Professional Documents

Culture Documents

Managing An International Partnership

Uploaded by

Sayed AnwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing An International Partnership

Uploaded by

Sayed AnwarCopyright:

Available Formats

Managing an International partnership US-T and ITA-Truck

Introduction

US-Truck and ITA-Truck are two family owned small enterprises oriented to develop their current activities through the assessment of the possibilities offered in the global context. Although these similarities, alongside other common feature they have several differences that may undermine the definition of the partnership they have started to evaluate.

History of ITA-truck

Family owned business founded by Alpha family in the year 1977. The production and supply operates in the home country. Main product of production is to produce Dump trucks. The company strength employee of the company is 30. The company invest heavy amount on R&D. In 2009 the companys estimated turnover was 10 million Euros. ITA-trucks has been appreciated in the home country, the firm also conducted few activities abroad. The companys export is between 5%-10% due to international activities of the industrial sector.

History of US-T

Family owned business founded by Jeff Smith Sr. in the year 1986. The company distributes, Install and repairs lubrication equipment as well as designing and building customized lubrication trucks which supply in the home country with 15 states. The head quarter is located in concord, North Carolina. The company strength employee of the company is 28. In 2007 the companys estimated turnover was 8 million Euros. US-T has been appreciated in the home country.

Governance of Transaction

ITA-TRUCK AND US-T INTERNATIONAL PARTNERSHIP Goods-US-T and ITA-Trucks product will results in good fit for the markets and industries due to long term relationship. Service- Resulted in better service. Knowledge- technical know-how will be shared among the two companies which will result in reducing the cost.

Complexity

1) Uncertainty of first order and second order: There is an uncertainty of production of the goods in the first and second batch. 2) Investing systems boundaries and potentials for surprises: The companies should be ready to take surprises as in the any future risks.

3) Need for stakeholder involvement for collecting and interpreting: Stake holder plays an important role as any gain/loss will affect the stakeholders. 4) Different frames: Both company has different frames of rules and regulation

5) Different concepts about route of risk handling: Both companies have different concepts of handling of risks which might results in conflicts between two companies.

HIERARCHY

As the two companies will have similar type of hierarchy 1) CEO 2) STAKE HOLDER 3) BOARD OF DIRECTORS 4) PRESIDENT 5) MANAGERS

TYPE OF OWNERSHIP

KEY POINTS GOVERNANCE STRATEGY POSITIONING EXPORTS BARRIERS SOLUTIONS WANTS

ITA-TRUCK

FAMILY OWNERSHIP R&D INVESTMENT LEADING FIRM STANDARDIZATION FEW (5 TO 10%) SHIPPING COSTS OUTSOURCE PRODUCTION ESTABLISH PARTNERSHIP PARTNERSHIP

US-T

FAMILY OWNERSHIP DIVERSIFICATION AND GEOGRAPHICAL ETENSION DESIGNED-TO-FIT MULTIPLE MARKETS NO OPPORTUNITIES EXPAND LOCALLY INSOURCING

PROPOSITION FOR ROLE DISTRIBUTION

ITA-TRUCK

DESIGN US TRUCK CHASSIS

DESIGN KNOWHOW TRANSFE R

US-T IDENTIFY DISTRIBUTOR FOR SALES DECIDE WHICH ITATRUCK TO SELL MARKET ANALYSI S

ADAPT US-T SUPPLY CHAIN

PROVIDE MANUFACTURING KNOWHOW Administrativ e ADMINISTRATIVE WORK

DETERMINE SPECIFICATION (CHASSIS)

PRICING

MANUFACTURING AND ASSEMBLING

DISTRIBUTING

Production & distribution

COMPLIANCE

1) DIFFERENT WAYS TO CONDUCT BUSINESS There are many way to conduct business as there is no single method. The two companies have different strategic. 2) CULTURAL DIFFERENCES Here the cultural difference can be a problem as one company is American and other is European. 3) ASSISTANCE FROM A THIRD NEUTRAL PARTY Third party can play a major role in the deals and might take major benefits. 4) ADAPT TO LOCAL MARKETS Adapting to the local market might take some times due to cultural differences. Risks Takeover: One major risk associate with the partnership is that takeover as in future one company might take over the other company. Profit distribution: There can be a quarrel between the two companies over the profit distribution so before entering into the partnership clear rules offers and rules should be laid down. Different strategies: Having different can results in breakup of the partnership, so the companies should follows common policies. Cultural Differences: As the two companies are from two different continents so the culture will be different, these cultural differences might cause problem in the companies. Conclusion Both the companies should be careful with its corporate governance and it must establish a well-defined partnership. The companies should be able to avoid the transactional relationship. As there is no doubt the international partnership will boost companies image and profit but both the companies should be ready to

