Professional Documents

Culture Documents

Aditya Container Freight Project

Uploaded by

Hemanth Kumar RamachandranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aditya Container Freight Project

Uploaded by

Hemanth Kumar RamachandranCopyright:

Available Formats

ICRA Credit Perspective

ADITYA CONTAINER FREIGHT STATION PRIVATE LIMITED

Rating Analyst Contacts

K. Ravichandran ravichandran@icraindia.com +91 44 4596 4301 Girishkumar Kadam girishkumar@icraindia.com +91-22-3047 0032 Aashay Choksey aashay.choksey@icraindia.com +91 79 40271519 Prateek Jain prateek.jain@icraindia.com +91 79 40271508 ICRA has assigned a rating of [ICRA]B+ (pronounced ICRA B plus) to the Rs. 5.50 crore,1 long-term, fund based facilities of Aditya Container Freight Station Private Limited (ACFSPL)2. Key Financial Indicators FY 2012 Provisional Net Sales Operating Income OPBDIT PAT Net Cash Accruals Total Debt (TD) Tangible Net worth (TNW) OPBDIT/OI PAT/OI RoCE RonW Total Gearing OPBDIT/Interest & Finance charges (GCF+ Interest)/Interest NCA/Total Debt Total Debt/OPBDITA Debtor days Inventory days Creditor days NWC/OI Rs Crore Rs Crore Rs Crore Rs Crore Rs Crore Rs Crore Rs Crore % % % % Times Times Times % Times Days Days Days % 9.95 9.95 2.51 0.91 2.25 8.95 6.27 25.18% 9.16% 12.33% 18.08% 1.43 6.17 8.99 25% 3.57 33 0 152 (26%) FY 2011 Audited 6.50 6.50 1.62 0.56 1.11 7.33 3.82 24.91% 8.59% 20.68% 26.32% 1.92 6.05 9.20 15% 4.53 21 0 198 (28%) FY 2010 Audited 2.10 2.10 (0.24) (0.33) (0.16) 1.95 0.43 (11.46%) (15.71%) (33.46%) (153.86%) 4.55 (3.30) 10.54 (8%) (8.10) 105 0 323 (48%)

Relationship Contact L. Shivakumar shivakumar@icraindia.com +91 22 3047 0005

September 2012

OI: Operating Income; OPBDITA: Operating Profit before Depreciation, Interest, Tax and Amortisation; PAT: Profit after Tax; PBIT: Profit before Interest and Tax; DTL: Deferred Tax Liability; GCF: Gross Cash Flows; NWC: Net Working Capital; RoCE (Return on Capital Employed) = PBIT/Avg. (Total Debt + Tangible Net Worth + Deferred Tax Liability Capital Work-In-Process); RoNW (Return on Net Worth) = PAT/Avg. (Tangible Net Worth + Minority Interest) Website www.icra.in

1 2

100 lakhs = 1 crore = 10 million For complete rating scale and definitions, please refer to ICRAs website www.icra.in or other ICRA Rating Publications.

ICRA Credit Perspective

Aditya Container Freight Station Private Limited

Key Rating Considerations

Credit Strengths

Long standing experience of the promoters in the container handling business Established relationships with custom house agents, who are the primary business drivers of the company Locational advantage accruing by way of presence in Gujarat, resulting in a rich hinterland Favourable outlook for containerised trade in the long term, resulting in favourable prospects for ACFSPL; although current economic slowdown could affect operations in the near to medium term Relatively limited competition, with the presence of only three players. High entry barriers for entry of new players serving the port

