Professional Documents

Culture Documents

Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings Release

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relatório Trimestral 1T13 1Q13 Earnings Release Relatório Trimestral 1T13 1Q13 Earnings Release

Uploaded by

Klabin_RICopyright:

Available Formats

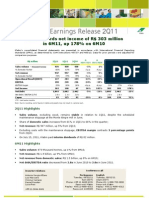

1Q13 Earnings Release April 25, 2013 Relatrio Trimestral 1T13

25 de abril de 2013

Adjusted EBITDA growth of 23% over 1Q12 Domestic sales increase of 11% compared with 1Q12

Sales volume

430 tsd tonnes

Net revenue

Sales volume of 430 thousand tonnes, with an improved mix. Domestic sales representing a share of 70%, versus 65% in 1Q Q12;

KLBN4 March 31 st, 2013

Preferred shares Stock price Daily trading vol. 1Q Market cap

600.9 million R$ 13.84 R$ 32 million R$ 12.3 billion

R$ 1,066 million

Adjusted EBITDA

Net revenue of R$1,066 million, 10% up on 1Q12.

Conference call English Friday, 04/26/13, 10 a.m. (NY) US Participants: 1-855-281-6021 BR Participants: +55 11 4688-6336 Password: Klabin webcall.riweb.com.br/klabin/english RI Antonio Sergio Alfano Vinicius Campos Daniel Rosolen Lucia Reis Mariana Arajo +55 11 3046-8401 www.klabin.com.br/ri invest@klabin.com.br

R$ 384 million

Net Debt / Adjusted EBITDA

Adjusted EBITDA of R$384 million, with a margin of 36%, 23% up compared with 1Q12. Seventh consecutive quarter of growth in last-twelve month EBITDA.

Reduction in net debt/adjusted EBITDA ratio from 2.4x in December 2012 to 2.2x in the end of March.

2.2 x

Investment grade

BBB- Investment Grade rating in the global scale and brAAA rating in the national scale assigned by S&P, confirming the rating assigned by Fitch.

BBB-

Klabin's consolidated financial statements are presented in accordance with International Financial Reporting Standards (IFRS), as determined by CVM Instructions 457/07 and 4 85/10. Vale do Coriscos information is not consolidated, being represented i n the financial statement by equity income. Adjusted EBITDA according to IN CVM 527/12. The specifications on the calculation are on page 7.

R$ million Sales volume (thousand tonnes) % Domestic Market Net Revenue % Domestic Market Adjusted EBITDA Adjusted EBITDA Margin Net Income (loss) Net Debt Net Debt / EBITDA (LTM) Capex *

1Q13 430 70% 1,066 76% 384 36% 202 3,136 2.2x 152

4Q12 437 70% 1,078 76% 384 35% 147 3,278 2.4x 199

1Q12 420 65% 969 76% 311 32% 459 2,674 2.4x 129

1Q13/4Q12 -2% 0 p.p. -1% 0 p.p. 0% 1 p.p. 38% -4%

1Q13/1Q12 3% 5 p.p. 10% 0 p.p. 23% 4 p.p. -56% 17%

-23%

18%

Notes: Due to rounding, some figures in tables and graphs may not result in a precise sum. Adjusted EBITDA margin is calculated over a pro-forma forma net revenue, which includes revenues from Vale do Corisco. Corisco Since 3Q12 investments are disclosed on a cash basis. *LTM - last twelve months

1Q13 Earnings Release

April 25, 2013

Summary

In 2012, Klabin recorded a significant improvement in performance and reported its best ever results, thanks to the increased efficiency of its mills and the improved product and market mix. The combination of these factors continued to positively impact the results in the first quarter of 2013, resulting in an adjusted EBITDA growth of 23% over the same period a year ago. In the international scenario, the pessimistic outlook for the Eurozone, which closed 2012 with four consecutive quarters of economic recession, continued into the beginning of this year. The United States, in turn, showed signs of economic recovery, with the lowest unemployment rate in March since December 2008 and a 2.2% GPD growth over 2011. In Brazil, low economic growth was reflected in 2012 GDP (1% over 2011), which missed market estimates from early 2012. In the first months of 2013, concerns over the resumption of the inflationary process, low investments and the ineffective heterodox policies implemented by the government led the Brazilian Central Bank to announce in the last Copom meeting a 0.25% increase in the Selic benchmark interest rate, the first since July 2011. Inflation is partly a reflex of the continuous increase in household consumption as percentage of the GDP, a fundamental factor for the continuity of growth in the country. According to the Brazilian Institute of Geography and Statistics (IBGE), consumption grew 3% in 2012, the ninth consecutive year of positive variation, accounting for 62% of GDP. This fact contributed to the solid results reported by Klabin in 2012 and in the first quarter of 2013, given the strong presence of the company in markets related to the consumption sector in Brazil. Despite this unfavorable scenario, the packaging paper market in Brazil expanded in 1Q13, also reflecting the reduced imports of packaged products, due to the appreciation of the real compared with 1Q12. According to the Brazilian Association of Pulp and Paper Producers (Bracelpa), national demand for coated boards, excluding liquid packaging boards, increased by 3% in 1Q13 over the same period last year. the In the same comparison Boxes period, the corrugated box market grew by 4%, according to Brazilian Corrugated Association (ABPO). According to FOEX, international kraftliner prices remained stable in the first three months of the year, averaging 582/t, 12% up on 1Q12.

