Professional Documents

Culture Documents

IRR Defined and Explained With Examples

Uploaded by

Ramamurthy VenkateshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRR Defined and Explained With Examples

Uploaded by

Ramamurthy VenkateshCopyright:

Available Formats

1/18/13

Internal rate of return (IRR) defined and explained with examples

Solution Matrix Limited Business Case Analysis

Home Books & Tools Seminars Business Terms & Methods Share

Internal Rate of Return (IRR) and Modified Internal Rate of Return (MIRR): Definition, Meaning, and Usage.

Ency clopedia of Business Terms and Methods, ISBN 978-1-929500-10-9. Rev ised 2013-01-11.

Internal Rate of Return (IRR) is a financial metric for cash flow analysis, often used for evaluating proposed investments, funding requests, acquisitions, or the results of business case analysis. Like several other cash flow metrics (such as net present value, payback period, and return on investment), IRR takes an "investment view" of expected financial results. This means, essentially, that the magnitude and timing of cash flow returns are compared to the magnitude and timing of cash flow costs. Each of these financial metrics compares returns to costs in its own way and each carries a unique message about the value of the investment. IRR analysis begins with a cash flow stream, a series of net cash flow figures expected to follow from the investment (or action, acquisition, or business case scenario). The expected cash flow stream for IRR analysis might appear something like this: Each bar represents the net of inflows and outflows for one twomonth period. The complete set of net cash flow events is a cash flow stream . If this cash flow stream represents one investment, another investment might show a different cash flow profile. IRRs for each investment can be compared to help decide which is the better business decision. Other things being equal, the investment with the higher IRR is viewed as the better choice. Notice especially the shape, or profile of this example cash flow stream. The figure shows a typical investment curve . Net cash outflows at the outset and net cash inflows in later periods mean that costs initially exceed incoming returns, but if the investment performs as expected, returns eventually outweigh the costs. The IRR metric, in fact, "expects" this kind of cash flow profileearly costs and later benefits. When the cash flow stream has this kind of profile, an IRR can probably be found and usefully interpreted. When the cash flow stream deviates substantially from this profile, however, it may not be possible to find an IRR for the stream. Or, other strange IRR results may appear, such as multiple IRRs for the same stream, or a negative IRR for the cash flow stream. In such cases, the resulting IRRs are either very difficult to interpret or meaningless. Most people in business have heard of "internal rate of return." Some are required by thier financial officers to produce an IRR to support budget requests or action proposals. IRR is in fact a favorite metric of many CFOs, Controllers, and other financial specialists. There is a widespread belief in the financial community, for instance, that IRR is a more "objective" metric than NPV, because NPV depends on an arbitrarily chosen discount rate, whereas IRR is determined eintirely by the cash flow figures and their timing. Many also believe that IRR allows investment returns to be compared readily with inflation, current interest rates, and financial investment alternatives. Many organizations establish an IRR hurdle rate, that is, an IRR rate that must be reached or exceeded by incoming proposals if they are to be approved and funded. It should no surprise to learn that most business people who are not in finance have a limited or poor understanding of IRR and its meaning. It may be more surprising, however, to learn that research on professional competencies finds

www.business-case-analysis.com/internal-rate-of-return.html 1/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

consistently that most of the same financial specialists who require IRRs with proposals or funding requests are themselves largely unaware of IRR's serious deficiences and unprepared to explain its meaning and proper use. For that reason, this entry puts a special emphasis on understanding IRR meaning and interpretation, as well as common misconceptions and misuses of IRR. And, in comparing IRR to other financial metrics, this entry also presents the modified internal rate of return (MIRR), a more easily interpreted alternative to the better known IRR.

Internal rate of return (IRR) defined and illustrated with an example - First IRR Interpretation: IRR as a measure of risk - Finding IRR: Can IRR be calculated? IRR re-defined: Why is it called internal rate of return? - Second IRR interpretation: Financing costs and reinvestment gains Modified Internal Rate of Return (MIRR): A better metric? Internal rate of return compared to other financial metrics - IRR vs. MIRR, NPV, ROI, and Payback Period - IRR disgused as yield to maturity (YTM) for bond investing Lease vs. buy and other problem IRR results - Lease vs. Buy vs. IRR - Negative, multiple, and impossible IRRs

Internal rate of return (IRR) defined and illustrated with an example

As the word "return" in its name implies, an IRR view of the cash flow stream is essentially an investment view: paid out funds are compared to returns. The best known IRR definition explains this comparison in terms that call for a basic understanding of discounted cash flow concepts present value, net present value (NPV), and the role of the discount rate (interest rate) in determining NPV: IRR Definition 1 (textbook definition): The internal rate of return (IRR) for a cash flow stream is the interest rate (discount rate) that produces a net present value of 0 for the cash flow stream. That definition, however, can be less than satisfying when first heard. Many ask: "What does that tell me about returns and costs? A first interpretation of IRR meaning is illustrated with an example. Consider two proposed investments compting for funding: Case A and Case B. The expected net cash flow streams for A and B are as follows:

