Professional Documents

Culture Documents

ECGA 6510 Problem Set 6 Solutions - Tariff Analysis

Uploaded by

Samuel WongOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECGA 6510 Problem Set 6 Solutions - Tariff Analysis

Uploaded by

Samuel WongCopyright:

Available Formats

ECGA 6510 INTERNATIONAL TRADE

BAYBARS KARACAOVALI

PROBLEM SET 6 SOLUTIONS: TARIFF ANALYSIS

1) The import demand equation, M, is found by subtracting the home supply equation from the home demand equation. This results in Q = 80 40P [M = D S => Q = 100 20P (20 + 20P) = 100 20P 20 20P = 80 40P]. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is 2 (80 40P = 0 => 80 = 40P => P = 80/40 = 2). Alternatively, one can equate Homes demand and supply equations and then solve for P which would again provide the autarky price level (100 20P = 20 + 20P => 80 = 40P => P = 2.) 2) a) Foreign's export supply curve, X*, is Q = 40P 40 which is obtained by subtracting the foreign demand equation from the foreign supply equation, S* D* [X*= S* D* => Q = 40 + 20P (80 20P) = 40 + 20P 80 + 20P = 40P 40]. In the absence of trade, the price is 1. (X*= 0 => 40P 40 = 0 => 40P = 40 => P = 40/40 = 1 OR D*=S* => 80 20P = 40 + 20P => 40 = 40P => P = 40/40 = 1.) b) When trade occurs, export supply is equal to import demand, X*= M. Thus, using the equations from problems (1) and (2a), P = 1.50 (X* = M => 40P 40 = 80 40P => 80P = 120 => P = 120/80 = 1.5), and the volume of trade is 20 [plug P = 1.5 in either of X* or M equations => X* = M => Q = 40(1.5) 40 = 80 40(1.5) =20.] 3) a) The new X* curve is X*' with Q = 40(P t) 40 (it shifts horizontally to the left by $t since we measure the export supply with Q), where t is the specific tariff rate, equal to 0.5 (Intuition: The foreign producers now receive (P t) for each unit that they sell, because they have to pay $t to the home government which needs to be deducted from the sale price P.) Thus, the equation for X*' is Q = 40(P 0.5) 40 = 40P 20 40 = 40P 60. The equation for the import demand curve by the home country is unchanged. Solving, we find that the price paid by home consumers is $1.75 (X*' = M => 40P 60 = 80 40P => 80P = 140 => P = 140/80 = 1.75), and the price received by the exporter (foreign country) is equal to $1.25. [NOTE: Foreign price after tariff= PT* = PT t = 1.75 + 0.5 = $1.25.] The volume of trade has been reduced to 10 [X*' = M => Q = 40(1.75) 60 = 80 40(1.75) = 10], and the total demand for wheat at home has fallen to 65 (from the free trade level of 70) [D(PT) => Q = 100 20(1.75) = 65]. The total demand for wheat in Foreign has gone up from 50 to 55 [ D*(PT*) => Q = 80 20(1.25) = 55]. {Alternative Solution: Alternatively, interpreting the shift in X* curve to X*' as a vertical shift by $t, we can start out by re-writing the equation for X* curve in terms of Q instead of P, i.e. Q = 40P 40 => 40P = Q + 40 => P = (1/40)Q + 1. Then, the equation for X*' is P = (1/40)Q + 1 + t. Re-writing M (which is unchanged) in terms of Q as well: Q = 80 40P => 40P = 80 Q => P = 2 (1/40)Q. Now, using X*' = M, (1/40)Q + 1 + t = 2 (1/40)Q => (1/20)Q = 1 t => Q = 20 20t = 20 20(0.5) = 10. Plugging this in M => P = 2 (1/40)10 = $1.75 = PT, hence PT* = PT t = 1.75 + 0.5 = $1.25.} b), c) The welfare of the home country is best studied using the combined numerical and graphical solutions presented below.

1/3

ECGA 6510 INTERNATIONAL TRADE

BAYBARS KARACAOVALI

Price

Home Supply

PT=1.75 PW=1.50 PT*=1.25

c e

Home Demand

50

55

65

70

Quantity

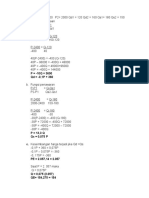

Figure 1 where the areas in the figure are: a: 55(1.75-1.50) -.5(55-50)(1.75-1.50)=13.125 b: .5(55-50)(1.75-1.50)=0.625 c: (65-55)(1.75-1.50)=2.50 d: .5(70-65)(1.75-1.50)=0.625 e: (65-55)(1.50-1.25)=2.50 Consumer surplus change: -(a+b+c+d)=-16.875. Producer surplus change: a=13.125. Government revenue (tariff revenue) change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. Figure 2

d)