Brazilian corrugated shipments (thousand tonnes)

Brazilian coated boards shipments (thousand tonnes)

Kraftliner brown 175 g/m2 list price (/t onne and R$/tonne)

802 772

125

129

1,532

1,202

582 519

1Q12

1Q13

1Q12

1Q13

1Q12

Kraftliner ( / tonne)

1Q13

Kraftliner ( R$ / tonne)

Source: ABPO

Source: Bracelpa

Source: FOEX

1Q13 Earnings Release

April 25, 2013

Klabin recorded sales volume of 430 thousand tonnes in 1Q13, 3% up on 1Q12. In the same comparison period, net revenue from sales increased by 10% to R$ 1,066 million. Despite the typical seasonality in the first months of the year, domestic sales accounted for 70% of total sales, versus 65% a year earlier. Domestic sales of paper and packaging paper increased by 11% over 1Q12, once again reflecting the Companys pursuit of markets with healthier margins. As a result, exports fell by 12%, though revenue from exports grew by 9% compared with 1Q12. The structured measures to generate efficiency gains at the Business Units continued to impact the Companys results in the quarter. In this context, the higher share of the product mix sold to the domestic market boosted cash generation, and the Company closed the quarter with adjusted EBITDA of R$ 384 million, in line with 4Q12.

Seventh consecutive quarter of growth in last-12-month adjusted EBITDA:

33% 32% 29% 28% 26% 24% Margin

1,028 922 1.7 939

31%

25%

1,180 1,089

1,352 1,286

1,424

1.7

1.7

1.7

1.7

1.7

1.7

1.7

Jun11

Sep11

Dec11

Mar12

Jun12

Sep12

Dec12

Mar13

LTM: Last twelve months

Sales Volume LTM (excluding wood million tonnes)

Adjusted EBITDA LTM (R$ million)

Note: Adjusted EBITDA does not include earnings from the sale of assets in 3Q11 and 4Q11.

Exchange Rate

The exchange rate, which stood at R$ 2.04/US$ on December 31, 2012, fell slightly to R$ 2.01/US$ in the end of March. It averaged R$ 2.00/US$ in 1Q13, 13% up on 1Q12, impacting imports of packaged products in Brazil.

1Q13

4Q12

1Q12

1Q13/4Q12

1Q13/1Q12

Average Rate End Rate

Source: Bacen

2,00 2,01

2,06 2,04

1,77 1,82

-3% -1%

13% 11%

1Q13 Earnings Release

April 25, 2013

Operating and financial performance

Sales Volume

Sales volume increased by 3% over the same period in the previous year, due to the better product mix and higher share of sales to the domestic market. Sales volume, excluding wood, totaled 430 thousand tonnes in 1Q13, reflecting the 1% drop in paper (kraftliner and coated boards) sales and the 8% growth in converted product (packaging paper and industrial bags) sales. Despite the seasonality typical of first quarters, Klabins domestic sales grew by 11% over 1Q12, accounting for 70% of total sales in 1Q13, versus 65% in 1Q12. As a result, exports declined by 12% compared with 1Q12, totaling 129 thousand tonnes.

Sales volume (excluding wood tsd tonnes) 430 420

35% 30%

Sales volume by product 1Q13

Ind. Bags 9% Others 3%

65%

70%

Kraftliner 21%

Coated Boards 38%

1Q12

1Q13

Corrugated Boxes 29%

Domestic Market

Export Market

does not include wood

In the first quarter, Klabin continued to concentrate its international sales in the emerging markets, especially Latin America and Asia. These regions accounted for 77% of exports, versus 72% in the same period last year.

Sales volume export market 1Q12

North America Africa 3% 8% Europe 18% Europe 17% Latin America 44% Asia 27% Latin America 50%

Sales volume export market 1Q13

North Africa America 2% 3%

Asia 28%

1Q13 Earnings Release

April 25, 2013

Net Revenue

First-quarter net revenue, including wood, totaled R$ 1,066 million, 10% up on 1Q12, due to the more selective sales approach to the different markets. Net revenue from paper sales (kraftliner and coated boards) grew by 11% over 1Q12, while net revenue from converted products (corrugated boxes and industrial bags) increased by 12%. Net revenue from domestic sales came to R$ 812 million, 10% up on 1Q12, due to the increase in volume. Given the more favorable exchange rate, with a 13% appreciation in the real over 1Q12, exports increased by 9% to R$ 254 million (US$ 128 million) in 1Q13. As a result, the mix remained stable in the comparison period. Pro-forma net revenue in the quarter, considering Klabins proportional revenue from Florestal Vale do Corisco S.A., came to R$ 1,079 million.

Net revenue (R$ million) 1,066 969

24% 24%

Net revenue by product 1Q13

Wood 7% Kraftliner 13% Others 1%

76%

76%

Ind. Bags 14%

Coated Boards 35%

1Q12

1Q13

Corruated Boxes 30%

Domestic Market

Export Market

The improved mix also impacted the regional distribution of export revenue in 1Q13, and Latin America became the most representative market, accounting for half the total, versus 45% in 1Q12.

Net revenue export market 1Q12

North America 3%

Net revenue export market 1Q13

North America 2%

Africa 6% Europe 14%

Africa 3%

Latin America 45%

Europe 17% Latin America 50%

Asia 32%

Asia 28%

1Q13 Earnings Release

April 25, 2013

Operating Costs and Expenses

The unit cash cost (excluding non-recurring items) was R$ 1,613/t, 1% down over 4Q12. In comparison with 1Q12, the unit cash cost presented a nominal increase of 3%, reflecting the consistent structured programs to improve operational efficiency, investments in productivity gains in 2012 and the payroll tax exemption implemented by the government. In 2Q13, maintenance stoppages will be carried out at the Monte Alegre (PR) and Otaclo da Costa (SC) plants for 11 and 7 days, respectively.

