Professional Documents

Culture Documents

Singtel - FIX

Uploaded by

Saungaji Saung Belajar IslamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Singtel - FIX

Uploaded by

Saungaji Saung Belajar IslamCopyright:

Available Formats

BUSINESS STRATEGY ASSIGNMENT

Strategic Audit

SINGAPORE TELECOM

Syndicate 2 Members of Syndicate : Tamadara Hilman (29112042) Adithya Nugraha(29112149) Yulianita Rahayu (29112060) Aditia Sovia Pramudita (29112061) Ratu Sonia Gardenia (29112065)

SCHOOL OF BUSINESS AND MANAGEMENT BANDUNG INSTITUTE OF TECHNOLOGY 2013

I. Current Situation A. Current performance The most profitable Singapore firm, with profit of S$1,88 billion for financial year 1998 and S$1,95 billion for 1999. Singapores Telecom infrastructure scored poorly in the choice and regulation subindex in the survey of Asia Pacific Telecommunications Index in 1999. They offering limited choice of service providers and having a regulator that was not responsive and transparent. Ranked 7th out of 26 international carriers in 1999 Data Communcations survey that rated telecom providrs on value, quality reliability, speed of repairs, billing, and general responsiveness for frame relay and leased-line services. Singapore Telecoms growth rate is relatively unstable, the growth earnings were flat. B. Strategic Posture 1. Mission To be a total service provider with a range that covers the entire spectrum of the telecom business 2. Objective To maintain its exceptional record of profitability and as much market share as possible. 3. Strategies Focus on the achievement os short- and medium-term profitability Pursuit of globally competitive service and effeciency standards High investment in proven technologies Establishment of a worldclass telecom infrastructure

II. External Environment A. Societal Environment Political Legal Trend in deregulation (T) Government support by providing sophisticated industrial policy (O)

Economics Possibilities of financial crisis (T) General movement toward more open and competitive markets (O) & (T) Economic growth (O) Singapore has the highest GDP in Asia (O)

Sociocultural More sophisticated and demanding customers (O)

Technological Techonological advancement (T) Singapore have the most advanced information technology infrastructure (O)

B. Task Environment 5F Porters Threat of new entrance = MEDIUM (O) The telecommunication industry was growing rapidly, but the government will not easily allow a free entry of carriers in the future for domestic market, because Singapore is a small country state and the industry will suffer if there are to many competitor. The government support liberalization through introducing competition by issued limited licenses for moblie phone services and fixed telephone services in order to bring positive benefits. Bargaining power of buyers = HIGH (T) There are several competitors emerging like MobileOne & StarHub, and they also provide same function of product and sometimes offering cheaper price, then it could be a price war between the firm. Customer will be able to shop around for services which offer better value for money. Threat of subtitutes products or service = LOW (O) Nowdays telecommunication is one of the primer needs so there are no subtitutes product in this business. Bargaining Power of Suppliers = LOW (O) Suppliers of telecommunication equipment know that firms are wary of them if they are at the same time telecommunication operators. As doing this has the potenstial of competing againts their customer, so they usually would refrain from forward integration. Rivalry amongst competing firms = HIGH (O) From the case we know that the first direct competitor to Singapore Telecom is MobileOne. In the case we can conclude that these two firm are very competitive to win the customers, they constantly monitor each others performance and make countermoves. In domestic rivalry, Singapore Telecom also faces international as well as domestic competitors in its globalization drive in countries which are opening up their markets to foreigners.

III. Internal Environment A. Corporate Structure In March 1999, Singapore Telecom announced a major restucturing, they moved to divisional corporate organization, whose primary aim was to focus on growth areas such as overseas ventures and new business areas such as e-commerce, system integration, multimedia, and Internet-based service. So, they divided into three new units: 1. Consumer business unit : covering residential customers and small and medium-sized enterprises 2. Corporate business unit : dealing with corporate accounts 3. Global business unit : concerned with Singapore Telecoms overseas investment.

