Professional Documents

Culture Documents

Trust Receipts Cases

Uploaded by

Karlo Marco CletoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trust Receipts Cases

Uploaded by

Karlo Marco CletoCopyright:

Available Formats

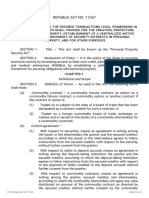

SPOUSES TIRSO VINTOLA AND LORETA DY VS INSULAR BANK OF A S I A A N D AMERICA, (1987) 150 SCRA 578 FACTS: Petitioner spouses

Vintola owns and manages manufacturing of raw s e a shells into finished products, under their business name, Dax kin International. They applied for domestic letter of credit by respondent Insular Bank of Asia and America which was granted. Then, executed a Trust Receipt Agreement with Insular bank stipulating that the Vintolas shall hold the goods in trust for IBAA. Having defaulted in its payment, the Vintolas offered to return the goods to IBAA, but the latter refused. Due to their continued refusal, IBAA charged them with estafa. The Court acquitted the Vintolas. I S S U E : W h e t h e r o r n o t I B A A b e c a m e t h e r e a l owners of the goods held in trust by the Vintolas. RULING: No. Insular bank of Asia and America did not become the holder or realowner of the goods. The Vintolas retained ownership of the goods. TheCourt held that the trust receipt arrangement did not convert the IBAA intoan investor, it remained a lendor and creditor. Under the law, a trust receipt is a document wherein the entrustee binds himself to hold thedesignated goods, documents or instruments in trust for the entruster to sell or otherwise dispose of the goods, to the amount owing to the entruster.

METROPOLITAN BANK and TRUST COMPANY, petitioner, vs. JOAQUIN TONDA and MA. CRISTINA TONDA, respondents. [G.R. No. 134436. August 16, 2000]

Facts: Spouses Joaquin G. Tonda and Ma. Cristina U. Tonda, hereinafter referred to as the TONDAS, applied for and were granted commercial letters of credit by petitioner Metropolitan Bank and Trust Company, hereinafter referred to as METROBANK for a period of eight (8) months beginning June 14, 1990 to February 1, 1991 in connection with the importation of raw textile materials to be used in the manufacturing of garments. The TONDAS acting both in their capacity as officers of Honey Tree Apparel Corporation (HTAC) and in their personal capacities, executed eleven (11) trust receipts to secure the release of the raw materials to HTAC. The imported fabrics with a principal value of P2,803,000.00 were withdrawn by HTAC under the 11 trust receipts executed by the TONDAS. Due to their failure to settle their obligations under the trust

receipts upon maturity, METROBANK through counsel, sent a letter dated August 10, 1992, making its final demand upon the TONDAS to settle their past due TR/LC accounts on or before August 15, 1992. They were informed that by said date, the obligations would amount to P4,870,499.13. Despite repeated demands therefor, the TONDAS failed to comply with their obligations stated in the trust receipts agreements, i.e. the TONDAS failed to account to METROBANK the goods and/or proceeds of sale of the merchandise, subject of the trust receipts. Issue: WHETHER METROBANK HAS SHOWN A PRIMA FACIE VIOLATION OF THE TRUST RECEIPTS LAW IN RELATION TO ART. 315 OF THE REVISED PENAL CODE. Held: SEC. 13 of P.D. 115 provides that the failure of an entrustee to turn over the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owing to the entruster or as appears in the trust receipt or to return said goods, documents or instruments if they were not sold or disposed of in accordance with the terms of the trust receipt shall constitute the crime of estafa. Given that various trust receipts were executed by the TONDAS and that as entrustees, they did not return the proceeds from the goods sold nor the goods themselves to METROBANK, there is no dispute that that the TONDAS failed to comply with the obligations under the trust receipts despite several demands from METROBANK. .It is in the context of upholding public interest that the law now specifically designates a breach of a trust receipt agreement to be an act that "shall" make one liable for estafa."

