Professional Documents

Culture Documents

Business Plan On Internet Service Provider

Uploaded by

Anonymous 55cr6tsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Plan On Internet Service Provider

Uploaded by

Anonymous 55cr6tsCopyright:

Available Formats

Business Plan On Internet Service Provider

06. Mar, 2013 View with images and charts Business Plan On Internet Service Provider

Company History

Web Services Provider began as a Web hosting company. The company developed a highlyskilled engineering team dedicated to developing a system to offer clients the greatest degree of reliability and bandwidth at a more affordable price. Web Services Provider, with its in-depth knowledge of Web hosting systems, is now evolving into a large, specialized, Web hosting service provider. Past Performance Sales Gross Margin Gross Margin % Operating Expenses Collection Period (days) Balance Sheet 1997 Current Assets Cash Accounts Receivable Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 1998 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 1999 $2,450 $14,200 $1,050 $17,700 $5,250 $1,000 $4,250 $21,950 $10,000 $500 $10,900 1997 $0 $0 0.00% $0 0 1998 $0 $0 0.00% $0 0 1999 $900,000 $700,000 77.78% $700,000 3

(interest free) Total Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Other Inputs Payment Days Sales on Credit Receivables Turnover

$0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 0 $0 0.00

$21,400 $3,550 $24,950 $100,000 ($103,000) $0 ($3,000) $21,950 30 $900,000 63.38

Total Capital and Liabilities $0 0 $0 0.00

Services

Main services provided by Web Services Provider are outlined below. 1. DSL. A Digital Subscriber Line (DSL) is high-speed Internet access that is an on all the time connection and ranges in speed from 144k to 6Gb transfer rate. 2. Hosting. Web hosting clients generally have the company place a single, or several, website on a server in our facility and pay for the amount of disk space that they need to operate their site. 3. Dedicated Server. Clients seeking to maximize the speed of their site due to high traffic or download will lease a dedicated server from Web Services Provider, leaving the maximum capability of the server all to their own site. 4. Co-location. Co-location customers provide the hardware themselves and administer their site or sites via the Internet. When hosting and dedicated server clients are secured, orders will be processed immediately and the customer can be up and running within a few minutes. Dedicated server clients can be online within 1-2 hours unless a special server must be built.

Future Services

Having already established the relationships and infrastructure, Web Services Provider will continue to search for emerging and existing technologies to improve and expand lines of business. As advances in technology continue, Web Services Provider will upgrade to meet specific objectives of present and future clientele. Web Services Provider plans to respond to market needs by keeping abreast of all new technologies and updates to be first to market using its already established lines of business as a

market vehicle. Web Services Provider will move quickly on plans for next generation products/services. Market Analysis Summary Web Services Providers key markets for DSL are small and medium businesses, nationwide. Web Services Providers key markets for Web hosting and resale accounts are Web design firms, individuals, and small businesses with a need for space on a server. Web Services Providers key markets for dedicated servers are small to large companies where security and speed are necessary. Web Services Providers key markets for co-location include medium and small businesses such as online trading, e-tailers, online information sites, and entertainment companies. Within these markets, Web Services Provider focuses on the more lucrative dedicated server and co-location clientele because they create less overhead and more profit than equal revenue generating, smaller clients. Additionally, these markets require less service-intensive efforts and create more profit. Its margins are 40%-80% on larger and medium size clients. Computer telephony integration (CTI) is the convergence of the telephone and computing industries. Currently, the CTI market totals $4 billion and is growing at 30% a year, with many segments growing at a rate of over 100% a year. The Washington-based MultiMedia Telecommunications Association estimates that the CTI market will grow by nearly 70% in the next year, and triple by the year 2000. Consumers improve their shopping experiences In a relatively short period of time, the Internet has provided the savvy consumer with a number of benefits, particularly convenience and information. Obviously, consumers who shop online face a much different experience than they would in real-world retail. First and foremost, a shopper need not leave the comfort of home or office in order to make a purchase. The convenience of online shopping has proven to be a big attraction for many consumers, particularly for goods that are not needed immediately, like books, CDs, or apparel. The information that is currently available online is another boon to consumers. It is relatively easy to conduct research on various products over the Internet, giving consumers all the information they need to help make an informed decision regarding a major purchase. Consumers can thoroughly research big-ticket items like cars, electronics, or computers for desired features, product performance, or price. The cost of a product has become simple to research through many search engines. A consumer need only specify a product, type it in the appropriate place on a comparison-oriented website, and then examine the resulting list of prices, which contains links to the selling websites. While consumers do not always purchase the lowest-priced item, the nature of the Internet makes comparison shopping so easy that prices in many categories of goods will undoutably decline over time. Market Analysis 2000 2001 2002 2003 2004

Potential Growth CAGR Customers Online E15% 200,000 230,000 264,500 304,175 349,801 15.00% trading Entertainment 10% 160,000 176,000 193,600 212,960 234,256 10.00% Global 15% 95,000 109,250 125,638 144,484 166,157 15.00% Corporations Corporations 10% 100,000 110,000 121,000 133,100 146,410 10.00% Total 12.74% 555,000 625,250 704,738 794,719 896,624 12.74%

Market Segmentation

Web Services Provider is aiming to establish itself in markets that it believes will define the future of Web hosting. The company is pursuing dedicated server and co-location accounts, online trading companies, and e-entertainment companies because they need bandwidth, 24-hour access for their customers, faster connections, and other services for their clients which the company able to provide. The companys target customers are as follows.

