Professional Documents

Culture Documents

Synopsis

Uploaded by

Ai Lin ChenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Synopsis

Uploaded by

Ai Lin ChenCopyright:

Available Formats

SYNOPSIS The case study is about Haute Couture Fashion Bhd (HCF) and how it ran into trouble

in early 2009. HCF was established in the 1974 with first fully equipped factory in Penang then started out as a small unlisted family business in the clothing manufacturing business. HCF has very quick established as high quality manufacturer of both mens and womens clothes. The case relates, in particular, to the problems currently being faced by HCF. Its new Managing Director, Jeffrey Cheong had just taken over and was immediately and inundated with problems. Two of HCFs major client Kiki and Houida, two European fashion houses had informed Jeffrey of their attention to pull out contracts with HCF and look towards China as their supplier. HCF is no match to Chinas growing economy and this new development will definitely cause the downfall of HCF unless something is done quickly. Loss of Kiki and Houida would mean that HCF would then be incurring losses. Jeffrey had garnered the assistance of his senior management team to brainstorm on possible options HCF can look at. Although acknowledging that looking into China is inevitable, the team was divided in the approach to be taken. One option is to completely shut down operations in Malaysia and Thailand and move all operation to China. This way, HCF would be able to support its current customers with much lower prices while being competitive. The downside to this option is that HCF will have to retrench its entire staff in Malaysia and Thailand. However the two factories in Jitra and Chieng Mai had very low resale value as the factories were located in rural areas and it would be difficult to sell these factories. The cost of shutting down the factories at both sites would cost HCF RM 1.2 million. Another option put forth by the Factory Operations Director is to move to China to manufacture clothes for HCFs current customers at competitive prices. They have come out with two possible ways of expanding into China which are first by setting up its own factory in China that was large enough to manufacture clothing for its existing customers and second one by manufacture in China in a joint venture with a Chinese manufacturer that they has identified. However there are pro and cons as well as consequences that HCF need to take into consideration before choose either one of it. The last option they have is developing its own label by manufacturing out of Malaysia and Thailand. This was a fairly new area for HCF that required them to work hard to survive if it were to consider this option. The positive impact of this option was that HCF did not need to retrench all of the employees. However HCF were need to terminate all its contracts with the fashion houses in short-term and only depend on the success of its label to survive. HCF would have to price its product relatively low to penetrate the market and will incur advertising cost would be high. Moreover this option seems more risky than others. Jeffrey convened a Board of Directors meeting to inform them of the latest development and put forth the strategic options identified by his management team. The strategic issues were discussed by the Board and it was agreed that a consultant would be appointed to advise the Board on which proposal HCF should take.

INTRODUCTION Haute Couture Fashions was established in the 1974 with the first fully equipped factory in Penang by the Tan family. He ran a small business but successful business tailoring mens clothing in Argyll Road, Penang. HCF started out as a family owned business with all of its shares being held by the Tan family. HCF very quickly established itself as a high quality manufacturer of both mens and womens clothes. HCF has managed to convince and contracting with them to sign outsourcing deals with HCF. They have recruited several European-trained Malaysians designer to join the team to help meeting the demand of the fashion houses. After rapid expansion and growth of HCF, they had started face some problems. The factory located in Penang was no longer big enough to cope with the production capacity. After years by years, HCF currently has four factories, including one factory located in Chiang Mai, Thailand to cater the demand from their clients. HCF manufactured ready-to-wear clothes for a number of European and American fashion houses. HCFs customers have remained loyal over the last three decades, although its major coup was the securing of two major American fashion houses as its customers within the last five years. All HCFs clothing was manufactured under the customers own label.