Credit Concerns

Small scale of present operations Absence of agreements with major shipping lines serving the port Volumes and profitability vulnerable to any downturns in export-import (exim) trade as well as any adverse changes in government regulations related to exports or imports Moderate risk of cargo concentration; ACFSPL deals primarily in inbound metal scrap and timber logsthereby exposing the company to cyclicality and supply constraints relating to these products Moderate financial risk profile characterized by high gearing levels Substantial term loan and equipment loan repayments in FY2013 could stretch cash flow position of the company in the near to medium term Rating Rationale The assigned rating is constrained by the small scale of operations coupled with vulnerability to any adverse trends in trade (export-import) volumes at Kandla Port. The rating also takes into account the dependence on metal and timber import resulting in exposure to cyclicality and supply constraints relating to these products. The rating are further constrained by the absence of firm agreements with major shipping lines docking at Kandla port and vulnerability caused due to economic slowdown in the near to medium term. Also, the companys financial risk profile remains high, given the moderate gearing level as on March 31, 2012 and sizeable term loan repayments scheduled in the near to medium term, which could stretch the cash flow position. The rating, however, favourably factors in the long experience of the promoters in container handling industry, by way of engagement with other group companies operating at different ports in Gujarat, favourable location of the companys facility, established relationships with Custom House Agents, limited competitive pressure, favourable outlook of containerized trade and favourable financial risk profile characterised by healthy operating profitability.

Business & Competitive Position

Aditya Container Freight Station Private Limited (ACFSPL) is one of two privately operated Container Freight Stations (CFSs) located at the Kandla port. ACFSPL is promoted by Captain Rajeev Niroola and Captain Navjeet Grewal, who operate three Container Freight Stations under three separate group companies in the state of Gujarat, resulting in long standing experience in handling containerized cargo. The rich hinterland which includes the states of Gujarat, Rajasthan, Madhya Pradesh, Haryana, Punjab and Uttar Pradesh has helped in increasing throughput handled at Kandla port; reflected by ~5% growth from 1.60 lakh TEUs in FY2011 to 1.67 lakh TEUs in FY2012.

ICRA Rating Services

Page 2

ICRA Credit Perspective

Aditya Container Freight Station Private Limited

Import cargo comprises mostly of metal scrap and timber; metal scrap is sourced from European and North American countries by smelting companies in Gujarat, while timber is imported from Malaysia, Nigeria, Ghana, New Zealand, Canada, Burma and Indonesia by saw mills based in Gandhidham. Export containers mostly consist of cotton cultivated in the states of Gujarat and Rajasthan, with onward movement to China and Malaysia. The operations of the company remain vulnerable to regulations related to timber import in the exporting countries, as a significant volume handled by the company includes timber imports. The export volumes remain exposed to government regulations and agro-climatic risk associated with cotton, although the contribution of cotton to total throughput remains low. The throughput for ACFSPL in terms of TEUs has witnessed a CAGR of 27% (from 8,369 TEUs to 15,189 TEUs) during FY10-12, with import containers comprising 82% of total throughput in FY2010, which has increased to 91% in FY2012, while the contribution of export containers has declined over the same period from 18% in FY2010 to 9% in FY2012. The average realization in terms of TEUs has gradually increased from about Rs 2,504 per TEU in FY2010 to Rs 6,553 per TEU in FY2012 due to longer storage period, changing cargo mix and periodic upward revision of container handling charges; the last revision reported in the month of April 2011. Customer concentration remains moderate; although it has decreased over the past three fiscals, with sales contributed by the top ten customers decreasing from 66% in FY2010 to 55% in FY2012 with most of the customers comprising of Custom House Agents (CHAs), timber and metal scrap traders, smelting plants and export-import houses. Currently ACFSPL does not have any fixed agreements with any company for handling of import goods, nor does it have any formal tie ups with the shipping lines that dock at Kandla port. Kandla Port is served by four CFSs including two Government owned CFSs namely; Container Corporation of India and Central Warehousing Corporation. The presence of a relatively lesser number of CFSs has resulted in limited competitive pressure for ACFSPL; although the containerized throughput capacity of Kandla port remains lower as compared to other container ports in India, resulting in lesser CFSs operating out of Kandla. In the initials years of operation, ACFSPL operated leased equipment for handling containers, however due to increasing rentals and difficulties in service support, the company procured all its equipment. Capital cost in Container Freight Stations with exception to the cost of land, is mostly incurred towards cranes, stacking machines and other container loading and unloading machines. ACFSPL has procured all these equipments, with no major addition is planned with respect to the same in the near to medium term.

