Professional Documents

Culture Documents

Insurance Notes

Uploaded by

paul_jurado18Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Notes

Uploaded by

paul_jurado18Copyright:

Available Formats

Sec. 1. This Decree shall be known as "The Insurance Code of 1978". P.D. 1460 June 11, 1978. Sec.

2. The following terms; (1) A "contract of insurance" is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent even Elements: a. There is insurable interest; b. The insured is subject to a risk of loss through the destruction or impairment of that interest by the happening of designated perils; c. The insurer assumes that risk of loss; d. Such assumption is part of a general scheme to distribute actual losses among a large group of persons bearing somewhat similar risks; e. Consideration for the insurers promise, the insured makes a ratable contribution called a premium, to a general insurance fund. A contract of suretyship shall be deemed to be an insurance contract, within the meaning of this Code, only if made by a surety who or which, as such, is doing an insurance business as hereinafter provided. (2) The term "doing an insurance business" or "transacting an insurance business", within the meaning of this Code, shall include: (a) making or proposing to make, as insurer, any insurance contract; (b) making or proposing to make, as surety, any contract of suretyship as a vocation and not as merely incidental to any other legitimate business or activity of the surety; (c) doing any kind of business, including a reinsurance business, specifically recognized as constituting the doing of an insurance business within the meaning of this Code; (d) doing or proposing to do any business in substance equivalent to any of the foregoing in a manner designed to evade the provisions of this Code. Characteristics: 1. Aleatory- Liability of depends upon some contingent event. 2. Contract of indemnity for non-life insurance cause actual loss only and investment for life insurance cause it is a measure of economic security during lifetime and death. 3. Personal contract

4. Executory and conditional on the part of the insurer for the happening of the peril insured against and the conditions having met, he has the obligation to pay the insured. Executed to the insured after payment of premium. 5. Uberrimae fides or one of good faith 6. Contract of Adhesion. Insurers prepared agreements in printed form which the insured may not change. 7. Synallagmatica a highly reciprocal contract where the rights and obligations of the parties correlate and mutually correspond WHAT MAY BE INSURED Sec. 3. Any contingent or unknown event, whether past or future, which may damnify a person having an insurable interest, or create a liability against him, may be insured against, subject to the provisions of this chapter. The consent of the husband is not necessary for the validity of an insurance policy taken out by a married woman on her life or that of her children. R.A. 6809- October 20, 1989- 18 years old New Civil Code August 30, 1950- 21 years old Any minor of the age of eighteen years or more, may, notwithstanding such minority, contract for life, health and accident insurance, with any insurance company duly authorized to do business in the Philippines, provided the insurance is taken on his own life and the beneficiary appointed is the minor's estate or the minor's father, mother, husband, wife, child, brother or sister. The married woman or the minor herein allowed to take out an insurance policy may exercise all the rights and privileges of an owner under a policy. All rights, title and interest in the policy of insurance taken out by an original owner on the life or health of a minor shall automatically vest in the minor upon the death of the original owner, unless otherwise provided for in the policy.

PARTIES TO THE CONTRACT Sec. 6. Every person, partnership, association, or corporation duly authorized to transact insurance business as elsewhere provided in this code, may be an insurer. Except mutual benefit associations. Parties: Insurer, Insured and Beneficiary Sec. 7. Anyone except a public enemy may be insured.

Public enemy is a nation at war with the Philippines and includes every citizen or subject of such nation.\ Congress should declare by legislation when there is war. Sec. 8. Unless the policy otherwise provides, where a mortgagor of property effects insurance in his own name providing that the loss shall be payable to the mortgagee, or assigns a policy of insurance to a mortgagee, the insurance is deemed to be upon the interest of the mortgagor, who does not cease to be a party to the original contract, and any act of his, prior to the loss, which would otherwise avoid the insurance, will have the same effect, although the property is in the hands of the mortgagee, but any act which, under the contract of insurance, is to be performed by the mortgagor, may be performed by the mortgagee therein named, with the same effect as if it had been performed by the mortgagor. Mortgagor may insure the mortgaged property to its full value and mortgagee insure it only to the extent of the debt. Sec. 9. If an insurer assents to the transfer of an insurance from a mortgagor to a mortgagee, and, at the time of his assent, imposes further obligation on the assignee, making a new contract with him, the act of the mortgagor cannot affect the rights of said assignee. Transfer of insurance with approval of insurer.

Sec. 11. The insured shall have the right to change the beneficiary he designated in the policy, unless he has expressly waived this right in said policy. Old rule- once insured it is irrevocable New rule- it is irrevocable only when waived When waived, such is a vested interest. Beneficiary is for whose benefit the policy is issued and recipient of the proceeds of the insurance. Not a valid beneficiary: Article 2012 in relation to Article 739 Art. 739. The following donations shall be void: 1. Those guilty of adultery and Concubinage at the time of the donation 2. Those guilty of the same criminal offense 3. those made to a public officer or his wife, descendants and ascendants, by reason of his office Art. 2012. Any person who is forbidden from receiving any donation under Article 739 cannot be named beneficiary of a life insurance policy by the person who cannot make any donation to him, according to said article. Sec. 12. The interest of a beneficiary in a life insurance policy shall be forfeited when the beneficiary is the principal, accomplice, or accessory in willfully bringing about the death of the insured; in which event, the nearest relative of the insured shall receive the proceeds of said insurance if not otherwise disqualified. Sec. 13. Every interest in property, whether real or personal, or any relation thereto, or liability in respect thereof, of such nature that a contemplated peril might directly damnify the insured, is an insurable interest. Sec. 14. An insurable interest in property may consist in:

INSURABLE INTEREST Sec. 10. Every person has an insurable interest in the life and health: (a) Of himself, of his spouse and of his children; (b) Of any person on whom he depends wholly or in part for education or support, or in whom he has a pecuniary interest; (c) Of any person under a legal obligation to him for the payment of money , or respecting property or services, of which death or illness might delay or prevent the performance; and (d) Of any person upon whose life any estate or interest vested in him depends. Insurable interest is present in the subject matter where he will derive pecuniary benefit or advantage from its preservation and suffer pecuniary loss from its destruction.