There is also a new Chief Operating Officer (COO) position and three customer unit under the COO. And Chief Executife Officer who focus more on growth areas such as overseas venture and new business areas such as e-commerce, system integration, multimedia, and Internet-based service.

B. Corporate Culture In the corporate culture, they always emphasis on providing execellent of service and high quality product. They also constanly seek new business opporrtunities to generate more revenues. (S)

C. Corporate Resources 1. Marketing - Have a strong image of a former monopoly in the mobile market and fixed-line market. (W) - Always concern in providing execellent service for customers (S) 2. Finance - Take advantages of their existing assets, such as billing system, telecom networks, and real estateto generate revenue through services such as facility management and billing service (S) - Pursue global and regional expansion through investments (S) - Have a good financial return from overseas project (S)

- Implement stricter cost control measures to protect its bottem line, including recing the salaries of senior managers and management flying economy instead of business class (S) - Decreasing total revenue (W) 3. R&D - Have a great quality of sing-tel infrastructure (S) 4. Operations - Implement the lates technology to offer innovative service (S) 5. Human Resources - There is no information about HR in the case, but we assume that they have experienced and expertise in Singapore telecommunication (S). 6. Information System - Advanced information system to support its growth, reduce and control cost (S)

V.

Financial Analysis PROFITABILITY 1994 1995 19,9 10,5 7,91 8,74 23,2 22,5

1993 Net Profit Growth Earnings Per share Return on Total Assets 6,59 22,2

1996 12,6 9,85 22,3

1997 12,4 11,07 20,3

1998 11,8 12,37 17,5

1999 3,7 12,82 15,1

Profitability

25 20

Percentage

15 10 5 0 1993 1994 1995 1996 1997 1998 1999

Net Profit Growth Earnings Per share Return on Total Assets

Turnover Growth

1993 11,2

1994 15,6

1995 10,2

1996 13,7

1997 6

1998 16,5

1999 -1,2

Turnover Growth

18 16 14 12 10 8 6 4 2 0 -2 -4

Percentage

Turnover Growth

1993 1994 1995 1996 1997 1998 1999

1993 Return on Shareholders Funds Operating Return on Net Fixed Assets 27,4 44,7

1994 32,8 47,4

1995 35,9 49,1

1996 36,1 49,2

1997 34,6 47,1

1998 30,3 44,6

1999 26,4 40,4

Activity Ratio

60 50

Percentage

40 30 20 10 0 1993 1994 1995 1996 1997 1998 1999 Return on Shareholders Funds Operating Return on Net Fixed Assets

1. The Net Profit of Singapore Telecom is increase but not significantly, and net profit growth has been decreasing in 2009, its because first direct competitor to Singapore Telecom, MobileOne captured significant market share is 32% within two years. 2. Singapore Telecom has refocused its overseas investment on Asia with rapidly changing technology for change are consumers themselves, who expect consistenly high quality of services. VI. Analysis of Strategic Factors (SWOT) A. Situational Analysis 1. Summary of Internal Factors Strength : Always concern in providing execellent service for customers

- Take advantages of their existing assets, such as billing system, telecom networks, and real estateto generate revenue through services such as facility management and billing service - Pursue global and regional expansion through investments - Have a good financial return from overseas project - Implement stricter cost control measures to protect its bottem line, including recing the salaries of senior managers and management flying economy instead of business class - Have a great quality of sing-tel infrastructure - Implement the lates technology to offer innovative service - have experienced and expertise in Singapore telecommunication - Advanced information system to support its growth, reduce and control cost Weaknesses : - Have a strong image of a former monopoly in the mobile market and fixed-line market - Decreasing total revenue

2. Summary of External Factors Opportunity : Telecommunication become one of the primary needs Government support by providing sophisticated industrial policy General movement toward more open and competitive markets Economic growth Singapore has the highest GDP in Asia

More sophisticated and demanding customers Singapore have the most advanced information technology infrastructure

Threat : Trend in deregulation Possibilities of financial crisis General movement toward more open and competitive markets Techonological advancement There are several strong competitors, such as StarHub and M1

B. Review of Mission and Objective The current mission appears appropiate. The objectives needs to be quantified and given time horizons.

