Professional Documents

Culture Documents

APOLLO DKV Kirang

Uploaded by

kirang gandhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APOLLO DKV Kirang

Uploaded by

kirang gandhiCopyright:

Available Formats

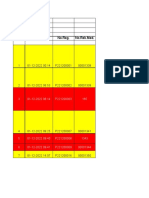

EASY HEALTH Standard

Sum Insured per Insured Person per Policy Year 1.00, 1.50, 2.00, 2.50, 3.00, 4.00, 5.00

1 a) In-patient Treatment Covered

1 b) Pre-hospitalization Covered

1 c) Post-hospitalization Covered

1 d) Day Care Procedures Covered

1 e) Domiciliary Treatment Covered

2 a) Daily Cash for choosing Shared Accommodation Rs.500 per day, Max. Rs.3,000

2 b) Organ Donor Covered

2 c) Emergency Ambulance Upto Rs.2000

2 d) Daily Cash for accompanying an insured child Not Covered

2 e) Newborn baby Not Covered

3 a) Maternity Expenses Not Covered

Waiting Period of 4 years Not Covered

3 b) Outpatient Dental Treatment. Waiting Period 3 years Not Covered

3 c) Spectacles, Contact Lenses, Hearing Aid Not Covered

Every Third Year

Not Covered

3 d) E-Opinion in respect of a Critical Illness

4 Critical Illness Not Covered

5 Health Checkup Upto 1% of Sum Insured. Every 4th Year

Benefits under 3b), 3c), 3d) and 5 are subject to pre-authorisation by

Exclusive Premium

3.00, 4.00, 5.00 7.5 3.00, 4.00, 5.00 7.50, 10.00

Covered Covered

Covered Covered

Covered Covered

Covered Covered

Covered Covered

Rs.500 per day, Max. Rs.800 per day, Max.

Rs.500 per day, Max. Rs.3,000 Rs.800 per day, Max.Rs.4,800

Rs.3,000 Rs.4,800

Covered Covered

Upto Rs.2000 Upto Rs.2000

Rs.500 per day,

Rs.300 per day, Max.Rs.9,000 Rs.500 per day, Max.Rs.15,000 Rs.300 per day, Max.Rs.9,000

Max.Rs.15,000

Optional Optional Optional Optional

Normal Delivery Rs. 15,000* Normal Delivery Rs. 25,000* Normal Delivery Rs. 15,000* Normal Delivery Rs. 25,000*

Caesarean Delivery Rs. Caesarean Delivery Rs.

Caesarean Delivery Rs. 25,000*

Caesarean Delivery Rs. 40,000* 25,000* 40,000*

(* Including Pre/Post Natal limit of

(* Including Pre/Post Natal limit of Rs. (* Including Pre/Post Natal (* Including Pre/Post Natal

Rs.1,500 and New Born limit of

2,500 and New Born limit of Rs.3500) limit of Rs.1,500 and New limit of Rs. 2,500 and New

Rs.2,000)

Born limit of Rs.2,000) Born limit of Rs.3500)

Not Covered Upto 1 % of Sum insured subject to a Max. of Rs.5,000

Not Covered Upto Rs.5,000

Not Covered Covered

Optional, if opted then the

Critical Illness Sum Insured is as Optional, if opted then the Critical Illness Sum Insured is

per the Insured Persons Table in as per the Insured Persons Table in the Schedule

the Schedule

Upto 1% of Sum Insured subject

Upto 1% of Sum Insured subject to a Max. of Rs.5,000.

to a Max. of Rs.5,000. Every 3rd

Every 2nd Year

Year

d 5 are subject to pre-authorisation by the TPA (FAMILY HEALTH PLAN)

You might also like

- FII Inflows After ElectionDocument2 pagesFII Inflows After Electionkirang gandhiNo ratings yet

- Income Tax Calculator FY 2014/15 in ExcelDocument4 pagesIncome Tax Calculator FY 2014/15 in Excelkirang gandhiNo ratings yet

- European Central Bank Deposit Rates Are Now Negative.Document2 pagesEuropean Central Bank Deposit Rates Are Now Negative.kirang gandhiNo ratings yet

