Professional Documents

Culture Documents

Negotiable Instruments Act

Uploaded by

Narendran Kamal'iyanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Negotiable Instruments Act

Uploaded by

Narendran Kamal'iyanCopyright:

Available Formats

EXAMPLE:

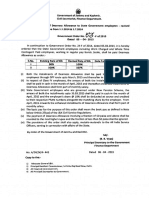

TYPES OF CROSSING

SCRUTINY OF CHEQUE Mutilation Crossing Date Payee Amount in words and Figure should Tally Alteration in cheque Available Balance Signature of Customer

AMOUNT

QUESTIONS: 1. If the space is insufficient for endorsement, it may be done on a paper attached to the cheques. Such an attachment is called an __________*Allonge 2. The elaborate enquiries has to be made by the bank or debtor before making the payment of the cheque *Necessary 3. What words are printed on the cheques issued to savings account customers ? *Or bearer` 4. Partners of a firm are called *Agents of the firm 5. In case of legal entities, the cheques should be signed for and on behalf of the entity. This is done by putting a ____________carrying the name of the entity and the position of the

signatory *Rubber stamp 6. If a cheque is crossed and restricted, its mode of payment is *Not treated as a condition. 7. Mr.Hari issues a cheque to Mr.Ram and it is dishonoured, hence here Ram can file a ________against Har *Suit 8. The promise to pay should be unconditional *Yes 9. Who can `transfer` an order instrument by `endorsing` it? *Payee 10. What is the penalty given to drawer in as per Section 138, when the cheque is dishonoured? *The drawer may be imprisoned for up to one year or asked to pay a fine of up to twice the amount of the cheque or both 11. Which of the following are the three negotiable instruments? *Promissory Notes*Cheques*Bills of Exchange 12. The procedure of re-presenting the bill to the drawee through a lawyer and getting the fact of dishonour confirmed is called *Protest 13. Who signs in the cheque? *Drawer 14. The usual form of signature in case of limited companies is as follows *For and on behalf of Company`s name (signed) Director 15. What is post dated cheque? *A cheque that bears a date later than the date of presentment for payment 16. If both order or bearer is written on an instrument, it will be treated as *A bearer instrument 17. ______ is necessary when there is contract or agreement between two persons. *Consideration 18. If a bearer cheque is missing,and the person who found out in favour of someone else, delivers it to a shop keeper, in payment of some purchase, the shop keeper becomes a holder in due course in case he did not know that the cheque had been missing *The debtor is duty bound to make payment to the holder in due course who `presents` the instrument to him for payment 19. Which of the features are not considered as condition? *Making the amount payable after a period of time, in a usance instrument 20. In case of Bills of exchange, the drawer is called the________and in case of promissory notes the drawer is called the______himself *Creditor and debtor 21. In which year was the NI ACT passed? *1881 22. A cheque is a *Demand bills of exchange 23. What is cheque? *A cheque is an instruction from the account holder to his bank to pay a certain sum of money to the person named in the cheque 24. The promise to pay whenever payee demands payment, is called *Demand promissory note 25. A holder of a cheque putting a date on an undated cheque is termed as alteration of cheque