ISSUES IN HAUTE COUTURE BHD The issues that have been highlighted in Haute Couture Fashions Bhd (HCF) are the company had been experiencing loss over the last few years. Their two major clients have intention to pull out contract with HCF since they want to contract manufacture with China supplier as the price there were very competitive. If these clients really want to terminate their contract, HCF will suffer tremendous loss. This is because, Kiki and Houida are their major clients which contribute to the large portion of profit in HCF. Therefore, it would be disastrous to HCF if it really want to tie a contract with a China manufacturer. In addition, many of the European and American fashion houses were looking at importing clothes from China since it offers very low price. It indicates that, China is a well known country for textile industry and was forecasted to grow further. China products also are no longer in low quality as the perception of Made In China labels had slowly changed. Based on the financial position of HCF, the company is experiencing loss for the last few years. Based on the ratio that has been calculated, it shows that the companys financial position is weak.

RATIO | 2007RM000 | 2008RM000 | GROSS PROFIT MARGINRevenue- COGS Revenue 120,000 - 77,250 120,000=0.36 | | 130,000 - 72,510 130,000=0.44 |

OPERATING PROFIT MARGINEarnings before interest & taxSales | 13840 120,000=0.04 |

130,000=0.11

| 4600

STOCK HOLDING(INVENTORY TURNOVER)COGSAverage/closing stock | times360/3.35=107.4 days | 77,25028,420=2.72 times360/2.72=132.4 days | AVERAGE COLLECTION PERIOD/( DEBTORS)Account receivableCredit sales/ 360 | (130,000/360)=110.03 days | 43,865 (120,000/360)=131.6 days | DEBT RATIOTotal debtTotal asset 4,50033,413+72,661=21.04% | | 12,292 + 4,50036,375+61,729=17.12% |

72,51021,634=3.35

39,734

17,820

Gross profit margin When the company shows the higher gross profit margin, it indicates that the company is better in controlling their cost of goods sold. HCF gross profit margin in 2008 is lower than 2007. It means that, the company have problem in controlling their cost of goods sold. The company also faced problem in their pricing policy. The cost of goods sold of HCF increase in 2008 because their resources are expensive in terms of the clothes materials. Operating profit margin When the company shows the higher operating profit margin ratio, it indicates that the company is profitable. Based on the calculation, HCF current year shows lower operating profit margin from the previous year. This is because, the company has increase in their operating expenses in terms of administrative and selling expenses. Inventory turnover The shorter period took to sell the stock, the better the company performance is. This company took longer period to sell the stock than the previous year. When the company has low turnover, it shows a bad sign because the product tend to deteriorate as they sit in the warehouse. In 2008, the turnover is slow because the company has to hold the stock in the warehouse for 6 months period before they are due for delivery. Average collection period (debtors) The shorter the period collect to the payment from debtor, it shows the company was efficient in their debtor collection. When the company shows higher ratio, it means the company is having the problem in collecting payments from their debtors. This maybe because of the company has poor screening when accepting their new customer and there is no reminder and follow up for the late payment or no cash discount given to their debtor to attract early payment from their customer.

There are few proposals that have been discussed by the management team to overcome the problems faced by HCF. The proposals includes, they plan to expand to China, proposal to close down factories in Malaysia and Thailand and proposal to manufacturing its own label for the Malaysian and Asian Market. From the previous brainstorm session, they have identified the advantages and disadvantages of each proposal. Proposal 1 Proposal to expand to China. The management had discussed two possible ways of expanding to China. The first option is by set up the new factory in China that was large enough to manufacture closing for its existing customers. The advantages from having this option is, the new factory would be able to manufacture at a similar capacity as it current operations in Butterworth, Jitra and Chieang Mai in total. There are also disadvantages that arise from choosing this option. It includes HCF did not have sufficient funds to fund this expansion since it require to invest a large sum of money in China. Other than that, HCF needs to wait for the new factory to be ready in 18 months. The time consumption is too long for HCF. If HCF still wants to proceed with this proposal, they need to have additional fund. This proposal will not be possible without the full support from the top management. The second option is to manufacture in China by the joint venture with one of the Chinese manufacture which is Celestial Clothes. The advantages that can be derived are, HCF only has to wait for 6 months instead of waiting for 18 months for the factory to be ready. Other than that, it can increase the manufacturing capacity of one and half times HCFs current manufacturing capacity. However, there are few disadvantages that can be found. First, the joint venture would be 70/30 profit share where HCF only gets the portion of 30%. Next, the Chinese currency fluctuates was also a risk for HCF as the exchange rates volatile.