- FCNR AccountsDocument2 pagesFCNR Accountskirang gandhiNo ratings yet

- Uncertainty On LiquidityDocument2 pagesUncertainty On Liquiditykirang gandhiNo ratings yet

- Sensex Cross 100,000 by 2020Document2 pagesSensex Cross 100,000 by 2020kirang gandhiNo ratings yet

- With Marriage Comes Greater Responsibilities - 1Document4 pagesWith Marriage Comes Greater Responsibilities - 1kirang gandhiNo ratings yet

- Common Money MistakesDocument3 pagesCommon Money Mistakeskirang gandhiNo ratings yet

- Free Advice Vs Fees Based AdviceDocument4 pagesFree Advice Vs Fees Based Advicekirang gandhiNo ratings yet

- Reality of Real EstateDocument2 pagesReality of Real Estatekirang gandhiNo ratings yet

- Market at High What To DoDocument2 pagesMarket at High What To Dokirang gandhiNo ratings yet

- FCNR DepositsDocument2 pagesFCNR Depositskirang gandhiNo ratings yet

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Document2 pagesFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNo ratings yet

- Invite Finacial DisasterDocument5 pagesInvite Finacial Disasterkirang gandhiNo ratings yet

- FMPDocument2 pagesFMPkirang gandhiNo ratings yet

- Points To Consider When Buying Health InsuranceDocument7 pagesPoints To Consider When Buying Health Insurancekirang gandhiNo ratings yet

- Invite Finacial DisasterDocument5 pagesInvite Finacial Disasterkirang gandhiNo ratings yet

- FIIs Invest $1 BN in Debt MarketDocument1 pageFIIs Invest $1 BN in Debt Marketkirang gandhiNo ratings yet

- How Life Insurance Agents Fools Me Due To My Laziness.Document7 pagesHow Life Insurance Agents Fools Me Due To My Laziness.kirang gandhiNo ratings yet

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Document2 pagesFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- April F.D.Document14 pagesApril F.D.kirang gandhiNo ratings yet

- Lic Jeevan Sugam 5.59% After 10 YearsDocument2 pagesLic Jeevan Sugam 5.59% After 10 Yearskirang gandhiNo ratings yet

- Health Insurance Comparison Chart NEWDocument10 pagesHealth Insurance Comparison Chart NEWkirang gandhiNo ratings yet

- Investors Lost Rs.1.5 Lakh CroreDocument7 pagesInvestors Lost Rs.1.5 Lakh Crorekirang gandhiNo ratings yet

- Finland Prepares For Expected Euro Zone Break UpDocument1 pageFinland Prepares For Expected Euro Zone Break Upkirang gandhiNo ratings yet

- Common Mistakes To Avoid The Situation of Financial CrisesDocument5 pagesCommon Mistakes To Avoid The Situation of Financial Criseskirang gandhiNo ratings yet

- The Countdown Has Begun Euro Is The HistoryDocument2 pagesThe Countdown Has Begun Euro Is The Historykirang gandhiNo ratings yet

- Eurozone Debt CrisisDocument2 pagesEurozone Debt Crisiskirang gandhiNo ratings yet

- Few Days Are Left To Finish The EuroDocument2 pagesFew Days Are Left To Finish The Eurokirang gandhiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Wildseed Dinner MenuDocument1 pageWildseed Dinner MenuCaleb PershanNo ratings yet

- Certificate of Analysis: Ship Date: Port of Discharge: Carrier: Vessel: Voyage: Quantity (MT) : Us GallonsDocument1 pageCertificate of Analysis: Ship Date: Port of Discharge: Carrier: Vessel: Voyage: Quantity (MT) : Us GallonsMercadeo BelaraviNo ratings yet

- Best WiFi Adapter For Kali Linux - Monitor Mode & Packet InjectionDocument14 pagesBest WiFi Adapter For Kali Linux - Monitor Mode & Packet InjectionKoushikNo ratings yet