Cash cost breakdown 1Q12

Energy 10% Freight 12% Labor 33% Maintenance 15% Wood/ Fibers 15% Chemicals 15% Maintenance 15% Wood / Fibers 15% Chemicals 16% Freight 12% Labor 32%

Cash cost breakdown 1Q13

Energy 10%

The cost of goods sold (COGS) came to R$ 720 million in 1Q13, 1% down on 4Q12 and 15% up on 1Q12, due to the increased depletion of the biological assets. However, excluding the impacts from the depletion of biological assets, COGS grew by 6% from the same period last year. Selling expenses moved up by 8% over 1Q12 to R$ 86 million, despite the 10% increase in net revenue in the period. Excluding freight expenses, selling expenses grew by 2%. Selling expenses remained stable compared with 4Q12 and represented 8.0% of net revenue. Administrative expenses came to R$ 64 million in 1Q13, 13% down on 4Q12, due to the impact from the payroll tax exemption, and 8% up on 1Q12. Other operating revenue/expenses was a revenue of R$ 7 million in 1Q13.

Effect of the variation in the fair value of biological assets

In 1Q13, the effect of the variation in the fair value of biological assets was a positive variation of R$ 62 million, driven by the increase in wood prices, despite the negative impact from the increase in Companys average cost of capital used to calculate the fair value of its forests. The effect from the depletion of the fair value of biological assets on cost of goods sold was R$ 104 million in 1Q13, unchanged from the prior quarter. As a result, the non-cash effect of the variation in the fair value of biological assets on operating income (EBIT) was a loss of R$ 42 million in 1Q13.

1Q13 Earnings Release

April 25, 2013

Operating Cash Flow (EBITDA)

Instruction 527/12, issued by the Securities and Exchange Commission of Brazil (CVM) established rules for the calculation of EBITDA. These rules, which are effective as of January 1, 2013, define EBITDA as net income plus income taxes, the net financial result, amortization, depreciation and depletion. Given its commitment to transparency and fair disclosure of information, and in accordance with article 4 of the referred instruction, the Company considers as necessary adjustments to the EBITDA, the effects of the equity income, of the variation in the fair value of biological assets, of the proportional EBITDA from jointly-owned subsidiaries (Vale do Corisco) as well as other items that may contribute to a better understanding of its information. Therefore, the company will adopt the term adjusted EBITDA to express this figure as of this quarter.

R$ million

Net Income (loss) (+) Income taxes and social contribution (+) Net Financial Revenues (+) Depreciation, amortization, depletion Adjustments according to IN CVM 527/12 art. 4 (-) Equity Pickup (-) Biological assets adjustment (+) Vale do Corisco Ajusted EBITDA Adjusted EBITDA Margin

N / A - Not applicable

1Q13

202 81 (17) 173

4Q12

147 97 78 169

1Q12

459 231 (54) 108

1Q13/4Q12 38% -17% n/a 3%

1Q13/1Q12 -56% -65% -69% 60%

(1) (62) 7 384 36%

(0) (113) 7 384 35%

(4) (435) 6 311 32%

65% -46% 2% 0% 1 p.p.

-77% -86% 16% 23% 4 p.p.

Note: EBITDA margin is calculated considering the pro forma net revenue, w hich includes Vale do Corisco

Impacted by the appreciation of the exchange rate in early 2013, which reduced imports of packaged products, the paper and packaging markets presented a solid performance in Brazil compared with 1Q12, despite the slow economic growth. In this context, Klabin improved its sales mix, increasing the share of products sold to the domestic market, significantly increasing net revenue compared with the same period in the previous year. As a result, despite the typical seasonal effects in the quarter, operating cash flow remained in line with 4Q12, which benefitted from a more positive scenario, leading to a substantial increase of 23% in adjusted EBITDA over the same period a year earlier. Operating cash flow (adjusted EBITDA) totaled R$ 384 million in the first quarter, with an EBITDA margin of 36%. This figure includes EBITDA related to 51% of wood sales by Florestal Vale do Corisco S.A. (Klabin's share in the company), in the amount of R$ 7 million.

Indebtedness and Financial Investments

Gross debt stood at R$ 5,886 million on March 31, compared with R$ 6,035 million on December 31, 2012. The reduction was mainly due to the amortizations and the impact of foreign exchange variation on our foreigncurrency debt. Of this total, R$ 4,152 million, or 71% (US$ 2,062 million) was denominated in foreign currency, primarily export pre-payment facilities. Cash and financial investments remained stable at R$ 2,750 million. This amount exceeds the amortizations of loans maturing in the next 33 months. Despite the amortizations, the cash generation kept the cash and financial investments stable during the quarter.

1Q13 Earnings Release

April 25, 2013

Net debt stood at R$ 3,136 million on March 31, R$ 142 million lower than the R$ 3,278 million recorded on December 31, 2012. The better performance of the Companys results and the relatively stable exchange rate in the quarter reduced the net debt/adjusted EBITDA ratio from 2.4x in 4Q12 to 2.2x in 1Q13. At the end of March, the net foreign exchange exposure was US$ 1,903 million, of which US$ 2,062 million corresponded to export pre-payment facilities maturing by 2022 and with average term of over 4 years and assets in foreign currency, maturing in the short term, of US$ 159 million. The average maturity term stood at 41 months (31 months for local currency debt and 44 months for foreign currency debt). At the end of March, short-term debt represented 18% of total debt, and the average borrowing costs in local and foreign currency stood at 6.72% p.a. and 4.50% p.a., respectively.