X*`=X*+t X*

b+d

PT=$1.75 PW=$1.50 PT*=$1.25

c e

M 10 20

2/3

ECGA 6510 INTERNATIONAL TRADE

BAYBARS KARACAOVALI

where we have used the same notation to refer to the regions that are of identical size in figures 1 and 2. Net Surplus = -b-c-d, Government Revenue = +c+e, Total Welfare=-b-d+e 4) If a good is imported into (small) country H from country F, then the imposition of a tariff for this good in country H increases the price of this good in H by the exact amount of the tariff but does not affect the price of this good in F. 5) Price of computers after tariff becomes, PT = $500 + $500 (0.10) = $550. The value added for the computer industry at world prices is, VW = $500 $100 = $400 and the value added after the tariff is, VT = $550 $100 = $450. Thus, the effective rate of protection for the domestic computer sector is, = 0.2, 1 = 0.15, 2 = 0.1, p=$800 => a1 = (300/800) = 0.375, a2 = (200/800) = 0.25=> ai i 0.2 (0.375)(0.15) (0.25)(0.1) 0.11875 0.32 ERP 1 1 0.375 0.25 0.375 ai 6) a) With free trade and no tariffs, the quantity of Widgets imported is 110 10 = 100. b) With a specific tariff of $3 per unit, the quantity of Widget imports is 80 40 = 40 c) In the absence of international trade (i.e. under autarky), The countrys consumer plus (CS): (148)(60)(1/2) = 180 The producer surplus (PS): (82)(60)(1/2) = 180 d) After the $3 specific tariff The change in consumer surplus: [After=(146)(80)(1/2)=320][Before=(143)(110)(1/2)=320]=320605=-285 The change in producer surplus: [After=(62)(40)(1/2)=][Before=(32)(10)(1/2)]=805=75 The change in government revenue: [After=(63)(8040)=][Before=0]= 1200=120 The change in total welfare: -285+75+120=-90 e) The lowest specific tariff which would be considered prohibitive is $5 (that increases the price to autarky levels). 7) a) i) Figure 8-5 (Salvatore, 2007), ii) Figure 8-6 (Salvatore, 2007) c) i) Welfare unambiguously reduced. ii) Depending on the magnitude of the terms of trade gain versus the deadweight loss from consumption and production distortions, the welfare may improve or deteriorate.

3/3

You might also like

- CH8 EconomicsDocument5 pagesCH8 EconomicslonlinnessNo ratings yet

- Practice: 1. Suppose There Is A Perfectly Competitive Industry Where All The Firms AreDocument10 pagesPractice: 1. Suppose There Is A Perfectly Competitive Industry Where All The Firms Aremaddie isnt realNo ratings yet

- Assignment 3Document8 pagesAssignment 3Tajinder singh UppalNo ratings yet

- Econ 181: Int'l Trade Homework SolutionsDocument9 pagesEcon 181: Int'l Trade Homework Solutionschoiinho1050% (2)

- 10 MEP PracticeNumericalsDocument18 pages10 MEP PracticeNumericalsDevansh JainNo ratings yet

- SolutionsDocument12 pagesSolutionsartikanwarNo ratings yet

- College Mathematics Assignment 1Document9 pagesCollege Mathematics Assignment 1abdulbasit100% (1)

- Government subsidy policy comparison for agricultural commodityDocument4 pagesGovernment subsidy policy comparison for agricultural commoditySampad BiswasNo ratings yet

- MBA 500 Managerial Economics-AssignmentDocument23 pagesMBA 500 Managerial Economics-AssignmentHarris LuiNo ratings yet

- Microeconomics Assignment 3Document6 pagesMicroeconomics Assignment 3Mai Nữ Song NgânNo ratings yet

- Exercise Final SolutionsDocument7 pagesExercise Final SolutionsashutoshNo ratings yet

- AE4 Activity 7 Break Even Analysis SolutionDocument5 pagesAE4 Activity 7 Break Even Analysis SolutionMaricar PinedaNo ratings yet

- EC260 Assignment 2Document11 pagesEC260 Assignment 2mitty101sanNo ratings yet

- Vudee Blanket Market AnalysisDocument5 pagesVudee Blanket Market Analysisrevocatus barakaNo ratings yet

- Market equilibrium point for wholesaler and retailersDocument11 pagesMarket equilibrium point for wholesaler and retailersMuhammad TalalNo ratings yet

- SMB Assignment 01 PDFDocument15 pagesSMB Assignment 01 PDFSadia YasmeenNo ratings yet

- Eco Assignment - 1234567 - UpdatedDocument14 pagesEco Assignment - 1234567 - UpdatedpriyanshiNo ratings yet

