Professional Documents

Culture Documents

Filed & Entered: United States Bankruptcy Court Central District of California Santa Ana Division

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Filed & Entered: United States Bankruptcy Court Central District of California Santa Ana Division

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 1 of 28

Desc

FILED & ENTERED

1 2 3 4 5 6 7 8 9 10 UNITED STATES BANKRUPTCY COURT 11 CENTRAL DISTRICT OF CALIFORNIA 12 SANTA ANA DIVISION 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 1 ) ) WESTCLIFF MEDICAL LABORATORIES, ) ) INC., ) ) Debtor. ) ________________________________ ) ) ) BIOLABS, INC., ) ) Debtor. ________________________________ ) ) ) Affects Both Debtors ) ) ) Affects WESTCLIFF MEDICAL ) LABORATORIES, INC. only ) ) Affects BIOLABS, INC. only ) ) ) ) ) ) ) In re: Case No. 8:10-bk-16743-TA Lead Case, Jointly Administered with Case No. 8:10-bk-16746-TA Chapter 11 Cases INTERIM ORDER (A) AUTHORIZING USE OF CASH COLLATERAL, AND (B) GRANTING GE BUSINESS FINANCIAL SERVICES, INC. ADEQUATE PROTECTION

Court Scheduled Hearing: Date: May 27, 2010 Time: 11:00 a.m. Place: Courtroom 5B 411 West Fourth Street Santa Ana, CA 92701-4593 Continued third Interim Hearing: Time: June 23, 2010 10:00 a.m .

RON BENDER (SBN 143364) JACQUELINE L. RODRIGUEZ (SBN 198838) TODD M. ARNOLD (SBN 221868) JOHN-PATRICK M. FRITZ (SBN 245240) LEVENE, NEALE, BENDER, RANKIN & BRILL L.L.P. 10250 Constellation Boulevard, Suite 1700 Los Angeles, California 90067 Telephone: (310) 229-1234; Facsimile: (310) 229-1244 Email: rb@lnbrb.com; jlr@lnbrb.com; tma@lnbrb.com; jpf@lnbrb.com [Proposed] Attorneys for Chapter 11 Debtors and Debtors in Possession

JUN 07 2010

CLERK U.S. BANKRUPTCY COURT Central District of California BY ngo DEPUTY CLERK

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 2 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

This matter came before the Court on May 27, 2010 on the motion (the Motion) of Biolabs, Inc., a Delaware corporation (BioLabs), and Westcliff Medical Laboratories, Inc., a California corporation (Westcliff and, together with Biolabs, the Debtors or the Borrowers), debtors and debtors in possession, for entry of an interim and final order authorizing the Debtors to (i) use Cash Collateral (as defined below) pursuant to Bankruptcy Rule 4001(b) and section 363 of the Bankruptcy Code, and provide adequate protection therefor in accordance with sections 363 and 361 of the Bankruptcy Code; (ii) grant other related relief; and (iii) schedule a final hearing. It appearing that notice of the Motion has been given and served by the Debtors on: (i) the Office of the United States Trustee, (ii) counsel for the Agent (defined below), (iii) the Official Committee of Unsecured Creditors (the Committee), (iv) the Debtors alleged secured creditors, to the extent known, (v) the creditors holding the twenty largest unsecured claims against the Debtors estates, on a consolidated basis, as reflected in the lists submitted pursuant to Bankruptcy Rule 1007(d), and (vi) any other parties required to receive notice pursuant to Bankruptcy Rules 2002, 4001 or 9014 or requesting notice pursuant to a written and timely received request (collectively, the Notice Parties); and the interim hearing having been held; and upon all of the pleadings filed with the Court and evidence presented in support of the Motion, and all of the proceedings held before the Court; and the Court having noted the appearances of parties in interest at the hearing in the record of this Court; and any objections to the relief requested in the Motion having been resolved or overruled by 2

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 3 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

the Court; and it appearing that the relief requested in the Motion is in the best interests of the Debtors, their estates and their creditors, and that such relief is essential for the continued operations of the Debtors businesses and to enable the Debtors to avoid immediate and irreparable harm pending a sale of substantially all of their assets; and after due deliberation and consideration, and sufficient cause appearing therefor, THE COURT HEREBY FINDS:1 A. The Debtors and Their Bankruptcy Cases. Each of the

Debtors filed a voluntary chapter 11 petition (the Chapter 11 Cases) in the United States Bankruptcy Court for the Central District of California, Santa Ana Division, on May 19, 2010 (the Petition Date). Each is presently operating as a debtor in

possession pursuant to sections 1107 and 1108 of the Bankruptcy Code. No request has been made for the appointment of a trustee or

examiner. B. Necessity and Best Interest. The Debtors allege they do

not have sufficient unencumbered cash or other assets with which to continue to operate their businesses in Chapter 11 pending a proposed sale (the Asset Sale) of substantially all of their assets to Wave Newco, Inc. or a buyer with a better and higher bid under section 363 of the Bankruptcy Code (the Buyer). The

Debtors thus require authority to use Cash Collateral to continue their business operations without interruption with the objective of maximizing the value of property of the estates pending a sale. Use of Cash Collateral, to the extent and on the terms and

1

Pursuant to Bankruptcy Rule 7052, findings of fact shall be construed as conclusions of law and conclusions of law shall be construed as findings of fact. No findings of fact herein shall be binding upon any parties other than the Debtors.

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 4 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

conditions set forth herein, is necessary to avoid immediate and irreparable harm to the Estates. C. (1) Loan Documents. The Debtors are parties to that certain Credit Agreement

dated as of June 30, 2006 (as amended, restated, or otherwise modified, including all annexes, exhibits and schedules thereto, the Credit Agreement) among the Debtors, as borrowers, GE Business Financial Services, Inc., a Delaware corporation (formerly known as Merrill Lynch Capital, a division of Merrill Lynch Business Financial Services Inc.), for itself as a lender and as administrative agent (in such capacity, Agent), and the lenders from time to time parties thereto (collectively with Agent, the Lenders). The Debtors and Lenders are also parties to certain

related security and other documents executed in connection with the Credit Agreement (the Credit Agreement, together with all other documents executed in connection therewith, collectively, the Prepetition Loan Documents). Pursuant to the Prepetition Loan

Documents, the Lenders extended loans and other financial accommodations to the Debtors (the Prepetition Loans). (2) In order to secure the Prepetition Obligations (as used

herein, Prepetition Obligations shall mean all Obligations under and as defined in the Credit Agreement, the Debtors granted to the Lenders senior liens and security interests (the Prepetition Liens) in substantially all of the Debtors assets, including all personal property of the Debtors (whether now owned or hereafter acquired and wherever located) (the Prepetition Collateral).

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 5 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

2

(3)

Under the Prepetition Loan Documents, the Debtors cash,

wherever located, whether as original collateral or cash proceeds2 of the Prepetition Collateral constitutes the Lenders cash collateral (as defined in section 363(a) of the Bankruptcy Code, Cash Collateral) pursuant to section 363 of the Bankruptcy Code. (4) The Lenders security interest and lien attaches to,

inter alia, all funds and property of the Debtors representing the product, issues, rents, profits and other proceeds of Prepetition Collateral. (5) The Debtors are in default of their debts and obligations As of the Petition Date, the

under the Prepetition Loan Documents.

