answer 'Yes' to Part VII, Section A, questions 3, 4, or 5? If 'Yes,' complete

Schedule J

24a Did the organization have a tax-exempt bond Issue With an outstanding principal amount of more than $100,000

as of the last day of the year, and that was Issued after December 31, 2002? If 'Yes,' answer questions 24b·24d and complete Schedule K. If 'No, 'go to question 25

b Did the orqaruzation Invest any proceeds of tax-exempt bonds beyond a temporary period exception?

Page 3

X

X

X

Yes No

2

X

3

X

4

X

6

X

7

X

8

X

9

10

X

11

19

X

20

X

21

X

22

X

23 X

24a X

24b

c Did the organization maintain an escrow account other than a refunding escrow at any time dunnq the year to defease

any tax-exempt bonds? r-:::2c.:4..:.c+-_+- __

d Did the organization act as an 'on behalf of' Issuer for bonds outstanding at any time dunnq the year? !-=2:_:4d=+_-I __

25a Section 501 (cX3) and 501 (cX4) organizations. Did the organization engage In an excess benefit transaction With a

disqualified person dunnq the year? If 'Yes, ' complete Schedule L, Part I f----"'25.:..a+_-+_X_

b Did the organization become aware that It had engaged In an excess benefit transaction With a disqualified person from

a prior year? If 'Yes, ' complete Schedule L, Part I t--=25~b=-t-_-+-....:X..:._

26 Was a loan to or by a current or former officer, director, trustee, key emplovee, highly compensated employee, or

disqualified person outstanding as of the end of the organization's tax year') If 'Yes, ' complete Schedule L, Part II r-:::2..:.6-t_-I........:X..:._

27 Did the organization provide a grant or other assistance to an officer, director, trustee, key employee, or substantial

contributor, or to a person related to such an mdivrdual? If 'Yes,' complete Schedule L, Part III 27

X

BAA

Form 990 (2008)

TEEAO I 03L 1 0113/08

Form 990 (2008) Cf nc i.nna t i Iris t i. tute of Fine Arts

31-0537138

Page 4

lPart IV I Checklist of Required Schedules (continued)

28 Dunng the tax year, did any person who IS a current or former officer, director, trustee, or key employee

a Have a direct business relationship With the organization (other than as an officer, director, trustee, or employee),

or an Indirect business relationship through ownership of more than 35% In another entity (individually or collectively With other person(s) listed In Part VII, Section A)? If 'Yes,' complete Schedule L, Part IV

b Have a family member who had a direct or Indirect business relationship With the organization? If 'Yes,' complete Schedule L, Part IV

c Serve as an officer, director, trustee, key employee, partner, or member of an entity (or a shareholder of a professional corporation) domq busmess With the organization? If 'Yes,' complete Schedule L, Part IV

29 Did the organization receive more than $25,000 In non-cash contnbutrons? If 'Yes, ' complete Schedule M

30 Did the organization receive contrrbutrons of art, hrstoncal treasures, or other similar assets, or qualified conservation contnbutrons? If 'Yes,' complete Schedule M

31 Did the organization liquidate, terminate, or dissolve and cease operations? If 'Yes,' complete Schedule N, Part 1 32 Did the organization sell, exchange, dispose of, or transfer more than 25% of ItS net assets? If 'Yes,' complete Schedule N, Part II

33 Did the organization own 100% of an entity disregarded as separate from the organization under Regulations sections 301_7701-2 and 301 7701-3? If 'Yes,' complete Schedule R, Part I

34 Was the organization related to any tax-exempt or taxable entity? If 'Yes,' complete Schedule R, Parts II, III, IV, and V, Ime 7

35 Is any related organization a controlled entity Within the meaning of section 512(b)(13)? If 'Yes,' complete Schedule R, Part V, tine 2

36 Section 501 (cX3) orqanizatlons, Did the organization make any transfers to an exempt non-chantable related organization? If 'Yes,' complete Schedule R, Part V, Ime 2

37 Did the organization conduct more than 5% of ItS activities through an entity that IS not a related organization and that IS treated as a partnership for federal Income tax purposes? If 'Yes,' complete Schedule R, Part VI

BAA

TEEAOI04l 12118108

Yes No

I

I

_- -- _j

28a X

28b X

28c X

29 X

30 X

31 X

32 X

33 X

34 X

35 X

36 X

37 X

Form 990 (2008) Form 990(2008) Cincinnati Institute of Fine Arts

31-0537138

Yes No

I Part V I Statements Regarding Other IRS Filings and Tax Compliance

Page 5

la

1 a Enter the number reported In Box 3 of form 1096, Annual Summary and Transmittal of U S Information Returns. Enter ·0· If not applicable

b Enter the number of Forms W-2G Included In line 1 a Enter -0· If not applicable

lb

c Old the organization comply With backup Withholding rules for reportable payments to vendors and reportable gaming (gambling) winnings to prize winners?

2a Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax Statements, filed for the I I

calendar year ending With or Within the year covered by this return 2 a 1 25

2b If at least one IS reported on line 2a, did the organization file all required federal employment tax returns?

Note. If the sum of lines 1 a and 2a IS greater than 250, you may be required to e-ftle this return (see instructions) 3a Old the organization have unrelated business gross Income of $1,000 or more dunnq the year covered by

this return?

b If 'Yes' has It filed a Form 990·T for this year? If 'No,' provide an explenetton In Schedule Q

4a At any time dunnq the calendar year, did the organization have an Interest In, or a signature or other authority over, a financial account In a foreign country (such as a bank account, secuntres account. or other financial account)?

b If 'Yes,' enter the name of the foreign country: ~ ....:C::..a:::cl~yffi,:.:a::..:n:.:...._.::Ic.=s;.:1::..a:::cn:.:.::d:..::s:...,_ -l

See the Instructions for exceptions and filing requirements for Form TO F 90-22.1, Report of Foreign Bank and

Financial Accounts

5a Was the organization a party to a prohibited tax shelter transaction at any time dunnq the tax year?

b Old any taxable party notify the organization that It was or IS a party to a prohibited tax shelter transaction?

c If 'Yes,' to question 5a or 5b, did the organization file Form 8886·T, Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction?

6a Old the organization sohcit any contributions that were not tax deductible?

b If 'Yes,' did the organization Include With every sohcitauon an express statement that such contributions or gifts were not deductible?

7 Organizations that may receive deductible contributions under section 170(c).

a Old the organization provide goods or services In exchange for any quid pro quo contribution of more than $75? b If 'Yes,' did the organization notify the donor of the value of the goods or services provided?

31

o

1 c X

I

I i

-- ~ --- -~-j

2b X

I __ ~~ __ J

I

I

-- ~--- ~___j

5a X

5b X

--_j

7a X

3a

3b

4a X

5c

6a X

6b

7b X

X

c Old the organization sell, exchange, or otherwise dispose of tangible personal property for which It was required to file Form 8282?