VII. Strategic Alternatives and Recommended Strategy Corporate Strategy To formulate the corporate strategy, we use the external factors from the EFAS Table (Table 2) and the internal factors from IFAS (Table 1). Based on the SFAS Matrix result so the corporate strategic alternatives are : a. Growth Strategy b. Stability Strategy c. Retrenchment Strategy

IFAS 1 Internal Strategic Factors Strenghts s1 Always concern in providing execellent service for customers Take advantages of their existing assets, such as billing system, telecom networks, and real estateto generate revenue through services such as facility management and billing service Pursue global and regional expansion through investments Have a good financial return from overseas project Implement stricter cost control measures to protect its bottem line, including recing the salaries of senior managers and management flying economy instead of business class Have a great quality of sing-tel infrastructure Implement the lates technology to offer innovative service Weight Rating Weighted Score 0.4

0.100

s2 s3 s4

0.125 0.075 0.075

4 3 3

0.5 0.225 0.225

s5 s6 s7

0.050 0.090 0.050

3 4 3

0.15 0.36 0.15

Internal Strategic Factors

Weight Rating

Weighted Score 0.24 0.225

s8

have experienced and expertise in Singapore telecommunication

0.060 0.075

4 3

Advanced information system to support its growth, reduce and s9 control cost Weaknesses Have a strong image of a former monopoly in the mobile market and w1 fixed-line market w2 Decreasing total revenue TOTAL SCORES

0.100 0.200 1.000

3 4

0.3 0.8 3.575

Table 2 EFAS External Strategic Factors Opportunities o1 o2 o3 o4 o5 o6 o7 Threats t1 t2 t3 t4 t5 TOTAL SCORES Telecommunication become one of the primary needs Government support by providing sophisticated industrial policy General movement toward more open and competitive markets Economic growth Singapore has the highest GDP in Asia More sophisticated and demanding customers Singapore have the most advanced information technology infrastructure Trend in deregulation Possibilities of financial crisis General movement toward more open and competitive markets Techonological advancement There are several strong competitors, such as StarHub and M1 0.1 0.125 0.075 0.075 0.05 0.1 0.05 0.1 0.075 0.1 0.075 0.075 1 4 3 3 3 3 3 4 3 3 3 3 2 0.4 0.375 0.225 0.225 0.15 0.3 0.2 0.3 0.225 0.3 0.225 0.15 3.075 Weight Rating Weighted Score

Based on the IFAS and EFAS, we can conclude that Singtel should do Growth Strategy. We choose Horizontal growth and expand their business abroad. We prefer choose acquisition when they expand their business. Business Strategy To formulte the business strategy we can use QSPM analysis as below :

Table 3 Differentiation Weight Strenghts Always concern in providing execellent service for customers Take advantages of their existing assets Pursue global and regional expansion through investments Have a good financial return from overseas project Implement stricter cost control measures to protect its bottom line Have a great quality of sing-tel infrastructure Implement the lates technology to offer innovative service have experienced and expertise in Singapore telecommunication Advanced information system to support its growth, reduce and control cost Weaknesses Have a strong image of a former monopoly in the mobile market and fixed-line market AS TAS Cost Leadership AS TAS

0,100 0,125 0,075 0,075 0,050 0,090 0,050 0,060 0,075

4 4 3 3 3 4 3 4 3

0,4 0,5 0,225 0,225 0,15 0,36 0,15 0,24 0,225

4 4 3 3 3 4 3 4 3

0,37 0,2 0,22 0,225 0,15 0,15 0,17 0,21 0,115

0,100

0,3

0,25

Differentiation Decreasing total revenue Opportunities Telecommunication become one of the primary needs Government support by providing sophisticated industrial policy General movement toward more open and competitive markets Economic growth Singapore has the highest GDP in Asia More sophisticated and demanding customers Singapore have the most advanced information technology infrastructure Threats Trend in deregulation Possibilities of financial crisis General movement toward more open and competitive markets Techonological advancement There are several strong competitors, such as StarHub and M1 TOTAL Weight 0,200 AS 4 TAS 0,8 0 0,4 0,375 0,225 0,225 0,15 0,3 0,2 0,3 0,225 0,3 0,225 0,15 6,65

