Professional Documents

Culture Documents

Project On Salt

Uploaded by

bulbul12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project On Salt

Uploaded by

bulbul12Copyright:

Available Formats

A case study is an intensive description and analysis of a single individual or group, a company or any specific sector.

It could also be regarding any particular economy or country. It all depends on the requirement of the reader. A case study could be descriptive in nature, describing all the cause and effect relationship of any particular situation. Or it could be an unsolved case study which has a problem for the readers to solve. These case studies have enough information in them that readers can understand what the problems are and, after thinking about them and analyzing the information; the readers should be able to come up with a proposed solution. Case Study teaches the reader how to draw definite cause-effect conclusions based on given information. Although its Hard to generalize from a single case, the reader is expected to apply his logic and comprehension power for understanding and solving the problem proposed in form of case study. Case Study also provides good opportunity for innovation as rare phenomenon is discussed in the case study.

INDIAN SALT INDUSTRY IS GOING GLOBAL: AN OVERVIEW

India ranks third in the production of salt in the world next to USA and China. The Average annual production is about 20.31 million tones against the average annual world production of 240-250 million tones. Worldwide about 25 million tones of salt are used for edible purposes and rest is used for non-edible and industrial purpose. Salt Production Worldwide Huge consumption The world wide salt production is currently 200 million tons and exceeding the mark rapidly. The worldwide industries manufacture this huge quantity of salt not only for consumption but for non-edible and industrial purpose as well. Ways of extraction Almost sixty percentage of salt production in the whole world goes to the industrial usage. Only the remaining forty percent is used for miscellaneous purposes that major constitutes the application in the form of food additives. When you talk about the worldwide salt production, it is mandatory to know the different ways that the salt is obtained all over the globe. Prima facie, evaporation of sea water to obtain salts is the method carried out in majority parts of the Asian subcontinents. Especially in the India and china, the salt production is done in this ways and they obtain almost 99.5 percentage of purity still. The salts produced this ways are being washed again chemically to remove the impurities and then it is shipped. Different parts of the globe There are still other forms of obtaining salts as well. Even in India and china you could find some of these different forms of extracting salt. One is through mining process. This is salt extraction from the salt beds underneath the earth. Such a sort of salts is then allowed to be prepared in the laboratories to be modified to the form of fine granules as we see the table salt. Salts obtained in this way are in majority from the United States of America as well as other European continents. Their purity levels are a big challenge though. They are not competent to the great purity levels obtained as one gets from the salts of India and china. 99.5 to 99.7 is the range of purity that could be obtained from these salts of the west. Most of them find applications only in the industries. It could be evident by now that almost all of those fine graded salts are just the western brand names carrying eastern salt inside. Anyhow, there is one more variety of salt obtained from the brine. This is called as solution mining process. This is almost one third of the total salt production methods in the world.

All those salts extracted from the Australia and Mexico is essentially of this kind of manufacturing. The level of purity that is obtained is of the highest grade when you compare with the other forms of salt extraction. The purity range varies somewhere in between to the second decimals of 99.9. It depends from place to place from the set standards of production process carried out. Industrial applications Sometimes it is also about the raw salt content which is obtained from a particular place. There are certain traces of impurities at micro levels which are just integral part of the salt itself and it could not be removed even after so many sophisticated processes and techniques employed. Worldwide salt production for industrial applications includes the organic synthesis, petroleum production, byproducts fractional distillation and many more processes. Salt Industry in India India is the third largest Salt producing Country in the World after China and USA with Global annual production being about 230 million tones. The production of salt during 1947 was 1.9 million tones which has increased tenfold to record 20 million tones during 2005. In a very short period of time sufficiency was achieved (in 1953) and made a dent in the export market. Since then, the country has never resorted to imports. Exports touched an all time high of 1.6 million in the year 2001. The per-capita consumption of salt in the country is estimated at about 12 kg, which includes edible as well as industrial salt. The current annual requirement of salt in the country is estimated to be 60 lakhs tones for industrial use. Caustic soda, soda ash, chlorine etc., are the major salt-based industries. Besides about 15 lakhs tones of salt is exported every year. Sea salt constitutes about 70% of the total salt production in the country. Salt manufacturing activities are carried out in the coastal states of Gujarat, Tamil Nadu, Andhra Pradesh, Maharashtra, Karnataka, Orissa, West Bengal Goa and hinter land State of Rajasthan. Among these States only Gujarat, Tamil Nadu and Rajasthan produces salt surplus to their requirement. These three states produce about 70%, 15% and 12% respectively of the total salt produced in the country and cater to the requirement of all the salt deficit and non-salt producing states. Private sector plays a dominant role contributing over 95% of the salt production, while the public sector contributes about 2-3%. The co-operative sector contributes about 8% whereas the small-scale sector (less than 10 acres) accounts for nearly 40% of the total salt production in the country. op Brands of Salt in India