Online E-trading. Entertainment. Global Corporations. Corporations.

The Internet As of year-end 1998, almost 160 million users accessed the Internet regularly, up from approximately 101 million at the end of 1997, according to IDC, an industry analysis and research company. Clearly, the Internet is in an exceptional growth phase. This growth has pushed the capacity of existing networking infrastructure to its limits, resulting in frustration by Internet users. Still, consumers have found the Internet to be a useful tool in the research and purchase of goods and services. Corporations have found that, while the Internet is challenging traditional business models, it also offers significant advantages to companies that fully embrace the medium. Market Trends Exceptional growth By any measure, the Internet is one of the fastest-growing commercial phenomena ever witnessed by society. Host computers, or servers, have exploded from 3.2 million in 1994 to roughly 56.2 million as of July 1999. During the same time period, the number of websites roared to more than 5 million from only 3,000. A key factor in the recent growth of the Internet is the popularity of the sub-$1,000 PC. Rapidly falling component prices have allowed PC manufacturers to pass cost savings on to their customers, resulting in a more attractively priced product. Computers sold at or below the $1,000

level have appealed to first-time PC users and lower income families. Because of the more affordable prices, PC penetration in the United States is now approximately 50%, according to Dataquest, a market research firm based in San Jose, California. As a result of the Internets historical roots in the U.S. Department of Defense, as well as the rising penetration of PCs, the United States accounts for more than half of the worlds total Internet users. The European market, by contrast, has been held back by the high cost of Internet access. Consumers are typically billed twice in these markets, once by the ISP and once by the phone company. However, the forces of telecommunications deregulation in Europe finally appear to be having an effect, as several phone companies have recently eliminated access fees and now bill only on a per-minute basis. Such moves should eventually increase the penetration of the Internet in Europe. In the United States, less than one-third of the population is connected, leaving plenty of room for growth. In 1996, people asked colleagues and friends if they had an electronic mail address. In 1997, people were asked what their electronic mail address was. When consumers today are asked why they purchased a personal computer, the most common answer is to connect to the Internet to get their email.

Market Growth

Bandwidth bottlenecks frustrate consumers Todays telecommunications network infrastructure was not designed for the booming traffic created by Internet use. Ordinary telephone lines are optimized for short conversations, whereas Internet users typically stay online for ours at a time. Growing corporate use of the Internet to communicate with suppliers and customers has put additional strains on the system. Adding to the capacity problem are the use of multimedia attachments to email, more complex multimedia websites, larger files being downloaded by users, and other bandwidth-hungry applications. Although the predicted global meltdown of the Internet has not come to pass, delays in navigating the Web and in receiving email continue to plague the industry and frustrate users. But solutions are on the way The vast majority of Internet users use dial-up modems to access the Internet through their ISPs. As a result of the capacity constraints inherent in using analog modem technology over copper wires, 56 kilobits per second is the maximum capacity available today for most residential customers. New technologies, such as cable modems and digital subscriber line (DSL) systems, promise a quantum leap in bandwidth: up to 30 megabytes per second (Mbps) and 12 Mbps, respectively. Both technologies also offer an added advantage in that they are always on: a consumer need not physically dial into an ISP to access the Internet.

Cable modems. The nascent market for cable modems is beginning to exhibit strong growth. The number of cable Internet service subscribers numbered more than 1 million as of July 1999, up from 500,000 in 1998. The current leaders in this burgeoning market are Excite@Home and RoadRunner, North Americas No. 1 and No. 2 cable modem services, respectively. RoadRunner is provided by ServiceCo LLC-a joint venture, led by time Warner Inc. that includes MediaOne Group, Inc., Microsoft Corporation, Compaq Corporation, and Advance/Newhouse Partnership, a private firm. Digital subscriber lines. These systems allow telephone companies to offer faster service over copper wires by reducing signal distortion. The number of DSL subscribers was approximately 20,000 in 1998. The fastest form of DSL is asymmetric digital subscriber line, or ADSL, includes Ameritech Corporation, SBC Communications Inc., Bell Atlantic Corporation, U S. WEST Inc., Sprint Corporation, MCI World Com Inc., and GTE Corporation.

In contrast to cable modems, which have been deployed in select regions for a few years, consumer-oriented DSL service is only now being rolled out more aggressively. Cable companies have also resolved their standardization issues and have come further in preparing their networks for broadband than have the telcos. While the number of DSL subscribers should exhibit strong growth in 1999, it appears that cable modems will still command the bulk of the broadband market. One reason is that cable modems have an inherent speed advantage. The consumer friendly version of ADSL, known as G.Lite, offers speeds of up to 1.5 Mbps, compared with top speeds of 30 Mbps for cable modems. Limitations Aside from bandwidth constraints, another more serious problem has recently been brought to light, which threatens to forestall the previously explosive growth of the Internet. According to a study conducted by the Department of Commerce, significant disparities continue to exist between certain demographic groups and regions with regard to Internet access. For example, those households with incomes of $75,000 or higher are more than twenty times as likely to have Internet access than those at the lowest income level. The presence of such disparities would seem to limit the potential growth of the Internet, and would likely impact many of the market forecasts discussed in the Industry Profile section of this report. However, both government and businesses are aware of the problem and are currently taking steps to close this so-called digital divide. The U.S. government plans to use community centers to increase access to the Internet for all Americans. Meanwhile, many businesses also plan to help educate and train individuals who may otherwise be at a disadvantage i n todays increasingly technological workplace. Far-reaching benefits Although the Internet is still evolving as a medium for communications and commerce, it has already had a substantial impact on both consumers and businesses. For consumers, the advent of

online shopping has brought greater convenience, while businesses have enjoyed productivity gains.

