Professional Documents

Culture Documents

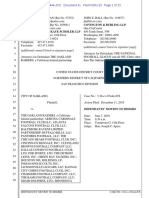

Joint Motion For Approval of Term Sheet and Authorization To Implement Certain Matters Set Forth Therein

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joint Motion For Approval of Term Sheet and Authorization To Implement Certain Matters Set Forth Therein

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

4838-9404-7505.

4

UNITED STATES BANKRUPTCY COURT

DISTRICT OF COLORADO

In re

CORDILLERA GOLF CLUB, LLC dba The

Club at Cordillera,

Tax ID / EIN: 27-0331317

Debtor.

Case No. 12-24882 ABC

Chapter 11

JOINT MOTION FOR APPROVAL OF TERM SHEET AND

AUTHORIZATION TO IMPLEMENT CERTAIN MATTERS SET FORTH

THEREIN

The Debtor and Debtor-in-Possession, Cordillera Golf Club, LLC, dba The Club at

Cordillera (the Debtor), and the Official Committee of Unsecured Creditors appointed in the

Bankruptcy Case (as defined herein) (Committee), by and through their undersigned counsel,

hereby respectfully submit this Joint Motion for Approval of Term Sheet and Authorization to

Implement Certain Matters Set Forth Therein ("Joint Motion"). The Debtor, the Committee,

Cordillera Golf Holdings, LLC, a Delaware limited liability company (CGH), Cordillera F &

B, LLC, a Delaware limited liability company, including any successor thereto (CFB), WFP

Cordillera, LLC, a Delaware limited liability company (WFP), WFP Investments, LLC, a

Delaware limited liability company (WFPI), CGH Manager, LLC, a Delaware limited liability

company (CGHM), David A. Wilhelm (Wilhelm), Patrick Wilhelm (P. Wilhelm),

Cordillera Transition Corporation, Inc., a Colorado not for profit corporation (CTC),

Cordillera Property Owners Association, Inc., a Colorado not for profit corporation (CPOA),

Cordillera Metropolitan District, a quasi-municipal corporation and political subdivision of the

State of Colorado (CMD), Cordillera Valley Club Property Owners Association, Inc., a

Colorado not for profit corporation (CVCPOA), Cheryl M. Foley, Thomas Wilner, Jane

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page1 of 29

4838-9404-7505.4

Wilner, Charles Jackson, Mary Jackson, Kevin B. Allen, as representatives of a certified class in

Case Number 11CV552, pending in the District Court of Eagle County, Colorado (collectively,

the Member Representatives) and Alpine Bank (Alpine) (collectively, all such parties, the

Approving Parties), have all executed a Term Sheet dated September 17, 2012, a copy of

which is attached hereto as Exhibit 1 and incorporated herein by reference (the Term Sheet),

providing for the settlement of various matters as provided therein and as more fully set forth

below. The Debtor, the Committee and the other Approving Parties respectfully request and

recommend the approval of the matters as set forth below.

///

///

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page2 of 29

4838-9404-7505.4

i

TABLE OF CONTENTS

Page

I. BACKGROUND................................................................................................................ 1

A. The Cordillera Club ................................................................................................ 1

B. The Membership Plan............................................................................................. 2

C. The Debtors Acquisition of the Cordillera Club ................................................... 2

D. Secured Debt Obligations ....................................................................................... 3

E. Tension With the Club Members............................................................................ 5

F. The Pending State Court Litigation ........................................................................ 5

a. CTC Lawsuit ........................................................................................... 5

b. Class Action Lawsuit............................................................................... 5

G. The Debtors Chapter 11 Filing.............................................................................. 6

a. The DIP Financing Motion...................................................................... 7

b. The Trustee Motion................................................................................. 9

II. JURISDICTION ................................................................................................................. 9

III. SETTLEMENTS............................................................................................................... 10

A. Summary of Term Sheet ....................................................................................... 10

a. The DIP Loan............................................................................................ 10

b. Partial Settlement of Class Action Lawsuit .............................................. 11

c. Settlement of CTC Lawsuit ...................................................................... 12

IV. RELIEF REQUESTED..................................................................................................... 19

V. BASIS FOR RELIEF........................................................................................................ 21

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page3 of 29

4838-9404-7505.4

ii

TABLE OF AUTHORITIES

Page

FEDERAL CASES

Kaiser Steel Corp. v. Frates (In re Kaiser Steel Corp.),

105 B.R. 971 (D.Colo.1989)....................................................................................................21

Stanpec Corp. v. Jelco, Inc.,

464 F.3d 1184 (10th Cir. 1972) ...............................................................................................21

FEDERAL STATUTES

11 U.S.C. 101................................................................................................................................7

11 U.S.C. 105................................................................................................................................7

11 U.S.C. 361................................................................................................................................7

11 U.S.C. 362................................................................................................................................7

11 U.S.C. 363(c) ...........................................................................................................................7

11 U.S.C. 364(c) ...........................................................................................................................7

11 U.S.C. 363(b) ........................................................................................................................16

11 U.S.C. 363(f).........................................................................................................................16

11 U.S.C. 364(d) ...........................................................................................................................7

11 U.S.C. 364(e) ...........................................................................................................................7

11 U.S.C. 365.............................................................................................................................14

11 U.S.C. 506(b) ...................................................................................................................15, 20

11 U.S.C. 1107(a) ........................................................................................................................7

11 U.S.C. 1108.............................................................................................................................7

28 U.S.C. 157................................................................................................................................9

28 U.S.C. 157(b)(2) ......................................................................................................................9

28 U.S.C. 1334..............................................................................................................................9

28 U.S.C. 1408..............................................................................................................................9

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page4 of 29

4838-9404-7505.4

iii

TABLE OF AUTHORITIES

(Continued)

Page

28 U.S.C. 1409..............................................................................................................................9

RULES

Fed. R. Bankr. P. 2002.....................................................................................................................7

Fed. R. Bankr. P. 4001.....................................................................................................................7

Fed. R. Bankr. P. 9014(I).................................................................................................................7

Fed. R. Bankr. P. 9019.........................................................................................................9, 21, 22

C.R.C.P. 26(a)(1) .....................................................................................................................14, 21

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page5 of 29

4838-9404-7505.4

1

I. BACKGROUND

A. The Cordillera Club

1. The Debtor is the owner and operator of a golf club (the Cordillera Club or

"Club") located in a community in Edwards, Colorado (Cordillera).

2. Initially conceived in the early 1990s, Cordillera today has burgeoned into a

sprawling development spanning approximately 7,000 acres. The Cordillera community is

governed by homeowners associations known as the CPOA and the CVCPOA. Cordillera is

comprised of four distinct residential neighborhoods known as the Divide, the Ranch, the

Summit and the Cordillera Valley Club, which collectively consist of approximately 1087

privately owned residential lots, over half of which are improved with high-end custom and

semi-custom single family homes.

3. The Cordillera Club lifestyle and experience are punctuated by private amenities

and facilities available to dues-paying members (collectively, Club Members) who join the

Cordillera Club. The Club Members are not equity owners in the Cordillera Club, the Debtor or

any of its property.

4. The Cordillera Club boasts of three signature golf courses, a Dave Pelz designed

short course, two tennis centers and fitness facilities, three indoor and outdoor pools, a summer

camp with Trailhead clubhouse for children, three restaurants, and Nordic ski trails along the

Mountain golf course (collectively, the Club Facilities).

5. Each property owner within the Cordillera community is a voting member of the

CPOA and CVCPOA and pays dues and assessments respectively. Ownership of property at

Cordillera with the concomitant membership in CPOA or CVCPOA does not include a right of

access to, or use of, the Club Facilities offered by the Cordillera Club.

6. The Debtor sells non-equity and non-voting memberships to the Cordillera Club

(the Club Memberships) by which its Club Members, if they are members in good standing,

may access and use the Club Facilities.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page6 of 29

4838-9404-7505.4

2

7. The primary source of revenue to fund the operations and management of the

extensive Club Facilities is derived from membership initiation fees and annual membership

dues. Other sources of revenue include transfer fees, golf fees, guest fees, pro shop revenue,

food and beverage revenues and operating department revenues.

