Professional Documents

Culture Documents

MPRI India

Uploaded by

Sumit RoyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MPRI India

Uploaded by

Sumit RoyCopyright:

Available Formats

Mobile Payments Readiness Index

mobilereadiness.mastercard.com/india

INDIA

Mobile Commerce Clusters Consumer Readiness

Environment

31.5

Financial Services

Infrastructure

Regulation

Country Score

Index Average

SUMMARY

WHAT YOU NEED TO KNOW

On the MasterCard Mobile Payments Readiness Index, India achieved a score of 31.5, driven by high scores in the Infrastructure component, moderate scores in Financial Services

and Consumer Readiness, and lower scores in overall Environment. Consumer Readiness scores are in line with Indias overall ranking on the Indexnumber 21.

Indias annual investment in telecommunications of $69.7B gives it a leading spot in Infrastructure Consumers in India have not yet fully embraced mobile payments 14% of Indian consumers are familiar with both P2P and m-commerce transactions, and 10% are familiar with POS transactions

COUNTRY OVERVIEW

Market Forces

India received high marks for Infrastructure, the second best on the Index, with a high number of mobile phone subscriptions; in addition, India has made considerable investments in telecom over the past few years. Financial Services scores were a bit lower than average, due to the limited number of cards in circulation among Indian consumers.

*Calibrated to the highest country average

MOBILE READINESS FACTORS IN INDIA

2%

8%

88%

Mobile phone prevalence* Payment card prevalence*

India Index Average

Internet penetration

When it comes to Regulation, India is once again middle of the road compared to its

global counterparts. Specifically, Indias intellectual property

protection scores low, along with the procurement of advanced technology products. Indias score is weighed down

by its overall Environment, which ranks second to last. India has significantly low household consumption expenditure per

capita; the percentage of Indians using the Internet is 7.5 percent compared to an Index average of 52 percent.

Consumer Sentiment

Indian consumers are below average from a consumer readiness perspective. Familiarity with and willingness to use P2P payments is approximately the same. Willingness to use P2P payments tends to skew male, higher income, and between Those who demonstrate willingness to use mobile payments at POS also tend to the ages of 18 and 34. There tends to be less familiarity regarding mobile payments at POS. be male and have higher income levels. Familiarity with and willingness to use m-commerce is on par with P2P payments; m-commerce also tends to skew male, young, and higher income.

GLOBAL PERSPECTIVE ON CONSUMER SENTIMENT IN INDIA

100%

75%

50%

25%

16% 14%

11% 10%

20% 14%

19% 14%

17% 8%

21% 12% 8% 5%

5% 5%

9% 7%

0%

P2P

POS m-comm FAMILIAR

Country Score

P2P

POS m-comm WILLING

Index Average

P2P

POS

m-comm

USING

Leading Country Score

To view this data in more detail, visit mobilereadiness.mastercard.com/india

MASTERCARD CONCLUSION Indias overall readiness for mobile payments falls in the middle of the pack. In order to better position itself for mobile payments, India will need to focus on furthering partnerships between banks and telcos, strengthening its overall environment to be more amenable to mobile payments, and engaging with consumers to highlight the benefits mobile payments can provide in both the short and long term.

IN

INDIA

31.5

DE

X AVG 33

.2

View Data Sources at mobilereadiness.mastercard.com/about

Mobile Payments Readiness Index

mobilereadiness.mastercard.com/india

You might also like

- Time Value of MoneyDocument69 pagesTime Value of MoneyawaisjinnahNo ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- Nike, Inc Cost of CapitalDocument6 pagesNike, Inc Cost of CapitalSilvia Regina100% (1)

- 10 Historical Speeches Nobody Ever HeardDocument20 pages10 Historical Speeches Nobody Ever HeardSumit Roy100% (1)

- Portfolio SelectionDocument6 pagesPortfolio SelectionAssfaw KebedeNo ratings yet

- Determinants of Customers' Online Purchase Intention: An Empirical Study in Indiady in IndiaDocument16 pagesDeterminants of Customers' Online Purchase Intention: An Empirical Study in Indiady in IndiaAyukie FarizqiNo ratings yet

- CRM HSBCDocument26 pagesCRM HSBCRavi Shankar100% (1)

- Research Paper Small and Medium Scale BusinessDocument16 pagesResearch Paper Small and Medium Scale BusinessMusa0% (1)