Colinares vs. Court of Appeals [339 SCRA 609 (Sept. 25,2000)] Trust Receipts Law Facts: Melvin Colinares and Lordino Veloso (Petitioners) were contracted for a consideration of P40,000 by the Carmelite Sisters of Cagayan de Oro City to renovate the latters convent. Petitioners obtained the materials needed for the construction project from CM Builders Centre. Petitioners applied for a commercial letter of credit with the Philippine Banking Corporation (PBC) in favor of CM Builders Centre. PBC approved the letter of credit to cover the full invoice value of the goods. Petitioners signed a pro-forma trus receipt as security. PBC wrote to Petitioners demanding that the amount be paid within seven days from notice. Instead of complying with the demand, Veloso confessed that they lost P19,195 in the Carmelite Monastery Project and requested for a grace period to settle the

account. The grace period lapsed and PBC sent a new demand letter to Petitioners. Petitioners proposed that the terms of payment of the loan be modified. Petitioners were charged with the violation of P.D. No. 115 (Trust Receipts Law) in relation to Art. 315 of the Revised Penal Code. The Petitioners were convicted. Issue: Assuming there was a valid trust receipt, whether or not the accused were properly charged, tried and convicted for violation of P.D. No. 115 in relation to Art. 315 of the RPC, notwithstanding the novation of the so-called trust receipt converting the trustor-trustee relationship to creditor-debtor situation Held: Section 4 of P.D. No. 115 defines a trust receipt transaction as any transaction by and between a person referred to as the entruster, and another person referred to as the entrustee, whereby the entruster who owns or holds absolute title or security interest over certain specified goods, documents or instruments, releases the same to the possession of the entrustee upon the latters execution and delivery to the entruster of a signed document called a trust receipt wherein the enteustee binds himself to hold the designated goods, documents or instruments with the obligation to turn over to the entruster the proceeds thereof to the extent of the amount owing to the entruster or as appears in the trust receipt or the goods, documents or instruments themselves if they are unsold or not otherwise disposed of, in accordance with the terms and conditions specified in the trust receipt. A thorough examination of the facts obtaining in the case at bar reveals that the transaction intended by the parties was a simple loan, not a trust receipt agreement. On the day the Petitioners received the merchandise from CM Builders Centre, ownership was already transferred to Petitioners who were to use the materials for the construction project. It was only a day later that they went to the bank to apply for a loan to pay for the merchandise. This situation belies what normally obtains in a pure trust receipt transaction where goods are owned by the bank and only released to the importer in trust subsequent to the grant of the loan. Nowhere in the testimony of PBCs witness does it appear that PBC represented to Petitioners that the transaction they were entering into was not a pure loan but had trust receipt implications. The Information charged Petitioners with intent to defraud and misappropriating the money for their personal use. But Petitioners employed no artifice in dealing with PBC and never did they evade payment of their obligation. Petitioners acquitted.

Consolidated Bank vs CA GR No. 114286, 19 April 2001 356 SCRA 671 FACTS Continental Cement Corp obtained from Consolidated Bank letter of credit used to purchased 500,000 liters of bunker fuel oil. Respondent Corporation made a marginal

deposit to petitioner. A trust receipt was executed by respondent corporation, with respondent Gregory Lim as signatory. Claiming that respondents failed to turn over the goods or proceeds, petitioner filed a complaint for sum of money before the RTC of Manila. In their answer, respondents aver that the transaction was a simple loan and not a trust receipt one, and tht the amount claimed by petitioner did not take into account payments already made by them. The court dismissed the complaint, CA affirmed the same. ISSUE Whether or not the marginal deposit should not be deducted outright from the amount of the letter of credit. HELD No. petitioner argues that the marginal deposit should be considered only after computing the principal plus accrued interest and other charges. It could be onerous to compute interest and other charges on the face value of the letter of credit which a bank issued, without first crediting or setting off the marginal deposit which the borrower paid to it-compensation is proper and should take effect by operation of law because the requisited in Art. 1279 are present and should extinguish both debts to the concurrent amount. Unjust enrichment.

Abad v. Court of Appeals, 181 SCRA 191 (1990) FACTS: - TOMCO, Inc.applied for, and was granted by the Philippine Commercial and Industrial Bank (hereafter called "PCIB"), a domestic letter of credit in favor of its supplier, Oregon Industries, Inc., to pay for one Skagit Yarder with accessories. PCIB paid to Oregon Industries the cost of the machinery against a bill of exchange . -After making the required marginal deposit, TOMCO, Inc. signed and delivered to the bank a trust receipt acknowledging receipt of the merchandise in trust for the bank, with the obligation "to hold the same in storage" as property of PCIB, with a right to sell the same for cash provided that the entire proceeds thereof are turned over to the bank, to be applied against acceptance(s) and any other indebtedness of TOMCO, Inc. -In consideration of the release to TOMCO, Inc. by PCIB of the machinery covered by the trust receipt, Ramon Abad signed an undertaking entitled, "Deed of Continuing

