Professional Documents

Culture Documents

Cash Department

Uploaded by

Kiran ReddyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Department

Uploaded by

Kiran ReddyCopyright:

Available Formats

Cash Department

1. Currency chest is the property of 2. Banks maintain Currency chests as an agent of 3. One rupee coin form part of 4. The minimum transactions from/to Currency Chest will be of 5. Vault Register is held in the custody of 6. Where the vault register should be kept 7. What is Currency Transfer 8. Daily Currency Transfer figure will be advised to 9. In case of any delay in reporting of Currency Transfer figures or in case of wrong reporting, Reserve Bank of India charges penal interest at the rate of 10. Verification of Currency Chest balances by officials other than Joint custodian is done at ___________ intervals 11. Surprise verification of Critical Currency Chests is made by LHO at 12. What type of entry should be passed when remittance is sent from one currency chest to another currency chest? 13. Charges towards police escorts, transport etc. for chest to chest remittances of treasure is.. 14. Repository is part of 15.What is the periodicity for obtention of Strong Room Fitness Certificate 16.Counterfeit banknotes can be impounded by 17. Guarantee Bond system is applicable to Currency Notes upto Rs... 18.Printing & Circulation of forged Indian currency notes is an offence u/s 19.Small Coin Depot is the property of 20. Small Coin depot comprises of 21.Minimum transactions from/to Small coin depot will be 22.Branches report Small Coin Depot transactions to 23.Fidelity insurance cover for single window operator is obtained for 24. When a Rs 100/- note is found in the branch/cash dept., it is credited to

Prepared by S.V.Satyanarayana, Manager (Training),SBLC, Tirupati

25.Colour of vertical polymer band printed with SBI name and logo shall be _______ for preparing note packets upto denomination of Rs 20/26. Colour of vertical polymer band printed with SBI name and logo shall be _______ for preparing note packets of denomination above Rs 20/- and upto Rs 1000/27.Petty Cash should be checked by ____________ at _____________ interval 28.Safe deposit receipt relating to deposit of duplicate keys is entered in BD register and the safe deposit receipt is held by _________________ 29.One Re coin is issued under _______ act 30.Clean Note Policy has been issued by RBI under 31.Penalty for violation of Clean Note Policy is 32.Currency Notes are printed at 33.Cash retention limit of the branch will be reviewed by _________ every year in the month of __________ 34.Cash Retention Limit review note of branches will be put to __________ for approval in the month of __________ 35.Controller of the branch will arrange for periodical cash verification of the Hand Balance Branches at 36. Expand ICCOMS 37. In- Branch Cash Handling Process has been introduced at___________ branches 38. Overnight cash retention limit allotted to the SWO / Assistant (Cash) in the system for keeping cash in a aluminium box is ______________ 39. The person preparing the Note packets for denomination ______________ upto Rs.100/- is responsible for

40. Recounting is not required for denominations upto Rs.________ 41. For replenishment of currency chest, indents should be sent to currency officer at _________ intervals 42. What is an uncurrent coin ? 43. In case any shortage is found in remittance received from Reserve Bank of India, the option available to branch is.. 44. Coins upto _______ paise are demonetized wef 01-07-2011

Prepared by S.V.Satyanarayana, Manager (Training),SBLC, Tirupati

Answers 1. RBI 2. RBI 3. Currency Chest 4. 100000 and in multiples of 50000 5. Joint Custodians

6. Inside the strong room 7. Difference between deposits & withdrawals 8. FSLO 9. 2% above Bank Rate 10. Bimonthly Paid initially by Bank and get

11. Quarterly intervals reimbursement from RBI

12. No entry 13. 14. Currency Chest

15. Yearly, inside the strong room Banks

16. PSB, Private Banks, Foreign Banks, RRBs, Coop.

17. Rs.100/- 18. 489A & 489 E of Indian Penal Code 19. Government of India 20. Coins of 59 paise and below 22. FSLO 25. Pink

21. Rs.100 and in multiples of Rs.50/23. Rs.5 lacs 24. Sundry Deposit Account 26. While

27. Branch Manager, Monthly 28. BM outside the strong room 29. Coinage Act, 1906 30. Sec.35 of BR Act. 32. Nasik, Dewas, Mysore & Salboni 33.