Both cases call for an initial cash outlay of $220. Case A brings a net gain of $200 over 7 years while case B brings a net gain of $240 over the same 7 years. Before finding IRRs and other metrics, note in the image below how the two cash flow streams streams differ: Both streams have the investment curve profile described above. Case A (blue bars) has large early returns but these diminish year by year. A's profile could represent an investment in an income producing asset that becomes less productive or more costly to maintain each year. Case B (yellow bars) has smaller returns at first, but B's returns grow each year. B's profile could result from investing in a product launch that returns greater profits each year. The analyst will thus compare two different kinds of investments with the same metric, IRR, to address questions like these: Which is the better investment? Which is the better business decision? The net cash flow figures above, when analyzed with a spreadsheet function or another IRR program, show an IRR of 30.6% for Case A and an IRR of 20.8% for Case B.

www.business-case-analysis.com/internal-rate-of-return.html 2/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

The next table and figure below show the result of applying IRR Definition 1 (the discount rate that brings an NPV of 0). Only one of the above cash flow streams is shown here, Case A. The first table row shows net cash flow each year, and the second row shows the discounted values (present values) of the same cash flows. Discounting is applied using the IRR rate found by the analyst for this cash flow stream, 30.6%.

Notice in the table that this discount rate leads to a total present value (NPV) of 0. The chart at left also shows the same thing in visual terms. Dark blue bars are future value net cash flows for Case A . Light blue bars are present values of the same cash flows at the IRR discount rate of 30.6%. You may just be able to see or imagine that the heights of the seven positive (upward pointing) light blue bars starting with Yr 1 add up exactly to the height of the one negative (downward pointing) light blue bar at "Now." In other words, at the IRR discount rate, the sum of positive PVs excactly cancels the sum of negative PVs. First IRR interpretation: IRR as a measure of risk In the example above, which is the better Investment, Case A or Case B? Case A has an IRR of 30.6%, Case B has an IRR of 20.8%. Other things being equal, and using IRR as the decision criterion, the one with the higher IRR (Case A) is considered the better choice. One reason for this conclusion is that a higher IRR indicates less risk. That is, IRR indicates just how high inflation rates or risk probabilities have to rise in order to eliminate the present value of this investment.

For the Investment A cash flow, the prevailing discount rate (which includes an inflation component and a risk component) would have to rise all the way to 30.6% to drain this investment of present value. The B investment would lose all present value if the discount rate rose to 20.8%. Most people, however, find this first interpretation of IRR of little value for evaluting and comparing proposed investments. The sections below, therefore, move torward a second, more useful IRR interpretation, a comparison of IRR with other cash flow metrics, and a description of a more easily interpreted metric, the modified internal rate of return (MIRR). Finding IRR: Can IRR be calculated? Other cash flow metrics such as NPV, ROI, and even payback period, can be calculated directly from simple

www.business-case-analysis.com/internal-rate-of-return.html 3/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

formulas, assuming you have the proper input data. However, the verbal IRR Definition 1 above does not lend itself readily to presentation in formula form. The best that can be done for producing an IRR formula is this: Consider the formula for calculating net present value (NPV) for a cash flow stream, using end of period discounting: The "FVs" in the formula are the net cash flow figures for each year. For Case A and Case B above, n = 7 (7 periods). The person who wants a "formula" for IRR can be handed the above formula along with the FVs (net cash flow values) and then asked to do the following: Set NPV equal to 0, then solve the formula for i. i = IRR when NPV = 0. In fact, there is no easily applied analytic solution to the above request, and it is more accurate to say that IRR is "found" rather than "calculated." IRR can be found either by graphical analysis oras Excel doesby "trial and error" (more precisely, by "successive approximations"). Consider first the plotting data for a graphcial IRR solution: Using the formula above, NPV was calculated for A and B cash flow streams at 10 different discount rates. The table shows the calculated NPV values. These are plotted below, showing the relationship between discount rate (horizontal axis) and resulting NPV (vertical axis). As you would expect, increasing discount rates brings lower NPVs for both streams. However, Case A's NPV reaches 0 at a discount rate of 30.6%, while B's NPV reaches 0 at a discount rate of 20.8%. Therefore, IRRA = 30.6%. and IRRB = 20.8% Instead of finding a graphical solution for IRR, most people use Microsoft Excel or a pre-programmed calculator. Either way, the software starts with an arbitrarily chosen discount rate and finds the NPV for a given cash flow stream. It then keeps changing the rate until it finds a rate that produces a 0 NPV. This occurs very quickly, so that the IRR result seems to appear as soon as the data are entered. The analyst, for example, might enter the Excel IRR function into a formula like this: =IRR (B3:B10, .1) The spreadsheet cell with this formula shows the IRR for a range of cells with net cash flow figures in cells B3 through B10. These could be, for instance, the eight cash flow values for Case A in the example above The ".1" figure is simply the analyst's first "guess" at the IRR. The guess is simply a starting discount rate for calculating NPV on the first iteration and it can be almost anything or even omitted. The analyst will probably format the spreadsheet cell as a percentage, so that the IRR result looks like this: 30.6%

IRR re-defined: Why is it called internal rate of return?

