Professional Documents

Culture Documents

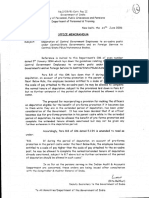

DCC Bank

Uploaded by

Nicolas ShepherdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCC Bank

Uploaded by

Nicolas ShepherdCopyright:

Available Formats

After Bifurcation from Madurai District Central Cooperative Bank, Dindigul Central Co-operative Bank was formed and

started its functions from 01-06-1991. Its area of operation consist of 7 Taluk and 14 Blocks. Details of Bank Branches and PACBs are furnished below. DISTRICT CENTRAL COOPERATIVE BANKS (DCCB) schemes and services The central co-operative banks are located at the district headquarters or some prominent town of the district. These banks have a few private individuals also who provide both finance and management. The central co-operative banks have three sources of funds, Their own share capital and reserves Deposits from the public and Loans from the state co-operative banks

Their main function is the banks are To meet the credit requirements of member-societies To perform banking business To act as balancing centre for the PACS by diverting the surplus funds of some societies to those which face shortage of funds To undertake non-credit activities To maintain close and continuous contact with PACS and provide leadership and guidance to them To supervise and inspect the PACS and To provide a safe place for the investment of the resources of PACs

There are 23 District Central Cooperative Banks in the State with 717 branches mostly in rural areas to serve the Primary Agricultural Cooperative Banks and the rural public. In addition, they meet the credit needs of dairy, handlooms, sugar and such other affiliated cooperatives. They also lend directly to the public for non-agricultural purposes within the area of operation of their branches.

ADDRESS OF DISTRICT CENTRAL COOPERATIVE BANKS S.No ADDRESS TELEPHONE FAX

1. Chennai Central Cooperative Bank Ltd. No. 114/1, prakasam salai, broadway p.o.,215, chennai city Chennai - 600 108. 044 25387771 25381102/25381103 25381087

2. Coimbatore District Central Cooperative bank Ltd. P.b.no.3781, Coimbatore DCCB building Central p.o., 80, SBI road, Coimbatore - 641 018. 0422-2302447/2302448 2302449 2300436

3.

Cuddalore District Central Cooperative Bank Lltd. P. B. No. 1, no. 1a beach road, Head post office, Bharathi road Cuddalore - 607 001 04142-295911/295912 295913 295916

4. Dharmapuri District Central Cooperative bank Ltd. Arignar anna Pavala Vizha Ninaivu building Ninaivu bldg., H. P. O. , Netaji by-pass rd., Dharamapuri - 636 701. 04342-262168/260181 260051/260571 260181

5. Dindigul Central Cooperative Bank Ltd. Dindigul CCB building, Balkrishnapuram post office, trichy rd. Dindigul - 624 005 0451-2433153/2421830 2420158 2421430

6. Erode District Central Cooperative Bank Ltd. P.b.no.558, administrative office door 1, P.o. Karungapalayam, bhavani main road, Erode - 638 003. 0424-2213401/2213402 2213403/2213404 2210530

7. Kancheepuram Central Cooperative Bank Ltd. P.b.no. 9, 2nd floor, vedachalam bldg., 15-g, sheikpet north street, railway rd. Kancheepuram - 631 501. 044-27222296/27222297 27222298 27222064

8. Kanyakumari District Central Cooperative Bank Ltd. P.B.no.18, door no.15/8-21, Ramchandra Nadar bldg.,no.y-11,Alexandra Press rd., Nagercoil - 629 001. 04652-222684/233384

232864 232864

9. Kumbakonam Central Cooperative Bank Ltd. P. B. No. 2, Ramlingam building, No. 2, t.s.r. Big street, Kumbakonam - 612 001. 0435-2430619 2430073 2431220 2431220

10. Madurai District Central Cooperative Bank Ltd. P.b.no.14, 187, north veli street, Head post office, district madurai Madurai - 625 001. 0452-2342051/2342052 2342053/2342054 2345747

11. Nilgiries Central Cooperative Bank Ltd. P.b.no.47, ndcc bank bldg.,charing cross

Commercial road, udhagamandalam Udhagamandalam - 643 001. 0423-2441254/2441271 2441255/2443978 2442764

12. Pudukkottai Central Cooperative Bank Ltd. P. B. No. 62, t. S. No. 823/824, ramabhavanam, East main street, p. O. & distt. Pudukkottai Pudukkottai - 622 001. 04322-222063/222389 225300 222313

13. Ramanathapuram District Central Coop. Bank Ltd. P. B. No. 25, 265-e, vandikkara street, Ramanathapuram head p.o., palace road, Ramanathpuram - 623 501. 04567-221245/220240 220008/220149 20018

14.