Competition and Buying Patterns

Competitive threats come from the more established hosting companies with large amounts of operating capital. Their weaknesses are, however, even with strong brand awareness, they cannot afford to move their facilities. This ties them to their current locations, which lack adequate bandwidth, speed, and reliability due to their connections through local telco connectivity. DSL. Web Services Providers competitors include other XDSL resellers. Hosting. Web Services Providers competitors include online Web hosting companies. Dedicated Server. Web Services Providers competitors include companies providing single site Web servers for increased speed and reliability. Co-location. Web Services Providers competitors include Web hosting companies offering customer or vendor provided large server or servers housed in their facilities and usually managed over the Internet by the custome Marketing Web Services Provider markets its products as solutions to high traffic and bandwidth-intensive Web companies whose online reliability and speed are critical to daily business. Target companies include online stock trading companies, e-tailers, and corporations with graphics and/or streaming video. Sales are made through Web Services Providers national advertising campaign. The sales process involves several steps which include: 1. The first contact when the perspective customers first impression is made while viewing one the magazines in which we advertise. 2. At this point, the customer will call our sales line or go to our website. 3. The customer can then call the sales line where a trained representative will answer questions and proceed with initiating service and billing. This approach will be used because each customers concerns and needs will be met immediately to capture the customer at this point of contact. The average sales cycle from first contact to closing the sale is between one and seven days. Sales Forecast 2000 Sales All Services 2001 2002

$1,500,000 $4,500,000 $7,500,000

Other Total Sales Direct Cost of Sales All Services Other Subtotal Direct Cost of Sales

$0 $0 $0 $1,500,000 $4,500,000 $7,500,000 2000 $100,000 $0 $100,000 2001 $150,000 $0 $150,000 2002 $200,000 $0 $200,000

Value Proposition

Web Services Providers products and services offer the following advantages to customers.

Bandwidth. Reliability. Service. Flexibility.

Competitive Edge

Strategic alliance with VISP VISP is opening up two new facilities in the next three months, one in Atlanta and the other in Seattle. Web Services Provider will have access space on both sites, and with special load-balancing software, will enable the company to guarantee 100% uptime for any dedicated server and co-location client where uptime is critical to their business. AB 299 Internet Connectionmore beneficial than tier system; a tier 1 connection means that you are actually directly connected to the Internet. Downtime-Dynamic load balancinga large part of the problem and downtime with an Internet connection for hosting companies is due to local phone company. Pricedue to the tier 1 connection, Web Services Provider does not have to pay local phone companies connection fees and, as such, its prices are lower than those of competitors.

Marketing Strategy

The Web Services Provider strategy is to advertise key competitive advantages in an effective advertising campaign. The company plans to develop a larger clientele and maintain a price advantage through rapid growth. The companys goal in the next year is to grow its core customer base quickly and efficiently while focusing on the most profitable sector of the market. The companys goal in the 2-5 years is to grow through acquisitions of smaller companies and separate itself from the competition by price and services.

Distribution Strategy

Web Services Provider uses a direct sales force, relationship selling, and sales/support lines to reach its markets. These channels are most appropriate because each customer has special demands and needs to be treated differently. After the initial contact, by magazine, referral, or email, the customer is assessed and assigned a sales rep and tech support person to help them and to familiarize themselves with each individual companys needs and history.

Marketing Programs

The key message associated with the companys products and services is better reliability, speed, and bandwidth for the same price. The companys promotional plan is diverse and includes a range of marketing communications: 1. Public relations. Press releases are issued to both technical trade journals and major business publications such as Wall Street Journal, Business Week, and others. 2. Trade shows. Company representatives attend and participate in several trade shows such as Apex and Comdex. 3. Industry conferences and seminars, research publishing, and print media . Web Services Provider presents its key advantages at conferences and publishes articles about its work in publications such as e-business Advisor, Wired, Microsoft Internet Developer, Web Techniques, Business 2.0, and PC Computing. Local and national public relations will be handled by Creative Garage IIs marketing firm. 4. Print advertising and article publishing. The companys print advertising program includes advertisements in technical trade publications such as E-business Journal, Wired, Web Techniques, Microsoft Internet Developer, Business 2.0, PC Computing, direct mail pieces, brochures, and other print media. 5. Internet. The company currently has plans to redevelop its current website because that is a primary marketing channel.

Strategic Alliances

The company has strategic alliances with VISP. This alliance is valuable because it provides a direct connection to an AB-299 Internet connection with unlimited bandwidth. This relationship is explored more in the Competitive Advantages section.