Tata salt Captain cook i-shakthi Aashirvadh Annapurna Surya salt Sambhar salt Nirma shudh and many more

Salt Works and Acreage under Salt Production There are about 10107 salt works, mostly in small sector engaged in the production of salt. The total area under salt production is about 5.0 lakhs acres. The salt manufacturing activities provide direct employment to about one-lakh persons per day. Distribution of Salt Railways play an important role in transporting salt from three surplus states to the entire length and breadth of the country. On an average, 55% of edible salt is transported by rail from production centers.

The remaining quantity moves by road and waterway. odized Salt With a view to ensure universal access of iodized salt for the prevention and control of goiter and other iodine deficiency disorders in the country, Salt Commissioner's Office has been identified as the nodal agency for creation of adequate salt iodization capacity, its distribution and quality monitoring at production centers, under NIDDCP. Salt Department has granted permission to more than 878 salt iodized units with an annual installed capacity of 112 lakh tones so far. Exports Export of common salt and iodized salt is permitted under Open General License (O.G.L.). Salt is exported manly to Japan, Philippines, Indonesia, Malaysia, Nepal, and Bhutan etc. India has, for the first time, exported 32,500 tonnes of common salt to the US during December 2002, creating a history of sorts. Liberalization and Simplification of Procedure Following amendments to Central Excise and Salt Act, 1944 in 1996, de-licensing the salt industry and Salt Cess Rules, 1964 in 2001 and introducing self-removal procedure (SRP) instead of permit system for payment of cess and removal of salt from salt factories, several registers have been discontinued or reorganized.

Sources of Salt The main sources of salt in India are

Sea brine Lake brine Sub-soil brine and Rock salt deposits

Major Salt Producing Centers Sea water is an inexhaustible source of salt. Salt production along the coast is limited by weather and soil conditions. The major salt producing centers are

Marine Salt works along the coast of Gujarat (Jamnagar, Mithapur,Jhakhar, Chira, Bhavnagar, Rajula, Dahej, Gandhidham, Kandla, Maliya, Lavanpur), Tamil Nadu (Tuticorin, Vedaranyam, Covelong), Andhra Pradesh (Chinnaganjam, Iskapalli, Krishnapatnam, Kakinada & Naupada), Maharashtra(Bhandup, Bhayandar, Palghar), Orissa (Ganjam, Sumadi) and West Bengal (Contai) Inland Salt Works in Rajasthan using lake brine and sub-soil brine viz. Sambhar Lake, Nawa, Rajas, Kuchhaman, Sujangarh and Phalodi Salt works in Rann of Kutch using sub-soil brine viz: Kharaghoda, Dhrangadhra; Santalpur Rock Salt Deposits at Mandi in the State of Himachal Pradesh

Profile & Status of Salt Industry There are about 13000 salt manufacturers engaged in production of Common salt in an extent of about 5.50 lakh acres in the Country. It is estimated that 90 per cent of the total number of salt manufacturers are