B. The Membership Plan

8. Membership at the Cordillera Club is governed by the terms and conditions of the

Debtor's Club Membership plan (as amended or revised from time to time, the "Membership

Plan") and the particular membership classification selected by any individual. The primary

difference between the various Club Membership classifications is related to rights, benefits,

privileges, transferability, reissue priorities and financial obligations.

9. The Membership Plan provides for different rights, privileges and obligations

based upon designated categories of Club Memberships.

C. The Debtors Acquisition of the Cordillera Club

10. In June 2009, the Debtor acquired the Club Facilities.

11. Prior to June 2009, the Debtors current indirect equity owner, Wilhelm, owned

an approximate 30% interest in the entities owning the Club Facilities, but held no management

position with such entities. Following a forensic audit completed at Wilhelms request, Wilhelm

asserted that the prior owners and their then-current management none of whom are associated

in any way with the Debtor or its current management or ownership had allegedly diverted

substantial funds away from the Cordillera Clubs operations. This lead to arbitration

proceedings among Wilhelm (in his capacity as 30% owner) and the Cordillera Clubs owners

and then-current management team, which also owned the remaining 70% interest in the

Cordillera Club. As a result of that arbitration, entities formed by Wilhelm acquired a 100%

ownership interest in the Cordillera Club and the Club Facilities and anyone associated with the

Cordillera Clubs former owners and then-current managements mismanagement of the

Cordillera Club was relieved of their positions.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page7 of 29

4838-9404-7505.4

3

D. Secured Debt Obligations

12. Or about June 26, 2009, Alpine and the Debtor entered into that certain Business

Loan Agreement (the Loan Agreement), pursuant to which Alpine loaned to the Debtor the

original principal amount of $13,700,000 (the Alpine Loan).

13. The Alpine Loan is evidenced by a Promissory Note dated June 29, 2009 (the

Alpine Note). The Note matured on June 26, 2012. The Alpine Loan purports to be secured

pursuant to a Deed of Trust dated June 26, 2009 and recorded in Eagle County Records Office

on June 29, 2009 as Document No. 200912623 (the Alpine Deed of Trust).

14. As security for the Debtors obligations under the Alpine Note, the Alpine Deed

of Trust purports to encumber the real property described therein, including all or a portion of the

Facilities (the Real Property). The Alpine Deed of Trust also purports to encumber certain

personal property described therein, including all equipment, fixtures, and other articles of

personal property now or hereafter owned by Grantor, and now or hereafter attached or affixed to

the Real Property. . . . The Alpine Note also purports to be secured pursuant to: (i) a Collateral

Assignment of Contracts dated June 26, 2009 purporting to encumber certain water rights, and

related contracts as listed therein; (ii) a Collateral Assignment and Security Agreement Covering

Agreements, Permits and Contracts dated June 26, 2009, purporting to encumber the Collateral

as defined therein, including contracts, licenses, and other agreements as described therein; (iii) a

Collateral Assignment and Security Agreement Covering Golf Membership Revenues dated

June 26, 2009, purporting to encumber Net Sales Revenues and Income from Dues as

defined therein, including revenues from the sale of golf course memberships with respect to the

Courses and dues, assessments, fees or other charges on account of memberships in the Club;

(iv) a Commercial Pledge Agreement dated June 26, 2009 purporting to encumber all

memberships in the Club; and (v) a Commercial Security Agreement dated June 26, 2009

purporting to encumber furniture, fixtures, equipment, inventory, accounts receivable, general

intangibles, contracts and contract rights, permits, goods, instruments, investment property, letter

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page8 of 29

4838-9404-7505.4

4

of credit rights, chattel paper, commercial tort claims, and all proceeds from the disposition

thereof (all of the personal property purporting to be collateral for the Alpine Note, collectively,

the Personal Property). On June 30, 2009, Alpine filed a UCC Financing Statement with the

Delaware Secretary of State purporting to perfect its security interest in the Personal Property.

The documents executed in connection with the Alpine Loan are collectively referred to as the

Alpine Loan Documents. All collateral purported to secure the Alpine Note is collectively

referred to as the Alpine Collateral.

15. On or about June 23, 2010, Wilhelm made a loan to the Debtor in the original

principal amount of $6,500,000 (the Wilhelm Loan), evidenced by a Promissory Note dated

June 23, 2010 (as at any time amended or modified, the Wilhelm Note). The Wilhelm Note

purports to be secured by a Deed of Trust, Security Agreement, Assignment of Leases and Rents

and Fixture filing dated June 23, 2010, and recorded with the Eagle County Recorders Office on

August 12, 2010 as Document No. 20105834 (as at any time amended or modified, the Wilhelm

Deed of Trust), purportedly encumbering the Real Property and portions of the Personal

Property, as further described therein. The Wilhelm Note has purportedly been amended from

time to time evidencing additional loans made to the Debtor by Wilhelm, including without

limitation an amendment increasing the maximum principal amount of such note to $7,470,000.

The documents executed in connection with the Wilhelm Loan are collectively referred to as the

Wilhelm Loan Documents. All collateral purported to secure the Wilhelm Note is collectively

referred to as the Wilhelm Collateral. The purported Alpine Collateral and the purported

Wilhelm Collateral are collectively referred to as the Collateral, and Collateral which is

personal property is collectively referred to as the Personal Property Collateral.

16. The Debtors schedules reflect the amount of the Alpine Loan and the Wilhelm

Loan as approximately $12,763,617.00 million and $7,532,608.02 million, respectively.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page9 of 29

4838-9404-7505.4

5

E. Tension With the Club Members

17. Starting in August 2010, the Debtors and Wilhelms relationship with certain

Club Members became strained and many Members began to resign from the Club.

18. In May 2011, the Club advised the Club Members that as a result of financial

conditions, the Cordillera Club had no alternative but to open only one of the four club facilities

the Valley Club. Later in 2011, the decision was made to also open the Summit Course. The

Mountain Course and the Short Course were not opened in 2011 and neither were two

restaurants (including the main club restaurant), the Trailhead with its swimming pool, and the

Nordic trails.

F. The Pending State Court Litigation

19. The Debtor is a party to the following litigation matters pending in Colorado state

court.

a. CTC Lawsuit

20. On May 24, 2011, the Debtor filed a complaint (the CTC Complaint) in the

District Court for Eagle County, Colorado (the Eagle County Court) against the CPOA and the

CTC styled Cordillera Golf Club, LLC, et al. v. Cordillera Transition Corporation, Inc., et al.

assigned case number 2011 CV 456 (the CTC Lawsuit).

21. The CTC Complaint asserts seven causes of action for (1) Tortious Interference

with Contract; (2) Tortious Interference with Prospective Business Advantage; (3) Colorado

Organized Crime Control Act; (4) Fraud; (5) Fraud in the Inducement; (6) Civil

Conspiracy/Collusion; and (7) Defamation. The CTC defendants contended that they have

meritorious defenses to the CTC Complaint. A three week jury trial is set for April 1-19, 2013.

b. Class Action Lawsuit

22. On June 20, 2011, a lawsuit was filed against the Debtor and WFP, CGH, CFB,

WFPI, CGHM, CFB, Wilhelm, and P. Wilhelm for, among other things, (1) Breach of Contract,

(2) Promissory Estoppel, and (3) False Representation, alleging that management was required to

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page10 of 29

4838-9404-7505.4

6

open all facilities. The lawsuit was later amended to assert claims on behalf of the class and to

add additional claims for securities and consumer fraud violations and other causes of action.

This lawsuit is styled Foley v. Cordillera Golf Club LLC, 2011 CV 552, pending in Eagle

County Court (the Class Action Lawsuit). Plaintiffs in the Class Action Lawsuit seek return of

all 2011 Club Membership dues paid, their Club Membership deposits, avoidance of further

membership obligations, decline in home values, exemplary damages, etc. The Court has

certified this matter as a Class Action and has appointed the Member Representatives as the

Class Representatives. The Debtor and other defendants in the Class Action Lawsuit believe

they have multiple meritorious defenses to the claims in the Class Action Lawsuit. The Debtor

and other defendants in the Class Action Lawsuit have tendered their defense to their insurers.