Debtors were indebted and liable to the Lenders in the aggregate amount of approximately $58 million. D. Good Cause. Good cause exists for approval of this

Interim Order.

The Debtors require use of Cash Collateral to allow

the Debtors time to consummate the Asset Sale to maximize the value of their estates for the benefit of their creditors. Without such

authority, the Debtors will not be able to pay their payroll and other expenses. At this time, the Debtors ability to use Cash

Collateral in order to fund the Debtors' expenses is vital to maximize the value of the Debtors assets and the Debtors estates.

For purposes of this Interim Order, proceeds of any collateral shall mean proceeds (as defined in the Uniform Commercial Code) of such collateral as well as (x) any and all proceeds of any insurance, indemnity, warranty or guaranty payable to the Debtors from time to time with respect to such collateral, (y) any and all payments (in any form whatsoever) made or due and payable to the Debtors in connection with any requisition, confiscation, condemnation, seizure or forfeiture of all or any part of such collateral by any governmental body, authority, bureau or agency (or any person under color of governmental authority), and (z) other payments, dividends, interest or other distributions on or in respect of any of such collateral.

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 6 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

The Court having determined that good cause exists for the relief requested in the Motion, IT IS HEREBY ORDERED as follows: 1. Jurisdiction and Venue. This Court has jurisdiction over This is a core

this matter pursuant to 28 U.S.C. 157 and 1334.

proceeding within the meaning of 28 U.S.C. 157(b)(2)(D) and (M). The statutory predicates for the relief sought are sections 362 and 363 of title 11 of the United States Code 101 et seq. (the Bankruptcy Code) and Rules 4001(b) and (d) of the Federal Rules of Bankruptcy Procedure. Venue of these cases in the Central

District of California is proper under 28 U.S.C. 1408 and 1409. 2. Notice. Under the circumstances, notice of the Motion

and the interim hearing on the Notice Parties constitutes due and sufficient notice thereof and complies with all applicable Bankruptcy Rules, including Rules 2002, 4001(b), and 9014, and the local rules of this Court, and no other notice need be given. 3. Granting of Motion. The Motion is granted on an interim

basis pending a final hearing as set forth herein. 4. Use of Cash Collateral; Budget. Subject to the terms and

conditions set forth in this Interim Order, the Debtors are hereby authorized to use Cash Collateral, solely in accordance with and in compliance with the terms set forth on the initial budget prepared by the Debtors, in form and substance satisfactory to Agent and attached to this Interim Order as Exhibit A (as amended, supplemented, extended or otherwise modified from time to time, the Budget), subject to a 15% cumulative variance on a weekly basis, with any unused budgeted amount to carry-forward into subsequent weeks on the Budget. Within a reasonable time after the closing of 6

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 7 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

the Asset Sale, the Debtors shall delver to Agent a new budget that reflects the actual closing date of the Asset Sale. The new budget

shall be generally consistent with the initial Budget, but shall reflect the actual closing date of the Asset Sale. The new budget

shall be subject to the reasonable approval of Agent and, upon such approval, shall become the Budget hereunder and shall replace and supersede the earlier Budget. Thereafter, the Debtors may from

time to time submit to Agent a new proposed budget reflecting changed circumstances and, if such proposed budget is approved by Agent in its sole and absolute discretion, such new budget shall become the Budget hereunder and replace any earlier Budget. Debtors authority to use Cash Collateral shall terminate on the Termination Date (as defined below); provided, however, that the Debtors have authority to use Cash Collateral after the Termination Date to pay expenses incurred or accrued in accordance with the Budget prior to the Termination Date. The (Termination Date) The

shall be the earliest of the following: (a) June 25, 2010, if the Asset Sale has not occurred by such date, (b) October 29, 2010, if the Asset Sale occurs on or before June 25, 2010, and (c) the occurrence of an Event of Default. Compliance with the

disbursement provisions of the Budget shall be measured by line item on a cumulative basis at the end of each week. The Debtors

may request Agents consent to use Cash Collateral in excess of the budgeted amounts or beyond the Termination Date, but shall only be authorized to use such additional Cash Collateral upon receipt of Agents and Committees prior written consent or order of the Court. To the extent Agent consents to use of additional Cash

Collateral, all such additional amounts shall be governed by and 7

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 8 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

subject to the terms of this Interim Order.

In no event shall the

Cash Collateral be used by the Debtors to pay any claim arising prior to the Petition Date (including any claim arising under section 503(b)(9) of the Bankruptcy Code) unless payment of such claim shall have been approved by the Court or consented to by Agent. 5. Effect of Termination Date. Except as otherwise set

forth herein, from and after the Termination Date, the Debtors shall have no authority to use Cash Collateral of Agent or the Lenders unless authorized in writing by Agent or authorized by the Court. Notwithstanding the occurrence of the Termination Date or

anything herein to the contrary, all of the rights, remedies, benefits and protections provided to Agent and the Lenders under this Interim Order shall survive the Termination Date. 6. Cash Management. The Debtors shall maintain their

prepetition cash management arrangements as required under the Prepetition Loan Documents or maintain cash management arrangements otherwise satisfactory to the Agent. The Agent consents to the

modifications of the cash management system as set forth in the Debtors concurrently filed Emergency Motion for Entry of an Order (1) Authorizing the Continued Use of Certain Portions of the Debtors Cash Management System, and (2) Authorizing the Maintenance of Certain of the Debtors Existing Bank Accounts (the Cash Management Motion). 7. Adequate Protection. Agent and the Lenders are entitled,

pursuant to Bankruptcy Code sections 361 and 363(e), to adequate protection of their interest in the Prepetition Collateral, including the Cash Collateral, for any diminution in value of 8

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 9 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Agents or the Lenders interests in the Prepetition Collateral, including any such diminution resulting from the use by the Debtors of Cash Collateral and any other Prepetition Collateral and the imposition of the automatic stay pursuant to Bankruptcy Code section 362. As adequate protection, Agent, for the benefit of the

Lenders, will receive (a) the Replacement Lien and (b) the Superpriority Claim, each as defined below, each of which shall be subject to the Carve Out (as defined below). 8. Replacement Lien. For adequate protection of Agent and

the Lenders interests in the Prepetition Collateral, including the Cash Collateral, and the Debtors use of the same during these Chapter 11 Cases, Agent, for the benefit of the Lenders, is hereby granted, pursuant to sections 361, 363 and 552(b) of the Bankruptcy Code, a valid, binding, perfected, enforceable, unavoidable replacement lien (the Replacement Lien) upon all pre-petition assets and all assets of the Debtors estates (except any avoidance actions arising under Bankruptcy Code sections 544, 545, 546, 547, 548 or 550 of the Bankruptcy Code) (the Postpetition Collateral and together with the Prepetition Collateral, including the Cash Collateral, the Collateral), to the extent of any decrease in the value of Agents or the Lenders interests in the Prepetition Collateral occurring subsequent to the Petition Date. The sale of