Proposal 2 Proposal to close down HCFs factories in Malaysia and Thailand This proposal requires HCF to close down all of its factories in Malaysia and Thailand. The benefits that HCF can get from this option are, HCF can fetch reasonable resale value for its equipment in their Butterworth and Penang factories. Moreover, HCF will be able to sale the land for a substantial profit as they were located in a fast developing area. There are also disadvantages by having this proposal. By closing the factories in Jitra and Chieng Mai, HCF will sale those factories at the very low resale value as the factories were located at rural area. The cost of pulling down the factories at both sites would cost HCF RM 1.2 million. It is also expected that

redundancy payment to cost around RM 3.3 million at a minimum. HCF also needs to retrench their employees.

Proposal 3 Proposal to manufacturing its own label for Malaysian and Asean Market This proposal require terminate all its contracts with the fashion houses in short term and needs to depends on success of its own label to survive. This proposal is better than second proposal which HCF no need to retrench their employees and HCF could still operate factories in Jitra and Butterworth. Since HCF is unknown company in this region, so it will difficult for them to venture into the business in this region. HCF would have to price its product relatively low to penetrate the market. Advertising costs would also be high as HCF created its own brand. There were also uncertainties present in this option.

RECOMMENDATIONS As a consultant of HCF Sdn Bhd, before determine which proposal that is suitable for HCF Sdn Bhd to go on, we need to investigate the company itself. One of the techniques is by using SWOT analysis. Through SWOT analysis, we can identify in detail the strength, weakness, opportunity and threats. Based on the strength, this company is a family based business and each of them come from a different background of qualification. The company also has a strong management composition because they had applied heterogeneity leadership in their company. They also had employed skillful and loyal worker. Previously, HCF had faced economic downturn in 1997 but they are able to cope with that situation by implementing effective strategy. They are slowly recovered from this situation and successfully earned profit for the year forward. Other than that, the company also has implementing just in time system to satisfy their clients demand. By having this, the system will prevent them from experiencing excess capacity in production. This is the best choice because eventually they can reduce their operating cost. HCF also had not realized that they have a large number of loyal customers. It can be seen when they have owned three well known manufacturing factories in order to meet customer demand. Even though HCF has remarkable strength, we also have identified some weaknesses. From our observation, the company is quite depending on their two main customers which are Kiki and Houida. If they lose them, the companys profit will tremendously drop. Next, the location of the factory is one of their problems. The monitoring process will be difficult as the location is scattered and far from one another. Other than that, lack of innovation also can be considered as the companys weaknesses.

Instead of manufacturing product for client, the company can also produce their own product. So, they will have another source of income by having this. We also can see that the company operates in a very competitive market. Therefore, they must have the ability and capability to compete or otherwise they will face problems. To come out with the suggestion to deal with the problems, we have analyzed the threat and opportunity of the company. There are many opportunities from the proposal such as the company can set up their own factory in China. By implement this proposal, they can reduce the operating cost in terms of material, labour and overhead cost. If the company joint venture with the Chinese manufacturer, maybe that can gain some benefit from that. By having joint venture, they can also develop broader networking. This can ensure them to have good relationship with the Chinese suppliers and customers. They also can reduce cost and time consuming for research and development. If HCF closes their factory in Malaysia and Thailand, this strategy will help them to raise more capital as they can focus on operation in China to gain more profit. If the company decides to manufacture their own label, they are able to compete with existing rivalry. This is because, one of their Board of Director has expertise in designing European clothes where the company can utilize their ability to sustain competitive advantage. Moreover, this will help them to a well known manufacturer in the market. Besides that, the employees are safe from the retrenchment and company can also avoided the cost of compensation. Furthermore, they can increase companys profit by penetrating Asean market. The biggest that the company will face is in term of globalization. Every country has their own rules and regulation as in China. Chinas government has a strict regulation for the foreign company to enter their market because they want to protect their local products. If the company successfully enters into China, they still need to compete with the existing competitors. Besides, there are also risks of Chinese currency fluctuating against the Ringgit over the next 5 years as the forecasted exchange rates could be assured. Other than that, if the company closes their factories they will not get any gain from the disposal of old machinery. Furthermore, the company also will faces liquidity problem. So, if they decide to expand to China, they will not have enough funds to finance their business. Therefore, they have to make long term loan to support their investment capital. Moreover, they also need to consider their employee welfare. If they close down the factories, the company needs to pay compensation for the retrenchment of the employees. In addition, they will lose their human capital.

