Professional Documents

Culture Documents

A Project Report On Working Capital Management Nirani Sugars LTD

Uploaded by

Babasab Patil (Karrisatte)Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Project Report On Working Capital Management Nirani Sugars LTD

Uploaded by

Babasab Patil (Karrisatte)Copyright:

Available Formats

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

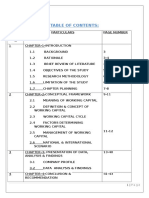

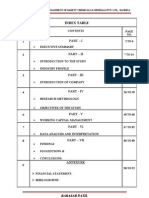

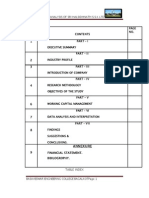

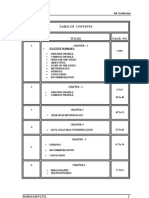

CONTENTS

S.NO TITLES CHAPTER I 1) EXECUTIVE SUMMARY 2) OBJECTIVES OF STUDY 3) THE WORKING CAPITAL NEED ARISES FOR THE 1. FOLLOWING PURPOSE 4) SCOPE OF STUDY 5) LIMITATION OF THE STUDY 6) METHODOLOGY 7) REVIEW OF EARLIER LITERATURE 2. CHAPTER II COMPANY PROFILE CHAPTER III 3. PRODUCTION PROFILE 4. CHAPTER IV STUDY OF DEPARTMENTS CHAPTER V WORKING CAPITAL MANAGEMENT CHAPTER - VI DATA REPORT FINDINGS AND SOLUTIONS BIBLIOGRAPHY ANNEXURE 27-48 49-59 20-26 12-19 1-11 PAGE NO

6 7 8

60-78 79-82 83-84 85

Babasabpatilfreepptmba.com

Page - 1

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER - I

8) EXECUTIVE SUMMARY 9) OBJECTIVES OF STUDY 10) THE WORKING CAPITAL NEED ARISES FOR THE FOLLOWING PURPOSE 11) SCOPE OF STUDY 12) LIMITATION OF THE STUDY 13) METHODOLOGY 14) REVIEW OF EARLIER LITERATURE

Babasabpatilfreepptmba.com

Page - 2

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

1) EXECUTIVE SUMMARY

This summer project A STUDY OF WORKING CAPITAL IN NIRANI SUGARS LTD. deals to ascertain this efficiency of working capital management of the company. Working capital may be regarded as lifeblood of business. Working capital is needed to meet the day-to-day requirement of the business unit. The exploitation of working capital assets is possible only by efficient working capital management. This study on working capital management is conducted in NIRANI SUGARS Ltd. Working capital management not only shows the financial efficiency of business, but also its credit worthiness, which has gained importance in these days of credit squeeze. Therefore, study of the management of working capital is very necessary. Objective of the project was to study the pattern and procedures followed for managing various components of working capital, so as to evaluate the efficiency of working capital management. So, this study intends to comprehensively evaluate the inventory, receivables, creditors and cash management. The study also aims to analyze the alternative sources of working capital financing employed by NIRANI SUGARS Ltd. Desk Research method is adopted for this study. The required information was collected through secondary sources.+ Secondary data were collected from various sources including the annual reports of the company for the year 2004-05, 2005-06, 2006-07, 2007-08 and 2008-09. Ratio analysis is the major tool for analyzing the working capital management of NIRANI SUGARS Ltd.. and also the information for 5 years is collected. Ratio Analysis has been Carried out using Financial Information for last five accounting years i.e. from 2004 to 2009 Ratio have also been analyzed.

Babasabpatilfreepptmba.com

Page - 3

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

2) OBJECTIVES OF STUDY 1) To study the overall working of the organization. i.e. organization structure 2) To study the efficiency of working capital management of the company 3) To study the efficiency of cash, inventory and receivables management of the company 4) To understand and analyze the working capital position of NIRANI Sugars Ltd. During the period of 2004-2008. 5) To measure the overall financial position of the organization with the help of ratio analysis. study of all department &

3) THE WORKING CAPITAL NEED ARISES FOR THE FOLLOWING PURPOSE

For purchasing raw materials, components and spare parts For paying wages and salaries To increase day-to-day expense and overhead costs like fuel, power and office expense etc. To meet selling costs of packing advertising etc To provide credit facilities to customers

4) SCOPE OF STUDY

Since the decision regarding working capital are of an operating nature not one time decision, the scope of the study is geared towards identifying important areas of control and to establish model for better control of the various components of working capital The study would also attempt to identify the various sources available for financing of working capital. The study gives a fair idea of improvement in efficiency of working capital management and also to have proper control over the components of working capital and managing of efficiency.

Babasabpatilfreepptmba.com

Page - 4

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

5) LIMITATION OF THE STUDY

This study deals only with the data made available. Hence the result of this study cannot judge the business of the firm in general The study have been influenced by the limitation of the ratio analysis The study extensively uses the data provided is the financial reports of the firm which may also have their own limited perspective The analysis made on the working capital management is for a particular period of time the current assets and current liabilities will change for an analysis made at any other of time.

6) METHODOLOGY

Desk Research method is adopted for this study. The required information was collected through secondary sources. Secondary data were collected from various sources including the annual reports of the company for the year 2004-05, 2005-06, 2006-07, 2007-08, 2008-09. Ratio analysis is the major tool for analyzing the working capital management of Nirani Sugars Ltd.. and also the information for 5 years is collected.

7) REVIEW OF EARLIER LITERATURE

Annual reports of the company

Babasabpatilfreepptmba.com

Page - 5

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

INDUSTRIAL PROFILE

India is the largest consumer & second largest producer of sugar in the world. The Indian sugar industry second large agro industry Located in the rural India. The Indian sugar has a turnover of rs.500 billion per annum & it contributes almost rs.22.5 billion to the central & state exchequer as tax, cess & excise duty every year. It is the second largest agro-processing industry in the country after cotton textiles. With 453 operating sugar mills in different part of the country, Indian sugar industry has been a focal point for a socio-economic development in the rural areas. About 50 million sugarcane farmers & a large number of agricultural labors are involved in sugarcane cultivation & ancillary activities, constituting 7.5 % of the rural population. Besides, the industry provides employment to about 2 million skilled/semi-skilled workers & others mostly from the rural areas. The industry not only generates power for its own requirement but surplus power for export to the grid based on by-product-bagasse. It also produces ethyl alcohol, which is used for industrial &portable uses,& can be used to manufacture ethanol, an ecology friendly &renewable fuel for blending with petrol. The sugar industry in the country uses only sugarcane as input; hence Sugar Companys have been established in large sugarcane growing states like Uttar Pradesh, Maharashtra, Karnataka, Gujarat, and Tamil Nadu & Andhra Pradesh. In the year 2005-06 these six states contributed more than 85 % of total sugar production in the country; Uttar Pradesh, Maharashtra & Karnataka together contribute more than 65 % of total production

Babasabpatilfreepptmba.com

Page - 6

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The given chart shows the state manner wise production in India for 2003-04 & 2005-06.

Sugar production by state in India

Source: Indian sugar magazine December 2005, published by isma. The government de-licensed the sugar sector in august 1998, thereby removing the restrictions on expansion of existing capacity as well as on establishment of new units, with the only stipulation that a minimum distance of kms . Would continue to be observed between an existing sugar mill & a new mill. State Uttar Pradesh Maharashtra Karnataka Gujarat Tamil Nadu Andhra Pradesh Haryana Punjab Uttaranchal Bihar Others Total 2003-04 % of total 2005-06 % of total 5.65 28.06% 4.55 33.60% 6.22 30.86% 3.18 23.44% 1.87 9.28% 1.12 8.24% 1.25 6.22% 1.07 7.87% 1.64 8.16% 0.92 6.80% 1.21 6.01% 0.89 6.54% 0.64 3.16% 0.58 4.30% 0.59 2.91% 0.39 2.88% 0.50 2.47% 0.39 2.86% 0.41 2.03% 0.27 2.02% 0.17 0.85% 0.20 1.46% 20.14 100.00% 13.55 100.00%

There are 566 installed sugar mills in the country with a production capacity of 180 lack mts of sugar, of which only 453workinG.These mills are located in 18 states of the country. Around 315 of the total installed mills are co-operative sector, 189 in the private sector & 62 in public sector.