The textbook IRR Definition 1 above explains how to find an IRR but says very little about what it represents. IRR's more important meaning is easier to understand in terms of another definition, one that refers investment financing costs and reinvested returns.

www.business-case-analysis.com/internal-rate-of-return.html 4/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

IRR Definition 2: The internal rate of return (IRR) for a cash flow stream is based on two assumptions: 1. There is a financing cost (or opportunity cost) for using the funds to make the investment. Investment costs will be financed across the time until the final cash flow event.

and 2. Incoming returns will be reinvested for the time remaining until the last cash flow event. IRR is then defined as the single interest rate (for financing costs and for reinvestment earnings) that sets the total gains exactly equal to total costs. The example below shows how IRR can be defined as the interest rate that balances these two factors. Cash flow figures in blue cells are from example Case A above. In the example, an initial cash outflow of $220 (at "Now") represents initial investment costs. Each year after that, the investment brings positive net cash flow returns. Excel's IRR function has been entered in the yellow cell below Year 7 net cash flow and it reports that a discount rate of 30.63% produces an NPV of 0 for the cash flow stream. The IRR for this cash flow stream is thus 30.63%. Consider first the interest earned by re-investing the incoming cash flows from Years 1 through 7. If each incoming return is reinvested with for the remaining years, at an annual interest rate of 30.63%, the total seven year gains would be $1,428.17 (inflows + interest earned). Now, assume that the initial cash outflow of $220 is borrowed and financed at the same 30.63% annual rate. The example shows shows the total cost of repaying this loan is also $1,428.17 (initial cash outflow plus financing). The IRR rate exactly balances total investment costs with total investment gains. Second IRR Interpretation: Financing costs and reinvestment gains The second-definition example above should begin to suggest a reason that financial people look to IRR and often trust it as an important decision criterion: IRR has built into it the presumption that investment costs (opportunity costs or borrowing) are financed at a cost, and that incoming returns are reinvested, earning additional gains. This view provides meaning for another IRR interpretation, namely that the analyst will compare the IRR rate to actual financing rates and actual reinvestment rates. This comparison, however, has to be interpreted carefully. It is easy to overinterpret or misinterpret IRR at this point. When a proposed investment produces IRR's like those shown above30.6% for examplemany are tempted to reason as follows:

www.business-case-analysis.com/internal-rate-of-return.html 5/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

"For this investment, we will not actually borrow (or pay an opportunity cost) at the IRR rate. Our real cost will be subject to rates closer to our cost of capital, probably less than 10%. Therefore [the reasoning goes], the investment is a net gain because financing rates will really be under 10%, while returns represent earnings at a much higher rate, something like 30.6%." In reality, that conclusion may or not be supportable, depending on the company's actual financing cost rates (or opportunity cost rates) and the actual reinvestment rates to be applied. The conclusion is most supportable when the IRR rate is close to actual cost of capital and actual reinvestment rate. The conclusion is most likely misleading or wrong when IRR is quite different from actual cost of capital and reinvestment rates. This reasoning can grossly overstate the value of investments like, for example, Case A above. Suppose, for instance, that the company's real reinvestment rate is closer to 8%, even though the cash flow stream has an IRR of 30.6%. Notice especially that cash flow stream A expects large returns in the first and second years of the 7-year investment (that is, Investment A is "front loaded," or "biased" towards the early years). The high IRR assumes year 1 and year 2 gains will be reinvested at 30.6% for all the remaining years but in fact, this long term of high-rate reinvestment will be absent. Cash flow stream B, on the other hand has a lower IRR than A, but when real investment returns are compared to the reinvestment earnings presumed by the IRR, B in fact has less "missing" returns of this kind than A. IRR overstates the real value of investment A far more than it overstates the value of investment B for two reasons: First, stream A is front loaded and stream B is "back loaded," and second, because A's IRR is further from the real reinvestmen rate than B's IRR. In brief, it is reasonable to view a proposed investment as a net gain when IRR is greater than the company's cost of capital. However, using IRR to assess the magnitude of the net gain is problematic, especially when (a) IRR greatly exceeds cost of capital and the real reinvestment rate, and (b) when comparing two cash flow streams with different profiles as in the example above. The latter point (b) is illustrated again in the discussion below on IRR in "Lease vs. buy" comparisions.

Modified Internal Rate of Return (MIRR): A better metric?