Collateral to the Buyer pursuant to the Asset Sale does not constitute a decrease in the Lenders interest in the Prepetition Collateral. The Replacement Lien shall have the same validity,

priority and scope as the Prepetition Lien, except that the Replacement Lien shall be subordinate to the Carve Out and to any valid, perfected, and unavoidable liens on or security interests in 9

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 10 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

the Postpetition Collateral in existence on the Petition Date. Replacement Lien granted to Agent for the benefit of the Lenders

The

hereby shall be perfected by operation of law, and Agent shall not be required to file financing statements or other documents in any jurisdiction or to take any other action in order to validate or perfect the Replacement Lien granted hereunder. This Interim Order

shall be deemed sufficient and conclusive evidence of the Replacement Lien granted hereunder. 9. Super-Priority Administrative Claim. As additional

adequate protection, Agent for the benefit of the Lenders shall also be entitled to a superpriority administrative claim (the Superpriority Claim) pursuant to sections 503(b) and 507(b) of the Bankruptcy Code to the extent of any decrease in the value of Agents or the Lenders interests in the Prepetition Collateral occurring subsequent to the Petition Date. The sale of Collateral

to the Buyer pursuant to the Asset Sale does not constitute a decrease in the Lenders interest in the Prepetition Collateral. No costs or administrative expenses, whether incurred in, during, in connection with, on account of or prior to these Chapter 11 Cases, or in or after any conversion of either or both of these cases to chapter 7 cases, other than the Carve Out, and no priority claims, including any other super-priority claims over any and all administrative expenses of the kinds specified in sections 105, 330, 365, 503(a), 503(b) (including 503(b)(9)), 506(c), 507(a), 507(b), 546(c), 546(d), 726(d), 1113 and 1114 of the Bankruptcy Code), are or will be prior to or on parity with the Superpriority Claim.

10

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 11 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

10.

Carve Out.

The Carve Out shall mean (a) the unpaid

fees and expenses incurred by professionals retained by the Debtors and the Committee that have been approved by this Court pursuant to sections 327, 328, and 1103 or 363 of the Bankruptcy Code, (collectively, the Retained Professionals) that were incurred (i) on and after the Petition Date and before a Termination Date (both only if the Lenders terminate the Debtors use of cash collateral as a result of the occurrence of a Termination Date and the Agent delivers notice to counsel for the Debtors and the Committee informing them that Agent has exercised its right to terminate the Debtors use of cash collateral as a result of the occurrence of a Termination Date which shall be referred to herein as a Trigger Date)) but not in excess of the total aggregate amounts set forth in the Budget through October 29, 2010, and (ii) that were incurred on or after a Trigger Date in an aggregate amount not exceeding $150,000; provided that, in each case, such fees and expenses are ultimately allowed on a final basis by this Court pursuant to sections 330 and 331 of the Bankruptcy Code and are not excluded from the Carve Out under the later provisions of this paragraph; and (b) any unpaid fees payable to the U.S. Trustee and Clerk of the Bankruptcy Court pursuant to section 1930 of Title 28 of the United States Code. Nothing in this Interim Order

shall waive the right of any party to object to the allowance of any such fees and expenses of any Retained Professional. Notwithstanding any other provision of this Interim Order, no portion of the Cash Collateral or the Carve Out may be used for the payment of professional fees, disbursements, costs or expenses incurred in connection with: (w) objecting, contesting or raising 11

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 12 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

any defense to the validity, perfection, priority, or enforceability of, or any amount due under the Prepetition Loan Documents or any liens or rights granted to Agent or the Lenders under the Prepetition Loan Documents; (x) asserting any claims, actions or causes of action against Agent or any Lender or any of their respective employees, agents, affiliates, subsidiaries, directors, officers, representatives, attorneys or advisors; (y) preventing, hindering or otherwise delaying enforcement or realization by Agent or any Lender on any Prepetition Collateral; or (z) seeking to amend or modify any of the rights granted to Agent or the Lenders under this Interim Order or taking any other action adverse to the interests of Agent and Lenders or opposed by Agent and Lenders; provided, however, that no more than $25,000 in the aggregate of the Cash Collateral and the Carve-Out may be used by the Committee to analyze or investigate (but not prosecute or challenge) the Prepetition Liens. All of the claims and liens of

the Agent and the Lender shall be subordinate to the Carve Out regardless of the occurrence of the Termination Date; provided, however, that obligations constituting the Carve Out shall first be paid from any unencumbered funds of the Debtors estate before being paid from any collateral of Agent or the Lenders. The claims

and liens of Agent and the Lenders do not attach to any prebankruptcy retainers paid to any professionals employed by the Debtors, unless those retainers have been returned to the estate by order of the Court. 11. MTS. In addition to the use of Cash Collateral permitted

by Section 4 of this Order, if the Asset Sale occurs by June 25, 2010, the Debtors are authorized and directed to use Cash 12

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 13 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Collateral to pay to MTS Health Partners L.P.

("MTS") at the

closing of the Asset Sale all allowed and unpaid fees and expenses of MTS under the MTS engagement letter dated, May 13, 2010 (the "MTS Agreement") directly from the sale proceeds of the Asset Sale; provided that if the Court has not ruled on the allowance of fees and expenses sought by MTS under the MTS Agreement at the time of closing of the Asset Sale, the Debtors shall escrow an amount equal to such fees and expenses from the sale proceeds of the Asset Sale until the Court has ruled on the matter. Upon such ruling, the

escrowed funds shall be disbursed to MTS to the extent approved by the Court and any balance shall be treated the same as the balance of the Asset Sale proceeds. 12. (a) Reporting Requirements. The Debtors shall:

Continue to prepare and deliver to Agent and/or the Lenders all documents and reports required to be prepared and delivered to Agent and/or the Lenders under the Loan Documents, except as Agent may agree in writing.

(b)

Deliver to Agent on each Wednesday, (i) a comparison of the items in the Budget for the preceding week to the Debtors actual performance that includes a narrative summary of any variances from the Budget for the preceding week on a line item and on a cumulative basis, and (ii) a detailed bank account and loan balance reconciliation and report summarizing, for the previous week, (A) actual daily cash activity (including receipts of Cash Collateral), (B) expenditures of Cash Collateral (i.e., checks issued and wire transfers sent) by line item as set forth in the Budget, (C) checks cleared, and 13

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 14 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 13.