Babasabpatilfreepptmba.com

Page - 7

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Sugarcane availability

Sugarcane occupies about 2.7% of the total cultivated area & it is one of the most important cash crops in the country. The area under sugarcane gradually increased from 2.7 million hectors in 1980-81 to 4.3 million hector in 2003-04, mainly because of much larger diversion of land from other crops to sugarcane by the farmer for economic reason. The sugarcane area however declined in the year 2005-06 to 3.9 million hector & to 3.7 million hector in 2004-05, mainly due to drought & pest attacks. From a level of 154 MMT in 1980-81, the sugar production increased to 241 MMT IN 1990-91 & further to 296 MMT in 2000-01. Since then it has been hovering around 300 MMT until last year. In the season 2004-05, however, sugarcane production decline to 236 MMT mainly due to drought & pest attacks. Not only sugarcane acreage & sugarcane production has been increasing, ever drawl of sugarcane by the sugar industry has also been increased over the period. In India, sugarcane is utilized by sugar mils as well as by traditional sweeteners like jiggery & khadisakhar producers. The chart given below gives data on sugarcane utilization for different purposes:

SUGARCANE UTILIZATION

(% of sugarcane utilization for) Year 1990-1991 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 White sugar 33.4 50.7 59.7 57.4 68.9 56.1 Gur & Khandsari 54.8 37.4 28.8 31.5 20.1 32.5 Seed, feed & chewing 11.8 11.8 11.5 11.1 11.1 11.4

Babasabpatilfreepptmba.com

Page - 8

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Sugar production:

Most of the sugar in India is manufacture & sold as plantation white sugar which is produced by double sulphitation process, while the norms in developed & emerging nations is refined sugar which is produced by the phosphitation process. Most of the mills in India are not equipped to make refined sugar mills which are designed to produce refined sugar can manufacture sugar not only from sugarcane but also from raw sugar which can be imported. Therefore, such mills can run their production all the year round, as opposed to single state mills, which are dependent upon the seasonal supply of sugarcane.

International sugar industry demand & supply

Brazil & India are the largest sugar producing countries followed by china, USA, Thailand, Austria, Mexico, Pakistan, and France & German. Global sugar production inched from approximately 125.88 MMT in 1995-96 to 149.4 MMT in 2002-03 & then declined to 143.7 MMT in 2003-04, where as consumption increased steadily from 118.1 MMT in 1995-96 to142.8 MMT in 2003-04 as shown in below given chart. The word consumption is projected to grow to 160.7 MMT by 2010 & 176.1 MMT by 2015. The worlds largest consumers of sugars are India, china, Brazil, USA, Russia, Mexico, Pakistan, Indonesia, Germany & Egypt. According to USDA foreign agriculture service, the consumption of sugar in Asian countries has increased at a faster rate, as a direct result of increasing population, increasing per capita income & increased availability.

World sugar trade

World trade in raw sugar is typically around 22MMT & white sugar around 16MMT. Brazil is the largest importer followed by EU, Thailand, Australia & Cuba. The largest importers are Russia,

Babasabpatilfreepptmba.com

Page - 9

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Indonesia, UK, South Korea, Japan, Malaysia, and the Middle East & North Africa.

Babasabpatilfreepptmba.com

Page - 10

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Babasabpatilfreepptmba.com

Page - 11

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

SYNOPSIS 1) Objectives of Study

To study the overall working of the organization. i.e. study of all department & organization structure To study the efficiency of working capital management of the company. To study the efficiency of cash, inventory and receivables management of the company. To understand and analyze the working capital position of NIRANI Sugars Ltd. During the period of 2005-2009. To measure the overall financial position of the organization with the help of ratio analysis.

The working capital need arises for the following purpose

For purchasing raw materials, components and spare parts For paying wages and salaries To incure day-to-day expense and overhead costs like fuel, power and office expense etc. To meet selling costs of packing advertising etc To provide credit facilities to customers

2) Scope of Study

Since the decision regarding working capital are of an operating nature not one time decision, the scope of the study is geared towards identifying important areas of control and to establish model for better control of the various components of working capital The study would also attempt to identify the various sources available for financing of working capital. The study gives a fair idea of improvement in efficiency of working capital management and also to have proper control over the components of working capital and managing of efficiency.

Babasabpatilfreepptmba.com

Page - 12

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

4) Limitation of the study

This study deals only with the data made available. Hence the result of this study cannot judge the business of the firm in general The study have been influenced by the limitation of the ratio analysis The study extensively uses the data provided is the financial reports of the firm which may also have their own limited perspective The analysis made on the working capital management is for a particular period of time the current assets and current liabilities will change for an analysis made at any other of time.

Babasabpatilfreepptmba.com

Page - 13

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Babasabpatilfreepptmba.com

Page - 14

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER 2

COMPANY PROFILE

Babasabpatilfreepptmba.com

Page - 15

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

INTRODUCTION OF NIRANI SUGARS LTD.

M/s Nirani sugars Ltd, Promoted by Mr.Murugesh R Nirani. B.E, D.B.M. a technical Graduate and local MLA of Bilagi and Minister of large and Medium Scale Industry Govt of Karnataka. He comes from an agricultural family from Bilagi Taluk of Bagalkot Dt. He started as an industrialist with setting up of a modern Khandasari Unit at Mudhol. He is also very actively involved as a Managing Director OF Bilagi sugars mill Ltd, a new 2500 TCD sugar and Co-gen plant at his constituency Bilagi. The new unit is completed and commenced commercial production in December 2005. He has also been recognized and awarded Bharat Udyog Ratna award from Govt of India. He has also taken over a sick mini cement plant of 100 TPD capacities at Mudhol area, which has now been put into commercial operation with a capacity of 200 TDP within a short span of time. He has also contributed his service in setting up residential school and D, Ed College at Mudhol.

Nirani sugars Ltd. Is presently operating a sugar mill of 5000 tones cane / day (5000 TCD). This sugar mill was originally established as a khandasari sugar factory of 500 TCD in the year 1997-98. In fact this was the most modern khandasari sugar factory & was first in the country to have started with high pressure boiler, turbo generator set with captive power generation, multiple effect pressure evaporator system with falling film evaporators etc. it successfully produced goods quality white crystal sugar. But as khandasari unit, it had its own constraints due to technical limitations and govt policies.

Subsequently, making use of the govt. of Indias liberalized policy, vide govt of India notification DCS /S/14/97 dated 2-6-98, which permitted conversion of khandsari sugar Readopting vaccum evaporation & vaccum pan boiling systems along with related changes. NSL did not lose time to expand the capacity to 5000 TCD, side by side taking development measures to increase cane area & cane availability. Today NSL is a regular sugar factory with 5000 TCD capacity with improved efficiencies. But however, NSL could not enjoy the economy of scale. According the company conceived a project to expand the sugar mill to 2500 TCD with cogeneration of power of 16MW. In order to reach the minimum viable capacity for a sugar unit, as per govt of indias norms. While the same was in conceptual stage, the industrial scenario started changing. The industry in general started realizing that the sugar mills with cogeneration of power should have still higher capacities up to 10000 TCD. This has been widely recognized & appreciated by the policy makers at all levels, & the financial institutions. Further, it is also recognized that the stand

Babasabpatilfreepptmba.com

Page - 16

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

alone sugar mills, even with viable capacity may find it difficult to operate profitably on a sustained basis in a view of the exposure to the international market. The industry has to with stand the pulls & pressures or ups & downs of the global market, which fluctuates depending upon the sugar scenario in different part of the world.

Babasabpatilfreepptmba.com

Page - 17

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Having regard to the above. The new sugar projects in the country, are coming up with a capacity of 5000 TCD & more with the facility of cogeneration of power. A number of existing mills in the country are expanding to even bigger capacities like 7500 TCD, 10000 TCD & so on.

Falling in line with the above, NSL thought it prudent to make an upward revision and accordingly enhance the capacity to 5000 TCD from 2500 TCD as conceived earlier.

