Professional Documents

Culture Documents

Arbaz Final Report II ABL 2013

Uploaded by

Haider SarwarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arbaz Final Report II ABL 2013

Uploaded by

Haider SarwarCopyright:

Available Formats

Page |1

1. EXECUTIVE SUMMARY:

The aim of an internship was to have the practical knowledge about the organizational working. The organization I selected to me for an internship was ABL Branch. Departments working in this building are Operations department, Credit department, Retail department, I accepted this task as a challenge and tried my best to explore & cover each and every aspect of ABL with in my 6 weeks internship. This internship report covers many important aspects which are basically related with the operations and financial aspects of the bank. In this study, first of all, I have discussed about the United Bank, its history, nature and product lines. I have also discussed the functional and departmental organization of the bank that Allied Bank Limited providing the general banking services. Allied Bank Limited Pakistan currently has a wide network of branches inside the country and in all commercial centers of the world as well. The Bank is providing deposits facilities to more than five hundred thousand customers in the country and which is increasing day by the time. In the deposits area the bank is providing special accounts such as PLS Term Deposit (Monthly Income account), which provides a monthly withdraw able return on the account The bank is trying to revolutionize the services. In the advances side the bank has been successful in deploying its resources in the best way in all commercial, industrial and agricultural sectors of the country. Financial statements from year 2007 to 2011 were analyzed. Ratio analysis gave the overall view of the financial condition of the bank. The ratio analysis helps in planning and forecasting. Ratios of return on equity, return on asset, return on deposits, net profit margin, average profit per branch, loan to deposit ratio, debt to equity, total asset turn over, debt ratio, gross profit margin, loan to asset and earning per share were analyzed. Both horizontal and vertical analyses were done. In the light of these analyses, positive indicators were described. In the end of my Internship report. Weaknesses were also stated and recommendations were given for the improvement of the organizational performance.

Page |2

2. OBJECTIVES OF STUDYING THE ORGANIZATION

The primary purpose of this study is to fulfillment of the requirements for the degree of MBA (Banking & Finance).For this connection each student of this particular course is required to undertake training in a relevant organization selected by them, for a period of 6-8 weeks. The secondary purpose of this internship is to understand how the theoretical knowledge can be applied to the practical situations and examine an organizations financial issues and identify its opportunities/ problems and also suggest corrective measures. This internship is also very necessary to gain confidence and become aware of the mechanism of an organization.

PURPOSE OF THE STUDY

Purpose of the study was two pronged.

General Purpose

To get acquaintance to the banking operations. To know what sort of changes IT brings in managerial activities. To see the application of our Professional studies especially.

Specific Purpose

Specific purpose of the study includes. A partial fulfillment as a requirement for the completion of MBA degree in Banking and Finance Sector. To objectively observe the operations of Allied Bank of Ltd in general and the operations of ABL, Shah Ruke ne Alam Branch, Multan in specific. To make recommendations or implementation plans for the improvement of the operations of ABL, in the Shah Ruke ne Alam Branch, Multan light of our professional studies.

Page |3

NATURE OF THE STUDY

The study is critical in nature. It was conducted to investigate critically into the operations of Allied Bank Ltd and it also explains that how ABL provides facilities of online banking to its customers. The annual reports or the consolidation data of the Bank has not been focused in specific because it does not reflect on the operational performance of branches. However, they have been referred to as when and where required.

SCOPE OF THE STUDY

The study covers two areas with its variables, which affects the operations of the branch directly, or indirectly. These two areas of variables are: Branch specific variable. Bank specific variable.

The branch specific variables are the variables under the control of the branch management and directly affect its operations e.g. Layout of the branch. Customers relations. Departments in the branch ATM Online banking.

The bank specific variables are those variables, which are not in control of the branch management e.g. History of ABL Services provided by ABL Role of ABL

Data Sources

Both primary and secondary have been used in the compilation of this report. The methodology used is as under:

Page |4

During the compilation of this report, I relied mainly on the primary data. The tools used for the collection of primary data are interviews and observation. To get primary data I also performed some practical work. The secondary data was mainly used for as a background material and for purpose of references. The major sources of secondary data were the annual report 2007; other printed material of the Bank and internet played a vital role as a source of secondary data.

LIMITATIONS

The Study was subject to the following limitations, the absence of which could made this report more accurate, systematic and factual: have

Lake of published financial data. Lack of ATMs back hand information with stuff. Access to data. The non cooperative behavior of some managers and staff members.

Page |5

3. 3.1

OVERVIEW OF THE ORGANIZATION BRIEF HISTORY OF ALLIED BANK LIMITED

ABL is the first Muslim Bank established on territory that later on became Pakistan. It was established on December 3, 1942 as Australasia Bank at Lahore with capital of 0.12 million. At that time the chairman was Kh. Bashir Baksh. ABLs story was one of the dedication, commitment to professionalism and adaptation to changing environmental changes. The bank's history is divided into many phases. During 25 years of united Pakistan the bank advanced forward in all areas of its activities. 1970s were a difficult decade for all Banks of Pakistan. In 1971 East Pakistan was separated and Australasia Bank lost its 50 branches and a lot of capital as well. Nevertheless the growth remained steady. In 1974 all the Banks were nationalized including Australasia Bank. The small provincial Banks were merged into Australasia Bank. On 1st July 1974 the new entity was renamed as ABL of Pakistan Limited. Then it started its operations as Public sector financial institution. Different Phases of the Bank Are as Follows: THE PRE INDEPENDENCE PERIOD (1942-47) Australasia Bank had the unique distinction of being closely identified with some of the countrys most Prominent leaders of the freedom moment. Such as Mian Mumtaz Daultana (Board of directors), Mian Iftikhar Hussain and Maulana Zafar Ali Khan. The bank originally started its operation in the garage of Khawaja Bashir Bakshs bungalow (who was the chairman) near the Lahore Railway Station. But the success of Bank enforced the directors to open its another branch in Anarkali on 1st March 1944. Kh. Bashir was first chief executive. He was the person who was really working in its development. His sincerity of purpose can be judged from his great moments. Another branch was opened at Amaratsar in 1945. In June 1946, the bank earned the status of scheduled bank. During 1946-47 many other branches were opened at Mcleod Road Lahore, Jallandhar, Ludhiana, Agra and Delhi. At independence the industrial and commercial sectors were underdeveloped but ABL contributed a lot in the development of these sectors.

Page |6

AUSTRALASIA BANK IN PRIVATE SECTOR (1947-74) It was the only full functional Muslim Bank on the land of Pakistan. On August 14, 1947 bank was identified with Pakistan moment. Many of its Board of Directors were prominent Muslim League leaders. Jallandhar and Ludhiana branches were attacked by rioters because of Muslim staff appointed in these branches of bank. But when the Pakistan flags wee hoisted on the branches then all the banks in India were closed down. With this, the bank lost a lot of capital and its deposits and almost 6 branches. During 1948 new branches were opened at Karachi, Rawalpindi, Peshawar, Sialkot, Sargodha, Jhang, Gujranwala and Kasur. But later on its branches were spread to Multan and Quetta. At that time, the bank financed trade in cloth and food grains and thus maintained consumers supplies during the riot effected early months of 1948. Australasia Bank made a profit of 50,000/= in 1947-48. In August 1948, Australasia Bank became the first Pakistani Bank to successfully negotiate and open L/C for a Sialkot based importer of books. So it also made correspondence relations with Midland (UK), Chase Manhattan (USA) and Lloyds (India). During the treasury functions of Federal Govt. of Pakistan and it also acted as Banker to several local Govt. Bodies and to the Punjab University during this period. Treasury functions were taken by National Bank of Pakistan in 1949. In 1950-51, Chairman was replaced with his own brother Kh. Sharif Baksh. During 1955-56, Mr. Naseer A. Sh. became the Chairman of Board and close working relationship was forged between the new Chairman and Managing Director. This partnership proved in modernizing its operations and consolidating its financial position. In 1963, Bank had 29 branches in various cities. And deposits were 89 million and advances were 66 million. Bank was mainly concerned with general banking and trade financing (including foreign exchange transactions). It helped a lot in development of small and medium sized business houses. These were Nishat, Crescent, Pak Cement, Haroon traders, Takht Bhai Sugar, Insaf, Punjab soap, Pak fruit and Saboor Oil Mills etc. In 1964, 13 new branches were opened including 3 in East Pakistan. In 1965, 17 new branches were opened and over 83 % of gross profit for the year was earmarked for development expenditure in connection with opening of new branches. In 1966 bank opened 26 new branches and doubled its reserved funds. For the first time in history, its advances were increased to Rs. 160 million and deposits raised by almost 58 % exceeding Rs. 232 million mark. In 1966, Central Office was built in Karachi but Head Office remaining at Shah Chiragh Building, Lahore.