(D) items in transit, and (E) line item balances for such receipts and expenditures from the Petition Date to the close of business on the last business day of the preceding week. Monitoring of Collateral. Agent and the Lenders will

continue to have all of their rights under the Loan Documents to inspect and have access to the Debtors (including their employees and any contractors), the Debtors facilities and properties, and the Collateral. 14. Remittances. Except as explicitly set forth herein, all

payments or proceeds remitted to Agent or the Lenders pursuant to the provisions of this Interim Order or otherwise shall be received by Agent and the Lenders, free and clear of any claim, charge, assessment or other liability, including any such claim or charge arising out of or based on section 552(b) of the Bankruptcy Code, whether directly or indirectly, all of which are hereby waived by the Debtors. 15. Modification of Automatic Stay. The automatic stay of

section 362 of the Bankruptcy Code is hereby modified to the extent necessary to effectuate the provisions of this Interim Order. 16. (a) Miscellaneous. The Debtors are authorized and directed to do and perform all acts, to make, execute and deliver all instruments and documents to implement the provisions of this Interim Order. The Debtors shall also maintain any and all

insurance on their assets to the same extent that the Lenders were insured prior to the Petition Date for the full replacement value of those assets and Agent shall 14

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 15 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 (c) (b)

continue to be named as loss payees and/or as an additional insured on all insurance policies. Agent

shall be entitled to the insurance proceeds to the same extent as Agent currently holds liens or interests against the insured property. Notwithstanding anything herein, this Interim Order is without prejudice to, and does not expressly or implicitly remove, restrict, or otherwise impair, (i) any of the rights of Agent or the Lenders under the Bankruptcy Code or under non-bankruptcy law, including the right of the Lenders to (A) request additional adequate protection of their interests in the Collateral or relief from or modification of the automatic stay extant under section 362 of the Bankruptcy Code and (B)request dismissal of the Chapter 11 Cases or conversion of the Chapter 11 Cases to proceedings pursuant to Chapter 7 of the Bankruptcy Code, or (ii) any other rights, claims or privileges (whether legal, equitable or otherwise) of the Lenders. This Interim

Order is also without prejudice to the rights of the Debtors or any other party in interest to oppose any such relief sought by the Lenders. Notwithstanding anything

herein, the entry of this Interim Order shall not be deemed to constitute consent by any party to relief of the kind set forth in the preceding sentence. To the extent there exists any conflict between the terms of this Interim Order and any motion, pleading, document, agreement or term sheet, this Interim Order shall govern. 15

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 16 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 (d)

For purposes of compliance with the Budget, all Cash Collateral expended after the Petition Date shall be deemed to have been expended hereunder. The following shall constitute Events of Default hereunder: (i) use of Cash Collateral by the Debtors other than as set forth herein and as set forth in the Budget (subject to the authorized variance herein); (ii) the Debtors direct any party to make, or consent to any party making, a payment outside of the structure required under the cash management system, as may be modified pursuant to the Cash Management Motion and any order thereon; (iii) the filing by the Debtors of a request to pay (A) any prepetition claim without the consent of Agent, other than a request to honor pre-petition wages, salaries, commissions, vacation (including PTO), severance, and sick leave pay subject to the limitations set forth in section 507(a)(4) of the Bankruptcy Code, (B) any postpetition or administrative claim other than as set forth in the Budget without the consent of Agent; (iv) failure by the Debtors to comply with any reporting requirements set forth or incorporated herein (subject to the Debtors right to cure within three business days following written receipt of notice from the Agent or the Lender);

16

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 17 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

(v)

any stay, reversal, vacatur or rescission of the terms of this Interim Order, or any other modification of the terms of this Interim Order that is not acceptable to Agent;

(vi)

entry of an order by this Court dismissing either or both of these Chapter 11 Cases or converting either or both of these cases to cases under Chapter 7 of the Bankruptcy Code;

(vii)

the appointment of a trustee or the appointment of an examiner with enlarged powers in these Chapter 11 Cases unless such appointment is approved Agent;

(viii) either (A) the Prepetition Liens or (B) the Replacement Lien granted under this Interim Order shall cease to be valid, binding, perfected, enforceable and unavoidable except as set forth herein; (ix) the Debtors shall seek approval for the payment of, or shall have paid, any employee stay, retention or performance bonus without the consent of Agent; (x) the Debtors shall seek approval to modify or amend or otherwise modify or amend the Budget without the consent of Agent; (xi) failure by the Debtors to perform or comply with any other obligation contemplated by this Interim Order; or (xii) the sale of a controlling interest in the Debtors. 17

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 18 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Upon an Event of Default, the Debtors authority to use Cash Collateral pursuant to this Interim Order shall immediately terminate and Agent and the Lenders shall have the right to seek to have any request for relief from the automatic stay be heard on an expedited basis (pursuant to sections 362(d) and 362(e) of the Bankruptcy Code) as soon as the Courts schedule permits. The

Debtors reserve the right to oppose any such request for relief from the automatic stay. The Debtors also reserve the right to

seek to obtain a Court order authorizing the Debtors to continue using Cash Collateral, and Agent and the Lenders reserve the right to oppose any such request of the Debtors. 17. No Marshaling. Agent and the Lenders shall be entitled

to apply Cash Collateral received in accordance with the provisions of the Loan Documents and this Interim Order, and in no event shall Agent or the Lenders be subject to the equitable doctrine of marshaling or any other similar doctrine with respect to any of the Collateral or otherwise. 18. Modification. In the event any or all of the provisions

of this Interim Order are hereafter modified, amended or vacated by a subsequent order of this or any other court, no such modification, termination, amendment or vacation shall affect (a)the validity of any payment made to Agent or the Lenders pursuant to this Interim Order or incurred; or (ii) the validity or enforceability of any lien or priority authorized hereby. Notwithstanding any such modification, termination, amendment or vacation, any claim granted to Agent or the Lenders hereunder arising prior to the effective date of such modification, amendment or vacation shall be governed in all respects by the provisions of 18

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 19 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

this Interim Order, and Agent and the Lenders shall be entitled to all of the rights, remedies, privileges and benefits, including the liens and priorities granted herein, with respect to any such claim. 19. Headings. The headings in this Interim Order are for

reference purposes only and will not in any way affect the meaning and interpretation of the terms of this Interim Order. 20. Immediate Docketing and Effect of Order. The Clerk of

the Court is hereby directed to forthwith enter this Interim Order on the docket of this Court maintained in regard to these Cases. This Interim Order shall take effect immediately upon execution hereof, and, notwithstanding anything to the contrary contained in the Bankruptcy Rules, including Bankruptcy Rule 4001(a)(3), there shall be no stay of execution of effectiveness of this Interim Order. All objections to the entry of this Interim Order have been

withdrawn or overruled and the Motion is approved on an interim basis on the terms and conditions set forth herein. 21. Final Hearing. The Motion is set for a final hearing

(the Final Hearing) to be held at 2:00 p.m. (Pacific time) on June 3, 2010 with an objection deadline of 4:00 p.m. (Pacific time) on June 2, 2010 (the Objection Deadline). Any objection to entry

of the Final Order shall be filed with this Court, and served upon the respective counsel to the Debtors, the U.S. Trustee, the Committee, counsel to the Committee, and counsel to the Agent so as to be actually received on or before the Objection Deadline. The

Debtors shall promptly mail copies of this Interim Order (which shall constitute adequate notice of the Final Hearing) to the

19

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 20 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Notice Parties, unless such parties are on the Notice of Electronic Filing List, and any party that objected to the Motion. APPROVED AS TO FORM: WINSTON & STRAWN, LLP By:__/s/ Randy Rogers_____________ Justin E. Rawlins Randy Rogers Attorneys for GE Business Financial Services, Inc. BUCHALTER NEMER, A PROFESSIONAL CORPORATION By:__/s/ Benjamin S. Seigel_______ Benjamin S. Seigel Jeffrey K. Garfinkle [Proposed] Attorneys for the Official Committee of Unsecured Creditors The third interim cash collateral hearing is set for June 23, 2010 at 10:00 a.m. ###