small salt producers (having an individual extent of less than 10 acres for salt manufacture), 5.5% is large scale producers (having an individual extent of more than 100 acres) and 4.5 % is medium scale producers (having an individual extent between 10 and 100 acres). Average Annual Production of Salt in India is 176 lakh tones whereas ever high production of 199 lakh tones was recorded during 2005 followed by 181 lakh tonnes during 2006. Gujarat, Tamil Nadu and Rajasthan are surplus Salt producing States accounting for about 96 per cent of the Countrys production. Gujarat contributes 76 per cent to the total production, followed by Tamil Nadu (12 %) and Rajasthan (8%). The rest 4% production comes from Andhra Pradesh, Maharashtra, Orissa, Karnataka, West Bengal, Goa, Himachal Pradesh, Diu & Daman. On an average 62% of the total production is from large salt producers followed by small scale producers (36%) and rest by medium scale producers. The average annual supplies of salt for human consumption is about 57 lakh tonnes and that for industrial consumption is about 83 lakh tones; 57% of the salt for human consumption moves by rail and 43% by road. 89% of the salt for industrial consumption moves by road, 7% by rail and 4% by coastal shipment to various industries; when the total indigenous supplies is taken, 69% moves by road, 27% moves by rail and 3% by sea. India exports surplus production of salt to the tune of about 25 lakh tonnes on an average; during the year 2005, a record export of 38 lakh tonnes was achieved primarily due to surge of demand from China. Other major countries importing salt from India are Japan, Bangladesh, Indonesia, South Korea, North Korea, Malaysia, U.A.E., Vietnam, etc. Government of India has adopted the strategy of Universal Salt Iodization and Consumption for elimination of Iodine Deficiency Disorders (IDD) in the country under the National Iodine Deficiency Disorders Control Program (NIDDCP). Iodine is supplemented in the diet through Iodized Salt for combating IDD. The Program was started in 1962 initially confining to Goiter endemic areas but after 1984 it was implemented throughout the country. Thus, as on date, a significant progress has been made on Universal Salt Iodization. The country produces about 50 lakh tones of Iodized salt and about 49 lakh tones of iodized salt is supplied for human consumption against the requirement of about 54 lakh tones for entire population. The country has created more than adequate salt iodization capacity of over 110 lakh tones. Salt Industry is labor intensive in the country. About 1.4 lakh laborers are employed daily in the Salt Industry, on an average. Salt Commissioners Organisation has put in place a number of Labor Welfare Schemes ameliorating the working and living conditions of salt laborers. Government of Indias Role in Development of Salt Industry Salt is a Central subject in the Constitution of India and appears as item No.58 of the Union List of the 7th Schedule, which reads: a) Manufacture, Supply and Distribution of Salt by Union Agencies; and b) Regulation and control of manufacture, supply and distribution of salt by other agencies. Central Government is responsible for controlling all aspects of the Salt Industry. Salt Commissioners Organisation, an attached Office under the Ministry of Commerce & Industry (Department of Industrial Policy & Promotion), Government of India, is entrusted with the above task. Government of India has de-licensed Salt Industry by deleting provisions relating to Salt in the Central Excise & Salt Act, 1944 vide Finance Bill of 1996-97. In line with Government of Indias Policy of Liberalization and simplification of Procedures, the Salt Cess Rules, 1964, have been amended vide Notification No.GSR 639(E) dated 04.09.2001. Salt Commissioners Organisation plays a facilitating role in overall growth and development of Salt Industry in the country. The thrust of the Salt Commissioners Organisation currently is on the following:

Technological Development and Quality Improvement Salt Iodization Program for combating Iodine Deficiency Disorders

Infrastructure Development promoting Salt Industry Labor Welfare Schemes for Salt Workers particularly housing under NAMAK MAZDOOR AWAS YOJNA Export of Salt

Indian Salt Industry - Present Status The Salt Department is under the Ministry of Commerce and Industry and is headed by The Salt Commissioner of India. The duty on salt was abolished from 1st April 1947. For administrative purposes, the 5 Regions viz. Gujarat Region, Chennai Region, Mumbai Region, Kolkata Region, Rajasthan Region, implement the policies of the Salt Department. There are salt department laboratories in all regions to help salt manufacturers to maintain quality of salt. At state level, the development of industry and welfare of salt workers is being looked after by Industry Commissioner ate and labor department. The Indian Salt Manufacturers Association is an apex body of Indian salt manufacturers. There is Central Salt and Marine Chemicals research Institute at Bhavnagar in Gujarat. Their main function is to help salt industry through their research work. This institute was established in 1956. In addition to R & D work the institute provides training courses for salt manufacturers for salt production & quality. Majority of salt works are still having manual operations, but large salt works are going for mechanization. Edible Salt Indian salt industry is meeting the challenge of supplying iodized salt to entire country. The production of iodized salt is now more than 5.0 million tons as against the total requirement of 6 million tons of edible salt. There are 900 iodization plants the usual process of iodization adopted is spray method with a capacity of 16 million tons per annum. There are 42 salt refineries with a total capacity of 3.76 million tons per annum located in the states of Gujarat, Tamil Nadu, Uttar Pradesh and Rajasthan. In addition to above there are two giant vacuum salt plants of capacity one million tons. Other varieties of edible salt consumed in India are Iron Fortified Salt, Double Forfeited Salt. A new product Health Salt Containing micronutrients iodine, iron, folic acid, was also come up near Chennai in Tamil Nadu. Salt based Industry There are four giant Soda Ash factories in India. Total production of Soda Ash is about 2.5 million tons per annum and in addition there are large numbers of Caustic Soda & Chlorine industries in India. The Salt based Industry is concentrated more in Gujarat. Total Salt consumption for Industries is 6.5 million tons annum. The New Chemicals Industries are coming up and existing units are going for major expansions; growth is at 8%. India is a net exporter of Soda Ash and emerging as a significant regional player. The current low per capita Soda Ash consumption also shows tremendous growth potential over next few years. Unlike to world average of 56% consumption of Soda Ash by the glass industry, the Indian glass industry only consumes 25%. The major share is used by Indian detergents industry.