The cogeneration of power permits generation of surplus power, which is encashable and thus helps augmentation of income to the industry substantially on a sustained basis. The profitability of the cogeneration plant increases with increase in the size of the plant. Bigger cogeneration plants are feasible only with bigger sugar mills, either as forward integration or with back up support for fuel.

The market and the price for the power produced is assured as the surplus power so generated is under written by KPTCL through power purchase Agreement. The govt of Karnataka also shares the aforesaid viewpoint & encourages cogeneration of power by sugar factories using bagasse as a fuel. In support of this, the govt has announced a capital subsidy of Rs. 25 lakhs per MW of surplus power, for such cogen projects.

More importantly, it is important to note that private companies have come forward to purchase power from cogen. Plants offering even higher prices than those offered by electricity corporations of the state. In fact NSL has already entered into an agreement with TATA power trading company Ltd. For sale of power at a price of Rs3.61 per unit.

Having appreciated the above, it is imperative for NSL to go for expansion of the sugar mill from the present capacity of 5000 TCD to 10000 TCD. While doing so, it makes sense to update the technologies & modernize the entire plant. It needs no emphasis that the expansion project would be meaningful only if associated with the cogeneration of power & in turn associated with energy saving devices.

Babasabpatilfreepptmba.com

Page - 18

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

To match the sugar mill expansion from 5000 TCD to 10000 TCD, NSL proposes to double its cogeneration capacity also from 16MW to 48MW.

COMPANY PROFILE

Name of the company Address : NIRANI SUGARS LIMITED. MUDHOL : Nirani Sugars Limited. Vinayak Nagar, Sy No-166 Near Kulali Cross, Jamakhandi Road, Mudhol 587313 Dist: Bagalkot Regd. Office : # 2053, High Point- II 45 Palace Road, Bangalore 560 001 Branch Office Status of Company Constitution of the firm Financial Institutions : Bijapur : Sole trading concern. : Registered under companies act 1956 : K.S.I.D.C, IDBI, BOI,

Babasabpatilfreepptmba.com

Page - 19

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

K.S.F.C Bankers of the Company : I.C.I.C.I Bank Jamakhandi S.B.I Mudhol Branch. Indian Bank Lokapur. Grameen bank Mudhol.

Babasabpatilfreepptmba.com

Page - 20

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Products

: Sugar (L30, M30, S30) Molasses, Press Mud, Bagasse. Electricity.

Press Mud / Filter cake

: This is also another type of product. It is sold for Rs.250 per Ton.

Sugar Storing Capacity

: 3 lakh Bags.

Babasabpatilfreepptmba.com

Page - 21

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

AIMS AND OBJECTIVES OF THE COMPANY

To produce entire crystal sugar at international par quantity standards. Optimum utilization of the Raw material, Time, Manpower & Money. Socio friendly environment, Pollution free condition. Power generation, Petroleum products and even distribution. To make available good working condition and opportunity development with proper training and high moral. Maintain continuous improvement programs in Technology. Help farmers to increase there yield through research & development. Establish an effective & reliable process control. To produce good quality sugar at acceptable prices to meet the increasing demand

VISION OF NIRANI SUGARS LTD.

To establish production 7,500 T.C.D at Mudhol. To produce 40 Megawatt electricity. To produce 12,000 liters of distillery unit.. To produce 10,000 ton Bio fertilizers. To establish agricultural development and resource center at Mudhol. Plan to establish Nirani Education Institution in Bilagi and Mudhol. Vijaya Co-operative Credit society. Vijayanagar Mudhol. To implement highly technical Nirani Educational institutes Mudhol & Bilagi

Babasabpatilfreepptmba.com

Page - 22

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

MISSION

We will provide products of superior quality at competitive price and ensure sustained profitability and growth. We will protect the interest of all concerned promoters, shareholders, customers, distributors, employees and community. We believe in fair trade practice, standards and strive for total customers satisfaction, keeping the environment eco friendly. We believe that our people are most valuable assets for personal and organizational growth. We will treat our people with dignity and look after the safety and welfare of individuals and there families. We provide electricity which is major necessity for the country. Sugar industries are providing ethanol which can be added in diesel and diesel is major requirement of the company.

Babasabpatilfreepptmba.com

Page - 23

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

ORGANIZATION STRUCTURE OF NSL

Chairman & MD Board of Directors : : Murugesh R Nirani. (B.E.Civil.MBA) H R Nirani.Advocative Kamala M Nirani L R.Nirani S R.Nirani Administration : Sangamesh R Nirani (ExecutiveDirector) R.V. Vatnal (Technical Director) S.V. Karriyannavar (CEO) S.C. Iitnal (GM of Plant) M.R. Dabade (Dy GM Production) M.S. Heggalagi (Manager, PMP) B.S. Khandekar (GM Cane) M.M. Hiremath (Finance) S.C. Salagare (Chief Engineer) S.G. Yaragatti (Stores purchase officer) M.R. Agnihotri (Personnel officer)

Babasabpatilfreepptmba.com

Page - 24

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER 3

PRODUCTION PROFILE

Babasabpatilfreepptmba.com

Page - 25

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

BY-PRODUCTS OF SUGAR INDUSTRY

Fiberous Products

Fuel Gases Filter Mud

Bagass

Utilisation as Fuel for COGEN Sugar Furnace Ash

Sugar Cane Composite Fertilizer Molasses Direct Utilization

Protein From Cane Juice Ethnol Rectified Spirit

Distillery Industry

Babasabpatilfreepptmba.com

Page - 26

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

PRODUCT PROFILE

The factory produces about 184400 Tones of plantation crystal white sugar. As per statute from Govt of India the sugar can be packed in 100 Kg net Gunny bags and 50 Kg net Polythene bags. As per the Indian sugar standards the sugar can be graded in 3 grades by size and color namely L, M, S (size) and 29, 30 (color). The factory envisages producing M30 and s30 grades. The storage of sugar will be done in a warehouse built in masonry and roofed with AC sheets. The size of the warehouse will be suitable to store about 50% of a seasons production. The molasses which is a by product, is a highly viscous liquid. The total production of molasses in a season will be about 40,480 Tone. Two steel storage tanks of capacity 4000 tone each will be added. This can accommodate about 2 months production. As the demand for molasses is high, it is proposed to sell the molasses to distilleries as raw material to produce alcohol. Beside the finished goods and molasses storage space is required for Bagasse, ash and filter mud. Adequate open will be provided for these in the factory for easy and smooth working of the factory.

Main Product- White Crystal Sugar

The main product of the sugar manufacturing process is white crystal sugar. This white crystal sugar is manufactured in the following grades: 1) L-30 [Large size sugar] 2) M-30 [Medium size sugar] 3) S1-30 [small size sugar] 4) S2-30 [very small size]

Babasabpatilfreepptmba.com

Page - 27

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

PERFORMANCE OF NSL

1. TABLE SHOWING PRODUCTION OF SUGAR

YEAR 2005-2006 2006-2007 20007-2008 2008-09

SUGAR (in Qtls) 47,995 1,62,446 2,65,148 3,43,132

Babasabpatilfreepptmba.com

Page - 28

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

2. TABLE SHOWING PRODUCTION OF BAGASSE

YEAR 2005-2006 2006-2007 20007-2008 2008-2009 BAGASSE (in Qtls) 142322.22 402859.12 684097.67 759807.39

Babasabpatilfreepptmba.com

Page - 29

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

YEAR 2005-2006 2006-2007 20007-2008 2009-2009

MOLASSES (in Qtls) 17895.70 49700.00 90781.42 143572.53

3. TABLE SHOWING

PRODUCTION OF MOLASSES

Babasabpatilfreepptmba.com

Page - 30

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

P R O D U C T I O N

Babasabpatilfreepptmba.com

Page - 31

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

4. TABLE SHOWING SUGAR RECOVRY

YEAR 2005-2006 2006-2007 20007-2008 2008-2009

SUGAR RECOVRY (%) 10.09 % 12.11 % 11.62 % 12.09%

Babasabpatilfreepptmba.com

Page - 32

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER 4

Babasabpatilfreepptmba.com

Page - 33

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

STUDY OF DEPARTMENTS

Babasabpatilfreepptmba.com

Page - 34

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Babasabpatilfreepptmba.com

Page - 35

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

FUNCTIONAL DEPARTMENTS STUDY OF DEPARTMENTS

1. Human Resource Department 2. Marketing Department 3. Purchase Department 4. Cane Development Department 5. Production Department 6. Finance Department 7. Sales and Distribution Department

Babasabpatilfreepptmba.com

Page - 36

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

1 HUMAN RESOURCE DEPARTMENT

The Human Resource department is the primarily concerned with the human constitution of an organization. It is concerned with the manpower recruitment, remuneration, promotion, retirement etc., all related to human resource or labors of the organization. The Human Resource Department refers to the systematic approach to the problem of selection, training motivating and retaining personnel in any organization. It also consider with planning, organizing, directing the personnel functions in the organization.