Guaranty" appearing on the back of the trust receipt, whereby he Promised to pay the obligation jointly and severally with TOMCO, Inc. -Except for TOMCOs P28,000 marginal deposit in the bank, no payment has been made to PCIB by either TOMCO, Inc. or its surety, Abad, on the P80,000 letter of credit. -Consequently, the bank sued TOMCO, Inc. and Abad -TOMCO did not deny its liability to PCIB under the letter of credit but it alleged that inasmuch as it made a marginal deposit the same should have been deducted from its principal obligation, on which the bank should have computed the interest, bank charges, and attorney's fees.

TC: -in favor of PCIB ordering TOMCO and ABAD to pay jointly and severally to PCIB with the marginal deposit still included in the computation of the obligation. CA: - Affirmed in toto decision of TC.

ISSUE: - Whether or not the marginal deposit paid for should first be deducted from its principal before computing interests and other charges.

HELD: - The marginal deposit requirement is a Central Bank measure to cut off excess currency liquidity which would create inflationary pressure. It is a collateral security given by the debtor, and is supposed to be returned to him upon his compliance with his secured obligation. Consequently, the bank pays no interest on the marginal deposit, unlike an ordinary bank deposit which earns interest in the bank. As a matter of fact, the marginal deposit requirement for letters of credit has been discontinued, except in those cases

where the applicant for a letter of credit is not known to the bank or does not maintain a good credit standing therein. - It is only fair then that the marginal deposit (if one was made, as in this case), should be set off against his debt, for while the importer earns no interest on his marginal deposit, the bank, apart from being able to use said deposit for its own purposes, also earns interest on the money it loaned to the importer. It would be onerous to compute interest and other charges on the face value of the letter of credit which the bank issued, without first crediting or setting off the marginal deposit which the importer paid to the bank. To allow such would be a clear case of unjust enrichment.

THE PEOPLE OF THE PHILIPPINE ISLANDS, plaintiff-appellee, vs. YU CHAI HO, defendant-appellant. Vicente Pelaez for appellant. Office of the Solicitor-General Reyes for appellee. Ross, Lawrence & Selph, Araneta and Zaragoza, Ohnick and McFie, and Abad Santos, Camus and Delgado as amici curiae.

OSTRAND, J.: This is an appeal from a decision of the Court of First Instance of Cebu in which the defendant was found guilty of the crime of estafa under paragraph 5 of article 535 of the Penal Code and was sentenced to suffer five months of arresto mayor and to pay the costs. It appears from the evidence that on December 19, 1925, the accused Yu Chai Ho, in representation of his firm, Gui Sing & Co., of which he was the managing partner, placed an order with Wm. H. Anderson & Co. for a quantity of Colgate perfumes and soap to be shipped from New York to Cebu. The order was transmitted to Colgate & Co., New York, and the merchandise was by them shipped to Cebu, consigned to themselves and subject to their order. The bill of lading and the invoices were forwarded to the Cebu branch of the International Banking Corporation, subject to delivery to the purchaser on payment of the purchase price, $259.70. The shipping documents were accompanied by a draft on Gui Sing & Co., who accepted the draft but was unable to pay. The International Banking Corporation of Cebu, therefore, retained the shipping documents and invoices, without which the merchandise could not be cleared through