Soda Ash uses in glass & detergents is 65% Glass industry estimated to grow @ 7% and Detergent @ 4.5% over the next 4 years Tightness in the global demand-supply situation expected There is good opportunity to increase export Low per capita consumption leaves a lot of potential to be tapped Despite the steep drop in duty rates over the years, the industry has been able to effectively compete with imports and is geared up for further reductions. Growth of Soda Ash and Salt industry directly connected hence good growth in salt demand is expected.

Indian salt industry is going global Salt production of India is 18 to 20 million tons per annum and India is the third largest salt manufacturer of the World, after China & USA. Out of this about 3.5 million tons salt is washed in mechanized washing plants and up graded to international standard having purity 99.5% for Chlor-Alkali industry. The major quantity of washed salt is exported to Quatar, Japan and other countries and consumed by Indian chlor-alkali industry. The washing plants are increasing day by day and quality is also improving very fast. About 218020 Hectares land is under salt production

In last five years more than 15 Salt Washing plants have come up to meet requirement for high purity salt. Now few Salt Works are fully mechanized with washing plants and they have achieved the following qualityi) Sodium Chloride (NaCl) % 96.50 ii) Moisture (H2O) % ii) Calcium (Ca) % iv) Magnesium (Mg) % v) Sulphate(So4) % vi) Insolubles % 00.01 - 00.03 97.50 01.50 00.03 00.02 00.10 ( on wet basis) 03.00 00.05 00.03 00.15

The price of above salt, having purity 99.5%, after taking into consideration washing losses, stevedoring and other logistic expenses with marginal profit is about 15 to 16 USD per ton on FOBT basis. At present this quality salt is available in limited quantity but availability is increasing very fast as more and more washing plants are coming up in India.

Salt export may see uptrend this season (http://articles.economictimes.indiatimes.com/2011-12-08/news/30490364_1_salt-production-salt-pricessalt-export) According to news article of Economic Times on 8th Dec. 2011, Salt production has started in the Kutch belt of Gujarat and the Sambhar-Phalodi belts in Rajasthan. Export orders are expected to increase with demand coming from China and South Asian countries. Salt prices increased post-Japanese tsunami earlier this year and have been stable since then. Salt production in Rajasthan is in full swing. By mid-December, the production will begin from Covelong, Marakanam, Cuddalore, Vedaranyam, Tuticorin and Nagercoil in Tamil Nadu along with Andhra Pradesh's Naupada to Isakapalli. By January, the production will begin from south Gujarat (Kambhat to Surat) and Palghar, Rai, Wadala centres of Maharashtra," said BC Raval, secretary, Indian Salt Manufacturers Association. Flooding, un-seasonal rains, foggy weather in China and Australia have ensured the demand picking up from Japan, Bangladesh, Nepal, Vietnam, Indonesia and Malaysia for the industrial salt. Exports in this calendar year (till date) have touched 3.8 million tonne and expected to cross 4.3 million tonne by December-end. On an average, India exports 2.5 million tonne salt. Salt production in India is to the tune of about 19-20 million tonne per annum, of which Gujarat produces 70%. In the domestic market, over 5.5-6 million tonne is used by the edible salt industry, 8.5 million tonne is used by the chlor-alkali industry (which mainly produces caustic soda, chlorine and soda ash) and over 2 million tonne in the water softening and tanning industry. Export contracts were signed at $35-40 a tonne. Raw salt prices are currently ruling higher by Rs 100 to Rs

150 than the previous year's Rs 600-800 a tonne. In the retail, refined iodized salt was selling at Rs 1,200 to Rs 1,800 a tonne, depending on the brand and packaging, compared to Rs 1,000 to Rs 1,200 a tonne at the beginning of the year. India's edible salt market is 5.5-6 million tonne with branded salt market accounting for 1.3 million tonne. With a market share of 64% in the branded salt market, Tata Salt is the leading player, followed by Hindustan Unilever's Annapurna, Nirma's Shudh Salt and ITC's Aashirvaad Salt. On the backdrop of a balanced supply and demand, the prices are supposed to remain stable. Exports will be the real game changer in the coming days. The largest producer of caustic soda in India, Gujarat Alkalies & Chemicals (GACL), expects salt prices to increase if pre-winter rain lashes across the state. "We are annually experiencing pre-winter rain showers, which delay production and increase prices by 15-20%. If there is no shower till March, the industry won't have to worry," said an official from GACL. All major players like GACL, Indian Rayon, Gujarat Fluorochemicals are on an expansion mode. By 2014, GACL will increase caustic soda production by 300 tonne per day from the current production of 1,100-1,150 tonne per day. Potential for the Growth of Salt Industry

