Professional Documents

Culture Documents

CAATs For Auditing in Real World

Uploaded by

Harun Raaj GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAATs For Auditing in Real World

Uploaded by

Harun Raaj GuptaCopyright:

Available Formats

Use of CAATs in the Real World

Babu Jayendran B.Sc(Hons), FCA, CISA I am a great supporter of the Institutes initiative in introducing Practical Computer Training for CA Students. I will endeavor in this article to highlight some of the practical aspects of using CAATs by an auditor, with examples linked to the syllabus, so that the student will appreciate the power of this tool, in this digital age.

Use

CAATs (Computer Aided Audit Techniques) may be used for performing various auditing procedures, including the following:

Tests of details of transactions and balances. For example, sales below cost can be extracted to check for appropriate approvals. Analytical procedures, for example, identifying inconsistencies or significant fluctuations in costs. Tests of general controls, for example, reviewing the access control by extracting the operational and management rights of different system objects in an organization. Use of Sampling Techniques to extract data for audit testing. For example, attribute sampling for physical inventory counts. Tests of application controls for example, testing the functioning of a programmed control and Re-performing calculations and checking the accuracy.

Scope

Software and data used by an auditor to carry out audit tests, on data of audit significance, residing in an organisations databases can be termed as CAATs. The data may be master or transaction data pertaining to the organisations business operations or operating system level information and parameters for controlling the computer operations, access security etc. The auditor can use CAATs to review those files to gain evidence of the existence and operation of those controls. CAATs may consist of generalised audit software bought off the shelf, specifically written programs, utility programs or system tools.

a) Generalised Audit Software

Such software are designed to perform the following functions:

Import files from any other source Compute statistics for all numeric and date fields within a database. For each numeric field, values such as net, maximum, minimum and average values as well as numbers of debit, credit and zero value items are provided. For each date field, statistics provide information such as the earliest and latest dates and daily and monthly analyses of numbers of transactions. Maintains an audit trail or log of all operations carried out on a database. Extractions, or exception testing, are used to identify items, which satisfy a specific characteristic. Provides functions, which can be used for date arithmetic, text manipulation and conversion and numerical, financial and statistical calculations.

Databases can be joined to combine fields from two databases into a single database for testing or test for data, which matches or does not match across files. Files can be joined or matched if they contain a common link (referred to as the "key") e.g. part number if joining the pricing and inventory files.

The Append Databases option can be used to append or concatenate two or more files into a single database for audit testing. For example, you may append 12 monthly payroll files to produce a database of all payroll transactions for the year. The database could then be summarized by Employee to produce year-to-date gross, net, tax, deductions, etc. The Compare option can be used to identify differences in a numeric field within two files for a common key. Files could be compared at two points in time, e.g. the payroll at the beginning and end of the month to identify changes in salary for each employee. You can also compare a numeric field from different systems, e.g. the quantity of inventory on the inventory master file versus the quantity of inventory on the inventory count file. Duplicate items in a database can be identified. e.g. duplicate invoice numbers, duplicate account numbers, duplicate addresses or duplicate insurance or benefit claims. Databases can be searched for gaps in numeric or date sequence, or alphanumeric sequences. E.g., Missing invoice numbers etc. The Sort option is used to create a new database physically sorted in the specified order for easy review. The Chart Data option can be used to graph data files or test results, in bar, stacking bar, pie, plot or area charts.