Babasabpatilfreepptmba.com

Page - 37

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The department is also concerned with recruitment selection and placement.

1

Development and training to the workers. Development evaluation of the workers. Wage and salary administration.

2 3

In Nirani Sugars the personnel manager takes all the above responsibilities and undertakes the activities concerned with him. Suitable candidates are selected to a particular job according to their qualification and experience. There is no necessary to give training to the workers on separate machine other than actual production process. Hence training is given on the job only. Manager and supervisor are continuously inspecting every worker ti access their performance and there is a better scope for hard workers.

TIME OFFICE Time office is one of the important sections of administration department. This section maintains the attendance of workers. It also shows records of particular workers about his working hours, dit, etc. it evaluates the workers punctuality, discipline and uniforms and maintains documents and records for the future reference purpose.

FUNCTIONS 1 Showing the absenteeism report of HOD. 2 To receive the attendance cards from the workers. 3 To put attendance of the workers in he muster role.

Babasabpatilfreepptmba.com

Page - 38

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

In time office there are 4 types of leaves.

SICK LEAVE : employees are eligible to take have on the sickness. 8 days sick leave shall be granted with full wages. CASUAL LEAVE : 10 days casual leave shall be granted with full wages or pay including DA to the every workman. PRIVILEGED LEAVE: 15 Days privileged leave shall be granted with full wages or pay including DA to the every workman for every completed year. SECURITY OFFICE : Security officer also one of the important section of the administration department. There are totally 39 guards.

DUTIES OF SECURITY OFFICER

1 2 3 4 5 6 7 Maintain the silencing in the factory area. Time maintenance of workers. Raw materials is checked according to the voucher. Incoming materials are checked, if they are right, they will records inward and seal the bill and leave inside. If out going material from the industry that person must and should have got pass and it is entered in outwards. If goods are returnable, it will be entered in return A/C book. All times of A/Cs are submitted to M.D. daily.

FACILITY TO WORKERS

1

Availability of rest house with TV facility. Availability of quarters. Providing 2 wheelers for employees who are visiting the field to supervise and check the availability cane. Executive levels are provided with 4 wheelers.

2 3 4

Babasabpatilfreepptmba.com

Page - 39

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Weekly one holiday of any in a week

NATIONAL HOLIDAYS

The industry can give the leave for the national holidays, fair days of national holidays should be given to the employees, such as Independence day, Republic Day, Gandhi Jayanti etc. DUTIES OF TIME OFFICE:1 2 3 4 5 6 7 8 Maintenance of clock Sequencing the punching cards Siren maintenance ( signal value ) Observation of employees Maintaining Notice Board Accepting leave letter application Over time requisition Absent statement

SHIFT WORKING:In a shift of 8 hours factory is providing 4 types of shifts:1st shift 2nd shift 3rd shift General shift 4 am 12 pm 12 pm 8 pm 8 pm 4 am 8.30 am 5.30 pm

The time office maintains register of muster role absenteeism, accident report file and leave letter file.

Babasabpatilfreepptmba.com

Page - 40

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

OBJECTIVES OF HUMAN RESOURCE DEPARTMENT

1. To maintain good relation between employer and employees. 2. To maintain good industrial relation. 3. To select right person at right job. 4. To cope with a chain. 5. To develop employees in organization. 6. To full utilization of human resource.

FUNCTIONS OF HUMAN RESOURCE DEPARTMENT

Recruitment Job analysis and job description Promotion Wages and salary administration Training and development Records and incentives Welfare maintenance

Babasabpatilfreepptmba.com

Page - 41

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

H. R. D NUMBER OF WORKERS

Officers Regular Trainees Daily wages with order Total 24 172 351 17 564

Babasabpatilfreepptmba.com

Page - 42

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

II MARKETING DEPARTMENT

Babasabpatilfreepptmba.com

Page - 43

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

MARKETING PROCESS

The term marketing has been derived from the word MARKET. involving transfer of ownership of goods, service, and securities.

Market is generally

understood as a place or geographical area where buyers and sellers meet and enter in to transactions

Features of Marketing

1

It is consumer oriented. It starts and ends with consumer. Marketing is a system It is a goal oriented. Exchange process is the essence of marketing. It is the guiding element of business.

2 3 4 5 6

Babasabpatilfreepptmba.com

Page - 44

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

MARKETING

Marketing is a social and managerial process by which individual and group obtains what they need and what through creating, offering and exchanging products of values with others. This marketing is important element in every organization, which should be maintained compulsory in a systematic manner. This section will take care of all sale transactions like sale of sugar, molasses, Bagasse and scrap material. This section works by 7 employees including sales manager. The factory has sold the sugar according to central government notification. The central government sends the notice to the factory every month regarding sale of sugar, without notice the sugar is not sold to anybody. The government is giving permission for a particular period, particular for sale of sugar. The sugar is sold to the buyer who quotes highest price. In this section, some records like sale of sugar register, molasses register, Bagasse registers and scrap material registers are maintained.

PRODUCT OF SALE

The organization undertakes selling activities in two methods:1

FREE SALE:- free sale of sugar is being done to bulk purchases on the basis of tenders called, collected, negotiated and sold. LEVY SALE:- This is being sold to the government of Karnataka on levy basis. The government then distributes the same to the public through public distribution outlets at predetermined reasonable price.

PURCHASE DEPARTMENT

Purchase success and failure of any company depends on the cost of materials, the proper buying of materials and procurement of materials at the right time from the right source is having greater importance in any business. There is a need for separate department for buying the materials known as Purchasing department.

Babasabpatilfreepptmba.com

Page - 45

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The purchase section also connected to administrative department. In this section 3 workers are working including purchase officers. This section is purchasing all types of materials for the factory, plant and machinery. This department also maintains the quality of raw materials, by taking the sample of cane to laboratory test then if the raw material will below standard then will be rejected, otherwise the raw material will be purchased at the particular price.

FUNCTIONS OF PURCHASE DEPARTMENT

Receiving purchasing requisition Determining the volume of materials to be ordered Placing orders Inviting tenders and quotations from different suppliers Checking and passing bills for payment. Receiving and inspecting materials.

QUALITIES OF PURCHASE MANAGER

In Nirani Industry the purchase has to follow the following qualities.

Good knowledge of industry and material used in the industry. Administrative and organizing ability Honesty and integrity Knowledge and contract of law Knowledge of economic principles and demand and supply Knowledge of government policies

RESPONSIBILITIES OF PURCHASING MANAGER

Purchasing of materials at right time and in proper way from right source. Receiving or materials. Storing of materials. Issuing of materials. Accounting of materials.

Babasabpatilfreepptmba.com

Page - 46

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Keeping proper records of material purchased. Properly planned for material required. Co-ordination and co-operation between different departments.

CANE DEVELOPMENT DEPARTMENT

OBJECTIVES OF CANE DEVELOPMENT DEPARTMENT

to get high yield of sugarcane to the factory in right time. To improve variety of cane To develop the backward area To provide all facilities like seeds, fertilizers, unloading and loading charges To maintain registration of cane, gang and plantation. To undertake seed distribution programme

The soil of this area is varying alluvial fertile soil is there on the bank of Krishna and Ghataprabha rivers. Further upwards, there is a medium deep black soil, vary fertile well drained light to medium clay soil, which has received heavy application if from yard Manu science last 10-12 years also is presently in some parts.

