Professional Documents

Culture Documents

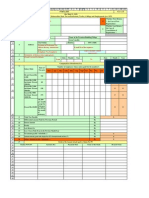

Form 231

Uploaded by

vishnucnkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 231

Uploaded by

vishnucnkCopyright:

Available Formats

B 2 3

O P Q R S T U V W X Y Z AA AB AC FORM_231 Ver 1.6.0 Return-cum-chalan of tax payable by a dealer under M.V.A.T.Act, 2002 (See Rule 17, 18 and 45) M.V.A.T. R.C. No. Name of Dealer BLOCK NO/ FLAT STREET/ ROAD CITY Location of Sales Tax officer having jurisdiction over Address Phone No Of Delar If Holding CST RC Separate Please Select Return Code Eligible For 704

D E

G H

J K L

4 7 8 9 10

1 2. Personal Information of the Dealer

Name of Premises/Building/Village Area/ Locality District Pin code

11 13 3 Please Select which ever is Applicable

E_mail id of Dealer

14

Type of Return (Select appropriate) Periodicity of Return (Select appropriate)

16

Whether First Return ? (In Case of New Registration / New Package scheme dealer) Whether Last Return ? (In Case of Cancellation of Registration Or For new Package scheme dealers for end of non package scheme period Or end of package scheme period) No To Date Month Year

18 Year From Date Month Period Covered by 19 4 Return 21 22 5 Particulars Gross turnover of sales including, taxes as well as turnover of non Computation of sales transactions like value of branch/ consignment transfers , job net turnover of a) work charges etc 23 sales liable to tax Less:-Value ,inclusive of sales tax.,of Goods Returned including reduction of sales price on account of rate difference and discount . b) 24 25 26 Less:-Net Tax amount ( Tax included in sales shown in (a) above less c) Tax included in(b) above) Less:-Value of Branch Transfers / consignment transfers within the d) State If Tax is Paid by an Agent Less:-Sales u/s 8(1) i.e Inter state sales including Central Sales Tax,Sales in the course of Imports, Exports and value of Branch Transfers / Consignment Transfers outside the State Turnover of export sales u/s 5(1) and 5(3) of the CST Act 1956 included in Box (e) Turnover of sales in the course of import u/s 5(2) of the CST Act e) 1956 included in Box (e) Less:-Sales of tax-free goods specified in Schedule" A" of MVAT f) Act Less:-Sales of taxable goods fully exempted u/s 41 and u/s. 8 other g) than sales under section 8(1) & covered in Box 5(e) h) Less:-Labour Charges/Job work charges i) j) Less:-Other allowable deductions, if any Balance: Net turnover of Sales liable to tax [a-(b+c+d+e+f+g+h+i)]

Amount ( Rs)

27

28

29 30 31 32 33 34

B 36 37 38 39 40 41 42 43 44 46 48

D E

G H

J K L

Y Z AA AB AC

6 Computation of Sales Tax payable under the M VAT Act 6A

a) b) c) d) e) f)

Rate of tax 12.50%

Turnover of sales liable to tax (Rs.) 678

Total 678 Sales Tax collected in Excess of the Amount of Tax payable.

Particulars a) Total turnover of Purchases including taxes, value of Branch

Tax Amount ( Rs) 85 0 0 0 0 0 85 0 Amount ( Rs)

49 7 .Computation of Purchases Eligible for Set50 off 51 52 53 54 55 56 57 58 59 60 61 62

Transfers/ Consignment Transfers received and Labour/ job work charges Less:-Value of goods return(inclusive of tax,including reduction of Purchase price on account of rate difference and discount . c) Less:-Imports (Direct imports) d) Less:-Imports (High seas purchases) e) Less:-Inter-State purchases (Excluding purchases against certificate in form 'H') e1) Less: Purchases of taxble goods (either local or Interstate) against certificate in Form'H' f) Less:-Inter-State branch / consignment transfers received g) Less:-Within the State Branch Transfers /Consignment Transfers received where tax is to be paid by an Agent h) Less:-Within the State purchases of taxable goods from unregistered dealers i) Less:-Within the State Purchases of taxable goods from registered dealers under MVAT Act, 2002 and which are not eligible for setj) Less:-Within the State purchases of taxable goods which are fully exempted from tax u/s 41 and u/s 8 but not covered under section k) Less:-Within the State purchases of tax-free goods specified in Schedule "A" l) Less:-Other allowable deductions, if any m) Balance: Within the State purchases of taxable goods from registered dealers eligible for set-off [a(b+c+d+e+e1+f+g+h+i+j+k+l) ]

b)

63 66 67 68 69 70 71 72 73 74 75 76 77 7A. Computation of Purchase Tax payable on the purchases effected during this period or previous periods 8 Tax Rate wise breakup of within state purchases from registered and unregistered dealers eligible for set-off as per box 7(m) and 7A

0 Tax Amount ( Rs) 0 0 0 0 0

Rate of Tax a) b) c) d) e) Total

Turnover of Purchases liable to tax (Rs.)