the customhouse and delivered to the defendant or his firm. Through the intervention of Morrison, the Manager of the Cebu branch of Wm. H. Anderson & Co., the International Banking Corporation agreed to deliver the documents to Gui Sing & Co. upon their giving a trust receipt. The trust receipt was duly executed by Gui Sing & Co. and delivered to the International Banking Corporation, whereupon the shipping documents were surrendered to the defendant, who upon presentation of them to the customs authorities, obtained delivery of the merchandise. The defendant thereupon sold the merchandise but, in violation of the terms of the trust receipt, failed to make payment to the International Banking Corporation, and Wm. H. Anderson & Co., as guarantors, were compelled to pay the amount of the draft for the purchase price of the merchandise to the International Banking Corporation. The trust receipt is in the usual form and, among other things, contains the following provisions: I/We hereby agree to hold said goods in trust for the said corporation, and as its property with liberty to sell the same for its account, but without authority to make any other disposition whatever of the said goods or any part thereof (or to proceeds thereof) either by way of conditional sale, pledge, or otherwise. In case of sale I/We further agree to hand the proceeds, as soon as received, to the International Banking Corporation to apply against the relative acceptances (as described above) and for the payment of any other indebtedness of mine/ours to the International Banking Corporation. That under this trust receipt the title to the merchandise remained in the International Banking Corporation and did not pass to the defendant, is almost too elementary for discussion. It is sufficient to quote the language of the court in the case of In re Dunlap Carpet Co. (206 Fed., 726), in regard to trust receipts: By this arrangement a banker advances money to an intending importer, and thereby lends the aid of capital of credit, or of business facilities and agencies abroad, to the enterprise of foreign commerce. Much of this trade could hardly be carried on by any other means, and therefore it is of the first importance that the fundamental factor in the transaction, the banker's advance of money and credit should receive the amplest protection. Accordingly, in order to secure that the banker shall be repaid at the critical point that is, when the imported goods finally reach the hands of the intended vendee the banker takes the full title to the goods at the very beginning; he takes it as soon as the goods are brought and settled for by his payments or acceptances in the foreign country, and he continues to hold that title as his indispensable security until the goods are sold in the United States and the vendee is called upon to pay for them. This security is not an ordinary pledge by the importer to the banker, for the importer has never owned the goods, and moreover he is not able to deliver

the possession; but the security is the complete title vested originally in the bankers, and this characteristics of the transaction has again and again been recognized and protected by the courts. Of course, the title is at bottom a security title, as it has sometimes been called, and the banker is always under the obligation to reconvey; but only after his advances have been fully repaid and after the importer has fulfilled the other terms of the contract. (Emphasis ours.) (See also Moors vs. Kidder, 106 N. Y., 32; Farmers & Mechanics' Nat. Bk. vs. Logan, 74 N. Y., 568; Barry vs. Boninger, 46 Md., 59 Moors vs. Wyman, 146 Mass., 60; and New Haven Wire Co. Cases, 5 L. R. A., 300.) But counsel for the defendant argues vigorously that inasmuch as the price of the merchandise in question had been paid to the International Banking Corporation by Wm. H. Anderson & Co., the bank had suffered no loss, and that, therefore, an essential element of the crime of estafa was lacking; that the only party prejudiced by the actions of the defendant was Wm. H. Anderson & Co. and that as to the latter, the defendant had incurred a civil obligation. We cannot accept this theory. Paragraph 5 of article 535 of the Penal Code reads as follows: Any person who, to the prejudice of another, shall convert or misappropriate any money, goods, or other personal property received by such person for safe-keeping, or on commission, or for administration, or under any other circumstances giving rise to the obligation to make delivery of or to return the same, or shall deny having received such money, goods, or other property. The language of the paragraph is clear and requires no special construction. As will be seen, the person whose interests are prejudiced through the conversion or misappropriation of the money, goods, or other personal property need not necessarily be the owner thereof; if such had been the intention of the authors of the Code, the phrase "to the prejudice of another" would have read "to the prejudice of the owner." Our opinion is also supported by the Supreme Court of Spain in its sentence of May 8, 1884, which in principle is exactly in point. The facts of that case are that one Enrique Mariano handed his watch to his friend, the accused, keep for him while he, Mariano, was engaged in certain professional work in a circus. Instead of returning the watch to its owner, Mariano the accused pawned it in a pawnshop for a loan of 225 pesetas. Mariano recovered the watch from the pawnbroker almost immediately and without any expense. In that case, as in the present one, it was argued that as the owner of the watch suffered no loss, no estafa had been committed. the Spanish Supreme Court held that it was immaterial whether the loss had been suffered by the owner or by a third person, and among other things, said:

Considering that in view of the literal terms of the provision of said article, as well as its spirit and legal reason, whenever damages are caused as a consequence of the aforesaid appropriation or taking away, the act constitutes the crime of estafa, even though the person who suffered the damage is a third party, and not the on to whom the misappropriated or converted goods belongs or to whom it is to be returned, for this is an incidental element which in no way affects the juridical nature of the crime. The correctness of the view we taken seems quite clear when it is considered that the action is not one between the defendant and Wm. H. Anderson & Co. or between the defendant and the International Banking Corporation; it deals with a public offense and is brought against the defendant by the People of the Philippine Islands. The very evident object of the article of the Penal Code under which the action is brought is to discourage dishonesty and unfaithfulness in the administration or care of money, goods, or other personal property received for such purposes. The object is not simply to enforce payment of indemnities; that is merely a side issue of aquasi civil nature and is not the gist of the crime or the cause of action. The fact that the defendant gave surety for the fulfillment of his obligations under the trust receipt, is of no consequence and does not alter the case. In the case of United States vs. Tabotabo (11 Phil., 372), the court said: "Assuming that the surety company has in fact paid the sum misappropriated, this payment by the bonding company, made by virtue of its obligation to guarantee the liability of their client does not exempt the latter from the punishment provided for . . . ." In the case of Canal-Commercial Trust & Savings Bank vs. N. O. Tex. & Mex. Ry. Co., Appt., International Trading & Rice Company, Warrantor, Appt. (49 A. L. R., 274), it was held that the bank could recover from the appellants, including the warrantor, the value of the sugar, the bill of lading for which had been delivered upon trust receipt. In that case the court said: "The improper use of pledged securities, by the pledgor holding them under a trust receipt, is a species of embezzlement." In the case of People vs. De Lay (80 Cal., 52), the defendant, an assigneee for the benefit of creditors, was convicted of embezzlement of funds which came into his possession by virtue of collection of accounts and sales of property of the assignor. The court said: "The fact that Nunan and Lowney took a written indemnity from the defendant in no way affects the guilt or innocence of the defendant, who is charged with embezzling the property entrusted to him for certain purposes by Mrs. Furlong." The fact that a defendant has given an indemnity bond is no defense to a prosecution for embezzlement; (20 C. J., 456). It has been asserted that the information upon which the present action is brought is defective in that it is alleged therein that the offense was committed to the prejudice

of Wm. H. Anderson & Co. when it should have been alleged that the International Banking Corporation was the prejudiced party inasmuch as the loss suffered by Wm. H. Anderson & Co. was not contemporaneous with the commission of the crime. The information itself is the best answer to this proposition. It reads as follows in translation: The undersigned, sworn, accuses Yu Chai Ho of the crime of estafa, because on or about April 25, 1926, in the municipality of Cebu, Province of Cebu, the above-named defendant, under a trust receipt and a guaranty signed by Wm. H. Anderson & Co., in favor of the International Banking Corporation, withdrew and received from said International Banking Corporation, 2 cases of merchandise worth P539.65, consisting of bottles of perfumes and soap, Colgate brand, belonging to Colgate & Co., which merchandise was consigned to said bank in Cebu for the purpose of holding them in trust and selling them with the express obligation of turning over the proceeds of the sale to said International Banking Corporation, but the said accused, instead of complying with this obligation, wilfully, unlawfully, and criminally, with intent of gain, and through fraud, converted said merchandise to his own use and benefit, to the damage of Wm. H. Anderson & Co., who for lack of payment by the accused, notwithstanding the repeated demands made to that effect, had to pay the sum of P539.65 to said International Banking Corporation. Contrary to law. Cebu, Cebu, P. I., August 24, 1926. (Sgd.) LUCIO SANCHEZ Deputy Provincial Fiscal As will be seen, the facts of the case are fully set forth in the information; it clearly shows the consequences of the defendant's acts to the International Banking Corporation as well as to Wm. H. Anderson & Co. and was entirely sufficient to enable the defendant to prepare his defense. Assuming for the sake of the argument, that the fiscal erred in alleging that Wm. H. Anderson & Co. suffered damages by reason of the defendant's acts, the alleged error was , therefore, non-prejudicial and did not vitiate the proceedings. (Sec. 10, G. O., 58.) We do not however, think that the fiscal erred in alleging that the commission of the crime resulted to the prejudice of Wm. H. Anderson & Co. It is true that originally the International Banking Corporation was the prejudiced party, but Wm. H. Anderson & Co. compensated it for its loss and thus became subrogated to all its rights against the defendant (article 1839, Civil Code). Wm. H. Anderson & Co., therefore, stood exactly in the shoes of the International Banking Corporation in relation to the defendant's acts, and the commission of the crime resulted to the prejudice of the firm previously to the filing of the information in the case. The loss suffered by the firm was the ultimate result of the defendant's unlawful acts, and we see no valid reason why this fact should not be