Numeric Stratification, Character Stratification and Date Stratification are powerful tools used to total the number and value of records within specified bands. Examples of use include analyzing items by postal code or alphanumeric product code or fixed assets by date of acquisition. The Quick Summarization function can be used to accumulate the values of numeric fields for each unique key where there is a single field in the key. The Aging function can be used to age a file from a specified date. Pivot Tables allows users to create multi-dimensional, multi-variable analysis of large data files. Sampling methods together with the ability to calculate sample sizes based on parameters entered and evaluate the results of sampling tests. Some of the sampling methods available are systematic (e.g. every 1000th record), random (number of items chosen purely at random), stratified random (a specified number of items selected randomly from within range bands), and monetary unit (e.g. every 1000th monetary unit). It also provides an Attribute Planning and Evaluation option, which can be used to calculate sample sizes, confidence levels, error limits and number of sample errors. These calculations are used to plan and then evaluate the results of the samples.

b) Specifically-Written Programs

These programs are specifically developed for the auditor to perform a specific audit test.

c) Utility Programs

These programs are used to perform common data processing functions, such as sorting, creating, and printing files and are generally not designed for audit purposes. Therefore they will not have the functionalities provided in Generalised Audit Software.

d) System Tools

These are enhanced productivity tools that are typically part of a sophisticated operating system. For example, debugging tools, data retrieval software or code comparison software. As with utility programs, these tools are not specifically designed for auditing use and their use requires additional care.

e) Embedded Audit Routines

These are specific routines built into an organisations software to provide data for later use by the auditor. These include: 1) Snapshots This technique involves taking a snapshot of a transaction as it flows through the computer systems. Audit software routines are embedded at different points in the processing logic to capture images of the transaction as it progresses through the various stages of the processing. Such techniques permits an auditor to track data and evaluate the computer processes applied to the data. 2) System Control Audit Review File This involves embedding audit software modules within an application system to provide continuous monitoring of the systems transactions. The information is collected into a special computer file that the auditor can examine. Embedding audit routines can be a very efficient and an effective way for auditors to detect errors, suspicious transactions or unusual data patterns. If auditors are involved in the Systems Development Life Cycle process, these routines can be included before finalizing the specifications. For example, if the functional specifications for identifying dormant inventory are being discussed in an organization, it may be worthwhile for the auditor to suggest capturing information of all Purchase Orders placed for items identified by the system, as dormant. Therefore, whenever a Purchase Order is placed after an item has been identified as dormant an entry would be recorded in the Audit Review File, which should be reviewed by the auditors.

f) Test Data Techniques

Are sometimes used during an audit by entering data into an organisations computer system, and comparing the results obtained with predetermined results. An auditor might use test data to: 1) Test specific controls in computer programs 2) Test transactions selected from previously processed transactions or created by the auditor to test specific processing characteristics of an organisations information systems. Such transactions are generally processed separately from the organisations normal processing; and

3) Test transactions used in an integrated test facility where a dummy unit (for example, a fictitious department or employee) is established, and to which test transactions are posted during the normal processing cycle. When test data are processed with the organisations normal processing, the auditor ensures that the test transactions are subsequently eliminated from the organisations accounting records. Planning CAATs by no means are a substitute for the manual audit procedures that have to be performed. However, a prudent mix of manual and computer assisted audit techniques can be very useful in meeting the audit objectives. In determining whether to use CAATs, the factors to consider include: 1) The knowledge, expertise and experience of the audit team in Information Technology 2) The availability of CAATs and an adequate computer infrastructure in the organisation 3) The unavailability of data for manual tests 4) The effectiveness and efficiency of CAATs vis--vis manual methods 5) The time constraints A complete understanding of the organizations computer environment and controls in place is required, before the auditor uses CAATs. This will help the auditor in structuring the different CAATs to be used. Knowledge, Expertise, and Information Technology Experience of the Audit Team in

If the audit team does not have sufficient knowledge in Information Technology then the use of CAATS will not produce the desired results. The level of knowledge required would be directly related to the complexities of the computer environment being audited. Auditors can set parameters in software to identify all records meeting selection criteria. Actual sampling techniques may be applied at the time records are selected from the production system, or all records of a given type may be selected and sampling or more detailed selection may be applied in the analysis process. Record selection criteria may be based on prior audits, but auditors should continuously assess opportunities to improve audit coverage especially if this can be accomplished at reduced overall cost.