Page |7

16 new branches were opened in 1967 and 20 in 1968. Respectively their funds were increased gradually. 21 new branches were opened in 1971. But separation time the 51 branches were lost by the bank which was a big loss. ALLIED BANK: PUBLIC SECTOR YEARS (1974-91) Under the Nationalization Act of 1974, 14 scheduled banks were taken over by the Government. Australasia Banks Board of Directors was dissolved and the bank was renamed as Allied Bank of Pakistan Limited. Sarhad Bank, Lahore Commercial Bank and Pakistan Bank Limited were merged into Australasia Bank. At time of merge, ABL was second highest among all the banks Nationalized in 1974. Allied Banks first Executive Board was constituted of Mr. Iqbal A. Rizvi as President, Mr. Ajmal Khalil as Joint President and Mr. Khadim Hussain Siddique as member. In 1974 Mr. I.D. Junejo and Mr. Safdar Abbas Zaidi joined the Board later. 116 new branches were opened in 1974 and it started participation in commodity Operation program of Government. In 1970s Bank played an important part of agricultural area loans and other loans. In 1976 Mr. Ajmal replaced Mr. Rizvi as Chief Executive and President. During 1974-77, 361 new branches were opened and 230 of these were located in villages and small towns. It also opened its foreign branch in London, near the Bank of England. In 1980 the Bank of England granted Allied Bank recognition as a full fledge Bank under the U.K. Banking Act. In 1981, President was changed. In 1984, again new president was come to know. He tries to increase the international business. It also initiated a major counter program. In 1985, mainframe computer was installed and effective management system was developed. During this period profitability was increased. New President Mr. Maqbool introduced different schemes in 198788. In 1989, new 13 branches were installed. Over 1991, 745 branches were there in all over the Pakistan. A NEW BEGINNING In November/ December 1990, the Government announced its commitments to the rapid privatization of the Banking sector. Allied Banks management under the leadership of Mr. Khalid Latif decided to react positively to this challenge. In September 1991, ABL entered in a new era of its history as worlds first bank to be owned and managed by its employees. The 850 executives and 7200 staff members spread over 750 branches throughout the Pakistan established a high degree of cooperation and family feelings After this, it grows more and more, even at present in Year 2012 it has near about 1900 domestic branches throughout the country and 4 foreign branches in U.K.

Page |8

Allied bank Objectives: Allied bank has following objectives: i) Main objective of Allied bank is to earn profit. ii) To provide services to their customers and assistance in the development of commerce and trade. Allied bank also have another responsibility to give service to their communities. It watches the growth and development of his community especially the commerce and business of the area.

Page |9

3.2 Nature of Allied Bank Limited

The Bank was incorporated in Pakistan and is engaged in commercial banking and related services. The Bank is listed on all the three stock exchanges of Pakistan. The Bank operates 1078 branches inside Pakistan including the Karachi Export Processing Zone branch and 17 branches outside Pakistan. The domestic branch network includes 5 Islamic Banking Branches. The Banks principal activities are to provide commercial banking and other financial services. The Bank offers personal banking, cash management, retail loans and other financial services. These services include deposits, savings/current bank account, vehicle loans, personal loans, retail trade finance, global banking, lending to priority sector and small scale sector, foreign exchange and export finance, corporate loans and equipment loans. ABL is a commercial bank, which transacts the business of banking in accordance withthe provisions of BCO, 1962. Section 7 of the Act authorizes banks to engage in the prescribed form of business. In the light of this section ABLs functions can be categorized as under: Agency services General Utility Services Underwriting of loans raised by the Government or public bodies and trading by corporations etc. Providing specialized services to customers, and Hajj-related services

P a g e | 10

3.3 BUSINESS VOLUME OF ALLIED BANK LIMITED

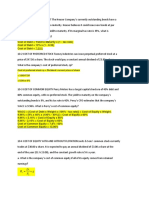

Rupees in Millions Year Total Assets Deposits Advances Reserves Investments

Table 3.1

2008 553,231,467 465,571,717 220,794,075 10,813,914 149,350,096

2009 577,719,114 463,426,602 268,838,779 13,536,041 156,985,686

2010 645,132,711 501,872,243 316,110,406 13,879,260 139,946,995

2011 762,193,593 591,907,435 340,677,100 15,772,124 210,787,868

2012 817,758,326 624,939,016 412,986,865 19,941,047 170,822,491

UBL Annual Report

Horizontal Analysis (%)

Year Total Assets Deposits Advances Reserves Investments

Table 3.2

2008 100 100 100 100 100

2009 104 100 122 125 105

2010 117 108 143 128 94

2011 138 127 154 146 141

2012 148 134 187 184 114

Source: ABL Annual Report

P a g e | 11

Total customers Total branches Utility booths Airport booths Total clients in Multan region Table 3.3

4,605,000 735 34 1 145,000 Source: ABL Annual Report

BRANCH NETWORK OF ALLIED BANKLIMITED

Allied Bank has been divided into 16 regions, each under the control of a regional General Manger (RGM). The RGM is not any fixed designation in the organizational hierarchy. The person appointed for its position can be a SEVP and EVP.

The details of these regions are given below: Region Abbottabad Bahawalpur Faisalabad Gujranwala Hyderabad Islamabad Karachi Lahore Mardan Email coablatd@brain.net.pk ro_bahawalpur@ikr.abl.com.pk ablcircle@fds.comsats.net.pk ro_gujranwala@lhr.abl.com.pk ro_hyderabad@abl.com.pk ro_Islamabad@isb.abl.com.pk ro_karachi@abl.com.pk ro_lahore@lhr.abl.com.pk allieds@brain.net.pk

P a g e | 12

Mirpur (AJK) Multan Peshawar Quetta Sargodha Sialkot Sukkar Table- 3.4

ro_Mirpurak@isb.abl.com.pk ro_multani@lhr.abl.com.pk ro_peshwar@isb.abl.com.pk ro_quetta@abl.com.pk ro_surgodha@lhr.abl.com.pk ro_sialkot@lhr.abl.com.pk ro_sukkir@abl.com.pk

ABL has a large network of branches, which extends to the remotest areas of the country. In December 1983, there were 1623 branches whereas in 1974 it had only 1238 branches and in 2009 these figures show total number of1112 Domestic and 17 overseas Branches.ABL has been very active in increasing its overseas branches network. The first foreign branches were established in London in 1963. Now ABL has branches in Bahrain, Qatar, Saudi Arabia, United Arab Emirates, Yemen Arab Republic, UK Switzerland, Egypt, Oman and The United States. These branches are playing a significant role in channeling home remittances and foreign trade of Pakistan.

3.4 NUMBER OF EMPLOYEES OF ALLIED BANK LIMITED

Permanent Temporary/ On Contractual basis Bank's own staff strength at the end of the year 9520 12 9532

P a g e | 13

Outsourced Total Staff Strength

Table 3.3 Source : ABL Annual Report

5522 15054

An employee may be defined as: "A person in the service of another under any contract of hire, express or implied, oral or written, where the employer has the power or right to control and direct the employee in the material details of how the work is to be performed." 1An employee contributes labor and expertise to an endeavor. Employees perform the discrete activity of economic production. Of the three factors of production, employees usually provide the labour. Specifically, an employee is any person hired by an employer to do a specific "job". In most modern economies, the term employee refers to a specific defined relationship between an individual and a corporation, which differs from those of customer, or client. The relationship between ABL and its employees is usually handled through the Human Resource Management & Administration Group & Employees benefit disbursement & trustee division. These groups handle the incorporation of new hires, and the disbursement of any benefits which the employee may be entitled, or any grievances that employee may have. There are differing classifications of workers within Allied Bank Limited, these are: Permanent Temporary / On Contractual Outsourced

P a g e | 14

3.5 Product Lines

The most precise definition of product is anything capable of satisfying needs, including tangible items, services and ideas. In marketing, a product is anything that can be offered to a market that might satisfy a want or need. Since 1575, the word "product" has referred to anything produced. Since 1695, the word has referred to "thing or things produced. The economic or commercial meaning of product was first used by political economist Adam Smith.In general usage, product may refer to a single item or unit, a group of equivalent products, a grouping of goods or services, or an industrial classification for the goods or services. The consumer banking products include personal accounts, credit cards, loans, investment products, treasury products and many more. The ABL offering for sale several related products individually, which is commonly known as product lining. A product line is defined as A group of products that are closely related because they function in a similar manner, are sold to the same customer groups, are marketed through same types of outlets, or fall within the given price ranges. The followings are the main consumer banking products of ABL.

CONSUMER PRODUCTS

In line with the Banks aim to provide a host of products and services to its customers, substantial ground work has been done to establish a strong consumer banking business. Furthermore, to achieve this objective, professionals from across the industry have been recruited into areas of product development, sales, credit policy, research, consumer analytics, call centers and service quality departments. The consumer portfolio, comprising the debit card, credit cards, auto loans, personal loans and mortgages will be established phase by phase. However, we are confident that our strengths, together with our largest network of online branches, a superior technology platform and a big customer base, will take the Banks profitability to new heights.

P a g e | 15

Commercial & Retail Banking Group (CRBG) The Commercial & Retail Banking Group is the core business arm of the bank generating a major share in income. It caters to the needs of the customers from almost every segment of life including Individuals like salaried persons, students, senior citizens, house wives and Businesses from small shops and cottage industries to middle / large size organized businesses. CRBG offers full range of Deposit and Advances products from general to specific & tailormade solutions to meet the customer needs. This includes various deposit products, Commercial & SME Loans, Agriculture Loan, Trade Facilities, Bancassurance, online banking including instant transfer of funds within the entire banking network. The Group is driven by the ambition to continue contributing as the leading Business, serving our 2.5 million longstanding customers with candid and reliable banking services. The Commercial & Retail Banking group is organized under four geographical territories consisting of 28 regions and over 800 branches (100% online) spread across the country for providing quality banking services to the customers. CRBG has always been focusing to establish Allied Bank as market leader by proactively identifying needs of its customers and satisfying those needs in true spirit. Accordingly innovative and unique business products were offered from the platform of CRBG including Allied Advance Profit Scheme, Allied Business Account, Allied Business Finance and Agriculture Finance Products & Bancassurance products which significantly contributed to our customer convenience. As a matter of fact Allied Advance Profit Scheme was first of its kind in the banking history of Pakistan. In terms of commercial assets, focus was laid on various sectors of economy and large number of customers were brought to the fold of the bank from different sectors, such as, Rice, Cotton, Pesticide, Wheat, traders and exporters. CRBG at ABL continued with its commitment to facilitate existing customers and expanding its reach with a comprehensive plan for branches & ATM network expansion.

P a g e | 16

INTERNET BANKING

Banking is now at Customer fingertips! Allied Direct Internet Banking offers Customer the convenience to manage and control Customer banking and finances - when Customer want, where Customer want! It's Simple, Convenient, Secure and Faster. Allied Direct Internet banking is now on Customerr Mobile phone as well.

Corporate Leasing

Allied Bank started lease operations when it integrated with Ibrahim Leasing Limited. Facilities include leases for machinery, commercial vehicles and equipments. The Bank provides lease facilities to corporate and commercial clients in all industrial enterprises for balancing, modernization, replacement and expansion schemes .

Agriculture Finance

The Bank, under the guidelines of the State Bank of Pakistan, extends short, medium and long term Agriculture credit facilities to farming community of Pakistan on easy terms to increase the credit flow to Farm and Non-Farm segments of Agriculture sector. Farm credit is extended for the purpose of production of crops to meet working capital expenses and Development of Agri land. Non-Farm Credit facilities are offered for Livestock (Cow, Buffaloe, Goats, and Sheep etc.), Poultry (Eggs, Day Old Chicks, Layer, Broiler, Hatchery) and fisheries (inland and marine, excluding deep sea fishing).

Farm Loans

Production Loans 1. Inputs like seeds, fertilizers, pesticides, weedicides, herbicides, labour charges, water charges, vegetables, floriculture, forestry etc. 2. Working capital finance to meet various farming expenses.

Development Loans

Improvement of agricultural land, orchards, etc. Construction of Godowns

P a g e | 17

Purchase of Tractors, Machinery & other equipments Installation of Tube wells Farm Transportation, etc.

Non-Farm Loans Livestock

Working capital 1. Purchase of animal fodder and feeds, Vaccinations, Vitamins and other medications for animals including artificial insemination 2. Overhead expenses i.e. labor, fuel, electricity etc

Term loan 1. Purchase of mature milk yielding buffaloes/cows, Purchase of Young animals for rearing for dairy farming 2. Purchase of Milk storage chilling tanks and milk carrying containers, feed grinders, tokas, feed mixing machines and feed/milk containers etc. 3. Construction/Procurement of permanent sheds, water tanks, water pumps etc.

Poultry

Working capital 1. Purchase of Eggs, Birds / Day old chicks, bird feed and feed raw material and vaccination

2. Overhead expenses i.e. labor, utility bills, Cost of fuel for generators & vehicles, transportation etc. Term loan 1. Purchase of Equipment/Machinery for Broiler/Layer farm & Hatchery

2. Farm construction for broiler, layer, hatchery and procurement of other items required for the establishment of poultry farming industry etc.

P a g e | 18

Fisheries

Forestry Agriculture Revolving Credit Scheme Loan Tenure: 3 Years (Clean up once a year) One time documentation for 3 years. Loan limit will be based on the Indicative per Acre limit prescribed by ABL/SBP and/or requirement of the applicant. Development Loans/Finances (Term Loans) Loan Tenure: up to 7 years Repayment: Monthly/Quarterly/Bi-Annual/Lump sum

Utility Bill

Customers can pay their utility bills (e.g. electricity, gas, telephone) at any of the Banks branches. For further convenience, bills are collected on all working days during normal banking hours and also at certain times during the evening. Bills can be paid with cash or cheque, plus customers can even drop crossed cheques in drop-boxes available at all branches. Furthermore, customers can also pay their bills using any of the Banks ATMs or via Internet Banking for SSGC and SNGP bills.

CORPORATE FINANCE

Corporate

The Corporate Investment Banking Group (CIBG) holds the Banks loan portfolio and enjoys a leading position in corporate lending in the country. It offers a wide range of financial services to medium and large sized public and private sector entities. These services include, providing and arranging tenured financing, corporate advisory, underwriting, cash management, trade products, corporate finance products and customer services on all bank related matters.

P a g e | 19

The Bank has played a key role in the countrys economic growth by providing a vast amount of funds to large industrial and corporate sectors of the economy. And because it has played a big part in major investment and corporate banking transactions, Allied Bank is considered one of the top investment banks in the country today. CIBG (Corporate Investment Banking Group) Corporate Banking - Project Finance - Long Term Financing - Short Term Financing - Trade Finance - Project Finance - Syndication - Advisory - Cash Management - Home Remittances Allied Bank-IBG is the most Preferred Investment Banking Outfit because of Timely Completion of Mandates Highly talented and experienced analysts An employee focused work culture Flexible delivery models to satisfy client specific requirements A cost effective, one window solution for customers Its ability to rapidly adapt to changing industrial & client specific processes. The dedicated Transaction Manager Model ensuring high quality service at all times Investment Banking Financial Institution

ABL INCOME FUND

P a g e | 20

ABL Income Fund (ABL-IF) is an open end, fixed income fund with no direct exposure to the stock market. The objective of ABL Income Fund is to earn superior risk adjusted rate of return by investing in a blend of short, medium, and long-term instruments, both within and outside Pakistan. ABL-IF would benefit Investors who want to earn a competitive return and avail tax benefits also having the ease of withdrawing money at their convenience

ABL STOCK FUND

ABL Stock Fund (ABL-SF) is an open end equity fund. The objective of ABL-SF is to provide higher risk adjusted returns to the investors by investing in diversified portfolio of equity instruments offering capital gains and dividends. It would benefit Investors seeking higher growth on capital with high risk exposure and availing tax benefits with the ease of withdrawing money at their convenience.

ABL CASH FUND

ABL Cash Fund (ABL-CF) is an open end, money market fund with no direct or indirect exposure to shares, TFCs and long term debt instruments. The objective of ABL-CF is to provide investors, consistent returns with a high level of liquidity, through a blend of money market and sovereign debt instruments. It benefits Investors seeking low risk investments and consistent returns with ready access to funds. Given its highly liquid profile, the fund can be used by retail and institutional investors for efficient cash management.

Flexible Income Plan

If Customer would like to receive income based on the performance of ABL-CF on monthly, quarterly, half yearly or annual intervals then Flexible Income Plan is what Customer should opt for. Customer return will vary with funds performance during that period. Fixed Income Plan

P a g e | 21

If Customer would like to receive regular/fixed income on Customerr investment on monthly, quarterly, half yearly or annual intervals, as per Customerr preference then Fixed Income Plan is the option for Customer. Distribution in the form of Bonus Units only, as and when declared. Growth Units (minimum investment of Rs 5,000) For investors who prefer capital growth on investments The unit value grows in line with the growth in NAV. If Customer would like Customerr investment to grow over a period of time with redemption at Customerr discretion, then Growth Units are the option for Customer. The management company shall calculate the redemption value to be paid to the Unit Holder(s) based on the redemption price of the business day. Distribution in the form of cash or bonus units, as and when declared.

ABL ISLAMIC CASH FUND

ABL Islamic Cash Fund (ABL-ICF) is a Shariah compliant, open end, money market fund having no direct or indirect exposure to shares/stock market or long term debt instruments. The objective of ABL-ICF is to seek maximum possible preservation of capital and offer steady rate of return by investing in liquid Shariah compliant instruments.

Flexible Income Plan

If Customer would like to receive income based on the performance of ABL-CF on monthly, quarterly, half yearly or annual intervals then Flexible Income Plan is what Customer should opt for. Customerr return will vary with funds performance during that period. Fixed Income Plan If Customer would like to receive regular/fixed income on Customerr investment on monthly, quarterly, half yearly or annual intervals, as per Customerr preference then Fixed Income Plan is the option for Customer.

P a g e | 22

Distribution in the form of Bonus Units only, as and when declared. Growth Units (minimum investment of Rs 5,000) For investors who prefer capital growth on investments The unit value grows in line with the growth in NAV. If Customer would like Customer investment to grow over a period of time with redemption at Customer discretion, then Growth Units are the option for Customer. The management company shall calculate the redemption value to be paid to the Unit Holder(s) based on the redemption price of the business day. Distribution in the form of cash or bonus units, as and when declared. Allied Visa Gold Credit Card

With Allied Visa Credit Card customer can enjoy a variety of state-of-the-art features and unmatched value by spending at over 49,000 merchants across Pakistan and 27 million merchant outlets worldwide! And what more, Customer can also use Customer credit card at over 1 million ATMs internationally.

Allied Phone Banking

In case a customer requires any additional help regarding his Allied Visa Credit Card, Allied Phone Banking is there to provide Customer with immediate help, 24 hours a day. Just calling on 0800-22522.

P a g e | 23

4 ORGANIZATIONAL STRUCTURE OF ALLIED BANKLIMITED

Head offices Structure

Registered Office: 3-4 Tipu Block, Main Boulevard. Garden Town, Lahore. . Share Registrar Technology Trade (Pvt.) Ltd Email: General Info: info@abl.com.pk Human Resource: Group.Chief.Hr@abl.com.pk cmu@abl.com.pk

Complaint Management Unit: Postal Address:

Khyaban-e-Iqbal, Main Clifton Rd, Bath Island, Karachi, Pakistan

Legal Advisors Haidermota and Company (Barrister-at-Law & Corporate Counselors)

AUDIT COMMITTEE

Mubashir A. Akhtar (Chairman) Pervaiz Iqbal Butt

P a g e | 24

A. Akbar Sharifzada Sheikh Jalees Ahmed

4.1 ORGANIZATIONAL (MANAGEMENT) LEVELS AT ABL

MANAGEMENT SYSTEM OF ABL

Successful and profitable banking management depends on two principal factors. a) The manner in which the functions of banking, that is the acquiring of deposits, the investing or converting such deposits into earning assets, and the servicing of such deposits, are performed. b) The degree to which officers and employees contribute their talents to the progress and welfare of the bank in discharging duties and responsibilities. Allied Bank Management Banks are managed by board of director or similar group of men who are responsible to the owners, creditors, and the government for the well being of their institutions. The government selects all or some of directors of ABL. Management of ABL are given as follows: Banks Information 1. Directors: Rashid M. Chaudhry is the chairman and Mohammadi Yaqoob is secretary of ABL, are also the board of directors.ABLs other directors are M. Saleem Shaikh, S. Jauhar Husain, I.A. Usmaini, Raja Raza Arshad, Mohammad Saleem Sethi, Athar Mahmood Khan. Stockholders elect the directors for a term of one year and they are eligible for re-election. Voting is cumulative, that is, each shareholder has the right to vote the member of shares owned by him. The boards may format major policies and select officers to execute them. They may supervise these officers, review their act. 2. Executive Committee

P a g e | 25

Executive Committee consists of Rashid M. Chaudary (president), M. Salim Shaikh, S. Jauhar Husain, I. A. Usmain, Naveed Masud, Bilal Mustafa, M. Saleem Khan Durrani, Ashfaq Hassan Qureshi, Shariqe Umar Farooqi (secretary). 3. Officers: Officers are selected by the directors to manage their banks. An officers relationship to the board is that of an employee to an employer. Chief Officer (Rashid M. Chaudary) of ABL is known as Chairman, Senior Executive Vice President (M. Saleem Sheikh, S. Jauhar,). They are also members of the board of director and are large shareholders. They are in a position, to dominate the bank's policies as well as its administration. The Chief duty of the chairman is to lend the bank's funds. This work is often subject to little supervision by the board of directors.

STRUCTURE OF ABL LIMITED

No bank can be expected to operate efficiently unless all employees with in a department, division or section know: A) From whom they are to receive the work they are to do. B) What they are supposed to do with the work after they receive it. C) How they are supposed to handle the operation of item.

D) When they are supposed to do work, perform the operation.

E) To whom they give the item or function after finishing it. To perform the functions efficiently the bank has its Head Office in Karachi, which is controlled by the president of the Bank. The bank has regional office under head office in major areas of the country. Regional Chief heads this office. The region Consist of many zonal offices with a zonal chief. There are many branches in a zone to carry the functions effectively and performing customer services locally. ABL Ltd. is functionally organized into divisions and divisions are further divided into department and sections. Every province has its own regional office and zonal offices. Executive vice president heads the divisions and departments are further headed by OGI (Officer of Grade I). Manager heads branches.

P a g e | 26

BRANCH NETWORK

There are Four Provincial Headquarters of Allied Bank Limited situated at Lahore (Punjab), Karachi (Sind), Peshawar (NWFP & Azad Kashmir) and Quetta (Baluchistan).

PROVINCIAL HEADQUARTERS PUNJAB:

7E/3, Main Boulevard, Gulberg, Lahore

SINDH:

Jubilee Insurance House, I.I. Chundrigar Road, Karachi

NWFP:

1st floor, State Life Building, The Mall,

AZAD KASHMIR:

Peshawar Cantt.

CITY CIRCLE LAHORE

Zones 2 Branches 47

MULTAN CIRCLE

Zones 2 Branches 66

P a g e | 27

MANAGEMENT LEVELS

The ABL has four types of management levels which are as fallows:

TOP MANAGERS

Top managers are responsible for making organization-wide decisions and establishing the plans and goals that affect the entire organization. These individuals typically have titles such as executive vice president, president, managing director, chief operating officer, chief executive officer or chairman of the board. The ABL have its top management in their head office at Karachi. They are responsible for making the plans and establishing goals the run their business smoothly all over Pakistan & around the globe. Among seven member of group Chief Executive is called the president. The bank has directors for superintendence and direction of its business. The Government appoints six directors as members and one president. These members are also responsible for making the policy of the bank.

MIDDLE MANAGERS

Middle managers include all levels of management between the first line level and the top level of the organization. These managers manage the work of first line managers and may have titles such as department head, project leader, plant manager or division manager. ABL divided his management into various regions such as Rawalpindi region, Gujranwala region etc. In ABL, regional management falls under this category. They are responsible for the planning, organizing, leading and controlling of the resources and staff of the whole region.

FIRST LINE MANAGERS OR LOWER LEVEL MANAGEMENT

P a g e | 28

First level managers are the lowest level of management and manage the work of non-managerial individuals who are involved with the production or creation of the organizations products. The branch managers of ABL fall under this category. These managers are responsible for planning, organizing, leading and controlling the staff and all affairs of the branch.

NON MANAGERIAL EMPLOYEES

Non managerial employees are not concerned with any decision making. They are normally specialized in their work. The nature of their job is repetitive & clerical as they do same work again & again. The non managerial employees of ABL consist of OG-II, OG III and clerical staff.

HIERARCHY OF ALLIED BANK LIMITED

The Hierarchy (An arrangement of objects, people, elements, values, grades, orders, classes etc., any system of persons or things ranked one above another) of ABL is shown as Annexed at the end of this report. The hierarchy may include: Categorization of a group of people according to ability or status. A body of clergy organized into successive ranks or grades with each level subordinate to the one above. A series in which each element is graded or ranked A body of officials disposed organically in ranks and orders each subordinate to the one above it; a body of ecclesiastical rulers. An organization with few things, or one thing, at the top and with several things below each other thing.

P a g e | 29

The President of ABL is ranked Top at the hierarchy. The other six directors of ABL are ranked second in the hierarchy. The Provisional, Regional & Zonal chiefs are ranked 3 rd, 4th& 5th respectively. The vice President & assistant vice Presidents of ABL are ranked 6th& 7th respectively. The Officers Grade I, II & III are ranked 8th at the hierarchy of ABL. The lower level of ABL is consist of Clerical & non- clerical staff.

4.2 ORGANIZATION STRUCTURE OF THE BRANCH

A well-developed and properly coordinate structure is an important requirement for the success of any organization. It provides the basic framework within which functions and procedures are performed. Any organization needs a structure, which provides a framework for successful operations. The operation of an organization involves a number of activities, which are related to decision making, and communication of these decisions. These activities must be well coordinated so that the goals of the organization are achieved successfully. The organization chart & Organogram of ABL Shah Ruk ne Alam Branch Multan is shown on Annexed at the end of this report. This chart defines the line of authority in the branch and its departments. It is a sort of visual presentation of the organizational structure. It specifies the duties and responsibilities of the personnel or staff of the branch. The purpose of an organizational structure is to help in creating an environment for human performance. Although the structure must define the task to be done, the rules so established must also be designed in the light of abilities and motivation of the human recourse available. By analyzing the organization structure of the branch following elements can be found in the structure.

A) CENTRALIZED

DECISION MAKING

The Branch Manager of ABL is responsible for all the affairs of the Bank. All the decisions relating to Branch are made by him and the subordinates have to obey these decisions. All the employees of the Bank are report directly to the Branch Manager. The branch has two operation Managers. Operation Manager I controls Clearing house & Remittance Department and Operation Manager II controls Deposits, Advance & Branch accounts department. Both of them

P a g e | 30

are report directly to the Manager regarding affairs of their departments. The Chief Accountant controls Accounts department & is report directly to branch Manager. The branch also has two cashiers responsible for cash & Pension disbursement department reports directly to branch Manger. The BBO (Branch Back Office System) Operator controls computer department of the branch and is report directly to Operation Manager I and Branch Manager.

B) DOWNWARD

COMMUNICATION

Communication is the process by which information is exchanged and understood by two or more people, usually with the interest to motivate or influence the behavior of others in the organization. Downward communication is the message and information sent from top management to subordinates in a downward direction. The same pattern is followed at ABL Bahawalpur Central branch, the Manager of the branch sent orders, information & messages to following subordinates Operation Manager I Operation Manager II BBO ( Branch Back Office System) Operator Chief Accountant Cashier I Cashier II Clerk I Clerk II Non Clerical Staff

P a g e | 31

C) CHAIN OF

COMMAND

The chain of command is an unbroken line of authority that links all persons in an organization and shows who reports to whom. By analyzing the organizational structure of the ABL Bahawalpur Central branch it can be found that there is a scalar principle followed with in the branch because each and every employee of the branch knows to whom they can report. The authority and responsibility for different tasks and duties are different, as well as every one knows the successive levels of management all the way to the top.

D) AUTHORITY AND

RESPONSIBILITY

The chain of command illustrates the authority structure of ABL Bahawalpur Central Branch. Authority is the formal and legitimate right of the manger to make decisions, issues orders and allocates resources to achieve organizational desired outcomes. By analyzing the chain of command of ABL, one can come to the conclusion that, as there is scalar pattern followed at the organizational setup of ABL, therefore it is implied that everyone in his position knows that what is ones authority and what is the responsibility and the authority it allocated.

E) DELEGATION

Delegation is the process, which managers use to transfer the authority and responsibility to position below in the hierarchy. Most organizations today encourage managers to delegate authority to the lowest possible level to provide maximum flexibility to meet customer needs and adapts to the environment. At ABL Bahawalpur Central branch Operation Managers have some authority & responsibility relating to affairs of the Branch.

P a g e | 32

4.3 DEPARTMENTS OF THE BRANCH

Banking procedures are divided between various departments. Different departments do their jobs in occurrence with the bank policies. In ABL each branch is divided into various departments depending on their size and volume of business. Head of department manages each department & officials of the branch follow procedures. The departments working within ABL Bahawalpur Central branch are as under: 1. Clearing House Department 2. Remittance Department 3. Computer Department 4. Deposits Department 5. Advances Department 6. Account Opening Department 7. Accounts Department 8. Cash Department

P a g e | 33

1. CLEARING HOUSE DEPARTMENT

As part of their daily business activity, banks receive cheques and other financial instruments from their customers drawn on other banks, to be collected and credited to their accounts. Similarly, banks receive cheques/instruments from other banks, deposited by customers of the banks drawn on the customers of the drawee banks. Therefore, the banks act as Collecting Banks when they send cheques/instruments for collection and as paying Banks, when they receive cheques/instruments for collection from other banks. Since each bank receive and sends cheques/instruments for collection to and from an number of banks, the process of settlement would clearly be very cumbersome and time consuming if every cheques/instrument had to be sent by the collection bank to each of the drawee banks or branch upon which different collection items are drawn and to individually pay the proceeds to each of the bank sending cheques/instrument in for collection. Therefore, the banks have evolved what is called the Bankers Clearing arrangement. The Clearing System enables cheques to be paid or cleared centrally and settlement made for receivables and payables between the banks. The SBP co-ordinates clearing activity through its offices, called the Clearing Houses, set up in big cities and towns. Where SBP does not maintain its own office, some other bank, usually ABL (ABL) performs this function. But the clearing house facility is available only for cheques/instruments drawn on banks situated within the same city/clearing house area.

P a g e | 34

W ORKING

OF THE

C LEARING P ROCESS

Under the clearing arrangements, the State Bank of Pakistan (SBP) offers a Clearing House or a centralized exchange facility, which works on the following general lines: All the banks operating in a city who are members of the Clearing House maintain an account with the SBPs Clearing House. Every day representatives of all the banks in every city meet the Clearing House, first meeting in the morning, at an appointed time, for the purpose of depositing their own customers , cheques/instruments to be collected from other banks and receiving cheques/instrument drawn on their account holders from the others banks. At the Clearing House accounts of all the banks are debited by the total amount of cheques/instruments drawn on their customers accounts and credited with the amount of their customers cheques/instruments drawn on other banks, as per the list of cheques submitted by each bank. The cheques/instruments received, also called Inward Clearing, and are taking back by each bank to its bank/branch. The amounts of each cheques/instrument is debited or recovered from each drawee customers account and credited to the Clearing House account. Similarly, against the amount credited by the Clearing House as Outward Clearing, the appropriate customers accounts are credited and clearing House account is debited. Any cheques/instruments received by a bank that cannot be paid, due to insufficient balance in its customers account or for any other reason, are returned back to the Clearing House and a credit is claimed and obtained there against.

R ULES & R EGULATIONS

OF

C LEARING H OUSE

Timing:(Monday to Saturday)

P a g e | 35

i. ii.

1st Clearing at 10:00 a.m. 2nd Clearing at 2.30 p.m.

Each bank will send competent representative to exchange the cheques. Each bank is required to insure that all cheques and other negotiable instruments are properly stamped and suitably discharged

An objection memo must accompany each and every cheque when return unpaid duly initialed.

Each bank is required to maintain sufficient funds in the principal account with SBP to meet the payment obligations.

The State Bank of Pakistan debit the account of each member of the clearinghouse with the proportionate working expenses incurred on the operation of clearing house. These expenses are very nominal.

O UTWARD C LEARING

AT THE

B RANCH

The following points are to be taken into consideration while an instrument is accepted at the counter to be presented in outward clearing: The name of the branch appears on its face where it is drawn o. It should not stale or post dated or without date. Amount in words and figures does not differ. Signature of the drawer appears on the face of the instrument. Instrument is not mutilated.

P a g e | 36

There should be no material alteration, if so, it should be properly authenticated. If order instrument suitably indorsed and the last endorsees account being credited. Endorsement is in accordance with the crossing if any. The amount of the instrument is same as mentioned on the paying-in-slip and counterfoil.

The title of the account on the paying-in-slip is that of payee or endorsee (with the exception of bearer cheque).

If an instrument received other than ABL then special crossing stamp is affixed across the face of the instrument. Clearing stamp is affixed on the face of the instruments, paying-in-slip and counterfoil (The stamp is affixed in such a manner that half appears on counterfoil and paying-in-slip). The instrument is suitably discharged, where a bearer cheque does not require any discharge and also an instrument in favor a bank not need be discharged.

The instrument along with pay-in-slip is retained while the counterfoil is given to the customer duly signed. Then the following steps are to be taken: 1. The particulars of the instrument and the pay-in-slip or credit voucher are entered in the outward clearing register. 2. Serial no is given to each voucher. 3. The register is balanced; the credit vouchers are balanced from the instruments and are released to the respective departments against acknowledgement in the register. 4. The instruments are arranged bank wise. 5. The schedules are prepared in triplicate, two copies which are attached with the relevant instrument and the third is kept as office copy.

P a g e | 37

6. The house page is prepared from schedules in triplicate. 7. The schedules and house pages are signed by the house in charge with branch stamp. 8. The grand total of the house page is taken and agreed with that of the outward clearing register. 9. The instrument along with duplicate schedule and house page are sent to the main office. 10. The entry of the instrument returned unpaid is made in Cheques returned Register. If the instrument is not to be presented again in clearing then a covering memo is prepared. The covering memo along with returned instrument and objection memo is sent to the customer who sent the same to his account.

I NWARD C LEARING

OF THE

B RANCH

1. The particulars of the instruments are compared with the list. 2. The instruments are detached and sort out department wise. 3. The entry is made in the inward clearing register (serial no. Instrument no. Account No) 4. The instruments are sent top the respective departments 5. The instruments are scrutinized in each respect before honoring the same.

S PECIAL C LEARING

In addition to the normal clearing function at Clearing house it is mutually agreed to hold an extra clearing at the clearing house on the particular day and time which is known as special clearing it is arranged due to the rush of work arising out of say, more Holidays declared by the Central Govt. at a time, but normally special clearing is held on last working day of half yearly and yearly closing i.e. 30th June and 31st Dec. every year.

2. REMITTANCE DEPARTMENT

P a g e | 38

The Remittance department deals with the transfer of money from one place to another. Funds transfer facility or remittance of funds is on of the key functions of the banks all over the world. Remittances through banking channels save time, costs less and eliminate the risks involved in physical transportation of money from one place to another. ABL transfers money in the following ways. Pay Order Demand Draft Mail Transfer Telegraphic Transfer Pay Slip Call Deposit Receipt Letter of Credit Travelers Cheque

The Job responsibilities & requirements of remittance department include: Responsible for money transfers, issuance of pay-orders & drafts, collection items, maintenance of cheque books & ATM cards and all other counter specific products and services Ensure highest level of customer service in a professional and competent manner Must ensure that the activities are carried out strictly in accordance with the laid down procedures/processes, and SBP/Compliance guidelines

P a g e | 39

Responsible for Cash, Clearing, Inland remittances including Demand Drafts and Pay Orders

Ensure high standards of customer services within the assigned turn around time Ensure compliance with SBP's regulations and internal controls handling cash, clearing, local remittances, and other related activities at branch level

P ARTIES INVOLVED IN R EMITTANCES

There are four parties involved in Remittance, which are Remitter Remittee Issuing Bank paying Bank

R EMITTER

One who initiates, or requests for a remittance. The remitter comes to the issuing or originating branch, asks for a remittance to be made, and deposits the money to be remitted. The bank charges him a commission for this service. He may or may not be the branchs customer.

I SSUING B ANK

The bank that sends or affects the remittance through demand drafts, telegraphic transfers, Mail Transfers, Pay order etc

P AYING B ANK

P a g e | 40

Paying Bank also knows as the drawee branch, the branch on which the instrument is drawn. It has to make the payment (usually located in a different city or country).

K INDS

OF

R EMITTANCES

Transfer within the branch Transfer from one branch to another Transfer from one bank to another bank in the same city Transfers from one bank to another bank in two cities.

3. ACCOUNT OPENING DEPARTMENT

The opening of an account is the establishment of banker-customer relationship. This department performs the duty of opening accounts for customers. It also issues checkbooks to customers. A person who wishes to open an account with the bank has to fill an account opening form obtained from any branch of ABL. The bank officer tactfully obtains information about character, integrity, responsibility, occupation and the nature of business of the perspective customer. Any individual, who has attained the age of majority and is of sound mind can open and maintain his/her account. Two or more individuals may open an account jointly. Similarly, business organizations such as sole proprietary concerns, partnership firms, and limited liability companies as well as non-profit organizations like clubs, trusts, societies, associations and NGOs etc, may open their accounts. The documents required for ABLs Account opening are showed as Annexed at the end of this report. The following requirements are necessary for opening an account. Identification of the new customer. Ascertaining the genuineness of the stated occupation business of the customer.

P a g e | 41

Determining the correct residential and permanent address. Completion of all relevant columns of the Account opening form. Proper completion of documentation.

OF

F UNCTIONS

A CCOUNT O PENING D EPARTMENT

Providing account opening form according to the customer's requirements, Guide the customer about the requirements of the account opening and form filling, Check the forms whether they are correctly completed or not, Preparing checklist, Stamping on the form, Maintaining account opening register, Pasting of forms in register after release from general banking in charge, Issuance of cheque books, Issuance of accounts maintenance certificate, Closure of account Verification of signature in case of cheque presented before releasing of account opening from SS card is not yet scanned

4. CASH DEPARTMENT

P a g e | 42

All physical movement of cash in the bank is made through the cash department. As bank is borrowing and lending institution, therefore cash is the top most priority of Bank. Another aspect is that cash department is for the security purpose, security in a sense that there should be no embezzlement of funds or in money leaded to bank by any party or person. The efficiency of bank is also related to this department the more efficient the bank is the stronger and busy is the cash department. Cash department perform following functions Cash department owes its important to the fact that it is a major point of contract between the bank and the customer, the banks most valued relationships. This department is the showcase of the bank and conveys the first impressions about the banks commitment to professionalism in its systems and procedures and to courteous and efficient customer service. Normally cash department performs following functions Collection of funds Acceptance of deposits Collection of utility bills Payment of checks Remittances Act according to any standing instructions Transfer of funds from one account to another Verification of signatures Posting Handling of Prize bond

P a g e | 43

The two main activities of cash department are as fallows:

D EPOSIT C ASH I N C USTOMER S A CCOUNT

When the customer want to deposit amount in his account at opening of account or after that then he has to fill a deposit slip that shows the amount and the account in which the cash will be deposited. Then teller will receive amount and credit the customers account that shows increase in customers bank account.

M AKE P AYMENTS F ROM C USTOMER S A CCOUNT

When the customer draws a cheque on the bank to pay a certain amount then BBO Operator will debit the customers account that shows reduction in his account balance.

C HEQUE

ENCASHMENT PROCEDURE

R ECEIVING O F C HEQUES The cash is paid against the cheques of the client. The following points are important. Cheque is drawn on same branch Cheque is not post dated. Amount in words and figure are same. It should be bearer cheques so the word bearer should not cross.

OF

V ERIFICATION

S IGNATURE

After receiving the cheques the cheques the operation manager verify the signature of the account holder and the signature on the cheques. If the signature is not same it is returned back otherwise forward to BBO Operator for posting. C OMPUTER T ERMINAL P ROCESS

P a g e | 44

The cheque is received in computer terminal, where BBO operator checks the balance of the account holder. The BBO operator also sees the stop payment instructions, whether received from account holder or not. After considering these points BBO Operator post the cheque in BBO (Branch back office system) and forward to operation manager. P AYMENT O F C ASH After posting the cheque the operation manager cancelled the cheque and returned back to cashier. The cashier enters the cheque in cash paid registered and pays against the second signature of receiver on the back of the cheque.

5. DEPOSITS DEPARTMENT

The primary function of ABL is to accept and receive surplus money from the people, which they willingly deposit with the Bank. Like all other Banks, ABL also take incitation to attract as much depositors as it can. The deposit department accepts/collects deposit from accountholders. The ABL offer different deposit schemes to its customers, which includes the following: Current Deposits PLS Saving Deposits Fixed Deposit Account ( Time Deposits) Foreign Currency Account ABL Premium Aamdani Foreign Currency Account National Income Daily Account (NIDA)

6. ADVANCES DEPARTMENT

P a g e | 45

The bank is profit seeking institution. It attracts surplus balance from the customer at low rate of interest and makes advances at a higher rate of interest to the individuals and business firms. Credit extensions are the most important activity of all the financial institutions, because it is the main source of earnings. Advances department is one of the most sensitive and important department of the bank. The major portion of the profit is usually earned through this department. The job of this department is to make proposals about the loans; the credit management division of head office directly controls all the advances. The advances Department receive application from intending borrowers. After receiving application the advance department processes it further. After analyzing and detailed investigation, they decide whether to approve the loan or not. Some loan approvals are made by the Manager of the branch within his powers as prescribed by the banks higher authorities, while some loan applications are submit to higher authorities for their approval. Some advances are of the following nature Agriculture advance to farmers Medium term advance for working capital Long term advance for setting industry Short term advance to businessman

The Advances department deals in following transactions: 1. Preparation and submission of proposals of Running finance, Cash finance, Demand finance, Export finance, Staff finance, Finance against imported merchandise etc for sanction of finance limit from the hire authority. 2. Preparation and posting of vouchering of all type of finance. 3. Accruals & recovering of Markup on finances on periodical basis.

P a g e | 46

4. Approval of transfer of funds through DD-TT, PO, MT, IBCO etc to various branches by debiting the limits. 5. Preparation of weekly, monthly, quarterly, and annually statement to the hire authority. 6. Transfer of funds from one account to another account of the party taking the authority letter. 7. Preparation of advances record. 8. Timely submission of returns/reports, daily, weekly, monthly & quarterly. 9. Checking of computer outputs of the department on daily basis. 10. Balancing of all financing heads.

7. COMPUTER DEPARTMENT

This department is playing a very important role in making the banking procedures faster and helping the bank for providing better services to its customers. The ABL has three types of branches in all over Pakistan, these included

A)

ONLINE BRANCHES

The branches, which are directly, link with central computer AS-400, through wide area networking through fiber optics. These branches have dumb terminal directly linked with central computer.

B)

BATCH BRANCHES

The branches where all transactions are carried out with the computer base system but these branches are not connected to the central computer with wide area net working. Batch branches are using three type of system, Branch Back Office (BBO) based on FoxPro, Branch Automated System based (BAS) on UNIX, Branch Integrated System (BIS) based on FoxPro in Karachi mostly branches are facing this problem. BAS was establish in the beginning while BBO is

P a g e | 47

currently implemented now efforts are under way to convert all branches into Electronic Banking System (EBS) which is used by online branches as this system does not require a person to remain sitting till the branch closed its daily operation but the system automatically close it self when the branch timing is over. The database in head office is also based on this system.

C)

MANUAL BRANCHES

The branches where all transactions are carried out manually and records are maintained on registers usually stored in big wardrobes. Manual branches reports Regional head office regarding their daily transactions. In Regional head office through On Line, terminal data goes to head office central computer; Except for branches those are On Line as they transfer there daily data directly through there own terminal. As day-to-day, activities of all branches are recorded in a central computer.

E VENING

DATA RECEIVING CENTER

Data form batch branches reach the main branch in floppy diskettes while form manual branches it is in form of hard copy. Data comprises of transactions in profit loss account, current account, advances etc termed as Daily Transaction Report. Clerk in charge register all diskettes and manual in registers called job booking register one for each of two type of data. These floppies and manual are bring in by riders. There are fourteen riders in total who bring information form all branches located in Karachi region.

D ATA

ENTRY

D EPARTMENT

The next task after receiving the data is to enter that data in to a computer. The floppy disk is directly inserted in the computer. The program in used is based on COBOL language. This program is designed in away that it demand Hash Value value before opening the floppy for further action this value serve the purpose of password or pin code send by the branch on entering that value the data enter in to the computer. This computer is attached with the terminal of central computer. The operator of that terminal takes the data from the computer and converted it in to a text file through that terminal the data finally goes to the central computer.

P a g e | 48

D EFECTS

AND

E RROR H ANDLING

Errors of different origin occur when the data goes to central computer. Sometime retrieving data from the system (BAS, BBO, and BIS), other than used in HO (EBS) also caused errors. Other errors include Unmatched (This error occurs when document no matched with the previous one exists), no master (when opening of new account is not mentioned), Date in Valid, duplicate cheques (this error occur when the last objection is not removed). These and other such errors are seen by the person in charge. In the end of day print out of the data enter in central computer is taken. AnyIncomplete information for any branch and any information require by that particular branch is sent to that branch. More over material is used to make a WST which is sent to State Bank of Pakistan.