Net Debt/Adjusted EBITDA

2.1

2.0

2.4

2.5

2.3

2.5

2.3

2.4

2.2

Mar-11

Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12

Mar-13

Net Debt / Adjusted EBITDA (LTM)

LTM: Last twelve months

Debt (R$ million) Short term Local currency Foreign currency Total short term Long term Local currency Foreign currency Total long term Total local currency Total foreign currency Gross debt (-) Cash Net debt Net debt / EBITDA (LTM) LTM - last twelve months

3/31/13

12/31/12

403 680 1.083

7% 11% 18%

387 734 1.121

7% 12% 19%

1.331 3.472 4.803 1.734 4.152 5.886 2.750 3.136 2.2 x

23% 59% 82% 29% 71%

1.279 3.635 4.914 1.666 4.369 6.035 2.757 3.278 2.4 x

21% 60% 81% 28% 72%

1Q13 Earnings Release

April 25, 2013

Financial Result

Financial expenses came to R$ 89 million in 1Q13, in line with 1Q12. Financial revenues came to R$ 46 million in the quarter, versus R$ 68 million in 1Q12, mainly due to the reductions in the Selic benchmark interest rate in 2012. With little dollar volatility during the quarter, the net foreign exchange variation was positive by R$ 60 million. Note that the effect from foreign exchange variation on the companys balance sheet has a merely accounting effect. The financial result, excluding foreign exchange variations, was an expense of R$ 43 million in 1Q13, versus an expense of R$ 21 million in 1Q12.

Net Income

The Company posted net income of R$ 202 million in 1Q13, primarily reflecting the operating cash flow in the period.

Business Performance

Consolidated information by business unit in 1Q13.

R$ million Net revenue Domestic market Exports Third part revenue Segments revenue Total net revenue Change in fair value - biological assets Cost of goods sold Gross income Operating expenses Operating results before financial results

Note: In this table, total net revenue includes sales of other products. Nota: * Forestry cost of goods sold includes the exaustion of the fair value of biological assets of R$ 104 million in the period.

Forestry

Papers

Conversion

Consolidation adjustments

Total

69 69 136 205 62 (229) 38 (19) 19

305 222 527 232 759 (482) 277 (74) 203

438 32 470 2 472 (376) 96 (49) 47

(370) (370) 367 (3) (3)

812 254 1.066 1.066 62 (720) 408 (142) 266

BUSINESS UNIT FORESTRY

thousand tonnes Wood R$ million Wood 69 71 71 -2% -3% 1Q13 641 4Q12 683 1Q12 1Q13/4Q12 1Q13/1Q12 719 -6% -11%

In 1Q13, the depreciation of the real against the dollar and the improvement in the U.S. construction industry continued to fuel exports of wood products of Klabins clients. Even so, wood log sales to the Companys third parties fell by 11% over 1Q12, totaling 641 thousand tonnes, impacted by the heavy rainfall levels in the south

1Q13 Earnings Release

April 25, 2013

region of Brazil in the period, which affected wood transportation, and the increase in wood transfers to paper producers. Net revenue from wood sales totaled R$ 69 million in 1Q13, 3% down on 1Q12. The cost reduction program at the Forestry Unit, whose initial results became apparent in September, impacted the 4Q12 results and continued to impact costs in 1Q13. The measures involved benchmarking, implementing expense matrix management and the insourcing of planting and harvesting.

BUSINESS UNIT PAPER

thousand tonnes Kraftliner DM Kraftliner EM Total Kraftliner Coated boards DM Coated boards EM Total Coated boards Total Paper R$ million Kraftliner Coated boards Total Paper 1Q13 42 48 90 93 72 165 256 138 376 514 4Q12 50 51 101 95 72 167 268 148 388 536 1Q12 34 62 95 87 77 164 259 119 345 464 1Q13/4Q12 1Q13/1Q12 -16% 25% -4% -22% -10% -5% -2% 6% 0% -6% -1% 1% -5% -1% -7% -3% -4% 16% 9% 11%

Kraftliner

The increase of approximately 6% in scrap prices in Europe supported the high kraftliner prices in 1Q13, consequently benefitting producers. According to FOEX, first-quarter international prices stood at 582/ton in euros, in line with 4Q12 and 12% up over 1Q12 (2% and 13% up, respectively, in dollars). Sales volume fell by 5% over 1Q12, due to the higher internal transfers of kraftliner for the production of corrugated boxes. However, net revenue moved up by 16%. Domestic sales remained solid in 1Q13, totaling 42 thousand tonnes, 25% up in 1Q12. As a result, exports contracted, reaching 48 thousand tonnes. The mix improved considerably, since the domestic market accounted for 47% of total sales, versus 36% in 1Q12.

Coated boards

According to Bracelpa, domestic demand for coated boards, excluding liquid packaging boards, increased by 3% in relation to 1Q12. Klabins domestic sales of coated boards, including liquid packaging boards, moved up by 6% over the same period last year. Klabin concentrated sales in the domestic market in the quarter, which came to 93 thousand tonnes, with exports totaling 72 thousand tonnes, 6% down on 1Q12, giving a total of 165 thousand tonnes, 1% higher than in the same period a year before. Net revenue stood at R$ 376 million, 9% up on 1Q12.