DATED: June 7, 2010

United States Bankruptcy Judge

20

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 21 of 28

Desc

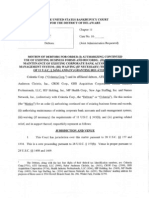

EXHIBIT "A"

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 22 of 28

Desc

In re Westcliff Laboratories / Biolabs Inc. Weekly Cash Flow Forecast Through Wind-Down As of 5/18/2010, Subject to Revision ($000s) 1 partial week 5/21/2010 FCST $ 816,343 977,365 2 5/28/2010 FCST 943,207 1,826,532 3 6/4/2010 FCST 1,201,455 1,648,510 4 6/11/2010 FCST 171,485 1,826,532 6 Outside Close Date 6/18/2010 6/25/2010 FCST FCST 979,870 164,779 1,693,805 1,802,635 5 7 7/2/2010 FCST 699,117 1,714,863 8 7/9/2010 FCST 513,943 1,525,150 9 7/16/2010 FCST 1,849,393 1,708,763 10 7/23/2010 FCST 3,315,555 438,620 11 7/30/2010 FCST 3,583,475 438,620

Beginning Cash balance Total Cash Deposits Operating Cash Disbursements: Payroll & Related Health & other Benefits Lab Supplies & Sendout Test Fees Specialty Payments Specialty Cure Payment Other G&A Outside Services LIS Vendors Office/Maintenance Rent Leases Billing and Collection Expense/Postage Telephone Utilities Insurance Legal & Professional Bus. Licenses & Taxes Employee Reimbursement Other Total Operating Cash Disbursements Operating Cash Flow Ending Cash Balance Before Non-Operating GBS Lawyers Kirkland and Ellis FTI Healthcare LNBRB Other Financial Advisors / UCC Counsel MTS Health Partners Utility and other Deposits Omni Management UST Fees Total Non-Operating Cash Disbursemen Ending Book Balance after all Vendor Paymen Reversal of uncleared checks Cash Infusion Ending Operating Cash Balance - Book

(640,000) (28,000) (85,000) (72,500) (25,000) (850,500) 126,865

(29,044) (400,000) (125,000) (75,389) (14,000) (31,250) (610,000) (32,000) (31,600) (10,000) (25,000) (1,383,283) 443,248

(1,261,250) (330,000) (400,000) (175,000) (75,389) (10,000) (31,250) (9,500) (106,091) (15,000) (25,000) (2,438,480) (789,970)

(35,000) (400,000) (125,000) (75,389) (12,008) (31,250) (65,000) (9,500) (72,500) (17,500) (25,000) (868,147) 958,385

(1,616,168) (400,000) (175,000) (75,389) (11,371) (31,250) (84,968) (25,000) (9,500) (36,250) (19,000) (25,000) (2,508,896) (815,091)

(35,000) (500,000) (25,000) (75,389) (10,308) (31,250) (120,000) (9,500) (36,250) (31,600) (19,000) (50,000) (943,297) 859,338

(1,498,939) (36,200) (200,000) -

(107,416) (3,200)

(80,995)

(500) (10,000)

(2,500)

(2,500)

(2,500)

(2,500)

(25,625) (37,473)

(14,000) (51,250) (11,250) (12,000)

(51,250) (11,250) (2,685)

(51,250) (11,250)

(50,000) (25,250) (11,250) (2,025) (1,200)

(2,500) (1,775,037) (60,174)

(2,500) (129,700) 1,395,450

(2,500) (177,601) 1,531,162

(2,500) (70,700) 367,920

(2,500) (175,720) 262,900

(75,000) (150,000) (50,000) (50,000) (100,000) (85,000) (90,000) (50,000) (10,000) 943,207 (185,000) 1,201,455 (240,000) 171,485 (150,000) 979,870 164,779 (325,000) 699,117 (125,000) 513,943 (60,000) 1,849,393 (150,000) (50,000) (100,000) (125,000)

(15,000) (50,000) (105,000) (100,000)

(65,000) 3,315,555

(100,000) 3,583,475

(40,000) (145,000) 3,701,375

943,207

$ 1,201,455

171,485

979,870

164,779

699,117

513,943

1,849,393

3,315,555

3,583,475

3,701,375

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 23 of 28

Desc

12 8/6/2010 FCST 3,701,375 438,620

13 8/13/2010 FCST 4,056,896 438,620

14 8/20/2010 FCST 4,389,684 236,697

15 8/27/2010 FCST 4,512,181 236,697

16 9/3/2010 FCST 4,595,188 236,697

17 9/10/2010 FCST 4,740,285 236,697

18 9/17/2010 FCST 4,901,445 152,128

19 9/24/2010 FCST 5,047,374 152,128

20 10/1/2010 FCST 5,087,925 152,128

21 10/8/2010 FCST 5,074,253 152,128

22 10/15/2010 FCST 5,163,027 124,843

23 10/22/2010 FCST 5,282,150 124,843

24 10/29/2010 FCST 5,306,938 124,843

(78,860) (18,100) (1,600)

(71,893) (1,600)

(60,767) (8,250)

(55,197) (800) (800)

(53,711) (3,300)

(53,711) (320)

(53,711) (640)

(2,500) (10,000)

(2,500)

(2,500)

(2,500)

(2,500) (10,000)

(2,500)

(2,500)

(2,500)

(2,500) (10,000) (50,000)

(2,500)

(2,500)

(2,500)

(2,500) (50,000)

(20,000)

(7,000)

(50,000)

(1,972) (600)

(1,797)

(1,519) (400)

(1,380)

(1,343) (400)

(1,343)

(1,343) (400)

(2,500) (33,100) 405,520

(2,500) (105,832) 332,788

(2,500) (14,200) 222,497

(2,500) (128,691) 108,007

(2,500) (16,600) 220,097

(2,500) (75,537) 161,161

(2,500) (6,200) 145,928

(2,500) (61,577) 90,551

(2,500) (65,800) 86,328

(2,500) (63,354) 88,774

(2,500) (5,720) 119,123

(2,500) (60,054) 64,789

(2,500) (111,094) 13,749

(25,000) (75,000) (100,000) (50,000) (50,000)

(25,000) (75,000)

(125,000) (150,000) 225,000 (40,000) (40,000) 5,306,938 (50,000) 5,270,687

(50,000) 4,056,896

4,389,684

(100,000) 4,512,181

(25,000) 4,595,188

(75,000) 4,740,285

4,901,445

5,047,374

(50,000) 5,087,925

(100,000) 5,074,253

5,163,027

5,282,150

4,056,896

4,389,684

4,512,181

4,595,188

4,740,285

4,901,445

5,047,374

5,087,925

5,074,253

5,163,027

5,282,150

5,306,938

(1,724,086) $ 3,546,600

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 24 of 28

Desc

1

In re:

2 3 4 5 6 7 8 9 10 11

WESTCLIFF MEDICAL LABORATORIES, INC.

Debtor(s).