stated in the information; it stands to reason that, in the crime of estafa, the damage resulting therefrom need not necessarily occur simultaneously with the acts constituting the other essential elements of the crime. In the sentence of the court below provision for the payment of indemnity is omitted on the ground that the defendant being insolvent, the prejudiced party has probably presented his claim in the insolvency proceedings. There being no direct evidence to that effect, we do not think that there is sufficient reason for such omission. 1awph!l.net For the reasons stated the appealed sentence is modified by ordering the defendant to indemnify Wm. H. Anderson & Co. in the sum of P519, with subsidiary imprisonment in case of insolvency. In all other respects the judgment of the court below is affirmed, with the costs of this instance against the appellant. So ordered. Avancea, C. J., Johnson, Malcolm, Villamor, Romualdez, and Villa-Real, JJ., concur.

People vs. Cuevo No. L-27607, 104 SCRA 312, May 07, 1981 G.R. No. L-27607 May 7, 1981 THE PEOPLE OF THE PHILIPPINES, plaintiff-appellee vs. BEN CUEVO, defendant-appellant. AQUINO, J.: This case presents for reexamination the liability for estafa of the holder of a trust receipt who disposed of the goods covered thereby and, in violation of its terms, failed to deliver to the bank the proceeds of the sale as payment of the debt secured by the trust receipt. We say reexamination because it is a well-entrenched rule in our jurisprudence that the conversion by the importer of the goods covered by a trust receipt constitutes estafa through misappropriation under article 315(l) (b) of the Revised Penal Code, (People vs. Yu Chai Ho 53 Phil. 874 and Samo vs. People. 115 Phil. 346. As to civil cases, see National Bank vs. Viuda e Hijos de Angel Jose, 63 Phil. 814; Philippine National Bank vs. Catipon, 98 Phil. 286 and Philippine National Bank vs. Arrozal 103 Phil. 213). In this case, an information dated July 27, 1966 was filed in the Court of First Instance of Manila, charging Ben Cuevo with estafa committed as follows (Criminal Case No. 83309):

That on or about the 16th day of February, 1964 in the City of Manila, Philippines, the said accused did then and there willfully, unlawfully and feloniously defraud the Prudential Bank and Trust Company in the following manner, to wit: the said accused having received in trust from the Prudential Bank and Trust Company merchandise, i.e., 1,000 bags of grind yellow corn and 1,000 bags of palay specified in a trust receipt covered by Letter of Credit No. 5643, executed by him in favor of said bank, of the total value of P24,000.00, to be sold by him, under the express obligation on the part of the said accused to account for the said merchandise, or to deliver and turn over to the Prudential Bank and Trust Company the proceeds of the sale thereof; But said accused once in possession of said merchandise, far from complying with the aforesaid obligation, notwithstanding repeated demands made upon him, with intent to defraud, willfully, unlawfully and feloniously misappropriated, misapplied and converted the said merchandise or the value, thereof in the sum of P24,000.00 to his own personal use and benefit, to the damage and prejudice of the Prudential Bank and Trust Company in the aforesaid of P24,000.00, Philippine Currency. (p. 2, Rollo.) Upon arraignment, the accused pleaded not guilty (p. 11, Record). Later, or on December 13, 1966, before the trial had started, Cuevo filed a motion to dismiss on the ground that the facts alleged in the information do not constitute an offense. Judge Ruperto Kapunan, Jr., in his order of January 3, 1967, granted the motion and dismissed the case but "without prejudice to whatever civil action the complaining bank may take to recover the amount of P24,000" which it had advanced to cover the price of the merchandise delivered to the accused (p. 7, Rollo). From that order of dismissal, the prosecution appealed to this Court. The appeal is meritorious. Judge Kapunan, Jr. erred in holding that the accused did not commit estafa under article 315(l) (b), which reads: (b) By misappropriating or converting, to the prejudice of another, money, goods, or any other personal property received by the offender in trust or on commission, or for administration, or under any other obligation involving the duty to make delivery of or to return the same, even though such obligation be totally or partially guaranteed by a bond; or by denying having received such money, goods, or other property. Judge Kapunan, Jr., in sustaining the motion to dismiss, relied on the Spanish version of paragraph (b) of article 315 wherein the expression used is "recibido en deposito". In his opinion, that phrase is not accurately translated as "in trust" and, as he explained, it does not allegedly cover the conversion or misappropriation of the goods covered by a trust receipt. The Spanish version reads: (b) Apropiandose o distrayendo, en perjuicio de otro dinero, efectos o cualquiera otra cosa mueble, que hubiere recibido en deposito, commission o administracion o por otro titulo que produzca obligacion de entregarla o devolveria, aungue dicha obligacion estuviese afianzada total or parcialmente, o negando haberla recibido.

