Professional Documents

Culture Documents

Bai Nhom

Uploaded by

americus_smile7474Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bai Nhom

Uploaded by

americus_smile7474Copyright:

Available Formats

Definition Personal income tax (PIC) is the direct tax levied upon real income of an individual periodically such

as annually or monthly to contribute to the budget irrespective of occupation and social statue. Basing on the characteristics, income is classified as regular income and irregular income so that each kind of income can have a suitable tax method. Personal tax was first invented in England in 1799 as a contemporary means to support the war between the country and France and in 1942 it was officially legislated. Later on, many countries followed England and adopted this tax such as Japan (1887), Germany (1899), USA (1903), France (1916) and Soviet Union (1922). According to a statistic by ERNST & YOUNG there are more than 136 countries applying PIC in the world. Due to the WTO participation and the global integration, reduction in import and export tax is unavoidable. With the development of our country, PIC revenue is on the increasing and becoming one of the most important sources of revenue for the Governments budget.

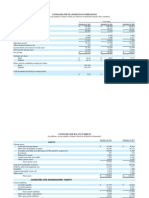

History of Personal Income Tax PIC was first applied in Vietnam in 1991, but throughout 22 years, it only accounts for about 2% of the total Governments revenue. TOTAL GOVERNMENT 'S REVUE 123.860 152.274 190.928 228.287 279.472 315.915 416.783 442.340 558.158 PERSONAL INCOME PERCENTAGE TAX (%) REVENUE 2338 2951 3521 4234 5179 7422 12940 14329 26288 1,89 1,94 1,84 1,85 1,85 2,35 3,10 3,24 4,71

YEAR

2002 2003 2004 2005 2006 2007 2008 2009 2010 -

According to the table we can see that the total revenue obtained from Personal Income Tax is still low comparing with the average percentage of about 40%-50%

of other countries (America: 45%, UK: 33%, Japan: 40%...). However, on the bright side, the amount of PIC in the national budget has increased gradually comparing to the 63 billion VND in 1991 (0.63%). During 22 years, the threshold for tax payer has been adjusted 5 times, increasing from 500.000 VND/month (in 1991) to 5.000.000 VND/month . The applicable tax rate is also reduced from 80% to 72%, then to 65%, 40% and 35% as stipulated in the current Personal Income Tax Law. Throughout the world, average Personal Income Tax in ASEAN: 5-10%, in developed countries is 15-16% and some countries for example England, America is 30-40%, we can see that our tax rate is still high.

Characteristic of Personal Income tax Personal tax income is an obligation stipulated by law. Personal income tax is one-sided contribution, the tax payer cannot expect service in return by offered by the Government. Personal tax income is a direct tax: the tax payer is also the one who suffers the tax burden. Personal tax income has a wide coverage including all individual with income within the nation territory: permanent resident, foreigners who regular or irregular reside in Vietnam Personal tax income is calculated based on progressive method for the purpose of equity in the society: the richer people are the more they have to pay.

Purpose of Personal Income tax To the economy and society The most important and salient purpose of personal income tax in specific and tax in general is to generate budget for public service and operation as well as maintaining equity in the society. To regulate the economy: the tax rate will directly affect the saving and spending habit of an individual, therefore, the production activity within the economy will be affected. To identify illegal income: personal tax income can help the authority to trace out money laundering, corruption, smuggling or tax evasion

To the tax system

To complement some weakness of other taxes: Some indirect taxes such as VAT, excise tax have weakness of regressive tax calculation, thus the tax burden is borne more by the poor than on the rich for example tax will be the same when people consuming the same kind of tax without concerning about income. To reduce the loss of corporate tax: There is always a close relationship between personal income tax and the corporate income tax. When the corporation and its employee conspire to boost the salaries to reduce the taxable income for tax avoidance purpose, the personal tax income will make up the loss by levying tax on such increased income.

Some improvement in Personal Income Tax Comparing to the Decree 100/2008/N-CP the Decree 65/2013/N-CP has made the following amendments

Applicable entities Increase the counting period from 90 to 183 days in considering residence period (b,2, Article 2, Chapter 1). However, foreigners who lodge in Vietnam under 183 days but cannot prove the identity will be considered as residing in Vietnam.