CHAPTER 11 CASE NUMBER Lead Case No. 8:10-bk-16743 Jointly Administered with Case No. 8:10-bk-16746

NOTE: When using this form to indicate service of a proposed order, DO NOT list any person or entity in Category I. Proposed orders do not generate an NEF because only orders that have been entered are placed on the CM/ECF docket.

PROOF OF SERVICE OF DOCUMENT

I am over the age of 18 and not a party to this bankruptcy case or adversary proceeding. My business address is: 10250 Constellation Boulevard, Suite 1700, Los Angeles, California 90067. A true and correct copy of the foregoing document described as [AMENDED PROPOSED] INTERIM ORDER (A) AUTHORIZING USE OF CASH COLLATERAL, AND (B) GRANTING GE BUSINESS FINANCIAL SERVICES, INC. ADEQUATE PROTECTION will be served or was served (a) on the judge in chambers in the form and manner required by LBR 5005-2(d); and (b) in the manner indicated below: I. TO BE SERVED BY THE COURT VIA NOTICE OF ELECTRONIC FILING (NEF) Pursuant to controlling General Order(s) and Local Bankruptcy Rule(s) (LBR), the foregoing document will be served by the court via NEF and hyperlink to the document. On _________, I checked the CM/ECF docket for this bankruptcy case or adversary proceeding and determined that the following person(s) are on the Electronic Mail Notice List to receive NEF transmission at the email address(es) indicated below: Service information continued on attached page

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Service information continued on attached page Counsel to GE Business Financial Services, Inc. rrogers@winston.com; jrawlins@winston.com Counsel for Committee bseigel@buchalter.com; jgarfinkle@buchalter.com II. SERVED BY U.S. MAIL OR OVERNIGHT MAIL(indicate method for each person or entity served): On , I served the following person(s) and/or entity(ies) at the last known address(es) in this bankruptcy case or adversary proceeding by placing a true and correct copy thereof in a sealed envelope in the United States Mail, first class, postage prepaid, and/or with an overnight mail service addressed as follows. Listing the judge here constitutes a declaration that mailing to the judge will be completed no later than 24 hours after the document is filed. Service information continued on attached page III. SERVED BY PERSONAL DELIVERY, FACSIMILE TRANSMISSION OR EMAIL (indicate method for each person or entity served): Pursuant to F.R.Civ.P. 5 and/or controlling LBR, on June 2, 2010, I served the following person(s) and/or entity(ies) by personal delivery, or (for those who consented in writing to such service method), by facsimile transmission and/or email as follows. Listing the judge here constitutes a declaration that personal delivery on the judge will be completed no later than 24 hours after the document is filed. Via Personal Attorney Service The Hon. Theodor C. Albert United States Bankruptcy Court 411 West Fourth Street Santa Ana, CA 92701 Via E-Mail

28 21

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 25 of 28

Desc

1 2 3 4

I declare under penalty of perjury under the laws of the United States of America that the foregoing is true and correct. June 2, 2010 Date Lourdes Cruz Type Name /s/ Lourdes Cruz Signature

This form is mandatory. It has been approved for use by the United States Bankruptcy Court for the Central District of California.

5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

January 2009

F 9013-3.1

22

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 26 of 28

Desc

1

In re:

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

WESTCLIFF MEDICAL LABORATORIES, INC.

Debtor(s).

CHAPTER 11 CASE NUMBER Lead Case No. 8:10-bk-16743 Jointly Administered with Case No. 8:10-bk-16746

NOTE TO USERS OF THIS FORM: 1) Attach this form to the last page of a proposed Order or Judgment. Do not file as a separate document.

2) The title of the judgment or order and all service information must be filled in by the party lodging the order. 3) Category I. below: The United States trustee and case trustee (if any) will always be in this category. 4) Category II. below: List ONLY addresses for debtor (and attorney), movant (or attorney) and person/entity (or attorney) who filed an opposition to the requested relief. DO NOT list an address if person/entity is listed in category I.

NOTICE OF ENTERED ORDER AND SERVICE LIST

Notice is given by the court that a judgment or order entitled INTERIM ORDER (A) AUTHORIZING USE OF CASH COLLATERAL, AND (B) GRANTING GE BUSINESS FINANCIAL SERVICES, INC. ADEQUATE PROTECTION was entered on the date indicated as Entered on the first page of this judgment or order and will be served in the manner indicated below: I. SERVED BY THE COURT VIA NOTICE OF ELECTRONIC FILING (NEF) Pursuant to controlling General Order(s) and Local Bankruptcy Rule(s), the foregoing document was served on the following person(s) by the court via NEF and hyperlink to the judgment or order. As of June 2, 2010, the following person(s) are currently on the Electronic Mail Notice List for this bankruptcy case or adversary proceeding to receive NEF transmission at the email address(es) indicated below. Todd M Arnold tma@lnbrb.com Ron Bender rb@lnbrb.com Jeffrey K Garfinkle bkgroup@buchalter.com, jgarfinkle@buchalter.com Nancy S Goldenberg nancy.goldenberg@usdoj.gov Michael J Heyman michael.heyman@klgates.com Rodger M Landau rlandau@lgbfirm.com, kmoss@lgbfirm.com Michael B Lubic michael.lubic@klgates.com Jacqueline L Rodriguez jlr@lnbrb.com United States Trustee (SA) ustpregion16.sa.ecf@usdoj.gov Sharon Z Weiss sharon.weiss@hro.com Jasmin Yang jyang@swlaw.com Service information continued on attached page II. SERVED BY THE COURT VIA U.S. MAIL: A copy of this notice and a true copy of this judgment or order was sent by U.S. Mail to the following person(s) and/or entity(ies) at the address(es) indicated below:

Westcliff Medical Laboratories, Inc. 1821 E. Dyer Road, #100 Santa Ana, CA 92705

Service information continued on attached page

23

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 27 of 28

Desc

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

III. TO BE SERVED BY THE LODGING PARTY: Within 72 hours after receipt of a copy of this judgment or order which bears an Entered stamp, the party lodging the judgment or order will serve a complete copy bearing an Entered stamp by U.S. Mail, overnight mail, facsimile transmission or email and file a proof of service of the entered order on the following person(s) and/or entity(ies) at the address(es), facsimile transmission number(s) and/or email address(es) indicated below: Service information continued on attached page

This form is mandatory. It has been approved for use by the United States Bankruptcy Court for the Central District of California.