Cost Leadership AS TAS 4 0,7

0,1 0,125 0,075 0,075 0,05 0,1 0,05 0,1 0,075 0,1 0,075 0,075

4 3 3 3 3 3 4 3 3 3 3 2

4 3 3 3 3 3 4 3 3 3 3 2

0,4 0,3 0,18 0,115 0,2 0,2 0,2 0,25 0,115 0,3 0,2 0,2 5,42

Based on the analysis, we can conclude that Singapore Telecom should do cost leadership. Portofolio Analysis Based on the BCG matrix below, we can see that each there are some strategies depend on each business unit. - Dogs: sale of equipment and public message - Question Mark: Directory advertisement, IT and engineering, and postal service - Cash Cow: International Telephone - Star: National telephone, Public data and private net, and mobile communication.

Based on the diagram above the firm can decide what direction that the company will do in the future. Functional Strategy From the Table 5, we can formulate the startegy as below : a. Marketing Expand the business to grow their market share in regional and global section Sponsoring big and global event to support their brand awareness Create a second line product to avoid brand image of monopoly company Create differentiation in products and services Create diversification in products Using discount for uncompetitive timing b. Finance Make some cooperations with other telecommunication company related to international service Invite big investor to join the business c. Operation Minimize production cost Create more efficient resources d. Research and Development Provide excellent service and innovative technology for sophisticated customers

Development in R&D to create innovative products

e. Human Resources Create advanced tecnology by utilizing experienced and expertise employee in telecommunication

VIII. Implementation 1. To increase profitability Singapore Telecom should Horizontal growth and expand their business abroad. We prefer choose acquisition when they expand their business. 2. 3. R&D needs to be improved, as does marketing, to attract more customer quickly. Create advanced tecnology by utilizing experienced and expertise employee in telecommunication.

Table 4 TOWS Matrix

Strength 1. Always concern in providing execellent service for customers 2. Take advantages of their existing assets, such as billing system, telecom networks, and real estateto generate revenue through services such as facility management and billing service 3. Pursue global and regional expansion through investments 4. Have a good financial return from overseas project 5. Implement stricter cost control measures to protect its bottom line, including reducing the salaries of senior managers and management flying economy instead of business class 6. Have a great quality of sing-tel infrastructure 7. Implement the latest technology to offer innovative service 8. Have experienced and expertise in Singapore telecommunication 9. Advanced information system to support its growth, reduce and control cost Opportunity 1. Telecommunication become one of the primary needs 2. Government support by providing sophisticated industrial policy 3. General movement toward more open and competitive markets 4. Economic growth SO Strategy 1. Expand the business to grow their market share in regional and global section (O1, O4, S3) 2. Provide excellent service and innovative technology for sophisticated customers (O6, S1, S7) 3. Create advanced tecnology by utilizing experienced and expertise employee in telecommunication (O6, S6, S8) 4. Make some cooperations with other telecommunication 1. WO Strategy Create a second line product to avoid brand image of monopoly company (O6, W1, W2) 2. Create differentiation in products and services (O3, W2) Weakness a. Have a strong image of a former monopoly in the mobile market and fixed-line market b. Decreasing total revenue

5. Singapore has the highest GDP in Asia 6. More sophisticated and demanding customers 7. Singapore have the most advanced information technology infrastructure Threat 1. Trend in deregulation 2. Possibilities of financial crisis 3. General movement toward more open and competitive markets 4. Techonological advancement 5. There are several strong competitors, such as StarHub and M1

company related to international service (O3, S4) 5. Sponsoring big and global event to support their brand awareness (O2, S4)

ST Strategy 1. Development in R&D to create innovative products (T5, S7, S8) 2. Invite big investor to join the business (T3, S3, S6) 3. Create diversification in products (T4, S7, S8)