Babasabpatilfreepptmba.com

Page - 47

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The main function of cane development department is to arrange for raw material, which is required to the factory. For this the order is received by priority basis ( that is growers who grows sugar cane first in his lead ). They also provide a loading gang with 8 to 10 members per village and also a bonded tractor for transportation.

Babasabpatilfreepptmba.com

Page - 48

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

SUGAR CANE VARIETIES

At present COC-671, COC-8011 are very popular sugar cane varieties growing in this area. The factory had introduced a new variety of sugar cane that is COC 86032 two years back. Here more than 85% of sugar cane is of variety COC 671 which is mainly grown in this area. S.L 1 2 3 NAME OF THE VARIETY CO-C-671 CO-8011 CO-86032 AREA IN HA (P) 1153 ha 480 ha 1921 ha (R) 60.02% 24.99% 14.99%

PRODUCTION DEPARTMENT

The production department is center of the center organization. The main function of the production department is Functions: To maintain close and co-ordinates relationship with all others. To upgrade the technical efficiency of the production. To flow up the daily production schedule of as per plan. To produce the future needs of the company and to promote the organization.

OBJECTIVES: To plan and meet the production requirements as per customer specification through the continuous improvement in the planning processing and optimum utilization of resource. To identify control the customer supplied products. To produce for future needs and customers specification.

This department is one of the core parts in every organization and it plays a vital role in the organization, smooth going, basically, in every sugar industry production is divided in to two sections. Engineering section Manufacturing section

Babasabpatilfreepptmba.com

Page - 49

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

PRODUCTION PROCESS

Step 1. weighing of sugar cane, it means, when the sugar cane comes to the factory. After weighing of sugar cane the unloaded carrier cane weigh bridge. Step 2. In the next step sugar cane go to the cane cutter machine and it cuts the fine pieces after that, there are 3 mills and 5 mills tandem that is sequential mill. Step 3. After the milling of sugar cane there is a separation of baggasse and juice milk, baggasse will be used as a fuel. There are 7 boilers. They used as a fuel and there is production steam and steam is used to produce the electricity. Step 4. The juice, weighing takes place and there are mixing the juice and there is addition of phosphoric. After heated of juice milk 75 C that juice is called as Raw juice. Additional of milk of lime and SO2 is called Sulfur and this again goes to juice heater it heated up to 104 C. Step 5. Then the next step, the juice sent to clarifier and in that there is a separation of dust and clear transferals juice. Clear juice sends to Bhoomi Labh. This is the produce fertilizer. Clear juice will be thick. It calls as syrup. Again add to the milk and SO2 then it is called syrup suplitation. Step 6. sulpitation comes to the pan boiling station and this there are 3 categories, A,B and C first of all the sulpitation goes to the A category. And the pan boiling directly goes to pan crystal. Raw sugar goes to the centrifugal machine routed to the high speed of around 1200 rpm. It will be separated sugar crystal and molasses. Step 7. In this, the sugar crystal downs and passes through grass happer. In the grass happer the sugar goes to the one place to another place. After there is gradation, in that there are 3 grades. It will be divide the 3 grades:- high grade, small grade, low grade. Step 8. And then the sugar goes to the different vessels. In that, package of sugar. In this there are 2 types packing exporting and domestic is different.

Babasabpatilfreepptmba.com

Page - 50

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

FINISHED PRODUCTS

Finished product is sugar. There are 3 types of finished sugars, High Quality, Middle Quality and Low Quality. These are 3 types of bye products Molasses Bagasse Filters mud

ENGINEERING SECTION

This section is assisted by workshop. It maintains all the work connected with plant and machinery.

WORKSHOP

In this workshop machinery work is done. The spares, materials are fabricated using the lather machines in the workshop, shaping like square cutting etc is also done in the workshop. Following machines are used in this workshop. o 2 lathe machines for round job o 1 redial drilling machines for drilling hole o 1 shaping machine of 32* for right angle planning o 1 hacksaw machine for cutting o 1 grinding machine for tool grinding

MANUFACTURING SECTION

The manufacturing section again divided in to 3 sub sections. Laboratory Manufacturing process

Babasabpatilfreepptmba.com

Page - 51

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Go down

LABORATORY:The factory has a separate well equipped laboratory. The main activity of the lab is to check the content of sugar in the sugarcane and also fixing the correct shape and size of sugar. The lab prepares hourly reports which advice on the addition of other chemicals in he production.

OTHER CONCERNED ACTIVIGIES OF THE LABORAORY

It determines the percentage of water content in the dilution of juice. It determines as well as maintaining the temperature of boiling juice. Choice of color and size of sugar. To manage time and quality. It decided the percentage and contents and chemicals to be added during production. To finds the PH of water through universal indicator.

CHEMICAL DEPARTMENT

Babasabpatilfreepptmba.com

Page - 52

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHEMICALS USED IN PRODUCTION

Caustic Soda ( Sodium Carbonate ) Washing soda ( Sodium Bicarbonate ) Common salt ( sodium Chloride ) Phosphoric Acid ( To maintain the PH ) Ammonium Bi-fluoride Formalin quality maintain and preservative Mill sanitation chemical to prevent the generation of bacteria and germs Hydrous Viscosity Misopropile Commercial HCL Bleaching Powder - Shining purpose - Used for Color - Used for reducer - Used for Alcohol

Babasabpatilfreepptmba.com

Page - 53

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Led Acitate

-For laboratory purpose

Babasabpatilfreepptmba.com

Page - 54

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

FINANCE DEPARTMENT

Babasabpatilfreepptmba.com

Page - 55

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

SALES AND DISTRIBUTION DEPARTMENT SALES MANGEMENT PRACTICE OF NIRANI SUGARS

The marketing department of Nirani Sugars is working in two ways. 1. Free Scale 2. Levy Scale

The out put of the factory produced is sold to public and Government in the ratio of 40 : 60 all the functions of marketing department are generally done by the sales manage who is in charge of assistant manager. The factory has big market area for sugar in Bagalkot, Bijapur and Belgum Districts. Little in local area covered by local sugar dealers. The bi-products is also sold in large volume to biscuits, chocolate and wine industries and also is used by distilleries.

SALESMANSHIP AT NIRANI SUGARS

It is the duty of marketing manager to appoint sales representatives salesmanship is not necessary at Nirani Sugar, because the reasons are: Because their product is available at ever corner of the district As the product is not a lectury one so it is not necessary to appoint sales man.

As the product is an essential one salesman are not required to approach the customers at their door step and induce them to purchase their product.

Babasabpatilfreepptmba.com

Page - 56

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER 5

WORKING CAPITAL MANAGEMENT

Babasabpatilfreepptmba.com

Page - 57

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

WORKING CAPITAL MANAGEMENT INTRODUCTION:

The aim of the present study is to examine the Working Capital management. Since the efficiency of the Working Capital management is determined by the efficient administration of its various components- cash, accounts receivable and inventory, the study attempts to determine the management of each component. Working Capital in a business enterprise may be compared to the blood in a human body: Blood gives life and strength to the human body. Similarly Working Capital injects life and strengthprofits and solvency - to the business organization. Working Capital refers to short term funds required for the purpose of business operations. The funds used for meeting day to day expenses like, purchase of raw materials, payment of wages and other expenses, stocking of goods, granting of credit to customers and maintenance of the minimum balance. It is not necessary that the funds should be in the form of cash only. It can be in the form of near cash items like, marketable securities, inventories and account receivable

Babasabpatilfreepptmba.com

Page - 58

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CONCEPT OF WORKING CAPITAL

Like most other financial concepts, the concept of Working Capital is used in different connotations by different writers. Obviously, it is understood either as the total current assets or as the excess of current assets over current liabilities. The former is referred to the gross working Capital and the latter the net Working Capital. So there are two concepts in Working Capital: 1. Gross Working Capital. 2. Net Working Capital. Gross Working Capital is the total of all current assets, viz. cash, marketable securities account receivable and inventory Net Working Capita refers to excess of current assets over current liabilities. Both of these concepts have their own importance. The gross concept is a going concern concept in which management is particularly interested because for the productive utilization of fixed assets all the currents are necessary. The net concept is useful to gauge the financial soundness of a form and is of special interest to sundry creditors and suppliers of short-term loans and advances. It creates confidence among the creditors about the security of their amounts. No special distinction is made between the terms total current assets and Working Capital by some authors Working Capital is nothing but total of current assets. It is a substitute for Working Capital, though not a perfect one Working Capital is the capital circulating into cash over an operating cycle. Working Capital is equated with all the current assets. Working Capital and current assets are interchangeable.