The meaning of IRR magnitude is difficult to interpret, as shown, because IRR can differ from the actual financing and reinvestment rates. It is natural to ask, therefore, "Why not calculate an internal return metric that does reflect the real financing cost rate and real reinvestment rate?" In fact, this solution is readily available as the modified internal rate of return (MIRR) metric. Input data for MIRR include the same net cash flow figures as IRR, but the MIRR calculation also requires as input a financing rate and a reinvestment rate . Here for comparison are the IRR and MIRR results for example Cases A and B from above. MIRR for this example is based on a reinvestment rate of 8% and a financing rate of 6%: Investment Case A: Investment Case B: IRR = 30.6% IRR = 20.8% MIRR = 15.1% MIRR = 14.7%

Notice immediately that Case A also has a higher MIRR value than Case B, but both MIRR values are much closer to each other than are the two IRR values. The full meaning of MIRR is easier to explain after showing how the MIRR results are derived. MIRRunlike IRRcan be computed directly from a formula: Future values of cash inflows are calculated using the reinvestment rate. Present values of the cash outflows are calculated using the financing rate. The radical sign calls for the nth root of the Future

www.business-case-analysis.com/internal-rate-of-return.html 6/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

value/Present value ratio. n is the number of periods, here 7. Subtracting 1.0 from the resulting root yields MIRR. For example cash flow stream A using a reinvestment rate of 8% . . . FV (Positive CFs) = $120(1.08)6 + $100(1.08)5 + $80(1.08)4 + $55(1.08)3 + . . . . . . +35(108)2 + $20(1.08)1 + 10(1.08)0 = $190.42 + $146.93 + $108.84 + $69.28 + $40.82 + $21.60$ + $10.00 = $587.91 Present values of negative cash flows are also calculated using the financing rate, which is 6% in this case. However, for this particular example there is only one negative cash flow and because that occurs immediately ("Now") its present value shows 0 discounting effect. PV (Negative CFs) = ($220)(1.06)0 = ($220.00) Negative cash outflows will have a negative present value, so the formula preceeds the Present Value sum with a "" making it a poisitive number. Using the above formula, MIRR for Investment Case A is thus:

Here, at last, is an investment result with a clear, easily understood meaning: If the original $220 investment is simply put on deposit, earning interest at the MIRR annual rate of 15.1% for 7 years, the total value with compound interest would be $587.91. Or, if instead the projected cash inflows from the Investment Case A were reinvested at 8.0%, the total investment value with compound interest would be the same $587.91. Similarly, Case B has a MIRR of 14.7%. If B's initial cash outflow is simply put on deposit for 7 years, earning interest compounded at the MIRR rate, the total investment value would be 573.76. Or, if instead, the projected incoming cash flows from investment B were reinvested at the reinvestment rate of 8.0%, the total investment value after 7 years would be the same $573.76. Note: To check these calculations yourself, use the more precise MIRRA rate of 15.0757% and MIRRB rate of 14.6732%. In other words, maki ng these investments brings the same result as simply putting the investment costs in the bank and receiving interest at the MIRR rate. Note that IRR results show a larger advantage for Case A over Case B. The realtive investment advanage of A over B is much smaller with MIRR. However, most people can easily compare MIRR results with compound interest growth and understand the magnitude of the MIRR difference. As shown, understanding the meaning of the IRR difference is more problematic. Incidentally, the MIRR formula is really a geometric meanexactly the same formula used to find comulative average growth rate for figures that grow exponentially, such as compound interest earnings. And, calculations like those above can be avoided entirely by simply using Excel's MIRR function. For Case A, whose cash flows are located in cells B3 through B10, using a reinvestment rate of 8% and financing rate of 6%, Excel's MIRR function would be: =MIRR(B3:B10, 0.06, 0.08).

Internal rate of return compared to other financial metrics

www.business-case-analysis.com/internal-rate-of-return.html 7/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

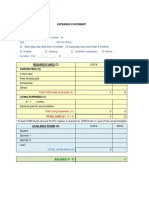

Referring to the example cases above, which is the better business investment: Case A or Case B? In many organizations, IRRs may play a role in answering such questions, but generally, such questions should not be answered on the basis of a single financial metric. The prudent financial specialist, investor, or business analyst will compare both investments with several financial metrics. As shown below, different metrics may suggest different answers to the question. This section compares A and B investmentson the basis of net cash flow, internal rate of return, modified internal rate of return, net present value, return on investment, and payback period. For more coverage of the individual metrics in this encyclopedia, please follow the links provided with each metric. IRR vs. Net Cash Flow, MIRR, NPV, ROI, and Payback period IRR results in the above examples required only the net cash flow figures for each investment each period. In order to compare investments with a wider range of cash flow metrics, however, the analyst needs to see individual cash inflows and outflows as well as the net figures:

Before looking at the individual metrics, notice some of the most apparent differences between Case A and Case B cash flow. First, A's inflows and outflows are much larger than B's. A actually brings in larger inflows but these come at larger costs. This difference is not apparent when viewing only the annual net cash flow figures. Secondly, as already noted, A's large returns arrive early, whereas B's larger returns occur in later years. It will take more than one financial metric to fully develop the implications of these differences. Financial metrics results for Case A and Case B based on these data are as follows:

Total Net Cash Flow

The net cash flow metric favors investment B over investment A: A brings a $200 net gain over 7 years, while B brings in $240. Case B thus has a $40 (20%) advantage in net cash flow over A. For situations where cash flow and working capital are problematic, this could be an important advantage for Case B. However, see the discussion on Payback Period, below, for a different view of these cash flow consequences.