WT Strategy 1. Minimize production cost (T5, W2) 2. Using discount for uncompetitive timing (T3, T5, W2) 3. Create more efficient resources (T4, W2)

You might also like

- Strategic Management Analysis On Globe Telecom, Inc. (Glo) : College of Business and AccountancyDocument46 pagesStrategic Management Analysis On Globe Telecom, Inc. (Glo) : College of Business and AccountancyAlicia FelicianoNo ratings yet

- Philippine Competition Act and IRR SummaryDocument64 pagesPhilippine Competition Act and IRR SummaryBinkee Villarama100% (1)

- Principles of Managerial EconomicsDocument110 pagesPrinciples of Managerial EconomicsSean Lester S. NombradoNo ratings yet

- 2023.02.09 CirclesX PetitionDocument161 pages2023.02.09 CirclesX Petitionjamesosborne77-1100% (2)

- Consumer Protection ActDocument60 pagesConsumer Protection Actapi-3705334100% (12)

- Competition Law and Protection of ConsumerDocument24 pagesCompetition Law and Protection of Consumermanish9890No ratings yet

- Basic Economic ConceptsDocument67 pagesBasic Economic ConceptsMuhammad TauseefNo ratings yet

- PLDT SwotDocument11 pagesPLDT SwotKim Gozum67% (3)

- Implementing the Public Finance Management Act in South Africa: How Far Are We?From EverandImplementing the Public Finance Management Act in South Africa: How Far Are We?No ratings yet

- Israel Kirzner - Market Theory and The Price SystemDocument338 pagesIsrael Kirzner - Market Theory and The Price SystemDiego SchmidtNo ratings yet

- STCDocument18 pagesSTCSar100% (1)

- Gios Samar v. DOTCDocument3 pagesGios Samar v. DOTCTrisha Paola Tangan50% (2)

- Airtel VRIO & SWOT AnalysisDocument11 pagesAirtel VRIO & SWOT AnalysisRakesh Skai50% (2)

- Economics & Institutions: Starbucks CoffeeDocument21 pagesEconomics & Institutions: Starbucks CoffeeThilina DkNo ratings yet

- Brand Management ProjectDocument37 pagesBrand Management Projectanindya_kundu67% (6)

- Business Strategy Assignment - Final TelecomDocument10 pagesBusiness Strategy Assignment - Final TelecomAishwarya SankhlaNo ratings yet

- Singapore Telecom: Strategic Audit WorksheetDocument19 pagesSingapore Telecom: Strategic Audit Worksheetadeel02No ratings yet

- Analysis of Singapore TelecomDocument4 pagesAnalysis of Singapore TelecomAlvin Cardoza DE VillaNo ratings yet

- Singapore Telecom Strategic ChallengesDocument6 pagesSingapore Telecom Strategic ChallengesJodinaire Party NeedsNo ratings yet

- Mobilink Internship ReportDocument11 pagesMobilink Internship ReportTariq SaleemNo ratings yet

- PESTL Singapore - Strategic Analysis On SingTelDocument21 pagesPESTL Singapore - Strategic Analysis On SingTelWooGimChuan100% (5)

- Strategic Management Report On UfoneDocument11 pagesStrategic Management Report On UfoneMahaAqeelNo ratings yet

- MGT's Premium Internet ServicesDocument6 pagesMGT's Premium Internet ServicesHsu Yadanar AungNo ratings yet

- Department of Business Management SciencesDocument21 pagesDepartment of Business Management SciencesSaYam ReHaniaNo ratings yet

- Etisalat CorporationDocument21 pagesEtisalat Corporationremon mounirNo ratings yet

- UTStarcom in China - Case Study - GRP 10 - FMG19CDocument20 pagesUTStarcom in China - Case Study - GRP 10 - FMG19CVarun BhatiaNo ratings yet

- Kinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghDocument39 pagesKinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghKanchan VardhaniNo ratings yet