Management Summary

The companys management philosophy is based on responsibility and mutual respect. Web Services Provider has an environment and structure that encourages productivity and respect for customers and fellow employees. Officers and Key Employees Web Services Providers management is highly experienced and qualified. Key members of the management team, their backgrounds, and responsibilities are as follows. Michael Smith, President and CEO.

James Boyd, Vice President. Personnel Plan 2000 Marketing and Sales Technical Services Accounting Administrative and HR Total People Total Payroll 2001 2002 $150,000 $198,000 $254,000 $150,000 $198,000 $254,000 $60,000 $99,000 $136,000 $120,000 $132,000 $194,000 15 18 22

$480,000 $627,000 $838,000

Financial Plan

Funding Requirements and Uses The company is raising significant new investment for the purpose of growth and operations. This funding will cover operating expenses and product development during this period.

Important Assumptions

The company operates as a Virginia Corporation. The following financial projection is based on sales volume at the levels described in the revenue section and presents, to the best of managements knowledge and belief, the companys expected assets, liabilities, capital, revenues, and expenses. The projections reflect managements judgement of the expected conditions and its expected course of action given the hypothetical assumptions. The table below provides significant assumptions that drive the companys financial projections. General Assumptions 2000 Plan Month 1 Current Interest Rate 10.00% Long-term Interest Rate 10.00% Tax Rate 25.42% Other 0 2001 2 10.00% 10.00% 25.00% 0 2002 3 10.00% 10.00% 25.42% 0

Break-even Analysis

The following chart and table provide the Break-even Assumptions for Web Services Provider.

Break-even Analysis Monthly Revenue Break-even Assumptions: Average Percent Variable Cost Estimated Monthly Fixed Cost $106,438 7% $99,342

Projected Profit and Loss

Web Services Provider is in the early stage of development, thus initial projections have only been made on accounts that are believed to most drive the income statement. Pro Forma Profit and Loss Sales Direct Cost of Sales Other Total Cost of Sales Gross Margin Gross Margin % 2000 $1,500,000 $100,000 $50,000 $150,000 $1,350,000 90.00% 2001 $4,500,000 $150,000 $50,000 $200,000 $4,300,000 95.56% $627,000 $453,000 $4,500 $18,000 $2,000 $7,000 $45,000 $20,000 $15,000 $300,000 $94,050 $0 $1,585,550 $2,714,450 $2,718,950 $0 $678,613 2002 $7,500,000 $200,000 $50,000 $250,000 $7,250,000 96.67% $838,000 $675,000 $5,000 $30,000 $2,000 $8,000 $48,000 $20,000 $24,000 $400,000 $125,700 $0 $2,175,700 $5,074,300 $5,079,300 $0 $1,289,718

Expenses Payroll $480,000 Sales and Marketing and Other Expenses $249,500 Depreciation $4,200 Repairs and Maintenance $12,000 Bank Charges $2,000 Insurance $6,000 Rent $40,000 Depreciation $14,400 Software $12,000 Product Development $300,000 Payroll Taxes $72,000 Other $0 Total Operating Expenses Profit Before Interest and Taxes EBITDA Interest Expense Taxes Incurred $1,192,100 $157,900 $162,100 $0 $39,802

Net Profit Net Profit/Sales

$118,098 7.87%

$2,035,838 45.24%

$3,784,582 50.46%

Projected Cash Flow

The chart and table below depict the projected cash flow for the company. Pro Forma Cash Flow 2000 Cash Received Cash from Operations Cash Sales Cash from Receivables Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations $0 $1,268,367 $1,268,367 $0 $0 $0 $0 $0 $0 $1,250,000 $2,518,367 2000 $480,000 $835,682 $1,315,682 $0 $4,008,333 $4,008,333 $0 $0 $0 $0 $0 $0 $0 $4,008,333 2001 $627,000 $1,754,052 $2,381,052 $0 $0 $0 $0 $0 $300,000 $0 $2,681,052 $0 $7,008,333 $7,008,333 $0 $0 $0 $0 $0 $0 $0 $7,008,333 2002 $838,000 $2,786,959 $3,624,959 $0 $0 $0 $0 $0 $300,000 $0 $3,924,959 2001 2002

Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $0 Principal Repayment of Current Borrowing $500 Other Liabilities Principal Repayment $10,900 Long-term Liabilities Principal Repayment $3,550 Purchase Other Current Assets $0 Purchase Long-term Assets $600,000 Dividends $0 Subtotal Cash Spent $1,930,632

Net Cash Flow Cash Balance

$587,734 $590,184

$1,327,281 $1,917,466

$3,083,375 $5,000,840

Projected Balance Sheet

Projected Balance Sheets for 2000 2002 can be found in the table below, and in the appendices. Pro Forma Balance Sheet 2000 Assets Current Assets Cash Accounts Receivable Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Subtotal Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth $590,184 $245,833 $1,050 $837,068 $1,917,466 $737,500 $1,050 $2,656,016 $5,000,840 $1,229,167 $1,050 $6,231,057 $1,205,250 $14,700 $1,190,550 $7,421,607 2002 $236,089 $0 $0 $236,089 $0 $236,089 $1,350,000 $2,050,936 $3,784,582 $7,185,518 $7,421,607 2001 2002