Trial is scheduled for March 2013.

23. On June 24, 2011, the District Court entered a TRO in the Class Action Lawsuit

which provided, among other things: that defendants shall not use funds from 2011 annual dues

received from Club at Cordillera (Club) members for any purpose other than the necessary

maintenance and operation of the Clubs four golf courses and related facilities. The TRO was

extended multiple times and became a Preliminary Injunction, which has since expired.

24. On December 2, 2011, the Class Representatives filed a Verified Motion for

Issuance of Contempt Citation alleging seven (7) payments made from June 30, 2011 to

August 31, 2011, by CGC were in violation of the TRO (the Contempt Motion).

25. A hearing was scheduled to begin on the Contempt Motion on July 20, 2012,

which hearing was later continued to September 7, 2012. The Eagle County Court has not

scheduled further hearing.

G. The Debtors Chapter 11 Filing

26. Due to economic, industry and other circumstances, which the Debtor alleges

were beyond its control, Club Membership sales slowed. By mid-2012, it was clear that the

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page11 of 29

4838-9404-7505.4

7

Cordillera Club lacked the critical mass of Club Members necessary to maintain the high level of

services and operations at the Club Facilities.

27. These conditions were exacerbated by the mass resignations of Club Members.

The Debtor had attempted to work out a loan extension with Alpine, but Alpine did not agree to

extend the due date of the Debtors loan.

28. As a result of the foregoing, the Debtor determined that it would be unable to

make the payment due to Alpine by close of business on June 26, 2012.

29. In March 2012, the Debtor retained Daniel L. Fitchett, Jr. as its Chief Executive

Officer (CEO), and Mr. Fitchett has been running the day-to-day operations of the Debtor

since that date. The Debtor engaged Alfred Siegel as Chief Restructuring Officer (CRO) on

June 22, 2012 (which retention was subsequently approved by this Court). The Debtor, in

consultation with its management and professionals (including its CRO), retained the services of

an experienced real estate consultant and investment banker with significant experience in the

golf and hospitality industries, GA Keen Realty Advisors, LLC (Keen), (which retention was

subsequently approved by this Court).

30. On June 26, 2012 (the Petition Date), the Debtor filed a voluntary petition (the

Petition) for relief under chapter 11 of title 11 of the United States Code, 11 U.S.C. 101

et seq. (the Bankruptcy Code), in an effort to preserve and maximize the value of its chapter 11

estate. The Debtor has been operating its business and managing its properties as a debtor-in-

possession under sections 1107(a) and 1108 of the Bankruptcy Code since the Petition Date.

a. The DIP Financing Motion

31. On July 19, 2012, the Debtor filed its Emergency Motion for (A) Approval of

Interim Order Pursuant to 11 U.S.C. 105, 361, 362, 363(c), 364(c), 364(d), and 364(e) and

Fed. R. Bankr. P. 2002, 4001, and 9014 (I) Authorizing Debtor to Obtain Post-Petition Secured

Financing, (II) Granting Security Interests and Superpriority Administrative Expense Claims,

and (III) Authorizing the Use of Cash Collateral [Dkt. No. 200] (the Emergency DIP Motion).

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page12 of 29

4838-9404-7505.4

8

Through the Emergency DIP Motion, the Debtor sought approval of its interim debtor in

possession financing agreement (the Interim DIP Loan) with Alpine and use of cash collateral.

On July 27, 2012, the Court entered an Interim Order approving the Emergency DIP Motion

[Dkt. No. 270] (the Interim Order). Under the Interim Order, the Court authorized the Debtor

to use cash collateral and approved the DIP financing as provided therein through August 31,

2012. The Court also set a final hearing on the Emergency DIP Motion for August 27, 2012.

Subsequent to entry of the Interim Financing Order, the Debtor and Alpine worked diligently to

negotiate the terms of a final debtor in possession financing agreement. On August 22, 2012,

concerned regarding the impending expiration date of the Interim Order, the Debtor filed a

Motion to (A) Extend and Increase Interim Financing and (B) Extend Use of Cash Collateral

Under the Terms of the Prior Order (the Motion to Extend Interim Financing). On August 27,

2012, the Court entered an order granting the Motion to Extend Interim Financing, thereby

extending the Interim Order and approved an increase in the borrowing limit.

32. After much negotiation, the Debtor and Alpine reached agreement as to the terms

of a final debtor in possession post-petition financing arrangement. On August 30, 2012, the

Debtor filed its Motion for Final Order Approving Debtor-in-Possession Financing, Use of Cash

Collateral and Adequate Protection (the Final DIP Loan Motion) [Dkt. No. 402]. Wilhelm and

The Rush Family Trust consented to the relief requested, while the Committee advised the

Debtor and Alpine that the Committee intended to object to the Final DIP Loan Motion. The

Court set the hearing on the Final DIP Loan Motion for September 17, 2012. In light of the

settlement discussions, described below, Alpine agreed to a short extension of the Interim DIP

Loan (which extension was previously approved by the Court [Dkt. No. 457]), the Committee

consented to such extension, and the Court continued the hearing on the Final DIP Loan Motion

to September 27, 2012, at 3:00 p.m. Pursuant to the Term Sheet, the Final DIP Loan Motion was

modified by the agreement of the parties and the Court approved the Final DIP Loan Motion, as

modified by order entered on September 28, 2012 [Dkt. No. 495].

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page13 of 29

4838-9404-7505.4

9

b. The Trustee Motion

33. On July 24, 2012, the Member Representatives filed a Motion to Appoint a

Chapter 11 Trustee (the Trustee Motion). The Committee, the CPOA, the CMD and

approximately 600 individuals claiming to be members and/or former members of the Club filed

joinders to the Trustee Motion. The Debtor filed opposition to the Trustee Motion and Wilhelm

filed a joinder to the Debtors opposition.

34. The Court set the matter for trial to commence on October 1, 2012, and set an

abbreviated discovery schedule.

35. On September 12-13, 2012, a mediation, which included within its scope the Final

DIP Loan Motion, the ongoing chapter 11 case, the Trustee Motion, the CTC Lawsuit, and the

Class Action Lawsuit was held in an effort to achieve a global settlement of the disputes between

the parties. The parties to the mediation included the Debtor, the Member Representatives, the

Committee, the CPOA, and CMD, Wilhelm, Alpine, and representatives of the other Approving

Parties. After extensive negotiations, the parties reached settlement of many of the major

disputes, which settlement terms are set forth in the Term Sheet. See Exhibit 1, hereto.

36. On September 25, 2012, the Debtor and certain other Approving Parties submitted

a Stipulation to Vacate Trial Date, under which they sought to vacate the dates related to the

Trustee Motion, including trial and discovery [Docket No. 486]. On September 26, 2012, the

Court approved such Stipulation [Docket No. 489].

II. JURISDICTION

37. The Court has jurisdiction over this matter pursuant to 28 U.S.C. 157 and

1334. This matter is a core proceeding within the meaning of 28 U.S.C. 157(b)(2). Venue is

proper pursuant to 28 U.S.C. 1408 and 1409.