31. 5 lakhs and cancellation of license RM or CM (Admin.), May 34. GM (Network), June

35. Half yearly intervals 37. All

36. Integrated Computerised Currency Operations & Management Systems branches 38. 1 lakh 39. Quality and Quantity 40. Rs.100/- 41.Half yearly

42. Coin withdrawn from circulation 43. Send remittance to RBI for the difference amount 44. Rs.25 paise & below

Prepared by S.V.Satyanarayana, Manager (Training),SBLC, Tirupati

You might also like

- Adobe Photoshop 9 Cs2 Serial + Activation Number & Autorization Code ADocument1 pageAdobe Photoshop 9 Cs2 Serial + Activation Number & Autorization Code ARd Fgt36% (22)

- Cash Management Training ManualDocument44 pagesCash Management Training ManualSamra QasimNo ratings yet

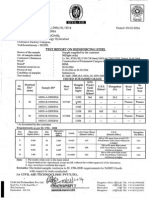

- Test Results for 53 Grade CementDocument1 pageTest Results for 53 Grade CementKiran Reddy86% (7)

- Tube Coupler Poster1Document1 pageTube Coupler Poster1Kiran Reddy100% (1)

- Mensuration & Quantity Survey PDFDocument21 pagesMensuration & Quantity Survey PDFShareenMuneebNo ratings yet

- Contract of Lease-Water Refilling StationDocument4 pagesContract of Lease-Water Refilling StationEkeena Lim100% (1)

- Important One Liners For Promotion Exam 2016 For Clerk To OfficerDocument34 pagesImportant One Liners For Promotion Exam 2016 For Clerk To OfficerNavneet PatelNo ratings yet

- Banking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Document9 pagesBanking Awareness For SBI PO Mains 2017 - Gradeup - pdf-47Mathew ChackoNo ratings yet

- Cbe CH3 N 4Document13 pagesCbe CH3 N 4Solomon Abebe100% (2)

- SB ACCOUNT AND DEPOSIT PRODUCT DETAILSDocument18 pagesSB ACCOUNT AND DEPOSIT PRODUCT DETAILSవేణుఎస్No ratings yet

- What Is A Currency ChestDocument1 pageWhat Is A Currency ChestAbraham JosephNo ratings yet

- Cash Operation: Niraj Sharma NCC BankDocument39 pagesCash Operation: Niraj Sharma NCC BankMayank ShresthaNo ratings yet

- Indian CurrencyDocument6 pagesIndian CurrencyGahininathJagannathGadeNo ratings yet

- Cash System and Procedure Part 1Document8 pagesCash System and Procedure Part 1Rohit BhaduNo ratings yet

- Forex 1Document5 pagesForex 1Akhil MadavanNo ratings yet

- Attachment Regulatory Bodies in India - Rbi 3 Lyst2540Document19 pagesAttachment Regulatory Bodies in India - Rbi 3 Lyst2540Vaishali SinghNo ratings yet

- Reserve Bank of India: Central BoardDocument25 pagesReserve Bank of India: Central Boardganesh_280988No ratings yet

- Session 1 Basic Cash ManagementDocument10 pagesSession 1 Basic Cash ManagementManik MehtaNo ratings yet

- Iibf ExamDocument21 pagesIibf ExamMukeshKataraNo ratings yet

- RTGS Neft Faq1Document5 pagesRTGS Neft Faq1Omsai SinghNo ratings yet

- Annual Clean Note CertificateDocument1 pageAnnual Clean Note CertificateHaniyaHanifNo ratings yet

- 19O306 EE Unit - 5 Performance of An EconomyDocument70 pages19O306 EE Unit - 5 Performance of An Economy22iz014No ratings yet

- Master Circular - Scheme of Incentives & Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicDocument5 pagesMaster Circular - Scheme of Incentives & Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicPrasad NayakNo ratings yet

- One Liner Updates Banking AwarenessDocument15 pagesOne Liner Updates Banking AwarenessTanuja SinghNo ratings yet

- NRI BankingDocument33 pagesNRI BankingKrinal Shah0% (1)

- Clearing ProcessDocument10 pagesClearing ProcessBalajie PadmanabhanNo ratings yet

- RemittanceDocument2 pagesRemittanceAbhijit PhoenixNo ratings yet

- Economics Unit 5Document62 pagesEconomics Unit 5sumanthlogn007No ratings yet

- Unit 5Document71 pagesUnit 522m146No ratings yet

- English WorksheetDocument31 pagesEnglish WorksheetBinoy TrevadiaNo ratings yet

- Current Affairs 2017Document43 pagesCurrent Affairs 2017BaskarBossYuvanRomeo'zNo ratings yet

- Reserve Bank of India (Rbi) Department of Currency ManagementDocument5 pagesReserve Bank of India (Rbi) Department of Currency Managementteja_sapNo ratings yet

- RRB Main Exam. Recollected Questions Asked in RRB Main Exam Held On 25.09.2021Document5 pagesRRB Main Exam. Recollected Questions Asked in RRB Main Exam Held On 25.09.2021Raveendranathan CNo ratings yet

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Document4 pagesJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nNo ratings yet

- Indo Nepal Remittance Facility SchemeDocument3 pagesIndo Nepal Remittance Facility SchemeVikas PassiNo ratings yet

- Currency ManagementDocument7 pagesCurrency ManagementArvind HarikrishnanNo ratings yet

