Professional Documents

Culture Documents

Financial Statements

Uploaded by

Kaylie MCginnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements

Uploaded by

Kaylie MCginnCopyright:

Available Formats

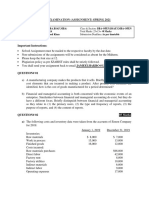

Financial Statements Kaylie McGinn ACC/290: Principles of Accounting 1 Michael Arnone June 18, 2012

Financial Statements Financial statements are various reports created about a businesss financial condition and the financial results. Financial statements are essential to determine the businesses ability to generate a profit, the sources and the uses of cash, the ability to pay back debts, track any trends that may lead to financial problems, and plan for the future. There are four main financial statements: balance sheets, income statements, statements of cash flow, and retained earnings statements. Balance Sheet The balance sheet reports a firms assets, liabilities, and owners equity on a specific date. According to Kimmel, Weygandt, and Kieso (2010), balance sheets obtained their name because it confirms that the accounting equation has remained in balance. This means the balance sheet should show that assets equal the liabilities of the business plus the stockholders equity (p. 14). The balance sheet displays the businesses assets, liabilities, and the equity of the business. Assets The assets listed include current assets and long-term assets. Current assets are expected to be converted into cash or used by the business within a year or operating cycle. Current assets include cash and other monetary assets, including accounts receivable, inventory, market securities, and prepaid expenses. Long-term assets are the assets whose benefits are expected to come about in a year or more. Long-term assets include long-term investments, operating assets, such as equipment, and intangible assets such as patents and trademarks. Liabilities

Liabilities are both the current liabilities and the long-term liabilities. Current liabilities are those that will be paid utilizing the current assets. Current liabilities are accounts payable such as, to vendors, wages, rent, and taxes. Long-term liabilities are things like pensions and long-term leases. Owners Equity The owners equity is derived from two sources: contributed capital and retained earnings. Contributed capital is usually made up of common stock but can also include preferred stock. Retained earnings are the net income that has been held back by the business after the payment of dividends (return on investments paid to stockholders). Income Statement Income statements report the profitability of business operations for a specific period. Income statements report the net income or the net loss of a business. The basic equation used to demonstrate this would be the revenue minus the expenses of the business will yield the net income or the net loss depending on if the revenues exceed the expenses or not. The key elements of an income statement are revenues, expenses, gains, losses, and net income or net loss.

Revenues Revenues are the total amount earned by selling the products or services provided by the business during a specific time period. This may include the sales, fees, and earnings from

interest, dividends, lease income, and royalties. Net sales are the sales listed and are the value of the businesss sales of goods and services minus the returns and allowances and discounts.

Expenses Expenses are the costs am entity incurs for doing business in a specific period of time. These expenses include the costs of materials, supplies, labor, leases, and utilities. Expenses must also directly relate to generating revenues for an entity. Cost of sales includes the costs of manufacturing, supplies, and labor used in the production of the goods. The cost of sales is calculated by the adding together beginning inventory and purchases and subtracting the ending inventory. Selling, general, and administrative expenses are the companys operational expenses. Selling expenses are the expenses generated by the selling and marketing of the products.

Gross Profit, Gains, and Losses Gross profits or gross margin is the difference between net sales and cost of sales. Gains are from peripheral or incidental transactions of the business. Losses are decreases in the owners equity from the peripheral or incidental transactions of the business.

Net Income

Net income is the excess of all revenues and gains for a designated period over all expenses and losses of that period. A net loss is the excess of expenses and losses over revenues and gains for a designated period.

Statements of Cash Flow

Statements of cash flow show the amount of cash collected and the amount of cash paid out by the business over a specific period of time regarding the operating, investing, and financial activities of the business. This statement is generated to cover the same time period as the income statement. The statement of cash flow places all cash exchanges into one of three categories operating, investing, or financing to calculate the net change in cash during an accounting period. Statements of cash flow focuses on the cash flow rather than income.

Operating Cash Flows Operating cash flow comes from the day-to-day business operations such as, inventory purchases, sales revenue, and payroll expenses. Interest, dividends, interest payments, and income taxes are also reported under operating cash flow.

Investing Cash Flows

Investing cash flows relate to cash exchanges involving long-term assets, such as purchase or sale of land, buildings, equipment, or long-term investments in another companys stock or debt.

Financing Cash Flows Financing cash flows involve changes in long-term liabilities and owners equity. This includes receipt or early retirement of long-term loans, the sale or repurchase of stock, and the payment of dividends to shareholders.