$605,250 $905,250 $5,200 $9,700 $600,050 $895,550 $1,437,118 $3,551,566 2000 $72,019 $0 $0 $72,019 $0 $72,019 2001 $150,630 $0 $0 $150,630 $0 $150,630

$1,350,000 $1,350,000 ($103,000) $15,098 $118,098 $2,035,838 $1,365,098 $3,400,936 $1,437,118 $3,551,566

$1,365,098 $3,400,936 $7,185,518

Business Ratios

The following table outlines some of the more important ratios from the information retrieval industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 7375. Ratio Analysis 2000 Sales Growth Percent of Total Assets Accounts Receivable Other Current Assets Total Current Assets Long-term Assets Total Assets Current Liabilities Long-term Liabilities Total Liabilities Net Worth Percent of Sales Sales Gross Margin Selling, General & Administrative Expenses Advertising Expenses Profit Before Interest and Taxes Main Ratios Current Quick Total Debt to Total Assets Pre-tax Return on Net Worth Pre-tax Return on Assets Additional Ratios Net Profit Margin Return on Equity 66.67% 17.11% 0.07% 58.25% 41.75% 100.00% 5.01% 0.00% 5.01% 94.99% 2001 200.00% 20.77% 0.03% 74.78% 25.22% 100.00% 4.24% 0.00% 4.24% 95.76% 2002 66.67% 16.56% 0.01% 83.96% 16.04% 100.00% 3.18% 0.00% 3.18% 96.82% 100.00% 96.67% 45.92% 8.00% 67.66% 26.39 26.39 3.18% 70.62% 68.37% 2002 50.46% 52.67% 6.10 48 12.17 Industry Profile 9.70% 25.00% 46.30% 76.60% 23.40% 100.00% 49.40% 21.20% 70.60% 29.40% 100.00% 0.00% 78.10% 0.90% 1.90% 1.57 1.19 70.60% 4.10% 13.80% n.a n.a n.a n.a n.a

100.00% 100.00% 90.00% 95.56% 82.10% 14.13% 10.53% 11.62 11.62 5.01% 11.57% 10.99% 2000 7.87% 8.65% 50.31% 8.89% 60.32% 17.63 17.63 4.24% 79.81% 76.43% 2001 45.24% 59.86% 6.10 40 12.17

Activity Ratios Accounts Receivable Turnover 6.10 Collection Days 58 Accounts Payable Turnover 12.46

Payment Days Total Asset Turnover Debt Ratios Debt to Net Worth Current Liab. to Liab. Liquidity Ratios Net Working Capital Interest Coverage Additional Ratios Assets to Sales Current Debt/Total Assets Acid Test Sales/Net Worth Dividend Payout

27 1.04 0.05 1.00

22 1.27 0.04 1.00

25 1.01 0.03 1.00

n.a n.a n.a n.a

$765,048 $2,505,386 $5,994,968 n.a 0.00 0.00 0.00 n.a 0.96 5% 8.21 1.10 0.00 0.79 4% 12.74 1.32 0.00 0.99 3% 21.19 1.04 0.00 n.a n.a n.a n.a n.a

Appendix

Sales Forecast Jan Sales All 0 $125, Servi % 000 ces 0 Other $0 % Total $125, Sales 000 Direc t Cost of Sales All Servi ces Other Subto tal Direc t Cost of Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

$125, $125, $125, $125, $125, $125, $125, $125, $125, $125, $125, 000 000 000 000 000 000 000 000 000 000 000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$125, $125, $125, $125, $125, $125, $125, $125, $125, $125, $125, 000 000 000 000 000 000 000 000 000 000 000 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 3 3 3 3 3 3 3 3 3 3 3 7 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 3 3 3 3 3 3 3 3 3 3 3 7

Sales Personnel Plan Marketing and Sales Technical Services Accountin g Administra tive and HR Total People Total Payroll 0 % 0 % 0 % Jan $12,5 00 $12,5 00 $5,00 0 Feb $12,5 00 $12,5 00 $5,00 0 Mar $12,5 00 $12,5 00 $5,00 0 Apr $12,5 00 $12,5 00 $5,00 0 May $12,5 00 $12,5 00 $5,00 0 Jun $12,5 00 $12,5 00 $5,00 0 Jul $12,5 00 $12,5 00 $5,00 0 Aug $12,5 00 $12,5 00 $5,00 0 Sep $12,5 00 $12,5 00 $5,00 0 Oct $12,5 00 $12,5 00 $5,00 0 Nov $12,5 00 $12,5 00 $5,00 0 Dec $12,5 00 $12,5 00 $5,00 0

0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 $10,0 % 00 00 00 00 00 00 00 00 00 00 00 00 15 15 15 15 15 15 15 15 15 15 15 15

$40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 00 00 00 00 00 00 00 00 00 00 00 00 Mar 3 Apr 4 May 5 Jun 6 Jul 7 Aug 8 Sep 9 Oct 10 Nov 11 Dec 12

General Assumptions Jan Feb Plan 1 2 Month Curre nt 10.00 10.00 Interes % % t Rate Longterm 10.00 10.00 Interes % % t Rate Tax 30.00 25.00 Rate % % Other 0 0