(a) An existing interest; ownership or lessee (b) An inchoate interest founded on an existing interest; or partnership or stockholder (c) An expectancy, coupled with an existing interest in that out of which the expectancy arises. expected freightage by owner of vessel Sec. 15. A carrier or depository of any kind has an insurable interest in a thing held by him as such, to the extent of his liability but not to exceed the value thereof.

Sec. 16. A mere contingent or expectant interest in anything, not founded on an actual right to the thing , nor upon any valid contract for it, is not insurable. Sec. 17. The measure of an insurable interest in property is the extent to which the insured might be damnified by loss or injury thereof. Insured building for 200k is worth only 100k, insurer liable only for 100k. Sec. 18. No contract or policy of insurance on property shall be enforceable except for the benefit of some person having an insurable interest in the property insured. Sec. 19. An interest in property insured must exist when the insurance takes effect, and when the loss occurs, but not exist in the meantime; and interest in the life or health of a person insured must exist when the insurance takes effect, but need not exist thereafter or when the loss occurs. Interest in property is limited to actual value while life insurance is unlimited; In property the expectancy must be coupled with an existing legal basis while in life there is no need of such. Sec. 20. Except in the cases specified in the next four sections, and in the cases of life, accident, and health insurance, a change of interest in any part of a thing insured unaccompanied by a corresponding change in interest in the insurance , suspends the insurance to an equivalent extent, until the interest in the thing and the interest in the insurance are vested in the same person. Non-life insurance only. X insured his building for 200k. Sold it to Y for 300k the next year. X cannot anymore recover. Sec. 21. A change in interest in a thing insured, after the occurrence of an injury which results in a loss, does not affect the right of the insured to indemnity for the loss. Sec. 22. A change of interest in one or more several distinct things, separately insured by one policy, does not avoid the insurance as to the others. Sec. 23. A change on interest, by will or succession, on the death of the insured, does not avoid an insurance; and his interest in the insurance passes to the person taking his interest in the thing insured. Sec. 24. A transfer of interest by one of several partners, joint owners, or owners in common, who

are jointly insured, to the others , does not avoid an insurance even though it has been agreed that the insurance shall cease upon an alienation of the thing insured. Sec. 25. Every stipulation in a policy of insurance for the payment of loss whether the person insured has or has not any interest in the property insured , or that the policy shall be received as proof of such interest, and every policy executed by way of gaming or wagering, is void. But valid as to the extent CONCEALMENT Sec. 26. A neglect to communicate that which a party knows and ought to communicate, is called a concealment. Sec 48 2nd par. Incontestability Clause Sec. 27. A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. (As amended by B.P. Blg. 874) Sec. 28. Each party to a contract of insurance must communicated to the other, in good faith, all facts: Within his knowledge and at the time insurance takes effect Material to the contract Other party has no means of ascertaining As to which the party with the duty to communicates makes no warranty

Sec. 29. An intentional and fraudulent omission, on the part of one insured, to communicate information of matters proving or tending to prove the falsity of a warranty, entitles the insurer to rescind. Marine insurance, seaworthiness of vessel is an implied warranty. Sec. 30. Material Facts which need not be disclosed except upon injury (a) Those which the other knows; (b) Those which, in the exercise of ordinary care, the other ought to know , and of which the former has no reason to suppose him ignorant; (c) Those of which communication; the other waives

(d) Those which prove or tend to prove the existence of a risk excluded by a warranty, and which are not otherwise material; and (e) Those which relate to a risk excepted from the policy and which are not otherwise material. Sec. 31. Materiality is to be determined not by the event, but solely by the probable and reasonable influence of the facts upon the party to whom the communication is due, in forming his estimate of the disadvantages of the proposed contract, or in making his inquiries. Materiality is determined not by event but by the probable or reasonable influence of the facts on the judgment of the parties in entering into an insurance contract. Sec. 32. Each party to a contract of insurance is bound to know all the general causes which are open to his inquiry, equally with that of the other, and which may affect the political or material perils contemplated; and all general usages of trade. Constructive notice to both parties of the general causes and usage of trade Sec. 33. The right to information of material facts may be waived, either by the terms of the insurance or by neglect to make inquiry as to such facts, where they are distinctly implied in other facts of which information is communicated. Sec. 34. General rule:Information of the nature or amount of the interest of one insured need not be communicated Exception: Unless in answer to an inquiry whether in life or property insurance; Prescribed by section 51, where insurance policy must specify the interest of the insured in property insured if he is not the absolute owner.