7c X

d If 'Yes,' Indicate the number of Forms 8282 filed dunnq the year 1 7dl _j

e Old the organization, dunnq the year, receive any funds, directly or Indirectly, to pay premlumL-s.:..o.::n.._a-p-e-rs-o-n-a-I-----i-~ ~~

benefit contract? 7e X

f Old the organization, dunnq the year, pay premiums, directly or Indirectly, on a personal benefit contract? 7f X

g For all contributions of qualified Intellectual property, did the organization file Form 8899 as required? 7g X

h For all contributions of cars, boats, airplanes, and other vehicles, did the organization file a Form 1098-C as required? 7h X

8 Section 501 (c)(3) and other sponsoring organizations maintaining donor advised funds and section 509(a)(3) I

supporting organizations. Old the supporting organization, or a fund maintained by a sponsoring organization, have -- -~ ____j

excess busmess holdings at any time dunnq the year? 8

9 Section 501 (c)(3) and other sponsoring organizations maintaining donor advised funds. _~ _~ __j

a Old the organization make any taxable distributions under section 4966? 9a

b Old the organization make any drstnbutron to a donor, donor advisor, or related person? 9b

10 Section 501(c)(7) organizations. Enter.

a Initiation fees and capital contributions Included on Part VIII, line 12

b Gross Receipts, Included on Form 990, Part VIII, line 12, for public use of club tacihtres 11 Section 501 (c)(12) organizations. Enter

110al

lOb

a Gross Income from other members or shareholders 11 a _j'

b Gross Income from other sources (Do not net amounts due or paid to other sources against

amounts due or received from them) L......:.l...;,l..::b.._ --;~ _

12a Section 4947(a)(1) non-exempt charitable trusts. Is the organization filing Form 990 In lieu of Form 1041?

b If 'Yes,' enter the amount of tax-exempt Interest received or accrued dunnq the year 1 ize]

12a

BAA

Form 990 (2008)

TEEA0105L 04108109

Form 990 (2008 Cincinnati Institute of Fine Arts 31-0537138 Page 6

Governance, Management and Disclosure (Sections A, B, and C request mtormetton about poltctes not required by the Internal Revenue Code.)

Section A Governing Body and Management

1 a Enter the number of voting members of the governing body

I 1 al 48

For each 'Yes' response to tines 2-7b below, and for a 'No' response to ltnes 8 or 9b below, describe the ctrcumsiences, .----_r--:-Y_;:e.::.s-t-N:=o--; processes, or changes in Schedule 0 See msiructtons

b Enter the number of voting members that are Independent 1.___;_1,::cb...__I 4.:;,_8.,

2 Old any officer, director, trustee, or key employee have a family relationship or a business relationship With any other

officer, director, trustee or key employee? See Schedule 0

3 Old the organization delegate control over management duties customarily performed by or under the direct supervrsion of officers, directors or trustees, or key employees to a management company or other person?

4 Old the organization make any Significant changes to ItS organizational documents

since the prior Form 990 was flied?

5 Old the organization become aware durrnq the year of a material diversion of the organization's assets? 6 Does the organization have members or stockholders?

7a Does the organization have members, stockholders, or other persons who may elect one or more members of the governing body?

b Are any decrsions of the governing body subject to approval by members, stockholders, or other persons?

8 Old the organization contemporaneously document the meetings held or written actions undertaken durrnq the year by the followrnq

a The governing body?

b Each committee With authonty to act on behalf of the governing body? 9a Does the organization have local chapters, branches, or affiliates?

b If 'Yes,' does the organization have written pohcies and procedures governing the activities of such chapters, affiliates, and branches to ensure their operations are consistent With those of the organization?

10 Was a copy of the Form 990 provided to the organization's governing body before It was flied? All organizations must descnbe In Schedule 0 the process, If any, the organization uses to review the Form 990 See Schedule 0

11 Is there any officer, director or trustee, or key employee listed In Part VII, Section A, who cannot be reached at the organization's rnailmq address? If 'Yes,' provide the names and addresses m Schedule 0

Section B Policies

~- ----- ---

2 X

3 X

4 X

5 X

6 X

7a X

7b X

i

i

,

,

-- -- -~

8a X

8b X

9a X

9b

10 X

11 X

Yes No

12a X

12b X

12c X

13 X

14 X

--- -- _j 12a Does the organization have a written conflict of Interest policy? If 'No,' go to Ime 13

b Are officers, directors or trustees, and key employees required to disclose annually Interests that could give rise to conflicts?

c Does the organization regularly and consistently monitor and enforce compliance With the policy? If 'Yes, ' descnbe m

Schedule 0 how tins IS done See Schedule 0

13 Does the organization have a written whistleblower policy? 14 Does the organization have a written document retention and destruction policy? See s~~ c::L",le 0

15 Old the process for determining compensation of the followrnq persons Include a review and approval by Independent

persons, comparability data, and contemporaneous substantiation of the deliberation and decisron

a The organization's CEO, Executive Director, or top management offrcial? 15a X

b Other officers of key employees of the organization? See Schedule 0 15b X

Descnbe the process In Schedule 0 (see Instructions) _j

16a Old the organization Invest In, contribute assets to, or participate In a JOint venture or Similar arrangement With a taxable -- ---

entity dunnq the year? 16a X

b If 'Yes,' has the organization adopted a written policy or procedure requmnq the organization to evaluate ItS participation I

In JOint venture arrangements under applicable federal tax law, and taken steps to safeguard the organization's exempt J

status With respect to such arrangements? 16b

Section C. Disclosures

17 List the states With which a copy of this Form 990 IS requrred to be filed ~ _.Q~ _K.¥ _

18 Section 6104 requires an organization to make ItS Forms 1023 (or 1024 If applicable), 990, and 990-T (501 (c)(3)s only) available for public Inspection Indicate how you make these available Check all that apply

o Own website [R] Another'S website [R] Upon request

19 Descnbe In Schedule 0 whether (and If so, how) the orparuzatron makes ItS governing documents, conflict of Interest policy, and Imancial

statements available to the public See Schedu Le 0

20 State the name, physical address, and telephone number of the person who possesses the books and records of the organization

~ _ME!l M~C~1J:.o~g~-_H~g_s...9.!_l_2_0_~ _Ci!I2~rEJ:. J>~~ _ ~u_i!~ _2_QQ. _ ~:in_c.!l2n_a!:i _OB_4_51Q.~ ~J:.3_-~11_-118_7_

BAA

TEEAOI06l 12118108

Form 990 (2008)

Form 990 (2008 Cincinnati Institute of Fine Arts 31-0537138

Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

Page 7

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

, a Complete this table for all persons required to be listed Use Schedule J·2 If additional space IS needed

• List all of the organization's current officers, directors, trustees (whether Individuals or organizations), regardless of amount of compensation, and current key employees Enter ·0· In columns (D), (E), and (F) If no compensation was paid

• List the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee) who received reportable compensation (Box 5 of Form W·2 and/or Box 7 of Form 1099·MISC) or more than $100,000 from the organization and any related organizations

• List all of the organization's former officers, key employees, and highest compensated employees who received more than $100,000 of reportable compensation from the organization and any related organizations

• List all of the organization's former directors or trustees that received, In the capacity as a former director or trustee of the organization, more than $10,000 of reportable compensation from the organization and any related organizations

List persons In the followmq order: Individual trustees or directors, Institutional trustees, officers, key employees, highest compensated employees, and former such persons

n Check this box If the organization did not compensate any officer, director, trustee, or key employee

(A) (B) (c) (0) (E) (F)

Name and Title Average Posrtron (check all that apply) Reportable Reportable Estimated

hours compensation from compensation from amount of other

per week 0- g A co I -n

_ :J the orognlzatlon related 0b§an,zat,ons compensation

0.9- CD 3,;; Q

::; :5: n -c "0:'- 3 (W·211 9·MISC) (W·211 9·MISC) from the

!'l co ~!!

coo. 3 !'l organization

o c:

Q"Q?. "0 m 8 and related

0 organizations

~ -c 3

CD "0

CD CD ro

:J

CD ~

CD

0.

Mark Serrianne

--------------------- X O. D. D.

Chairman 5 X

Ellen Van Der Horst

--------------------- X X O. D. O.

Vice Chair 1

_E.9g:<g"_~._ §~i_tE_~_: _______ O.

Secretary 2 X X O. D.

_KE~e_n _ fi· _ _£IQ_9}1_§t_ _________ D. D. O.

Treasurer 1 X X

Dennis Cuneo

---------------------

Trustee 0 X O. O. D.