For example, if a Query in SQL is created and saved this can be repeatedly used for all subsequent audits for the same client. It should be remembered that the database structures could vary from client to client, depending on the software that is used, and therefore the Queries should be created specific to a client. Therefore, the initial planning, design and development of a CAAT will usually benefit audits in subsequent periods. Time Constraints Certain data, such as transaction details, are often kept for only a short time, and may not be available in machine-readable form by the time the auditor wants them. Thus, the auditor will need to make arrangements for the retention of data required, or may need to alter the timing of the work that requires such data. Where the time available to perform an audit is limited, the auditor may plan to use a CAAT because its use will meet the auditors time requirement better than other possible procedures. Using CAATs The major steps to be undertaken by the auditor in the application of a CAAT are to: a) Set the objective of the CAAT application b) Determine the content and accessibility of the organizations computer files c) Based on the set objective, identify the specific files or databases to be examined d) For the audit area to be reviewed, understand the relationship between the data tables and data elements e) Define the specific audit tests to meet the desired audit objective f) Define the output in terms of content, media to be generated (printout, computer file etc) g) Obtain approval to access the data from the client or custodians of the data. If required transfer the files to a separate audit library so that audit tests are not carried out directly on the live data. h) Identify the auditors and systems personnel who will be involved in the design and application of the CAAT i) Establish the costs and benefits of performing an audit test using CAATs

j) Ensure that the use of the CAAT is properly controlled, documented and access to the databases is given only to the appropriate persons. k) The administrative activities for obtaining access to the data and computer facilities should be planned well in advance of the audit, so that it does not disrupt the organizations production environment. l) Execute the CAAT application m) Ensure that the data selected, based on the cut off dates, is reconciled with the accounting records and n) Evaluate the results Controlling the CAAT Application It is important to review the general controls of the organisations computer environment prior to carrying out any tests using CAATs. This is necessary in order to establish the integrity and reliability of the data. For example, if there are no access controls in place there is always a possibility of the data being changed after the audit test. Some of the steps the auditor should do to control CAAT applications may include: a) Involvement, from the beginning, in the design and testing of the CAAT b) If the CAAT has been internally created, reviewing the program logic and confirming its correctness. c) Ensuring that the operating system requirements have been considered when developing the CAAT. d) Testing the CAAT with test data prior to running it on the main database. e) Ensuring that the correct files were used and are reliable f) Verifying control totals and information to ensure that the audit software has performed as expected. g) Establishing appropriate security measures to safeguard the integrity and confidentiality of the data. Normally the auditor should not carry out his tests on live online data, to prevent any data corruption. However, if this is required the auditor must obtain the necessary approval from the client, prior to performing any tests.

Documentation The standard of working paper documentation and retention procedures for a CAAT should be consistent with that for the audit as a whole. The working papers need to contain sufficient documentation to describe the CAAT application, such as: a) Planning a.1) CAAT objectives a.2) Consideration of the specific CAAT to be used a.3) Controls to be exercised and a.4) Staffing, timing and cost. b) Execution b.1) CAAT preparation and testing procedures and controls b.2) Details of the tests performed by the CAAT b.3) Details of input, processing and output and b.4) Relevant technical information about the organisations application systems, such as databases used, structures, data elements, interfaces etc. c) Audit Evidence c.1) Output provided c.2) Description of the audit work performed on the output and c.3) Audit conclusions d) Other d.1) Recommendations made to the client In addition, it may be useful to document suggestions for using the CAAT in future years.