Salem District Central Cooperative Bank Ltd. P.b.no.171, 65 a, Salem Central Cooperative Bank Building, Salem head P.O., Cherry road, Dist.Salem - 636 001. 0427-2451761/2451762 2451763/2451764-65 2450647

15. Sivagangai Dist. Central Cooperative Bank Ltd. P.b.no.3, coop. Bank bildg., 2nd foor, 163, gandhi road, at & p.o. Sivagangai Sivagangai - 630 561. 04575-240654 240645 241180

16. Thanjavur Central Cooperative Bank Ltd. P. B. No.331, ramalingasamy memorial bldg., West main street, srinivaspuram p. O. Thanjavur - 613 009 04362-223322/223422 224017 223284

17. Thiruvannamalai Sambuvarayar District Central No. 9, 6th cross street., Gandhi nagar Main Post Office, Tindivanam road Thiruvannamalai- 606 601. 04175-224814 224331 224332

18. Thoothukudi Dist. Central Cooperative Bank Ltd. P. B. No. 4, DCCB building, . 109/5d, w. GC.Road Mellur post office, ettayapuram road Thoothukudi - 628 002. 0461-2347604/2347605 2347606 2347607

19. Tiruchirapalli District Central Coop. Bank ltd. P. B. No. 324, 1, fort station rd, P.o. Teppakulam, district tiruchirapalli Tiruchirapalli - 620 002. 0431-2702441/2702442

2702443 2702071

20. Tirunelveli central cooperative bank ltd. Dr. M.g.r. Maligai vannarpet., P.o. Vannarpet, no. 4, trivandrum rd. Tirunelveli - 627 003. 0462-2500281 2500282/2500283 433289

21. Vellore District Central Cooperative Bank ltd. Vellore DCCB Ltd. No. 3, Officers Lane , H. P. O., Thorappadi Road Vellore - 632 001 0416-2220522 2232524 2222634

22. Villupuram District Central Cooperative Bank Ltd. P.b.no.18, Bank Bldg., Trichy Trunk Road, No. 2, govt. Hospital rd, Villupuram post

Villupuram - 605 602. 04146-224802/224803 221020 224801

23. Virudhunagar Dist. Central Cooperative Bank Ltd. P.b.no.8, V.C.C Bank bldg., r.k. 10, 104/1, Madurai road,Virudhunagar H.P.O. Virudhunagar - 626 001. 04562- 245815/244589 245497 2 Various deposits scheme performance in

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses.Contents [hide] 1 Institutions 1.1 Credit unions 1.2 Cooperative banks 1.3 Building societies 1.4 Others 1.5 International associations 2 By region 2.1 Quebec 2.2 United Kingdom 2.3 Continental Europe 2.4 United States 2.5 India 3 Microcredit and microfinance 4 List of cooperative banking institutions 5 See also 6 References 7 External links

[edit] Institutions [edit]

Credit unions Main article: Credit union

Credit unions have the purpose of promoting thrift, providing credit at reasonable rates, and providing other financial services to its members.[1] Its members are usually required to share a common bond, such as locality, employer, religion or profession, and credit unions are usually funded entirely by member deposits, and avoid outside borrowing. They are typically (though not exclusively) the smaller form of cooperative banking institution. In some countries they are restricted to providing only unsecured personal loans, whereas in others, they can provide business loans to farmers, and mortgages.

[edit] Cooperative banks

Larger institutions are often called cooperative banks. Some are tightly integrated federations of credit unions, though those member credit unions may not subscribe to all nine of the strict principles of the World Council of Credit Unions (WOCCU).

Like credit unions, cooperative banks are owned by their customers and follow the cooperative principle of one person, one vote. Unlike credit unions, however, cooperative banks are often regulated under both banking and cooperative legislation. They provide services such as savings and loans to nonmembers as well as to members, and some participate in the wholesale markets for bonds, money and even equities.[2] Many cooperative banks are traded on public stock markets, with the result that they are partly owned by non-members. Member control is diluted by these outside stakes, so they may be regarded as semi-cooperative.