Joint venture with China manufacturer After evaluating all 3 proposals, we agreed that HCF Sdn Bhd should expand the business in China by joint venture with a Chinese Manufacturer. This is because, China is the fastest growing emerging market, and the largest economy on the globe. Although it offers vast prospects for an expanding

business, the chances of success without sufficient knowledge and expertise are considered hard to survive. Moreover, China offers an entrepreneurial economy for expanding businesses. China price is practically a synonym for the world's lowest cost, with suppliers even often asking their biggest clients to open factories, or at least find subcontractors. A joint venture is a business arrangement in which the joint venture partners create a new business entity or official contractual relationship, and share the investment and operational costs, management responsibilities, profits and losses. There are two types of Joint Venture, the Equity Joint Venture and Contractual Joint Venture. Both investment vehicles require the drafting and agreement of a joint venture contract between the foreign partner and the Chinese partner, specifying the responsibilities, rights and interests of each partner in detail. Whereas the Equity Joint Venture has this division in accordance with the ratio of equity interests, the division in a Contractual Joint Venture is up to the partners to decide. HCF has shortlisted several potential partners and plan to choose Celestial Clothes as a possible partner. Celestial Clothes had been manufacturing since 1995 for several British High-Street stores and was interested in penetrating the European market. It had already established itself as a high quality clothes manufacturer. The joint venture would be a 70/30 a profit share with Celestial Clothes. Both HCF and Celestial Clothes would form a separate company under the joint venture agreement. Anyway, Celestial Clothes would need to build an annexure its current factory to cater for this new venture as HCF wanted the manufacturing activities to remain separate from Celestial Clothes existing business. Even though 70/30 profit sharing seems give disadvantage to HCF, basically this is how joint venture take place. The home joint venture entity will benefit more as the portion of profit sharing is 70%. HCF will also face higher risk when joint venture because of the rapid growing economic in China. This is because the market over there is very competitive. There is also risk of China currency fluctuating again the Ringgit as the forecasted exchange rates could be assured the fluctuation of currency may lead to instability and uncertainty into trade. Both parties maybe unsure on how much money they will earn and pay upon the transaction. To overcome this problem HCF can set up specific price by sign a future contract with them. The company can reduces the risk that the price of materials will rise above the price specified in the contract. It means they can set the incoming five years time price today. Other disadvantages are they expect the cash flow may further affected by 5% negative variation if the exchange rate moved over the next 5 years. It can be directly affect HCF profit in the future. From the joint venture with Celestial Clothes, there are several advantages. First, by entering into joint venture with an existing Chinese manufacturer, HCF would be able service their customer in about 6 months instead of waiting for 18 months if they set up their own factory in China. The 12 months period

would be significance to them. The 6 months time will be better than waiting for 18 months since they can cater the demand of customer immediately. In the other way round, HCF would lose significance revenue if they wait for 12 months time. When doing joint venture with Celestial Clothes, HCF can increase manufacturing capacity of one and half time they had. It means, they are able to manufacture more than their capacity as they had before. Therefore, they are not only manufacture clothes to the European Market but the excess capacity can be exported to other region to broaden their segment. Its better for them to go to Asean Market as they can try to penetrate the market since HCF is Malaysian based manufacture. They can try to expand their business in this region. Other than that, they can develop broader networking. This is to ensure that they can built a good relationship. The quality of the clothes is already trusted by European market. Therefore, with their well known reputation in European Market, HCF can develop trust for Asean Market to gain their confidence in HCF high quality manufacture of clothes.