- Functions of RBI: Prof. Divya GuptaDocument22 pagesFunctions of RBI: Prof. Divya GuptaNeha SharmaNo ratings yet

- ConfidentiaDocument4 pagesConfidentiaandrew philipsNo ratings yet

- Money Supply Measures in IndiaDocument5 pagesMoney Supply Measures in Indiaanshu.gpt09No ratings yet

- Central Bank of India RTGS NEFT FormDocument1 pageCentral Bank of India RTGS NEFT FormAnkit Moses Yoel0% (1)

- A.p.treasury Code Vol-1 PDFDocument25 pagesA.p.treasury Code Vol-1 PDFChamu Phani0% (1)

- NBPDocument25 pagesNBPShaikh JunaidNo ratings yet

- Assignments: Banking and FinanceDocument19 pagesAssignments: Banking and FinanceAamir Hussian100% (1)

- Central Bank of IndiaDocument5 pagesCentral Bank of Indiagauravbansall567No ratings yet

- RBI Master Circular on Facility for Exchange of Notes and CoinsDocument8 pagesRBI Master Circular on Facility for Exchange of Notes and CoinsadswerNo ratings yet

- RBI Notice For Depositing Counterfeit NotesDocument24 pagesRBI Notice For Depositing Counterfeit NotesaaannnnniiiiiiiiNo ratings yet

- Compendium of Cash Operations in Currency Chest and Branches 04.07.2020Document242 pagesCompendium of Cash Operations in Currency Chest and Branches 04.07.2020Goutam MalakarNo ratings yet

- Action On Fake NotesDocument25 pagesAction On Fake NotesK MuruganNo ratings yet

- RTGS NeftDocument3 pagesRTGS NeftAshish Kumar AgnihotriNo ratings yet

- Money NotesDocument8 pagesMoney NotesPrerna RawatNo ratings yet

- Master Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicDocument4 pagesMaster Circular - Scheme of Penalties For Bank Branches Based On Performance in Rendering Customer Service To The Members of PublicVasu Ram JayanthNo ratings yet

- Image: Stockxpert: WebsiteDocument19 pagesImage: Stockxpert: WebsiteyogeshNo ratings yet

- Q1. L1-01-EbclDocument1 pageQ1. L1-01-EbclIyappanNo ratings yet

- 2MF0B3059C2Document8 pages2MF0B3059C2Devishka ShahNo ratings yet

- Bank Reconciliation Statement 6Document2 pagesBank Reconciliation Statement 6suresh kumar10No ratings yet

- PAYMENT SYSTEMSDocument8 pagesPAYMENT SYSTEMSyugandharNo ratings yet

- Detection and Impound of Counterfeit NotesDocument23 pagesDetection and Impound of Counterfeit Notesabhishekchauhan0096429No ratings yet

- Cheque ProcessDocument12 pagesCheque ProcessAmosjude JudeNo ratings yet

- NRE and NRO AccountDocument4 pagesNRE and NRO AccountayaznptiNo ratings yet

- RBI Related Current AffairDocument4 pagesRBI Related Current AffairAnsh OzaNo ratings yet

- RBI's Role as the Central Bank of India: Regulator, Supervisor and Developmental InstitutionDocument11 pagesRBI's Role as the Central Bank of India: Regulator, Supervisor and Developmental InstitutionAmit PirankarNo ratings yet

- RBI/2017-18/3 DCM (Ne) No.G - 1/08.07.18/2017-18 July 03, 2017Document8 pagesRBI/2017-18/3 DCM (Ne) No.G - 1/08.07.18/2017-18 July 03, 2017MeghaNo ratings yet

- Manufacturer test certificate for GI metal productsDocument1 pageManufacturer test certificate for GI metal productsKiran ReddyNo ratings yet

- SMA Ref Guide V61Document63 pagesSMA Ref Guide V61Kiran ReddyNo ratings yet

- MasterKure 106 (Masterkure 106) - ZADocument2 pagesMasterKure 106 (Masterkure 106) - ZAKiran ReddyNo ratings yet

- MasterRheobuild 1122AP AF28715Document1 pageMasterRheobuild 1122AP AF28715Kiran ReddyNo ratings yet

- A.dimension and Surface Quality Tests To Be Performed On TilesDocument1 pageA.dimension and Surface Quality Tests To Be Performed On TilesKiran ReddyNo ratings yet

- Rural Urban 2011Document17 pagesRural Urban 2011Kiran ReddyNo ratings yet

- Gypsum Plaster Testing LetterDocument1 pageGypsum Plaster Testing LetterKiran ReddyNo ratings yet

- 4885-4889 Testing of Conrete CubesDocument3 pages4885-4889 Testing of Conrete CubesKiran ReddyNo ratings yet

- Daily Bulk Receipt Master File As On 09 08 2013Document538 pagesDaily Bulk Receipt Master File As On 09 08 2013Kiran ReddyNo ratings yet