- Msae Msae2018-Arwm012 Full Dronespraying 2Document4 pagesMsae Msae2018-Arwm012 Full Dronespraying 2Muhammad Huzaifah Mohd RoslimNo ratings yet

- Traceability Summary - Supplies July 2015 - June 2016: PT Multimas Nabati Asahan, Kuala TanjungDocument4 pagesTraceability Summary - Supplies July 2015 - June 2016: PT Multimas Nabati Asahan, Kuala TanjungAbu KhalidNo ratings yet

- Food Salt: By: Saad, Rehan, Asad, Hasan, Adil, Abdur Rehman, AzharDocument10 pagesFood Salt: By: Saad, Rehan, Asad, Hasan, Adil, Abdur Rehman, AzharsaadNo ratings yet

- Glaus Corp. inventory note amortization adjusting entryDocument5 pagesGlaus Corp. inventory note amortization adjusting entryPatrick HarponNo ratings yet

- Soap Making: Borax (NaDocument15 pagesSoap Making: Borax (Naa aNo ratings yet

- Antox Pickling Paste MSDSDocument10 pagesAntox Pickling Paste MSDSKrishna Vacha0% (1)

- CoWIN Portal StepsDocument23 pagesCoWIN Portal StepsU VenkateshNo ratings yet

- Final National HCF WASH Guideline ETHIOPIADocument97 pagesFinal National HCF WASH Guideline ETHIOPIAEfrem TsegabuNo ratings yet

- Bed MakingDocument14 pagesBed MakingHarold Haze Cortez100% (1)

- All About VapingREALDocument8 pagesAll About VapingREALKatherine CroweNo ratings yet

- Crosbys Molasses and MoreDocument37 pagesCrosbys Molasses and MoreShaikh MeenatullahNo ratings yet

- DSI-DYWIDAG Geotechnics Rock Bolts enDocument6 pagesDSI-DYWIDAG Geotechnics Rock Bolts enTomás Nunes da SilvaNo ratings yet

- Defined Contribution PlanDocument12 pagesDefined Contribution Planrap rapadasNo ratings yet

- Nigeria Trainers ManualDocument131 pagesNigeria Trainers ManualVivi ALNo ratings yet

- Performance Task MidTerm Second Sem. AY 2022 2023Document2 pagesPerformance Task MidTerm Second Sem. AY 2022 2023KZpathryn Jemimench AleurevNo ratings yet

- Menu Selector - Hyatt Regency LucknowDocument11 pagesMenu Selector - Hyatt Regency LucknowShoubhik SinhaNo ratings yet

- Lappasieugd - 01 12 2022 - 31 12 2022Document224 pagesLappasieugd - 01 12 2022 - 31 12 2022Sri AriatiNo ratings yet

- Bangladesh National Building Code 2012 Part 07 - Construction Practices and SafetyDocument83 pagesBangladesh National Building Code 2012 Part 07 - Construction Practices and SafetyPranoy Barua100% (3)

- Habit TrackersDocument38 pagesHabit Trackersjesus100% (1)

- Guidance On The 2010 ADA Standards For Accessible Design Volume 2Document93 pagesGuidance On The 2010 ADA Standards For Accessible Design Volume 2Eproy 3DNo ratings yet

- ACCT 4410 Taxation Salaries tax (Part II) Key areasDocument40 pagesACCT 4410 Taxation Salaries tax (Part II) Key areasElaine LingxNo ratings yet

- Round Warre HivesDocument16 pagesRound Warre HivesBender Rodríguez100% (1)

- Butterfly Valve ConcentricDocument6 pagesButterfly Valve ConcentricpramodtryNo ratings yet

- Unit 23 The Interior LandscapeDocument21 pagesUnit 23 The Interior LandscapesNo ratings yet

- Rules of SungazingDocument2 pagesRules of SungazingaustralexdiNo ratings yet

- Ciso Workshop 2 Security Management PDFDocument37 pagesCiso Workshop 2 Security Management PDFHigino Domingos de Almeida JoãoNo ratings yet

- Air Regulations CPL Level QuestionsDocument56 pagesAir Regulations CPL Level QuestionsRahul100% (3)