Professional Documents

Culture Documents

Sections of NI Act

Uploaded by

Ketan MahajanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sections of NI Act

Uploaded by

Ketan MahajanCopyright:

Available Formats

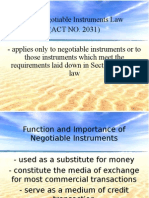

NEGOTIABLE INSTRUMENTS ACT- 1881

SECTION-4: "Promissory note

A " promissory note" is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument. A signs instruments in the following terms (a) "I promise to pay B or order Rs. 500." (b) " I acknowledge myself to be indebted to B in Rs. 1,000 to be paid on demand, for value received." (c) Mr. B, O U Rs. 1,000." (d) I promise to pay B Rs. 500 and all other sums which shall be due to him." (e) I promise to pay B Rs. 500, first deducting thereout any money which he may owe me." (f) " I promise to pay B Rs. 500 seven days after my marriage with C." (g) " I promise to pay B Rs. 500 on D's death, provided D leaves me enough to pay that sum." (h) " I promise to pay B Rs. 500 and to deliver to him my black horse on 1st January next."

The instruments respectively marked (a) and (b) are promissory notes. The instruments respectively marked (c), (d), (e), (f), (g) and (h) are not promissory notes.

SECTION-5: "Bill of exchange"

A "bill of exchange" is an instrument in writing, containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument. A promise or order to pay is not " conditional ", within the meaning of this section and section 4, by reason of the time for payment of the amount or any installment thereof being expressed to be on ,the lapse of a certain period after the occurrence of a specified event which, according to the ordinary

expectation of mankind, is certain to happen, although the time of its happening may be uncertain. The sum payable may be "certain", within the meaning of this section and section 4, although it includes future interest or is payable at an indicated rate of exchange, or is according to the course of exchange, and although the instrument provides that, on default of payment of an installment, the balance unpaid shall become due. The person to whom it is clear that the direction is given or that payment is to be made may be a "certain I person", within the meaning of this section and section 4, although he is misnamed or designated by description only.

SECTION-6: "Cheque"

A "cheque" is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.

SECTION-10: "Payment in due course"

"Payment in due course" means payment in accordance with the apparent tenor of the instrument in good faith and without negligence to any person in possession thereof under circumstances which do not afford a reasonable ground for believing that he is not entitled to receive payment of the amount therein mentioned.

SECTION-31: Liability of drawee of cheque

The drawee of a cheque having sufficient funds of the drawer in his hands properly applicable to the payment of such cheque must pay the cheque when duly required so to do, and, in. default of such payment, must compensate the drawer for any loss or damage caused by such default.

SECTION-85: Cheque payable to order

Where a cheque payable to order purports to be endorsed by or on behalf of the payee, the drawee is discharged by payment in due course.

SECTION-89: Payment of instrument on which alteration is not apparent

Where a promissory note, bill of exchange or cheque has been materially altered but does not appear to have been so altered, or where a cheque is presented for payment which does not at the time of presentation appear to be crossed or to have had a crossing which has been obliterated, payment thereof by a person or banker liable to pay, and paying the same according to the apparent tenor thereof at the time of payment and otherwise in due course, shall discharge such person or banker from all liability thereon ; and such payment shall not be questioned by reason of the instrument having been altered or the cheque crossed.

SECTION-126: Payment of cheque crossed generally

Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker.

Payment of cheque crossed specially:

Where a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed, or his agent for collection.

SECTION-131: Non-liability of banker receiving payment of cheque

A banker who has in good faith and without negligence received payment for a customer of a cheque crossed generally or specially to himself shall not, in case the title to the cheque proves defective, incur any liability to, the true owner of the cheque by reason only of having received such payment.