- Managing the Development of Digital Marketplaces in AsiaFrom EverandManaging the Development of Digital Marketplaces in AsiaNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- 01 - Harvard - I - Argentina - Guidelines - Application - 005 FortabatDocument7 pages01 - Harvard - I - Argentina - Guidelines - Application - 005 FortabatcallejerocelesteNo ratings yet

- 2019 Year in Search Report - Indonesia PDFDocument70 pages2019 Year in Search Report - Indonesia PDFOpal Priya WeningNo ratings yet

- Ecommerce-In India-project-SunilBrid-2022-2023-Sem IV-Sales and MarketingDocument57 pagesEcommerce-In India-project-SunilBrid-2022-2023-Sem IV-Sales and MarketingJagdishNo ratings yet

- A Study On E-Satisfaction in Online Shopping PlatformsDocument15 pagesA Study On E-Satisfaction in Online Shopping PlatformsKarthick RaviNo ratings yet

- MPRI MalaysiaDocument2 pagesMPRI MalaysiaTan Tek JauNo ratings yet

- Zaggle YES BANK Caselet Explores Innovative Prepaid Instrument PartnershipDocument11 pagesZaggle YES BANK Caselet Explores Innovative Prepaid Instrument PartnershipSushant AnandNo ratings yet

- Rajeev Gandhi College of Management Studies Plot No. 01, Sector-08, Ghansoli, Navi Mumbai - 400701Document9 pagesRajeev Gandhi College of Management Studies Plot No. 01, Sector-08, Ghansoli, Navi Mumbai - 400701Nilesh ShirodkarNo ratings yet

- Hariom: GujaratDocument24 pagesHariom: GujaratParagNo ratings yet

- Akshat NTCC Sem5 For PlagiarismDocument23 pagesAkshat NTCC Sem5 For PlagiarismAkshat SrivastavaNo ratings yet

- Impact of Customers (Retailers) Towards E-Commerce''Document15 pagesImpact of Customers (Retailers) Towards E-Commerce''salmanNo ratings yet

- Research Based Learning - 1Document17 pagesResearch Based Learning - 12022496261.deepakNo ratings yet

- Study of Changing Attitude of Indian Consumers Towards Online ShoppingDocument62 pagesStudy of Changing Attitude of Indian Consumers Towards Online ShoppingAayush AryaNo ratings yet

- A Study On Consumer Perceptions Towards Digital Finance and Its Impact On Financial Inclusion - Indian ScenarioDocument12 pagesA Study On Consumer Perceptions Towards Digital Finance and Its Impact On Financial Inclusion - Indian ScenarioIAEME PublicationNo ratings yet

- Rural Retail Banking in IndiaDocument12 pagesRural Retail Banking in IndiaItee Shree ChaudharyNo ratings yet

- What went wrong with SnapdealDocument77 pagesWhat went wrong with SnapdealJeetendar PeswaniNo ratings yet

- Ewallet Ugc PublicationDocument6 pagesEwallet Ugc PublicationVaishnavi TSNo ratings yet

- 04-Financial Inclusion and Mobile MoneyDocument43 pages04-Financial Inclusion and Mobile MoneymibuhariNo ratings yet

- State of e-Commerce in India Report Sept 2012Document19 pagesState of e-Commerce in India Report Sept 2012sudeep_nairNo ratings yet

- Ey Re-Birth of Ecommerce PDFDocument88 pagesEy Re-Birth of Ecommerce PDFPrateek DubeyNo ratings yet

- Digital Payments IndiaDocument23 pagesDigital Payments IndiaLakshay SolankiNo ratings yet

- Bain Report How India Shops Online LinkedinDocument27 pagesBain Report How India Shops Online LinkedinVruti TikyaniNo ratings yet

- Insights e Commerce in Asia Bracing For Digital DisruptionDocument28 pagesInsights e Commerce in Asia Bracing For Digital DisruptionJasjivan AhluwaliaNo ratings yet

- [23538414 - Marketing of Scientific and Research Organizations] Understanding Factors Influencing Consumers Online Purchase Intention via Mobile App_ Perceived Ease of Use, Perceived Usefulness, System Quality, Information Quality, And ServDocument31 pages[23538414 - Marketing of Scientific and Research Organizations] Understanding Factors Influencing Consumers Online Purchase Intention via Mobile App_ Perceived Ease of Use, Perceived Usefulness, System Quality, Information Quality, And ServtoktokNo ratings yet