.pE!!.i_e_l. _ CJlD!!.i_ng~a_!ll ________

Trustee 1 X D. O. O.

John Barrett

---------------------

Trustee 0 X D. D. O.

_J.2~n_ ~~a_t!y_ ____________

Trustee 0 X D. D. O.

Rosa E. Blackwell

---------------------

Trustee 1 X O. O. D.

Karen R. Bowman

--------------------- D.

Trustee 0 X O. d.

_ME~g_af~~ ~~c:__hE!!.C!_n ________ D.

Trustee 1 X D. d.

_O!t_o_~;_ ~~<!i_g.L _J_F_: _______ D.

Trustee 2 X O. D.

William Butler

---------------------

Trustee 0 X D. O. D.

_?E~l_ ~;_ _CE~l_lg~e_n ________ O. D. D.

Trustee 2 X

_NE!!.<:Y_ t!_e_f!!!.e_F _ Q_o_n.2~a_n _____ D. D.

Trustee 1 X O.

Kenneth Goldhoff

--------------------- D. O.

Trustee 1 X D.

_JE~~s_ I·_ I:!:.~zg~r_a_l.<! ______ D. D.

Trustee 1 X D. BAA

TEEA0107L 04/24/09

Form 990 (2008)

Form 990 (2008) Cincinnati Institute of Fine Arts

31-0537138

Page 8

I Part VII I Section A. Officers, Directors, Trustees Key Employees, and Hiqhest Compensated Employees (cont.)

(A) (B) (c) (D) (E) (F)

Name and Title Average Positron (check all that apply) Reportable Reportable Estimated

hours compensation from compensation from amounl of other

per week Q " g ;>; CD I "T1

o.g. '" ~.g. 0 Ihe orqamzation related or~anlzatlons compensation

n '< 3 (W·211099·MISC) (W-2110 9-MISC) from Ihe

::; :s '"

CD a. !!! 3 ~; !!! organization

n c:

Q"QL "0 ~ a and relaled

5" organizations

2" '< 3

'" "0

~ '" CD

CD "

'" !G

CD

a.

~~~~nl~~~~~ey ________________

Trustee 1 X O. O. O.

Doris S. Jackson

---------------------------

Trustee 1 X O. O. o.

~!~~~~~~5g~~o~~~ ___________

Trustee 0 X O. O. O.

~Eg_g_e_~~tD~n_i~~ ~.2~~s_l~e!L ______

Trustee 0 X O. O. O.

Kevin T. Kabat

---------------------------

Trustee 0 X O. O. O.

~~~-:_Ml~ll.e.!~ _L~l_!!o_n_~~E~e_y ________

Trustee 1 X O. O. o.

~~_M3EY~~Qu5E ________________

Trustee 1 X O. O. O.

Robert Lawrence

---------------------------

Trustee 0 X O. O. O.

Evans N. Nwankwo

---------------------------

Trustee 1 X O. O. O.

_Mlt.~h~~_Llyi_ng~~oEL l'D.:._D_· ________

Trustee 2 X O. O. O.

Rod Robinson

---------------------------

Trustee 0 X O. O. O.