Rate of tax a) b)

Net Turnover of purchases (Rs.)

Tax Amount ( Rs)

8 Tax Rate wise breakup of within state purchases from B C andD registered unregistered 78 dealers eligible for set-off as per 79 box 7(m) and 80 7A 81 82 83 9. Computation of set-off claimed in this 84 return

E c) d) e)

G H

J K L

Y Z AA AB AC

Total Particulars

a)

0 Purchase Value(Rs.)

0 Tax Amount (Rs.)

b)

85

86 c) 87 d) 88 e) 89 90 91

Within the State purchases of taxable goods from registered dealers eligible for set-off as per Box 8 Less: Reduction in the amount of set_off u/r 53(1) of the corresponding purchase price of (Sch C, D & E) goods Less: Reduction in the amount of set_off u/r 53(2) of the corresponding purchase price of (Sch B) goods Less: Reduction in the amount of set-off under any other sub rule of Rule 53 Add: Adjustment on account of set-off claimed Short in earlier return Less: Adjustment on account of set-off claimed Excess in earlier return

f) Set-off available for the period of this return [a(b+c-d+e)]

92 10. Computation for Tax payable along with return 93 A. Aggregate of 94 credit available for a) the period covered 95 b) under this return 96 97 c) d) Particulars Set off available as per Box 9 (f) Excess credit brought forward from previous return Amount already paid ( Details to be entered in Box 10 E) Excess Credit if any , as per Form 234 , to be adjusted against the liability as per Form 231 Adjustment of ET paid under Maharashtra Tax on Entry of Goods into Local Areas Act 2002 /Maharashtra Tax on Entry of Motor Vehicle Act into Local Areas Act 1987 Amount of Tax collected at source u/s 31A Refund adjustment order No. ( Details to be entered in Box 10 F) Total available credit (a+b+c+d+e+e1+f) Sales Tax payable as per box 6 + Purchase Tax payable as per box 7A Adjustment on account of MVAT payable, if any as per Return Form 234 against the excess credit as per Form 231. Adjustment on account of CST payable as per return for this period Adjustment on account of ET payable under Maharashtra tax on Entry of Goods into Local Areas Act, 2002 / /Maharashtra Tax on Entry of Motor Vehicle Act into Local Areas Act1987 0 85 Amount ( Rs) 0

98 99 100 101

e) e1) f)

g) B Total tax payable 102 and adjustment of a) CST/ET payable 103 against available b) credit 104 c)

105

d)

and adjustment of CST/ET payable against available credit

B 106 107 108 109 110

D E

F e) f) f1) g)

G H

J K L

Y Z AA AB AC 0

Amount of Tax Collected in Excess of the amount of Sales Tax payable if any ( as per Box 6A) Interest Payable Late Fee Payable Balance: Excess credit =[10A(g)-(10B(a)+10B(b)+10B(c)+ 10B(d)+ 10B(e)+ 10 B(f)+ 10 B(f1))] Balance Amount payable= [ 10B(a)+10B(b)+10B(c)+ 10B(d)+10B(e)+10 B(f)+ 10 B(f1)-10A(g)] Excess credit carried forward to subsequent tax period Excess credit claimed as refund in this return(Box10 B(g)- Box 10 C(a)) Total Amount payable as per Box 10B(h) Amount paid as per revised return/fresh return ( Details to be included in Box 10 E) Amount paid as per Revised /Fresh return ( Details to be entered in Box 10 E) Amount (Rs) Payment date Name of the Bank

0 85

h) C Utilisation of 111 Excess Credit as per a) box 10B(g) 112 b) D. 114 Tax payable with a) return-Cum-Chalan 115 b) 116 118 119 120 121 122 123 124 125 126 127 128 129 130 132 133 134 135 136 137 138 139 c) Chalan CIN No

0 85

E. Details of Amount Paid along with this return and or Amount already Paid

Branch Name

TOTAL

0 Amount Adjusted( Rs) Date of RAO

F. Details of RAO

RAO No

140 TOTAL 0 143 144 G. The Statement contained in Box 1 to 10 are true and correct to the best of my knowledge and belief. 145 Date of Filing of Return 146 Name Of Authorised Person 147 Designation 148 E_mail_id 149 150 Date Month Year Place Remarks Mobile No

Instructions For Submission Of Forms

1.All The Fields In red Colour are Mandatory 151 2.After Filling The Fields Please Press The Validate Button

B 152

D E

G H

J K L

Y Z AA AB AC

3.Please Correct The Mistakes Pointed Out By Validate Function 153 4.You Can Save The Form For Submission if validate Function Returns The same Message 154 5. Please Check the ERRORS Excel Sheet for Any Errors. 155 6.Remarks if any (V1)

7. If " Press To Validate " Button is not operative , please ensure that MICRO SECURITY 156 in TOOLs menu of Excel Sheet has set at MEDIUM or LOW