Taxable income Supplement some regulation about allowances, subsidies which are eligible for exemption such as allowances for medical purpose transferred from employer to the workers and workers relatives (spouse, parents, children), subsidies for round-trip airplane ticket for people working abroad or for foreigner working in Vietnam to visit their home countries one a year, subsidies for tuition fee from nursery to high school for children of Vietnamese employee working abroad (b, 2, Article 3, Chapter 1). Previously the Circular 62/2009/TT-BTC only allowed exemption for tuition fee at high school level. Adding 10% tax rate to the amount of accumulated insurance and voluntary pension fund (d, 2, Article 3, Chapter 1). Authorization of land or assets: if the authorized parties can have the right to transfer assets or having the same right as in the asset transfer relationship, the authorization will be considered transferring of assets

Income which is tax exempt

Supplementing the requirement of owing only one residential house or residential land block, income from transfer of right to use residential land and the assets attached to the second land will also be exempted from taxable income if only individual possesses the second land for a period shorter than 183 days (2, Article 4, Chapter 1). For residential house, construction which are under constructed: transferring, inheriting of receiving gift of such assets from relatives are also exempted. (1, Article 4, Chapter 1) Income paid by voluntary or foreign Pension Fund is exempted from tax (10, Article 4, Chapter 1) Income being scholarship: scholarship for subsistence expenses are exempted from tax (11, Article 4, Chapter 1)

Tax deduction For insurance expenses: premium paid to voluntary unemployment insurance or Pension fund is deductible from assessable income, the maximum level for deduction is 1 million/month, 12 million/year (1, Article 21, Section 1, Chapter II) Deduction for family circumstances: the deduction for family circumstances is increased from 4 million/month to 9 million/month (108 million/year); the deduction level for each dependant increase to 3.6 million/month. The income to identify dependant is increase from 500.000 to 1.000.000 (Article 19, Section 1, Chapter II) Dependant: dependants can be offspring, stepchild, offspring over 18 years old but still studying at high school, step father, step mother, legal foster father, legal foster mother.

Tax rate Tax rate applicable to transfer of stock ownership to 20%

For taxable income winning from Casino On the condition that the organization, casino cannot assess the income of the winning party for tax deduction purpose, the Casino will pay the tax proportionally to the amount of the prize comparing to the total prize on behalf of the winning party.

Implementing and controlling Personal Income Tax

Register tax: Individuals have to register to get the tax code from tax authority for themselves and for tax dependant. Thus, the amendment of Personal Income tax represents the respect of Government to the citizens opinion, increases transparence of tax system, reduces bureaucratic procedures and advances quality, effectiveness of Tax controlling authority.

Some weakness of Personal Income Tax PIC only accounts for a small proportion of the national budget. This fact undermines the role of this tax in the Governments policy, contrary to the world trend. PIC does not protect equity in distribution income in the economy: PIC stipulate the discrimination of tax payer between Vietnamese tax payer and foreignersthe threshold for beginning paying tax is different, and the difference is profitable for the foreigners. This regulation is not in accordance with the world standard and is unfair as Vietnamese and foreigners are all tax payers. Nowadays, personal income usually comes from human labor, business activity, direct and indirect investment, asset transfer..Among them, income from human labour, business activity, and asset transfer all have different tax rates. Personal income from indirect investment such as interest on deposit, yield on Governments bond is still exempted from tax, while income from transfer asset (stock or real estate) does not belong to taxable object. This reality raises the question of equity, effectiveness in executing PIC in Vietnam. The maximum tax rate of 35% is not encouraging enough to stimulate high qualified people participating into our workforce. Many countries in the world has tried hard to cut tax to attract investment and labour such as Indonesia, Malaysia, Singapore, Czech RepublicEspecially some countries have replace progressive tax system with flat tax rate: Russia 13%, Czech 15% and Bulgaria 10%. Therefore, abolishing 35% tax rate and retain only 6 scale for calculating tax is worth considering. Comparing to the Corporate tax rate of 25% the PIC tax rate is quite high, this will have some bad effect on the economy.