10

1Q13 Earnings Release

April 25, 2013 BUSINESS UNIT - CONVERSION

thousand tonnes Total conversion R$ million Total conversion 1Q13 164 468 4Q12 161 458 1Q12 1Q13/4Q12 1Q13/1Q12 152 2% 8% 419 2% 12%

According to ABPO, the corrugated box market expanded in 1Q13, with a 4% increase in Brazilian shipments of boxes and boards over 1Q12. In addition to the significant market growth, the Companys strategy of diversifying its client base for a steady adequate margin level has been contributing to such better results. The new corrugator in the Jundia (SP) plant is still undergoing its learning curve and will continue its operations in the coming months to meet the increased volume expected for the plant in the following quarters. Preliminary data from the National Cement Industry Union (SNIC) and market estimates indicate that domestic cement sales was down 2% in 1Q13 year over year, mainly due to the slowdown of the civil construction segment. The sales volume of converted product totaled 164 thousand tonnes in 1Q13, while net revenue stood at R$ 468 million. Compared to 1Q12, sales volume grew 8%, while net revenue increased by 12%.

Capital Expenditure

Klabin invested R$ 152 million in 1Q13. Of this total, R$ 60

R$ million Forestry Maintenance Special Projects Growth Total

1Q13 21 60 6 65 152

million went to the continuity of mill operations, R$ 21 million to forestry operations, R$ 6 million to special projects and R$ 65 million to expanding sack kraft and recycled paper capacity. The installation of the sack kraft machinery in Correia Pinto (SC) is within budget and schedule. The construction works have already been concluded and equipment has started to be installed.

The Goiana plant is undergoing land preparation and piping process to receive the 110 thousand tonne per year recycled paper machine. Start-up is scheduled for mid-2014. The last Board of Directors Meeting held on April 24 approved one more high-return project for the modernization of the Monte Alegre (PR) lumber yard, through the elimination of lumber reception lines so that the plant can receive 7-meter wood logs. The project will be carried out during the 2014 maintenance stoppage.

11

1Q13 Earnings Release

April 25, 2013

Capital Markets

Stock performance

In 1Q13, Klabins preferred shares (KLBN4) appreciated by 9%, while the Ibovespa index depreciated 8%. Klabin stock was traded in all sessions on the BM&FBovespa, registering 351,000 transactions that involved 142 million shares, for average daily trading volume of R$ 32 million, 1% higher than in the previous quarter. Klabin's capital stock is represented by 918 million shares, comprising 317 million common and 601 million preferred shares. Klabin stock is also traded on the U.S. over-the-counter market as Level 1 ADRs, under the ticker KLBAY.

Performance KLBN4 x Brazilian Index (Ibovespa)

Average Daily Volume

(R$ million/day)

32 24 21 21 17 16 12 11 13 14 19 24 22 22 18 21 19 27 29 33 34 34 34 28

204

100

81

Klabin

Ibovespa Index

Dividends

The Extraordinary Board of Directors Meeting held on April 23 approved the distribution of supplementary dividends, which were paid as of April 23, corresponding to R$ 80.52 per lot of one thousand common shares and R$ 88.57 per lot of one thousand preferred shares, totaling R$ 76 million.

Rating

On March 15, 2013, Standard & Poors Rating Services assigned investment grade to the Company, upgrading its rating from BB+ to BBB- (Investment Grade) in global scale and from brAA+ to brAAA in domestic scale, with a stable outlook. This confirms the previously rating assigned by Fitch Ratings.

12

Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13

Mar-11

Mar-12

Mar-13

Sep-11

Dec-11

Sep-12

Dec-12

Jun-11

Jun-12

1Q13 Earnings Release

April 25, 2013

Conference Call

Portuguese

Friday, April 26, 2013 - 10:00 a.m. (Braslia). Password: Klabin Dial-in: (11) 4688-6336 Replay: +55 (11) 46886312 Code: 3652278# The conference call will also be broadcast by internet. Access: http://webcall.riweb.com.br/klabin

English

Friday, April 26, 2013 10:00 a.m. (NY). Password: Klabin Dial-in: U.S. participants: 1-855-281-6021 International participants: 1-786-924-6977 Brazilian participants: (55 11) 4688-6336 Replay: (55 11) 46886312 Password: 5751612 The conference call will also be broadcast by internet. Access: http://webcall.riweb.com.br/klabin/english

With gross revenue of R$ 5.0 billion in 2012, Klabin is the largest integrated manufacturer, exporter and recycler of packaging paper in Brazil, with annual production capacity of 1.9 million tonnes. Klabin has adopted a strategic focus on the following businesses: paper and coated boards for packaging, corrugated boxes, industrial bags and wood logs. It is the leader in all of its market segments.

The statements made in this earnings release concerning the Company's business prospects, projected operating and financial results and potential growth are merely projections and were based on Management's expectations regarding the Company's future. These expectations are highly susceptible to changes in the market, the general economic performance of the Brazilian economy, industry and international markets and, hence, are subject to change.