You might also like

- Business Plan For Vending Machine in Ethiopia 2013 E.CDocument28 pagesBusiness Plan For Vending Machine in Ethiopia 2013 E.CBirukee Man100% (3)

- Computer Assisted Audit Tools Chap-04Document30 pagesComputer Assisted Audit Tools Chap-04I-am KumNo ratings yet

- Quality CricleDocument22 pagesQuality CricleQSSD ENTERPRISESNo ratings yet

- Internal Control in A CIS EnvironmentDocument25 pagesInternal Control in A CIS Environmentjunalyn150% (1)

- JAMES A. HALL - Accounting Information System Chapter 17Document41 pagesJAMES A. HALL - Accounting Information System Chapter 17Joe VaTa100% (1)

- CH 08Document37 pagesCH 08France SerdeniaNo ratings yet

- 09 - Auditing IT Using CAAT and TechniquesDocument24 pages09 - Auditing IT Using CAAT and TechniquesgoklasNo ratings yet

- ISO 14001 2015 Upgrade ChecklistDocument10 pagesISO 14001 2015 Upgrade ChecklistDariush Rumi100% (1)

- Iso 9000 - Quality HandbookDocument331 pagesIso 9000 - Quality HandbookJavier Pozo Santana92% (13)

- Effects of Computers on Auditing: Internal Controls in a Computer EnvironmentDocument26 pagesEffects of Computers on Auditing: Internal Controls in a Computer Environmentnagarajuvcc123No ratings yet

- Auditing Standards and Practices Council: Philippine Auditing Practice Statement 1009 Computer-Assisted Audit TechniquesDocument25 pagesAuditing Standards and Practices Council: Philippine Auditing Practice Statement 1009 Computer-Assisted Audit TechniquesDaphne0% (1)

- Computer-Assisted Audit Techniques (CAATs)Document5 pagesComputer-Assisted Audit Techniques (CAATs)Esther WanjukiNo ratings yet

- Managing Enterprise Risks EffectivelyDocument7 pagesManaging Enterprise Risks EffectivelyJeric Lagyaban AstrologioNo ratings yet

- Chapter 28 - Answer PDFDocument11 pagesChapter 28 - Answer PDFjhienellNo ratings yet

- Chapter 10 IS Audit Tools and TechniquesDocument8 pagesChapter 10 IS Audit Tools and TechniquesMuriithi MurageNo ratings yet

- SAP FICO New GL Accounting TrainingDocument41 pagesSAP FICO New GL Accounting TrainingDeepti Siripurapu100% (1)

- SI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITDocument39 pagesSI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITCynthia Herlina LeonardoNo ratings yet

- Information Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessFrom EverandInformation Systems Auditing: The IS Audit Study and Evaluation of Controls ProcessRating: 3 out of 5 stars3/5 (2)

- Information Systems Auditing: The IS Audit Testing ProcessFrom EverandInformation Systems Auditing: The IS Audit Testing ProcessRating: 1 out of 5 stars1/5 (1)

- Computer Assisted Audit ToolsDocument41 pagesComputer Assisted Audit ToolsLaiza Mechelle Roxas MacaraigNo ratings yet

- Implementation of BCG Matrix in Malaysia CompanyDocument21 pagesImplementation of BCG Matrix in Malaysia CompanyMisz Azzyati75% (4)

- SS 620Document20 pagesSS 620jennalyn miraflor100% (1)

- Awareness Session On: Computer-Assisted Audit Tools and Techniques"Document22 pagesAwareness Session On: Computer-Assisted Audit Tools and Techniques"Sunil Kumar PatroNo ratings yet

- Chapter 4Document51 pagesChapter 4Ralph AvakianNo ratings yet

- Philippine Auditing Practices Statements (PAPS) 1009 Computer Assisted Audit TechniquesDocument9 pagesPhilippine Auditing Practices Statements (PAPS) 1009 Computer Assisted Audit Techniqueserjan nina bombayNo ratings yet

- CAATs LectureDocument3 pagesCAATs LecturejossieNo ratings yet

- Computer Info System AuditDocument4 pagesComputer Info System AuditAdin IhtiNo ratings yet

- Computer Audited TechniquesDocument23 pagesComputer Audited Techniquesmonica perambulyNo ratings yet

- AUDCIS - 2022 - Mod5 - Tools and Techniques in IT AuditDocument43 pagesAUDCIS - 2022 - Mod5 - Tools and Techniques in IT AuditBea GarciaNo ratings yet