10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 % % % % % % % % % %

10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 % % % % % % % % % % 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 % % % % % % % % % % 0 0 0 0 0 0 0 0 0 0 Mar Apr May Jun Jul Aug Sep Oct Nov Dec $125, $125, $125, $125, $125, $125, $125, $125, $125, $125, 000 000 000 000 000 000 000 000 000 000 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 $8,33 3 3 3 3 3 3 3 3 3 7 $4,16 $4,16 $4,16 $4,16 $4,16 $4,16 $4,16 $4,16 $4,16 $4,16 7 7 7 7 7 7 7 7 7 7 $12,5 $12,5 $12,5 $12,5 $12,5 $12,5 $12,5 $12,5 $12,5 $12,5

Pro Forma Profit and Loss Jan Feb $125, $125, Sales 000 000 Direct $8,33 $8,33 Cost of 3 3 Sales $4,16 $4,16 Other 7 7 Total $12,5 $12,5

Cost of Sales Gross Margin Gross Margin % Expense s Payroll Sales and Marketin g and Other Expense s Deprecia tion Repairs and Mainten ance Bank Charges Insuranc e Rent Deprecia tion Software

00

00

00

00

00

00

00

00

00

00

00

04

$112, $112, $112, $112, $112, $112, $112, $112, $112, $112, $112, $112, 500 500 500 500 500 500 500 500 500 500 500 496 90.00 90.00 90.00 90.00 90.00 90.00 90.00 90.00 90.00 90.00 90.00 90.00 % % % % % % % % % % % %

$40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 00 00 00 00 00 00 00 00 00 00 00 00

$29,5 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 $20,0 00 00 00 00 00 00 00 00 00 00 00 00

$350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 $1,00 0 0 0 0 0 0 0 0 0 0 0 0 $167 $167 $167 $167 $167 $167 $167 $167 $167 $167 $167 $167 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $1,25 0 $1,20 0 $1,00 0 $2,50 0 $1,20 0 $1,00 0 $2,50 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0 $3,75 0 $1,20 0 $1,00 0

Product $25,0 Develop 00 ment Payroll 15 $6,00 Taxes % 0 Other $0 Total Operatin

$25,0 $25,0 $25,0 $25,0 $25,0 $25,0 $25,0 $25,0 $25,0 $25,0 $25,0 00 00 00 00 00 00 00 00 00 00 00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 $6,00 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$105, $97,7 $97,7 $98,9 $98,9 $98,9 $98,9 $98,9 $98,9 $98,9 $98,9 $98,9 967 17 17 67 67 67 67 67 67 67 67 67

g Expense s Profit Before Interest and Taxes EBITDA Interest Expense Taxes Incurred Net Profit Net Profit/Sa les $6,53 $14,7 $14,7 $13,5 $13,5 $13,5 $13,5 $13,5 $13,5 $13,5 $13,5 $13,5 4 84 84 34 34 34 34 34 34 34 34 30 $6,88 $15,1 $15,1 $13,8 $13,8 $13,8 $13,8 $13,8 $13,8 $13,8 $13,8 $13,8 4 34 34 84 84 84 84 84 84 84 84 80 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$1,96 $3,69 $3,69 $3,38 $3,38 $3,38 $3,38 $3,38 $3,38 $3,38 $3,38 $3,38 0 6 6 3 3 3 3 3 3 3 3 2 $4,57 $11,0 $11,0 $10,1 $10,1 $10,1 $10,1 $10,1 $10,1 $10,1 $10,1 $10,1 4 88 88 50 50 50 50 50 50 50 50 47 3.66 % 8.87 % 8.87 % 8.12 % 8.12 % 8.12 % 8.12 % 8.12 % 8.12 % 8.12 % 8.12 % 8.12 %

Pro Forma Cash Flow Jan Feb Cash Receive d Cash from Operati ons Cash Sales Cash from Receiva bles Subtotal Cash from Operati ons Additio nal Cash

Mar

Apr

May Jun

Jul

Aug

Sep

Oct

Nov

Dec

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$7,100

$11,26 $125, $125,0 $125, $125, $125, $125, $125, $125, $125, $125, 7 000 00 000 000 000 000 000 000 000 000

$7,100

$11,26 $125, $125,0 $125, $125, $125, $125, $125, $125, $125, $125, 7 000 00 000 000 000 000 000 000 000 000

Receive d Sales Tax, VAT, 0.0 HST/G 0% ST Receive d New Current Borrowi ng New Other Liabiliti es (interest -free) New Longterm Liabiliti es Sales of Other Current Assets Sales of Longterm Assets New Investm ent Receive d Subtotal Cash Receive d Expendi tures Expendi

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$1,250 $0 ,000

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$1,257 $11,26 $125, $125,0 $125, $125, $125, $125, $125, $125, $125, $125, ,100 7 000 00 000 000 000 000 000 000 000 000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

tures from Operati ons Cash Spendin g Bill Paymen ts Subtotal Spent on Operati ons Additio nal Cash Spent Sales Tax, VAT, HST/G ST Paid Out Principa l Repaym ent of Current Borrowi ng Other Liabiliti es Principa l Repaym ent Longterm Liabiliti es Principa