13

1Q13 Earnings Release

April 25, 2013

Appendix 1 Consolidated Income Statement (R$ thousands)

(R$ thousand)

Gross Revenue Net Revenue Change in fair value - biological assets Cost of Products Sold Gross Profit Selling Expenses General & Administrative Expenses Other Revenues (Expenses) Total Operating Expenses Operating Income (before Fin. Results) Equity pickup Financial Expenses Financial Revenues Net Foreign Exchange Losses Net Financial Revenues Net Income before Taxes Income Tax and Soc. Contrib. Net income Depreciation and amortization Change in fair value of biological assets Vale do Corisco EBITDA

1Q13

1,294,947 1,066,404 61,609 (719,699) 408,314 (86,479) (64,195) 7,364 (143,310) 265,004 823 (88,806) 46,098 59,662 16,954 282,781 (81,227) 201,554 173,066 (61,609) 7,263 383,724

4Q12

1,294,027 1,078,364 113,410 (724,937) 466,837 (85,958) (73,646) 14,537 (145,067) 321,770 498 (104,286) 51,381 (25,463) (78,368) 243,900 (97,385) 146,515 168,725 (113,410) 7,135 384,220

1Q12

1,165,113 969,241 434,606 (628,038) 775,809 (80,128) (59,565) (4,358) (144,051) 631,758 3,586 (89,152) 68,130 75,146 54,124 689,468 (230,950) 458,518 107,845 (434,606) 6,269 311,266

1Q13/4Q12 0% -1% -46% -1% -13% 1% -13% -49% -1% -18% 65% -15% -10% N/A N/A 16% -17% 38% 3% -46% 2% 0%

1Q13/1Q12 11% 10% -86% 15% -47% 8% 8% N/A -1% -58% -77% 0% -32% -21% -69% -59% -65% -56% 60% -86% 16% 23%

14

1Q13 Earnings Release

April 25, 2013

Appendix 2 Consolidated Balance Sheet (R$ thousands)

Assets

Current Assets Cash and banks Short-term investments Securities Receivables Inventories Recoverble taxes and contributions Other receivables

Mar-13

4,465,189 103,121 2,412,410 234,532 1,021,368 479,501 132,250 82,007

Dec-12

4,432,090 41,939 2,475,373 240,077 981,986 473,658 135,310 83,747

Liabilities and Stockholders' Equity

Current Liabilities Loans and financing Suppliers Income tax and social contribution Taxes payable Salaries and payroll charges REFIS Adherence Other accounts payable

Mar-13

1,660,897 1,083,470 289,035 57,462 61,765 80,766 34,432 53,967

Dec-12

1,767,389 1,120,770 318,077 54,387 57,095 125,807 39,383 51,870

Noncurrent Assets Long term Taxes to compensate Judicial Deposits Other receivables Other investments Property, plant & equipment, net Biological assets Intangible assets

9,637,813 108,085 87,789 149,077 457,916 5,414,894 3,411,079 8,973

9,665,813 128,402 87,123 158,520 462,193 5,379,426 3,441,495 8,654

Noncurrent Liabilities Loans and financing Deferred income tax and social contribution Other accounts payable - Investors SCPs REFIS Adherence Other accounts payable StockholdersEquity Capital Capital reserve Revaluation reserve Profit reserve Valuation adjustments to shareholders'equity Treasury stock Total

6,824,494 4,802,576 1,410,149 70,561 390,987 150,221 5,617,611 2,271,500 4,417 49,802 2,371,947 1,069,721 (149,776) 14,103,002

6,909,593 4,914,334 1,392,257 69,214 389,793 143,995 5,420,921 2,271,500 1,423 49,980 2,170,215 1,081,379 (153,576) 14,097,903

Total

14,103,002

14,097,903

15

1Q13 Earnings Release

April 25, 2013

Appendix 3 Loan Maturity Schedule March 31, 2012

2020 R$ million 2Q13 3Q13 4Q13 1Q14 9M14 2015 2016 2017 2018 2019 121 0 121 197 12 20 229 350 87 87 160 3 23 186 273 99 3 102 136 2 10 148 250 92 2 94 80 2 35 117 211 299 299 357 7 40 404 703 449 19 468 375 36 75 486 954 169 9 178 181 100 146 427 605 114 13 127 426 268 694 821 104 20 124 375 144 519 643 70 12 81 344 84 50 478 560

Forward

Total 1,646 88 1,734 2,967 686 500 4,152 5,886

BNDES

Others Local Currency

42 10 52 336 28 101 465 517

Trade Finance Fixed Assets

Others Foreign Currency Gross Debt

R$ million

954 703

821 643

404 350 337 229 121 273 186 87 140 250 148 102 211 117 94 299

486

605 694 519 451

560 517

Foreign Currency 4,152 Gross Debt 5,886

427

478 465

468 178 127 124 81 52

Local Currency 1,734

2Q13 3Q13 4Q13 1Q14 9M14

2015

2016

2017

2018

2019

2020 Forward

Average Cost Average Tenor

Local Currency Foreign Currency Gross Debt 6.72 % p.y. 4.50 % p.y. 31 months 44 months 41 months

16

1Q13 Earnings Release

April 25, 2013

Appendix 4 Consolidated Cash Flow Statement (R$ thousands)