concealment is the passive form for the insured neglects or fails to disclose a material fact. Sec. 38. The language of a representation is to be interpreted by the same rules as the language of contracts in general. Sec. 39. A representation as to the future is to be deemed a promise, unless it appears that it was merely a statement of belief or expectation. Affirmative is an affirmation of the existence or non-existence of a fact when the contract begins. Promissory is a promise by the insured concerning what is to happen during the existence of the contract

Sec. 40. A representation cannot qualify an express provision in a contract of insurance , but it may qualify an implied warranty. A mere collateral inducement and not part of the contract Sec. 41. A representation may be altered or withdrawn before the insurance is effected, but not afterwards. The reason is that the insurer is not yet induced to issue the policy Sec. 42. A representation must be presumed to refer to the date on which the contract goes into effect. Sec. 43. When a person insured has no personal knowledge of a fact, he may nevertheless repeat information which he has upon the subject, and which he believes to be true, with the explanation that he does so on the information of others; or he may submit the information, in its whole extent, to the insurer; and in neither case is he responsible for its truth, unless it proceeds from an agent of the insured, whose duty it is to give the information. Sec. 44. A representation is to be deemed false when the facts fail to correspond with its assertions or stipulations. Representation needs only to be substantially true. Sec. 45. If a representation is false in a material point, whether affirmative or promissory, the injured party is entitled to rescind the contract from the time when the representation becomes false. The right to rescind granted by this Code to the insurer is waived by the acceptance of premium payments despite knowledge of the ground for rescission. (As amended by B.P. Blg. 874).

Sec. 35. Material facts are the only ones to be disclosed and not mere opinion, speculation or expectation.

REPRESENTATION Sec. 36. A representation may be oral or written. Sec. 37. A representation may be made at the time of, or before, issuance of the policy. Misrepresentation is the active form of deceit for the insured makes oral or written false statement while

Misrepresentation is false representation of a material point or matter Sec. 46. The materiality of a representation is determined by the same rules as the materiality of a concealment. Sec. 47. The provisions of this chapter apply as well to a modification of a contract of insurance as to its original formation. Sec. 48. Whenever a right to rescind a contract of insurance is given to the insurer by any provision of this chapter, such right must be exercised previous to the commencement of an action on the contract. Incontestability Clause-After a policy of life insurance made payable on the death of the insured shall have been in force during the lifetime of the insured for a period of two years from the date of its issue or of its last reinstatement, the insurer cannot prove that the policy is void ab initio or is rescindible by reason of the fraudulent concealment or misrepresentation of the insured or his agent. However it is void or rescissible: Lack of insurable interest Non-payments of premiums Caused of death is an expected risk Fraud committed was a particularly vicious type as when the insured substituted himself with another during the medical examination or policy was in furtherance of a scheme to murder the insured.

Unless applied for by the insured or owner, any rider, clause, warranty or endorsement issued after the original policy shall be countersigned by the insured or owner, which countersignature shall be taken as his agreement to the contents of such rider, clause, warranty or endorsement. Group insurance and group annuity policies, however, may be typewritten and need not be in printed form. Form should be approved by the Insurance Commissioner, failure may be prosecuted for using unapproved form.

Sec. 51. A policy of insurance must specify: (a) The parties between whom the contract is made; (b) The amount to be insured except in the cases of open or running policies; (c) The premium, or if the insurance is of a character where the exact premium is only determinable upon the termination of the contract, a statement of the basis and rates upon which the final premium is to be determined; (d) The property or life insured; (e) The interest of the insured in property insured, if he is not the absolute owner thereof; (f) The risks insured against; and (g) The period during which the insurance is to continue. Period of reinstatement, policy loan and grace period Sec. 52. Cover notes may be issued to bind insurance temporarily pending the issuance of the policy. Within sixty days after the issue of the cover note, a policy shall be issued in lieu thereof, including within its terms the identical insurance bound under the cover note and the premium therefor. Cover notes may be extended or renewed beyond such sixty days with the written approval of the Commissioner if he determines that such extension is not contrary to and is not for the purpose of violating any provisions of this Code. The Commissioner may promulgate rules and regulations governing such extensions for the purpose of preventing such violations and may by such rules and regulations

THE INSURANCE POLICY Sec. 49. The written instrument, in which a contract of insurance is set forth , is called a policy of insurance. Interpreted in favor always of the insured. Sec. 50. The policy shall be in printed form which may contain blank spaces; and any word, phrase, clause, mark, sign, symbol, signature, number, or word necessary to complete the contract of insurance shall be written on the blank spaces provided therein. Any rider, clause, warranty or endorsement purporting to be part of the contract of insurance and which is pasted or attached to said policy is not binding on the insured, unless the descriptive title or name of the rider, clause, warranty or endorsement is also mentioned and written on the blank spaces provided in the policy.