SECTION-138: Dishonour of cheque for insufficiency, etc.. of funds in the account

Where any cheque drawn by a person on an account maintained by him with a banker for payment of any amount of money to another person from out of that account for the discharge, in whole or in part, of any debt or other liability, is returned by the bank unpaid either because of the amount of money standing to the credit of that account is insufficient to honour the cheque or that it exceeds the amount arranged to be paid from that account by an agreement made with that bank, such person shall be deemed to have committed an offence and shall, without prejudice to any other provision of

this Act, be punished with imprisonment for a term which may extend to one year, or with fine which may extend to twice the amount of the cheque, or with both: Provided that nothing contained in this section shall apply unless(a) The cheque has been, presented to the bank within a period of three months from the date on which it is drawn or within the period of its validity, whichever is earlier; (b) The payee or the holder in due course of the cheque as the case may be, makes a demand for the payment of the said amount of money by giving a notice, in writing, to the drawer of the cheque, within fifteen days of the receipt of information by him from the bank regarding the return of the cheque as unpaid; and (c) The drawer of such cheque fails to make the payment of the said amount of money to the payee or, as the case may be, to the holder in due course of the cheque, within fifteen days of the receipt of the said notice.

You might also like

- Illustrations: - "Promissory Note".-A "Promissory Note" Is An Instrument in Writing (Not Being ADocument3 pagesIllustrations: - "Promissory Note".-A "Promissory Note" Is An Instrument in Writing (Not Being ADeep ChatterjeeNo ratings yet

- 3-Vol-V-NI-BR-IT Acts-Page Nos-1-34Document34 pages3-Vol-V-NI-BR-IT Acts-Page Nos-1-34pashamharikareddyNo ratings yet

- Negotiable Instrument: Prama MukhopadhyayDocument44 pagesNegotiable Instrument: Prama MukhopadhyayManjeev Singh SahniNo ratings yet

- Batas Pambansa Blg. 22Document2 pagesBatas Pambansa Blg. 22Ben SantosNo ratings yet

- Batas Batas Batas BatasDocument3 pagesBatas Batas Batas BatasLeah MarshallNo ratings yet

- Collecting BankerDocument15 pagesCollecting Bankeranusaya1988100% (2)

- Batas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesDocument2 pagesBatas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesApril CaringalNo ratings yet

- Batas Pambansa Bilang 22Document3 pagesBatas Pambansa Bilang 22Crisanto King CortezNo ratings yet

- BP 22 penalizes bad checksDocument1 pageBP 22 penalizes bad checksJass ElardoNo ratings yet

- Batas Pambansa Blg. 22-Check and Bouncing LawDocument2 pagesBatas Pambansa Blg. 22-Check and Bouncing LawRocky MarcianoNo ratings yet

- The Negotiable InstrumentsDocument11 pagesThe Negotiable InstrumentsabdurrajakNo ratings yet

- BP 22 Bouncing Check LawDocument1 pageBP 22 Bouncing Check LawJaneth NavalesNo ratings yet

- Negotiable Instruments Act 1881Document43 pagesNegotiable Instruments Act 1881Ahmad Bin AmjadNo ratings yet

- The Negotiable Instruments Act 1881Document42 pagesThe Negotiable Instruments Act 1881amuandrabiNo ratings yet

- Funds. - The Making, Drawing and Issuance of A CheckDocument1 pageFunds. - The Making, Drawing and Issuance of A CheckChrisel Joy Casuga SorianoNo ratings yet

- NI ActDocument20 pagesNI ActshapnokoliNo ratings yet

- Nego SylabusDocument44 pagesNego SylabusRose Mae GullaNo ratings yet

- Interpretation of Banker and Promissory NoteDocument4 pagesInterpretation of Banker and Promissory Noteaditya pariharNo ratings yet

- Collecting BankerDocument16 pagesCollecting Bankeranusaya1988No ratings yet

- Dishonour of ChequesDocument15 pagesDishonour of Chequesabose06No ratings yet

- Banking Law Assignment on Dishonor of ChequeDocument26 pagesBanking Law Assignment on Dishonor of Chequemahendra pawarNo ratings yet

- BP Blg. 22 (Bouncing Checks Law)Document2 pagesBP Blg. 22 (Bouncing Checks Law)Kirk BejasaNo ratings yet

- Law On Negotiable Instruments Sections 1-10Document3 pagesLaw On Negotiable Instruments Sections 1-10Santi ArroyoNo ratings yet