- A Term Paper On: A Study of Customer Buying Behavior Towards Mobile PhonesDocument10 pagesA Term Paper On: A Study of Customer Buying Behavior Towards Mobile Phonesjatin soniNo ratings yet

- Macro Level Current Business EnvironmentDocument36 pagesMacro Level Current Business EnvironmentAvaniAgnihotriNo ratings yet

- Ezetap Caselet Case Study PDFDocument12 pagesEzetap Caselet Case Study PDFSaurabh KumarNo ratings yet

- MPRI ColombiaDocument2 pagesMPRI ColombiaManoj KrNo ratings yet

- Credit Score EssayDocument24 pagesCredit Score EssaypavistatsNo ratings yet

- Factors Influencing Customers' Attitude Towards Online Shopping: Evidence From Dhaka CityDocument14 pagesFactors Influencing Customers' Attitude Towards Online Shopping: Evidence From Dhaka CityAR RafiNo ratings yet

- International Journal of Information Technology and Knowledge ManagementDocument6 pagesInternational Journal of Information Technology and Knowledge Managementrakeshkmr1186No ratings yet

- 037 - Shadab Ansari - A Study On Parameters of Brand Preference ofDocument95 pages037 - Shadab Ansari - A Study On Parameters of Brand Preference ofShadab AnsariNo ratings yet

- Project Draft v1Document7 pagesProject Draft v1SudeepNayakNo ratings yet

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- Retail Banking ThesisDocument7 pagesRetail Banking Thesisrebeccaevansspringfield100% (2)

- Mobile CommerceDocument3 pagesMobile CommerceRuturaj PatilNo ratings yet

- RRL7 (Practical Research)Document25 pagesRRL7 (Practical Research)J-ira LariosaNo ratings yet

- 1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONDocument5 pages1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONSarath MNo ratings yet

- Paper 1Document8 pagesPaper 1ronakideaNo ratings yet

- Project Ibm FinalDocument83 pagesProject Ibm FinalnitishagrawalNo ratings yet

- Employee Convenience Center Project ReportDocument30 pagesEmployee Convenience Center Project ReportMaxPanduNo ratings yet

- Online Retail in India Clicking Towards GrowthDocument17 pagesOnline Retail in India Clicking Towards GrowthAsitya DevNo ratings yet

- Urban Customers' Perception and Attitudes on Digital PaymentsDocument10 pagesUrban Customers' Perception and Attitudes on Digital PaymentsMr David SarkarNo ratings yet

- Shivangi Dwivedi (E-Commerce)Document30 pagesShivangi Dwivedi (E-Commerce)shivangi dwivediNo ratings yet

- VAS Price, Waterhouse and CoopersDocument48 pagesVAS Price, Waterhouse and CoopersJoel JCNo ratings yet

- Indian FinTech Unicorns Driving Digital BoomDocument21 pagesIndian FinTech Unicorns Driving Digital BoomBharat DhodyNo ratings yet

- Article Report On Study of Customer PreferenceDocument15 pagesArticle Report On Study of Customer PreferenceJackie LesterNo ratings yet

- 2017mobiledepositbenchmark Report092517pdfDocument50 pages2017mobiledepositbenchmark Report092517pdfhtmnhung4No ratings yet

- Clicking Towards Growth in A Volatile, Uncertain, Complex and Ambiguous Environment - A Study On The State of Online Retail Industry in IndiaDocument16 pagesClicking Towards Growth in A Volatile, Uncertain, Complex and Ambiguous Environment - A Study On The State of Online Retail Industry in IndiaShashank SrivastavaNo ratings yet

- Protecting The Digital Consumers - Challenges and Possible SolutioDocument9 pagesProtecting The Digital Consumers - Challenges and Possible SolutioGurpreet SinghNo ratings yet

- Deloitte Consumer Insights: Dawn of The Digital Age in IndonesiaDocument36 pagesDeloitte Consumer Insights: Dawn of The Digital Age in IndonesiaWeirdo BlackNo ratings yet

- Indonesia Consumer Banking 2015Document42 pagesIndonesia Consumer Banking 2015vesparuleNo ratings yet

- Indian E-Commerce Industry AnalysisDocument16 pagesIndian E-Commerce Industry Analysisvinay_814585077No ratings yet