dispense with the requirement of written approval by him in the case of extension in compliance with such rules and regulations. Cover note is merely a written memorandum of the most important terms of a preliminary contract of insurance. Also known as binder, binding slip or binding receipt. Sec. 53. The insurance proceeds shall be applied exclusively to the proper interest of the person in whose name or for whose benefit it is made unless otherwise specified in the policy. Sec. 54. When an insurance contract is executed with an agent or trustee as the insured, the fact that his principal or beneficiary is the real party in interest may be indicated by describing the insured as agent or trustee, or by other general words in the policy. Sec. 55. To render an insurance effected by one partner or part-owner, applicable to the interest of his co-partners or other part-owners , it is necessary that the terms of the policy should be such as are applicable to the joint or common interest. Sec. 56. When the description of the insured in a policy is so general that it may comprehend any person or any class of persons, only he who can show that it was intended to include him can claim the benefit of the policy. Sec. 57. A policy may be so framed that it will inure to the benefit of whomsoever, during the continuance of the risk, may become the owner of the interest insured. Sec. 58. The mere transfer of a thing insured does not transfer the policy, but suspends it until the same person becomes the owner of both the policy and the thing insured. Sec. 59. A policy is either open, valued or running. Sec. 60. An open policy is one in which the value of the thing insured is not agreed upon, but is left to be ascertained in case of loss. Actual cash value at the time of loss Sec. 61. A valued policy is one which expresses on its face an agreement that the thing insured shall be valued at a specific sum. Sec. 62. A running policy is one which contemplates successive insurances, and which provides that the object of the policy may be from time to time

defined, especially as to the subjects of insurance, by additional statements or indorsements. Sec. 63. A condition, stipulation, or agreement in any policy of insurance, limiting the time for commencing an action thereunder to a period of less than one year from the time when the cause of action accrues, is void. More than a year, such is valid. No period stipulated, being written contract, the action may be bring ten years from the accrual of cause of action . Art. 1144. Sec. 64. No policy of insurance other than life shall be cancelled by the insurer except upon prior notice thereof to the insured, and no notice of cancellation shall be effective unless it is based on the occurrence, after the effective date of the policy, of one or more of the following: (a) non-payment of premium; premiums subsequent

(b) conviction of a crime arising out of acts increasing the hazard insured against; (c) discovery of misrepresentation; fraud or material

(d) discovery of willful or reckless acts or omissions increasing the hazard insured against; (e) physical changes in the property insured which result in the property becoming uninsurable; or (f) a determination by the Commissioner that the continuation of the policy would violate or would place the insurer in violation of this Code. Said notice must be in writing, mailed or delivered to the named insured at the address shown in the policy. Sec 65 Not based on the grounds, such is ineffective.

Sec. 65. All notices of cancellation mentioned in the preceding section shall be in writing, mailed or delivered to the named insured at the address shown in the policy, and shall state (a) which of the grounds set forth in section sixty-four is relied upon and (b) that, upon written request of the named insured, the insurer will furnish the facts on which the cancellation is based. Sec. 66. Requisites for renewal of policy An insurance policy other than life is renewed:

The insurer does not mail or deliver to the insured at least 45 days before its expiry date a notice of its intention to either:

By agreement immaterial provision can be a material provision that can make the policy void. Sec. 76. A breach of warranty without fraud merely exonerates an insurer from the time that it occurs , or where it is broken in its inception, prevents the policy from attaching to the risk.

1. Not to renew 2. Condition the renewal upon reduction of limits or elimination of coverage Payment of premium due on the effective date of renewal

PREMIUM Sec. 77. An insurer is entitled to payment of the premium as soon as the thing insured is exposed to the peril insured against. Notwithstanding any agreement to the contrary, no policy or contract of insurance issued by an insurance company is valid and binding unless and until the premium thereof has been paid, except in the case of a life or an industrial life policy whenever the grace period provision applies. Exceptions to non-payment of premiums For individual life, endowment insurance, or group life insurance, grace period of thirty days or one month within which the payment of any premium after the first may be made. Sec 227 (a), Sec 228 (b) For industrial life insurance, grace period is four weeks and where premiums are payable monthly, either thirty days or one month. Sec 240 (a) Mora Accipiendi or refusal to accept the valid tender of the premium by the insured to the insurer. Payment of premium not excused by act of God, sickness or incapacity or war, since time of payment is the essence of the contract. Legal tender which is money as authorized by the BSP. Check not valid payment until such is encashed.

WARRANTIES Sec. 67. A warranty is either expressed or implied. Sec. 68. A warranty may relate to the past, the present, the future, or to any or all of these. Sec. 69. No particular form of words is necessary to create a warranty. Sec. 70. Without prejudice to section fifty-one, every express warranty, made at or before the execution of a policy, must be contained in the policy itself, or in another instrument signed by the insured and referred to in the policy as making a part of it. Sec. 71. A statement in a policy of matter relating to the person or thing insured, or to the risk, as a fact , is an express warranty thereof. Sec. 72. Promissory warranty A statement in a policy which imparts that it is intended to do or not to do a thing which materially affects the risk, is a warranty that such act or omission shall take place. Sec. 73. When, before the time arrives for the performance of a warranty relating to the future, a loss insured against happens, or performance becomes unlawful at the place of the contrac t, or impossible, the omission to fulfill the warranty does not avoid the policy. Non-performance of promissory warranty entitles the rescission of the other party. Sec. 74. The violation of a material warranty, or other material provision of a policy , on the part of either party thereto, entitles the other to rescind. Sec. 75. A policy may declare that a violation of specified provisions thereof shall avoid it, otherwise the breach of an immaterial provision does not avoid the policy.