You might also like

- Ac Guide Dec11 CH 11Document4 pagesAc Guide Dec11 CH 11americus_smile7474No ratings yet

- Economics AffairsDocument14 pagesEconomics AffairsAjdin ImsirovicNo ratings yet

- TT19BTCDocument9 pagesTT19BTCamericus_smile7474No ratings yet

- Econ 252 Spring 2011 Problem Set 5Document5 pagesEcon 252 Spring 2011 Problem Set 5americus_smile7474No ratings yet

- 983 BC Ket Qua Thuc Hien Co Che Tu Chu Ve Tai Chinh0001Document3 pages983 BC Ket Qua Thuc Hien Co Che Tu Chu Ve Tai Chinh0001americus_smile7474No ratings yet

- ActerDocument5 pagesActeramericus_smile7474No ratings yet

- Sentence TransformationDocument9 pagesSentence Transformationamericus_smile7474No ratings yet

- Econ252 15 032111 MCDocument3 pagesEcon252 15 032111 MCAaron CollinsNo ratings yet

- Review ExercisesDocument11 pagesReview Exercisesamericus_smile7474No ratings yet

- Chuong 1 Introduction 2013 SDocument82 pagesChuong 1 Introduction 2013 Samericus_smile7474No ratings yet

- Chuong3 Swaps 2013 SDocument50 pagesChuong3 Swaps 2013 Samericus_smile7474No ratings yet

- Bai Tap 16Document6 pagesBai Tap 16americus_smile7474No ratings yet

- 5021 Solutions 6Document5 pages5021 Solutions 6americus_smile7474100% (1)

- Econ 252 Spring 2011 Problem Set 5 SolutionDocument7 pagesEcon 252 Spring 2011 Problem Set 5 Solutionamericus_smile7474No ratings yet

- Chuong 2 Forward and Futures 2013 SDocument120 pagesChuong 2 Forward and Futures 2013 Samericus_smile7474100% (1)

- Lecture Notes (Financial Economics)Document136 pagesLecture Notes (Financial Economics)americus_smile7474100% (2)

- Margaret Thatcher A PortraitDocument235 pagesMargaret Thatcher A Portraitamericus_smile7474No ratings yet

- Lagrangian Methods For Constrained OptimizationDocument6 pagesLagrangian Methods For Constrained Optimizationcesar_luis_galliNo ratings yet

- Review ExercisesDocument11 pagesReview Exercisesamericus_smile7474No ratings yet

- DerivativesDocument10 pagesDerivativesamericus_smile7474No ratings yet

- SIngle Index MethodDocument17 pagesSIngle Index Methodamericus_smile7474No ratings yet

- CH 5 QaDocument2 pagesCH 5 Qaamericus_smile7474100% (1)

- UTP App CTA ExplanationDocument7 pagesUTP App CTA ExplanationDuyen HuynhNo ratings yet

- Derivatives Test BankDocument36 pagesDerivatives Test BankNoni Alhussain100% (2)

- 11 Understanding Samsungs Diversification Strategy The Case of Samsung Motors IncDocument17 pages11 Understanding Samsungs Diversification Strategy The Case of Samsung Motors IncSunita NairNo ratings yet

- Assignment1 SolutionsDocument10 pagesAssignment1 Solutionsamericus_smile7474No ratings yet

- Analysis of Variance (ANOVA)Document9 pagesAnalysis of Variance (ANOVA)americus_smile7474No ratings yet

- Portflolio Optimisation 2Document28 pagesPortflolio Optimisation 2americus_smile7474No ratings yet

- William Sharpe Simplified Model of Portfolio Analysis 0Document18 pagesWilliam Sharpe Simplified Model of Portfolio Analysis 0americus_smile7474No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Questions On Alphabet Series PDFDocument4 pagesQuestions On Alphabet Series PDFGajendra JoshiNo ratings yet

- Georgia Department of Corrections Audit (December 2018)Document38 pagesGeorgia Department of Corrections Audit (December 2018)Scott HolcombNo ratings yet

- Solution Manual For Financial Accounting Theory and Analysis Text and Cases, 11th EditionDocument20 pagesSolution Manual For Financial Accounting Theory and Analysis Text and Cases, 11th EditionYousef ShahwanNo ratings yet