The lower court ratiocinated that the contract covered by a trust receipt is merely a secured loan (U.S. vs. Tan Tok, 15 Phil. 538) where the borrower is allowed to dispose of the collateral, whereas, in a deposit the depositary is not empowered to dispose of the property deposited. Hence, the lower court concluded that the violation of the provisions of the trust receipt gives rise to a civil action and not to a criminal prosecution for estafa. The lower court also ventured the opinion that the other phrase in paragraph (b), por otro titulo que produzca obligacion de entregarla o devolverla" ("under any other obligation involving the duty to make delivery of or to return the same") is not applicable because that phrase allegedly refers to the very "money, goods, or any other personal property received by the offender" as a deposit, and not to the proceeds of the sale of the goods covered by the trust receipt. The lower court observed further that the framers of the Spanish Penal Code could not have contemplated the inclusion of the trust receipt in article 315(l) (b) because that transaction did not exist in the nineteenth century. The usual form of a trust receipt is as follows: I/We hereby agree to hold said goods in trust for the said corporation (meaning the bank as trustor), and as its property with liberty to sell the same for its account, but without authority to make any other disposition whatever of the said goods or any part thereof (or of proceeds thereof) either by way of conditional sale, pledge or otherwise. In case of sale I/We further agree to hand the proceeds, as soon as received, to the International Banking Corporation to apply against the relative acceptances (as described above) and for the payment of any other indebtedness of mine/ours to the International Banking Corporation. (People vs. Yu Chai Ho 53 Phil. 874, 876.) A trust receipt is considered as a security transaction intended to aid in financing importers and retail dealers who do not have sufficient funds or resources to finance the importation or purchase of merchandise, and who may not be able to acquire credit except through utilization, as collateral, of the merchandise imported or purchased" (53 Am. Jur. 961, cited in Samo vs. People, 115 Phil. 346, 349). In the instant case, it is alleged in the indictment that the accused, by means of a trust receipt, received from the Prudential Bank and Trust Company 1,000 bags of corn and 1,000 bags of palay to be sold by him with the express obligation to deliver the proceeds of the sale to the bank or, if not sold, to account for the merchandise and that, instead of complying with either obligation, he misappropriated the merchandise or the value thereof (p. 2, Rollo). We hold that even if the accused did not receive the merchandise for deposit, he is, nevertheless, covered by article 315(l) (b) because after receiving the price of the sale,

he did not deliver the money to the bank or, if he did not sell the merchandise, he did not return it to the bank. Those two situations are within the purview of article 315(l) (b). The first situation is covered by the provision which refers to money received under the obligation involving the duty to deliver it (entregarla) to the owner of the merchandise sold. The other contingency is covered by the provision which refers to merchandise received under the obligation to "return" it (devolvelra) to the owner. The fact that in the first case the money was received from the purchaser of the merchandise and not from the bank does not remove it from the operation of article 315(l) (b). As noted by Justice Street in People vs. Yu Chai Ho, supra, the conversion by the trustee in a trust receipt of the proceeds of the sale falls "most literally and directly under" the provisions of article 315(l) (b). Thus, it was held that where, notwithstanding repeated oral and written demands by the bank, the petitioner had failed either to turn over to the said bank the proceeds of the sale of the goods, or to return said goods if they were not sold, the petitioner is guilty of estafa under article 315(l) (b) (Samo vs. People, 115 Phil. 346). In this connection, it is relevant to state that Presidential Decree No. 115, the Trust Receipts Law, regulating trust receipts transactions, was issued on January 29, 1973. One objective of that law is "to declare the misuse and/or misappropriation of goods or proceeds realized from the sale of goods, documents or instruments released under trust receipts as a criminal offense punishable under" article 315. Section 13 of the decree provides that "the failure of an entrustee to turn over the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owing to the entruster or as appears in the trust receipt or to return said goods, documents or instruments if they were not sold or disposed of in accordance with the terms of the trust receipt shall constitute the crime of estafa, punishable under the provisions" of article 315 of the Revised Penal Code. The enactment of the said penal provision is confirmatory of existing jurisprudence and should not be construed as meaning that, heretofore, the misappropriation of the proceeds of a sale made under a trust receipt was not punishable under article 315. That penal provision removed any doubt as to the criminal liability of the holder of a trust receipt who misappropriated the proceeds of the sale. The other issue raised in the last part of accused Cuevo's brief is whether the lower court's erroneous dismissal of the information against him amounts to an acquittal