$40,00 $40,00 $40,0 $40,00 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 $40,0 0 0 00 0 00 00 00 00 00 00 00 00 $12,66 $79,85 $73,5 $73,59 $74,5 $74,5 $74,5 $74,5 $74,5 $74,5 $74,5 $74,5 9 9 62 4 00 00 00 00 00 00 00 00

$52,66 $119,8 $113, $113,5 $114, $114, $114, $114, $114, $114, $114, $114, 9 59 562 94 500 500 500 500 500 500 500 500

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$500

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$10,90 $0 0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$3,550 $0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

l Repaym ent Purchas e Other Current Assets Purchas e Longterm Assets Dividen ds Subtotal Cash Spent Net Cash Flow Cash Balance

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$150,0 $30,00 $30,0 $150,0 $30,0 $30,0 $30,0 $30,0 $30,0 $30,0 $30,0 $30,0 00 0 00 00 00 00 00 00 00 00 00 00 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$217,6 $149,8 $143, $263,5 $144, $144, $144, $144, $144, $144, $144, $144, 19 59 562 94 500 500 500 500 500 500 500 500 $1,039 ($138, ($18, ($138, ($19, ($19, ($19, ($19, ($19, ($19, ($19, ($19, ,481 593) 562) 594) 500) 500) 500) 500) 500) 500) 500) 500) $1,041 $903,3 $884, $746,1 $726, $707, $687, $668, $648, $629, $609, $590, ,931 38 776 82 683 183 683 183 684 184 684 184 Apr May Jun Jul Aug Sep Oct Nov Dec

Pro Forma Balance Sheet Jan Feb Mar Starti ng Assets Balan ces Curren t Assets Cash Accou nts Receiv able Other Curren t Assets Total Curren

$2,45 $1,04 $903, $884, $746, $726, $707, $687, $668, $648, $629, $609, $590, 0 1,931 338 776 182 683 183 683 183 684 184 684 184 $14,2 $132, $245, $245, $245, $245, $245, $245, $245, $245, $245, $245, $245, 00 100 833 833 833 833 833 833 833 833 833 833 833

$1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 $1,05 0 0 0 0 0 0 0 0 0 0 0 0 0 $17,7 $1,17 $1,15 $1,13 $993, $973, $954, $934, $915, $895, $876, $856, $837, 00 5,081 0,221 1,659 066 566 066 566 067 567 067 567 068

t Assets Longterm Assets Longterm Assets Accum ulated Deprec iation Total Longterm Assets Total Assets Liabilit ies and Capital Curren t Liabilit ies Accou nts Payabl e Curren t Borro wing Other Curren t Liabilit ies Subtot al Curren t Liabilit

$5,25 $155, $185, $215, $365, $395, $425, $455, $485, $515, $545, $575, $605, 0 250 250 250 250 250 250 250 250 250 250 250 250 $1,00 $1,35 $1,70 $2,05 $2,40 $2,75 $3,10 $3,45 $3,80 $4,15 $4,50 $4,85 $5,20 0 0 0 0 0 0 0 0 0 0 0 0 0

$4,25 $153, $183, $213, $362, $392, $422, $451, $481, $511, $540, $570, $600, 0 900 550 200 850 500 150 800 450 100 750 400 050 $21,9 $1,32 $1,33 $1,34 $1,35 $1,36 $1,37 $1,38 $1,39 $1,40 $1,41 $1,42 $1,43 50 8,981 3,771 4,859 5,916 6,066 6,216 6,366 6,517 6,667 6,817 6,967 7,118 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

$10,0 $77,4 $71,1 $71,1 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 00 07 10 10 16 16 16 16 16 16 16 16 19

$500 $0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$10,9 $0 00

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$21,4 $77,4 $71,1 $71,1 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 00 07 10 10 16 16 16 16 16 16 16 16 19

ies Longterm Liabilit ies Total Liabilit ies Paid-in Capital Retain ed Earnin gs Earnin gs Total Capital Total Liabilit ies and Capital $3,55 $0 0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$24,9 $77,4 $71,1 $71,1 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 $72,0 50 07 10 10 16 16 16 16 16 16 16 16 19 $100, $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 $1,35 000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 0,000 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ($103 ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) ,000) $4,57 4 ($3,0 $1,25 00) 1,574 $0 $15,6 61 $1,26 2,661 $26,7 49 $1,27 3,749 $36,8 99 $1,28 3,899 $47,0 50 $1,29 4,050 $57,2 00 $1,30 4,200 $67,3 50 $1,31 4,350 $77,5 00 $1,32 4,500 $87,6 51 $1,33 4,651 $97,8 01 $1,34 4,801 $107, 951 $1,35 4,951 $118, 098 $1,36 5,098

$21,9 $1,32 $1,33 $1,34 $1,35 $1,36 $1,37 $1,38 $1,39 $1,40 $1,41 $1,42 $1,43 50 8,981 3,771 4,859 5,916 6,066 6,216 6,366 6,517 6,667 6,817 6,967 7,118

Net ($3,0 $1,25 $1,26 $1,27 $1,28 $1,29 $1,30 $1,31 $1,32 $1,33 $1,34 $1,35 $1,36 Worth 00) 1,574 2,661 3,749 3,899 4,050 4,200 4,350 4,500 4,651 4,801 4,951 5,098 BRAC Bank Limited HRM in Dhaka Bank Ltd