The other advantages of having a Chinese partner are based on the support they can provide to foreign companies unfamiliar with doing business in China. Such support may include obtaining labor recruitment, sourcing raw materials, acquiring land & production facilities, and obtaining access to marketing and distribution channels. Whilst experienced Chinese staff may offer a similar range of support to a foreign investor as a Chinese partner in a joint venture, there are some aspects where established Chinese partners are able to provide greater levels of support than individuals themselves. The most important of these, which is pertinent when domestic sales are the main priority, is the provision of access to existing and established marketing and distributions channels. This greatly reduces upfront investment risks of the foreign investor, particularly in business to business transactions that are largely based on multiple personal relationships that take time to develop. However, it should be noted that some foreign investors have been greatly disappointed when the promises made by their joint venture partners turn out to have been exaggerations, and thus careful partner evaluation is recommended. Meanwhile, although HCF has decided joint venture with the Chinese manufacturer, they still need to retain all their factories and business in Malaysia and Thailand. This is because, if anything goes wrong with the business in China operation, they still have the other factories that can support their operation. Therefore, HCF will not suffer significant loss if China operation is in trouble. Moreover, HCF is a family business of Tan family that has been establish in Malaysia since 1974. Therefore, their heritage should be retaining as it would be a symbolic to Malaysia. Besides that, the employees are safe from the retrenchment and company can also avoided the cost of compensation.

CONCLUSION

After evaluated all the proposals that HCF comes out with, we agreed with the idea expand to China with a joint venture with a Chinese manufacturer, in this case is Celestial Clothes. With the joint venture of 70/30 profit sharing with Celestial Clothes taking 70% stake, we believe that it is an appropriate move to start with moving on to China. Celestial Clothes would need to build an annexure to its current factory to cater this new venture. Total cost estimated is RM8 million with HCFs investment at RM2.4 million. HCF has sufficient fund to be invested according to their financial result ended 30th September 2008. Other than that, all the advantages by expand to China by joint venture with Celestial Clothes seems will benefits HCF for the early stage of the bold and nerve plan. Take into account the advantages of joint venture such by doing joint venture, it can provide companies with the opportunity to gain new capacity and expertise. Example in this case, Celestial Clothes can provide extend their capacity and share the expertise with HCF to accomplish this joint venture. Another advantage is joint venture allow companies to enter related businesses or new geographic markets or gain new technological knowledge. Since both companies are in the manufacturing clothes industry, they can gain new markets that each company currently has. They may exchange the technological knowledge as well to improve the production method and process. Other than the advantages mentioned above, joint venture can contribute to access to greater resources, including specialized in staff and technology and sharing of risks with a venture partner. Why many businesses tend to go to China? China is one of the biggest economic success stories of the last 20 years. China's economy is expanding rapidly, so there's a huge demand for energy resources, infrastructure and technology. Business in China is becoming easier as many of its regions are encouraging foreign investment through tax incentives and the removal of previous legal restrictions. Chinas aggressive industrial development has led, in part, to the countrys reputation as a low -cost manufacturing centre, and has made Asian price the competitive standard in global product markets. China does not only offer massive market potential, but also a means for creating improved economies of scale and spreading the cost of R&D over a greater consumer base. Chinas increasingly influential role in the international business arena is undeniable. The fear is, those companies that choose not to do business in China now, may lose their chance of a long-term and sustainable competitive advantage or, in extreme cases, their very survival.