~~t.hy_~~l~~~ _________________

Trustee 1 X O. O. o.

~~~ioE~~~~~D ________________

Trustee 0 X O. O. O.

1 b Total ~ 532,176. O. 54,528. 2 Total number of Individuals (including those In l a) who received more than $100,000 In reportable compensation from the organization ~ 3

Yes No

3 Did the or~anlzalion list any former officer, director or trustee, key employee, or highest compensated employee -- -- __j

on line 1 a. If 'Yes,' complete Schedule J for such Individual 3 X

4 For any Individual listed on line la, IS the sum of reportable cornpensatron and other compensation from _j

the organization and related organizations greater than $150,0007 If 'Yes' complete Schedule J for such -- --

individual 4 X

5 Did any person listed on line 1 a receive or accrue compensation from any unrelated organization for services I

~- -- -~

rendered to the orqaruzatron? If 'Yes,' complete Schedule J for such person 5 X Section B. Independent Contractors

1 Complete this table for your five highest compensated Independent contractors that received more than $100,000 of

compensation from the orqaruzatron

(A) (B) (C)

Name and business address Descnptron of Services Compensahon

Fifth Third Bank 5050 Kingsley Dr Cincinnati, OH 45263 Investment mgmt 120 734.

2 Total number of Independent contractors (Including those In 1) who received more than $100,000 In

compensalion from the orqarnzauon ~ 1 BAA

TEEAO 1 O8L 10113/08

Form 990 (2008)

- __ -- __ --

Farm 990 (2008) lnClnnati Institute of Fine Arts 31-0537138 Page 9

LPart Villi Statement of Revenue

I (B) (0)

I (A) (C)

I Total revenue Related or Unrelated Revenue

exempt business excluded from tax

I function revenue under sections

revenue 512,513, or 514

~~ 1 a Federated campaigns la I

Zz b Membership dues lb

c(::>

11:0 C Fundrarsmq events.

~::;: lc

VIc(

til: d Related organizations ld

13:3 e Government grants (contnbutions) le

vi=:il

~iii

-II: f All other contnbullons, giftS, grants, and

1-",

::>:z: similar amounts not Included above 1f 12,436,071.

~b

1-0 9 Noncash contnbns Included In Ins la-H, $ 165,504.

Zz -----

8c( h Total. Add lines 1 a-l f ~ 12,436,071.

'" BUSiness Code ---__j

::::l

Z 2a Admissions 713990 22,592. 22,592.

'"

~ ------------------

II: b

'" ------------------

0 c

s ------------------

II: d

'"

VI ------------------

::;: e

c( ------------------

II:

CJ f All other program service revenue

0

II: g Total. Add lines 2a-2f ~ 22,592. I

e,

3 Investment Income (including dividends, Interest and

other similar amounts) ~ 1,123,705. 1,123,705.

4 Income from Investment of tax-exempt bond proceeds ~

5 Royalties ~

(I) Real (II) Personal _j

6a Gross Rents

b Less rental expenses

c Rental Income or (loss)

d Net rental Income or (loss) ~

7 a Gross amount from sales of (I) Secunties (II) Other

assets other than Inventory 28573181.

b Less' cost or other baSIS

and sales expenses 30051477.

c Gain or (loss) -1478296.

d Net gain or (loss) ~ -1,478,296. -1,478,296.

... Sa Gross Income from fundraismq events

::> (not Including $

z

... of contributions reported on line 1 c)

>

...

II: See Part IV, line 18 a

II:

... b Less direct expenses b

:z:

I-

0 c Net Income or (loss) from fundraismq events ~

9 a Gross Income from gaming activities _I

See Part IV, line 19 a

b Less' direct expenses b

c Net Income or (loss) from gaming actrvitres ~

lOa Gross sales of Inventory, less returns I

and allowances a

I

b Less cost of goods sold b I

--------- ---- ~-~--- ------ -- - -- ---- -- _ __j

c Net Income or (loss) from sales of Inventory ~

Miscellaneous Revenue Business Code I

- -- ----- - -- - - --- - - -- - ----- -- ---- - - - - --

11 a

------------------

b

------------------

c

------------------

d All other revenue

e Total. Add lines 11 a- 11 d ~ i

I

12 Total Revenue. Add lines 1 h, 2g, 3, 4, 5, 6d, 7d, 8c, 9c,

lOc, and l l e ~ 12,104,072. 22,592. 0. -354,591. BAA

TEEA0109L 1211812008

Form 990 (2008)

Form 990 (2008 Cincinnati Institute of Fine Arts

31-0537138

Pa e 10

Section 501 (cX3) and 501 (cX4) organizations must complete all columns.

All other organizations must complete column (A) but are not required to complete columns (B), (C), and (0).

(A) (B) (C) (0)

Do not include amounts reported on lines Total expenses Program service Management and Fundrarsmq

6b, 7b, 8b, 9b, and 70b of Part VIII. expenses general expenses expenses

1 Grants and other assistance to governments I

and organizations In the U S See Part IV, 10 332,904. 10,332,904.

line 21

2 Grants and other assistance to Individuals In I

the U S See Part IV, line 22

3 Grants and other assistance to governments, I

organizations, and Individuals outside the I

I

US See Part IV, lines 15 and 16 I

4 Benefits paid to or for members I

5 Compensation of current officers, directors, 426,756. 209,728. 139,717. 77,31l.

trustees, and key employees

6 Compensation not Included above, to

disqualified persons (as defined under

section 4958(f)(1) and persons described In O. O. O. O.

section 4958(c)(3)(B)

7 Other salaries and wages 1,206,486. 417,329. 170,867. 618,290.

8 Pension plan contributions (Include section

401 (k) and section 403(b) employer 86 974. 30,002. 14,873. 42,099.

contributions)

9 Other employee benefits 91 226. 29,810. 18,682. 42,734.

10 Payroll taxes 107,426. 39,076. 19,37l. 48,979.

11 Fees for services (non-employees)

a Management

b Legal 13,628. 3,537. 8,508. 1,583.

c Accounting 14,490. 14,490.

d l.obbymq

e Prof fundrarsmq svcs See Part IV, In 17

f Investment management fees 88,994. 88,994.

g Other 377 066. 321 703. 14 500. 40 863.

12 Advertrsmq and promotion 72 492. 550. 71,942.

13 Office expenses 144,408. 24 213. 8,894. 111,30l.

14 Information technology 114 406. 19 894. 16 898. 77 614.

15 Royalties

16 Occupancy 102 580. 30 342. 17 323. 54 915.

17 Travel 33 587. 17,324. 8,424. 7,839.

18 Payments of travel or entertainment

expenses for any federal, state, or local

public officrals

19 Conferences, conventions. and meetings 66,789. 24,423. 24,930. 17,436.

20 Interest

21 Payments to affiliates

22 Depreciatron, depletion, and amortization 42,958. 42,958.

23 Insurance 18,689. 18,689.

24 Other expenses Itemize expenses not

covered above (Expenses grouped together

and labeled miscellaneous may not exceed

5% of total expenses shown on line 25

below)

a _P!:!_c.QlJ.~c'!Jll!.e_J2}-~d.9~ ~x.E~~e ____ 338,509. 338,509.

b 5~~~!.t.Y ~!:!_g~~!!!.e.!!t:.._ E.r.Q~~~~ __ 98,613 . 98,613.

cY~.Q~~~~ ______________ 47,019. 2,138. 23,203. 21,678.

d Miscellaneous 21,645. 4,84l. 8,756. 8,048.

---------------------

e I!!.r.!!~!!.r~ ..!I!:!_d_ ~i.E~!:!_t _______ 12,59l. 5,776. 2,127. 4,688.

f All other expenses 7,976. 6 626. 1,350.

25 Total functional expenses Add lines 1 through 241 13,868,212. 11,618,829. 662,204. 1,587,179.

26 Joint Costs. Check here ~ U If following

SOP 98·2 Complete thrs line on~ If the

organization reported In column B) JOint

costs from a combined educational

campalqn and fundralslng sohcitatron Form 990 (2008)

BAA

TEEAOIIOL 12119/08

Form 990 (2008) Cincinnati Institute of Fine Arts

31-0537138

Page 11

I Part X I Balance Sheet

(A) (B)

Beginning of year End of year

1 Cash - non-mterest-beannq 1

2 Savings and temporary cash Investments 566,306. 2 798,093.

3 Pledges and grants receivable, net 5,425,857. 3 4,757,686.

4 Accounts receivable, net 4

5 Receivables from current and former officers, directors, trustees, key employees,

or other related parties Complete Part II of Schedule L 5

6 Receivables from other disqualified persons (as defined under section 4958(1)(1» _~~ ____ J

--- - - -- - --_--- -- ~---

and persons described In section 4958(c)(3)(B) Complete Part II of Schedule L 6

A 7 Notes and loans receivable, net

s 7

s 8 Inventories for sale or use

E 8

T 9 Prepaid expenses and deferred charges 22,605. 19,542.

s 9

lOa Land, buildings, and equipment cost basis lOa 396,414. I

b Less accumulated deprecratron Complete Part VI of i

------- ----- ~- ___________ J

Schedule D lOb 342,663. 66,305. 10c 53,751.

11 Investments - publicly-traded secunties 82,046,857. 11 69,999,698.

12 Investments - other securities See Part IV, line 11 4,463,046. 12 5,337,565.

13 Investments - program-related See Part IV, line 11 4,300. 13 1,550.

14 Intangible assets 14

15 Other assets See Part IV, line 11 3,350,107. 15 2,641,048.

16 Total assets Add lines 1 through 15 (must equal line 34) 95,945,383. 16 83,608,933.

17 Accounts payable and accrued expenses 201,135. 17 180,016.

18 Grants payable 167,450. 18 221,978.

19 Deferred revenue 19

L 20 Tax-exempt bond liabilities 20

1

A 21 Escrow account liability Complete Part IV of Schedule D 21

B

1 22 Payables to current and former officers, directors, trustees, key emplopees, I

L

1 highest compensated employees, and disqualified persons Complete art II

T of Schedule L

1 22

E 23 Secured mortgages and notes payable to unrelated third parties

s 23

24 Unsecured notes and loans payable 24

25 Other liabilities Complete Part X of Schedule 0 49,109,263. 25 42,753 898.

26 Total liabilities. Add lines 17 through 25 49,477,848. 26 43,155,892.

N Organizations that follow SFAS 117, check here ~ ~ and complete lines I

E

T 27 through 29 and lines 33 and 34.

A 27 Unrestricted net assets 35,398 479. 27 8,725,031.

s

s 28 Temporarily restricted net assets 1,249,028. 22,563,311.

E 28

T

s 29 Permanently restricted net assets 9,820 028. 29 9,164,699.

0 Organizations that do not follow SFAS 117, check here ~ o and complete I

R

F lines 30 through 34.

u

N 30 Capital stock or trust pnncipal, or current funds 30

D

B 31 Paid-in or capital surplus, or land, building, and equipment fund 31

A

L 32 Retained earnings, endowment, accumulated Income, or other funds 32

A

N 33 Total net assets or fund balances. 46,467,535. 33 40,453,041.

c

E

s 34 Total liabilities and net assets/fund balances 95,945 383. 34 83,608,933.

I Part XI I Financial Statements and Reportinq

Yes No

1 Accounting method used to prepare the Form 990 o Cash IRJ Accrual o Other I

--- - - __ _j

2a Were the organization's tmancial statements compiled or reviewed by an Independent accountant? 2a X

b Were the organization's fmancial statements audited by an Independent accountant? 2b X

c If 'Yes' to 2a or 2b, does the organization have a committee that assumes responsibihty for oversiqht of the audit, X

review, or compilation of ItS nnancral statements and selection of an Independent accountant? 2c

3a As a result of a federal award, was the organization required to undergo an audit or audits as set forth In the Single X

Audit Act and OMB Circular A-133? 3a

b If 'Yes,' did the organization undergo the required audit or audits? 3b BAA

Form 990 (2008)

TEEAO 1 IlL 12122108

SCHEDULE A (Form 990 or 990-EZ)

OMS No 15450047

Department 01 the Treasury Internal Revenue Service

Public Charity Status and Public Support

To be completed by all section SOl (cX3) organizations and section 4947(aX1) nonexempt charitable trusts.

~ Attach to Form 990 or Form 990-EZ. ~ See separate instructions.

2008

Open to Public Inspection

Name 01 the orqaruzanon Cincinnati Institute of Fine Arts I Employer sdenutrcanon number

dba Fine Arts Fund 31-0537138

I Part I I Reason for Public Charity Status (All oroaruzatrons must complete this part.) (see Instructions)