1Q13 Cash flow from operating activities Operating activities . Net income . Depreciation and amortization . Depletion in biological assets . Change in fair value - biolgical assets . Equity results . Results on Equity Pickup . Deferred income taxes and social contribution .Income taxes and social contribution . Interest and exchange variation on loans and financing . Interest Payment . REFIS Reserve . Others Variations in A ssets and Liabilities . Receivables . Inventories . Recoverable taxes . Marketable Securities . Prepaid expenses . Other receivables . Suppliers . Taxes and payable . Salaries, vacation and payroll charges . Other payables Net Cash Investing A ctivities . Purchase of property, plant and equipment . Cust biological assets planting (ex taxes) . Income of assets sale . Received from subsidiary . Sale of property, plant and equipment Net Cash Financing Activities . New loans and financing . Loan amortization . Minority shareholders entrance . Minority shareholders exit . Dividends payed . Stocks repurchase . Stocks disposal Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 4,894 (1,781) 2,517,312 2,515,531 364,404 2,341,064 2,705,468 (8,002) (720) 5,100 13,068 (69,345) 156,347 (230,586) 8,034 382,657 656,231 (264,852) 201,556 221,819 201,554 59,565 113,501 (61,609) 1,118 (823) 34,157 (32,426) 3,124 (77,943) 7,099 (25,498) (20,263) (40,896) (5,576) 55,803 5,545 3,793 (6,344) 5,614 7,745 (45,041) (906) (133,992) (130,956) (21,204) 1Q12 46,784 107,088 458,518 51,985 55,860 (434,606) 618 (3,586) 157,671 (93,444) (13,388) (68,871) 8,897 (12,566) (60,304) 5,893 (13,567) 131,592 (5,604) 5,865 (5,072) (150,691) (25,138) (21,465) 17,883 (65,037) (51,106) (21,467) (498)

17

You might also like

- Release 4Q12Document18 pagesRelease 4Q12Klabin_RINo ratings yet

- Ebitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Document17 pagesEbitda of R Up 25% From 1Q11 EBITDA of R$ 311 Million in 1Q12, Up 25% From 1Q11Klabin_RINo ratings yet

- Release 3Q13Document16 pagesRelease 3Q13Klabin_RINo ratings yet

- Release 3Q12Document17 pagesRelease 3Q12Klabin_RINo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- EBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Document18 pagesEBITDA of R$ 249 Million in 1Q11, With EBITDA Margin of 26%Klabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Release 1Q15Document17 pagesRelease 1Q15Klabin_RINo ratings yet

- First Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Document10 pagesFirst Quarter Results 2001: Qoq R$ Million 1Q/01 4Q/00 1Q/00Klabin_RINo ratings yet

- Cash Generation Exceeds R$ 181 Million: January/March 2002Document10 pagesCash Generation Exceeds R$ 181 Million: January/March 2002Klabin_RINo ratings yet

- Earnings Release 3Q11: EBITDA of R$277 Million in 3Q11Document20 pagesEarnings Release 3Q11: EBITDA of R$277 Million in 3Q11Klabin_RINo ratings yet

- iKRelease2005 2qDocument16 pagesiKRelease2005 2qKlabin_RINo ratings yet

- Klabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Document20 pagesKlabin Records Net Income of R$ 303 Million in 6M11, Up 178% On 6M10Klabin_RINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- Cash Generation Grows by 12% in The Third Quarter: July/September 2001Document13 pagesCash Generation Grows by 12% in The Third Quarter: July/September 2001Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Document15 pagesKlabin Reports A Net Profit of R$ 63 Million in 1Q03: January/March 2003Klabin_RINo ratings yet

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Document18 pages1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 366 Million Up To September 2004Document16 pagesKlabin Reports A Net Profit of R$ 366 Million Up To September 2004Klabin_RINo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- Klabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Document14 pagesKlabin Starts Up New Capacity at Its Guaíba Mill: April/June 2002Klabin_RINo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Klabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Document19 pagesKlabin Reports Gross Revenues of US$ 1.1 Billion in 2004: Oct / Nov / Dec 2004Klabin_RINo ratings yet

- Klabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Document15 pagesKlabin Reports Net Profit of R$ 163 Million in 1Q06: F I R S T Q U A R T e R R e S U L T S 2 0 0 6Klabin_RINo ratings yet

- iKRelease2005 1qDocument16 pagesiKRelease2005 1qKlabin_RINo ratings yet

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

- Release 4Q15Document16 pagesRelease 4Q15Klabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument9 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- 4q2009release BRGAAP InglesnaDocument22 pages4q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 940 Million Up To September 2003Document16 pagesKlabin Reports A Net Profit of R$ 940 Million Up To September 2003Klabin_RINo ratings yet

- Klabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Document17 pagesKlabin Reports A Net Profit of R$ 1.0 Billion in 2003: October/December 2003Klabin_RINo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- iKRelease2000 1qDocument6 pagesiKRelease2000 1qKlabin_RINo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Earnings ReleaseDocument7 pagesEarnings ReleaseBVMF_RINo ratings yet

- iKRelease2005 4qDocument17 pagesiKRelease2005 4qKlabin_RINo ratings yet

- KPresentation2009 1Q IngDocument34 pagesKPresentation2009 1Q IngKlabin_RINo ratings yet

- Release 2Q16Document19 pagesRelease 2Q16Klabin_RINo ratings yet

- Result Y15 Doc3Document6 pagesResult Y15 Doc3ashokdb2kNo ratings yet

- Earnings 1Q12Document8 pagesEarnings 1Q12Klabin_RINo ratings yet

- Klabin S.A.: Anagement EportDocument7 pagesKlabin S.A.: Anagement EportKlabin_RINo ratings yet

- Cash Generation Reaches R$ 979 Million in 2002: October/December 2002Document19 pagesCash Generation Reaches R$ 979 Million in 2002: October/December 2002Klabin_RINo ratings yet