Internal Rate of Return (IRR)

Investment A outscores Investment B on the IRR metric, 30.6% to 20.8%. Both IRR figures are very likely above the company's cost of capital, and both investments can thus be viewed as net gains. A's larger IRR can be taken as a signal that A provides a better rate of return than B (assuming that incoming cash flows are reinvested). Beyond that, however, the IRR figures themselves do not show the magnitude of A's real rate of return advantage over B. When IRRs are several times larger than cost of capital, or more, the real rate of return difference between two different investments depends heavily on the timing of cash flows, the cash flow stream profiles, and the actual rates available for cost of

www.business-case-analysis.com/internal-rate-of-return.html 8/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

capital and reinvestmentnone of which can be seen in the IRR figures.

Modified Internal Rate of Return (MIRR)

With an 8% real reinvestment rate, investment A slightly outscores investment B on the MIRR metric, 15.1% to 14.7%. The MIRR's meaning is easily understood: MIRR essentially compares investment results to the growth of compound interest earnings. Assuming that incoming returns are reinvested at 8%, investment A, for instance gives the investor exactly the same result as putting the initial cash outflow on deposit for seven years and receiving compound interest earnings at the MIRR annual rate, 15.1%.

Net Present Value (NPV)

The better business decisionor preferred investmentA or B, according to net present value depends on the discount rate . At a 5% discount rate, B's NPV of $155 exceeds A's $149 NPV. However, NPV leadership reverses at higher discount rates. With discounting at 10%, A's NPV of $107 is higher than B's $91. As the discount rate rises, B's large returns in later years suffer greater discounting impact than A's larger returns in the early years. This illustrates one reason some financial specialists prefer IRR to NPV when choosing between competing investments: NPV uses an arbitrarily chosen discount rate, which may determine results of the comparison, as shown. IRR, on the other hand, is sometimes seen as more "objective" because it does not rely on an arbitrarily chosen rate. IRR instead uses net cash flow figures themselves to find a rate that satisfies its definition.

Return on Investment (ROI)

According to the ROI metric, it's "no contest!" B's ROI of 52.2% beats A's ROI of 18.7%, hands down. The ROI metric shown here is Simple ROI, sometimes called "cash on cash" analysis (incremental gains divided by investment costs). All cash flow metrics above, including ROI, show both investments as net gains for the investor. ROI alone, however, is sensitive to the magnitudes of individual annual inflows and annual outflows. The other metrics derive only from the net cash flow figures. A's larger total costs ($1,200) are compared directly to A's incremental gain of $200. B scores much higher on ROI because B has a larger incremental gain ($240) and a much smaller total cost ($460). The large difference in costs is "masked" or hidden in the other metrics. This could be problematic because investment costs must be budgeted and paid for, no matter how large the returns, and the investor may simply have trouble providing the larger funding costs.

Payback Period

The payback period metric shows that investment A "pays for itself" in 2.0 years, while it takes 3.4 years for B's incoming gains to fully cover investment costs. Investors prefer payback periods that are shorter rather than longer for at least two reasons. First, the investment funds are available again for re-use sooner with a shorter payback period. Second, investments with longer payback periods are considered more risky.

Financial Metrics Conclusions

When stating a decision criterion as a general rule, business analysts and finance officers often borrow a phrase that is a favorite of economist: Other things being equal, the investment (or action, or decision, or scenario) with the higher IRR is the better business decision. The different financial metrics comparisons above illustrate the point that IRR is blind to many "other things" that may differentiate competing investments, these things may have important financial consequences, and they are very rarely truly equal. Consequently, it is usually recommended that IRR not be used as a decision criterion when comparing competing mutually exlusive investments or actions. When the investor can or will make only one of the two proposed investments, the choice of one over the other represents so-called constrained financing.

www.business-case-analysis.com/internal-rate-of-return.html 9/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

Finally, In business investingas in gamblinga wise investment (or a good gambling bet) is one where potential rewards compare favorably with investment risks. None of the metrics above fully measures investment risk, although risk considerations are partially visible in IRR, NPV, and payback period:

An Investment with a high IRR can be viewed as less risky than a low IRR investment. Interest rates for discounted cash flow include a "risk" component and an "inflation" component. If inflation rates rise during the investment period, or if the appropriate discount rate for NPV rises because of risk considerations, the high IRR investment retains greater NPV than the lower IRR investment. A longer payback period is considered more risky than a shorter payback, simply because of the longer time it takes to recover investment funds. When using the above metrics as decision criteria, however, the prudent investor will attempt to assess the likelihood that returns actually appear as projected, as well as the liklihood that other beter and worse results appear. IRR disgused as yield to maturity (YTM) for bond investing Another reason that IRR is a favorite metric for people trained in finance, is that IRR (disguised under a different name) is used in evaluating bond investments. If the IRR exercises above remind you of something you have seen beforesolving an NPV equation for an interest rateit is likely you are already familiar with the concept yield to maturity (YTM) used in bond investing. IRR and YTM are mathematically the same concept, with only a slight difference in definition (for a more complete coverage of yield and other bond concepts, see the encyclopedia entry for bond). Yield to Maturity is the interest rate, i, that satisfies this version of the NPV equation: Bond Purchase Price = FV1 / (1+ i )1 + FV2 / (1+ i )2 + ... + FVn / (1 + i )n This definition for YTM can be changed into Definition 1 for IRR, simply by subtracting "Bond Purchase Price" from each side of the equation. This way, Bond Purchase Price becomes the FV0 in the NPV equation that is used for IRR. The formula for IRR then asks for the same i that solves the equation: 0 = FV0 + FV1 / (1+ i )1 + FV2 / (1+ i )2 + ... + FVn / (1 + i )n Given the same cash inflows and outflows, the same value of i solves both equations. This is another reason that financial specialists use IRR as a metric for evaluating and comparing potential business investments, even when the investments are quite different in nature.

Lease vs. buy and other problem IRR results

IRR can usually be found and usefully interpreted when based on net cash flow streams with the "investment curve" profile" shown above: Net cash outflows appear very early in the stream while net cash inflows follow through the rest of the investment life. This profile is common for some kinds of financial investments, such as bond investments or bank deposits. The investment curve profile may also characterize some investments in income-producing assets, or sometimes even the financial consequences of projects, programs, product launches, and other actions. In many organizations, however, IRR is routinely calculatedor requiredto support action proposals, even when expected cash flows do not fit the investment curve profile. Those who are called upon to provide IRR support for funding

www.business-case-analysis.com/internal-rate-of-return.html 10/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

requests, project or program proposals, or business case analysis are often dismayed when they find that an IRR does not exist for their cash flow stream, or they find multiple IRRs for a single stream, or that there is a negative IRR. Or, they may be at a loss to interpret IRR message when one proposed action shows an IRR 10 or 20 times larger than a competing option. The situations described below illustrate the four "commandments" of IRR Usage. 1. Do not use IRR when the net cash flow stream differs substantially from the investment curve profile (early net cash outflows, later net cash inflows). 2. Do not use IRR to compare competing cash flow streams whose profiles differ substantially from each other, even if they are both roughly "investment curves." 3. Do not be tempted to over interpret IRR magnitude and suggested return rates when IRR differs substantially from the real cost of capital and real reinvestment rates. 4. Do not even try to find an IRR when the net cash flow stream is entirely positive or entirely negative. There is no IRR for such situations. Lease vs. Buy vs. IRR In a Lease vs. Buy comparison, the "Buy" option typically has a high initial cash outflow to buy the asset. In the remaining years of the asset's life, there should be cash inflows as the asset earns returns. The "Lease" option for the same asset starts with a very small initial cash outlay (if any), followed by almost the same net returns projected, but reduced somewhat by the periodic leasing fees (this would be the case for a typical operating lease). These cash flow streams fit this pattern

The "Buy" stream has an IRR of 42.6%. The "Leasing" option has an IRR of 1,400.0%. Imagine choosing between these two options, using IRR as the sole decision criterion! In fact, when results of this kind appear, most people immediatelly ask: "What's wrong with this picture?" Here are three of the problems:

The Buy option is properly called an "investment," but the Lease option is better described as a 7-year commitment to a service contract with periodic fees. The two profiles difffer substantially from each other. The Lease profile is not an investment curve. IRR looks only at the net cash flow figures each year. The leasing costs each year are "masked" or hidden from IRR by the larger positive inflows. When these options are compared with the Simple ROI metric (cash on cash), which is sensitive to individual periodic cash inflows and outflows, both options have exactly the same ROI, that is, 226% Both IRRs are certainly much higher than the company's real cost of capital and real reinvestment rates, especially the Lease option IRR. The analyst who still insists on taking an "investment" view of both options

www.business-case-analysis.com/internal-rate-of-return.html 11/12

1/18/13

Internal rate of return (IRR) defined and explained with examples

should probably turn instead to the modified internal rate of return. The MIRR for the Buy option is 22.5%, while MIRR for the Lease option is 99.3% (basing MIRR on an 8% reinvestment rate. In brief, a Lease vs. Buy decision based on IRR would always choose leasing as the better business decision because IRR views the action as a financial investment. However, IRR can be blind to period leasing costs, as shown, and in the Lease vs. Buy decision, other factors can be more important, such as the impact on the company's asset base, tax consequences, and flexibility to upgrade or replace assets. Negative, multiple, and impossible IRRs

With certain cash flow streams it is mathematically possible to produce negative IRRs, or multiple IRRs for the cash stream (more than one discount rate that leads to a 0 NPV). For other cash flow streams, there is simply no mathematically correct IRR solution.