- Auditing in A ComputerDocument4 pagesAuditing in A Computerkevior2No ratings yet

- ComputerassistedaudittechniquesDocument7 pagesComputerassistedaudittechniquesRinokukunNo ratings yet

- Sa Jan11 CAATsDocument6 pagesSa Jan11 CAATsVeloo ThiruchelvamNo ratings yet

- CAAT Techniques for Auditing Computer SystemsDocument4 pagesCAAT Techniques for Auditing Computer SystemsTanaka PutsaiNo ratings yet

- Audit in Cis Basic ConceptsDocument9 pagesAudit in Cis Basic ConceptsJamie RamosNo ratings yet

- Session 5aDocument22 pagesSession 5aRaffer Alvarado SuryaNo ratings yet

- Information System AuditDocument45 pagesInformation System AuditabcdNo ratings yet

- 4 - Computer Assisted Auditing Techniques (CAAT)Document3 pages4 - Computer Assisted Auditing Techniques (CAAT)gimata kochomataNo ratings yet

- Computer Assisted Audit Techniques (CAATs)Document14 pagesComputer Assisted Audit Techniques (CAATs)Manikandan ManoharNo ratings yet

- Audit - System Audit - CIS Audit - IT AuditDocument5 pagesAudit - System Audit - CIS Audit - IT AuditBHAVYAN AGARWALNo ratings yet

- Study Unit 10: F.3. Technology-Enabled Finance TransformationDocument20 pagesStudy Unit 10: F.3. Technology-Enabled Finance TransformationNhi Trần ThảoNo ratings yet

- Computer - Assisted Audit Tools & Techniques (Caatt) : Dr. Selasi OcanseyDocument29 pagesComputer - Assisted Audit Tools & Techniques (Caatt) : Dr. Selasi OcanseyHannett WoodNo ratings yet

- Statement of Auditing PracticeDocument8 pagesStatement of Auditing PracticeNestor Darío Duque MNo ratings yet

- Details: Test DataDocument3 pagesDetails: Test DataNisrina NSNo ratings yet

- Auditing in A Computer-Based Environment: Through Understanding The Entity and Its EnvironmentDocument6 pagesAuditing in A Computer-Based Environment: Through Understanding The Entity and Its Environmentrobarto2No ratings yet

- The Role of Computer Assisted Audit TechniqueDocument4 pagesThe Role of Computer Assisted Audit TechniquebeimnetNo ratings yet

- Notes in A25Document5 pagesNotes in A25ejrileyriegoNo ratings yet

- Practical Case Studies of CaatsDocument7 pagesPractical Case Studies of CaatsHarun Raaj GuptaNo ratings yet

- Preliminary ReviewDocument6 pagesPreliminary ReviewLet it beNo ratings yet

- Guidance Note On Computer Assisted Audit TechniquesDocument15 pagesGuidance Note On Computer Assisted Audit Techniquesapi-3828505100% (3)

- IT AuditDocument4 pagesIT AuditBryanNo ratings yet

- 10857p730 737Document8 pages10857p730 737mohammad.mamdooh9472No ratings yet

- Salami Fraud and CAATTsDocument4 pagesSalami Fraud and CAATTsErica CaliuagNo ratings yet

- Numerous Computer Aided Cost Estimation Software Systems Are Now AvailableDocument1 pageNumerous Computer Aided Cost Estimation Software Systems Are Now Availableengineer engrNo ratings yet

- Computer Assisted Audit Tools (CAAT)Document33 pagesComputer Assisted Audit Tools (CAAT)Irish Keith Sanchez100% (1)

- CMMSDocument5 pagesCMMSKushalKallychurnNo ratings yet

- Accounting Information SystemDocument4 pagesAccounting Information SystemtheateeqNo ratings yet

- Caat or Caatts: Software Tools Group 4Document2 pagesCaat or Caatts: Software Tools Group 4Alyssa Mae ArcillaNo ratings yet