UCPB vs. Masagana Telemart The first exception is provided by Section 77 itself, and that is, in case of a life or industrial life policy whenever the grace period provision applies. The second is that covered by Section 78 of the Insurance Code, which provides: A third exception was laid down in Makati Tuscany Condominium Corporation vs. Court of Appeals, wherein we ruled that Section 77 may not apply if the parties have agreed to the payment in installments of the premium and partial payment has been made at the time of loss. A fourth exception to Section 77, namely, that the insurer may grant credit extension for the payment of the

premium. This simply means that if the insurer has granted the insured a credit term for the payment of the premium and loss occurs before the expiration of the term, recovery on the policy should be allowed even though the premium is paid after the loss but within the credit term. Finally in the instant case, it would be unjust and inequitable if recovery on the policy would not be permitted against Petitioner, which had consistently granted a 60- to 90-day credit term for the payment of premiums despite its full awareness of Section 77. Estoppel bars it from taking refuge under said Section, since Respondent relied in good faith on such practice. Estoppel then is the fifth exception to Section 77.

(d) contract is viodable on account of facts, the existence of which the insured was ignorant of without his fault (e) when by any default of the insured other than actual fraud insurer never incurred liability under the policy (f) in case of over-insurance by several insurers Sec. 80. If a peril insured against has existed, and the insurer has been liable for any period, however short, the insured is not entitled to return of premiums, so far as that particular risk is concerned. Sec. 81. A person insured is entitled to return of the premium when the contract is voidable, on account of fraud or misrepresentation of the insurer, or of his agent, or on account of facts, the existence of which the insured was ignorant without his fault ; or when by any default of the insured other than actual fraud, the insurer never incurred any liability under the policy. Sec. 82. In case of an over-insurance by several insurers, the insured is entitled to a ratable return of the premium, proportioned to the amount by which the aggregate sum insured in all the policies exceeds the insurable value of the thing at risk. Over insurance is when the amount of the insurance is beyond the value of the insureds insurable interest, while in double insurance, the sum total of the policies need not exceed the insurable interest. One insurer is sufficient, while in the latter, there must be several insurers. FINMAN GENERAL ASSURANCE CORPORATION vs. C.A and USIPHIL INCORPORATED A perusal of the records shows that private respondent, after the occurrence of the fire, immediately notified petitioner thereof. Thereafter, private respondent submitted the following documents: (1) Sworn Statement of Loss and Formal Claim (Exhibit C) and; (2) Proof of Loss (Exhibit D). The submission of these documents, to the Courts mind, constitutes substantial compliance with the above provision. Indeed, as regards the submission of documents to prove loss, substantial, not strict as urged by petitioner, compliance with the requirements will always be deemed sufficient. DELSAN TRANSPORT LINES, INC., vs. C.A. and AMERICAN HOME ASSURANCE CORPORATION The payment made by the private respondent for the insured value of the lost cargo operates as waiver of its (private respondent) right to enforce the term of the implied warranty against Caltex under the marine insurance policy. However, the same cannot be validly interpreted as an automatic admission of the vessels

Sec. 78. An acknowledgment in a policy or contract of insurance or the receipt of premium is conclusive evidence of its payment , so far as to make the policy binding, notwithstanding any stipulation therein that it shall not be binding until the premium is actually paid. Sec. 79. A person insured is entitled to a return of premium, as follows: (a) To the whole premium if no part of his interest in the thing insured be exposed to any of the perils insured against; (b) Where the insurance is made for a definite period of time and the insured surrenders his policy, to such portion of the premium as corresponds with the unexpired time, at a pro rata rate, unless a short period rate has been agreed upon and appears on the face of the policy, after deducting from the whole premium any claim for loss or damage under the policy which has previously accrued; Provided, That no holder of a life insurance policy may avail himself of the privileges of this paragraph without sufficient cause as otherwise provided by law. Cash Surrender Value not applies: a. definite period; b. agreed upon, or c. one Insurance is not for a

A short period has been The policy is a life insurance

(c) contract is viodable on account of misrepresentation or fraud of the insurer or his agent.

seaworthiness by the private respondent as to foreclose recourse against the petitioner for any liability under its contractual obligation as a common carrier. The fact of payment grants the private respondent subrogatory right which enables it to exercise legal remedies that would otherwise be available to Caltex as owner of the lost cargo against the petitioner common carrier AMERICAN HOME ASSURANCE TANTUCO ENTERPRISES, INC. COMPANY vs.

In construing the words used descriptive of a building insured, the greatest liberality is shown by the courts in giving effect to the insurance. In view of the custom of insurance agents to examine buildings before writing policies upon them, and since a mistake as to the identity and character of the building is extremely unlikely, the courts are inclined to consider that the policy of insurance covers any building which the parties manifestly intended to insure, however inaccurate the description may be. LORENZO SHIPPING CORP., vs. CHUBB and SONS, Inc. When the insurer succeeds to the rights of the insured, he does so only in relation to the debt. The person substituted (the insurer) will succeed to all the rights of the creditor (the insured), having reference to the debt due the latter. In the instant case, the rights inherited by the insurer, respondent Chubb and Sons, pertain only to the payment it made to the insured Sumitomo as stipulated in the insurance contract between them, and which amount it now seeks to recover from petitioner Lorenzo Shipping which caused the loss sustained by the insured Sumitomo. PHILAMCARE HEALTH SYSTEMS, INC. vs. C.A. and JULITA TRINOS In the case at bar, the insurable interest of respondents husband in obtaining the health care agreement was his own health. The health care agreement was in the nature of non-life insurance, which is primarily a contract of indemnity. Once the member incurs hospital, medical or any other expense arising from sickness, injury or other stipulated contingent, the health care provider must pay for the same to the extent agreed upon under the contract. CARLO-PEARL NOTES