*No 26. If a cheque is torn in one corner and is received from another bank, the presenting bank has to *put a stamp reading `Mutilation Guaranteed, Please Pay` and signed the guarantee, the cheque can be paid 27. The lenders take post dated cheques in repayment of the loan because of *Criminal liability for non payment of cheques 28. The provision of Sec 138 of the NI ACT came into effect from ___________ *1.4.1989 29. A usance promissory note has to be stamped by affixing non-judicial stamps of requisite value, as per __________Act *Stamp 30. In case of Death, insolvency or insanity of the drawer before date of cheque,postdated cheque should not be paid *true 31. Who has to give `notice of dishonour` to drawer in case of dishonour by non payment *Drawee 32. If the endorser merely signs his name without specifying the name of the person to whom payment must be made, it is called *Blank endorsement 33. The printed words on the cheques ,the words `or order` or `or bearer` are printed by the ________ *Bank 34. In case of Bills of exchange,a usance bill has to be stamped with __________________ as per stamp act. *Non Judicial stamps 35. If a person promises to supply goods, it is not a promissory note *True,it should be to pay money to another person not goods 36. What is Promissory Notes? *An instrument in writing containing an unconditional promise signed by the maker to pay a certain sum of money to a certain person or to the bearer of the instrument 37. The drawer is the person who makes and signs the promissory note *true option 38. A usance bill has to be `accepted` by the drawee or debtor before it becomes _________ *Valid 39. In case of Bills of exchange,the due date is calculated after adding______________of __days to the usance period *Grace period ,3 40. What are the words, `for value received` in a promissory note and bill of exchange considered as *Affirmation by the drawer 41. If the signature is forged, then no statutory protection is available to the bank for payment in due course. This is accordance with _______ (section of ACT)? *Sec 85 42. Who signs the promissory notes? *Signed by the promissory or the person who makes promise 43. If the account is operated by an authorized agent then cheque should contain *a `per pro` signature 44. What are the methods to write a usance bill *Three months from acceptance pay *Three months from date, pay*On 31.12.200X pay

45. If a bill is a demand or usance instrument, a cheque will be *Demand instrument 46. Banks make physical presentation of bills *False 47. A negotiable instrument must be *Unconditional 48. The debtor is duty bound to make payment to the holder in due course who `presents` the instrument to him for payment *true 49. Mr.Rahul given a cheque dated 2nd March 2007, if presented for payment on 29th Sep 2007, then it is *Not a postdated cheque *It is not valid postdated cheque 50. The requirement of endorsement should be *Unbroken and regular 51. If the bill is on due date the payee of a usance bill will need a confirmation from the _________ *Debtor 52. ______________is checked against the numbers of the cheques issued to the customer at the time of payment, *The serial number of the cheque 53. Who gets `discharged` from his obligations on payment to the holder in due course? *The Debtor 54. In the bills of exchange, person liable to pay the money is called as the *Drawee 55. Stale cheque can be paid if the cheque is dated more than 6 months *No 56. The original creditor cannot claim the amount from the debtor if the ___________has been made to the holder in due course *Payment 57. A bill of exchange contains an *Message 58. Where is endorsement made? *Endorsement is made on the back of instrument 59. When a cheque is made payable to Mr.X or bearer, the payee can transfer the instrument to another person by merely handing it over to him or mere `delivery`. *true 60. The promissor is maker and the promisee is called as payee.The former is________while the latter is the ___________ *Debtor and creditor 61. What is not required for transfering the bearer instrument? *Endorsement 62. Who gets a better title than the transferor *A holder in due course 63. A person who becomes a holder of a negotiable instrument, for valuable consideration and good faith and not knowing that the transferor did not have good title to it; is called _________. *`Holder in due course` 64. Without the signature ,the cheque is *Not Valid 65. ________ is defined as a bill of exchange drawn on a specified banker and not expressed to be