- AirtelDocument22 pagesAirtelAbhinav DaharwalNo ratings yet

- Bav Assignment TelecomDocument36 pagesBav Assignment Telecomudit singhNo ratings yet

- Kinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghDocument39 pagesKinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghPrashant KumarNo ratings yet

- Telkom Integrated Report 2014 FULLDocument188 pagesTelkom Integrated Report 2014 FULLDaniel DumitricăNo ratings yet

- Straregic ManagementDocument57 pagesStraregic ManagementNisha KambleNo ratings yet

- Strategy Update November 2010Document41 pagesStrategy Update November 2010Jonathan GablerNo ratings yet

- 2013 Financial Accounting - Telecom Industry AnalysisDocument7 pages2013 Financial Accounting - Telecom Industry AnalysisPreethi VenkataramanNo ratings yet

- TP Group Performance AnalysisDocument25 pagesTP Group Performance Analysismaritz73No ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewMahin IftekharNo ratings yet

- Achieving Operational Excellence in Mobile Telecom: ApplicationsDocument8 pagesAchieving Operational Excellence in Mobile Telecom: ApplicationsjalexisrmNo ratings yet

- WaridDocument44 pagesWaridHumaRiazNo ratings yet

- Ali Latest Task - MobilinkDocument17 pagesAli Latest Task - MobilinkFarah TahirNo ratings yet

- Tech Mahindra: Presented byDocument24 pagesTech Mahindra: Presented bySuDhir SrkNo ratings yet

- SMRT Info SlidesDocument14 pagesSMRT Info Slidesselau642No ratings yet

- Mobifone Global Topic - Nam Do DinhDocument10 pagesMobifone Global Topic - Nam Do DinhĐỗ Đình NamNo ratings yet

- OB Group Assignment Group 7Document9 pagesOB Group Assignment Group 7Rekik Solomon100% (3)

- 2.6 Corporate Strategy Ethics GovernanceDocument43 pages2.6 Corporate Strategy Ethics GovernancebillNo ratings yet

- AirtelDocument31 pagesAirtelRajiv KeshriNo ratings yet

- Project Report Final1.1Document74 pagesProject Report Final1.1adsfdgfhgjhkNo ratings yet

- 1Document8 pages1getaneh yanteamlakNo ratings yet

- Re-Launch of Combo Calling CardsDocument44 pagesRe-Launch of Combo Calling CardsNouman KhanNo ratings yet

- Tech Mahindra: Presented By: Vivek Ojha Shibkesh Singh Pankaj Shishodia Vikas Bharti SharmaDocument24 pagesTech Mahindra: Presented By: Vivek Ojha Shibkesh Singh Pankaj Shishodia Vikas Bharti SharmasimerpuriNo ratings yet

- SingTel 41A4-OndheMandheDocument18 pagesSingTel 41A4-OndheMandhedianisme2No ratings yet

- Telstra Case (Exam)Document21 pagesTelstra Case (Exam)alfredc20000% (1)

- Project:: Ufone GSMDocument28 pagesProject:: Ufone GSMUniversityprojects100% (1)

- W.N.I. Abeygunawardana - 621438631Document10 pagesW.N.I. Abeygunawardana - 621438631AnujanNo ratings yet

- Strategic Marketing BUMKT 6923Document44 pagesStrategic Marketing BUMKT 6923Deen Mohammed ProtikNo ratings yet

- Project On World Call Limited: Subject Strategic Marketing ManagementDocument25 pagesProject On World Call Limited: Subject Strategic Marketing ManagementNaYan HaiderNo ratings yet

- Mobile Report Sr07Document38 pagesMobile Report Sr07Yuki MorimotoNo ratings yet

- T J Nyambishi 47491 Week 4Document11 pagesT J Nyambishi 47491 Week 4takuejoshNo ratings yet

- IB Nokia Group7Document4 pagesIB Nokia Group7Tyag RajanNo ratings yet

- Mobile Handset Industry AnalysisDocument52 pagesMobile Handset Industry AnalysisPayel ChakrabortyNo ratings yet