- RS ReportDocument1 pageRS ReportKiran ReddyNo ratings yet

- Ulcra 1976Document46 pagesUlcra 1976Ar Kunal PatilNo ratings yet

- 9013Document14 pages9013Sujoy RoyNo ratings yet

- Is 516 Method of Test For Strength of ConcreteDocument25 pagesIs 516 Method of Test For Strength of Concreteselva_65195078% (9)

- Inspect suspended scaffold checklistDocument2 pagesInspect suspended scaffold checklistKiran Reddy100% (2)

- Work 181Document28 pagesWork 181Sandeep RuchandaniNo ratings yet

- Self-Compacting ConcreteDocument68 pagesSelf-Compacting ConcreteMisgun SamuelNo ratings yet

- Application For Freshman Admission - PDF UA & PDocument4 pagesApplication For Freshman Admission - PDF UA & PVanezza June DuranNo ratings yet

- Salesforce Platform Developer 1Document15 pagesSalesforce Platform Developer 1Kosmic PowerNo ratings yet

- Webpage citation guideDocument4 pagesWebpage citation guiderogelyn samilinNo ratings yet

- X Ay TFF XMST 3 N Avx YDocument8 pagesX Ay TFF XMST 3 N Avx YRV SATYANARAYANANo ratings yet

- Ermac vs. MedeloDocument1 pageErmac vs. MedeloJessa F. Austria-CalderonNo ratings yet

- Shilpa PPT FinalDocument51 pagesShilpa PPT FinalDrakeNo ratings yet

- FTC470XETDocument2 pagesFTC470XETDecebal ScorilloNo ratings yet

- Ab Initio Interview Questions - HTML PDFDocument131 pagesAb Initio Interview Questions - HTML PDFdigvijay singhNo ratings yet

- Ex 1-3 Without OutputDocument12 pagesEx 1-3 Without OutputKoushikNo ratings yet

- OrcaSecurity Solution OverviewDocument2 pagesOrcaSecurity Solution Overviewandini eldanantyNo ratings yet

- Converted File d7206cc0Document15 pagesConverted File d7206cc0warzarwNo ratings yet

- Supplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDocument8 pagesSupplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDinuka MalinthaNo ratings yet

- Dse Placement Report PDFDocument78 pagesDse Placement Report PDFAbhijithKríshñàNo ratings yet

- Keys and Couplings: Definitions and Useful InformationDocument10 pagesKeys and Couplings: Definitions and Useful InformationRobert Michael CorpusNo ratings yet

- Danielle Smith: To Whom It May ConcernDocument2 pagesDanielle Smith: To Whom It May ConcernDanielle SmithNo ratings yet

- ASTM Reference RadiographsDocument3 pagesASTM Reference RadiographsAkbar ShaikNo ratings yet

- University of Texas at Arlington Fall 2011 Diagnostic Exam Text and Topic Reference Guide For Electrical Engineering DepartmentDocument3 pagesUniversity of Texas at Arlington Fall 2011 Diagnostic Exam Text and Topic Reference Guide For Electrical Engineering Departmentnuzhat_mansurNo ratings yet

- Timesheet 2021Document1 pageTimesheet 20212ys2njx57vNo ratings yet

- SSPC Paint 25 BCSDocument6 pagesSSPC Paint 25 BCSanoopkumarNo ratings yet

- CV of Prof. D.C. PanigrahiDocument21 pagesCV of Prof. D.C. PanigrahiAbhishek MauryaNo ratings yet

- Practice Questions & Answers: Made With by SawzeeyyDocument141 pagesPractice Questions & Answers: Made With by SawzeeyyPhake CodedNo ratings yet

- MBA Stats Essentials: Measures, Prob, Hypothesis TestsDocument4 pagesMBA Stats Essentials: Measures, Prob, Hypothesis TestsIbrahim JawedNo ratings yet

- Accor vs Airbnb: Business Models in Digital EconomyDocument4 pagesAccor vs Airbnb: Business Models in Digital EconomyAkash PayunNo ratings yet

- Cold Fear manual_englishDocument10 pagesCold Fear manual_englishHelmi IsmunandarNo ratings yet

- Superelement Modeling-Based Dynamic Analysis of Vehicle Body StructuresDocument7 pagesSuperelement Modeling-Based Dynamic Analysis of Vehicle Body StructuresDavid C HouserNo ratings yet

- Daftar Pustaka Marketing ResearchDocument2 pagesDaftar Pustaka Marketing ResearchRiyan SaputraNo ratings yet

- PH Measurement TechniqueDocument5 pagesPH Measurement TechniquevahidNo ratings yet

- Lab Equipment Catalog Research Concept LabDocument40 pagesLab Equipment Catalog Research Concept LabSeetanshu AwasthiNo ratings yet