You might also like

- Sample Construction ContractDocument7 pagesSample Construction ContractKim100% (1)

- Encyclopedia of American BusinessDocument863 pagesEncyclopedia of American Businessshark_freire5046No ratings yet

- KPMG Test-PackDocument403 pagesKPMG Test-PackEmmanuelNo ratings yet

- AP Cars SDN BHD - QuestionsDocument1 pageAP Cars SDN BHD - Questionsnadia0% (1)

- With Regards To Expiration Date Futures Contracts: CardsDocument4 pagesWith Regards To Expiration Date Futures Contracts: CardsChin Yee LooNo ratings yet

- Chris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8Document34 pagesChris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8augtour4977100% (1)

- Dokumen - Tips Unclaimed DividendsDocument107 pagesDokumen - Tips Unclaimed DividendsVM ONo ratings yet

- PCI Purchasing System AnalysisDocument29 pagesPCI Purchasing System AnalysisDivya Nandini0% (1)

- Inflation Title: Price Stability Definition, Causes, EffectsDocument20 pagesInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyNo ratings yet

- The Cold War - David G. Williamson - Hodder 2013 PDFDocument329 pagesThe Cold War - David G. Williamson - Hodder 2013 PDFMohammed Yousuf0% (1)

- Balakrishnan MGRL Solutions Ch06Document64 pagesBalakrishnan MGRL Solutions Ch06deeNo ratings yet

- PCI Case Study Maf680Document23 pagesPCI Case Study Maf680Nur Ifa100% (26)

- Axis IncoprationDocument9 pagesAxis IncoprationR •100% (1)

- Final Assessment S1, 2021Document5 pagesFinal Assessment S1, 2021Dilrukshi WanasingheNo ratings yet

- BMLW5103Document256 pagesBMLW5103Thethanh Phamnguyen67% (3)

- Hup Seng SlidesDocument13 pagesHup Seng SlidesSyed KtwentyNo ratings yet

- Study of Supply Chain at Big BasketDocument10 pagesStudy of Supply Chain at Big BasketPratul Batra100% (1)

- Inventory Management: Fin658 - Financial Statement AnalysisDocument6 pagesInventory Management: Fin658 - Financial Statement Analysisamirul baharudinNo ratings yet

- Market Manipulation Convictions UpheldDocument8 pagesMarket Manipulation Convictions UpheldMohamad SaniyNo ratings yet

- PCI SDN BHDDocument5 pagesPCI SDN BHDChristoper Lim100% (2)

- China Dolls ReportDocument5 pagesChina Dolls ReportNasran FadhNo ratings yet

- China Doll (Issues and Recommendation)Document8 pagesChina Doll (Issues and Recommendation)Murayysn Chandra100% (1)

- Maximizing Advantages of China JV for HCFDocument10 pagesMaximizing Advantages of China JV for HCFLing PeNnyNo ratings yet

- Board Meeting Discusses China ExpansionDocument9 pagesBoard Meeting Discusses China ExpansionSyahila Kadir50% (2)

- China Dolls - Full SlidehrDocument19 pagesChina Dolls - Full SlidehrSurainiEsaNo ratings yet

- Case Study 7 Pci SDN BHD (Answer)Document4 pagesCase Study 7 Pci SDN BHD (Answer)Nazzatulfasikin JamaliNo ratings yet

- Case 1 - Mystery of Disappearing OilDocument2 pagesCase 1 - Mystery of Disappearing OilFida Desu100% (1)

- Tega Payment SystemDocument8 pagesTega Payment Systemzarfarie aron67% (3)

- Ics Case 6Document24 pagesIcs Case 6Pui YanNo ratings yet

- Maf680 Role Play Report (3,4)Document3 pagesMaf680 Role Play Report (3,4)Mohd Syafiq Akmal100% (1)

- Cmi 019 EditDocument6 pagesCmi 019 EditSU YU THONGNo ratings yet

- ICS - Mat JonDocument6 pagesICS - Mat JonSiew YinNo ratings yet

- Case - Androids Under AttackDocument7 pagesCase - Androids Under AttackElaine NewNo ratings yet