payable otherwise than on demand? *A cheque 66. What are the conditions which attract the penalty? *The dishonor of the cheque should be on account of insufficiency of funds*courts have imposed penalty for return of cheques due to stop payment instructions also on being convinced that the stop payment instructions were given deliberately to avoid payment 67. Bearer cheques are payable to the person who is in ____________ of the instrument *Only a 68. State true /false When a cheque is crossed to more than one banker, the paying banker will refuse payment *true 69. What has all the qualities of a negotiable instrument which is not listed in Negotiable Instrument Act? *A currency note 70. What is forgery of the cheque? *If any person other than the customer himself, without his specific authority to sign, signs by copying customer`s signature with the intention to prejudice that customer 71. The undated cheque is not valid but the bank can write the date on the cheque *No 72. What is the transferee or the `holder` of the instrument called *Transferee of the instrument 73. When a cheque being presented for payment, the following needs to be checked to confirm that the cheque is in order *Date*Payee*Amount in Words and Figures Should Tally*Alteration of the Cheque and Available Balance*Signature of the Customer and Payment at the Branch Where the Account is Held and Anywhere Banking*Bearer / Order cheques and endorsements 74. To whom the promissory note payment is to be made? *Payee 75. The payee of the order can make the instrument payable to another person by writing on the back of the cheque `Pay Mr.x________ or order` and putting his signature below it. Such a notation on the back of the cheque is called an *Endorsement 76. The cheques executed by a partner is always signed on behalf of the firm so as to bind the firm *Always 77. The date in the promissory note should be in left corner *False 78. The amounts of cheque in words and figures should tally *true 79. To confirm the date of the cheque presented for payment,the bank has to check whether it is *Both a and b 80. If a cheque is crossed, the paying banker cannot pay cash across the counter *true 81. If the cheque is mutilated or torn by accident, the drawer has to confirm in ________________that the cheque can be paid *Only B 82. Mr.Prakash is holding the bearer instrument, can he claim the amount from the drawee *Any one holding the bearer instrument, can claim the amount from the drawee. 83. A payees name has to be necessarily specified in cheques *Yes

84. State whether the statement is true or false A conditional promissory note or bill of exchange or cheque is a negotiable instrument *False 85. A person who draws a Bill of exchange is known as the ___________ *Drawer 86. An order instrument can be transferred by endorsement and delivery whereasa a ________ instrument can be transferred by mere delivery *Bearer instrument 87. A crossed cheque can only be_____________to the bank account of the _________ *Credited ,payee 88. Transferring of ownership, free from defect, through endorsement and delivery in the case of an order instrument and mere delivery in the case of a bearer instrument is called *Negotiability 89. Proving lack of consideration is on the drawer which can prompt the lender to take _________ cheques from their borrowers *Post dated 90. What is usance promissory note? *Both b and c 91. If the bills of exchange is accepted it has to be presented to________ on due date for the payment *Drawer 92. An instrument in writing, containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument is called *All of the above 93. The drawee of a cheque is__________ *Payee 94. If the amount stated in the cheque is different in words and figures, the amount in words cannot be paid *False 95. Mr.Arunkumar gives a cheque dated 1st Jan 2006,but other party presented only after 12 months,is it valid cheque *No,It is stale cheque 96. A cheque which been circulating for more than six months from the date on the cheque is considered _____________and cannot be paid. It can be paid only after it is revalidated by the drawer. *Stale 97. Who should date the Cheque? *Drawer 98. Which type of cheques do not grant an authority to debit the account of the customer till the date arrives? *Date without mentioned 99. A payee should not be a certain person True or false *false 100. If accounts are jointly operated,the alterations should be signed by all the authorised signatories as per the operating instructions *true 101. In the promissory note, if `monthly rests` is not paid immediately,______________will be payable by the drawer*Floating interest

You might also like

- BANKING LAW AND PRACTICE MCQsDocument38 pagesBANKING LAW AND PRACTICE MCQsChris Shean100% (1)

- Nitin - Harshad Mehta Scam PDFDocument12 pagesNitin - Harshad Mehta Scam PDFAnkit SangwanNo ratings yet

- Industrial Credit and Investement Corporation of India (Icici)Document14 pagesIndustrial Credit and Investement Corporation of India (Icici)dishaNo ratings yet

- Project Report On Credit Risk ManagementDocument90 pagesProject Report On Credit Risk ManagementVasanth RajanNo ratings yet

- ICICI Khayaal AapkaDocument20 pagesICICI Khayaal AapkaShruti SharmaNo ratings yet

- Retail Banking (With Special Reference To Icici Bank)Document32 pagesRetail Banking (With Special Reference To Icici Bank)Varun PuriNo ratings yet