38. The statutory bases for the relief requested herein are section 105 of the

Bankruptcy Code and Bankruptcy Rule 9019.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page14 of 29

4838-9404-7505.4

10

III. SETTLEMENTS

A summary of the Term Sheets material terms, including the items that the Debtor and

other Approving Parties specifically request immediate approval of, are set forth below:

A. Summary of Term Sheet

1

a. The DIP Loan

39. The Debtor and other Approving Parties consented to the entry of the order

approving the Final DIP Loan Motion as contemplated by the Term Sheet. However, the Final

DIP Loan was modified as follows:

(i) The amount in the budget attached to the Final DIP Loan Motion provides

for professional fees of $965,000. It is agreed that Budget in the Final DIP

Loan Motion will be revised to provide that an amount of $300,000 for

professional fees shall be reserved exclusively for payment of the fees and

expenses incurred by professionals retained on behalf of the Committee

and expenses of members of the Committee (the $300,000 together with

the $50,000 previously paid to the Committee shall be collectively

referred to as the Committee Carveout). To the extent allowed

professional fees and expenses of the Committee and expenses of

members of the Committee are less than the Committee Carveout, any

amounts remaining shall be available for payment of allowed

administrative expenses of the Debtor. To the extent any such Committee

professionals and/or member fees and expenses exceed the Committee

Carveout, they will not be entitled to further payment until professionals

retained by the Debtor have received an equivalent pro rata payment; and

(ii) Alpine has consented to the Term Sheet and it is agreed that if and to the

extent the Final DIP Loan is inconsistent with any term, provision or

condition of the Term Sheet, the Final DIP Loan shall be deemed amended

so that it is consistent with the Term Sheet. Without limiting the

generality of the foregoing, performance by any of the Parties of the Term

Sheet shall not be a default under the Final DIP Loan.

1

Defined terms under the heading summary of Term Sheet shall have the meaning set forth in the Term

Sheet unless otherwise provided for herein, and the Term Sheet shall control to the extent of any inconsistencies.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page15 of 29

4838-9404-7505.4

11

A hearing was held on September 27, 2012 and the Court approved the Final DIP Loan, which

includes the above terms. Therefore, no further approvals of this portion of the Term Sheet are

sought in this Motion.

b. Partial Settlement of Class Action Lawsuit

40. Not later than October 5, 2012, the Member Representatives will file appropriate

pleadings in the Class Action Lawsuit (Class Action Settlement Motion) seeking approval of

the settlement of the Class Action Lawsuit as provided in the Term Sheet (the Class Action

Settlement) and will recommend and request that a hearing is scheduled on the Class Action

Settlement Motion such that appropriate notices are provided to Class Members and that the

deadline to opt out of the Class Action Settlement is November 30, 2012.

41. The Term Sheet contemplates that certain rights of the Class Action Lawsuit

plaintiffs will be compromised. The Class Action Settlement, as well as any releases related

thereto, are subject to the approval of the Eagle County District Court in the Class Action

Lawsuit and shall not become effective unless and until so approved. The Member

Representatives agree to recommend such approval by the Eagle County District Court. The

Member Representatives further agree to disseminate, either by email or United States mail, a

letter to the Class Members to be included in the notice of settlement recommending approval of

the Class Action Settlement. The Member Representatives and any of the CTC Individuals and

the CPOA Individuals who are Class Members agree to not opt out of the partial settlement of

the Class Action Lawsuit. Upon approval of the Class Action Settlement by the Eagle County

District Court and this Court, any objection by the Committee or the Debtor to use of proceeds

from any applicable insurance policy to defend the Class Action Lawsuit shall be deemed

withdrawn and consent to use of such proceeds to defend the Class Action Lawsuit shall be

deemed granted.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page16 of 29

4838-9404-7505.4

12

42. Upon approval of the Class Action Settlement by the Eagle County District Court

and this Court, the Member Representatives shall promptly file a Notice of Withdrawal of their

Verified Motion for Issuance of Contempt Citation as against the Debtor, WFP and Wilhelm and

shall not refile such motion.

43. If the Class Action Settlement is approved by the Eagle County District Court and

this Court, then all claims and causes of action which the Debtor may have or could have

asserted against any member who elects to opt out of the Class Action Settlement shall be

transferred and assigned to Wilhelm.

c. Settlement of CTC Lawsuit

44. The parties shall resolve the CTC Lawsuit as described below.

(i) Payment by CPOA and CTC: In consideration of the releases provided in

the Term Sheet, the CPOA and CTC shall pay the sum of $2,350,000

(CTC Settlement Payment) upon entry of an order by this Court

approving this Joint Motion, which order shall have become final and not

subject to any further appellate review. $1,600,000 of the CTC Settlement

Payment shall be held in a separate escrow account by the Debtor (the

CTC Escrow) and shall be used and applied only as permitted by the

Term Sheet. $750,000 of the CTC Settlement Payment shall be paid to

Wilhelm. CGH, CFB, WFP, WFPI, CGHM, Alpine, Wilhelm, P.

Wilhelm, and Rush will not assert any claim or lien against or any

distribution from any portion of the CTC Escrow. Substantially

contemporaneous upon payment of the CTC Settlement Payment,

Plaintiffs in the CTC Lawsuit will file a Joint Notice of Dismissal with

Prejudice of the CTC Lawsuit with the Eagle County District Court, which

Joint Notice will have been executed and held by Plaintiffs pending

receipt by Wilhelm of the $750,000.

(ii) The mutual releases contained in the Term Sheet at Section 2.a.i, as they

relate to the CTC Lawsuit, shall be effective upon approval by this Court

of the CTC Lawsuit Settlement and payment by the CPOA and CTC

described in the Term Sheet at Section 2.a.ii.

(iii) Distribution of the CTC Settlement Payment: Upon confirmation of the

Joint Plan, as provided for in the Term Sheet, the CTC Escrow shall be

used as follows: (1) for payment of non-member priority claims; and

(2) for the payment of unsecured claims for goods and services

(collectively Trade Claims), provided that the total payments shall be

the lesser of $600,000 or the allowed amount of the Trade Claims. The

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page17 of 29

4838-9404-7505.4

13

balance of the CTC Escrow shall be utilized to pay any allowed unpaid

administrative expenses for professionals retained at the expense of the

estate. To the extent of any excess, the CTC Escrow will be used to fund

Plan payments as provided under the Term Sheet at Section 2.a.iii.

45. Mutual Releases: The Debtor, CGH, WFP, CFB, WFPI, CGHM, CFB, Wilhelm

and P. Wilhelm (and their affiliates), on the one hand, and the Committee, CTC, CPOA, CMD,

CVCPOA, TSPOA, the Member Representatives, individually and as representatives of the

certified class represented by the Member Representatives, and each of the members of such

class who do not opt out of this settlement (subject to approval by the Eagle County District

Court), and each member and former member not represented by the Class, and all past, present,

and future board members and officers of CTC, CPOA, CMD, CVCPOA, and TSPOA, including

but not limited to those named as Defendants in the CTC Lawsuit and including but not limited

to the CPOA Individuals and the CTC Individuals, on the other hand, and their respective

affiliates, agents, attorneys, representatives, successors and assigns, will fully and forever

release, discharge, waive and acquit one another and their respective affiliates, agents,

employees, consultants, attorneys, representatives, predecessors, successors, shareholders,

officers, directors, Committee members, limited liability company members, heirs and assigns,

from and against any and all offsets, defenses, claims, counterclaims, actions, proceedings,

obligations, demands, debts, causes of action, and any other liability or loss, whether known or

unknown, at law or in equity (collectively, Claims), arising out of any fact, matter, act or

circumstance from the beginning of time to the date of the Term Sheet that relates to the

Bankruptcy Case, the CTC Lawsuit, the Class Action Lawsuit or the Club at Cordillera and all

matters related, connected or incidental thereto. Without limiting the generality of the foregoing,

(i) all claims in the CTC Lawsuit are resolved and the plaintiffs in the CTC Lawsuit will file a

Notice of Dismissal with prejudice with the District Court, Eagle County Colorado, upon

payment of the CTC Settlement Payment; (ii) any claims against any member or former member

for 2011 or 2012 Club dues, Club minimums, or late fees or other alleged obligations are

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page18 of 29

4838-9404-7505.4

14

released; provided, however, any obligations which arose on or after June 26, 2012 related to

actual use of facilities owned by the Debtor or actual receipt of actual services from the Debtor

(including, without limitation, food and drink, or use of any of the golf facilities) shall not be

released. Further, all members who have or in the future resign from the Club at Cordillera are

released from any liability associated with the Membership Documents (as described in the Term

Sheet), including any obligation to continue paying dues for any period into the future. Finally,

the Membership Documents will be deemed rejected as executory contracts pursuant to section

365 of the Bankruptcy Code and members will be deemed to have waived claims arising out of

rejection of such Membership Documents, save and except only claims for member deposits as

provided herein. Notwithstanding the foregoing, the releases provided in this paragraph shall not

extend to the following:

(i) The Claims asserted by the Member Representatives and the members of

the certified class represented by the Member Representatives in the Class

Action Lawsuit, nor to any of the defenses and offsets thereto in the Class

Action Lawsuit by the Debtor, CGH, WFP, WFPI, CFB, CGHM, Wilhelm

and P. Wilhelm; provided that recovery by the Member Representatives

and the members of the certified class represented by the Member

Representatives in the Class Action, if any, shall be limited to any

insurance coverage applicable to such claims and the proceeds of such

coverage, regardless of whether any such coverage is ultimately available.