- An Study of Factors Affecting On Online Shopping Behavior of ConsumersDocument4 pagesAn Study of Factors Affecting On Online Shopping Behavior of ConsumersAlex TefovNo ratings yet

- Challenges and Scope of Retail Banking in IndiaDocument6 pagesChallenges and Scope of Retail Banking in Indiasearock25decNo ratings yet

- Online Platforms, Pandemic, and Business Resilience in Indonesia: A Joint Study by Gojek and the Asian Development BankFrom EverandOnline Platforms, Pandemic, and Business Resilience in Indonesia: A Joint Study by Gojek and the Asian Development BankNo ratings yet

- Digital Technologies for Government-Supported Health Insurance Systems in Asia and the PacificFrom EverandDigital Technologies for Government-Supported Health Insurance Systems in Asia and the PacificNo ratings yet

- Wereldleiders Op TwitterDocument24 pagesWereldleiders Op TwitterHerman CouwenberghNo ratings yet

- TRAI Data Till 31st March, 2014Document19 pagesTRAI Data Till 31st March, 2014Tamanna Bavishi ShahNo ratings yet

- NokiaDocument1 pageNokiaSumit RoyNo ratings yet

- The State of Mobile Advertising in Emerging Countries TLS EmergingMarketsDocument8 pagesThe State of Mobile Advertising in Emerging Countries TLS EmergingMarketsSumit RoyNo ratings yet

- Risk Factors From Hepatitis BCDDocument1 pageRisk Factors From Hepatitis BCDSumit RoyNo ratings yet

- Mobile Advertising Research Trends and InsightsDocument15 pagesMobile Advertising Research Trends and InsightsSumit RoyNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- Nightingales - Philips Healthcare Tie UpDocument3 pagesNightingales - Philips Healthcare Tie UpSumit RoyNo ratings yet

- World Health Days 2014: JanuaryDocument2 pagesWorld Health Days 2014: JanuaryIvy Jorene Roman RodriguezNo ratings yet

- Hepatitis A eDocument1 pageHepatitis A eSumit RoyNo ratings yet

- The State of Airline Marketing Airlinetrends Simpliflying April2013Document21 pagesThe State of Airline Marketing Airlinetrends Simpliflying April2013Sumit RoyNo ratings yet

- Calendário de Jogos Do Mundial de Futebol-Brasil 2014Document0 pagesCalendário de Jogos Do Mundial de Futebol-Brasil 2014Miguel RodriguesNo ratings yet

- FINAL - Mobile Advertising DeckDocument73 pagesFINAL - Mobile Advertising DecksumitkroyNo ratings yet

- Global Top 100 Most Valueable Brands Brandz2014 - Infographic PDFDocument1 pageGlobal Top 100 Most Valueable Brands Brandz2014 - Infographic PDFSumit RoyNo ratings yet

- The State of Maternal Health, D Nutrition in Asia " World Vision DataDocument4 pagesThe State of Maternal Health, D Nutrition in Asia " World Vision DataSumit RoyNo ratings yet

- World Health Statisitics FullDocument180 pagesWorld Health Statisitics FullClarice SalidoNo ratings yet

- Calendar 14Document57 pagesCalendar 14Hanan AhmedNo ratings yet

- Mediamind Comscore Research Dwelling On EntertainmentDocument20 pagesMediamind Comscore Research Dwelling On EntertainmentSumit RoyNo ratings yet

- MGI China E-Tailing Executive Summary March 2013Document18 pagesMGI China E-Tailing Executive Summary March 2013Sumit RoyNo ratings yet

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- CEO Survey On Hiring, Profitability and PeopleDocument36 pagesCEO Survey On Hiring, Profitability and PeopleSumit RoyNo ratings yet

- The Evolution of Digital Advertising 3.0: Adobe Research InsightsDocument1 pageThe Evolution of Digital Advertising 3.0: Adobe Research InsightsSumit RoyNo ratings yet

- The 5 Free Alternatives To Microsoft WordDocument60 pagesThe 5 Free Alternatives To Microsoft WordSumit RoyNo ratings yet

- 2014 Bill and Melinda Gates Foundation Report On Global PovertyDocument28 pages2014 Bill and Melinda Gates Foundation Report On Global PovertySumit RoyNo ratings yet