You might also like

- FreeStudio SetupDocument313 pagesFreeStudio SetupAnonymous 55cr6tsNo ratings yet

- BrowserHelpersInstaller LogDocument1 pageBrowserHelpersInstaller LogAnonymous 55cr6tsNo ratings yet

- BrowserHelpersInstaller LogDocument1 pageBrowserHelpersInstaller LogAnonymous 55cr6tsNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Ams Oka2 PDFDocument26 pagesAms Oka2 PDFAnonymous 55cr6tsNo ratings yet

- Case 2 PresentationDocument7 pagesCase 2 PresentationAnonymous 55cr6tsNo ratings yet

- Saradiya Rannabati 2010Document33 pagesSaradiya Rannabati 2010Papri AdakNo ratings yet

- ADocument9 pagesAAnonymous 55cr6tsNo ratings yet

- Ams Oka2 PDFDocument26 pagesAms Oka2 PDFAnonymous 55cr6tsNo ratings yet

- Sadia Haque LuckyDocument47 pagesSadia Haque LuckyAnonymous 55cr6tsNo ratings yet

- DONL: Digital Online (PVT.) Limited: View With Images and ChartsDocument42 pagesDONL: Digital Online (PVT.) Limited: View With Images and ChartsAnonymous 55cr6tsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Project of PeachtreeDocument5 pagesProject of PeachtreeSalman SaeedNo ratings yet

- Kohinoor Textile MillsDocument79 pagesKohinoor Textile Millsfaruu93% (14)

- Financial ManagementDocument168 pagesFinancial ManagementHN Rakesh Raj ursNo ratings yet

- (Lecture 12) - Working CapitalDocument18 pages(Lecture 12) - Working CapitalAjay Kumar TakiarNo ratings yet

- Answers - V2Chapter 1 2012Document10 pagesAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

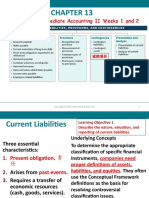

- Preview of Chapter 13: ACCT2110 Intermediate Accounting II Weeks 1 and 2Document84 pagesPreview of Chapter 13: ACCT2110 Intermediate Accounting II Weeks 1 and 2Chi IuvianamoNo ratings yet

- Account AccountDocument2 pagesAccount AccountApanar OoNo ratings yet

- Trial Balance InsightsDocument8 pagesTrial Balance InsightsRachelle JoseNo ratings yet

- Sample Chart of Accounts Template V 1.0Document3 pagesSample Chart of Accounts Template V 1.0Siva Naga Prasad TadipartiNo ratings yet

- Visa Vertical and Horizontal Analysis ExampleDocument9 pagesVisa Vertical and Horizontal Analysis Examplechad salcidoNo ratings yet

- Diploma in ManagementDocument16 pagesDiploma in ManagementASHWIN 2629No ratings yet

- Foundation Chart of AccountsDocument4 pagesFoundation Chart of Accountsbam04No ratings yet

- Chapter 5 - Financial Study 5%Document16 pagesChapter 5 - Financial Study 5%Louris NuquiNo ratings yet

- Tutorial Qs For Pro Forma Balance SheetDocument26 pagesTutorial Qs For Pro Forma Balance SheetHaniff Rez83% (6)

- Dena Bank Working Capital and Ratio Analysis VinayDocument106 pagesDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- Issues and Redemption LiabilitiesDocument75 pagesIssues and Redemption LiabilitiesOckouri BarnesNo ratings yet

- Problem 1Document2 pagesProblem 1Tk KimNo ratings yet

- Business Plan Law OfficeDocument39 pagesBusiness Plan Law OfficeJames ZacharyNo ratings yet

- Century Pulp and PapersDocument39 pagesCentury Pulp and PapersmalikhussNo ratings yet

- Ch13 CURRENT LIABILITIES AND CONTINGENCIESDocument67 pagesCh13 CURRENT LIABILITIES AND CONTINGENCIESNuttakan Meesuk100% (1)

- Project in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezDocument17 pagesProject in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezJoseph Asis50% (2)

- Butcher Shop Business PlanDocument39 pagesButcher Shop Business Planfuntwowatch78% (9)

- Butcher Shop SampleDocument23 pagesButcher Shop SampleFranchezka Pegollo0% (1)

- Asia Amalgamated Holdings Corporation Financials - RobotDoughDocument6 pagesAsia Amalgamated Holdings Corporation Financials - RobotDoughKeith LameraNo ratings yet

- TLC Wedding ConsultantsDocument25 pagesTLC Wedding ConsultantsimislamianNo ratings yet

- Problems: Problem 1-1Document4 pagesProblems: Problem 1-1Gwen Cornet Pugal Alimo-ot0% (1)

- ABC FinancialPosition1Document4 pagesABC FinancialPosition1paulineNo ratings yet

- Liquidity Position Project Jo2Document98 pagesLiquidity Position Project Jo2Jyoshna BoddedaNo ratings yet

- Workout Gym Business PlanDocument25 pagesWorkout Gym Business PlanZUZANI MATHIYANo ratings yet

- Ratio - of - Kohinoor Chemical Company (Bangladesh) LimitedDocument4 pagesRatio - of - Kohinoor Chemical Company (Bangladesh) LimitedAshif KhanNo ratings yet