Debtor, CGH, WFP, CFB, WFPI, CGHM, Wilhelm, and P. Wilhelm make

no representation regarding the existence or availability of any insurance

coverage for the Class Action Lawsuit and retain all rights under any

potentially applicable policy of insurance. However, the Debtor, CGH,

WFP, CFB, WFPI, CGHM, Wilhelm, and P. Wilhelm do specifically

warrant and represent that the Disclosure made by them in the Class

Action Lawsuit, pursuant to C.R.C.P. 26(a)(1), with respect to insurance

coverage, is true, accurate and complete. Nothing in the Term Sheet shall

be deemed or construed as an admission of liability or as an admission of

any measure of damages by the Debtor, CGH, WFP, CFB, WFPI, CGHM,

Wilhelm or P. Wilhelm related to any claim asserted against them in the

Class Action. Member Representatives and the members of the certified

class represented by the Member Representatives in the Class Action

hereby covenant not to execute any judgment or assert any claim for

attorneys fees or costs against the assets of Debtor, CGH, WFP, CFB,

WFPI, CGHM, Wilhelm or P. Wilhelm, other than their rights to any

applicable insurance coverage;

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page19 of 29

4838-9404-7505.4

15

(ii) The Claims of all members and former members of the Cordillera Club for

the return of deposits paid in connection with their club memberships, who

timely file proof of claims, shall be deemed allowed in favor of each such

member (the Member Deposit Claims) but subordinated as further

provided herein; provided, however, that nothing herein shall restrict the

right of the Debtor or any other party in interest to object to a Member

Deposit Claim to the extent such claim exceeds the amount of the

deposit(s) actually paid by such member. Proof of such claims, which

must be in accordance with the Term Sheet, may be included in a proof of

claim filed by the Class Representatives on behalf of the class members as

a class proof of claim;

(iii) Any claim of any Party for a breach of any obligation imposed by the

Term Sheet;

(iv) Any secured claim for unpaid real property or business personal property

taxes;

(v) The claim of Alpine, which, subject to verification as to calculation of

amount only, shall be deemed to be an allowed secured claim in the

amount of $13,037,559.18, plus such amounts, if any as are allowable

under 11 U.S.C. 506(b), plus the amounts advanced pursuant to or

otherwise due and owing with respect to the Final DIP Loan;

(vi) The claim of Wilhelm, which, subject to verification as to calculation of

amount only, shall be deemed an allowed secured claim in the amount of

$7,532,837.05, plus such amounts, if any, as are allowable under

11 U.S.C. 506(b) (the Wilhelm Claim). The Wilhelm Claim will be

inclusive of all claims of Dr. Jeffrey Rush and the Rush Family Trust

(collectively Rush) and any person or entity acting in whole or in part

through Rush and the Rush claims will not be separately allowed;

(vii) There has been no agreement to or settlement of any claim for any

administrative expense and the Parties reserve all of their rights with

respect to any past or future application by a party seeking allowance of an

administrative expense claim; and

(viii) Claims, if any, which the Debtor, CGH, CFB, WFP, WFPI, CGHM,

Wilhelm or P. Wilhelm may have against any member who exercises the

right to opt out of the Class Action Settlement.

46. Sale of Assets: The Approving Parties to the Term Sheet have agreed to and shall

take steps to implement a process for the sale of the Debtors operating assets. The Debtor and

the Committee shall jointly prepare and file with this Court, after consultation with the

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page20 of 29

4838-9404-7505.4

16

Approving Parties about the form thereof, a joint motion seeking approval of bidding procedures

(Sale Procedures Motion), and further seeking approval of the sale of all the Debtors

operating assets, pursuant to the Term Sheet and bidding procedures, free and clear of all liens

(other than liens which arise from unpaid real property taxes and/or all business personal

property taxes), claims, encumbrances and interests (including, without limitation free and clear

of all claims, interests or rights which may arise out of Membership Documents) pursuant to

sections 363(b) and (f) of the Bankruptcy Code (the Sale Motion). The Sale Procedures

Motion shall contain at least the following provisions:

(i) That bids must be for all operating assets owned by the Debtor and must

be received by December 3, 2012 (the Bid Deadline); provided that if

the holder of the Alpine claim or the Wilhelm claim desire to credit bid,

they must give written notice of their intent to do so by Thursday,

December 6, 2012;

(ii) If more than one qualifying bid is received or if a timely notice of an

intent to credit bid has been provided, then an auction will be held on

December 10, 2012 to select the highest and best bid;

(iii) That all bidders must qualify to bid;

(iv) That all bids must be for all cash, except that the holders of the Alpine

Claim and Wilhelm Claim can credit bid their allowed secured claims

including, in the case of Alpine, any amounts owed under or with respect

to the Final DIP Loan; provided that any bid of the holder of the Wilhelm

Claim must be a cash bid up to the amounts to which Alpine is entitled

under the Term Sheet plus taxes then due secured by a lien on the assets

sold;

(v) That all bids must seek to purchase all the Debtors operating assets;

(vi) That the highest bidder must close pursuant to its bid no later than

December 28, 2012 (the Closing). Time is of the essence.

(vii) That the sale of the assets will be free and clear of all interests. The sale,

however, shall not be free and clear of recorded covenants, declarations,

PUDs, easements, and other similar recorded documents to which the liens

securing the Alpine allowed secured claim are subject. Further, the sale

shall not be free and clear of liens for any unpaid real property taxes

and/or all business personal property taxes. The sale shall be on an as is

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page21 of 29

4838-9404-7505.4

17

basis without representation or warranty of any kind (other than as to

authority);

(viii) That the Mediator shall conduct the sale process, subject to ultimate

approval by the Court;

(ix) That current and former members of the Cordillera Club and prospective

bidders with an interest in less than all of the assets (including various

member groups) may approach, discuss and agree with other parties about

submitting a joint bid for all of the assets; and

(x) The order approving any sale shall require payment of allowed secured

claims at or about Closing to the extent cash is available from the sale.

47. Successful Bidder: If Wilhelm or any affiliate of Wilhelm or any entity in which

Wilhelm or any Wilhelm affiliate (collectively, Wilhelm Party) owns an interest, is selected as

the successful bidder at the sale of the Debtors assets as provided for herein, then such Wilhelm

Party shall transfer or cause to be transferred the Debtors ownership interest in (a) the Short

Course, (b) the Trailhead facilities and (c) the Athletic Club facilities (collectively the Non-

Essential Assets) to an entity (other than CTC) to be jointly designated by the CMD, the CPOA

and the Member Representatives for no additional consideration simultaneously with the later of

closing of the sale of the Debtors assets to such Wilhelm Party or approval of this Joint Motion

and the Class Action Settlement Motion. Additionally, if any Wilhelm Party is selected as the

successful bidder at the sale of the Debtors assets as provided for herein, and if memberships are

offered in a club which utilizes any of those assets, then the memberships must be offered to all

past and present members of the Club on the same terms as anyone else.

48. Plan of Reorganization: The Debtor and the Committee shall jointly prepare and

file a Joint Plan of Reorganization and related Disclosure Statement and diligently pursue

approval of the Disclosure Statement and confirmation of the Plan. The Plan and Disclosure

Statement will be filed with this Court so that hearing on confirmation of the Plan can be held

between December 10, 2012 and December 28, 2012, subject to the Courts calendar. The Plan

shall:

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page22 of 29

4838-9404-7505.4

18

(i) Provide for the implementation of the various settlements and

consummation of the sale process provided for in the Term Sheet.