Babasabpatilfreepptmba.com

Page - 59

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

In support of these above statements they put forth the following arguments:

1. Profits are earned with the help of the assets, which are partly fixed and partly current. To a certain degree, similarity can be observed in fixed and current assets in that both are partly borrowed and yield profit over and above the interest costs; logic then demands that current asset should be taken to mean the Working Capital of the corporation; 2. With every increase in funds, the gross Working Capital will increase while according to the net concept of Working Capital there will be no change in the funds available for the operating manager; 3. The management is more concerned with the total current assets as they constitute the total funds available for operating purposes than with the sources from which the funds came; 4. The net concept of Working Capital has relevance when the form of organization was single entrepreneurship or partnership. Contrary to the aforesaid view, some other authors have stated that Working Capital is the mere difference between current assets and current liabilities.

The reasons they cite in support of the above statements are:

1. In the long run what matters is the surplus of current assets over current liabilities; 2. It is this concept which helps creditors and investors to judge the financial soundness of the enterprise; 3. What can always be relied upon to meet the contingencies is the excess of current assets over current liabilities. Since it is not to be returned; and 4. This definition helps to find out the correct financial position of companies having the same amount of current assets. However, attempts have been made to remove the ambiguity regarding the definition of Working Capital. Kuchhal suggests that the concept of gross Working Capital may be used to refer to the total current assets over the current liabilities. Both the net and the gross concept of Working Capital have their own uses. The choice of a particular concept obviously depends upon the purpose in view. If the objective is to measure the size and extent to which current assets are being used to optimistic productivity of the concern, gross concept is more useful. If, on the other hand, the objective lies in evaluating the

Babasabpatilfreepptmba.com

Page - 60

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

liquidity position of an undertaking, the concept of net Working Capital becomes pertinent and preferable.

FACTORS AFFECTING WORKING CAPITAL NEEDS

The Working Capital requirements of a form depend on many factors. It is a common proposition that the size of Working Capital is a function of sales. Sales alone do not determine the size of Working Capital. But it is constantly affected by the crisis- crossing economic currents flowing in a business. The nature of the firms activities, the industrial health of the country, the availability of materials, the ease or tightness of the money market are all parts of these shifting forces. Realizing the complication involved in Working Capital estimates, Gerstenberg observes, Although no definite rule can be established for determining Working Capital requirements, we can arrive at some general principles. Certain influences, some inherent in the nature of the business and the others arising out of business management policies, affect each of the items of current capital. The following factors affect not only the requirements of Working Capital but also influence to a great extent the composition or structure of Working Capital. It is believed that any attempt at Working Capital management could be improved upon with greater understanding of the underlying factors. The following factors are important: a) b) c) d) e) f) g) h) i) j) k) Nature of business. Period of manufacture and cost of production, Volume and terms of purchase, Size of business unit, Capacity utilization, Degree of specialization, Seasonal variations, Coordination between production and distribution, Business cycles, Management policy, Miscellaneous factors such as government policies, transport and communication system and

economic and political environment.

Babasabpatilfreepptmba.com

Page - 61

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

TYPES OF WORKING CAPITAL

While planning for the Working Capital one has to keep in mind different classification of Working Capital. They are: 1. Permanent of fixed Working Capital: Permanent Working Capital is the minimum amount of current assets, which is needed to conduct a business even during the dullest season of the year. This amount varies from year to year, depending upon the growth of a company and the stage of the business cycle in which it operates. It is the amount of funds required to produce the goods and services, which are necessary to satisfy demand at a particular point. It represents the current assets, which are required on a continuing basis over the entire year. It is maintained as the medium to carry on operations at any time. 2. Temporary or variable Working Capital: Temporary or variable or fluctuating Working Capital is the amount of Working Capital which is required to meet seasonal in nature, it means the blocking of Working Capital in stock and it will take time to convert it into cash. In order to meet special exigencies like, launching of extensive marketing campaign, for conducting research etc., special Working Capital is required.

INADEQUACY OF WORKING CAPITAL

A business enterprise should have enough Working Capital. Without adequate Working Capital it cannot be run effectively a manufacturing concern is sure to collapse if it is run for longer period without or with meager amount of Working Capital. Therefore, the enterprise has to maintain adequate Working Capital can avail following advantages: 1. It enables the enterprise to enjoy uninterrupted flow of production by obtaining the raw material well in time. 2. It enables an enterprise to avail cash discounts on the purchase and hence, it reduces costs, 3. It enables to make regular payments of salaries, wages and other day to day commitments which raise the morale of its employees, increases their efficiency, reduce-wastage and costs, 4. It enables to extend favorable credit terms to customers,

Babasabpatilfreepptmba.com

Page - 62

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

5. It will help to maintain the good will and credit worthiness which is essential for raising the loans from banks and others on easy and favorable terms, 6. It helps to exploit favorable market conditions such as, purchasing its requirements in bulk when the prices are lower and by holding its inventories for higher prices, 7. This gains the confidence of its investors and creates a favorable market to raise additional funds in the future and 8. It creates an environment of security, confidence, high morale and overall efficiency in a business, etc.

INADEQUACY OF WORKING CAPITAL

At the same time inadequacy of Working Capital will affect business prospects adversely. Goodwill of the firm will be at stake if the Working Capital gap is not bridged. Shortage of Working Capital or inadequacy of Working Capital will affect profitability. Liquidity and soundness of a business enterprise. It can cause following damages: 1. It stagnates growth. It becomes difficult for the enterprise to undertake profitable projects for non-availability of the Working Capital funds, 2. It becomes difficult to implement operating plans and achieve an enterprises profit target, 3. An enterprise may not be able to take advantage of cash discount facilities, 4. An enterprise will not be able to pay its dividends because of the non availability of funds, 5. An enterprise may have to borrow funds at exorbitant rates of interest, 6. Operating inefficiencies creep in when it becomes difficult even to meet day-to-day commitments, 7. An enterprise loses its reputation when it is not in a position to honor its short term obligations. As a result, an enterprise faces tight credit terms.

Babasabpatilfreepptmba.com

Page - 63

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

LITERATURE REVIEW

As every enterprise knows that, working capital is the lifeblood and control of nerve center of the business. Just as circulation of blood is the essential for maintaining life, working capital is also essential for maintaining the smooth running of the business. The importance of working capital management is indisputable; Business liability relies on its ability to effective management of receivables, inventory, and payables. By minimizing the amount of funds tied up in current assets. Firms are able to reduce financing costs or increase the funds available for expansion. Many managerial efforts are put into bringing non-optimal level of current assets and liabilities back towards their optimal levels. Working Capital refers to the amount of capital which is readily available to an organization that is, working capital is the difference between resources in cash and readily convertible into cash (current assets) and organizational commitments for which cash will soon be required (current liabilities). Thus, working capital involves activities such as arranging the short-term finance, negotiating favorable credit terms, controlling the movement of cash, administrating accounts receivables and monitoring the investments also a great deal of time.

Factors influencing working capital requirements

Nature of business This is one of the primary factors influencing the working capital requirements of a firm. The NSL is a manufacturing firm, has a longer operating cycle for manufacturing the products, and investing more funds in its current assets. Therefore, it requires much more working capital. Market conditions The level of competition existing in the market also influences working capital requirement. When competition is high, the company should have enough inventories of finished goods to meet a certain level of demand. Otherwise, customers are highly likely to switch over to competitors products. It thus has greater working capital needs. When competition is low, but demand for the product is high, the firm can afford to have a smaller inventory and would consequently require lesser working capital. But this factor has not applied in these technological and competitive days.