Cooperative banking systems are also usually more integrated than credit union systems. Local branches of cooperative banks elect their own boards of directors and manage their own operations, but most strategic decisions require approval from a central office. Credit unions usually retain strategic decisionmaking at a local level, though they share back-office functions, such as access to the global payments system, by federating.

Some cooperative banks are criticized for diluting their cooperative principles. Principles 2-4 of the "Statement on the Co-operative Identity" can be interpreted to require that members must control both the governance systems and capital of their cooperatives. A cooperative bank that raises capital on public stock markets creates a second class of shareholders who compete with the members for control. In some circumstances, the members may lose control. This effectively means that the bank ceases to be a cooperative. Accepting deposits from non-members may also lead to a dilution of member control. [edit] Building societies Main article: Building society

Building societies exist in Britain, Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, their purpose is to provide home mortgages for members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. In the United Kingdom, regulations permit up to half of their lending to be funded by debt to non-members, allowing societies to access wholesale bond and money markets to fund mortgages. The world's largest building society is Britain's Nationwide Building Society. [edit] Others

Mutual savings banks and mutual savings and loan associations were very common in the 19th and 20th centuries, but declined in number and market share in the late 20th century, becoming globally less significant than cooperative banks, building societies and credit unions.

Trustee savings banks are similar to other savings banks, but they are not cooperatives, as they are controlled by trustees, rather than their depositors. [edit] International associations

The most important international associations of cooperative banks, both based in Brussels, are the International Association of Cooperative Banks (CIBP), which has member institutions from around the world, and the European Association of Co-operative Banks. [edit] By region [edit] Quebec

The caisse populaire movement started by Alphonse Desjardins in Quebec, Canada, pioneered credit unions. Desjardins opened the first credit union in North AmericaiIn 1900, from his home in Lvis, Quebec, marking the beginning of the Mouvement Desjardins. He was interested in bringing desperately needed financial protection to working people. [edit] United Kingdom

British building societies developed into general-purpose savings and banking institutions with one member, one vote ownership and can be seen as a form of financial cooperative (although some demutualised into conventionally-owned banks in the 1980s and 1990s). The UK Co-operative Group includes both an insurance provider, the CIS, and the Co-operative Bank, both noted for promoting ethical investment. [edit] Continental Europe

Important continental cooperative banking systems include the Crdit Agricole, Crdit Mutuel, Banque Populaire and Caisse d'pargne in France, Rabobank in the Netherlands, BVR/DZ Bank in Germany, Banco Popolare, UBI Banca and Banca Popolare di Milano in Italy, Migros and Coop Bank in Switzerland, and the Raiffeisen system in several countries in central and eastern Europe. The cooperative banks that are members of the European Association of Co-operative Banks have 130 million customers, 4 trillion euros in assets, and 17% of Europe's deposits. The International Confederation of Cooperative Banks (CIBP) is the oldest association of cooperative banks at international level.

In Scandinavia, there is a clear distinction between mutual savings banks (Sparbank) and true credit unions (Andelsbank). [edit] United States This section requires expansion. (July 2011)

[edit] India

The origins of the cooperative banking movement in India can be traced to the close of 19th century when, inspired by the success of the experiments related to the cooperative movement in Britain and the cooperative credit movement in Germany, such societies were set up in India. Cooperative banks are an important constituent of the Indian financial system. They are the primary financiers of agricultural activities, some small-scale industries and self-employed workers. The Anyonya Co-operative Bank in India is considered to have been the first cooperative bank in Asia. [edit] Microcredit and microfinance

The more recent phenomena of microcredit and microfinance are often based on a cooperative model They focus on small business lending. In 2006, Muhammad Yunus, founder of the Grameen Bank in Bangladesh, won the Nobel Peace Prize for his ideas regarding development and his pursuit of the microcredit concept.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sharp MX2310U Technical Handy ManualDocument64 pagesSharp MX2310U Technical Handy ManualUserNo ratings yet

- Elasticity of DemandDocument64 pagesElasticity of DemandWadOod KhAn100% (1)