take surprise risk also. The companies cost will reduce and will help to improve their goods, service and knowledge.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Study of Investment in Mutual FundDocument29 pagesThe Study of Investment in Mutual FundSayed AnwarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Better World BooksDocument11 pagesBetter World BooksSayed Anwar100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Research On Hollywood Movies of 2012Document176 pagesResearch On Hollywood Movies of 2012Sayed AnwarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Diamond (Cartel) IndustryDocument28 pagesDiamond (Cartel) IndustrySayed Anwar100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Economical of Fast Food Chains in USADocument4 pagesEconomical of Fast Food Chains in USASayed AnwarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Kanpur TOD Chapter EnglishDocument27 pagesKanpur TOD Chapter EnglishvikasguptaaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Voltas Case StudyDocument8 pagesVoltas Case StudyAlok Mittal100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Partner Ledger Report: User Date From Date ToDocument2 pagesPartner Ledger Report: User Date From Date ToNazar abbas Ghulam faridNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PDACN634Document69 pagesPDACN634sualihu22121100% (1)

- Boneless & Skinless Chicken Breasts: Get $6.00 OffDocument6 pagesBoneless & Skinless Chicken Breasts: Get $6.00 OffufmarketNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Final EA SusWatch Ebulletin February 2019Document3 pagesFinal EA SusWatch Ebulletin February 2019Kimbowa RichardNo ratings yet

- Partnership Dissolution and Liquidation ProcessDocument3 pagesPartnership Dissolution and Liquidation Processattiva jadeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Customer Master Data Views in CMDDocument22 pagesCustomer Master Data Views in CMDVasand SundarrajanNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Assumptions in EconomicsDocument9 pagesAssumptions in EconomicsAnthony JacobeNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- "Potential of Life Insurance Industry in Surat Market": Under The Guidance ofDocument51 pages"Potential of Life Insurance Industry in Surat Market": Under The Guidance ofFreddy Savio D'souzaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- DaewooDocument18 pagesDaewooapoorva498No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- BIM Report 2019Document31 pagesBIM Report 2019ziddar100% (1)

- Managerial Economics: Cheat SheetDocument110 pagesManagerial Economics: Cheat SheetSushmitha KanasaniNo ratings yet

- Environment PollutionDocument6 pagesEnvironment PollutionNikko Andrey GambalanNo ratings yet

- Pengiriman Paket Menggunakan Grab Expres 354574f4 PDFDocument24 pagesPengiriman Paket Menggunakan Grab Expres 354574f4 PDFAku Belum mandiNo ratings yet

- Business PeoplesDocument2 pagesBusiness PeoplesPriya Selvaraj100% (1)

- Partnership Formation Answer KeyDocument8 pagesPartnership Formation Answer KeyNichole Joy XielSera TanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manikanchan Phase II Project Information MemorandumDocument15 pagesManikanchan Phase II Project Information Memorandummy_khan20027195No ratings yet

- Request Travel Approval Email TemplateDocument1 pageRequest Travel Approval Email TemplateM AsaduzzamanNo ratings yet

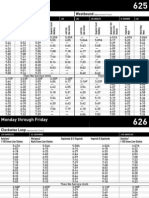

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- Instructor'S Manual Instructor'S Manual: An Introduction To Business Management 8Document18 pagesInstructor'S Manual Instructor'S Manual: An Introduction To Business Management 8arulsureshNo ratings yet

- Finland Country PresentationDocument28 pagesFinland Country PresentationLANGLETENo ratings yet

- LU3 Regional PlanningDocument45 pagesLU3 Regional PlanningOlif MinNo ratings yet

- Advt Tech 09Document316 pagesAdvt Tech 09SHUVO MONDALNo ratings yet

- Checklist ISO 20000-2018Document113 pagesChecklist ISO 20000-2018roswan83% (6)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Chairman, Infosys Technologies LTDDocument16 pagesChairman, Infosys Technologies LTDShamik ShahNo ratings yet

- REFRIGERATORDocument2 pagesREFRIGERATORShah BrothersNo ratings yet

- REKENING KORAN ONLINE ClaudioDocument1 pageREKENING KORAN ONLINE Claudiorengga adityaNo ratings yet

- IGPSA PresentationDocument11 pagesIGPSA Presentationisrael espinozaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)