January 2009

F 9021-1.1

24

Case 8:10-bk-16743-TA Doc 110 Filed 06/09/10 Entered 06/09/10 22:41:33 Imaged Certificate of Service Page 28 of 28

Desc

CERTIFICATE OF NOTICE

User: admin Form ID: pdf031 Page 1 of 1 Total Noticed: 18

District/off: 0973-8 Case: 10-16743

Date Rcvd: Jun 07, 2010

The following entities were noticed by first class mail on Jun 09, 2010. db +Westcliff Medical Laboratories, Inc., 1821 E. Dyer Road, #100, Santa Ana, CA 92705-5700 aty +Andy Kong, Arent Fox LLP, 555 W Fifth St Ste 4800, Los Angeles, CA 90013-1065 aty Aram Ordubegian, Arent Fox LLP, 555 W 5th St 48th Fl, Los Angeles, CA 90013-1065 aty +Jacqueline L Rodriguez, 10250 Constellation Blvd Ste 1700, Los Angeles, CA 90067-6253 aty +Jeffrey K Garfinkle, Buchalter Nemer, 18400 Von Karman Ave Ste 800, Irvine, CA 92612-0514 aty Jennifer Witherell Crastz, 15910 Ventura Blvd 12th Flr, Encino, CA 91436-2829 aty +Michael B Lubic, 601 S Figueroa St Ste 1500, Los Angeles, CA 90017-5720 aty +Michael J Heyman, 10100 Santa Monica Blvd, 7th Flr, Los Angeles, CA 90067-4003 aty Nancy S Goldenberg, 411 W Fourth St Ste 9041, Santa Ana, CA 92701-8000 aty +Richard L Barnett, 5450 Trabuco Road, Irvine, CA 92620-5704 aty +Rodger M Landau, Landau Gottfried & Berger LLP, 1801 Century Park E Ste 1460, Los Angeles, CA 90067-2316 aty +Ron Bender, 10250 Constellation Blvd Ste 1700, Los Angeles, CA 90067-6253 aty +Sharon Z Weiss, Holme Roberts & Owen LLP, 800 W Olympic Blvd 4th, Los Angeles, CA 90015-1360 aty +Todd M Arnold, Levene, Neale, Bender, Rankin & Bri, 10250 Constellation Blvd Ste 1700, Los Angeles, CA 90067-6253 ust +United States Trustee (SA), 411 W Fourth St., Suite 9041, Santa Ana, CA 92701-8000 cr +Beckman Coulter, Inc., c/o Hemar, Rousso & Heald, LLP, 15910 Ventura Blvd., 12th Floor, Encino, CA 91436-2802 cr +Enterprise Rent-A-Car of Los Angeles, dba Enterpri, 17210 South Main Street, Attn: Michael Gerges, Gardena, CA 90248-3130, UNITED STATES OF AMERICA intp +Laboratory Corporation of America, c/o K&L Gates LLP, 10100 Santa Monica Blvd., 7th Floor, Los Angeles, CA 90067-4003 The following entities were noticed by electronic transmission. NONE. intp crcm cr cr cr intp ***** BYPASSED RECIPIENTS (undeliverable, * duplicate) ***** Courtesy NEF Creditors Committee Grifols USA LLC Mission Hospital Regional Medical Center dba Missi Roche Diagnostics Corporation Specialty Laboratories, Inc. TOTALS: 6, * 0 Addresses marked + were corrected by inserting the ZIP or replacing an incorrect ZIP. USPS regulations require that automation-compatible mail display the correct ZIP. TOTAL: 0

I, Joseph Speetjens, declare under the penalty of perjury that I have sent the attached document to the above listed entities in the manner shown, and prepared the Certificate of Notice and that it is true and correct to the best of my information and belief. Meeting of Creditor Notices only (Official Form 9): Pursuant to Fed. R. Bank. P. 2002(a)(1), a notice containing the complete Social Security Number (SSN) of the debtor(s) was furnished to all parties listed. This official court copy contains the redacted SSN as required by the bankruptcy rules and the Judiciarys privacy policies.

Date: Jun 09, 2010

Signature:

You might also like

- Filed & Entered: United States Bankruptcy Court Central District of California Santa Ana DivisionDocument27 pagesFiled & Entered: United States Bankruptcy Court Central District of California Santa Ana DivisionChapter 11 DocketsNo ratings yet

- Iran-United States Claims Arbitration: Debates on Commercial and Public International LawFrom EverandIran-United States Claims Arbitration: Debates on Commercial and Public International LawNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument34 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Bar Review Companion: Remedial Law: Anvil Law Books Series, #2From EverandBar Review Companion: Remedial Law: Anvil Law Books Series, #2Rating: 3 out of 5 stars3/5 (2)

- United States Bankruptcy Court Southern District of New YorkDocument36 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Proposed Attorneys For Debtor and Debtor in PossessionDocument39 pagesProposed Attorneys For Debtor and Debtor in PossessionChapter 11 DocketsNo ratings yet

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument24 pagesJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument24 pagesJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument24 pagesJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Central District of California Riverside DivisionDocument57 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Rep 2910015757Document53 pagesRep 2910015757Fola AlamudunNo ratings yet

- GGP Dip OrderDocument525 pagesGGP Dip OrderChris AllevaNo ratings yet

- Doc. 153-1 - Affidavit of R. Lance FloresDocument13 pagesDoc. 153-1 - Affidavit of R. Lance FloresR. Lance FloresNo ratings yet

- /Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Document29 pages/Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument34 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDocument12 pagesFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 DocketsNo ratings yet

- Motion of The Debtors For An Order Establishing Procedures For Monthly and Quarterly Compensation and Reimbursement of Expenses of ProfessionalsDocument18 pagesMotion of The Debtors For An Order Establishing Procedures For Monthly and Quarterly Compensation and Reimbursement of Expenses of ProfessionalsChapter 11 DocketsNo ratings yet

- (Ii) (Iii) (Iv)Document55 pages(Ii) (Iii) (Iv)Chapter 11 DocketsNo ratings yet

- Original: Et Al.Document15 pagesOriginal: Et Al.Chapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument12 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- VVCH Emerg MotionDocument118 pagesVVCH Emerg Motionchristina_jewettNo ratings yet

- BAY:01512259 VLDocument15 pagesBAY:01512259 VLChapter 11 DocketsNo ratings yet

- Et Al.,: (II) (III)Document17 pagesEt Al.,: (II) (III)Chapter 11 DocketsNo ratings yet

- II 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenDocument10 pagesII 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of New Jersey: Counsel For The Debtor/Debtor-In-PossessionDocument6 pagesUnited States Bankruptcy Court District of New Jersey: Counsel For The Debtor/Debtor-In-PossessionoldhillbillyNo ratings yet

- Interim DIP Order Https - Ecf - Nysb.uscourts - Gov - Cgi-Bin - Show - Temp - PL - File 9662395-0-Nysb-27735Document46 pagesInterim DIP Order Https - Ecf - Nysb.uscourts - Gov - Cgi-Bin - Show - Temp - PL - File 9662395-0-Nysb-27735Dov KleinerNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document10 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument13 pagesUnited States Court of Appeals, Fourth CircuitScribd Government Docs100% (1)

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- BAY:01513641 VLDocument59 pagesBAY:01513641 VLChapter 11 DocketsNo ratings yet

- Et Al./: These CasesDocument34 pagesEt Al./: These CasesChapter 11 DocketsNo ratings yet

- 11 G.R. No. 138544 October 3, 2000 SECURITY BANK AND TRUST COMPANY, Inc., Petitioner, vs. RODOLFO M. CUENCA, Respondent.Document11 pages11 G.R. No. 138544 October 3, 2000 SECURITY BANK AND TRUST COMPANY, Inc., Petitioner, vs. RODOLFO M. CUENCA, Respondent.Joselle MarianoNo ratings yet

- Ft'y'te/: IN The United Bankruptcy Court The District DelawareDocument6 pagesFt'y'te/: IN The United Bankruptcy Court The District DelawareChapter 11 DocketsNo ratings yet