- Johnson Turnaround Case Study AnalysisDocument20 pagesJohnson Turnaround Case Study AnalysisMohamad Afif ShafiqNo ratings yet

- Freezing Out ProfitDocument9 pagesFreezing Out ProfitNormala HamzahNo ratings yet

- Micro Accounting SystemDocument1 pageMicro Accounting SystemkhanNo ratings yet

- JohnsonDocument3 pagesJohnson志祥No ratings yet

- Phone DialoguesDocument12 pagesPhone DialoguesLarisa CiopleaNo ratings yet

- Flight of Fund Final ReportDocument16 pagesFlight of Fund Final Reportsafra100% (1)

- Case Study 3 2Document30 pagesCase Study 3 2XINGSHI CHIENNo ratings yet

- Megan MediaDocument8 pagesMegan Mediarose0% (1)

- PBL 2 Mac 2020Document4 pagesPBL 2 Mac 2020Ummu UmairahNo ratings yet

- Crunchy Food IT upgrade tutorialDocument2 pagesCrunchy Food IT upgrade tutorialFredericaNo ratings yet

- Mystery of Disappearing OilDocument19 pagesMystery of Disappearing OilAini SalehaNo ratings yet

- Flight of FundDocument9 pagesFlight of Fundzarfarie aron67% (3)

- Full Report (Pbl1)Document18 pagesFull Report (Pbl1)NuHar Misran33% (3)

- BBDM3303 ES - Coursework Specs - S3 LONG SEM - JAN2021 - AY2020-21Document36 pagesBBDM3303 ES - Coursework Specs - S3 LONG SEM - JAN2021 - AY2020-21HuiTong LeeNo ratings yet

- Solutions: Universiti Teknologi Mara Final ExaminationDocument10 pagesSolutions: Universiti Teknologi Mara Final Examinationanis izzatiNo ratings yet

- Flat Cargo (C) 1Document13 pagesFlat Cargo (C) 1nadsirah100% (4)

- Organizational culture issues at Triple H Film ProductionsDocument18 pagesOrganizational culture issues at Triple H Film ProductionsRaihana Baharom50% (2)

- For The Full Essay Please WHATSAPP 010-2504287Document11 pagesFor The Full Essay Please WHATSAPP 010-2504287Simon RajNo ratings yet

- DTC Example Question Stage 1Document3 pagesDTC Example Question Stage 1aqilah_abidin_1No ratings yet

- HAFIZUL IKMAL MAMUN - 259198 - Group DDocument74 pagesHAFIZUL IKMAL MAMUN - 259198 - Group DHafizul Ikmal MamunNo ratings yet

- CMI Group AssignmentDocument2 pagesCMI Group AssignmentDesmond Chan0% (1)

- Chapter 9 - The Monetary SystemDocument5 pagesChapter 9 - The Monetary SystemRay JohnsonNo ratings yet

- Logbook Aisyah Athirah Abdul RazabDocument28 pagesLogbook Aisyah Athirah Abdul Razabauni fildzahNo ratings yet

- PBL Case 2 - Ais 630Document36 pagesPBL Case 2 - Ais 630Normala HamzahNo ratings yet

- Assignment Question BAC2634 2110Document11 pagesAssignment Question BAC2634 2110Syamala 29No ratings yet

- December 2019 Malaysian labour law updateDocument4 pagesDecember 2019 Malaysian labour law updateAziraNo ratings yet

- Thomas Forehand, CPADocument3 pagesThomas Forehand, CPAHeni OktaviantiNo ratings yet

- PFP Group Assignment - 17032019Document38 pagesPFP Group Assignment - 17032019Chuah Chong AnnNo ratings yet

- GSS - Final ReportDocument22 pagesGSS - Final ReportSzeshein Gan100% (1)

- Bass Pro Pitch Script OpeningDocument3 pagesBass Pro Pitch Script OpeningMark Aaron Wilson100% (1)

- Androids Under AttackDocument4 pagesAndroids Under AttackSyazwan Sufi100% (1)