The organization IS not a pnvate foundation because It IS (Please check only one organization)

1 ~ A church, convention of churches or association of churches descnbed In section 170(bX1XAXi).

2 A school descnbed In section 170(bX1)(AXii). (Attach Schedule E)

3 A hospital or cooperative hospital service organization described In section 1 70(bX1 XAXiii). (Attach Schedule H )

4 A medical research organization operated In conjunction with a hospital described In section 170(bX1XAXiii) Enter the hospital's

name, City, and state _

5 D An organization operated for the benefit of a college or university owned or operated by a governmental Unit descnbed In section 170(bX1XAXiv). (Complete Part II )

6 D A federal, state, or local government or governmental unit descnbed In section 170(bX1XAXv).

7 IKl An organization that normally receives a substantial part of ItS support from a governmental Unit or from the general pubhc described In section 170(b)(1XAXvi). (Complete Part II)

8 0 A community trust descnbed In section 170(bX1XAXvi). (Complete Part II )

9 0 An organization that normally receives (1) more than 33·1/3 % of ItS support from contnbutrons, membership fees, and gross receipts

from activities related to ItS exempt functions - subject to certain exceptions, and (2) no more than 33-1/3 % of Its support from gross Investment Income and unrelated business taxable Income (less section 511 tax) from businesses acquired by the organization after June 30, 1975 See section S09(aX2). (Complete Part III)

10 0 An organization organized and operated exclusively to test for pubhc safety See section S09(aX4). (see mstructions)

11 0 An organization organized and operated exclusively for the benefit of, to perform the functions of, or carry out the purposes of one or more publicly supported orqaruzatrons descnbed In section 509(a)(1) or section 509(a)(2) See section S09(aX3). Check the box that descnbes the type of supporting organization and complete lines 11 e through 11 h

a o Type I b OType II c 0 Type III - Funclionally Integrated dO Type 111- Other

e 0 By checking this box, I certify that the organization IS not controlled directly or Indirectly by one or more disqualified persons other than foundation managers and other than one or more publicly supported organizations descnbed In section 509(a)(1) or section 509(a)(2)

If the organization received a wntten determination from the IRS that IS a Type I, Type II or Type III supporling organization, D

check this box

9 Since August 17, 2006, has the organization accepted any gift or contnbutron from any of the followmq persons?

(i)

a person who directly or Indirectly controls, either alone or together With persons descnbed In (II) and (III) below, the governing body of the supported organization?

Yes No

11 9 (i)

"g (ii)

11g(iii) (ii) a family member of a person descnbed In (I) above?

(iii) a 35% controlled entity of a person descnbed In (I) or (II) above?

h P d h f II f b h t th

rovi e t e o owrnq In ormation a out t e orqaruza Ions e organization supper s

(I) Name 01 Supported (II) EIN (III) Type of orqamzanon (IV) Is the (v) DId you notlly (VI) Is the (VII) Amount of Support

Orqaruzatron (descrobed on Iones 1-9 or9aOlzatIOn In col the orqamzanon In organization In col

above or IRe section (I) lrsted In your col (I) of (I) orqaruzed on the

(see mstructionsj) governtng your support' US'

document'

Yes No Yes No Yes No

Total BAA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990.

Schedule A (Form 990 or 990-EZ) 2008

TEEA0401L 12/17/08

---------

~~-,Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi) (Complete only If you checked the box on line 5, 7, or 8 of Part I )

Schedule A Form 990 or 990·E 2008 Cincinnati Institute of Fine Arts 31-0537138

Page 2

SAP bli S rt

ectlon u IC Uppo

Calendar year (or fiscal year (a) 2004 (b) 2005 (c) 2006 (d) 2007 (e) 2008 (f) Total

beginning in) ~

1 Grtts, grants, contributions and

membership fees received )00 14016288. 13171476. 12162955. 13113552. 12436071. 64,900,342.

not Include 'unusual grants'

2 Tax revenues levied for the

organization's benefit and

either gald to It or expended O.

on ItS ehalf

3 The value of services or

facihties furnished to the

organization by a governmental

unit without charge Do not

Include the value of services or

tacrhties generally furnished to O.

the public without charge

4 Total. Add lines 1·3 14016288. 13171476. 12162955. 13113552. 12436071. 64,900,342.

5 The portion of total

contributions by each person

(other than a governmental

unit or publicly supported

organization) mcluded on line 1

that exceeds 2% of the amount

shown on line 11, column (f) 3,726,994.

6 Public support. Subtract line 5

from line 4 61,173,348.

ection ota upport

Calendar year (or fiscal year (a) 2004 (b) 2005 (c) 2006 (d) 2007 (e) 2008 (f) Total

beginning in) ~

7 Amounts from line 4 14016288. 13171476. 12162955. 13113552. 12436071. 64,900,342.

8 Gross mcorne from interest.

dividends, payments received

on securities loans, rents,

royalties and Income form 2,094,794. 2,218,143. 2,123,866. 1,413,708. 1,123,705. 8,974,216.

similar sources

9 Net Income form unrelated

business actrvitres. whether or

not the business IS regularly 269,814. 321,347. 591,161.

earned on

10 Other Income Do not mclude

gam or loss form the sale of

capital assets (Explain In O.

Part IV)

11 Total suPg0rt. Add lines 7

through 1 74,465,719.

12 Gross receipts from related activities, etc (see Instructions) I 12 O. S

B T

IS

13 First five years. If the Form 990 IS for the organization's first, second, third, fourth, or fifth tax year as a section 501 (c) (3) organization, check this box and stop here

Section C. Com utation of Public Su ort Percenta e

14 Public support percentage for 2008 (line 6, column (f) divided by line 11, column (f) 15 Public support percentage for 2007 Schedule A, Part IV ·A, line 26f

82.2 %

82.6%

16a 33-113 support test - 2008. If the organization did not check the box on line 13, and the line 14 IS 33·113 % or more, check this box Ivl

and stop here. The organization qualifies as a publicly supported organization ~ ~

b 33-113 support test - 2007. If the organization did not check a box on line 13, or 16a, and hne 15 IS 33·1/3% or more, check this box 0

and stop here. The organization qualifies as a publicly supported organization ~

17a 10%-facts-and-circumstances test - 2008. If the organization did not check a box on line 13, 16a, or 16b, and line 14 IS 10% or more, and If the organization meets the 'tacts-and-crrcumstances' test, check this box and stop here. Explain In Part IV how

the organization meets the 'tacts-and-crrcumstances' test The organization qualifies as a publicly supported organization. ~ 0

b 1 O%-facts-and-circumstances test - 2007. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 IS 10% or more, and If the organization meets the 'facts-and-crrcumstances' test, check this box and stop here. Explain m Part IV how the

organization meets the 'facts-and-crrcumstances' test The organization qualifies as a publicly supported organization. ~

18 Private foundation. If the organization did not check a box on line, 13, 16a, 16b, 17a, or 17b, check this box and see mstructrons ~

BAA Schedule A (Form 990 or 990·EZ) 2008

TEEA0402L 12117108

L..:....::::":"';':':__J Support Schedule for Organizations Described in Section 509(a)(2) (Complete only If you checked the box on line 9 of Part I )

Schedule A (Form 990 or 990-E 2008 Cincinnati Institute of Fine Arts

31-0537138

Page 3

SAP bli S rt

ection u IC uppo

Calendar year (or fiscal yr beginning In)~ (a) 2004 (b) 2005 (c) 2006 (d) 2007 (e) 2008 (f) Total

1 Gifts, grants, contributions and

membership fees received )Do

not Include 'unusual grants'

2 Gross receipts from

admissions, merchandise sold

or services performed, or

facilities furnished In a activity

that IS related to the

orqaruzatron's tax-exempt

purpose

3 Gross receipts from activities that are

not an unrelated trade or business

under section 513

4 Tax revenues levied for the

organization's benefit and

either paid to or expended on

ItS behalf

5 The value of services or

facilities furnished by a

governmental unit to the

organization without charge

6 Total. Add lines 1-5

7 a Amounts Included on lines 1,

2, 3 received from disqualified

persons

b Amounts Included on lines 2

and 3 received from other than

disqualified persons that

exceed the greater of 1 % of

the total of lines 9, 10c, 11,

and 12 for the year or $5,000

c Add lines 7a and 7b

8 Public support (Subtract line

7c from line 6 )

ection ota UPPO

Calendar year (or fiscal yr beginning In) ~ (a) 2004 (b) 2005 (c) 2006 (d) 2007 (e) 2008 co Total

9 Amounts from line 6

lOa Gross Income from Interest,

dividends, patments received

on secunties oans, rents,

royalties and Income form

similar sources

b Unrelated busmess taxable

Income (less section 51 1

taxes) from businesses

acquired after June 30, 1975

c Add lines lOa and lOb

11 Net Income from unrelated busmess

activities not Included mhne lOb,

whether or not the business IS

regularly earned on

12 Other Income Do not Include

gain or loss from the sale of

capital assets (Explain In

Part IV)

13 Total support, (add Ins 9, IOc, II, and 12) S

B T

IS

rt

14 First five years. If the Form 990 IS for the organization's first, second, third, fourth, or fifth tax year as a section 501 (c)(3) .. n

organization, check thrs box and stop here _

Section C. Com utation of Public Su ort Percenta e

15 Public support percentage for 2008 (line 8, column (f) divided by line 13, column (f» %

16 Public support ercentage from 2007 Schedule A, Part IV-A, line 27g %

Section D. Com utation of Investment Income Percenta e

17 Investment Income percentage for 2008 (line 10c, column (f) divided by line 13, column (f» %

18 Investment Income percentage from 2007 Schedule A, Part IV-A, line 27h. %

19a 33·113 support tests - 2008. If the organization did not check the box on line 14, and line 15 IS more than 33-1/3%, and line 17 IS not .. 0

more than 33-113%, check this box and stop here. The organization qualifies as a publicly supported organization

b 33-1/3 support tests - 2007. If the organization did not check a box on line 14 or 19a, and line 16 IS more than 33-1/3%, and line 18

IS not more than 33- 1 13%, check thrs box and stop here. The organization qualifies as a publicly supported organization ..

20 Private foundation. If the or aruzatron did not check a box on line 14, 19a, or 19b, check thrs box and see instructions

BAA

TEEA0403L 01129/09

Schedule A (Form 990 or 990-EZ) 2008

Schedule A (Form 990 or 990-EZ) 2008 Cincinnati Institute of Fine Arts 31-0537138 Page4

I Part IV I Supplemental Information. Complete this part to provide the explanation required by Part II, line 10;

Part II, line 17a or 17b; or Part III, line 12_ Provide any other additional mtorrnatron. (see Instructions)

BAA

TEEA0404l 10/07/0S

Schedule A (Form 990 or 990-EZ) 2008

SCHEDULE C (Form 990 or 990-EZ)

OMS No 1545-0047

Political Campaign and Lobbying Activities

2008

For Organizations Exempt From Income Tax Under section 501 (c) and section 527

~ To be completed by organizations described below. Open to Public