Babasabpatilfreepptmba.com

Page - 64

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

ESTIMATION OF WORKING CAPITAL REQIUREMENTS

Managing the working capital is a matter of balance. The firms must have sufficient funds on hand to meet its immediate needs. The NSL is manufacturing oriented organization; the following aspects have to be taken into consideration while estimating the working capital requirements. They are:

Total costs incurred on material, wages and overheads. The length of time for which raw material are to remain in stores before they are issued The length of the production cycle or work-in-process, i.e., the time taken for conversion of The length of sales cycle during which finished goods to be kept waiting for sales. The average period of credit allowed to customers. The amount of cash required paying day-today expenses of the business. The average amount of cash required to make advance payments The average credit period expected to be allowed by suppliers. Time lag in the payment of wages and other expenses.

for production. raw material into finished goods.

FINANCING OF WORKING CAPITAL

In that NSL, it was financing the working capital from the following five common sources. They are: 1. SHARES: The NSL has issued the equity shares for raising the funds. The Equity Shares do not

have any fixed commitment charges and the dividend on these shares is to be paid subject to the availability of sufficient funds. These funds have been injected from the companys own personal resources, from the members and from the third party investors. 2. TRADE CREDITORS: The trade creditors refer to the credit extended by the suppliers of milk in the normal course of business. The firm has a good relationship with the trade creditors. So that suppliers send the milk to the firm for the payment to be received in future as per the agreement or

Babasabpatilfreepptmba.com

Page - 65

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

sales invoice. In this way, the firm generates the short-term finances from the trade creditors. It is an easy and convenient method to finance and it is informal and spontaneous source of finance for the firm. 3. FACTORING OR ACCOUNTS RECIEVABLE CREDIT: Another method of raising short-

term finance in the NSL is through accounts receivables credit offered by the commercial banks and factors. A commercial bank has provided finance by discounting the bills or invoices of its customers. Thus, a firm gets immediate payment for sales made on credit. The factor is also a financial institution, which offers services relating to management and financing of debts arising out of credit sales. Factors render services varying from bill discounting facilities provide commercial banks to the total take over of administration of credit sales including maintenance of sales ledger, collection of accounts receivables, credit control, and protection from bad debts, provision of finance and rendering of advisory services to the firms clients. 4. LINE-OF-CREDIT: The business is well capitalized by equity and is has a very good collateral, the business (the firm) might quality fore one. A line-of-credit allows firm to borrow funds for shortterm needs when they arise. The funds are rapid once the collections of accounts receivables that result from the short-term sales peak. Lines-of-credit typically are made for one year at a time and expected to be paid it for 30 to 60 consecutive days some times during the year to ensure funds are used for short-term needs only. 5. SHORT-TERM LOAN: The firm has borrowed the funds from the commercial banks to finance for the working capital needs. The short-term loans duration is less than one year. They provide a wide verity of loans to meet the specific requirements of a concern. The different forms in which the banks normally provide loan and advances are Loans Cash credits Overdraft

Babasabpatilfreepptmba.com

Page - 66

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

DATA ANLYSISS ANLYSIS 0F WORKING CAPITAL MANAGEMENT

Working Capital management involves deciding upon the amount and composition of current asset and how to finance the asset. This decision involves trade off between risk and profitability. Working Capital Balances are measured from the financial dates of the companys balance sheet. A study of the causes for changes of working capital that take place in the balance from time to time is necessary. These changes can be measured in rupee amount and also in percentage by comparing current assets, current liabilities and working capital over the given period. The importance tools of Working Capital are, I. Ratio Analysis of Working Capital II. Funds Flow Analysis of Working Capital III. Working Capital Budget

Babasabpatilfreepptmba.com

Page - 67

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CHAPTER 5

DATA REPORT

Babasabpatilfreepptmba.com

Page - 68

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Babasabpatilfreepptmba.com

Page - 69

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

CALCULATOIN OF GROSS WORKING CAPITAL TABLE 01 TABLE SHOWING GROSS WORKING CAPITAL OF NIRANI SUGARS LTD

Particulars Current Assets Cash and Bank Balance Other Current Assets Loans & advances Inventories Sundry Debtors Gross Working Capital 21347 6300 18663 92717 69265 208232 16680 6300 32726 89713 76180 221599 9679 6300 42916 96322 45153 200370 9217 6300 56818 33818 583 106758 13618 ------34813 84221 2408 135060 2004-05 2005-06 2006-07 2007-08 2008-09

INFERENCE

The gross working capital has fluctuated with the growth of the business over a period of 20042009. There is an decrease in the current assets of the company.

CALCULATION OF NET WORKING CAPITAL TABLE 02 TABLE SHOWING NET WORKING CAPITAL NIRANI SUGARS,LTD.

Particulars Current Assets a) Current 2004-05 208232 327456 2005-06 221599 451021 2006-07 200370 499078 2007-08 106758 524,239 2008-09 135060 135060

Liabilities Net Working Capital (a-b)

-119224

-229422

-298708

-417481

61395

INTERPRETATION: Babasabpatilfreepptmba.com

Page - 70

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The net working capital table indicates that excess current asset is available at the disposal of the company for the operational requirements.

GRAPH SHOWING NET WORKING CAPITAL IN DEFFURENT YEARS.

]]

INTERENCE

The graph shows that there is a decrease in the working capital in the year 2007-08 In this year Inventories, Debtors and Loans & advances are increases, Due to increase in the production Capacity of the Co, so in this year Working capital is increase from Rs 29387228 to Rs 157043223.

Babasabpatilfreepptmba.com

Page - 71

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

1) Statement of changes in working capital(2004and2005)

(Rs in Lakhs) Effect of wc Increase

Particulars A. Current assets Cash and bank balance Other current assets Loans and advances Inventories Sundry debtors

As @ 31/3/04

As @ 31/3/05

decrease

2,44,36 79,00 2,94,34 8,91,91 7,23,76

2,13,47 63,00 1,86,63 9,27,17 6,92,05

-3526 -

3089 1600 10771 -3171

Total current assets B. Current liabilities Current liabilities Provisions Total current liability Net current assets(A-B)

22,33,37

20,82,32

27,46,63 88,64 2835,2 7 -601,90

31,53,2 7 1,21,2 9 32,74,5 6 -11,92,24

40664 3265

3526

62560

Increase or decrease in working capital

59034

59034

Total working capital

-60190

-60190

62560

62560

INTERPRETATION

The statement shows that the changes in working capital in the year 2003-2004 and 2004-2005. The changes in capital of two years is Rs. 59034 in 2004 - 2005 so its shows the working capital

Babasabpatilfreepptmba.com

Page - 72

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

decreased of Rs 59034 in 2004 -2005 which compare to 2003 -2004hear due to decreased the firm is no satisfactory with its working capital.

2) Statement of changes in working capital (2005and 2006)

Particulars A. Current assets 2 ,13,47 6 3,00 1 ,86,63 9 ,27,17 6 ,92,05 2 0,82,32 1 ,66,80 6 3,00 3 ,27,26 8 ,97,13 7 ,61,80 2 2,15,99 As @ 31/3/05 As @ 31/3/06 Effect of wc Increase

(Rs in Lakhs)

decrease

Cash and bank balance Other current assets Loans and advances Inventories Sundry debtors

4667

1 4063 3004 6 975

Total current assets

B. Current liabilities Current liabilities Provisions Total current liability 3 1,53,27 1 ,21,29 3 2,74,56 4 4,11,54 9 8,67 4 5,10,21 -2 2,94,22 1 10198 119224 1 25827 2 262

Net current assets(A-B) Increase or decrease in working capital

- 11,92,24

2 3300 1 10198 1 33498

1 33498

Total working capital

-119224

1 33498

INTERPRETATION

Babasabpatilfreepptmba.com

Page - 73

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The statement shows that the changes in working capital in the year 2004-2005 and 20052006. The changes in capital of two years is Rs. 11098 in 2005- 2006 so its shows the working capital decreased of Rs 110198 in 2005- 2006 which compare to 2004-2005 hear due to decreased the firm is not satisfactory with its working capital.