Financial Risk Profile

Revenue Growth & Profitability: The operating income of the company witnessed healthy growth of ~53% to Rs. 9.95 crore in FY2012 from Rs 6.50 crore in FY2011. The increase is primarily on account of increased throughput handled during the year coupled with increasing realisation rates. The operating margins of the company remain at healthy levels, with marginal improvement reported in FY2012 partly due to upward revision of cargo handling rates resulting in an increase in operating margins to 25.18% in FY2012 from 24.91% in FY2011. The return on capital employed (RoCE) of the company has remained moderate and has been reported at 12.33% in FY2012. Financial Policy and Capital Structure: The total debt of the company stood at Rs. 8.95 crore as on FY2012 end, as compared to lower levels of Rs. 7.33 crore as on FY2011 end. Gearing level was reported at higher levels of 1.43 times as on 31st March 2012, which has improved from 1.92 times as on 31st March 2011 on account of higher accruals to net worth. The coverage indicators have remained at healthy levels, with interest coverage at 6.17 times and NCA/Debt at 25% in FY 2012.

ICRA Rating Services

Page 3

ICRA Credit Perspective

Aditya Container Freight Station Private Limited

Working Capital Intensity and Liquidity: The net working capital intensity of the company has remained negative in FY2012 at (26%). Credit period offered varies from customer to customer, although on an average it remains between 30-45 days. Creditors normally offer a credit period of 30 days. Term loan and equipment loan repayments amounting to ~Rs 2.52 crore scheduled in FY2013 could stretch the cash flow position of the company.

Prospects

Going forward, ICRA expects a moderate growth in operating income on account of favourable demand scenario for containerized trade movement; although the ability of the company to scale up its throughput while maintaining its operating profitability and improve its capital structure remains key sensitivity factors.

Company Profile

Aditya Container Freight Station Private Limited (ACFSPL) was incorporated in January 2007 and is engaged in the business of operating a Container Freight Station (CFS) at Kandla Port, with a total capacity of 30,000 TEUs per annum. The facility has been developed on a 10 acre custom notified site and is located at a distance of about 23 kilometres from the Kandla port gate. Apart from the open container stacking yard, a 4000 square meters (about 1 acre) covered ware house facility has also been developed for storing special cargo.

Recent Results

In FY 2012, ACFSPL reported an operating income of Rs. 9.95 crore (as against Rs.6.50 crore in FY 2011) and profit after tax of Rs. 0.91 crore (as against a net loss of Rs. 0.56 crore in FY 2011).

September 2012

ICRA Rating Services

Page 4

ICRA Credit Perspective

Aditya Container Freight Station Private Limited

Annexure: Rating

Instrument Term Loans Amount Rs.5.50 Cr Rating Action [ICRA]B+ assigned

ICRA Rating Services

Page 5

ICRA Credit Perspective

Aditya Container Freight Station Private Limited

ICRA Limited

An Associate of Moody's Investors Service

CORPORATE OFFICE Building No. 8, 2nd Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002 Tel: +91 124 4545300; Fax: +91 124 4545350 Email: info@icraindia.com, Website: www.icra.in REGISTERED OFFICE 1105, Kailash Building, 11th Floor; 26 Kasturba Gandhi Marg; New Delhi 110001 Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434 0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559 4065 Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax + (91 40) 2373 5152 Pune: Tel + (91 20) 2552 0194/95/96, Fax + (91 20) 553 9231

Copyright, 2012 ICRA Limited. All Rights Reserved. Contents may be used freely with due acknowledgement to ICRA. All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure that the information herein is true, such information is provided 'as is' without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein must be construed solely as statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of this publication or its contents.