- Company SecretaryDocument2 pagesCompany Secretarynabilah natashaNo ratings yet

- 306 - Vatsal Maheshwari - Section E - HaierDocument3 pages306 - Vatsal Maheshwari - Section E - HaierVatsal MaheshwariNo ratings yet

- Unit 1 Case StudiesDocument2 pagesUnit 1 Case StudiesKaramjeet Singh50% (2)

- Work Sheet PDFDocument8 pagesWork Sheet PDFdhruv soniNo ratings yet

- Development in Islamic BankingDocument12 pagesDevelopment in Islamic BankingAi Lin ChenNo ratings yet

- Before and After The RevolutionDocument29 pagesBefore and After The RevolutionAi Lin ChenNo ratings yet

- DuPont Analysis Operating MethodDocument31 pagesDuPont Analysis Operating MethodAi Lin ChenNo ratings yet

- Backflush Accounting 1Document9 pagesBackflush Accounting 1Ai Lin ChenNo ratings yet

- ICAD Globalization and HIV E FINALDocument10 pagesICAD Globalization and HIV E FINALAi Lin ChenNo ratings yet

- 2nd Annual Latin America Rail Expansion SummitDocument16 pages2nd Annual Latin America Rail Expansion SummitenelSubteNo ratings yet

- Pi MorchemDocument1 pagePi MorchemMd Kamruzzaman MonirNo ratings yet

- Mineral Commodity Summaries 2009Document198 pagesMineral Commodity Summaries 2009Aaron RizzioNo ratings yet

- Memorandum of Agreement Maam MonaDocument2 pagesMemorandum of Agreement Maam MonaYamden OliverNo ratings yet

- COA - M2017-014 Cost of Audit Services Rendered To Water DistrictsDocument5 pagesCOA - M2017-014 Cost of Audit Services Rendered To Water DistrictsJuan Luis Lusong67% (3)

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- Society in Pre-British India.Document18 pagesSociety in Pre-British India.PřiýÂňshüNo ratings yet

- COCO Service Provider Detailed Adv. Madhya PradeshDocument5 pagesCOCO Service Provider Detailed Adv. Madhya PradeshdashpcNo ratings yet

- Manual Book Vibro Ca 25Document6 pagesManual Book Vibro Ca 25Muhammad feri HamdaniNo ratings yet

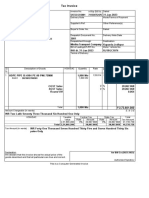

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- Knowledge, Attitude and Practice TowardsDocument19 pagesKnowledge, Attitude and Practice TowardsCory Artika ManurungNo ratings yet

- Eco - Grade 9 Question Bank 15-16Document13 pagesEco - Grade 9 Question Bank 15-16Vedic MantriNo ratings yet

- Beximco Pharmaceuticals International Business AnalysisDocument5 pagesBeximco Pharmaceuticals International Business AnalysisEhsan KarimNo ratings yet

- DocxDocument11 pagesDocxKeir GaspanNo ratings yet

- NSE ProjectDocument24 pagesNSE ProjectRonnie KapoorNo ratings yet

- MBA Strategic Management Midterm ExamDocument5 pagesMBA Strategic Management Midterm Exammaksoud_ahmed100% (1)

- "Tsogttetsii Soum Solid Waste Management Plan" Environ LLCDocument49 pages"Tsogttetsii Soum Solid Waste Management Plan" Environ LLCbatmunkh.eNo ratings yet

- PDACN634Document69 pagesPDACN634sualihu22121100% (1)

- Dhakras Bhairavi SDocument137 pagesDhakras Bhairavi SReshma PawarNo ratings yet

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNo ratings yet

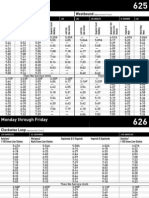

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- Infinity Hospitality - Wedding RatesDocument1 pageInfinity Hospitality - Wedding RatesgecogirlNo ratings yet