India has very long coast line and out of that Gujarat Coast line is of 1600 Kms In Gujarat in addition to existing salt industry lot of Land available along the side of coast for developing more salt works. Climatic conditions are suitable for salt industry. Easy Availability of skilled labors Good Administration of our Govt. and their Corporation. Our low cost of production Government support for critical infrastructure facilities. Minor Ports have loading capacity 5000 tons /day to 20000 tons /day in mid stream loading where as big port like Kandla have achieved the av. rate of loading of 25000 tons / day. We have a big advantage that ships of the capacity from 5000 tons to 100,000 tons could be loaded at our ports. There is potential for developing more ports as per requirement. In south India there is also a big port, Tuticorin close to salt manufacturing area. Now only 20% industries have gone for mechanization and modernization, 50% from balance can also go immediately. Average yield of salt works is only 100 tons per hectare. This can be increased to 300 tons per annum by adopting modernization.

Opportunities

Export Market- 1) Quatar 2) Malaysia 3) Philippines 4) Japan 5) China 6) Vietnam 7) Indonesia 8) Nepal Indias location is very suitable to supply salt to China, Japan, Middle East and to other Asian countries. India has potential to increase productivity as well as quality. Available manpower. Wind Power-largest coastal line of Gujarat has potential to Generate 5000 MW through Wind Energy. The Salt Industry can make use of this energy jointly through associations. Availability of good major and minor ports as well as of good anchor points. To grab the developing market of Middle East.

Conclusions

Indias salt production can be increased considerably by achieving average yield of 300 tons per hectare and by developing available large areas in Gujarat. Salt quality required to be improved in general in all sectors small and big to feed good quality salt to Indian Chlor-Alkali Industries as well as for export. Salt Industry has very good future hence new entrepreneurs should grab this opportunity.

You might also like

- Detail Project Report of Wheat FDocument27 pagesDetail Project Report of Wheat FYogesh PatilNo ratings yet

- Shyam JVL Submitted ProjectDocument66 pagesShyam JVL Submitted ProjectRaj Kishore Goswami100% (1)

- Indian Frozen Yogurt MarketDocument14 pagesIndian Frozen Yogurt Marketaakriti aroraNo ratings yet

- Chocolate Industry in IndiaDocument17 pagesChocolate Industry in Indiadilip15043No ratings yet

- Model Project Report On Fruit & Vegetable Processing UnitDocument24 pagesModel Project Report On Fruit & Vegetable Processing UnitSuhas Ninghot100% (1)

- Ntomani Sugar Company - Fund Raising Report - FinalDocument36 pagesNtomani Sugar Company - Fund Raising Report - FinalKamlesh SamaliyaNo ratings yet

- Project PPT On SpicesDocument31 pagesProject PPT On SpicesShilpa Dhawan100% (7)

- Electric Bulb Making PlantDocument25 pagesElectric Bulb Making PlantJohn100% (1)

- B PlanDocument20 pagesB Plany_378602342No ratings yet

- Performance Appraisal in Banking Sector by Ekta BhatiaDocument101 pagesPerformance Appraisal in Banking Sector by Ekta Bhatiadevrajforu92% (13)

- Produce Mango Jelly with NSIC's Mango Processing Project ProfileDocument3 pagesProduce Mango Jelly with NSIC's Mango Processing Project ProfileAnonymous EAineTizNo ratings yet

- Role of Agriculture Processing in Export Growth of Agricultural ProductsDocument8 pagesRole of Agriculture Processing in Export Growth of Agricultural ProductsAwadhesh YadavNo ratings yet

- Pepsi Potato Contract FarmingDocument14 pagesPepsi Potato Contract Farmingcobaltdeer50% (2)

- Design of A Table Salt Processing PlantDocument75 pagesDesign of A Table Salt Processing PlantTambok PandaNo ratings yet

- Annapurna Salt ProjectDocument52 pagesAnnapurna Salt ProjectMahesh Kumar100% (2)

- Nirma Project WordDocument83 pagesNirma Project WordKv RaluNo ratings yet

- NIRMA SHUDH Salt1Document79 pagesNIRMA SHUDH Salt1VIPULPATHAK33% (3)

- PRODUCT MARKET STUDY: INDIAN CONSUMER BEHAVIOR AND MARKETING STRATEGIESDocument15 pagesPRODUCT MARKET STUDY: INDIAN CONSUMER BEHAVIOR AND MARKETING STRATEGIESNISHANo ratings yet

- Safal Project DocumentDocument64 pagesSafal Project DocumentAlok Khuntia100% (1)