Impossible IRR: There is no possible IRR solution when the cash flow Includes only positive or only negative net cash flows. As shown above, there may be real cash outflows in every period, but when the inflows always outwiegh outflows, there will be no negative net cash flows. There is no IRR in such cases. Other patterns of negative and positive net cash flows can also have no IRR solution. Multiple IRRs: A net cash flow stream will have multiple IRRs when it Includes more than one sign change. When the first cash flow is negative and the second cash flow is positive, that is one sign change and there will be one IRR for the stream. If another, later, net cash flow event is negative, that makes 2 sign changes. There will be one IRR for every sign change in the cash flow stream. In such cases, it is probably best to consider the IRR closest to the real cost of capital as the "true" IRR. Negative IRR: It is also possible for some net cash flow streams to produce a negative IRR value. This signals simply that the investment or action should be considered a "net loss." Further quantitative analysis of negative IRRs is not advised. Negative IRRs should certainly be diregarded when the analyst prepares IRR averages, or weighted average IRRs for multiple investments. Page Top

Recommend 4

Share

By Marty Schmidt. Copy right 2004 - 2013 Solution Matrix Limited and Marty Schmidt+ . All Rights Reserv ed.

www.business-case-analysis.com/internal-rate-of-return.html

12/12

You might also like

- Anne Rooney-The Story of Mathematics (2009) PDFDocument210 pagesAnne Rooney-The Story of Mathematics (2009) PDFrafiawaqar50% (2)

- HCI and SDNDocument7 pagesHCI and SDNRamamurthy VenkateshNo ratings yet

- IBM Global Technology Services 2010/2011 Services CatalogDocument56 pagesIBM Global Technology Services 2010/2011 Services CatalogRamamurthy VenkateshNo ratings yet

- Foundations of The 4th UtilityDocument5 pagesFoundations of The 4th UtilityRamamurthy VenkateshNo ratings yet

- Turner Qualitative Interview Design 2Document7 pagesTurner Qualitative Interview Design 2Taufiq XemoNo ratings yet

- Shrinkage of ConcreteDocument25 pagesShrinkage of ConcreteRamamurthy VenkateshNo ratings yet

- 1043 4977 1 PBDocument4 pages1043 4977 1 PBRamamurthy VenkateshNo ratings yet

- The State of Bangladesh's Growing ICT Sector and the Path Towards Achieving $1B in Exports by 2018Document8 pagesThe State of Bangladesh's Growing ICT Sector and the Path Towards Achieving $1B in Exports by 2018Ramamurthy VenkateshNo ratings yet

- Ai For CRMDocument32 pagesAi For CRMRamamurthy VenkateshNo ratings yet

- Golafshani - Understanding Reliability and Validity in Qualitative ResearchDocument10 pagesGolafshani - Understanding Reliability and Validity in Qualitative ResearchWilliam MamudiNo ratings yet

- PrgmMO Setup Checklist Twelch - 0607031249Document1 pagePrgmMO Setup Checklist Twelch - 0607031249Ramamurthy VenkateshNo ratings yet

- Report Fraunhofer 2013 Studie Managing Open InnovationDocument44 pagesReport Fraunhofer 2013 Studie Managing Open InnovationRamamurthy VenkateshNo ratings yet

- Make Performance Improvement Strategic BSI RohmDocument2 pagesMake Performance Improvement Strategic BSI RohmRamamurthy VenkateshNo ratings yet

- Column Design - As Per BS CodeDocument16 pagesColumn Design - As Per BS CodeWanda BeasleyNo ratings yet

- Digital India ProductsDocument16 pagesDigital India ProductsRamamurthy VenkateshNo ratings yet

- Transactional Green Belt Training and Development ProgramDocument4 pagesTransactional Green Belt Training and Development ProgramRamamurthy VenkateshNo ratings yet

- Digital India ProductsDocument16 pagesDigital India ProductsRamamurthy VenkateshNo ratings yet

- Retailing in The United Arab EmiratesDocument34 pagesRetailing in The United Arab EmiratesRamamurthy VenkateshNo ratings yet

- Retailing in The United Arab EmiratesDocument34 pagesRetailing in The United Arab EmiratesRamamurthy VenkateshNo ratings yet

- IT in ME CEO AgendaDocument12 pagesIT in ME CEO AgendaRamamurthy VenkateshNo ratings yet

- What Is The Difference Between Management and Leadership - Management - WSJDocument3 pagesWhat Is The Difference Between Management and Leadership - Management - WSJRamamurthy VenkateshNo ratings yet

- Business Model Canvas Examples - Understanding Business ModelsDocument23 pagesBusiness Model Canvas Examples - Understanding Business ModelsRamamurthy Venkatesh67% (3)

- Six Sigma For SmallbusinessDocument224 pagesSix Sigma For SmallbusinessSaqueib KhanNo ratings yet