Retained Earnings Statements

Retained earnings statements are showing the amounts and causes of changes in retained earnings during the period (Kimmel, Weygandt, & Kieso, 2010, p. 14). Retained earnings statements are created for the same period as the income statement. The retained earnings statements start with the beginning retained earnings balance. The net income is added and the dividends are deducted to determine the current retained earnings. The retained earnings statements are meant to summarize the changes in the retained earnings over a specific period of time. Usefulness of Financial Statements Financial statements have both internal uses and external uses. The key internal users are business owners and managers. They use the information in the financial statements to determine

the businesss profitability and current condition and to measure the businesss performance. If the business is doing well the owners may wish to make additional investments toward growth and if it is poor find areas to cut or close the business altogether. Managers use it to make operating decisions such as how much and what kinds of inventory to carry and if they can hire more employees or offer raises. The primary external users are creditors and investors. Creditors use the information in the financial statements to determine the businesss profitability, current debts, and the assets available to pay debts. This aids creditors in determining if the business qualifies for a loan and for how much and what interest rate to charge. Investors use financial statements to determine if they should invest by looking at the business trends and profitability.

References Kimmel, P.D., Weygandt, J.J., & Kieso, D.E. (2010). Financial accounting: Tools for business decision making (5th ed.). Retrieved from The University of Phoenix eBook Collection database.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ref Acceleration CostDocument37 pagesRef Acceleration CostNovelyn DomingoNo ratings yet

- Cost Accaunting 5Document15 pagesCost Accaunting 5Simon MollaNo ratings yet

- Decision MakingDocument60 pagesDecision Makingdaariyak60% (5)

- Chapter 8 BudgetingDocument11 pagesChapter 8 BudgetingAira Kristel RomuloNo ratings yet

- Chapter 8 OkDocument37 pagesChapter 8 OkMa. Alexandra Teddy Buen0% (1)

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- Business Plan Erica Anne1Document28 pagesBusiness Plan Erica Anne1dancolico9No ratings yet

- Cost of Gooods Manufactured 5,060,000Document5 pagesCost of Gooods Manufactured 5,060,000yayayaNo ratings yet

- Notes On Elements of Cost and Cost SheetDocument14 pagesNotes On Elements of Cost and Cost SheetPOOJA WALZADENo ratings yet

- Cost Units, Cost Classification and Profit Reporting: Lesson 3Document41 pagesCost Units, Cost Classification and Profit Reporting: Lesson 3Kj NayeeNo ratings yet

- Overhead: Allocation & ApportionmentDocument10 pagesOverhead: Allocation & ApportionmentbiarrahsiaNo ratings yet

- C - TS4CO - 2021: There Are 2 Correct Answers To This QuestionDocument54 pagesC - TS4CO - 2021: There Are 2 Correct Answers To This QuestionHclementeNo ratings yet

- Calculating GPR under different assumptionsDocument4 pagesCalculating GPR under different assumptionsLily of the ValleyNo ratings yet

- Acctg 112Document3 pagesAcctg 112Rathew Cassey PencilNo ratings yet

- Louderback C6 TF&MCDocument4 pagesLouderback C6 TF&MCInocencio TiburcioNo ratings yet

- Answer Guidance For c6Document13 pagesAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Chapter 4 - Inventories - 27 PagesDocument27 pagesChapter 4 - Inventories - 27 PagesSamartha UmbareNo ratings yet

- ACC 203 Main Course (R.B. Jat)Document196 pagesACC 203 Main Course (R.B. Jat)Rolfu Bambido Looken100% (1)

- FQ1Document4 pagesFQ1Maviel Suaverdez100% (1)

- BiscuitDocument16 pagesBiscuitVishal JainNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Chapter 14 Ia2Document18 pagesChapter 14 Ia2JM Valonda Villena, CPA, MBA67% (3)

- UntitledDocument3 pagesUntitledKoki HabadiNo ratings yet

- 676254Document89 pages676254Shofiana IfadaNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Cost Accounting Quiz 1 - Statement of Cost of Goods ManufacturedDocument4 pagesCost Accounting Quiz 1 - Statement of Cost of Goods ManufacturedMarkJoven BergantinNo ratings yet

- Chapter 5 Financial Statement Analysis 1Document3 pagesChapter 5 Financial Statement Analysis 1Syrill CayetanoNo ratings yet

- 8 RatioAnalysisDocument22 pages8 RatioAnalysisDr. Bhavana Raj KNo ratings yet

- Cost bookkeeping: 4 questions on inventory, job order costing, and financial statementsDocument9 pagesCost bookkeeping: 4 questions on inventory, job order costing, and financial statementsMuhammad Hassan Uddin100% (1)

- Income Statement: (Company Name)Document3 pagesIncome Statement: (Company Name)AbNo ratings yet