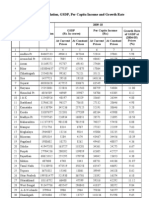

- Statewise GSDP PCI and G.RDocument3 pagesStatewise GSDP PCI and G.RArchit SingalNo ratings yet

- Gender and Social Networking Activity :facebook Vs OthersDocument18 pagesGender and Social Networking Activity :facebook Vs OthersSumit RoyNo ratings yet

- CVD Atlas 16 Death From Stroke PDFDocument1 pageCVD Atlas 16 Death From Stroke PDFRisti KhafidahNo ratings yet

- India InfographicsDocument3 pagesIndia InfographicsSumit RoyNo ratings yet

- Madrid Rmbs Iii Fondo de Titulización de ActivosDocument149 pagesMadrid Rmbs Iii Fondo de Titulización de Activossubramaniang_2No ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Barnes and Noble (BKS)Document8 pagesBarnes and Noble (BKS)Geoffrey HortonNo ratings yet

- Global Production Factors and Supply Chain LocationsDocument5 pagesGlobal Production Factors and Supply Chain LocationsBảoNgọcNo ratings yet

- Chapter 5 - Financial Management and Policies - SyllabusDocument7 pagesChapter 5 - Financial Management and Policies - SyllabusharithraaNo ratings yet

- Real Estate Marketplace - July 2015Document44 pagesReal Estate Marketplace - July 2015The Lima NewsNo ratings yet

- Ferguson RomDocument16 pagesFerguson Romkaps2385No ratings yet

- Accounting for Director's LoansDocument6 pagesAccounting for Director's LoansAunNo ratings yet

- 2019-2021 Mtef - FSP UpdatedDocument45 pages2019-2021 Mtef - FSP UpdatediranadeNo ratings yet

- MGM 3101 Case StudyDocument8 pagesMGM 3101 Case StudyNurul Ashikin ZulkefliNo ratings yet

- 2nd Call For Application MFA-OG 2017Document2 pages2nd Call For Application MFA-OG 2017Juma MpangaNo ratings yet

- Interim Order in The Matter of Aspen Nirman India LimitedDocument20 pagesInterim Order in The Matter of Aspen Nirman India LimitedShyam SunderNo ratings yet

- Top stockbrokers in Chandigarh regionDocument5 pagesTop stockbrokers in Chandigarh regionKelly BaileyNo ratings yet

- Tax Nirc PDFDocument93 pagesTax Nirc PDFHeber BacolodNo ratings yet

- Bangladesh-China-India-Myanmar (BCIM) Economic Corridor: Challenges and ProspectsDocument20 pagesBangladesh-China-India-Myanmar (BCIM) Economic Corridor: Challenges and ProspectsSammer RajNo ratings yet

- National Income EquilibriumDocument14 pagesNational Income EquilibriumAli zizoNo ratings yet

- An Endowment Policy Is A Life Insurance Contract Designed To Pay A Lump Sum After A Specific TermDocument3 pagesAn Endowment Policy Is A Life Insurance Contract Designed To Pay A Lump Sum After A Specific TermParmeshwar SutharNo ratings yet

- New Issue MarketDocument31 pagesNew Issue MarketAashish AnandNo ratings yet

- AppendixDocument36 pagesAppendixJudy PulongNo ratings yet

- Contango Oil & Gas Co. PresentationDocument18 pagesContango Oil & Gas Co. PresentationCale SmithNo ratings yet

- Caso Glen Mount Furniture CompanyDocument56 pagesCaso Glen Mount Furniture CompanyJanetCruces100% (2)

- Mb0045 Financial ManagementDocument242 pagesMb0045 Financial ManagementAnkit ChawlaNo ratings yet

- Finacle Knowledge To Bankers: Core Banking Solution LiteracyDocument5 pagesFinacle Knowledge To Bankers: Core Banking Solution LiteracyChirag Bhatt100% (2)

- QUIZ-1 Monetary Theory and PolicyDocument1 pageQUIZ-1 Monetary Theory and PolicyAltaf HussainNo ratings yet

![[23538414 - Marketing of Scientific and Research Organizations] Understanding Factors Influencing Consumers Online Purchase Intention via Mobile App_ Perceived Ease of Use, Perceived Usefulness, System Quality, Information Quality, And Serv](https://imgv2-2-f.scribdassets.com/img/document/498895791/149x198/235a509cfd/1615850549?v=1)