- Negotiable Instrument Act & Money Laundering Prevention Act in BriefDocument15 pagesNegotiable Instrument Act & Money Laundering Prevention Act in Briefapi-3844412No ratings yet

- NegotiableDocument1 pageNegotiableTawhidul IslamNo ratings yet

- Additional Law For Negotiable Instruments: Checks Without Sufficient FundsDocument2 pagesAdditional Law For Negotiable Instruments: Checks Without Sufficient FundsJEP WalwalNo ratings yet

- B.P. 22 PDFDocument2 pagesB.P. 22 PDFJester LimNo ratings yet

- Dishonour of ChequeDocument26 pagesDishonour of ChequeAnkit Tiwari0% (1)

- The Negotiable Instruments LawDocument5 pagesThe Negotiable Instruments LawEmman RiveraNo ratings yet

- The Negotiable Instruments Law IDocument6 pagesThe Negotiable Instruments Law IMarcial Gerald Suarez IIINo ratings yet

- Promissory and bills explainedDocument9 pagesPromissory and bills explainedHusain Daud AbidiNo ratings yet

- Assignment No. 2 PGB-20-078Document3 pagesAssignment No. 2 PGB-20-078kishan kanojiaNo ratings yet

- Dishonour of ChequeDocument22 pagesDishonour of ChequeD PNo ratings yet

- Batas Pambansa Blg. 22Document2 pagesBatas Pambansa Blg. 22Avianne VillanuevaNo ratings yet

- BP22-BouncingChecksLawDocument13 pagesBP22-BouncingChecksLawMary Jean C. BorjaNo ratings yet

- Cheques in Negotiable InstrumentsDocument7 pagesCheques in Negotiable InstrumentsAkello Winnie princesNo ratings yet

- Negotiable Instruments ActDocument34 pagesNegotiable Instruments Actx2No ratings yet

- The Negotiable Instruments LawDocument3 pagesThe Negotiable Instruments LawMheryza De Castro PabustanNo ratings yet

- Rules for negotiability of promissory notesDocument2 pagesRules for negotiability of promissory notesRae SlaughterNo ratings yet

- The Negotiable Instruments Law: I. Form and InterpretationDocument4 pagesThe Negotiable Instruments Law: I. Form and InterpretationJoanna AbañoNo ratings yet

- Meaning of Negotiable InstrumentsDocument13 pagesMeaning of Negotiable InstrumentsTaisir MahmudNo ratings yet

- Act No. 2031 The Negotiable Instruments LawDocument1 pageAct No. 2031 The Negotiable Instruments LawxxhoneyxxNo ratings yet

- Batas Pambansa BLG 22Document1 pageBatas Pambansa BLG 22Diazmean SoteloNo ratings yet

- Cheque Paying and Collecting BankDocument5 pagesCheque Paying and Collecting BankSyed RedwanNo ratings yet

- Liability of Collecting and Paying BankersDocument9 pagesLiability of Collecting and Paying BankersVijayNo ratings yet

- Types of negotiable instruments and their key featuresDocument24 pagesTypes of negotiable instruments and their key featuresvmalleshNo ratings yet

- Requisites of NegotiabilityDocument5 pagesRequisites of NegotiabilityRikki Joy C MagcuhaNo ratings yet

- Law On Negotiable Instruments: Colegio San Agustin - BacolodDocument15 pagesLaw On Negotiable Instruments: Colegio San Agustin - BacolodGabriel SincoNo ratings yet

- BP 22 and .... Paper 1Document4 pagesBP 22 and .... Paper 1James LouieNo ratings yet

- Final Topic 3Document2 pagesFinal Topic 3Vince Diza SaguidNo ratings yet

- The Negotiable Instruments Law in a NutshellDocument78 pagesThe Negotiable Instruments Law in a NutshelljaneNo ratings yet

- Bouncing Checks Law vs EstafaDocument4 pagesBouncing Checks Law vs EstafaLee Sung YoungNo ratings yet

- Negotiable Instruments Act Sections ExplainedDocument22 pagesNegotiable Instruments Act Sections ExplainedAggy Albotra100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- General Solicitation under New Rule 506: Crowd Funding on SteroidsFrom EverandGeneral Solicitation under New Rule 506: Crowd Funding on SteroidsRating: 5 out of 5 stars5/5 (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Comments on the SEC's Proposed Rules for Regulation CrowdfundingFrom EverandComments on the SEC's Proposed Rules for Regulation CrowdfundingNo ratings yet