- Microeconomics and Macroeconomics Exam QuestionsDocument26 pagesMicroeconomics and Macroeconomics Exam QuestionsAnirbit GhoshNo ratings yet

- Notes 14EDocument4 pagesNotes 14EJerich Ivan PaalisboNo ratings yet

- w7 L1 ConsumerProducerSurplus HandoutDocument2 pagesw7 L1 ConsumerProducerSurplus HandoutmarclsilverNo ratings yet

- The Monopolist Will Produce 180 Units. Its PS Is - Its Profit Will Be orDocument5 pagesThe Monopolist Will Produce 180 Units. Its PS Is - Its Profit Will Be orbibby88888888No ratings yet

- Managerial Economics Assignment Biruk TesfaDocument13 pagesManagerial Economics Assignment Biruk TesfaBirukee ManNo ratings yet

- bài tập ôn giữa kìDocument6 pagesbài tập ôn giữa kìNguyễn Mạnh NguyênNo ratings yet

- Final Exam Reminder: Deadline and DetailsDocument6 pagesFinal Exam Reminder: Deadline and DetailsBri MinNo ratings yet

- Topic 2:: Linear Economic Models (I) Market Equilibrium (Ii) Market Equilibrium + Excise TaxDocument16 pagesTopic 2:: Linear Economic Models (I) Market Equilibrium (Ii) Market Equilibrium + Excise TaxEmma PittmanNo ratings yet

- bài tập ôn giữa kìDocument6 pagesbài tập ôn giữa kìDiễm Hằng Nguyễn Thị100% (2)

- Assignment 1 SolutionDocument6 pagesAssignment 1 Solutionbilly0% (1)

- Optimal inventory order sizes and profits for four sweater stylesDocument7 pagesOptimal inventory order sizes and profits for four sweater stylesJyothi VenuNo ratings yet

- Monopolist profit maximizationDocument8 pagesMonopolist profit maximizationTôn Nữ Mỹ Duyên100% (1)

- Production Exercise 1Document8 pagesProduction Exercise 1Nasir Hussain100% (3)

- CVP BEP Analysis. Assignments, (In Class) : RequiredDocument3 pagesCVP BEP Analysis. Assignments, (In Class) : Requiredmuhammed shadNo ratings yet

- EC370 Intermediate Microeconomics SolutionsDocument8 pagesEC370 Intermediate Microeconomics SolutionsHamed KhazaeeNo ratings yet

- Lect 7 31102023 124920pmDocument21 pagesLect 7 31102023 124920pmmaliznahsyedNo ratings yet

- Econ 11 Final Exam Solutions: 1 Problem 1Document18 pagesEcon 11 Final Exam Solutions: 1 Problem 1Juan MadrigalNo ratings yet

- Practice Questions 5-KeyDocument5 pagesPractice Questions 5-KeyreemshadwaNo ratings yet

- (Document) Math Written Report Application of DerivatesDocument9 pages(Document) Math Written Report Application of DerivatespanganibanbeaNo ratings yet

- Pricing and Revenue Management Solutions in Supply ChainsDocument5 pagesPricing and Revenue Management Solutions in Supply ChainsTainá MeloNo ratings yet

- Tutorial 8 SolutionDocument8 pagesTutorial 8 Solutionfinance.assistantNo ratings yet

- GDP at factor cost, national income and componentsDocument7 pagesGDP at factor cost, national income and componentsSomasish GhoshNo ratings yet

- Elasticity and Demand ExerciseDocument10 pagesElasticity and Demand ExerciseOmar Faruk 2235292660No ratings yet

- Soal Cramers Rule Dan JawabanDocument6 pagesSoal Cramers Rule Dan JawabantwjayaNo ratings yet

- Some Problems On Quantitative Techniques in BusinessDocument16 pagesSome Problems On Quantitative Techniques in BusinessChao khanNo ratings yet

- IEOR 3402 Assignment 5 SolutionsDocument5 pagesIEOR 3402 Assignment 5 SolutionsSrikar VaradarajNo ratings yet

- Problem 1Document57 pagesProblem 1rockleeNo ratings yet

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseAurik IshNo ratings yet

- Mathematical ProblemsDocument7 pagesMathematical ProblemsMadhav LamichhaneNo ratings yet

- Lesson 7: Simplex Method CTND.: Unit 1Document10 pagesLesson 7: Simplex Method CTND.: Unit 1Abhinav ChhabraNo ratings yet

- Sample Exam SolutionsDocument7 pagesSample Exam SolutionsrichardNo ratings yet

- Chapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EDocument5 pagesChapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EKalyan SaikiaNo ratings yet

- Measurement of Elasticity of DemandDocument7 pagesMeasurement of Elasticity of DemandaquaacNo ratings yet

- Chapter 16 Answers To ExercisesDocument6 pagesChapter 16 Answers To ExerciseschrblsmsNo ratings yet