8. ACCOUNTS DEPARTMENT

Accounts Department of the bank can be considered the most important department. This department is basically concerned with processes and activities of recovering, sorting, summarizing and reporting data resulting from the whole day transactions of all the departments. Actually the process of this activity starts from the preparation of all the required vouchers by different related departments. When these vouchers are prepared, these are posted into respective computer terminals by the relevant departments. Before merging, a batch list is printed out by Computer Department and duly checked by the respective departments. After this, merging stage comes, after which a proof list is printed out. This is the stage, where Accounts Department starts performing its function. Proof list is checked by the Accounts Department. The account department prepare following vouchers and reports Monthly Profit & Loss account- F48 General Ledger General Ledger- Abstract Check Book Issue Register

P a g e | 49

Western Union payments Register Demand Notices Miscellaneous Book Bank Transfer scroll General Ledger- Head wise Hash Value Register End of Day register Monthly return register Charges A/c register P-L-S Profit list Weekly Telegram Mail Transfer Register Provident file Transfer Responding Advice Dispatched Register-F15 Cash Remittance IN Cash Remittance OUT ABL General Account Utilities register

P a g e | 50

Statement of affairs Closing entries Daily activity checking Minor expense recording

5.

STRUCTURE DEPARTMENT

OF

BRANCHS ACCOUNTS

P a g e | 51

5.1 Description of Accounts Structure

The structure of ABLs Accounts department is shown as Annexed at the end of this report. The Accounts department of the branch is controlled by the Chief Accountant under direct supervision of Branch Manager. The Branch has one cashier & two clerks for assistance and help of Chief Accountant. The BBO (Branch Back Office system) Operator has also assist Chief Accountant in various tasks. The head of branchs Accounts department is called Chief Accountant, who performs his functions under direct supervision of Branch Manager. The Chief Accountant is responsible for the central accounting records and controls over all financial transactions of the Branch. He also directs a wide variety of accounting activities and meets important deadlines& analyzes and interprets accounting data of the branch. The other responsibilities of Chief Accountant include: Plans and directs the activities of Cashier, BBO Operator and clerical employees of the branch engaged in the maintenance of a variety of accounting records. Directs and participates in the development and revision of procedures in order to meet requirements of law, provide services to Branch Manager, improve efficiency in branch activities, and coordinate branch activities with those of other departments. Directs and reviews the preparation of periodic and special financial statements, reports, projections, and recommendations, on which important administrative decisions are based. Directs and reviews the study of new and revised laws, rules, and programs affecting the central accounting system and records and installs or recommends changes as appropriate. Designing and operating a system to capture, record, process, and store all relevant documents and information about the financial activities of the branch.

P a g e | 52

Ensuring the integrity and reliability of the information system, and preventing fraud from inside and outside the branch.

Preparing financial statements that are reported to Regional Management of ABL. Preparing financial statements and accounting reports for distribution to the branch Manager for their planning, control, and decision-making needs.

The Chief Accountant with the help of branchs clerical staff is preparing following reports: o Monthly Profit & Loss account- F48 o Daily Statement- F21 o General Ledger o General Ledger Abstract o General Ledger head wise o Bank transfer Scroll o Misc Book o Monthly return file o Charger List o PLS Profit list o Weekly Telegram o Transfer Responding Advice Dispatched Register- F15

P a g e | 53

o Cash Remittance In o Cash Remittance Out o ABL General Account o Clearing register o Debit & Credit supplementary Debit supplementary is used for debit voucher and credit supplementary is used for credit voucher books and register maintained by bank are as fallows General ledger included: Statement of daily affairs Cash book or cash cum day book Transfer book Income & expenditure ledger

Income& expenditure includes: 1. Discount 2. Service charges 3. Commission from utility services 4. Salaries allowances & provident fund 5. Rent taxes insurance lighting 6. Profit paid on deposits and borrowings

P a g e | 54

7. Auditors fee & legal charges

5.2

BANK ACCOUNTING OPERATIONS

The ABLs accounting consists in making computerized, written and permanent records of every transaction. For Computerized recording of transactions the bank used software called BBO (Branch Back Office). BBO enable Bank to record a variety of transactions. The most common part of BBO which is operating by the BBO Operator is Individual Ledgers. Individual Ledgers are the accounts in which accounts with depositors are kept. They are kept so that the balance of each depositor's account may at any time be readily seen, and they should be frequently balanced to verify their correctness. The three column form of individual ledger is used because it has a column for checks paid or other debit entries, one for deposits or other items credited, and a third for showing the balance after each entry or the day's entries are made in the account. The BBO enlist Chart of Accounts of the Bank shown in Annexed . All the accounts shown in Annexed are opened and managed through BBO. All the Remittances of the bank are recorded managed and control through BBO. The End of the Day report is also generated through BBO. The most important record keeping and report generated by Banks Accounts Department is Statement of the Bank. The statement of the bank shows the general, or control, accounts of the bank, and the various books of the bank show the detail of these items. It would not be impossible, but it would be entirely impractical, to enter every figure directly on the statement of condition. Instead of total deposits, the balance of each depositor would appear opposite his name. On the other side, instead of loans and discounts, there would be an itemized list of the loans with the names of the borrowers. The first principle in bank accounting, as in all other bookkeeping, is that for every debit there must be a credit, and vice-versa. In accordance with this fundamental theory the books are maintained. With respect to the statement, every Rupee of liabilities is accounted for by another Rupee of resources. Similarly each accounts at the end of the day for each item of cash is balanced. Each bank employee has had the experience of remaining at his desk until a late hour at night checking up his day's work searching for a difference of a few cents. Often they become embittered at what seems to them a tyranny when

P a g e | 55

the small sum of money involved is considered. The reason they must settle, however, is not on account of the possible loss of ten cents, but because the most important principle in bank accounting is involved. "Accuracy first" is a motto that should be framed, figuratively at least, upon the wall of every banking room. The books used by ABL are of various kinds and their purpose is indicated by name. A ledger is a book used to keep a record of balances. To "post" means to enter in the proper columns either the debits or credits on the ledger, and the difference between them represents the balance either due by or to the bank. Another important book which is used by the ABL is journal, a book in which daily transactions are listed in regular order as to accounts, and the total debit or credit is then posted on the ledgers. All other books, cards and sheets used by bank of whatever nature is a part or subdivisions of these books. Often they become known among the clerks by some other name descriptive of their general appearance. For instance, the general ledger scratcher in one bank is known as the "red book," while the collection scratcher is the "black book." The records made by one clerk upon one set of books go to check the records of another clerk upon a different set of books. For instance, the paying teller and the receiving teller will each keep a record of checks cashed or deposited payable within the bank. The debit postings of the individual bookkeeper would agree with the teller's figures. Skillful accounting lies in making the fullest possible use of original entries, at the same time having a check on all figures to guard against either error or fraud. Every transaction ultimately affects the bank's statement of condition by debit or credit. For example, a deposit of Rs.1000 is made, consisting of Rs.200 cash and checks as follows: Rs.200 on the bank itself and Rs. 600 payable in another city. At the end of the day (assuming this to be the only deposit), on the liabilities side there is an increase of Rs 800 all of which appears in the item "deposits" being the total Rs.1000, less the check for Rs 200 which is charged to the account of the drawer. On the resource side, then, a corresponding increase of Rs.800 and this is made up by an increase in the cash of Rs 200 and an increase of Rs.600 in the item "due from banks." Or a transaction may appear on one side of the statement only. The bank has sold Rs.5, 000.00 of the bonds it owns.

P a g e | 56

5.3

ROLE OF CFO (CHIEF FINANCIAL OFFICER)

The organizations most senior executive role charged with leading and directing

financial strategy and operations.

Financial Management:

Public Financial Management (PFM) is the system by which financial resources are planned, directed, and controlled to enable and influence the efficient and effective delivery of public service goals.

ROLE OF CFO (Chief Financial Officer):