- NotesDocument6 pagesNotesRantharu AttanayakeNo ratings yet

- RobiDocument22 pagesRobiKhairul Alam DukeNo ratings yet

- SM Assignment - e S JayaweeraDocument11 pagesSM Assignment - e S JayaweeraAnujanNo ratings yet

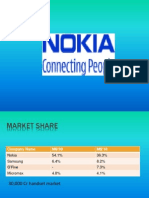

- Project:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesDocument45 pagesProject:-: Analysis of Telecom Sector Players According To Their Marketing StrategiesnawaljainNo ratings yet

- SWOT ANALYSIS Chapter SixDocument8 pagesSWOT ANALYSIS Chapter SixSetu MehtaNo ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Digitizing Government: Understanding and Implementing New Digital Business ModelsFrom EverandDigitizing Government: Understanding and Implementing New Digital Business ModelsNo ratings yet

- Multiple Choice: This Activity Contains 20 QuestionsDocument5 pagesMultiple Choice: This Activity Contains 20 Questionsmas_999No ratings yet

- PizzaDocument5 pagesPizzafox mNo ratings yet

- 4 FoL Annexure IV Revised Syllabus For BBA, LLBDocument70 pages4 FoL Annexure IV Revised Syllabus For BBA, LLBjairaj321No ratings yet

- Partial EquilibriumDocument195 pagesPartial Equilibriumbrianmfula2021No ratings yet

- Sticky Prices Notes For Macroeconomics by Carlin & SoskiceDocument13 pagesSticky Prices Notes For Macroeconomics by Carlin & SoskiceSiddharthSardaNo ratings yet

- Chapter 9,10,11 SummaryDocument9 pagesChapter 9,10,11 Summaryalif noonNo ratings yet

- The Justice Marvic M.V.F. Leonen Case Doctrines IN Mercantile LawDocument122 pagesThe Justice Marvic M.V.F. Leonen Case Doctrines IN Mercantile LawMellie Morcozo100% (1)

- E Book - MANAGERIAL ECONOMICSDocument193 pagesE Book - MANAGERIAL ECONOMICSSachin Singh100% (1)

- Business Strategy StarbucksDocument9 pagesBusiness Strategy StarbucksRajarshi ChakrabortyNo ratings yet

- The Rice Problem in The Philippines: Trends, Constraints, and Policy ImperativesDocument17 pagesThe Rice Problem in The Philippines: Trends, Constraints, and Policy ImperativesGracey MontefalcoNo ratings yet

- Assignment 4Document3 pagesAssignment 4Sleyzle IbanezNo ratings yet

- Assignment 1 MAE101 T2 2023Document7 pagesAssignment 1 MAE101 T2 2023ANSHU MAURYANo ratings yet

- 5SSMN933 Tutorial SolutionsDocument43 pages5SSMN933 Tutorial Solutionsexample3335273No ratings yet

- Chapter 1 Sample QuestionsDocument3 pagesChapter 1 Sample Questionschristina thearasNo ratings yet

- Customer Awareness Is A Part of A Company'sDocument21 pagesCustomer Awareness Is A Part of A Company'skrishnaNo ratings yet

- Cambridge Assessment International Education: Economics 0455/22 March 2019Document12 pagesCambridge Assessment International Education: Economics 0455/22 March 2019AhmedNo ratings yet

- 9.1 Price and Output Under Perfect Competition and MonoployDocument27 pages9.1 Price and Output Under Perfect Competition and Monoployakshat guptaNo ratings yet

- B 7006 Part 3 - PricingDocument108 pagesB 7006 Part 3 - PricingRito ChakrabortyNo ratings yet

- Branding, predatory pricing, environmental economics (39Document3 pagesBranding, predatory pricing, environmental economics (39AHMAD LEE TUBENo ratings yet

- BP Material On PFF and SwotDocument8 pagesBP Material On PFF and SwotausizuberiNo ratings yet

- Form 4 Economics Easter Mid Term 2021Document12 pagesForm 4 Economics Easter Mid Term 2021FrancinalanfermanNo ratings yet