~~~;n~7'~~~~~~~es:r~~~~ry ~ Attach to Form 990 or Form 990-EZ. Inspection

If the organization answered 'Yes,' to Form 990, Part IV, line 3, or Form 990-EZ, Part VI, line 46 (Political Campaign Activities), then

• Section 501 (c)(3) organizations complete Parts I-A and B Do not complete Part I-C

• Section 501 (c) (other than section 501 (c)(3» organizations complete Parts I-A and C below Do not complete Part I-B

• Section 527 organizations complete Part I-A only

If the organization answered 'Yes,' to Form 990, Part IV, line 4, or Form 990-EZ, Part VI, line 47 (Lobbying Activities), then

• Section 501 (c)(3) organizations that have filed Form 5768 (election under section 501 (h». Complete Part II-A Do not complete Part II-B

• Section 501 (c) (3) organizations that have NOT filed Form 5768 (election under section 501 (h) Complete Part II-B Do not complete Part II-A

If the organization answered 'Yes,' to Form 990, Part IV, line 5 (Proxy Tax), then • Section 501 c (4 , (5 ,or 6) organizations Complete Part III

Name of orqarnzatron

Employer rdennhcauon number

Cincinnati Institute of Fine Arts 31-0537138

Part I-A To be completed by all organizations exempt under section 501 (c) and section 527 organizations. See the Instructions for Schedule C for details.

1 Provide a description of the orqamzation's direct and Indirect pohtrcal campaign activmes In Part IV 2 Pohtrcal expenditures

3 Volunteer hours

~$---------------

I Part I-B I To be completed by all organizations exempt under section 501(cX3).

See the Instructions for Schedule C for details.

1

Enter the amount of any excise tax Incurred by the organization under section 4955

~$--------------~$

----~~----r=._--

B~:: ~~:

2 Enter the amount of any excise tax Incurred by orqaruzation managers under section 4955 3 If the organization Incurred a section 4955 tax, did It file Form 4720 for this year?

I Part I-C I To be completed by all organizations exempt under section 501 (c), except section 501 (cX3).

See the Instructions for Schedule C for details

4a Was a correction made?

b If 'Yes,' descnbe In Part IV

1 Enter the amount directly expended by the filing organization for section 527 exempt function activities ~ $ __

2 Enter the amount of the filing organization's funds contributed to other orqaruzatrons for section 527 exempt

function activities ~ $

---------------

3 Total of direct and indirect exempt function expenditures Add lines 1 and 2 and enter here and on

Form 1120-POL, line 170 ~ $--r==,.---.==;---

4 Old the filing organization file Form" 20-POL for this year? DYes D No

5 State the names, addresses and employer rdentrncatron number (EIN) of all section 527 political organizations to which payments were made Enter the amount paid and indicate If the amount was paid from the filing organization's funds or were political contnbutions received and promptly and directly delivered to a separate political orqaruzatron, such as a separate segregated fund or a political action

committee (PAC) If addrtional space IS needed, provide information In Part IV

(a) Name (b) Address (c)EIN (d) Amount paid Irom fllong (e) Amounl of pohtical

organization's own mternal contnbuhons received and

funds If none, enter 0- prompt~ and directly

delovere to a separate

pohucat orqaruzatron

II none, enter 0-

-------------------

-------------------

-------------------

-------------------

-------------------

------------------- BAA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990.

Schedule C (Form 990 or 990-EZ) 2008

TEEA3201L 12118108

ScheduleC(Form9900r990-EZ)2008Cincinnati Institute of Fine Arts 31-0537138 Page 2

I P~rt II-A I To be completed by organizations exempt under section 501 (c)(3) that filed Form 5768 (election

under section 501(h». See the Instructions for Schedule C for details.