- Skills and Attitudes at Workplace Evaluation I RoleplaysDocument7 pagesSkills and Attitudes at Workplace Evaluation I RoleplaysAASEEN ALAMNo ratings yet

- ICICI Bank NewDocument23 pagesICICI Bank NewTushar DevNo ratings yet

- Trade Certification Level I ALLDocument8 pagesTrade Certification Level I ALLRAHUL BISHWAS100% (1)

- Interim Report Ibs HyderabadDocument49 pagesInterim Report Ibs HyderabadNitin Hooda100% (1)

- R K Marble CSR PolicyDocument9 pagesR K Marble CSR PolicyAbhimanyu Singh BhatiNo ratings yet

- Icici Group Code of Business Conduct and EthicsDocument31 pagesIcici Group Code of Business Conduct and EthicsAshok KumarNo ratings yet

- Tools For Recovering NpaDocument4 pagesTools For Recovering Npanchaudhari_2100% (2)

- Project Report HDFCDocument58 pagesProject Report HDFCKr Ish NaNo ratings yet

- Knowledge Management Initiatives at ICICI BankDocument30 pagesKnowledge Management Initiatives at ICICI BankAkshay HemanthNo ratings yet

- The Best Answer To "Sell Me This Pen" - 4 Tips To Sell in A Super Competitive IndustryDocument4 pagesThe Best Answer To "Sell Me This Pen" - 4 Tips To Sell in A Super Competitive IndustryYanoNo ratings yet

- Presented By:-: Nitish Garg Gurharpreet RanganathDocument25 pagesPresented By:-: Nitish Garg Gurharpreet Ranganathinvestigation duediligenceNo ratings yet

- Code of Conduct & Business EthicsDocument46 pagesCode of Conduct & Business EthicsashokNo ratings yet

- Shopper’s Stop Revenue Models & Business Model EvolutionDocument6 pagesShopper’s Stop Revenue Models & Business Model EvolutionBro SlowNo ratings yet

- Business Code of ConductDocument6 pagesBusiness Code of ConductGaurav ChoudharyNo ratings yet

- Customer service Management: Cashier’s Roles and ResponsibilitiesDocument11 pagesCustomer service Management: Cashier’s Roles and ResponsibilitiesRiia JaisNo ratings yet

- ICICI Bank LTD Interview Questions and Answers Guide.: Global GuidelineDocument14 pagesICICI Bank LTD Interview Questions and Answers Guide.: Global GuidelineDIWAKAR KUMARNo ratings yet

- Insurance Marketing in Indian EnvironmentDocument6 pagesInsurance Marketing in Indian EnvironmentPurab MehtaNo ratings yet

- We Understand Your WorldDocument48 pagesWe Understand Your Worldkelvinsantis80% (5)

- Auditing VouchingDocument6 pagesAuditing VouchingDivakara ReddyNo ratings yet

- Asset and LiabilityDocument30 pagesAsset and LiabilitymailsubratapaulNo ratings yet

- Offer Acceptance LetterDocument2 pagesOffer Acceptance LetterkwangdidNo ratings yet

- ICICI Bank's Unethical Practices and Harassment in Locker AllotmentDocument7 pagesICICI Bank's Unethical Practices and Harassment in Locker AllotmentMayur KapoorNo ratings yet

- SOUTH INDIAN BANK'S PRODUCTS AND SERVICESDocument13 pagesSOUTH INDIAN BANK'S PRODUCTS AND SERVICESSourabh KondkarNo ratings yet

- Undertaking NewDocument3 pagesUndertaking NewAlbin BabyNo ratings yet

- Role of Insurance Industry in Economic Growth of IndiaDocument56 pagesRole of Insurance Industry in Economic Growth of IndiaOmkar pawarNo ratings yet