- Worksheet On Derivatives Elasticity and Optimisation Solutions (AutoRecovered)Document8 pagesWorksheet On Derivatives Elasticity and Optimisation Solutions (AutoRecovered)medhaNo ratings yet

- Important Facts and FormulaeDocument9 pagesImportant Facts and FormulaeWilliam WatersNo ratings yet

- Practice Question - CompetitionansDocument9 pagesPractice Question - Competitionansanwesh pradhanNo ratings yet

- Microeconomics - Midterm ExamDocument4 pagesMicroeconomics - Midterm ExamChattip KorawiyothinNo ratings yet

- Calculus Group5Document27 pagesCalculus Group5VictoriaReyes_No ratings yet

- Ekonomi Manajerial Chapter 14Document9 pagesEkonomi Manajerial Chapter 14vxspidyNo ratings yet

- TUgas 2Document4 pagesTUgas 2Qurrotul A'yunNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Quiz 5 W Answers 2004Document2 pagesQuiz 5 W Answers 2004Ngoc Anh TranNo ratings yet

- World: Barley - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Barley - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- What Is Export Management?Document2 pagesWhat Is Export Management?subbu2raj3372No ratings yet

- International Trade and Public PolicyDocument3 pagesInternational Trade and Public PolicyCat Valentine100% (1)

- Study on Promoting Olive Oil and Table Olives in ChinaDocument244 pagesStudy on Promoting Olive Oil and Table Olives in Chinareader1453No ratings yet

- Trade Questions 2059Document22 pagesTrade Questions 2059Omar Abid100% (3)

- Q.No. Question Options AnswerDocument23 pagesQ.No. Question Options Answerakshaykohli7890No ratings yet

- International Trade TheoryDocument35 pagesInternational Trade TheorySachin MalhotraNo ratings yet

- Pharma ReportDocument14 pagesPharma ReportZarian HanifNo ratings yet

- Open Economic BalanceDocument35 pagesOpen Economic BalanceNamira Sofwatul Farokhi100% (1)

- Sarkar-Singer Hypothesis AssessmentDocument8 pagesSarkar-Singer Hypothesis AssessmentArjun Garg100% (1)

- Export Credit and Guarantee CorporationDocument8 pagesExport Credit and Guarantee CorporationIndrajitNo ratings yet

- Granite Industry of Rajasthan, India - LitosonlineDocument3 pagesGranite Industry of Rajasthan, India - LitosonlineNikhil ToshniwalNo ratings yet

- Export Procedure and DocumentationDocument18 pagesExport Procedure and DocumentationElegant EmeraldNo ratings yet

- ch1 CarbaughDocument16 pagesch1 Carbaughmclennard78No ratings yet

- Sales ProcessesDocument16 pagesSales ProcessespraveerNo ratings yet

- Export Company Profile PDFDocument2 pagesExport Company Profile PDFMelissa0% (2)

- Oligopoly in Oil Refinery IndustryDocument5 pagesOligopoly in Oil Refinery IndustryDokania Anish100% (2)

- India's Import-Export Policy: A Brief History and OverviewDocument13 pagesIndia's Import-Export Policy: A Brief History and OverviewMir AqibNo ratings yet

- Trade Finance: GuideDocument36 pagesTrade Finance: Guidesujitranair100% (1)

- Comprehensive logistics solutions under one roofDocument20 pagesComprehensive logistics solutions under one roofpriyanka freyaNo ratings yet

- Marble IndustryDocument17 pagesMarble IndustryValeed ChNo ratings yet

- A Review of Steel Production and Consumption in South American Countries, Other Than BrazilDocument29 pagesA Review of Steel Production and Consumption in South American Countries, Other Than BrazilJorge MadiasNo ratings yet

- Role Played by MNCs in Facilitating Free Trade and Reducing Trade Barriers Among CountriesDocument10 pagesRole Played by MNCs in Facilitating Free Trade and Reducing Trade Barriers Among CountrieshareshNo ratings yet

- EDocument470 pagesETarek SetifienNo ratings yet

- Currency Devaluation and Economic Growth in EthiopiaDocument26 pagesCurrency Devaluation and Economic Growth in EthiopiaAdnanAhmadNo ratings yet

- Appointment of Overseas Agents and Remittance of Commission-1Document26 pagesAppointment of Overseas Agents and Remittance of Commission-1AKARSH JAISWALNo ratings yet

- Docs For Claiming Exp AssistanceDocument5 pagesDocs For Claiming Exp Assistancejuzerali007No ratings yet

- Gems and Jewelry Sector in IndiaDocument18 pagesGems and Jewelry Sector in IndiaMurali_Dhar_1824No ratings yet

- IndexDocument14 pagesIndexVijayKumar NishadNo ratings yet