- Aloe Vera Farming Is Known To Be A Profitable Business and Over The YearsDocument14 pagesAloe Vera Farming Is Known To Be A Profitable Business and Over The YearsKavish BhandoyNo ratings yet

- CuminbiscuitdprDocument26 pagesCuminbiscuitdprharshit bhatnagarNo ratings yet

- Project Profile On Woven Fabric of Cotton Yarn: By: Team MembersDocument14 pagesProject Profile On Woven Fabric of Cotton Yarn: By: Team MemberssajidaliyiNo ratings yet

- Agrochemical Industry: Importance of AgrochemicalsDocument8 pagesAgrochemical Industry: Importance of AgrochemicalsKommineni Krishna Prasad100% (1)

- Detailed Project Report For Biscuit Manufacturing Plant: Naganu Foods Pvt. LTDDocument21 pagesDetailed Project Report For Biscuit Manufacturing Plant: Naganu Foods Pvt. LTDGavin MathewNo ratings yet

- Biusiness PlanDocument10 pagesBiusiness PlanEliyas AdamuNo ratings yet

- Project Report Summary of The Grand Five Star Deluxe HotelDocument95 pagesProject Report Summary of The Grand Five Star Deluxe Hotelkuldeep_chand10No ratings yet

- Model Detailed Project Report Ready To Serve Fruit Juice: Check Point Threat Extraction Secured This DocumentDocument27 pagesModel Detailed Project Report Ready To Serve Fruit Juice: Check Point Threat Extraction Secured This DocumentEfebas FekaduNo ratings yet

- Indian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDocument13 pagesIndian Edible Oil Market: Trends and Opportunities (2014-2019) - New Report by Daedal ResearchDaedal ResearchNo ratings yet

- Hershey India Private LimitedDocument9 pagesHershey India Private LimitedBharath Raj SNo ratings yet

- PET Bottles ManufacturingDocument7 pagesPET Bottles ManufacturingUmesh Kumar Sharma Ramamoorthi100% (1)

- EMP Wet Coffee Pulping IndusryDocument64 pagesEMP Wet Coffee Pulping IndusryTemesgen feyissaNo ratings yet

- Swot Analysis of Indian EconomyDocument2 pagesSwot Analysis of Indian EconomymyeyesrbeautNo ratings yet

- Dry Fruits Marketing Ideas PDFDocument36 pagesDry Fruits Marketing Ideas PDFGhouse BaigNo ratings yet

- Sonalika ReportDocument35 pagesSonalika ReportHarmeet singh100% (4)

- PVC Cable Making PlantDocument25 pagesPVC Cable Making PlantEsayas Mekonnen100% (1)

- Cleaning, Grading and Packaging Feasibility ReportDocument75 pagesCleaning, Grading and Packaging Feasibility ReportNaumanNo ratings yet

- Group 3 - Section 3 - Business ProposalDocument16 pagesGroup 3 - Section 3 - Business ProposalMarielle Dela Torre LubatNo ratings yet

- Uncle Chips Market Analysis and SuveyDocument35 pagesUncle Chips Market Analysis and SuveyNavyanth Kaler100% (1)

- Cheap Oil Good or Bad For India?Document5 pagesCheap Oil Good or Bad For India?imran shaikhNo ratings yet

- Honey ProcesingRevisedfinalDocument25 pagesHoney ProcesingRevisedfinalFirezegiNo ratings yet

- Malabar Fruit Products Company: A Project Report On Organizational Study atDocument43 pagesMalabar Fruit Products Company: A Project Report On Organizational Study atAnees SalihNo ratings yet

- Industry ProfileDocument98 pagesIndustry Profileramjiraospeaking007100% (1)

- Detailed Project Report Orange Ready To Serve Manufacturing UnitDocument38 pagesDetailed Project Report Orange Ready To Serve Manufacturing UnitKRISHNA TANEJA TANEJANo ratings yet

- Market Research Study Cashew-Export & DomesticDocument13 pagesMarket Research Study Cashew-Export & DomesticAdwait GoreNo ratings yet

- Project On CoffeeDocument44 pagesProject On CoffeeHiren GogriNo ratings yet

- Project Report AmitDocument53 pagesProject Report AmitShashi GoswamiNo ratings yet

- Sugarcane Is An Important Industrial Crop of Tropical and Subtropical Regions and Is CultivatedDocument7 pagesSugarcane Is An Important Industrial Crop of Tropical and Subtropical Regions and Is CultivatedJanaksinh SolankiNo ratings yet

- Agrochemical Company Dhanuka Agritech's Growth DriversDocument10 pagesAgrochemical Company Dhanuka Agritech's Growth DriverstanvimhatreNo ratings yet