3) STATEMENT SHOWING CHANGES IN THE WORKING CAPITAL IN ( 2005-06)

Particulars As @ 31/3/06 As @ 31/3/07 Effect of wc Increase (Rs in Lakhs)

Decrease

A. Current assets Cash and bank balance Other current assets Loans and advances Inventor ies Sundry debtors Total current assets B. Current liabilities Current liabilities Provisio ns Total current liability Net current assets(AB) Increase or decrease in working capital Total working capital

1,66, 80 63,00 3,27, 26 8,97, 13 7,61, 80 22,15 ,99

96,79 63,00 4,29, 16 9,63, 22 4,51, 53 20,03 ,70 10190 6609

7001

31 027

44,1 1,54 98,67 45,10 ,21 -22,94,22

48,75 ,69 1,15, 09 49,90 ,78 -29,87,08 6928 6 16 799 69 286 86085

46 415 16 42

86 085

-229422

229422

86085

INTERPRETATION Babasabpatilfreepptmba.com

Page - 74

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The statement shows that the changes in working capital in the year 2005-2006 and 2006-2007. The changes in capital of two years is Rs. 69286 in 2006- 2007 so its shows the working capital decreased of Rs 69286 in 2006- 2007 which compare to 2005-2006 hear due to decreased the firm is not satisfactory with its working capital.

4) Statement of changes in working capital in (2006 and 2007)

(Rs in Lakhs) Particulars As @ 31/3/07 As @31/3/08 Effect of wc Increase decrease

A. Current assets Cash and bank balance Other current assets Loans and advances Inventories Sundry debtors Total current assets B. Current liabilities Current liabilities Provisions Total current liability Net current assets(A-B) Increase or decrease in working capital Total working capital -29,87,08 48,75,69 1,15,09 49,90,78 -29,87, 08 51,72,04 70,35 52,42,39 -417481 4474 18376 137149 2,96,35 96,79 63,00 4,29,16 9,63,22 4,51,53 20,03,70 92,17 63,00 5,68,18 3,38,40 5,83 10,67,58 13902 6,24,82 4,45,70 4,62

118773

118773

-29,87,08

137149

137149

INTERPRETATION Babasabpatilfreepptmba.com

Page - 75

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

The statement shows that the changes in working capital in the year 2006-2007 and 2007-2008. The changes in capital of two years is Rs. 118773 in 2007- 2008 so its shows the working capital decreased of Rs 118773 in 2007- 2008 which compare to 2006-2007 hear due to decreased the firm is not satisfactory with its working capital.

5) Statement of changes in working capital (2008and 2009)

(Rs in Lakhs) Particulars A. Current assets Cash and bank balance Other current assets Loans and advances 92,17 63,00 5,68,18 13618 34813 4401 63,00 22005 As @ 31/3/08 As @ 31/3/09 Effect of wc Increase decrease

Inventories Sundry debtors

3,38,40 5,83

84221 2408

50381 1825

Total current assets B. Current liabilities Current liabilities Provisions

10,67,58

135060

51,72,04 70,35

66597 7068

450607 33

Total current liability

52,42,39

73665

Net current assets(A-B)

-417481

61395

507214

28338

Increase or decrease in working capital Total working capital

478876 61395 61395 507214

478876 507214

Babasabpatilfreepptmba.com

Page - 76

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

INTERPRETATION

The statement shows that the changes in working capital in the year 2007-2008 and 2008-2009. The changes in capital of two years are Rs. 478876 in 2007- 2008 so its shows the working capital increased of Rs 478876 in 2008- 2009 which compare to 2007-2008 hear due to decreased the firm is not satisfactory with its working capital.

RATIO ANALYSIS INTRODUCTION

The financial statement of a company contains a lot of information about the financial performance of the company. Financial statements mainly consist of the Balance Sheet and Profit and Loss Accounts. These statements give the overall picture of the company, but to analyses each aspect of business extensively, financial ratios are used. The Balance Sheet and the Statement of Income are essential, but they are only the starting point for successful financial management. Financial Ratio Analysis derived from Financial Statements analyses the success, failure, and progress of business. Ratio Analysis is a very powerful analytical tool useful for measuring the performance of an organization. The ratio analysis concentrates on the interrelationship among the figures appearing in the mentioned financial statements. The ratio analysis helps the management to analyze the past performance of the firm and to make further projections.

Meaning

Ratio Analysis is a widely used tool of financial analysis. Ratio analyses will help to find out as to how optimally the working capital is utilized in the concern. These ratios can also caution the company if its financial position is threatening i.e. if it may not be capable of its liabilities or the production may be interrupted due to shortage of funds etc.

The important ratios are as follows. MERITS AND DEMERITS OF THE RATIO Merits of the Ratio

The following are the some important merits of the ratio

Babasabpatilfreepptmba.com

Page - 77

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

1. Ratio Analysis reflects the working efficiency of a concern. 2. Since, ratio analysis relates the financial health of a concern, insurance other financial institution relay on them while judging loan application and in taking vital investment decision. 3. It helps in establishing trends since the result are preparing plans for the future. 4. It is helpful in forecasting likely events in future.

Babasabpatilfreepptmba.com

Page - 78

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

Demerits of the Ratio

The following are the some important demerits of the ratio. 1. The striking aspect of ratio analysis is the absence of an explicit theoretical structure; different methods of collection are adopted by different concerns. 2. For concert analysis inside information must be known by the analyst since most concern report to portray of easy picture of the financial attachments. 3. Change in the basis of accounting may pose difficulty in analysis ratios between one period

The important ratios are as follows.

1. 2.

3.

Current asset total to assets Ratio Current Liabilities to Total Asset Ratio Sales to fixed Asset Ratio Current Assets Turnover Ratio Liquidity Current Ratio Quick Ratio Working Capital Turns Over Ratio

4. 5. 6. 7.

II. Funds Flow Analysis of Working Capital

It is an effective management tool to study how funds have been produced for a business and how they have been employed. This technique helps to analyze change in working capital components between two data. The comparison of current asset and current liability at the beginning and at the end of specific period show changes in such type of current assets and resources from which Working Capital has been obtained funds flow statement contributes materially to the financial aspects.

Babasabpatilfreepptmba.com

Page - 79

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

III. Working Capital Budget

The working capital budget is an important phase of overall financing budgeting. This budgeting should be distinguished from a cash budget that is designed to measure all the financial repayment of loans, term loan and similar item. On the other hand working capital repayment and assure that they are duly provided for. The objective of that budget is to secure an effective utility of investment.

Note: we have used the ratio analysis in this project in order to substantiate the managing of working capital. For this, we used some of the ratios to get the required output.

Various working capital ratios used by me are as follows:

Liquidity ratios Turnover/activity ratios

Babasabpatilfreepptmba.com

Page - 80

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

LIQUIDITY RATIOS

The liquidity ratios measure the firms ability to meet its short-term (less than one year) obligations as and when they become due. Liquidity ratios establish a relationship between cash and other current assets to provide a measure of then liquidity of the organization. The corporate liquidity has two dimensions namely, quantitative and qualitative concepts. The quantitative concept includes the quantum, structure and utilizations of liquid assets and in qualitative concepts, it is the ability to meet all present and potential demands on cash from any source in manner that minimizes cost and maximize the value of the form. Thus corporate liquidity is vital facto in business excess liquidity, through a generator of solvency would reflect lower profitability, deteriorations in managerial efficiency increased speculation and unjustified expansion, extension of too liberal credit and dividend policies. Too little liquidity then may lead to frustrations of business objections, reduced rate of return, business opportunity missed and weakening of morale. The important ratios to measure the liquidity of a firm are:

A) B)

Current Ratio Quick/Acid Test Ratio

Babasabpatilfreepptmba.com

Page - 81

WORKING CAPITAL MANAGEMENT NIRANI SUGARS LTD.

1) CURRENT ASSETS TO TOTAL ASSETS RATIO

= Current Assets / Total Assets Year 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 Current assets 208232 221599 200370 106758 135060 Total asset 1006289 887919 376591 264602 723385 Ratio 0.2069 0.2496 0.5320 0.4034 0.1867

current asset to total asset ratio

0.6 0.5 0.4 ratio 0.3 0.2 0.1 0 2003-2004 2004-2005 2005-2006 year 2006-2007 2007-2008 0.2069 0.2496 0.1867 Ratio 0.532 0.4034