ICRA Rating Services

Page 6

You might also like

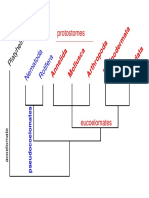

- In TH Es: ProtostomesDocument57 pagesIn TH Es: ProtostomesRodrigo TortillaNo ratings yet

- Water Potential Questions KeyDocument1 pageWater Potential Questions KeyHemanth Kumar RamachandranNo ratings yet

- Botany MendelDocument53 pagesBotany MendelHemanth Kumar RamachandranNo ratings yet

- How To Run A Self Sufficient Intensive AquariumDocument26 pagesHow To Run A Self Sufficient Intensive AquariumHemanth Kumar RamachandranNo ratings yet

- DesalinationDocument49 pagesDesalinationfalcon724100% (8)

- Haber Gold Proc Des CPDFDocument2 pagesHaber Gold Proc Des CPDFHemanth Kumar RamachandranNo ratings yet

- Aquaculture Chennai 2014 PamphletDocument2 pagesAquaculture Chennai 2014 PamphletHemanth Kumar RamachandranNo ratings yet

- Absorption RefrigerationDocument6 pagesAbsorption RefrigerationHemanth Kumar RamachandranNo ratings yet

- Model Bankable ProjectDocument10 pagesModel Bankable ProjectAmitNo ratings yet

- Solarpowerinindia Afinancialanalysis 130110135901 Phpapp01Document34 pagesSolarpowerinindia Afinancialanalysis 130110135901 Phpapp01Esha VermaNo ratings yet

- Concept - Note Aquaponic - SystemsDocument20 pagesConcept - Note Aquaponic - SystemsHemanth Kumar Ramachandran100% (2)

- Benz Bus Maintenance BookDocument104 pagesBenz Bus Maintenance BookDiego NicolaldeNo ratings yet

- Standard Membrane: SystemsDocument51 pagesStandard Membrane: SystemsVenkat RaguNo ratings yet

- Power Production Based On Osmotic PressureDocument10 pagesPower Production Based On Osmotic PressureHemanth Kumar RamachandranNo ratings yet

- Planning A Dairy Plant PDFDocument13 pagesPlanning A Dairy Plant PDFVikas NaikNo ratings yet

- Ramnad Desalination Specs 3.80 MLD PDFDocument22 pagesRamnad Desalination Specs 3.80 MLD PDFHemanth Kumar RamachandranNo ratings yet

- Ramnad Desalination Specs 3.80 MLD PDFDocument22 pagesRamnad Desalination Specs 3.80 MLD PDFHemanth Kumar RamachandranNo ratings yet

- Pondy Dairy ProductsDocument9 pagesPondy Dairy ProductsHemanth Kumar RamachandranNo ratings yet

- Auto Service StationDocument8 pagesAuto Service StationHemanth Kumar RamachandranNo ratings yet

- SMEDA Auto Repair & Service WorkshopDocument36 pagesSMEDA Auto Repair & Service Workshopvorexxeto50% (2)

- Hydraulic Briquetting Machine Manufacturer IndiaDocument6 pagesHydraulic Briquetting Machine Manufacturer IndiaHemanth Kumar RamachandranNo ratings yet

- Chennai Comprehensive Transport StudyDocument154 pagesChennai Comprehensive Transport StudyDevyani GangopadhyayNo ratings yet

- Economics For DairyDocument8 pagesEconomics For DairyHemanth Kumar RamachandranNo ratings yet

- Ausra CLFRDocument3 pagesAusra CLFRHemanth Kumar RamachandranNo ratings yet

- China 1 MW Tower CSP ModelDocument1 pageChina 1 MW Tower CSP ModelHemanth Kumar RamachandranNo ratings yet

- China 1 MW Tower CSP ModelDocument1 pageChina 1 MW Tower CSP ModelHemanth Kumar RamachandranNo ratings yet