A Check ~ H If the filing organization belongs to an affiliated group

B Check ~ If the filing organization checked box A and 'limited control' provrsions apply

Limits on Lobbying Expenditures - (a) FIling (b) Affiliated

(The term 'expenditures' means amounts paid or incurred.) orqaruzatron's totals group totals

1 a Total lobbyrnq expenditures to Influence public opinion (grass roots lobbyrnq) 14_

b Total lobbyrnq expenditures to Influence a legislative body (direct lobbymq) 1,426_

c Total lobbyrnq expenditures (add lines 1 a and 1 b) 1,440, 0_

d Other exempt purpose expenditures 13,866,772 _

e Total exempt purpose expenditures (add lines 1 c and 1 d) 13,868,212_ O.

f Lobbymq nontaxable amount Enter the amount from the following table In 843,411.

both columns

If the amount on hne 1e, column (a) or (b) IS The lobbying nontaxable amount is

Not over $500,000 20% of the amount on Ime 1 e

Over $500,000 but not over $1,000,000 $100,000 plus 15% of the excess over $500,000

Over $1,000,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000

Over $1,500,000 but not over $17,000,000 $225,000 plus 5% of the excess over $1,500,000

Over $17,000,000 $1,000,000

g Grassroots nontaxable amount (enter 25% of line 1 f) 210,853_ O.

h Subtract line 1 g from line 1 a Enter -0- If line g IS more than line a 0_ O.

i Subtract line 11 from line 1 cEnter -0- If line f IS more than line c 0_ 0_ If there IS an amount other than zero on either line 1 h or line 11, did the organization file Form 4720 reporting section 4911 tax for this year?

DYes [X]No

4-Year Averaging Period Under Section SOl (h)

(Some organizations that made a section S01(h) election do not have to complete all of the five columns below. See the instructions for lines 2a through 2'-)

o lymg xpen lures urmg ear veragmg erlo

Calendar year (or fiscal (a) 2005 (b) 2006 (c) 2007 (d) 2008 (e) Total

year beginning in)

2a l.obbymq non-taxable 1,000,000_ 853,522_ 873,303_ 843,411_ 3,570,236.

amount

b l.obbymq ceiling

amount (150% of line

2a, column (e» 5,355,354.

c Total lobbymq 380_ 1,602. 1,778. 1,440_ 5,200.

expenditures

d Grassroots non-taxable

amount 250,000_ 213,381. 218,326. 210,853_ 892,560_

e Grassroots ceiling

amount (15~:)of line 1,338,840_

2d, column e

f Grassroots lobbying 21- 14. 14. 14_ 63_

expenditures L bb - E

dit

D - 4-Y A

P - d

BAA

Schedule C (Form 990 or 990-EZ) 2008

TEEA3202L 12118108

ScheduleC(Form990or990-EZ)2008Cincinnati Institute of Fine Arts 31-0537138 Page 3

I Part 11-8 I To be completed by organizations exempt under section 501 (c)(3) that have NOT filed Form 5768 (election under section 50l(h». See the Instructions for Schedule C for detarls,

(a) (b)

Yes No Amount

1 DUring the year, did the filing organization attempt to Influence foreign, national, state or local

legislation, including any attempt to Influence public opinion on a legislative matter or referendum,

through the use of -- --

a Volunteers?

b Paid staff or management (Include compensation In expenses reported on lines 1 c through 11)? -

c Media advertisements?

d Mailings to members, legislators, or the public?

e Publications, or published or broadcast statements?

f Grants to other orqaruzations for lobbymq purposes?

9 Direct contact With legislators, their staffs, government oftrcrals, or a legislative body?

h Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means?

i Other activities? If 'Yes,' descnbe In Part IV

j Total lines 1c through 11 -- -

2a Old the activities In line 1 cause the organization to be not descnbed In section 501 (c)(3)? __j

b If 'Yes,' enter the amount of any tax Incurred under section 4912

c If 'Yes,' enter the amount of any tax Incurred by organization managers under section 4912 --

d If the filing organization Incurred a section 4912 tax, did It file Form 4720 for this year? I

I Part III-A I To be completed by all organizations exempt under section 50l(c)(4), section 501 (c)(5) , or section 50l(c)(6). See the Instructions for Schedule C for details.

1 Were substantially all (90% or more) dues received nondeductible by members? 2 Old the organization make only In-house lobbymq expenditures of $2,000 or less?

1

Yes No

2

3 Old the organization agree to carryover lobbyrnq and political expenditures from the prior year? 3

I Part 111-8 I To be completed by all organizations exempt under section 501 (c)(4), section 501 (c)(5), or section 501 (c)(6) if 80TH Part III-A, questions 1 and 2 are answered 'No' OR if Part III-A, question 3 is answered 'Yes.' See Schedule C Instructions for details.

1 Dues, assessments and Similar amounts from members. 1

2 Section 162(e) non-deductible lobb71ng and political expenditures (do not include amounts of political

expenses for which the section 52 (f) tax was paid). --

a Current year 2a

b Carryover from last year 2b

c TotaL 2c

3 Aggregate amount reported In section 6033(e)(1 )(A) notices of nondeduchble section 162(e) dues 3

4 If notices were sent and the amount on line 2c exceeds the amount on line 3, what portion of the excess

does the organization agree to carryover to the reasonable estimate of nondeductible lobbymq and political --

expenditure next year? 4

5 Taxable amount of lobbymq and political expenditures (line 2c total minus 3 and 4) 5

I Part IV I Supplemental Information Complete this part to provide the descnpnons required for Part I-A, line 1, Part 1-8, line 4, Part I-C, line 5, and Part 11-8, line 11 Also, complete this part for any addrtronal information

BAA

Schedule C (Form 990 or 990-EZ) 2008

TEEA3203L 121 18/0S

Schedule C (Form 990 or 990-EZ) 2008 Cincinnati Institute of Fine Arts

31-0537138

Page 4

[Part IV I Supplemental Information (continued)

BAA

Schedule C (Form 990 or 990-EZ) 2008

TEEA3204l 10/06/0S

SCHEDULE D (Form 990)

OMS No 15450047

Supplemental Financial Statements

2008

Department of the Treasury Attach to Form 990. To be completed by organizations that Open to Public

Internal Revenue Service answered 'Yes,' to Form 990, Part IV, lines 6, 7, 8, 9, 10, 11, or 12. Inspection

I Part I I Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts Complete If the organization answered 'Yes' to Form 990 Part IV line 6

Name of the orqaruzanon I Employer ldentrtrcanon number

Cincinnati Institute of Fine Arts 31-0537138

, ,

(a) Donor advised funds (b) Funds and other accounts

1 Total number at end of year

2 Aggregate contributions to (during year}

3 Aggregate grants from (during year)

4 Aggregate value at end of year 5 Old the orqamzatron Inform all donors and donor advisors In writing that the assets held In donor advised funds are the organization's property, subject to the orqaruzatron's exclusive legal control?

DYes

6 Old the orqaruzatron Inform all grantees, donors, and donor advisors In writing that grant funds may be

used only for charitable purposes and not for the benefit of the donor or donor advisor or other

Impermissible private benefit "? Yes No

1 Purpose(s) of conservation easements held by the organization (check all that apply)

§ Preservation of land for public use (e g , recreation or pleasure) 8 Preservation of an historically Important land area

Protection of natural habitat Preservation of certified historic structure

Preservation of open space

2 Complete lines 2a-2d If the organization held a qualified conservation contribution In the form of a conservation easement on the last day f h

a b

o t e tax year

Held at the End of the Year

Total number of conservation easements 2a

Total acreage restricted by conservation easements 2b

Number of conservation easements on a certified historic structure Included In (a) 2c

Number of conservation easements Included In (c) acquired after 8117/06 2d c d 3 Number of conservation easements modified, transferred, released, extrnqurshed, or terminated by the organization durrnq the taxable

year ~ _

4 Number of states where property subject to conservation easement IS located ~ _

5 Does the organization have a written policy regarding the penodrc monitoring, mspection, violations, and enforcement of the conservation easement It holds?