- Case Study 5 - q1Document2 pagesCase Study 5 - q1Ramamurthy VenkateshNo ratings yet

- 2009-2011 QoS Indicators UAE enDocument8 pages2009-2011 QoS Indicators UAE enRamamurthy VenkateshNo ratings yet

- Basic ConceptsDocument13 pagesBasic ConceptsRamamurthy VenkateshNo ratings yet

- McKinsey IT Enabled Business Trends - Ten IT-Enabled Business Trends For The Decade AheadDocument13 pagesMcKinsey IT Enabled Business Trends - Ten IT-Enabled Business Trends For The Decade AheadIntegr8 GroupNo ratings yet

- The Magic Number 30 - Gold EagleDocument2 pagesThe Magic Number 30 - Gold EagleRamamurthy VenkateshNo ratings yet

- Effective CVs For Research StudentsDocument13 pagesEffective CVs For Research StudentsRamamurthy VenkateshNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDocument11 pagesPESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDennis Varghese0% (1)

- Surname: First Name: Campus France Registration Number: IN Age: Marital StatusDocument2 pagesSurname: First Name: Campus France Registration Number: IN Age: Marital StatusSahil ShahNo ratings yet

- Oblicon DigestsDocument33 pagesOblicon Digestsjlumbres100% (1)

- Lavoie (2014) - New FoundationsDocument660 pagesLavoie (2014) - New FoundationsDaisy Pereira100% (1)

- Mortgage BasicsDocument37 pagesMortgage BasicsAnkita DasNo ratings yet

- The Companies Actchapter 388 of The Laws of ZambiaDocument342 pagesThe Companies Actchapter 388 of The Laws of Zambiajosh mukwendaNo ratings yet

- Dublin House Prices, A History of Boom and Bust From 1708-1949Document17 pagesDublin House Prices, A History of Boom and Bust From 1708-1949karldeeterNo ratings yet

- Octroi RulesDocument150 pagesOctroi Rulesbharadvaj_jsplNo ratings yet

- ABM - Fundamentals of ABM 1 CGDocument7 pagesABM - Fundamentals of ABM 1 CGKaye Villaflor100% (1)

- 6 Economics of International TradeDocument29 pages6 Economics of International TradeSenthil Kumar KNo ratings yet

- General Credit Corporation v. Alsons DevelopmentDocument5 pagesGeneral Credit Corporation v. Alsons DevelopmentbearzhugNo ratings yet

- Cashback Redemption Form PDFDocument1 pageCashback Redemption Form PDFdeepeshkumarpal5194No ratings yet

- Mobile services bill breakdownDocument3 pagesMobile services bill breakdownTuttu P.hNo ratings yet

- Sample MOA For Private Limited CompanyDocument33 pagesSample MOA For Private Limited CompanylpradeepNo ratings yet

- Oracle R12 Account PayablesDocument39 pagesOracle R12 Account PayablesCA Vara Reddy100% (1)

- Offer To Purchase Assets of Business (Long Form)Document7 pagesOffer To Purchase Assets of Business (Long Form)Legal Forms100% (1)

- Reyes V Sierra DigestDocument1 pageReyes V Sierra DigestRZ ZamoraNo ratings yet

- Accounting & Financial StatementsDocument44 pagesAccounting & Financial StatementsNhân HuỳnhNo ratings yet

- Green BankingDocument16 pagesGreen BankingRahSamNo ratings yet

- Development proposal for office & apartment blocks in Ampang, Kuala LumpurDocument16 pagesDevelopment proposal for office & apartment blocks in Ampang, Kuala Lumpursongkk100% (1)

- The Great Depression - Assignment # 1Document16 pagesThe Great Depression - Assignment # 1Syed OvaisNo ratings yet

- MODULE 1 Lecture Notes (Jeff Madura)Document4 pagesMODULE 1 Lecture Notes (Jeff Madura)Romen CenizaNo ratings yet

- 51 Checklist Buy BackDocument3 pages51 Checklist Buy BackvrkesavanNo ratings yet

- Frank Catania Complaint Answer - Misappropriating A Client's MoneyDocument25 pagesFrank Catania Complaint Answer - Misappropriating A Client's MoneyAll About The TeaNo ratings yet

- Sales Full Cases (Part I)Document173 pagesSales Full Cases (Part I)Niki Dela CruzNo ratings yet

- NoteDocument3 pagesNoterajesh kumarNo ratings yet

- Reimbursement Rate Update MemoDocument2 pagesReimbursement Rate Update MemoBrad AndersonNo ratings yet

- Bus-Org Cases-31 To 40Document7 pagesBus-Org Cases-31 To 40Dashy CatsNo ratings yet

- All About Sale and Mortgage Under Transfer of Property Act 1882 by Rohan UpadhyayDocument9 pagesAll About Sale and Mortgage Under Transfer of Property Act 1882 by Rohan Upadhyayved prakash raoNo ratings yet

- 1 Assignment BBA 101Document10 pages1 Assignment BBA 101Farhana78% (9)