- Topic ThirteenDocument37 pagesTopic ThirteenGordar BuberwaNo ratings yet

- Use of Caats1Document18 pagesUse of Caats1Artificial Intelligence ScientistNo ratings yet

- Origins of Computer AuditDocument5 pagesOrigins of Computer AuditihtashamNo ratings yet

- Computer Assisted Audit Techniques CAATs PDFDocument2 pagesComputer Assisted Audit Techniques CAATs PDFandika “RIEZ12” riez0% (1)

- Caats PDFDocument2 pagesCaats PDFTATENDA GANDIWANo ratings yet

- Quality Management in Software EngineeringDocument8 pagesQuality Management in Software Engineeringselinasimpson1201No ratings yet

- CisDocument6 pagesCisKezha CalderonNo ratings yet

- What Are The Classes of Input Control? Explain EachDocument8 pagesWhat Are The Classes of Input Control? Explain EachGeraldine Martinez DonaireNo ratings yet

- Business Intelligence Tools Improve Manufacturing InsightsDocument4 pagesBusiness Intelligence Tools Improve Manufacturing InsightsAdithyaSirikondaNo ratings yet

- Quality Management System DocumentsDocument8 pagesQuality Management System Documentsselinasimpson371No ratings yet

- CH8 Hunton CaatsDocument4 pagesCH8 Hunton Caatskimbavalentino100% (1)

- Soft CAATBrochureDocument6 pagesSoft CAATBrochureHarun Raaj GuptaNo ratings yet

- Soft CAATBrochureDocument6 pagesSoft CAATBrochureHarun Raaj GuptaNo ratings yet

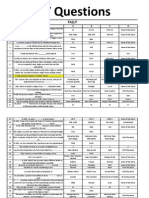

- QuestionsDocument168 pagesQuestionsHarun Raaj GuptaNo ratings yet

- Soft CAATBrochureDocument6 pagesSoft CAATBrochureHarun Raaj GuptaNo ratings yet

- Question 2Document80 pagesQuestion 2Harun Raaj GuptaNo ratings yet

- QuestionDocument16 pagesQuestionHarun Raaj GuptaNo ratings yet

- QuestionDocument16 pagesQuestionHarun Raaj GuptaNo ratings yet

- Question 1Document82 pagesQuestion 1Harun Raaj GuptaNo ratings yet

- QuestionDocument16 pagesQuestionHarun Raaj GuptaNo ratings yet

- QuestionsDocument172 pagesQuestionsHarun Raaj GuptaNo ratings yet

- Question PaperDocument16 pagesQuestion PaperHarun Raaj GuptaNo ratings yet

- Question PaperDocument16 pagesQuestion PaperHarun Raaj GuptaNo ratings yet

- Que 1Document33 pagesQue 1Harun Raaj GuptaNo ratings yet

- LanDocument5 pagesLanHarun Raaj GuptaNo ratings yet

- Module Ques Paper-May 08Document19 pagesModule Ques Paper-May 08Harun Raaj GuptaNo ratings yet

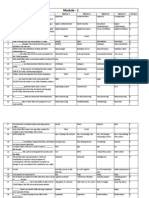

- Module - 1: S.No Name Option 1 Option 2 Option 3 Option 4 AnswerDocument3 pagesModule - 1: S.No Name Option 1 Option 2 Option 3 Option 4 AnswerHarun Raaj GuptaNo ratings yet

- Icai 4Document55 pagesIcai 4Harun Raaj GuptaNo ratings yet

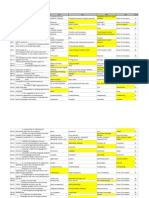

- Module-1 Question Paper To PondyDocument12 pagesModule-1 Question Paper To PondyHarun Raaj GuptaNo ratings yet

- Itt Training Model T PaperDocument31 pagesItt Training Model T PaperHarun Raaj GuptaNo ratings yet