- Klabin Webcast 20112 Q11Document8 pagesKlabin Webcast 20112 Q11Klabin_RINo ratings yet

- Billerud Interim Report Q1 2011Document20 pagesBillerud Interim Report Q1 2011BillerudNo ratings yet

- 3Q12 - Earnings ReleaseDocument18 pages3Q12 - Earnings ReleaseUsiminas_RINo ratings yet

- PHP WKPF BKDocument5 pagesPHP WKPF BKfred607No ratings yet

- Press 20130402eDocument4 pagesPress 20130402eRandora LkNo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- Glass Containers, Domestic World Summary: Market Sector Values & Financials by CountryFrom EverandGlass Containers, Domestic World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Rating Klabin - Fitch RatingsDocument1 pageRating Klabin - Fitch RatingsKlabin_RINo ratings yet

- Press Klabin Downgrade Mai17Document5 pagesPress Klabin Downgrade Mai17Klabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Management Change (MATERIAL FACT)Document1 pageManagement Change (MATERIAL FACT)Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Itr 1Q17Document70 pagesItr 1Q17Klabin_RINo ratings yet

- Free Translation Klabin 31 03 2017 Arquivado Na CVMDocument70 pagesFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Recommedation To New Chief Executive OfficerDocument1 pageRecommedation To New Chief Executive OfficerKlabin_RINo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP 2016Document87 pagesDFP 2016Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Notice To The Market - New Structure of The Executive BoardDocument2 pagesNotice To The Market - New Structure of The Executive BoardKlabin_RINo ratings yet

- Institutional Presentation 2016Document28 pagesInstitutional Presentation 2016Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Release 4Q16Document18 pagesRelease 4Q16Klabin_RINo ratings yet

- Presentation APIMEC 2016Document44 pagesPresentation APIMEC 2016Klabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Notice To Debenture HoldersDocument1 pageNotice To Debenture HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Release 3Q16Document19 pagesRelease 3Q16Klabin_RINo ratings yet

- Theory of Value - A Study of Pre-Classical, Classical andDocument11 pagesTheory of Value - A Study of Pre-Classical, Classical andARKA DATTANo ratings yet

- Swift MessageDocument29 pagesSwift MessageAbinath Stuart0% (1)

- Bangalore University SullabusDocument35 pagesBangalore University SullabusJayaJayashNo ratings yet

- Analisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Document25 pagesAnalisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Fauzan C LahNo ratings yet

- Management TheoryDocument63 pagesManagement TheoryFaisal Ibrahim100% (2)

- Résumé Rodrigo Marcelo Irribarra CartesDocument3 pagesRésumé Rodrigo Marcelo Irribarra CartesRodrigo IrribarraNo ratings yet

- PDFDocument14 pagesPDFBibhuti B. Bhardwaj100% (1)

- Figure 26.1 The Directional Policy Matrix (DPM)Document2 pagesFigure 26.1 The Directional Policy Matrix (DPM)Abdela TuleNo ratings yet

- The Role of Business ResearchDocument23 pagesThe Role of Business ResearchWaqas Ali BabarNo ratings yet

- SPDR Periodic Table WebDocument2 pagesSPDR Periodic Table WebCarla TateNo ratings yet

- Umjetnost PDFDocument92 pagesUmjetnost PDFJuanRodriguezNo ratings yet

- Crisostomo V Court of Appeals GR NO. 138334Document2 pagesCrisostomo V Court of Appeals GR NO. 138334Joshua OuanoNo ratings yet

- Washer For Piston Screw: Service LetterDocument2 pagesWasher For Piston Screw: Service LetterRonald Bienemi PaezNo ratings yet

- Cases in Civil ProcedureDocument3 pagesCases in Civil ProcedureJaayNo ratings yet

- BharatBenz FINALDocument40 pagesBharatBenz FINALarunendu100% (1)

- SAVAYA The Martinez-Brothers PriceListDocument2 pagesSAVAYA The Martinez-Brothers PriceListnataliaNo ratings yet

- Catalogue 2012 Edition 6.1 (2012-11) PDFDocument382 pagesCatalogue 2012 Edition 6.1 (2012-11) PDFTyra SmithNo ratings yet

- Understanding consumer perception, brand loyalty & promotionDocument8 pagesUnderstanding consumer perception, brand loyalty & promotionSaranya SaranNo ratings yet

- IC-02 Practices of Life Insurance-1Document268 pagesIC-02 Practices of Life Insurance-1ewrgt4rtg4No ratings yet

- Resilia OverviewDocument25 pagesResilia OverviewNoor Kareem100% (1)

- BUS835M Group 5 Apple Inc.Document17 pagesBUS835M Group 5 Apple Inc.Chamuel Michael Joseph SantiagoNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- Green Supply Chain Management PDFDocument18 pagesGreen Supply Chain Management PDFMaazNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- Case Study 1Document9 pagesCase Study 1kalpana0210No ratings yet

- 7 Steps To Eliminate DebtDocument4 pages7 Steps To Eliminate Debttiongann2535No ratings yet

- Managing Capability Nandos Executive Summary Marketing EssayDocument7 pagesManaging Capability Nandos Executive Summary Marketing Essaypitoro2006No ratings yet

- HESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectDocument50 pagesHESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectAyman AlkwaifiNo ratings yet

- 1-Loanee Declaration PMFBYDocument2 pages1-Loanee Declaration PMFBYNalliah PrabakaranNo ratings yet