- The Future of The Indian Print Media Ind PDFDocument22 pagesThe Future of The Indian Print Media Ind PDFAdarsh KambojNo ratings yet

- DLL Tle 6 Ict Entrepreneurship 6Document32 pagesDLL Tle 6 Ict Entrepreneurship 6Jewels Garcia100% (1)

- Office of The Controller of Examinations Anna University:: Chennai - 600 025Document4 pagesOffice of The Controller of Examinations Anna University:: Chennai - 600 025M.KARTHIKEYANNo ratings yet

- 2022 Semester 2 Letter To Parents - FinalDocument7 pages2022 Semester 2 Letter To Parents - FinalRomanceforpianoNo ratings yet

- Case Study ON: The Spark Batteries LTDDocument8 pagesCase Study ON: The Spark Batteries LTDRitam chaturvediNo ratings yet

- Research career paths in Spain: funding opportunities overviewDocument7 pagesResearch career paths in Spain: funding opportunities overviewfidalgocastroNo ratings yet

- University of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Document5 pagesUniversity of The West of England (Uwe) : Bristol Business School MSC Management (International Human Resource Management)Olusegun_Spend_3039No ratings yet

- z2OrgMgmt FinalSummativeTest LearnersDocument3 pagesz2OrgMgmt FinalSummativeTest LearnersJade ivan parrochaNo ratings yet

- E. Market Size PotentialDocument4 pagesE. Market Size Potentialmesadaeterjohn.studentNo ratings yet

- What Is Propaganda DeviceDocument3 pagesWhat Is Propaganda DeviceGino R. Monteloyola100% (1)

- Parents Day Script - PDF - Schools - LeisureDocument17 pagesParents Day Script - PDF - Schools - LeisureNAIDU SHAKEENANo ratings yet

- Proforma PromotionDocument1 pageProforma PromotionRavinderSinghNo ratings yet

- Grate Inlet Skimmer Box ™ (GISB™ ) Suntree Technologies Service ManualDocument4 pagesGrate Inlet Skimmer Box ™ (GISB™ ) Suntree Technologies Service ManualOmar Rodriguez OrtizNo ratings yet

- Validate Internet Backbone Routing and SwitchingDocument27 pagesValidate Internet Backbone Routing and SwitchingThành Trung NguyễnNo ratings yet

- Indian companies involved in trade dispute caseDocument15 pagesIndian companies involved in trade dispute caseakshay daymaNo ratings yet

- Thesis Statement About Plastic BagsDocument7 pagesThesis Statement About Plastic Bagslyjtpnxff100% (2)

- G.R. No. 226140 - People Vs EspirituDocument24 pagesG.R. No. 226140 - People Vs EspirituAlfred Robert BabasoroNo ratings yet

- In Gov cbse-SSCER-191298202020 PDFDocument1 pageIn Gov cbse-SSCER-191298202020 PDFrishichauhan25No ratings yet

- Stock Futures Are Flat in Overnight Trading After A Losing WeekDocument2 pagesStock Futures Are Flat in Overnight Trading After A Losing WeekVina Rahma AuliyaNo ratings yet

- Lesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019Document2 pagesLesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019mNo ratings yet

- 2018 Price List: Account NumberDocument98 pages2018 Price List: Account NumberPedroNo ratings yet

- Draft ASCE-AWEA RecommendedPracticeDocument72 pagesDraft ASCE-AWEA RecommendedPracticeTeeBoneNo ratings yet

- BVM Type B Casing Tong ManualDocument3 pagesBVM Type B Casing Tong ManualJuan Gabriel GomezNo ratings yet

- The Mpeg Dash StandardDocument6 pagesThe Mpeg Dash Standard9716755397No ratings yet

- Draft SemestralWorK Aircraft2Document7 pagesDraft SemestralWorK Aircraft2Filip SkultetyNo ratings yet

- VVIP Circuit House achieves 5-star GRIHA ratingDocument1 pageVVIP Circuit House achieves 5-star GRIHA ratingmallikaNo ratings yet

- 1 s2.0 S0313592622001369 MainDocument14 pages1 s2.0 S0313592622001369 MainNGOC VO LE THANHNo ratings yet

- My Sweet Beer - 23 MaiDocument14 pagesMy Sweet Beer - 23 Maihaytem chakiriNo ratings yet