DYes

D No

6 Staff or volunteer hours devoted to rnorutonnq, Inspecting, and enforcing easements durrnq the year ~ _

7 Amount of expenses Incurred In monitoring, Inspecting, and enforcing easements dunnq the year ~ $ _

8 Does each conservation easement reported on line 2(d) above satisfy the requirements of section

170(h)(4)(B)(I) and 170(h)(4)(B)(II)?

DYes

D No

9 In Part XIV, descnbe how the organization reports conservation easements In ItS revenue and expense statement, and balance sheet, and Include, If applicable, the text of the footnote to the orqaruzatron's financial statements that describes the organization's accounting for conservation easements

I Part III I Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets Complete If the organization answered 'Yes' to Form 990, Part IV, line 8.

1 a If the organization elected, as permitted under SF AS 116, not to report In ItS revenue statement and balance sheet works of art, historical treasures, or other Similar assets held for public exhrbrnon, education, or research In furtherance of public service, provide, In Part XIV, the text of the footnote to ItS financial statements that descnbes these Items

b If the organization elected, as permitted under SFAS 116, not to report In ItS revenue statement and balance sheet works of art, historical treasures, or other Similar assets held for public exhibrtron. education, or research In furtherance of pubhc service, provide the followmq amounts relating to these Items'

(i) Revenues Included In Form 990, Part VIII, line 1 ~ $ _

(ii) Assets Included In Form 990, Part X

~$--------

2 If the organization received or held works of art, historical treasures, or other Similar assets for financial gain, provide the tollowrnq amounts required to be reported under SF AS 116 relaling to these Items

a Revenues Included In Form 990, Part VIII, line 1 ~ $ _

b Assets Included In Form 990, Part X

~$--------

BAA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990.

Schedule 0 (Form 990) 2008

TEEA3301 L 12123108

-------- - -- -

Schedule 0 Form 990) 2008 Cincinnati Institute of Fine Arts

3 USing the organization's accession and other records, check any of the following that are a significant use of ItS collection Items (check all

that apply).

a § Pubhc exhibition

b Scholarly research

c Preservation for future generations

4 Provide a description of the organization's collections and explain how they further the organization's exempt purpose In

Part XIV

d 0 Loan or exchange programs -Ll Other

5 DUring the year, did the organization solicit or receive donations of art, historical treasures, or other Similar

assets to be sold to raise funds rather than to be maintained as art of the or amzation's collection? Yes No

Part IV Trust, Escrow and Custodial Arrangements Complete If organization answered 'Yes' to Form 990, Part IV, line 9, or reported an amount on Form 990, Part X, line 21.

1 a Is the organization an agent, trustee, custodian, or other Intermediary for contributions or other assets not Included on Form 990, Part X?

b If 'Yes,' explain the arrangement In Part XIV and complete the following table

DYes

c Beginning balance

d Additions durmq the year

e Distributions dunnq the year f Ending balance

2a Did the organization Include an amount on Form 990, Part X, line 21?

h P

Amount

1 c

ld

le

1f DYes

b If 'Yes,' explain t e arrangement In art XIV

I Part V I Endowment Funds Complete If orqaruzation answered 'Yes' to Form 990, Part IV, line 10.

(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back

1 a Beginning of year balance 41,497,628. !

b Contributions 747,716. I

c Investment earnings or losses -4,948,610. I

d Grants or scholarships I

e Other expenditures for tacrhtres 1,286,833. I

and programs

f Administrative expenses I

9 End of year balance 36,009,901. I 2 Provide the estimated percentage of the year end balance held as

a Board designated or quasi-endowment ~ 20.00 %

b Permanent endowment ~ 18 . 00 %

c Term endowment ~ 62.00 %

3a Are there endowment funds not In the possession of the organization that are held and administered for the organization by

(i) unrelated organizations (ii) related organizations

b If 'Yes' to 3a(II), are the related organizations listed as required on Schedule R?

4 Describe In Part XIV the Intended uses of the organization's endowment funds See Part XIV

Yes No

3a(i) X

3a(ii) X

3b X I Part VI I Investments-Land, Buildings, and Equipment. See Form 990, Part X, line 10.

Description of Investment (a) Cost or other basis (b) Cost or other (c) Depreciation (d) Book Value

(Investment) basis (other)

1 a Land

b BUildings

c Leasehold Improvements 219,112. 208,157. 10,955.

d Equipment

e Other 177,302. 134,506. 42,796.

Total. Add lines la-Ie l.Column(d) should equal Form 990, Part X, column (B), Ime 10(c)) ~ 53,751. BAA Schedule 0 (Form 990) 2008

TEEA3302L 12123/08

Schedule 0 (Form 990) 2008 Cincinnati Institute of Fine Arts 31-0537138 Page 3

I Part VII I Investments-Other Securities See Form 990, Part X, line 12.

(a) Description of security or category (b) Book value (c) Method of valuation

(Including name of security) Cost or end-of-year market value

Financial derivatives and other financial products

Closely- held equity Interests

Other _E:QQ.o_wL ~i_m.!-!.aJ _ fu_n.9~,_ ~~c!9~ _ fJ.lQQ. 5,337,565. End of Year Market Value

----------------------------

----------------------------

----------------------------

--------------------------_

---------------------------

---------------------------

---------------------------

---------------------------

---------------------------

Total. (Column (b) should equal Form 990 Part X, col (8) Ime 12 ) • 5,337,565. I

I Part VIII I Investments-Program Related (See Form 990, Part X, line 13) N/A

(a) Description of Investment type (b) Book value (c) Method of valuation

Cost or end-of-year market value

Total Column (b)(should eaual Form 990 Part X Col (8) lme 13 ) • I

I Part IX I Other Assets (See Form 990, Part X, line 15) N/A

(a) Description (b) Book value

Total. Column (b) Total (should equal Form 990, Part X, col (B), ltne 75) •

I Part X I Other Liabilities (See Form 990, Part X, line 25)

(a) Description of Liability (b) Amount I

,

Federal Income Taxes I

,

Appropriations payable 9,917,172. I

I

Funds held for the benefit of others 29,189,001. !

Funds held in trust for others 3,644,247.

Other miscellaneous liabilities 3,478.

,

Total. Column (b) Total (should equal Form 990, Part X, col (8) Ime 25) • 42,753,898. In Part XIV, provide the text of the footnote to the organization's fmancral statements that reports the organization's liability for uncertain tax positrons under FIN 48 See Part XIV

BAA TEEA3303L 10129/08 Schedule 0 (Form 990) 2008

Schedule 0 (Form 990) 2008 Cincinnati Institute of Fine Arts 31-0537138 Page 4

I Part XI I Reconciliation of Change in Net Assets from Form 990 to Financial Statements

1 Total revenue (Form 990, Part VIII,column (A), line 12) 12,104,072 .

2 Total expenses (Form 990, Part IX, column (A), lme 25) 13,868,212.

3 Excess or (deficit) for the year Subtract line 2 from line 1 -1,764,140.

4 Net unrealized gains (losses) on Investments -3,660,517.

5 Donated services and use of facilities 10,275.

6 Investment expenses

7 Prior period adjustments

8 Other (Describe m Part XIV) See Part XIV -589,837.

9 Total adjustments (net) Add lines 4·8 -4,240,079.

10 Excess or (deficit) for the year per frnancral statements Combine lines 3 and 9 -6,004,219.

lPart XII I Reconciliation of Revenue per Audited Financial Statements With Revenue per Return

1 Total revenue, gains, and other support per audited financial statements 1 7,999,442.

2 Amounts Included on line 1 but not on Form 990, Part VIII, line 12

a Net unrealized gams on investments 2a -3,660,517.