- Presentation Risks Opportunities SolarDocument33 pagesPresentation Risks Opportunities SolarHemanth Kumar RamachandranNo ratings yet

- STAGE STE PresentationFISEDocument52 pagesSTAGE STE PresentationFISEHemanth Kumar RamachandranNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ACCA Paper F7: NotesDocument15 pagesACCA Paper F7: NotesBrian CornwellNo ratings yet

- Management Thesis On Performance of Public Sector Banks Pre and Post Financial CrisisDocument36 pagesManagement Thesis On Performance of Public Sector Banks Pre and Post Financial Crisisjithunair13No ratings yet

- Notification GSR 739Document4 pagesNotification GSR 739Varinder AnandNo ratings yet

- Chapter 2-Traditional Approach For Stock AnalysisDocument20 pagesChapter 2-Traditional Approach For Stock AnalysisPeterNo ratings yet

- Income Tax-V - BookDocument60 pagesIncome Tax-V - BookSiddarood KumbarNo ratings yet

- CPA Income Tax QuizDocument15 pagesCPA Income Tax QuizApolinar Alvarez Jr.100% (4)

- SamHoustonState Fy 2020Document79 pagesSamHoustonState Fy 2020Matt BrownNo ratings yet

- CH 10 PPT IpmDocument19 pagesCH 10 PPT IpmAirlanggaZakyNo ratings yet

- EFE & IFE Matrix of Walt DisneyDocument2 pagesEFE & IFE Matrix of Walt DisneyWinne You100% (2)

- Set of Tuition Fee IncreaseDocument3 pagesSet of Tuition Fee IncreasePagkakaisa Ang Kailangan TolNo ratings yet

- Chapter 13 Property Plant and Equipment Depreciation and deDocument21 pagesChapter 13 Property Plant and Equipment Depreciation and deEarl Lalaine EscolNo ratings yet

- Contract of Employment & Types of OrganisationsDocument16 pagesContract of Employment & Types of OrganisationsKomborero MagurwaNo ratings yet

- Applied Corporate Finance TVM Calculations and AnalysisDocument3 pagesApplied Corporate Finance TVM Calculations and AnalysisMuxammil IqbalNo ratings yet

- Walt DisneyDocument13 pagesWalt Disneyfa2heemNo ratings yet

- Eicher MotorsDocument16 pagesEicher MotorsjehanbhadhaNo ratings yet

- Bbap2103 Management AccountingDocument15 pagesBbap2103 Management AccountingeugeneNo ratings yet

- Tata Motors CSR positively impacts communitiesDocument25 pagesTata Motors CSR positively impacts communitiesjasdeepNo ratings yet

- ACC722 Tutorial IIDocument4 pagesACC722 Tutorial IIJohn Tom50% (2)

- Handout No. 1 in Fundamentals of Accounting, Business, and Management 2Document8 pagesHandout No. 1 in Fundamentals of Accounting, Business, and Management 2Stephanie DecidaNo ratings yet

- Agriculture BussinessDocument5 pagesAgriculture BussinessaronNo ratings yet

- Financial Management - An IntroductionDocument8 pagesFinancial Management - An Introductionchautsi precious0% (1)

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn KyawNo ratings yet

- March 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDocument10 pagesMarch 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDillon CollierNo ratings yet

- Chapter 14Document27 pagesChapter 14Jayashree Menon0% (1)

- PercentagesDocument5 pagesPercentagesnatts9678100% (1)

- ACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsDocument43 pagesACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsAli H. AyoubNo ratings yet

- Mahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonDocument20 pagesMahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonPratik Kalekar100% (1)

- Informative Speech Outline LotteryDocument3 pagesInformative Speech Outline Lotteryapi-265257755No ratings yet

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresDocument30 pagesThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresabmyonisNo ratings yet

- Problem Ch.14Document3 pagesProblem Ch.14kenny 322016048100% (1)