- Helping 12,400 Children with $5MDocument4 pagesHelping 12,400 Children with $5MLincoln LowNo ratings yet

- Westco Airconditioning Ltd. v. Sui Chong Construction & Engineering Co. Ltd.Document2 pagesWestco Airconditioning Ltd. v. Sui Chong Construction & Engineering Co. Ltd.E ChengNo ratings yet

- Plans Margins and Plan Information: Charges Currency Futures Currency OptionsDocument1 pagePlans Margins and Plan Information: Charges Currency Futures Currency OptionsManu ShrivastavaNo ratings yet

- Omnibus Certification of Authenticity and Veracity of DocumentsDocument4 pagesOmnibus Certification of Authenticity and Veracity of DocumentsVanessa Lou TorejasNo ratings yet

- 1st International Composition Competition For Orchestra and ChoirDocument5 pages1st International Composition Competition For Orchestra and ChoirFlavioDpfOliveiraNo ratings yet

- Class Teachers Program 2022 2023Document2 pagesClass Teachers Program 2022 2023Jun junNo ratings yet

- PSAK 51-RevDocument5 pagesPSAK 51-Revapi-3708783No ratings yet

- A Project Report On NSEDocument48 pagesA Project Report On NSEraghavhindi75% (8)

- Comment On Entropy Production and The Second Law of Thermodynamics - An Introduction To Second Law Analysis,'' by Thoma PDFDocument3 pagesComment On Entropy Production and The Second Law of Thermodynamics - An Introduction To Second Law Analysis,'' by Thoma PDFCarlos JoseNo ratings yet

- Allotment List For IITBDocument4 pagesAllotment List For IITBShriniwas ApteNo ratings yet

- 06-07-10 Notice of Mediator SelectionDocument3 pages06-07-10 Notice of Mediator SelectionOrlando Tea PartyNo ratings yet

- Weekly LAS Template for Q3-Q4Document3 pagesWeekly LAS Template for Q3-Q4Kymberly Jean Radores QuimpanNo ratings yet

- Summary of Angelina Hernandez Defendant Estafa CaseDocument1 pageSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosNo ratings yet

- Affidavit of Loss of Land Title TCT No. T-66666Document2 pagesAffidavit of Loss of Land Title TCT No. T-66666Jholo AlvaradoNo ratings yet

- What Is Forensic AccountingDocument2 pagesWhat Is Forensic AccountingJonhmark AniñonNo ratings yet

- Fag 1Document53 pagesFag 1Mohd Muzammil Mohd AltafNo ratings yet

- Simmel Georges Grandes Cidades e Vida Do Esp RitoDocument122 pagesSimmel Georges Grandes Cidades e Vida Do Esp RitoGabriela Loureiro BarcelosNo ratings yet

- Barangay Budget ResolutionsDocument9 pagesBarangay Budget ResolutionsAngelynne N. Nievera100% (1)

- BSBFIM501 Assessment Templates V3.0920Document18 pagesBSBFIM501 Assessment Templates V3.0920Layla Correa da SilvaNo ratings yet

- Difference between file system and DBMS explained in 40 charactersDocument4 pagesDifference between file system and DBMS explained in 40 charactersWaleed AnwarNo ratings yet

- Human Kind Cannot Bear Much Reality Complete Essay - StudyBix PDFDocument13 pagesHuman Kind Cannot Bear Much Reality Complete Essay - StudyBix PDFKul SumNo ratings yet

- Unidad 5. - Modals Obligation, Permission, Deduction, AbilityDocument24 pagesUnidad 5. - Modals Obligation, Permission, Deduction, AbilitymapegilNo ratings yet

- Vda. de Bautista V Marcos DigestDocument1 pageVda. de Bautista V Marcos DigestBenedict EstrellaNo ratings yet

- User Training Manual-CMDocument37 pagesUser Training Manual-CMSrinivas GirnalaNo ratings yet

- Accounting For Business CombinationDocument11 pagesAccounting For Business CombinationMaika CrayNo ratings yet

- Germany Revision Theme 1Document20 pagesGermany Revision Theme 1jkjahkjahd987981723No ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet