Professional Documents

Culture Documents

Michael Buckley Medicare Op-Ed

Uploaded by

michaeleugenebuckleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michael Buckley Medicare Op-Ed

Uploaded by

michaeleugenebuckleyCopyright:

Available Formats

Medicare Reaches Middle Age by Edward F.

Coyle Medicare turns 47 this month and reaches a crossroads familiar at middle age: a proud record of success, but also an uncertain future. Medicare is a great American success story. Before it, many older Americans lived out their final years in terrible health and great poverty. While too many seniors today are still struggling, their poverty rate is now 75 percent lower since Medicare became law in 1965. Today, nearly all over 65 have health coverage; before Medicare only half did. Here in New Hampshire, Medicare helps over 220,000 retirees better afford to see a doctor and fill a prescription. But despite this success, Medicare faces three major political threats on its 47th birthday. That is why, in this election year, I believe it is imperative that both retirees and workers have a better understanding of the issues and where the candidates stand. The first threat to Medicare was the recent vote in the U.S. House to repeal the Affordable Care Act and its expanded Medicare benefits for retirees. In just a short time, the new law has helped 164,000 New Hampshire retirees receive at least one free preventive test or screening for a serious disease. The 13,000 Granite State seniors with the highest drug costs have saved an average of $620 per year on their prescriptions. The law is closing Medicares doughnut hole coverage gap, and strengthens Medicares long-term finances by ending taxpayer subsidies to private insurance companies. New Hampshire seniors should be troubled by Reps. Bass and Guintas votes to take away these new improvements to Medicare. The second threat to Medicare is a House Republican budget plan, supported by Mitt Romney, that would push seniors toward government-issued vouchers to buy health coverage in the costly, unfair private insurance market. This undercuts the reason Medicare was created the financial reality that only seniors lucky enough to be either healthy or wealthy can afford private insurance. For most seniors, Medicare is their only option. The third threat to Medicare will occur later this year when Congress is likely to consider sweeping spending cuts to lower the federal deficit. Retirees, who paid Medicare taxes in every paycheck of their lives, should not be the victim of unfair sacrifices to fund tax breaks for big corporations and millionaires. There is a New Hampshire angle to these upcoming budget talks former Senator Judd Gregg has recently begun a high-profile effort in Washington to advance the recommendations of a fiscal commission he served on in 2010. On that panel, Gregg supported reducing Medicare benefits, raising the eligibility age, and privatizing the program. In this years debate Gregg, now a paid adviser to Goldman Sachs, is advocating Medicare changes that are badly out of

touch with the needs of New Hampshire seniors and could also financially benefit corporations he works with in his new Wall Street role. Seniors care about more than just themselves. They worry about their children and grandchildren, and what life will be like when they are older. Todays retirees dont want to be the last generation to retire. They want Medicare to remain strong if not stronger for when todays workers retire. As Medicare reaches middle age, we must acknowledge the great strides that retirees have made in the 47 years since Medicare became law. But in this election year, we must make sure we do not turn back the clock on this progress.

Edward F. Coyle is the Executive Director of the Alliance for Retired American, a national grassroots organization with over 13,000 members in New Hampshire. For more information, visit www.retiredamericans.org or call 1-800-333-7212.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

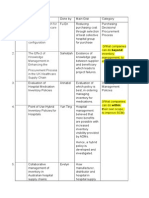

- Near Miss Error Log and Table 2Document2 pagesNear Miss Error Log and Table 2Nurfidini AzmiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lesson 15 Case StudyDocument6 pagesLesson 15 Case StudyMashaal Fasih100% (2)

- Picadilly Cinemas Excursion Risk Management PlanDocument8 pagesPicadilly Cinemas Excursion Risk Management Planapi-2955784680% (1)

- Athletes Payroll 1 SM SDP Month of August 2018Document28 pagesAthletes Payroll 1 SM SDP Month of August 2018kervin torresNo ratings yet

- Table B.1 Expenditure Program by Object 2010-2012Document4 pagesTable B.1 Expenditure Program by Object 2010-2012Burtonium PartosaNo ratings yet

- AARP - Medicare Starter Kit - EnglishDocument8 pagesAARP - Medicare Starter Kit - EnglishRichard G. FimbresNo ratings yet

- Older adults prefer active activitiesDocument6 pagesOlder adults prefer active activitiesErine Emmanuelle Cawaling HetrosaNo ratings yet

- Nueces County Hospital District Christus SpohnDocument19 pagesNueces County Hospital District Christus SpohncallertimesNo ratings yet

- Haiti Medical Clinic PowerpointDocument19 pagesHaiti Medical Clinic Powerpointodf3eeNo ratings yet

- Delegation DelegationDocument4 pagesDelegation Delegationapi-299331913No ratings yet

- NYS Dept. of Health: NY State of Health PresentationDocument39 pagesNYS Dept. of Health: NY State of Health PresentationState Senator Liz KruegerNo ratings yet

- Nathan Purdy CV 1Document2 pagesNathan Purdy CV 1api-254786944No ratings yet

- All India HospitalDocument98 pagesAll India HospitalVishal ChopraNo ratings yet

- 0275978850Document242 pages0275978850Cla ValenciaNo ratings yet

- AppendixDocument3 pagesAppendixAnnabel SeahNo ratings yet

- McKesson - Disruptors Path To Better Health EbookDocument14 pagesMcKesson - Disruptors Path To Better Health EbookBayCreativeNo ratings yet

- Healthcare Kaizen: Engaging Front-Line Staff in Sustainable Continuous ImprovementsDocument60 pagesHealthcare Kaizen: Engaging Front-Line Staff in Sustainable Continuous ImprovementsPinky CerebroNo ratings yet

- Organisational Structure - Asian HeartDocument13 pagesOrganisational Structure - Asian HeartshwetadhotarNo ratings yet

- ContarctDocument3 pagesContarctJunaid AnwerNo ratings yet

- Ayushman Bharat - KailashDocument11 pagesAyushman Bharat - KailashKailash NagarNo ratings yet

- New Approach to Insurance SegmentationDocument4 pagesNew Approach to Insurance Segmentationpriyanka555No ratings yet

- Medical Billing Training ManualDocument51 pagesMedical Billing Training ManualRadha Raman SharmaNo ratings yet

- Universal Health Care ActDocument1 pageUniversal Health Care Actdiocesan schoolsNo ratings yet

- OMB Notice of Medicare Coverage EndDocument2 pagesOMB Notice of Medicare Coverage Endjim ramirezNo ratings yet

- 834 2224 1 SMDocument1 page834 2224 1 SMpatelmsNo ratings yet

- Aravind Eye Care SystemDocument5 pagesAravind Eye Care SystemArpit GuptaNo ratings yet

- LaNay Abogah, RN, BSN, CEN ResumeDocument3 pagesLaNay Abogah, RN, BSN, CEN ResumeLaNay AbogahNo ratings yet

- Basics L10 U.S.Healthcaresystem PDFDocument7 pagesBasics L10 U.S.Healthcaresystem PDFNanyiLidiaMateoLucianoNo ratings yet

- Proposed Rule: Medicaid: Non-Emergency Medical Transportation Program State Option To EstablishDocument5 pagesProposed Rule: Medicaid: Non-Emergency Medical Transportation Program State Option To EstablishJustia.comNo ratings yet

- GEHealthcare Brochure Aisys CarestationDocument12 pagesGEHealthcare Brochure Aisys CarestationcardiacanesthesiaNo ratings yet