However, except as otherwise provided in the Plan, confirmation of the

Plan shall not be a condition precedent to either the settlements or

consummation and closing pursuant to the sale process contemplated by

the Term Sheet. In the event that the Bankruptcy Case is dismissed or

converted to Chapter 7, the CTC Escrow shall be used pursuant to further

order of the Court;

(ii) Provide for the distribution of any cash proceeds attributable to the sale of

the Debtors assets still in the possession of the Debtor (which does not

include the CTC Escrow) (save and except only the Non-Party Assets) as

follows: (1) first, to Alpine to the extent necessary to repay amounts

advanced by the Bank pursuant to, or otherwise due and owing with

respect to the DIP Loan, including interest, (2) second, to Alpine to the

extent necessary to satisfy Alpines allowed secured claim, (3) third, the

holder of the Wilhelm Claim to the extent necessary to satisfy the Wilhelm

Claim, (4) fourth, to satisfy any remaining allowed and unpaid

administrative expense claims, if any, (5) fifth, to any Trade Claim

unsecured creditors to the extent not paid in full from the CTC Escrow,

and other unsecured creditors, including the members, pro rata according

to the gross amount of such allowed claims, to satisfy their allowed

unsecured claims for deposits, and (6) the balance shall be paid to the

holder of equity interests in the Debtor. No distributions shall be made to

Rush or any affiliates of Rush on account of any alleged unsecured claim

for money loaned to the Debtor or obligations allegedly guaranteed by the

Debtor. Amounts, if any, alleged to be owed arising from the sale of any

Non-Party Asset shall be paid to the holder of the allowed claim related to

such Non-Party Asset;

(iii) Provide for the distribution of the CTC Escrow as provided in

paragraph 2(a)(iii) of the Term Sheet;

(iv) Contain such other provisions as may be reasonably necessary or desirable

to implement the Term Sheet; and

(v) Not contain any provisions which are inconsistent with the Term Sheet or

with orders entered by the Bankruptcy Court approving the 9019 Motion

contemplated by the Term Sheet or with the sale process described in the

Term Sheet.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page23 of 29

4838-9404-7505.4

19

IV. RELIEF REQUESTED

49. By this Joint Motion, the Debtor seeks entry of the Order, substantially in the

form attached hereto as Exhibit 2, approving the Term Sheet, and approving and authorizing

the Debtor to effectuate certain settlements and compromises set forth therein, as follows:

(i) Partial Settlement of Class Action: The Term Sheet provides for a partial

settlement of the Class Action for class members who do not opt out after

a notice period. Those remaining in the class are limited to seeking

recovery of any judgment obtained in their favor solely from proceeds of

the insurance policy and not from the Debtor or any of the other

defendants in the Class Action Lawsuit. Those members of the Class

remaining in the class shall also be included in the mutual release

described in the Term Sheet. Upon this Court's approval of this Joint

Motion, relief from stay shall be deemed granted to allow the Class Action

Lawsuit to proceed against the Debtor with recovery limited to insurance

proceeds, as provided in the Term Sheet. The Debtor and Wilhelm make

no representation or warranty that the claims asserted in the Class Action

Lawsuit are covered by the insurance policy. The parties will seek court

approval of the Class Action Settlement in the District Court for Eagle

County as provided in the Term Sheet. The mutual releases provided for

in the Term Sheet shall not be effective until approval by this Court and

the District Court for Eagle County. After approval of the Class Action

Settlement by the Eagle County District Court and this Court, with respect

to members who elect to opt out of the Class Action Settlement, the

Debtor shall assign and transfer all claims and causes of action it could

have or may have asserted against any member that opts out of the Class

Action Settlement to Wilhelm;

(ii) Mutual Releases. The Term Sheet provides for certain other mutual

releases, compromises, agreements, and settlements as provided in

Section 2.a.i (subject to the carve-outs) and the Joint Motion seeks Court

approval of same.

(iii) Membership Documents: Membership Documents, as defined in the Term

Sheet, shall be deemed rejected and members will be deemed to have

waived claims arising out of rejection of such Membership Documents,

except with respect to the claim for member deposits as provided for in the

Term Sheet.

(iv) Settlement of the CTC Lawsuit: Upon Court approval of this Joint Motion

and payment of the CTC Settlement Payment, the parties shall dismiss the

CTC Lawsuit and the mutual releases contained in Section 2.a.i related to

the CTC Lawsuit shall become effective;

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page24 of 29

4838-9404-7505.4

20

(v) Allowance of Alpines Claim: Subject to verification as to calculation of

amount only, the Alpine claim (as evidenced by the Alpine Loan

Documents and as described in the Term Sheet) shall be deemed to be an

allowed secured claim in the amount of $13,037,559.18, plus such

amounts, if any as are allowable under 11 U.S.C. 506(b), plus the

amounts advanced pursuant to or otherwise due and owing with respect to

the Final DIP Loan;

(vi) Allowance of Wilhelms Claim: Subject to verification as to calculation

of amount only, the Wilhelm Claim (as defined in the Term Sheet) shall be

deemed an allowed secured claim in the amount of $7,532,837.05, plus

such amounts, if any, as are allowable under 11 U.S.C. 506(b). The

Wilhelm Claim will be inclusive of all claims of Rush and any person or

entity acting in whole or in part through Rush and the Rush claims will not

be separately allowed; and

(vii) Club Member Claims: The Claims of members and former members of

the Cordillera Club for the return of deposits paid in connection with their

club memberships, who timely file proof of claims, shall be deemed

allowed in favor of each such member (the Member Deposit Claims),

but subordinated as provided in the Term Sheet at Section 2.a.i.2 and

Section 4.b; provided, however, that nothing in the Term Sheet shall

restrict the right of the Debtor or any other party in interest to object to a

Member Deposit Claim to the extent such claim exceeds the amount of the

deposit(s) actually paid by such Member. Proof of such claims, which

must be in accordance with the Term Sheet, may be included in a proof of

claim filed by the Class Representatives on behalf of the class members as

a class proof of claim.

(viii) Non Disparagement: The Debtor and the Approving Parties seek approval

of their agreement that the Debtor and the Approving Parties agree that in

future communications with third parties, they shall not make disparaging

statements about one another; provided that this provision shall not limit

the parties or a witness in the pursuit or defense of the claims or in

presenting any testimony or conducting or participating in any discovery

in the Class Action Lawsuit, and provided further that the Committee,

CTC, CVCPOA, TSPOA, CMD, CPOA and Member Representatives

shall have no liability for statements made by any other individual

property owner or other class member, including but not limited to

statements made in any meeting or other forum sponsored or held by the

CMD and/or the CPOA.

(ix) Debtors Representation of Disclosure: The Debtor, CGH, WFP, CFB,

WFPI, CGHM, Wilhelm, and P. Wilhelm do specifically warrant and

represent that the Disclosure made by them in the Class Action Lawsuit,

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page25 of 29

4838-9404-7505.4

21

pursuant to C.R.C.P. 26(a)(1), with respect to insurance coverage, is true,

accurate and complete as set forth in the Term Sheet at Section 2.a.i.1.

(x) Wilhelms Obligation if Successful Bidder: If any Wilhelm Party is

selected as the successful bidder at the sale of the Debtors assets as

provided for herein, then if memberships are offered in a club which

utilizes any of those assets, then the memberships must be offered to all

past and present members of the Club on the same terms as anyone else as

set forth in the Term Sheet at Section 5.k.

50. The Debtor and other Approving Parties further request that the Court provide a

hearing date for approval of the joint disclosure statement and plan of reorganization consistent

with the terms of the Term Sheet, without prejudice or in any way ruling on the ultimately

confirmability of any such plan.

V. BASIS FOR RELIEF

51. Debtor and the Committee seek entry of an Order authorizing the entry into the

Term Sheet and approving certain matters set forth therein, as described above, pursuant to Fed.

R. Bankr. P. 9019. The law generally favors compromises and settlements of disputes between

parties. See Stanpec Corp. v. Jelco, Inc., 464 F.3d 1184 (10th Cir. 1972).