- Ombudsman, Universal Banking, KYCDocument3 pagesOmbudsman, Universal Banking, KYCseanmor111100% (2)

- Tulasi SeedsDocument101 pagesTulasi SeedsAvinash ChinnaNo ratings yet

- Small Medium EnterprisesDocument84 pagesSmall Medium EnterprisesVijay SrivastavaNo ratings yet

- Aml 004 PDFDocument8 pagesAml 004 PDFShikhar PandeyNo ratings yet

- Recommendations of The Goiporia CommitteeDocument7 pagesRecommendations of The Goiporia Committeeneeteesh_nautiyalNo ratings yet

- Icici Bank FinalDocument25 pagesIcici Bank Finaldinesh mehlawatNo ratings yet

- Microfinance-A Way Out For Poor: Research ReportDocument77 pagesMicrofinance-A Way Out For Poor: Research ReportRia MakkarNo ratings yet

- Legal Aspects of Business Master NotesDocument44 pagesLegal Aspects of Business Master NotesSenthil Kumar GanesanNo ratings yet

- Project of Icici BankDocument39 pagesProject of Icici BankNitinAgnihotriNo ratings yet

- Code of Business Conduct EthicsDocument34 pagesCode of Business Conduct EthicsNaseem Shaik0% (2)

- Role of MFs in Retail InvestmentDocument11 pagesRole of MFs in Retail InvestmentSakshi GuptaNo ratings yet

- SPANCODocument6 pagesSPANCOShubham RajNo ratings yet

- ICICI Case StudyDocument11 pagesICICI Case StudyRavee Mishra0% (1)

- Banks NPA Performance ParametersDocument18 pagesBanks NPA Performance ParametersRam patharvat100% (3)

- ICICI Bank Services - Wealth ManagementDocument11 pagesICICI Bank Services - Wealth ManagementMegha Nair PillaiNo ratings yet

- Icici BankDocument41 pagesIcici BankSrinath Rao BompalliNo ratings yet

- Final Project (Donear)Document76 pagesFinal Project (Donear)GeorgeNo ratings yet

- ICICI PresentationDocument20 pagesICICI PresentationAkash KapoorNo ratings yet

- CHP 4 Buy BackDocument52 pagesCHP 4 Buy BackRonak ChhabriaNo ratings yet

- Security Analysis, Portfolio Management & Investment SettingDocument49 pagesSecurity Analysis, Portfolio Management & Investment SettingAlavudeen ShajahanNo ratings yet

- Icici BankDocument37 pagesIcici BankNitinAgnihotriNo ratings yet

- Small and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18Document13 pagesSmall and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18nishant oraon100% (1)

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- Principles of VerificationDocument3 pagesPrinciples of Verificationpathan1990No ratings yet

- Interim Report 2019Document11 pagesInterim Report 2019INDRAJEET JADHAVNo ratings yet

- What is forgery of a cheque and other key conceptsDocument501 pagesWhat is forgery of a cheque and other key conceptsVikasSharma80% (15)

- Unit VII The Negotiable Instruments Act, 1881Document42 pagesUnit VII The Negotiable Instruments Act, 1881Neha GeorgeNo ratings yet

- Negotiable Instruments Law - Promissory Note (SEC 184)Document3 pagesNegotiable Instruments Law - Promissory Note (SEC 184)Carlo Talatala100% (1)

- Negotiable Instruments Act EssentialsDocument3 pagesNegotiable Instruments Act EssentialsNethaji MudaliyarNo ratings yet

- FIN301 Final QuestionDocument5 pagesFIN301 Final QuestionJunaidNo ratings yet

- Commissioner of Internal Revenue V Burroughs Limited and The Court of Tax AppealsDocument1 pageCommissioner of Internal Revenue V Burroughs Limited and The Court of Tax AppealsJohn YeungNo ratings yet

