Professional Documents

Culture Documents

Mobile Banking A Growing and Lucrative Market PDF

Uploaded by

Ali ShamsheerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mobile Banking A Growing and Lucrative Market PDF

Uploaded by

Ali ShamsheerCopyright:

Available Formats

Mobile BankingA Growing and Lucrative Market

Deborah Sumner, VP, Financial Services Practice Lead

reprinted from November 2010 www.nielsenwire.com

SUMMARY: Consumers desire for a fast, easy way, to be in control of their finances is driving the increased adoption of mobile banking. Financial institutions are seeing positive effects to their bottom line as it creates cost savings and improved customer loyalty. Perhaps the most rewarding reason to pursue a mobile banking value proposition is because mobile bankers maintain higher average balances and have a greater net worth than the average customer.

The mobile banking consumer carries a higher balance than the average banking consumer and has a greater net worth. While still only representing a small percentage of banking households, that number is increasing. Understanding the unique needs of this lucrative segment could mean winning and retaining valuable customers. To get into the mindset of the mobile banking consumer, Nielsen profiles five segments of consumers and offers strategies on how to reach them. Consumer confidence and comfort levels in transacting over mobile devices are at an all time high. For financial institutions, mobile banking creates efficiencies, cost savings, drives customer loyalty, engages new segments and offers real-time solutions. But to truly understand the needs of the mobile banking user, banks must go beyond basic mobile services and learn how they interact with financial institutions. Nielsen examined the mobile banking user and found that 13.2% of households accessed their bank account via a mobile device in second quarter 2010 versus 20.8% who accessed their account via the banks customer service call center. While mobile access penetration is lower than other channels, it has grown from 11.6% in first quarter and call center access has remained relatively flat quarter-over-quarter.

Copyright 2010 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered trademarks of The Nielsen Company. 10/2448

Market Average

Phone Access

Online Banking

Mobile Access

Chart 1 Mobile Activities

% HHs Used Service in Last 90 Days

25 20 15 10 5 0 Accessed Acct Info by Phone Q1 2010 Accessed Accts via Mobile Device Q2 2010 11.6 13.2

20.7

20.8

Source: Nielsen Financial Track. National sample = 19,971 for Q1 and Q2 2010.

Mobile banking users also bring greater value to an institution by maintaining higher average balances ($64,303) versus ($48,384) for the average customer and greater net worth ($341,017) versus their online banking counterparts ($313,346) or the market average ($281,263).

$400,000 Chart 2 Average Deposit Balance $350,000 $100,000 $300,000 $80,000 $250,000

Average Household Net Worth

Average Balance Held in $317,113 Deposit Accounts per Household $281,263

$341,017 $313,346

$60,000 $200,000

$100,000 $40,000 $150,000 $20,000 $0 Market Average Phone Access Online Banking

$64,303 $48,384 $53,138 $49,553

Mobile Access

0 Market Average Phone Access Online Banking Mobile Access

Source: Nielsen Financial Track. National sample = 55,428 for three quarters ending Q3 2010.

vice in Last 90 Days

25 20

Copyright 2010 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered 15 trademarks of The Nielsen Company. 10/2448

20.7

20.8

Chart 3 Average Net Worth

$400,000 $350,000 $300,000 $250,000 $200,000 $100,000 $150,000 $0 Market Average Phone Access Online Banking Mobile Access

Source: Nielsen Financial Track. National sample = 55,428 for three quarters ending Q3 2010.

Average Household Net Worth

$317,113 $281,263 $341,017 $313,346

Who is the Mobile Banker

Unlike other channel strategies, mobile banking defies specific demographic categories such as age and income. Nielsen identified distinct characteristics of the mobile banker and grouped them into five segments, each with a specific mobile mindset. In order to deliver true customer value and a unique customer experience, it is necessary to know what drives the mobile banking consumer. Mobile Office Workers Representing 14.8% of mobile bankers and 9% of the U.S. population, this group of image-conscious, brand-centric, career-minded multi-taskers likes to stand out in the crowd. Mobile Office Workers are younger to middle age (35-54) and are more likely to engage in mobile banking than any of the other groups. They rank highest for Smartphone ownership and they stay connected by consuming information such as news, sports and finance. Their friends are a big part of their liveseven more important than their families. Social Texters Comprising one out of five mobile bankers and 14.3% of the population, this segment of racially-diverse, techno-adopter, social butterfly millennials believes money is a measure of success. Social Texters are the youngest mobile group (18-24) and are generally still in college. They are most are likely getting financial support from their parents and are more likely to have a prepaid feature phone. They index high on checking their balancesor more likely checking for deposits from parents (see Country Club Communicators). Country Club Communicators Making up 12.8% of mobile bankers and 11.6% of the population, this group of older, educated, wealthy empty nesters appreciates the finer things in life. Country Club Communicators are the oldest (45-64), wealthiest and most educated of the mobile mindsets. They index high for Smartphone ownership and they have adapted to mobile technology to keep in touch with their children (see Social Texters) and therefore have a higher propensity to use SMS text messaging. They are loyal to their bank and use a variety of banking services and products

Copyright 2010 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered trademarks of The Nielsen Company. 10/2448

Mobile Basics Covering 11.3% of mobile bankers and 10.8% of the population, this segment of practical, family oriented, small town, blue collar workers are interested in the no frills option. In Touch, On the Go Including 6.8% of mobile bankers and 7% of the population, these suburban soccer moms and dads tend to buy on impulse. Both Mobile Basics and In Touch, On the Go are middle age (35-54) and are more likely to own a feature phone. They have a lower propensity to mobile bank and use their phones for the most basic needs of communicating with family and checking balances. Both groups use a variety of credit to manage their cash flow and they are generally not savers except for retirement or their childrens college. Cashing in on Opportunities Mobile banking provides rewarding opportunities to financial institutions who know how to connect with the right consumer groups: Drives loyaltyMobile banking creates an ongoing uniform, consistent dialogue with the customer. Banks should look to Mobile Office Workers friends to help market the benefits of mobile banking, as they are an important part of their life. Tell-a-friend and word-of-mouth programs are ways to engage with this group. Engages new segments Mobile banking opens up new groups previously underserved; unbanked, younger or out-of-footprint. Even though Country Club Communicators are not as sophisticated as their Mobile Office Worker counterparts, they have adapted in order to remain connected with their children and have a higher propensity to use SMS text messaging. Banks should create family plans that parents and children can equally take advantage of; these plans should be communicated by Country Clubs personal banker or trusted financial advisor. Empowers Mobile banking provides customers with control of their finances with real-time interaction. Mobile Basics and In Touch, On the Go tend to be at the opposite end of the mobile banking spectrum, however they still have a need to be in charge of their finances. They rank high in checking their balances and using credit to manage their cash flow. Banks should create marketing messages that stress control and offer simple SMS text message alerts for overdrafts, potential fraud and payment due dates. Offers solutions, not a product push Mobile banking creates a vehicle for offering products that customers want and need at the exact moment when they need them. Real-time response isnt easily replicated in most other channels. Regardless of the consumer mindset, this creates a positive customer experience and can be used across all groups to broaden the mobile universe.

Its hard to deny the ubiquity of the mobile phone and mobile banking is the perfect complement, and offers something for every degree of technology adoption and comfort level. SMS, mobile web and downloadable applications provide a variety of simple functionality to a higher level of sophistication that is core to delivering unique customer engagements. Its important for banks to be able to connect the banking behavior to the face and mindset of the mobile consumer to deliver a relevant and valuable user experience.

Article printed from Nielsen Wire: http://blog.nielsen.com/nielsenwire

Copyright 2010 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered trademarks of The Nielsen Company. 10/2448

You might also like

- Reporting ProcedureDocument8 pagesReporting ProcedureAli ShamsheerNo ratings yet

- FATCADocument2 pagesFATCAAli ShamsheerNo ratings yet

- Annexure - G Customer Due Diligence Check List (To Be Filled in Before Sending The Same To CPU)Document1 pageAnnexure - G Customer Due Diligence Check List (To Be Filled in Before Sending The Same To CPU)Ali ShamsheerNo ratings yet

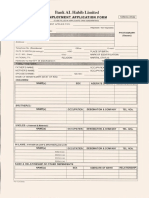

- Employment Application FormDocument4 pagesEmployment Application FormAli Shamsheer100% (1)

- ITRS User ManualDocument49 pagesITRS User ManualWajidSyed100% (1)

- Nielsen Global New Products Report Jan 2013Document22 pagesNielsen Global New Products Report Jan 2013Ali ShamsheerNo ratings yet

- FINAL Securities RulesDocument37 pagesFINAL Securities RulesAli ShamsheerNo ratings yet

- RMG Presentation PoretfolioDocument10 pagesRMG Presentation PoretfolioAli ShamsheerNo ratings yet

- KycDocument51 pagesKycAli ShamsheerNo ratings yet

- SBP Regulatory RegimeDocument73 pagesSBP Regulatory RegimeUmer SafdarNo ratings yet

- Outlook of Smartphone Usage in Brazil: A Study Analysis Made by Wmccann and GrupoDocument95 pagesOutlook of Smartphone Usage in Brazil: A Study Analysis Made by Wmccann and GrupoAli ShamsheerNo ratings yet

- Equal OpportunityDocument24 pagesEqual OpportunityAli ShamsheerNo ratings yet

- General ConsentDocument1 pageGeneral ConsentAli ShamsheerNo ratings yet

- Equal OpportunityDocument24 pagesEqual OpportunityAli ShamsheerNo ratings yet

- Lecture No20Document14 pagesLecture No20Ali ShamsheerNo ratings yet

- The Behavior of Costs: Part Two: Management AccountingDocument22 pagesThe Behavior of Costs: Part Two: Management AccountingAli ShamsheerNo ratings yet

- AML CFT RegulationsDocument35 pagesAML CFT RegulationsMussadaq JavedNo ratings yet

- Equal OpportunityDocument24 pagesEqual OpportunityAli ShamsheerNo ratings yet

- Socializing, Orienting, and Developing EmployeesDocument25 pagesSocializing, Orienting, and Developing EmployeesAli ShamsheerNo ratings yet

- Ali InflationDocument17 pagesAli InflationAli ShamsheerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit 17 Assignment 1Document25 pagesUnit 17 Assignment 1Zayan Bread100% (1)

- 3GPP TS 25.141Document268 pages3GPP TS 25.141holapaquitoNo ratings yet

- DWR 956 (D Link) - Manual - tcm94 309334Document72 pagesDWR 956 (D Link) - Manual - tcm94 309334theappstation.11aNo ratings yet

- SO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioDocument231 pagesSO On Manua Accounting Valix Peralta Valix VOL ME - 201 EditioAnne EstrellaNo ratings yet

- Health Suraksha Claim FormDocument2 pagesHealth Suraksha Claim FormAnna MalaiNo ratings yet

- Cfap1 Aafr PK PDFDocument386 pagesCfap1 Aafr PK PDFImran100% (1)

- 5f388b962f84e - BANK RECONCILIATION STATEMENT PDFDocument4 pages5f388b962f84e - BANK RECONCILIATION STATEMENT PDFYogesh ChaulagaiNo ratings yet

- Nokia Practice Exam For Nokia Services Architecture (4A0 104) Document ENDocument11 pagesNokia Practice Exam For Nokia Services Architecture (4A0 104) Document ENPadawan ingéNo ratings yet

- Screenshot 2023-06-23 at 11.12.58 AMDocument13 pagesScreenshot 2023-06-23 at 11.12.58 AMR P CNo ratings yet

- Lohit Express Second Ac (2A)Document1 pageLohit Express Second Ac (2A)bagdogra bagdograNo ratings yet

- Jio Company (1) - RemovedDocument53 pagesJio Company (1) - RemovedLucky SrivastavaNo ratings yet

- The Arts Club Membership ApplicationDocument5 pagesThe Arts Club Membership ApplicationkerstinsaidlerNo ratings yet

- MakeMyTrip - Case Study Pre - ReviewDocument21 pagesMakeMyTrip - Case Study Pre - ReviewUtkarsh SinghNo ratings yet

- TIA Guidelines WCP Final 7 Dec 2018Document99 pagesTIA Guidelines WCP Final 7 Dec 2018SJNo ratings yet

- Agilent G2571-65400 (Tested) - SPW IndustrialDocument4 pagesAgilent G2571-65400 (Tested) - SPW Industrialervano1969No ratings yet

- ABM 1 Module 3 - Lesson 1Document13 pagesABM 1 Module 3 - Lesson 1John Luis MartinezNo ratings yet

- HIPAA Authorization FormDocument4 pagesHIPAA Authorization FormAmhir Angedan VillanuevaNo ratings yet

- 8301077194, Cva - 0H34 - D8R PM Service 250 HRSDocument5 pages8301077194, Cva - 0H34 - D8R PM Service 250 HRSArifNo ratings yet

- The Basics of Underwriting InsuranceDocument4 pagesThe Basics of Underwriting Insurancenetishrai88No ratings yet

- Packet Tracer - Troubleshoot Etherchannel: ObjectivesDocument2 pagesPacket Tracer - Troubleshoot Etherchannel: Objectivesnasywa affhNo ratings yet

- Sl. No. Postal Division Office Name Office Status Pincode Telephone Number Postal Region Postal CircleDocument5 pagesSl. No. Postal Division Office Name Office Status Pincode Telephone Number Postal Region Postal CircleKavinth KarthikNo ratings yet

- Task 6Document3 pagesTask 6Ansell CristianNo ratings yet

- Gearlines Profile Final For PrintingDocument10 pagesGearlines Profile Final For PrintingMiguel Benedict GarciaNo ratings yet

- Electronic Funds TransferDocument14 pagesElectronic Funds TransferRaj KumarNo ratings yet

- Invoice 16584 PDFDocument1 pageInvoice 16584 PDFfranshadiNo ratings yet

- Case Study Questions Product ManagerDocument4 pagesCase Study Questions Product ManagerClinton OnyenemezuNo ratings yet

- Accounts Payable: Vendor Master, Invoicing, Payments & ReportsDocument23 pagesAccounts Payable: Vendor Master, Invoicing, Payments & ReportspsmNo ratings yet

- Òwb QVM Weáwßó: WWW - Cmc.Gov - BDDocument3 pagesÒwb QVM Weáwßó: WWW - Cmc.Gov - BDIqBal HossaiNNo ratings yet

- Cisco Ccie R - S Book Reading ListDocument4 pagesCisco Ccie R - S Book Reading ListGauthamNo ratings yet

- Guideline For Forex Transaction Bangladesh V2 2018Document168 pagesGuideline For Forex Transaction Bangladesh V2 2018ziad123456789No ratings yet