- Importance of PulsesDocument3 pagesImportance of Pulsesseesi alterNo ratings yet

- Guidelines For TEV Consultant PDFDocument6 pagesGuidelines For TEV Consultant PDFSatyanarayana Moorthy PiratlaNo ratings yet

- Corporate Presentation May2019Document42 pagesCorporate Presentation May2019Denish GalaNo ratings yet

- Hector Beverages PVT LTDDocument51 pagesHector Beverages PVT LTDKritika ChoudharyNo ratings yet

- Bicycle Parts Manufacturing Unit CarrierDocument17 pagesBicycle Parts Manufacturing Unit CarrierAftabunarNo ratings yet

- Project 1 HPCLDocument33 pagesProject 1 HPCLDubey AshwaniNo ratings yet

- 1.1 Background of The Problem Task UndertakenDocument47 pages1.1 Background of The Problem Task UndertakenraahoulNo ratings yet

- Salt Production Trend in Thoothukudi District: R.Ananthalaxmi and M.JeyakumariDocument7 pagesSalt Production Trend in Thoothukudi District: R.Ananthalaxmi and M.JeyakumariKrishnaNo ratings yet

- Salt IndustryDocument1 pageSalt Industrymayank9282100% (2)

- Salt Is An Essential CommodityDocument2 pagesSalt Is An Essential Commoditybulbul12No ratings yet

- Analysis of Sales and Distribution and Business Viability of Stockists of Branded SaltDocument18 pagesAnalysis of Sales and Distribution and Business Viability of Stockists of Branded SaltddNo ratings yet

- Experimental Learning Phase 1 Presentation: Production of Sodium CarbonateDocument47 pagesExperimental Learning Phase 1 Presentation: Production of Sodium CarbonatespidyNo ratings yet

- Sharad Joshi Part 8Document65 pagesSharad Joshi Part 8ananthalaxmiNo ratings yet

- Value Chain Analysis of Coco Cola CompanyDocument7 pagesValue Chain Analysis of Coco Cola Companybulbul12100% (1)

- Chapter 1 Labour WelfareDocument26 pagesChapter 1 Labour Welfarebulbul12No ratings yet

- Salt Is An Essential CommodityDocument2 pagesSalt Is An Essential Commoditybulbul12No ratings yet

- Welcome To The Brainstorming Toolbox Tutorial On CreativeDocument8 pagesWelcome To The Brainstorming Toolbox Tutorial On Creativebulbul12No ratings yet

- The Human Resource Has Immense PotentialDocument2 pagesThe Human Resource Has Immense Potentialbulbul12No ratings yet

- Labor WelfareDocument2 pagesLabor Welfarebulbul12No ratings yet

- Salt Is An Essential CommodityDocument2 pagesSalt Is An Essential Commoditybulbul12No ratings yet

- What Are The Ground Rules For BrainstormingDocument2 pagesWhat Are The Ground Rules For Brainstormingbulbul12No ratings yet

- Concept of Creativity IntelligenceDocument6 pagesConcept of Creativity Intelligencebulbul12No ratings yet

- M.S.A SaltDocument37 pagesM.S.A Saltbulbul12No ratings yet

- Stop and Go BrainstormingDocument7 pagesStop and Go Brainstormingbulbul1250% (2)

- Employee LegislationDocument491 pagesEmployee Legislationbulbul12No ratings yet

- Welcome To The Brainstorming Toolbox Tutorial On CreativeDocument8 pagesWelcome To The Brainstorming Toolbox Tutorial On Creativebulbul12No ratings yet

- N Most Developing CountriesDocument2 pagesN Most Developing Countriesbulbul12No ratings yet

- 433 Industrial RelationsDocument164 pages433 Industrial RelationsSuren TheannilawuNo ratings yet

- Kalpana Chawla Nasa AstronautDocument11 pagesKalpana Chawla Nasa Astronautbulbul12No ratings yet

- Jindal SteelDocument1 pageJindal Steelbulbul12No ratings yet

- PantaloonsDocument13 pagesPantaloonsbulbul12No ratings yet

- Indian Salt IndustryDocument4 pagesIndian Salt Industrybulbul12No ratings yet

- Kalpana Chawla: First Indian Woman in SpaceDocument6 pagesKalpana Chawla: First Indian Woman in Spacebulbul12No ratings yet

- About Salt IndustryDocument10 pagesAbout Salt Industrybulbul12No ratings yet

- Assignment On Labour LegislationDocument1 pageAssignment On Labour Legislationbulbul12No ratings yet