- The Economy of Greece:Challenges and ProspectsDocument40 pagesThe Economy of Greece:Challenges and ProspectsAnastasia(Natasa) MitronatsiouNo ratings yet

- FSA Atlas Honda AnalysisDocument20 pagesFSA Atlas Honda AnalysisTaimoorNo ratings yet

- Partnership Accounting Concepts and ProblemsDocument12 pagesPartnership Accounting Concepts and ProblemsAmber JasmineNo ratings yet

- J&K Govt Revises DA Rates for EmployeesDocument2 pagesJ&K Govt Revises DA Rates for EmployeesShowkat Ahmad LoneNo ratings yet

- Segment Wise Revenue and Cost Analysis of Consumer Goods CompanyDocument47 pagesSegment Wise Revenue and Cost Analysis of Consumer Goods Companyrahul1094No ratings yet

- Templates of Credit Rebuilding LettersDocument27 pagesTemplates of Credit Rebuilding LettersBobby67% (3)

- Superlines v. ICCDocument11 pagesSuperlines v. ICCRZ ZamoraNo ratings yet

- Luxury Housing Development in Ethiopia's CapitalDocument13 pagesLuxury Housing Development in Ethiopia's CapitalDawit Solomon67% (3)

- Service Bond: Toto As Part and Parcel of This BondDocument3 pagesService Bond: Toto As Part and Parcel of This Bondiona_hegdeNo ratings yet

- Fin603-Assignment 2-19164056Document8 pagesFin603-Assignment 2-19164056KAZI THASMIA KABIRNo ratings yet

- Abacus v. Manila BankingDocument3 pagesAbacus v. Manila BankingSean GalvezNo ratings yet

- The Dallas Post 08-26-2012Document18 pagesThe Dallas Post 08-26-2012The Times LeaderNo ratings yet

- Ar 06 EngDocument196 pagesAr 06 EngSandeep ReddyNo ratings yet

- A Short Course in International PaymentsDocument251 pagesA Short Course in International Paymentsoanhlekieu100% (1)

- Panlilio vs. Regional Trial Court, Branch 51, City of ManilaDocument10 pagesPanlilio vs. Regional Trial Court, Branch 51, City of ManilaMaria Nicole VaneeteeNo ratings yet

- Short Questions-Central BankDocument6 pagesShort Questions-Central BanksadNo ratings yet

- Home LoanDocument130 pagesHome LoanAnkit ButtoliaNo ratings yet

- Comparing Home Loans Across Top BanksDocument55 pagesComparing Home Loans Across Top BanksShikha Wadwa0% (1)

- Understanding Corporation AccountingDocument19 pagesUnderstanding Corporation AccountingMellanie Serrano100% (3)

- Company A Was Incorporated On January 1Document5 pagesCompany A Was Incorporated On January 1Fakihusman Aliyasa80% (15)

- Vishal Project Plastic MoneyDocument25 pagesVishal Project Plastic Moneyharjinder pal singh100% (2)

- A detailed study on The Malkapur Bank's operations and performanceDocument5 pagesA detailed study on The Malkapur Bank's operations and performanceSwapnil BhagatNo ratings yet

- Deutsche Bundesbank Examines Validation of Internal Rating SystemsDocument13 pagesDeutsche Bundesbank Examines Validation of Internal Rating SystemsselivesNo ratings yet

- Pricing Model For A Credit-Linked Note On A CDX TrancheDocument6 pagesPricing Model For A Credit-Linked Note On A CDX TranchechertokNo ratings yet

- Allied Banking Corporation VsDocument3 pagesAllied Banking Corporation VsSheilaNo ratings yet

- Customers and Account HoldersDocument23 pagesCustomers and Account HoldersMAHESH VNo ratings yet

- Standard Promissory Note TemplateDocument3 pagesStandard Promissory Note Templateaplaw67% (3)

- July 5, 2014Document16 pagesJuly 5, 2014Thief River Falls Times & Northern WatchNo ratings yet