52. Fed. R. Bankr. P. 9019 provides that, after a hearing on notice to creditors, the

bankruptcy court may approve a compromise or settlement. The standards by which to evaluate

a settlement proposal have been defined by the courts. Kaiser Steel Corp. v. Frates (In re Kaiser

Steel Corp.), 105 B.R. 971, 976 (D.Colo.1989). In general, the court must determine whether

the settlement is fair and equitable and in the best interests of the estate. Id. The factors to

consider in this determination are (1) the probability of success on the merits in the litigation;

(2) the difficulties, if any, to be encountered in collection of any judgment that might be

obtained; (3) the complexity of the litigation involved, and the expense, inconvenience and delay

necessarily attending it; and (4) the paramount interests of creditors and the proper deference to

their reasonable views in the premises. Id. at 976-77.

53. Entry into the Term Sheet and settlement thereunder is appropriate and consistent

with the 9019 factors set forth above. The terms of the Term Sheet are fair and reasonable, and

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page26 of 29

4838-9404-7505.4

22

entering into the Term Sheet is a sound exercise of Debtors business judgment that is supported

by all major constituencies and will resolve the Trustee Motion, the CPOA/CTC litigation and

streamline the estate's interests in the Class Action Lawsuit. Approval of the Term Sheet will

avoid further dispute regarding the Trustee Motion, CTC Lawsuit and the claims of Alpine and

Wilhelm and does so without the need to engage in costly litigation. Such litigation would have

generated substantial administrative expenses. In addition, resolution of the Trustee Motion and

submission of a joint plan with the Committee will allow Debtor to proceed with the orderly

administration of its estate. Accordingly, Debtor submits that entry into the Term Sheet is

appropriate, in the best interests of their estates and all stakeholders, and should be approved

under Bankruptcy Rule 9019.

WHEREFORE, Debtor moves for entry of an Order, substantially in the form attached

hereto as Exhibit 2, approving the terms of and authorizing Debtor to enter into the Term Sheet

attached hereto as Exhibit 1, and granting such other relief as deemed appropriate.

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page27 of 29

4838-9404-7505.4

23

Date: October 5, 2012 Respectfully submitted,

FOLEY & LARDNER LLP

By: /s/ Christopher Celentino

Christopher Celentino (CA No. 131688)

Mikel Bistrow (CA No. 102978)

Dawn A. Messick (CA No. 236941)

Admitted Pro Hac Vice

402 West Broadway, Suite 2100

San Diego, California 92101

Telephone: 619-234-6655

Facsimile: 619-234-3510

Email: ccelentino@foley.com

Email: mbistrow@foley.com

Email: dmessick@foley.com

-and-

SENDER & WASSERMAN, P.C.

Harvey Sender, #7546

1660 Lincoln Street, Suite 2200

Denver, CO 80264

Telephone: 303-296-1999

Facsimile: 303-296-7600

Email: sender@sendwass.com

Attorneys for Debtor and Debtor-in-Possession

-AND-

HOLLAND & HART LLP

By: /s/ Risa Lynn Wolf-Smith

Risa Lynn Wolf-Smith, #15835

Clarissa M. Raney, #40374

HOLLAND & HART LLP

555 Seventeenth Street, Suite 3200

Denver, Colorado 80202

Telephone: 303-295-8000

Facsimile: 303-295-8261

rwolf@hollandhart.com

cmraney@hollandhart.com

-and-

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page28 of 29

4838-9404-7505.4

24

MUNSCH HARDT KOPF & HARR, P.C.

Russell L. Munsch (admitted PHV)

Texas Bar No. 14671500

Joseph J. Wielebinski (admitted PHV)

Texas Bar No. 21432400

Jay H. Ong (admitted PHV)

Texas Bar No. 24028756

Zachery Z. Annable (admitted PHV)

Texas Bar No. 24053075

3800 Lincoln Plaza

500 N. Akard Street

Dallas, Texas 75201-6659

Telephone (214) 855-7500

Facsimile (214) 978-4335

ATTORNEYS FOR THE OFFICIAL

COMMITTEE OF UNSECURED CREDITORS

Case:12-24882-ABC Doc#:519 Filed:10/05/12 Entered:10/05/12 13:38:53 Page29 of 29

4838-9404-7505.4

25

Exhibit 1

(Term Sheet)

Case:12-24882-ABC Doc#:519-1 Filed:10/05/12 Entered:10/05/12 13:38:53 Page1 of 29

4266769.1

TERM SHEET

This Term Sheet is made and entered into as of this 17th day of September, 2012, by and

between CORDILLERA GOLF CLUB, LLC a Delaware limited liability company (Debtor),

The OFFICIAL COMMITTEE OF UNSECURED CREDITORS appointed in the Bankruptcy

Case (as defined herein) of CORDILLERA GOLF CLUB, LLC (Committee), CORDILLERA

GOLF HOLDINGS, LLC, a Delaware limited liability company (CGH), CORDILLERA F &

B, LLC, a Delaware limited liability company or any successor thereto (CFB),WFP

CORDILLERA, LLC, a Delaware limited liability company (WFP), WFP INVESTMENTS,

LLC, a Delaware limited liability company (WFPI), CGH MANAGER, LLC, a Delaware

limited liability company (CGHM), DAVID A. WILHELM (Wilhelm), PATRICK

WILHELM (P. Wilhelm), CORDILLERA TRANSITION CORPORATION, INC., a Colorado

not for profit corporation (CTC), CORDILLERA PROPERTY OWNERS ASSOCIATION,

INC., a Colorado not for profit corporation (CPOA), CORDILLERA METROPOLITAN

DISTRICT, a quasi-municipal corporation and political subdivision of the State of Colorado

(CMD), CORDILLERA VALLEY CLUB PROPERTY OWNERS ASSOCIATION, INC., a

Colorado not for profit corporation (CVCPOA), TIMBER SPRINGS PROPERTY OWNERS

ASSOCIATION, INC., a Colorado not for profit corporation (TSPOA), CHERYL M. FOLEY,

THOMAS WILNER, JANE WILNER, CHARLES JACKSON, MARY JACKSON, KEVIN B.

ALLEN, as representatives of a certified class in Case Number 11CV552, pending in the District

Court of Eagle County, Colorado (collectively, the Member Representatives) and ALPINE

BANK.

RECITALS

A. The parties to this Term Sheet are listed in the foregoing paragraph and are

sometimes referred to collectively in this Term Sheet as Parties.

B. The Debtor is the Debtor in Possession in connection with a Chapter 11

bankruptcy case pending in the United States Bankruptcy Court for the District of Colorado,

Case No. 12-24882-ABC (the Bankruptcy Case). The Debtor operates certain golf courses and

other amenities (collectively and generally referred to as the Club). Right to use of the Club is

governed by membership applications, membership plans, rules and regulations of the Club and

all amendments and modifications thereto (collectively Membership Documents).

C. The Committee is the official committee of unsecured creditors appointed by the

United States Trustee on July 6, 2012.

D. WFP is the holder of all of the limited liability company membership interests in

CGH.

E. CGH is the holder of all of the limited liability company membership interests in

the Debtor.

Case:12-24882-ABC Doc#:519-1 Filed:10/05/12 Entered:10/05/12 13:38:53 Page2 of 29

2

4266769.1

F. Wilhelm is the holder of all of the limited liability company membership interests

in WFP. P. Wilhelm is Wilhelms son.

G. The Debtor, CGH, WFP, Wilhelm, CTC, CPOA and various individuals: Glenn

Bourland, Lois Van Deusen, Roger Magid (collectively the CPOA Individuals), Robert

Vanourek, Denise Delaney, Gary Edwards, Raymond Oglethorpe, David Temin, Sarah Baker,

Nelson Sims, Dick Rothkopf, and David Bentley (collectively the CTC Individuals) are parties

to an action pending in the District Court, Eagle County Colorado, Case No. 2011CV456 (CTC

Lawsuit).

H. The Member Representatives, the Debtor, WFP, CGH, CFB, WFPI, CGHM,

CFB, Wilhelm and P. Wilhelm are (or were) parties to an action pending in the District Court,

Eagle County Colorado, Case No. 2011CV552 (Class Action Lawsuit).