- BP Oil Spill: Plaintiffs Steering Committee Report and Memorandum in Support of Reserve FundDocument43 pagesBP Oil Spill: Plaintiffs Steering Committee Report and Memorandum in Support of Reserve FundGeorge ConkNo ratings yet

- Ref. Docket Nos. 18, 47, 50 and 179Document51 pagesRef. Docket Nos. 18, 47, 50 and 179Chapter 11 DocketsNo ratings yet

- 2017 CFPB Ocwen-ComplaintDocument93 pages2017 CFPB Ocwen-ComplaintkmccoynycNo ratings yet

- Lead Case No. 8:10-bk-16743-TADocument29 pagesLead Case No. 8:10-bk-16743-TAChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument10 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- In Re:) : Debtors.)Document16 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Objection Deadline: November 3, 2011 at 4:00 P.M. (ET) Hearing Date: November 22, 2011 at 4:00 P.M. (ET)Document12 pagesObjection Deadline: November 3, 2011 at 4:00 P.M. (ET) Hearing Date: November 22, 2011 at 4:00 P.M. (ET)Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument34 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- 10000005545Document49 pages10000005545Chapter 11 DocketsNo ratings yet

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsDocument16 pagesMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaNo ratings yet

- Objection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Document20 pagesObjection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- Counsel To The Second Lien LendersDocument21 pagesCounsel To The Second Lien LendersChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument9 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefDocument34 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefChapter 11 DocketsNo ratings yet

- Et Al./: (II) (III)Document15 pagesEt Al./: (II) (III)Chapter 11 DocketsNo ratings yet

- Objection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Document19 pagesObjection Deadline: September 4, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsNo ratings yet

- 10000005126Document687 pages10000005126Chapter 11 DocketsNo ratings yet

- Order Confirming Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocument30 pagesOrder Confirming Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsNo ratings yet

- Ref. Docket Nos. 922 and 1287Document3 pagesRef. Docket Nos. 922 and 1287Chapter 11 DocketsNo ratings yet

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument17 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument38 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Motion of The Debtors For An Order Authorizing The Debtors To (I) Continue All Insurance Policies and Related Agreements and Honor Related ObligationsDocument22 pagesMotion of The Debtors For An Order Authorizing The Debtors To (I) Continue All Insurance Policies and Related Agreements and Honor Related ObligationsChapter 11 DocketsNo ratings yet

- CFPB Consent Order Portfolio Recovery Associates LLCDocument60 pagesCFPB Consent Order Portfolio Recovery Associates LLCSamuelNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Magdusa Vs Albaran and Villareal Vs RamirezDocument3 pagesMagdusa Vs Albaran and Villareal Vs RamirezrebellefleurmeNo ratings yet

- Principle of MasyaqqahDocument36 pagesPrinciple of MasyaqqahMahyuddin Khalid100% (2)

- In The United States Bankruptcy Court For The District of DelawareDocument7 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNo ratings yet

- Bhel Ratio AnalysisDocument5 pagesBhel Ratio AnalysisPuja AryaNo ratings yet

- Fall of Maytas Infra financials pre-post SatyamDocument23 pagesFall of Maytas Infra financials pre-post SatyamSrikanth SeelamNo ratings yet

- IBC, 2016 (1-20 PG)Document20 pagesIBC, 2016 (1-20 PG)C.A Dhwanik ShahNo ratings yet

- Lyme Regis Partners V Carl IcahnDocument32 pagesLyme Regis Partners V Carl IcahnDallasObserverNo ratings yet

- Fria Case DigestsDocument11 pagesFria Case DigestsRegion Ten100% (2)

- Working CapitalDocument62 pagesWorking CapitalSahil SethiNo ratings yet

- MBTC v. IEBDocument2 pagesMBTC v. IEBDGDelfinNo ratings yet

- CIMB Bank Facility Agreement SummaryDocument64 pagesCIMB Bank Facility Agreement SummaryfitrazminNo ratings yet

- China Banking v. CADocument6 pagesChina Banking v. CAVeraNataaNo ratings yet

- Adam Tracy SuspendedDocument39 pagesAdam Tracy SuspendedjaniceshellNo ratings yet

- Question Text: Complete Mark 1.00 Out of 1.00Document6 pagesQuestion Text: Complete Mark 1.00 Out of 1.00Aerl XuanNo ratings yet

- 07-21-12 EditionDocument27 pages07-21-12 EditionSan Mateo Daily JournalNo ratings yet

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDocument1 page1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaNo ratings yet

- Uncitral Model LawDocument3 pagesUncitral Model Lawyalini tholgappianNo ratings yet

- Memorandum and Articles of Association SHARE COMPANY Tentatively DraftedDocument9 pagesMemorandum and Articles of Association SHARE COMPANY Tentatively DraftedAbenezer A Gebremedhin100% (11)

- Mortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001Document5 pagesMortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001CHANDAN KUMARNo ratings yet

- Peter Paul's Answer To Stan Lee's 2nd Amend ComplaintDocument31 pagesPeter Paul's Answer To Stan Lee's 2nd Amend Complaintstanleemedia4No ratings yet

- Hostess Motion To Appoint Chapter 11 TrusteeDocument15 pagesHostess Motion To Appoint Chapter 11 TrusteeChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court For Southern District of New YorkDocument23 pagesIn The United States Bankruptcy Court For Southern District of New YorkChapter 11 DocketsNo ratings yet

- Bir Estate TaxDocument4 pagesBir Estate Taxlonitsuaf100% (1)

- Dnata - SGHA 2008Document202 pagesDnata - SGHA 2008chaouch.najehNo ratings yet

- Chapter 4Document5 pagesChapter 4Pauline Perez100% (2)

- Manila Surety and Fidelity Co., InC. vs. CADocument2 pagesManila Surety and Fidelity Co., InC. vs. CAApril Grace TenorioNo ratings yet

- ADJUSTMENTS AT FINANCIAL PERIOD ENDDocument18 pagesADJUSTMENTS AT FINANCIAL PERIOD ENDTevabless Suoived SpotlightbabeNo ratings yet

- Register Partnership FirmDocument5 pagesRegister Partnership FirmPrasadNo ratings yet

- Background Report: Pete SantilliDocument10 pagesBackground Report: Pete Santilliapi-139412189No ratings yet

- 2014-07-01 - Moneysaver - Lewis-Clark EditionDocument16 pages2014-07-01 - Moneysaver - Lewis-Clark EditionDavid ArndtNo ratings yet

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsFrom EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsRating: 4 out of 5 stars4/5 (18)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- Nolo's Essential Guide to Buying Your First HomeFrom EverandNolo's Essential Guide to Buying Your First HomeRating: 4 out of 5 stars4/5 (43)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionFrom EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionRating: 5 out of 5 stars5/5 (1)

- Form Your Own Limited Liability Company: Create An LLC in Any StateFrom EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNo ratings yet

- Everybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeFrom EverandEverybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedFrom EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNo ratings yet

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Nolo's Essential Guide to Child Custody and SupportFrom EverandNolo's Essential Guide to Child Custody and SupportRating: 4 out of 5 stars4/5 (1)