You might also like

- Insurance.: 1. A. B. C. 2. 8. ADocument10 pagesInsurance.: 1. A. B. C. 2. 8. ASantoy CartallaNo ratings yet

- LSP Insurance PDFDocument28 pagesLSP Insurance PDFGERARDO DAYAO III MARTINEZNo ratings yet

- Z - Banking - 2Document41 pagesZ - Banking - 2NetweightNo ratings yet

- Ra 7653 - NcbaDocument27 pagesRa 7653 - NcbaJen AnchetaNo ratings yet

- Banks OnlyDocument44 pagesBanks OnlyAmerkhan AliNo ratings yet

- Transfer Taxes Tax 2Document45 pagesTransfer Taxes Tax 2Nat PantsNo ratings yet

- Warehouse Line of Credit Agreement - Example - Uamc & Eagle Home Mortgage and Residential Funding CorporationDocument92 pagesWarehouse Line of Credit Agreement - Example - Uamc & Eagle Home Mortgage and Residential Funding Corporation83jjmackNo ratings yet

- Banking Laws Final Examinations: Instruments (Iuis)Document2 pagesBanking Laws Final Examinations: Instruments (Iuis)Patrick D GuetaNo ratings yet

- Bank of Commerce v. Sps. FloresDocument3 pagesBank of Commerce v. Sps. FloresBeltran KathNo ratings yet

- Acknowledgement Receipt: Sample FormatDocument88 pagesAcknowledgement Receipt: Sample FormatMary-ann GacusanaNo ratings yet

- Intellectual PropertyDocument3 pagesIntellectual PropertyJanelle TabuzoNo ratings yet

- Canon 7DDocument32 pagesCanon 7Dwmovies18No ratings yet

- Habeas Corpus PPT - RequisitesDocument7 pagesHabeas Corpus PPT - RequisitesNinaNo ratings yet

- BCS BI 2 NegotiableInstrumentsTestAnswerKeyDocument2 pagesBCS BI 2 NegotiableInstrumentsTestAnswerKeyJhedz CartasNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument32 pagesCommercial Law - Negotiable Instruments LawGlenda PambagoNo ratings yet

- Alter Ego Piercing The Corporate Veil Hagan Law FirmDocument6 pagesAlter Ego Piercing The Corporate Veil Hagan Law FirmDavid Alejandro100% (1)

- PAGES 178-185 Alluvion and Accretion DistinguishedDocument7 pagesPAGES 178-185 Alluvion and Accretion DistinguishedMa Veronica PineNo ratings yet

- SRC protects investors interestsDocument5 pagesSRC protects investors interestsMarion JossetteNo ratings yet

- Corporation LawDocument79 pagesCorporation LawliboaninoNo ratings yet

- Writ of Replevin: Recover Your Tricycle Through Court ProcessDocument1 pageWrit of Replevin: Recover Your Tricycle Through Court ProcessYza CruzNo ratings yet

- REGALIAN DOCTRINE: KEY CONCEPTSDocument7 pagesREGALIAN DOCTRINE: KEY CONCEPTSNullus cumunisNo ratings yet

- 3-T PP Vs AcostaDocument2 pages3-T PP Vs AcostaShaine Aira ArellanoNo ratings yet

- Commercial Law Review: "Banks" Shall Refer To Entities Engaged in TheDocument17 pagesCommercial Law Review: "Banks" Shall Refer To Entities Engaged in TheVal Escobar MagumunNo ratings yet

- Tax ReviewerDocument103 pagesTax ReviewerOscar Ryan SantillanNo ratings yet

- Sales ReviewerDocument16 pagesSales ReviewerOnat PNo ratings yet

- Syndicated Loan Agreement: PartiesDocument10 pagesSyndicated Loan Agreement: PartiesAleezah Gertrude RaymundoNo ratings yet

- 2004 Manual of Regulations For BanksDocument838 pages2004 Manual of Regulations For Bankskkkccccc111No ratings yet

- GUARANTY AND SURETY NOTESDocument8 pagesGUARANTY AND SURETY NOTESLRMNo ratings yet

- Negotiable Instruments Law Question and AnswerDocument7 pagesNegotiable Instruments Law Question and AnswerCyrusNo ratings yet

- Personal Property Security Act SummaryDocument4 pagesPersonal Property Security Act SummaryDianne SaltoNo ratings yet

- Obligations PDFDocument14 pagesObligations PDFArah OpalecNo ratings yet

- Escheats To TrusteeDocument15 pagesEscheats To TrusteeMichael Alerick Buenaventura TampengcoNo ratings yet

- Guaranty and SuretyhipDocument6 pagesGuaranty and SuretyhipMic UdanNo ratings yet

- Civil Pro ReviewDocument23 pagesCivil Pro ReviewjamesNo ratings yet

- The General Banking Law of 2000 Section 35 To Section 66Document14 pagesThe General Banking Law of 2000 Section 35 To Section 66Carina Amor ClaveriaNo ratings yet

- Preliminary Attach Ment Grounds: Provisional RemediesDocument13 pagesPreliminary Attach Ment Grounds: Provisional RemediesRizza Angela MangallenoNo ratings yet

- Issuance of Decree of Registration and Certificate of TitleDocument5 pagesIssuance of Decree of Registration and Certificate of TitleFatmah Azimah MapandiNo ratings yet