I. Alpine Bank asserts that it is a secured creditor of the Debtor and claims a lien on

substantially all of the Debtors real and personal property used on or in connection with the

operation of the real property and the operation of the Debtors business. Alpine Bank asserts

that its claim is secured by a first lien on such property.

J. Wilhelm asserts that he is a secured creditor of the Debtor and claims a lien on

substantially all of the Debtors real and personal property used on or in connection with the

operation of the real property and the operation of the Debtors business. Wilhelm asserts that

his claim is secured by at least a second lien on such property. Wilhelm has also asserted a first

lien on personal property owned by the Debtor.

K. CMD claims to be a secured creditor of the Debtor for unpaid taxes. CMD asserts

a first priority lien for unpaid 2011 taxes in the amount of $205,311.31. CMD also asserts a first

priority lien for 2012 taxes that will become due in 2013 (the CMD Tax Claims).

L. In addition to Wilhelm and Alpine, certain assets of the Debtor are subject to

purchase money liens in favor of creditors who are not parties to this Term Sheet (the Purchase

Money Lien Assets). Further, certain assets used by the Debtor are leased from creditors who

are not parties to this Term Sheet and such assets are not owned by the Debtor (the Leased

Assets) (the Purchase Money Lien Assets and the Leased Assets shall be collectively referred to

the Non-Party Assets).

M. By Motion dated August 30, 2012, Docket No. 402 (DIP Loan Motion), the

Debtor has sought final approval of a loan by Alpine Bank to the Debtor and approval of the use

of cash collateral. The DIP Loan Motion is set for hearing on September 17, 2012. The

Committee, the Member Representatives, the CPOA and the CMD were prepared to file

objections to the DIP Loan Motion. Because of the settlement embodied in this Term Sheet, the

objections have not been filed.

N. By Motion dated July 24, 2012, Docket No. 235 (Trustee Motion), the Member

Representatives have sought the appointment of a trustee in connection with the Bankruptcy

Case. The Committee, the CPOA and the CMD filed Joinders in the Trustee Motion. In

Case:12-24882-ABC Doc#:519-1 Filed:10/05/12 Entered:10/05/12 13:38:53 Page3 of 29

3

4266769.1

addition, an additional 608 Personal Joinders have been filed by members of the certified class

represented by the Member Representatives and other parties, Docket No. 414. The Debtor filed

its Opposition to the Trustee Motion and Wilhelm filed a Joinder to such Opposition. The

Trustee Motion is set for hearing on October 1-3, 2012.

O. The parties to this Term Sheet may be parties to various other disputes which are

the subject of motions, responses, objections or pleadings pending before the Bankruptcy Court.

P. The parties to this Term Sheet attended a voluntary mediation on September 12

and 13, 2012 (Mediation). The mediator conducting the Mediation was Deborah Williamson

(Mediator). The Mediation resulted in various agreements among the Parties that will resolve

various disputes among them in the Bankruptcy Case, a complete settlement of the CTC Lawsuit

among the parties to the CTC Lawsuit, and a partial resolution of the Class Action Lawsuit.

Q. The purpose of this Term Sheet is to set forth the agreements of the Parties

reached at the Mediation and to establish a process and procedure for documenting, seeking any

necessary court approval and implementing those agreements.

SETTLEMENT TERMS AND AGREEMENTS

1. DIP Loan.

a. Interim DIP Loan. The interim debtor-in possession loan from Alpine to

the Debtor (the Interim DIP Loan) pursuant to the terms of the Interim

Order Pursuant to 11 U.S.C. 105, 361, 362, 363(c), 364(c), 364(d),

and 364(e) and Fed. R. Bankr. P. 2002, 4001 and 9014 (i) Authorizing

Debtor to Obtain Post-Petition Secured Financing, (ii) Granting Security

Interests and Superpriority Administrative Expense Claims, and (iii)

Authorizing the Use of Cash Collateral as Provided Herein, Dkt. #270, as

extended by the Order granting the Debtors Motion to (a) Extend and

Increase Interim Financing and (B) Extend Use of Cash Collateral Under

the Terms of the Prior Order, Dkt. #393 shall be further extended by order

of the Bankruptcy Court, through and including September 28, 2012, and

shall be increased in such amount as shall be necessary to meet such

expenses for such extension period as are consistent with the budget

attached to the DIP Loan Motion. The Parties have no objection and

hereby consent to the foregoing extension of the Interim DIP Loan for the

purpose of permitting the Parties to prepare and, where necessary, file

with the Bankruptcy Court certain other pleadings contemplated by this

Term Sheet including such revisions to the relief requested in the DIP

Loan Motion, the proposed order attached thereto, and the form of the

applicable loan documentation as are necessary to conform to this Term

Sheet.

b. Permanent DIP Loan. Subject to the performance and satisfaction of the

terms, provisions and conditions contained in this Term Sheet, the Parties

Case:12-24882-ABC Doc#:519-1 Filed:10/05/12 Entered:10/05/12 13:38:53 Page4 of 29

4

4266769.1

consent to the entry of an order approving the Final DIP Loan Motion as

contemplated by and defined in the DIP Loan Motion. However, the Final

DIP Loan will be modified as follows:

i. The amount in the budget attached to the DIP Loan Motion

provides for professional fees of $965,000. It is agreed that

Budget in the DIP Loan Motion will be revised to provide that an

amount of $300,000 for professional fees shall be reserved

exclusively for payment of the fees and expenses incurred by

professionals retained on behalf of the Committee and expenses of

members of the Committee (the $300,000 together with the

$50,000 previously paid to the Committee shall be collectively

referred to as the Committee Carveout). To the extent allowed

professional fees and expenses of the Committee and expenses of

members of the Committee are less than the Committee Carveout,

any amounts remaining shall be available for payment of allowed

administrative expenses of the Debtor. To the extent any such

Committee professionals and/or member fees and expenses exceed

the Committee Carveout, they will not be entitled to further

payment until professionals retained by the Debtor have received

an equivalent pro rata payment.

ii. Alpine Bank has consented to this Term Sheet and it is agreed that

if and to the extent the Final DIP Loan is inconsistent with any

term, provision or condition of this Term Sheet, the Final DIP

Loan shall be deemed amended so that it is consistent with this

Term Sheet. Without limiting the generality of the foregoing,

performance by any of the Parties of the Term Sheet shall not be a

default under the Final DIP Loan.

2. Settlement of Claims.

a. Not later than October 5, 2012, the Member Representatives will file

appropriate pleadings in the Class Action Lawsuit (Class Action

Settlement Motion) seeking approval of the settlement of the Class

Action Lawsuit as provided in this Term Sheet (the Class Action

Settlement) and will recommend and request that a hearing is scheduled

on the Class Action Settlement Motion such that appropriate notices are

provided to Class Members and that the deadline to opt out of the Class

Action Settlement is November 30, 2012. Not later than October 5, 2012,

the Debtor and the Committee shall file a Joint Motion, pursuant to Rule

9019 of the Federal Rules of Bankruptcy Procedure, seeking approval of

the various compromises and settlements provided in this Term Sheet (the

9019 Motion). Approval of the 9019 Motion shall be pursued by the

Debtor and the Committee with reasonable diligence and all parties hereto

shall cooperate in that regard. The 9019 Motion and the Class Action

Case:12-24882-ABC Doc#:519-1 Filed:10/05/12 Entered:10/05/12 13:38:53 Page5 of 29

5

4266769.1

Settlement Motion (to the extent of the settlement of the Class Action

Lawsuit) will seek approval of the following terms:

i. Mutual Releases. The Debtor, CGH, WFP, CFB, WFPI, CGHM,

CFB, Wilhelm and P. Wilhelm (and their affiliates), on the one

hand, and the Committee, CTC, CPOA, CMD, CVCPOA, TSPOA,

the Member Representatives, individually and as representatives of

the certified class represented by the Member Representatives, and

each of the members of such class who do not opt out of this

settlement (subject to approval by the Eagle County District