- Disbursement Voucher: Provincial Government of CagayanDocument1 pageDisbursement Voucher: Provincial Government of CagayanJaleann EspañolNo ratings yet

- Va Ben StandardsDocument4 pagesVa Ben StandardsNinja2danNo ratings yet

- Income from Business and Profession Section 28,29&30Document14 pagesIncome from Business and Profession Section 28,29&30imdadul haqueNo ratings yet

- Gel Form 3ca-3cdDocument11 pagesGel Form 3ca-3cdravibhartia1978No ratings yet

- ACHQ ECheckPaymentAPI Merchants v2.0.1Document19 pagesACHQ ECheckPaymentAPI Merchants v2.0.1Urbano BallesterosNo ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- Terms and Conditions MyGate RentPayDocument5 pagesTerms and Conditions MyGate RentPaySwathiNo ratings yet

- Porters 5 Forces-e-Wallet Industry (India) & Impact On Reliance JioDocument6 pagesPorters 5 Forces-e-Wallet Industry (India) & Impact On Reliance Jiosaq66No ratings yet

- Ebook ManagementDocument33 pagesEbook ManagementBoova Ragavan80% (5)

- Focus Writing On Agent Banking in BangladeshDocument3 pagesFocus Writing On Agent Banking in BangladeshTonmoyNo ratings yet

- Delivery Boys PolicyDocument2 pagesDelivery Boys PolicyFlavours GuruNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningYogesh PawarNo ratings yet

- Pledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeDocument26 pagesPledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeAmie Jane MirandaNo ratings yet

- State Payment PlanDocument4 pagesState Payment PlanMary Grace Sastrillo MonicaNo ratings yet

- Postpaid Bill Anchal Jul 2022-1Document1 pagePostpaid Bill Anchal Jul 2022-1Mandhir BudhirajaNo ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)

- Manual en Individual PDFDocument34 pagesManual en Individual PDFJibu Hashim RaswiNo ratings yet

- Naf Is 2020 ReportDocument27 pagesNaf Is 2020 ReportSdrc IndiaNo ratings yet

- FAQs Online Payment of Stamp Duty and Registration FeesDocument4 pagesFAQs Online Payment of Stamp Duty and Registration FeesAryan KNo ratings yet

- MYOB Accounting GlossaryDocument14 pagesMYOB Accounting GlossarySyirleen Adlyna OthmanNo ratings yet

- Bis303 Mis q3 DoneDocument4 pagesBis303 Mis q3 DoneHf CreationNo ratings yet

- TENMET Financial PoliciesDocument48 pagesTENMET Financial PoliciesFrank AllanNo ratings yet

- How To Read Your MT4 Trading StatementDocument7 pagesHow To Read Your MT4 Trading StatementwanfaroukNo ratings yet

- Income Collection Deposit System With ConversionDocument6 pagesIncome Collection Deposit System With ConversionDane LavegaNo ratings yet

- Request For Proposal (RFP) : Implementation of Cloud Based Loan Management SystemDocument25 pagesRequest For Proposal (RFP) : Implementation of Cloud Based Loan Management Systemanubalan100% (1)

- BilldataDocument2 pagesBilldataNishantNo ratings yet

- Advertisement No 2462021 Assistant Engineer Civil 05514125Document12 pagesAdvertisement No 2462021 Assistant Engineer Civil 05514125Ashutosh PatelNo ratings yet

- TS19 HRBO Refund Transfer DocumentsDocument10 pagesTS19 HRBO Refund Transfer DocumentsChris brownNo ratings yet

- Complaint Affidavit of March T Noble VS Marilyn Florendo For BP 22Document11 pagesComplaint Affidavit of March T Noble VS Marilyn Florendo For BP 22Jaime GonzalesNo ratings yet

- Electricity Bill Receipt PDFDocument1 pageElectricity Bill Receipt PDFskh_1987No ratings yet