- Letters of Credit and Trust Receipt Digests Under Atty Zarah Castro VillanuevaDocument20 pagesLetters of Credit and Trust Receipt Digests Under Atty Zarah Castro VillanuevaJun TabuNo ratings yet

- Standby Letter Credit ExplanationDocument8 pagesStandby Letter Credit Explanationanujanair3146100% (1)

- SpecPro Recit 1Document22 pagesSpecPro Recit 1Michelle Anne OlivaNo ratings yet

- Sale with Right to Repurchase Ruled Equitable MortgageDocument3 pagesSale with Right to Repurchase Ruled Equitable MortgageChow Momville EstimoNo ratings yet

- Introduction To Legal FormsDocument24 pagesIntroduction To Legal FormsVincent Tan100% (1)

- Extensive Hearsay RulesDocument39 pagesExtensive Hearsay RulesRizza DacayananNo ratings yet

- The Securitization: Useful Financing OptionDocument4 pagesThe Securitization: Useful Financing OptionprashantsowmitryNo ratings yet

- R.A. 7042 (Foreign Investments Act)Document5 pagesR.A. 7042 (Foreign Investments Act)Ya Ni TaNo ratings yet

- Frequently Asked Questions in Commercial Law: Ommercial AW 2005 C B ODocument59 pagesFrequently Asked Questions in Commercial Law: Ommercial AW 2005 C B OIrish PDNo ratings yet

- (Billie Blanco) Agency Post-MT Memaid (Last Edit Dec. 1, 2019)Document54 pages(Billie Blanco) Agency Post-MT Memaid (Last Edit Dec. 1, 2019)Nea TanNo ratings yet

- 6-Merchants and Commercial TransactionsDocument21 pages6-Merchants and Commercial TransactionsJade Palace TribezNo ratings yet

- General Banking LawDocument31 pagesGeneral Banking LawMonalizts D.No ratings yet

- FINALS Reviewer Spec SommDocument57 pagesFINALS Reviewer Spec SommNito CoginNo ratings yet

- Constitution 1991Document81 pagesConstitution 1991tapia4yeabuNo ratings yet

- Civil Procedure Notes 02.19.22Document5 pagesCivil Procedure Notes 02.19.22Paul SchwarberNo ratings yet

- REPUBLIC ACT NO. 11057, August 17, 2018Document16 pagesREPUBLIC ACT NO. 11057, August 17, 2018edgardo100% (1)

- Letters of Credit Digest-Trust Receipts LawDocument3 pagesLetters of Credit Digest-Trust Receipts LawLeo Angelo LuyonNo ratings yet

- Loc and Trust ReceiptsDocument86 pagesLoc and Trust ReceiptsSam B. PinedaNo ratings yet

- Case Name Facts & Issue RulingDocument15 pagesCase Name Facts & Issue RulingApril ToledoNo ratings yet

- Debt To Equity ConditionsDocument29 pagesDebt To Equity ConditionsEphraim TuganoNo ratings yet

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithFrom EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNo ratings yet

- Insurance Code of The PhilDocument76 pagesInsurance Code of The PhilmattchalevNo ratings yet

- PlayDocument6 pagesPlaylance zoletaNo ratings yet

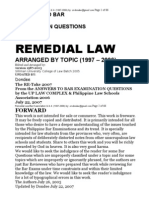

- Remedial Law Suggested Answers (1997-2006), WordDocument79 pagesRemedial Law Suggested Answers (1997-2006), Wordyumiganda95% (38)

- Deed of AssignmentDocument1 pageDeed of Assignmentpaul_jurado18No ratings yet

- Apex Mining Vs NLRCDocument5 pagesApex Mining Vs NLRCpaul_jurado18No ratings yet

- Phil Ports Authority Vs IloiloDocument12 pagesPhil Ports Authority Vs Iloilopaul_jurado18No ratings yet

- Ichong V HernandezDocument15 pagesIchong V Hernandezpaul_jurado18No ratings yet

- SC Dismisses Case Against Gov Due to ElectionDocument5 pagesSC Dismisses Case Against Gov Due to Electionpaul_jurado18No ratings yet

- Miaa V City of ParanaqueDocument69 pagesMiaa V City of Paranaquepaul_jurado18No ratings yet

- 1 Frivaldo V COMELECDocument8 pages1 Frivaldo V COMELECpaul_jurado18No ratings yet

- GR No. 170087Document7 pagesGR No. 170087taga_pi7ong_gatangNo ratings yet

- Napocor V IsabelaDocument10 pagesNapocor V Isabelapaul_jurado18No ratings yet

- Sawajaan Vs CA G.R.141735Document10 pagesSawajaan Vs CA G.R.141735MelvzNo ratings yet

- The Rule On The Writ of AmparoDocument10 pagesThe Rule On The Writ of AmparocristyjoymacasilNo ratings yet

- Miaa V City of ParanaqueDocument69 pagesMiaa V City of Paranaquepaul_jurado18No ratings yet

- Freedom of ExpressionDocument2 pagesFreedom of Expressionpaul_jurado18No ratings yet

- Deed of A Motor VehicleDocument1 pageDeed of A Motor Vehiclepaul_jurado18No ratings yet

- Yu Vs Hon. TatadDocument4 pagesYu Vs Hon. Tatadpaul_jurado18No ratings yet

- Criminal Procedure 1Document29 pagesCriminal Procedure 1lexresitaeNo ratings yet