157 158 159 160

Press To Validate

PLEASE

SAVE the information AFTER

VALIDATION

AE 2 3

AF

AG

AH

AI

AJ

AK

AL

4 7 8 9 10

11 13

14

16 18 19 21 22

23

24 25 26

27

28

29 30 31 32 33 34

AE 36 37 38 39 40 41 42 43 44 46 48 49

AF

AG

AH

AI

AJ

AK

AL

50 51 52 53 54 55 56 57 58 59 60 61 62

63 66 67 68 69 70 71 72 73 74 75 76 77

AE 78 79 80 81 82 83

AF

AG

AH

AI

AJ

AK

AL

84

85

86 87 88 89 90 91 92 93 94 95 96 97

98 99 100 101 102 103 104

105

You might also like

- What Is Fundamental AnalysisDocument13 pagesWhat Is Fundamental AnalysisvishnucnkNo ratings yet

- Form CSTDocument6 pagesForm CSTtejastejNo ratings yet

- E Return AnnexuresDocument306 pagesE Return AnnexuresvishnucnkNo ratings yet

- Form 501Document462 pagesForm 501vishnucnkNo ratings yet

- Form 501Document462 pagesForm 501vishnucnkNo ratings yet

- Maharashtra Profession Tax Return FormDocument2 pagesMaharashtra Profession Tax Return Formvishnucnk25% (4)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Metrobank vs. Chuy Lu TanDocument12 pagesMetrobank vs. Chuy Lu TanDexter CircaNo ratings yet

- Acct II Chapter 3edDocument11 pagesAcct II Chapter 3edmubarek oumer100% (2)

- Financial Statement Analysis of IDBI Federal Life Insurance Co Ltd. (FIN)Document81 pagesFinancial Statement Analysis of IDBI Federal Life Insurance Co Ltd. (FIN)kavya srivastavaNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Export Automobile Parts Business PlanDocument30 pagesExport Automobile Parts Business Plansagnikroy50% (2)

- Application of E-Commerce in BankingDocument14 pagesApplication of E-Commerce in Bankingswetanim86% (7)

- Merger Model Sample BIWS JobSearchDigestDocument7 pagesMerger Model Sample BIWS JobSearchDigestCCerberus24No ratings yet

- Certificate in Bookkeeping and Accounting Level 2Document38 pagesCertificate in Bookkeeping and Accounting Level 2McKay TheinNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthChen GretNo ratings yet

- PAMECA v. CADocument2 pagesPAMECA v. CAd2015member83% (6)

- Notice of Dispute and Demand for ValidationDocument6 pagesNotice of Dispute and Demand for ValidationNat Williams97% (29)

- Let's Plan Your Financial FreedomDocument11 pagesLet's Plan Your Financial FreedomvedantNo ratings yet

- Corporation Accounting - DividendsDocument13 pagesCorporation Accounting - DividendsAlejandrea LalataNo ratings yet

- Insurance Regulatory and Development Authority Policy Holder Complaints Registration FormDocument3 pagesInsurance Regulatory and Development Authority Policy Holder Complaints Registration FormSiddharth PandeyNo ratings yet

- Contract of AgencyDocument25 pagesContract of Agencynarayan89% (57)

- Chapter 6 - Organizational Study (Solar Powerbank)Document26 pagesChapter 6 - Organizational Study (Solar Powerbank)Red SecretarioNo ratings yet

- NJ GAP Presentation New Jan 2015Document22 pagesNJ GAP Presentation New Jan 2015Tejas AhalparaNo ratings yet

- Sid of Icici Prudential Alpha Low Vol 30 Etf PDFDocument101 pagesSid of Icici Prudential Alpha Low Vol 30 Etf PDFMit AdhvaryuNo ratings yet

- Tutorial 6Document6 pagesTutorial 6sami995No ratings yet

- Form5 PTDocument2 pagesForm5 PTShilpa KapoorNo ratings yet

- Governmental and Not-For-profit Accounting 5th Chapter 2 SolutionDocument28 pagesGovernmental and Not-For-profit Accounting 5th Chapter 2 SolutionCathy Gu75% (8)

- Test Bank: Risk Return AnalysisDocument2 pagesTest Bank: Risk Return AnalysisSatyam Dixit100% (1)

- Credit Risk Study of Overseas Education LoansDocument9 pagesCredit Risk Study of Overseas Education Loansnandini swamiNo ratings yet

- ACTG1A - Fundamentas of AccountingDocument17 pagesACTG1A - Fundamentas of AccountingdeltanlawNo ratings yet

- Survey of Makati RatesDocument5 pagesSurvey of Makati RatesMarcus DoroteoNo ratings yet

- Niraj Gami CV 2012Document2 pagesNiraj Gami CV 2012nirajgamiNo ratings yet

- Cost of Capital: Concept, Components, Importance, Example, Formula and SignificanceDocument72 pagesCost of Capital: Concept, Components, Importance, Example, Formula and SignificanceRamya GowdaNo ratings yet