- ITC LimitedDocument8 pagesITC Limitedbulbul12No ratings yet

- PantaloonsDocument13 pagesPantaloonsbulbul12No ratings yet

- The Land Acquisition Act 1894Document27 pagesThe Land Acquisition Act 1894Badri NathNo ratings yet

- LTC Rules 31011 - 3 - 2015-Estt.A-IV-18022016ADocument5 pagesLTC Rules 31011 - 3 - 2015-Estt.A-IV-18022016Arsureshs7735No ratings yet

- 994874457result Analysis For Xii 2014Document28 pages994874457result Analysis For Xii 2014AbhijitChatterjeeNo ratings yet

- Indian ConstitutionDocument81 pagesIndian ConstitutionSayantan HatiNo ratings yet

- Kishori Mohanlal Bakshi Vs Union of India & Ors On 11 April, 1961Document2 pagesKishori Mohanlal Bakshi Vs Union of India & Ors On 11 April, 1961farzishriNo ratings yet

- Foreign Contribution Regulation Act, 2010: 1. BasicDocument5 pagesForeign Contribution Regulation Act, 2010: 1. BasicNarinderpal SinghNo ratings yet

- Unit 3Document16 pagesUnit 3Taksh ChananaNo ratings yet

- Pmjdy Od 2018Document4 pagesPmjdy Od 2018Pranjal JaiswalNo ratings yet

- Indian Coal Mines Dataset - January 2021-1Document435 pagesIndian Coal Mines Dataset - January 2021-1Yash RaoNo ratings yet

- Frmt5: Frret6Tq,@Document3 pagesFrmt5: Frret6Tq,@VinothNo ratings yet

- 104 - 76 - 2011 AVD I 08102018EqeTQDocument6 pages104 - 76 - 2011 AVD I 08102018EqeTQAbhisikta ChakrabartyNo ratings yet

- Principal Secretaries TelanganaDocument5 pagesPrincipal Secretaries TelanganaachuthannayakiNo ratings yet

- Maharashtra Public Service Commission Maharashtra Agriculture Services Main Examination - 2022Document66 pagesMaharashtra Public Service Commission Maharashtra Agriculture Services Main Examination - 2022Lande AshutoshNo ratings yet

- Industrial Disputes Act 1947 (Module 3)Document37 pagesIndustrial Disputes Act 1947 (Module 3)shalini dixitNo ratings yet

- Ias BookmarksDocument29 pagesIas BookmarksDr-Jitendra VaishNo ratings yet

- BMS Delegation Met Finance Minister On NPS Issue - Demanded To Provide Guaranteed PensionDocument1 pageBMS Delegation Met Finance Minister On NPS Issue - Demanded To Provide Guaranteed PensionR Radha KrishnanNo ratings yet

- Punjab Panchayati Raj Act, 1994Document151 pagesPunjab Panchayati Raj Act, 1994Latest Laws TeamNo ratings yet

- Lok Sabha Telephone DirectoryDocument88 pagesLok Sabha Telephone DirectoryJappreet Singh50% (2)

- CLAT 2021 UG Law School AdmissionsDocument6 pagesCLAT 2021 UG Law School AdmissionsAnay MehrotraNo ratings yet

- District CollectorDocument12 pagesDistrict CollectorThe IndianNo ratings yet

- W.B.C.S.(EXE.) Officers of West Bengal CadreDocument113 pagesW.B.C.S.(EXE.) Officers of West Bengal Cadremdjhrmndl_849713581No ratings yet

- See Detailed Notification Attached BelowDocument3 pagesSee Detailed Notification Attached Belowtnpsc2busarNo ratings yet

- Legal AffairsDocument2 pagesLegal AffairsBhavik ShahNo ratings yet

- Handbook Guidelines18!03!2019Document133 pagesHandbook Guidelines18!03!2019AjayNo ratings yet

- Role of Queen and Indian President in Comparative ProspectiveDocument4 pagesRole of Queen and Indian President in Comparative ProspectiveAkshay MehraNo ratings yet

- BRANCH DETAILSDocument606 pagesBRANCH DETAILSOnal RautNo ratings yet

- Agenda For Change Manifesto 2011-16Document190 pagesAgenda For Change Manifesto 2011-16Chola MukangaNo ratings yet

- ROAS Summary - 19-12-2019Document347 pagesROAS Summary - 19-12-2019Prakhar SinhaNo ratings yet

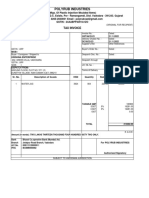

- Polyrub Industries Tax InvoiceDocument1 pagePolyrub Industries Tax Invoicejemish limbaniNo ratings yet

- RTI Manual BD PDFDocument2 pagesRTI Manual BD PDFShushant RanjanNo ratings yet