- Kabataan Vs ComelecDocument5 pagesKabataan Vs Comelecpaul_jurado18No ratings yet

- Environmental Law SyllabusDocument2 pagesEnvironmental Law Syllabuspaul_jurado18No ratings yet

- Social Welfare Leg ChartDocument7 pagesSocial Welfare Leg Chartpaul_jurado18No ratings yet

- Conflicts of Law Memory AidDocument10 pagesConflicts of Law Memory AidDannuel Go UyNo ratings yet

- Gamboa vs Cruz police lineup rulingDocument2 pagesGamboa vs Cruz police lineup rulingpaul_jurado18100% (1)

- PEOPLE V GenosaDocument18 pagesPEOPLE V Genosapaul_jurado18No ratings yet

- Addendum To Sec TransDocument12 pagesAddendum To Sec TransRuther Marc P. NarcidaNo ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- 2011 Remedial Law NotesDocument166 pages2011 Remedial Law NotesCarl TamNo ratings yet

- U.S v. WadeDocument1 pageU.S v. Wadepaul_jurado18No ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- Review of International Accounting Information SystemsDocument6 pagesReview of International Accounting Information SystemsMarwa RabieNo ratings yet

- GFR2017 3Document40 pagesGFR2017 3PatrickNo ratings yet

- PRIVATE PLACEMENT AND FUND RAISING OPTIONSDocument5 pagesPRIVATE PLACEMENT AND FUND RAISING OPTIONSAkanksha BohraNo ratings yet

- Construction - Draws - v8 (Ver-1) (2) GNX PDFDocument5 pagesConstruction - Draws - v8 (Ver-1) (2) GNX PDFMark McClureNo ratings yet

- 5479-Article Text-9982-1-10-20210515Document7 pages5479-Article Text-9982-1-10-20210515overkillNo ratings yet

- TB 3 - Mohammad MarufDocument14 pagesTB 3 - Mohammad MarufFalak EnayatNo ratings yet

- Ho Responsibility PDFDocument61 pagesHo Responsibility PDFrose OneubNo ratings yet

- PRINCIPLES OF TAXATION LAWDocument2 pagesPRINCIPLES OF TAXATION LAWChoudhary Shadab phalwanNo ratings yet

- Arab Region Fintech GuideDocument54 pagesArab Region Fintech GuideHisham DaelNo ratings yet

- Chap 014Document37 pagesChap 014Malak W.No ratings yet

- Job Cost Sheet AnalysisDocument13 pagesJob Cost Sheet AnalysisKailash Kumar100% (1)

- IAS 16 Property, Plant and EquipmentDocument9 pagesIAS 16 Property, Plant and Equipmentsalman jabbarNo ratings yet

- Accounting in Action: Adopted From: Accounting Principles, 13 EditionDocument57 pagesAccounting in Action: Adopted From: Accounting Principles, 13 EditionDimas Rizalul100% (1)

- Taking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipDocument1 pageTaking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipPrice LangNo ratings yet

- CH 40 - IFRIC InterpretationsDocument2 pagesCH 40 - IFRIC InterpretationsJoyce Anne GarduqueNo ratings yet

- Genral Insurance GlossoryDocument4 pagesGenral Insurance GlossoryVeeraswamy AmaraNo ratings yet

- Bonus Information FY 19-20 - v2 - tcm47-73104Document2 pagesBonus Information FY 19-20 - v2 - tcm47-73104KaranNo ratings yet

- Risk Appetite and Internal AuditDocument15 pagesRisk Appetite and Internal Auditmuratandac33570% (1)

- Public FinanceDocument8 pagesPublic FinanceAditi SinghNo ratings yet

- FINS 3616 Tutorial Questions - Week 8.questions.v4Document2 pagesFINS 3616 Tutorial Questions - Week 8.questions.v4Sarthak Garg0% (1)

- IE 307 Engineering Economy Gradient Series and Amortization ScheduleDocument8 pagesIE 307 Engineering Economy Gradient Series and Amortization ScheduleJayrMenes100% (1)

- Financial AccountingDocument20 pagesFinancial AccountingArveen NairNo ratings yet

- A Project Report ON: Working Capital ManagementDocument44 pagesA Project Report ON: Working Capital ManagementShubham More CenationNo ratings yet

- Bkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Document3 pagesBkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Mìthßæn GèñésæñNo ratings yet

- PMS - Data TTM Return Till May16bDocument15 pagesPMS - Data TTM Return Till May16bMoneylife FoundationNo ratings yet

- Northern Graphite's Bissett Creek Project Offers Low-Cost Production of High-Value Battery MaterialDocument16 pagesNorthern Graphite's Bissett Creek Project Offers Low-Cost Production of High-Value Battery MaterialMuhammad Saad HussainNo ratings yet

- Grand Banks Yachts Limited Annual Report 2020Document184 pagesGrand Banks Yachts Limited Annual Report 2020WeR1 Consultants Pte LtdNo ratings yet

- CH 5Document10 pagesCH 5malo baNo ratings yet

- Only Financial Weekly with 16% Returns in 2 MonthsDocument58 pagesOnly Financial Weekly with 16% Returns in 2 MonthshumbleNo ratings yet

- PPA Notes Module 2Document22 pagesPPA Notes Module 2Community Institute of Management StudiesNo ratings yet