- JayaramDocument23 pagesJayaramHarun Raaj GuptaNo ratings yet

- Type of Project: Sname College Assignment Title Platform Date of SubmissionDocument1 pageType of Project: Sname College Assignment Title Platform Date of SubmissionHarun Raaj GuptaNo ratings yet

- Icai 4Document55 pagesIcai 4Harun Raaj GuptaNo ratings yet

- Icai 1Document65 pagesIcai 1Harun Raaj GuptaNo ratings yet

- Itt Training Model T PaperDocument31 pagesItt Training Model T PaperHarun Raaj GuptaNo ratings yet

- ITT QuestionsDocument27 pagesITT QuestionsHarun Raaj GuptaNo ratings yet

- Icai 4Document55 pagesIcai 4Harun Raaj GuptaNo ratings yet

- Itt QuesDocument72 pagesItt QuesHarun Raaj GuptaNo ratings yet

- Icai 1Document65 pagesIcai 1Harun Raaj GuptaNo ratings yet

- D30 Thiyagu.a.c.Document1 pageD30 Thiyagu.a.c.Harun Raaj GuptaNo ratings yet

- Icai 1Document65 pagesIcai 1Harun Raaj GuptaNo ratings yet

- Advising - Payslip - 20309012 - Shamim Ara Jahan SharnaDocument2 pagesAdvising - Payslip - 20309012 - Shamim Ara Jahan SharnaFardin Ibn ZamanNo ratings yet

- Relationship Between Financial Management Skills and Job Satisfaction Amon The Teachers of Bagumbayan National High School - Group1 - ABM - Chapter1Document12 pagesRelationship Between Financial Management Skills and Job Satisfaction Amon The Teachers of Bagumbayan National High School - Group1 - ABM - Chapter1Wenzil CastillonNo ratings yet

- 5s PrincipleDocument22 pages5s PrincipleamaliaNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementlintoNo ratings yet

- PEST ANALYSIS OF PAKISTAN TOBACCODocument5 pagesPEST ANALYSIS OF PAKISTAN TOBACCOali_sattar150% (1)

- HDB Financial Services FY2019 Update PDFDocument8 pagesHDB Financial Services FY2019 Update PDFCharu BhattNo ratings yet

- 8K Miles: Keep Yourself Away 8K Miles'Document4 pages8K Miles: Keep Yourself Away 8K Miles'Suneel KotteNo ratings yet

- Nisha ChaudhariDocument2 pagesNisha ChaudhariGlen SalazarNo ratings yet

- Companies Act 2013 HighlightsDocument9 pagesCompanies Act 2013 Highlightsashishbajaj007100% (2)

- Depreciation by 150% Declining Balance MethodDocument28 pagesDepreciation by 150% Declining Balance MethodMarc ToresNo ratings yet

- Chapter 3Document3 pagesChapter 3Mariya BhavesNo ratings yet

- e-Commerce Course SyllabusDocument1 pagee-Commerce Course SyllabusFatima GorineNo ratings yet

- Student Of: "Financial Ratio Analysis of Mangalore Refinery and Petrochemicals LTD (MRPL)Document6 pagesStudent Of: "Financial Ratio Analysis of Mangalore Refinery and Petrochemicals LTD (MRPL)Khalid SayedNo ratings yet

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Investor Relations StrategyDocument10 pagesInvestor Relations Strategysembalap29No ratings yet

- Name: Onyango Loyce AchiengDocument4 pagesName: Onyango Loyce AchiengOn Joro ZablonNo ratings yet

- The External Environment Affecting A British AirwaysDocument13 pagesThe External Environment Affecting A British Airwayskunal ladNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- Value Chain E-Commerce AnalysisDocument30 pagesValue Chain E-Commerce AnalysisManish ChughNo ratings yet

- Random HRM DataDocument12 pagesRandom HRM DatasfarhanmehmoodNo ratings yet

- Final Effects of Product PacakgingDocument11 pagesFinal Effects of Product PacakgingMa Angeli GomezNo ratings yet

- 2 April 2018Document60 pages2 April 2018siva kNo ratings yet