which placed him in jeopardy and whether the return of the case to the lower court for trial would place him in double jeopardy. No person shall be twice put in jeopardy of punishment for the same offense" (Sec. 22, Art. IV of the Constitution). The maxim is non bis in Idem (not twice for the same). The ban against double jeopardy is similar to the rule onres judicata in civil cases. Jeopardy attaches when an accused was charged with an offense (a) upon a valid complaint or information sufficient in form and substance to sustain a conviction (b) in a court of competent jurisdiction and (c) after the accused had been arraigned and entered his plea, he was convicted or acquitted, or the case against him was "dismissed or otherwise terminated without his express consent". In such a case, his conviction or acquittal (autrefois convict or autrefois acquit) is a "bar to another prosecution for the offense charged, or for any attempt to commit the same or frustration thereof, or for any offense charged in the former complaint or information " (Sec. 9, Rule 117, Rules of Court). The accused invokes the ruling that "where a trial court has jurisdiction but mistakenly dismisses the complaint or information on the ground of lack of it, the order of dismissal is, after the prosecution has presented its evidence, unappealable because an appeal by the government therefrom would place the accused in second jeopardy for the same offense" (People vs. Duran, Jr., 107 Phil. 979). That ruling has no application to this case because in the Duran case (as in People vs. Caderao 69 Phil. 327, also cited by the accused herein) the dismissal was made after the prosecution had presented its evidence. The accused filed a demurrer to the evidence but the trial court dismissed the case, not on the ground of insufficiency of evidence, but on the ground of lack of jurisdiction. In the instant case, the prosecution has not commenced the presentation of its evidence. The dismissal was with the consent of the accused because he filed a motion to dismiss. In Esguerra vs. De la Costa, 66 Phil. 134, another case cited by the accused, the erroneous dismissal on the ground of lack of jurisdiction was made by the lower court motu proprio. Hence, the dismissal without the consent of the accused amounted to an acquittal which placed him in jeopardy. Moreover, in the Duran case, it was expressly indicated that the erroneous dismissal on the ground of lack of jurisdiction does not place the accused in jeopardy if the dismissal was made with the consent of the accused, as held in People vs. Salico, 84 Phil. 722. As already stated, in the instant case the dismissal was with the consent of accused Cuevo. The dismissal did not place him in jeopardy.

The Chief Justice and six Justices voted to reverse the order of dismissal. Justices Teehankee and De Castro dissented. As only seven Justices voted to reverse the order of dismissal, the same has to be affirmed. WHEREFORE, the order of dismissal is affirmed. Costs de oficio. SO ORDERED. Makasiar, Fernandez, Guerrero, Abad Santos, De Castro and Melencio-Herrera, JJ., concur. Fernando, CJ., concurs on the basis of absence of double jeopardy. Barredo, J., and Concepcion Jr., J., took no part.

Separate Opinions TEEHANKEE, J., dissenting: I concur with the dissent of Mr. Justice De Castro insofar as it upholds the more liberal interpretation to the trust receipt transaction which would give rise only to civil liability on the part of the offender. The very definition of trust receipt as given in the main opinion (at pp. 4-5) to wit, "'(A) trust receipt is considered as a security transaction intended to aid in financing importers and retail dealers who do not have sufficient funds or resources to finance the importation or purchase of merchandise, and who may not be able to acquire credit except through utilization, as collateral, of the merchandise imported or purchased' (53 Am. Jr. 961, cited in Samo vs. People, 115 Phil. 346, 349)," sustains the lower court's rationale in dismissing the information that the contract covered by a trust receipt is merely a secured loan. The goods imported by the small importer and retail dealer through the bank's financing remain of their own property and risk and the old capitalist orientation of putting them in jail for estafa for non-payment of the secured loan (granted after they had been fully investigated by the bank as good credit risks) through the fiction of the trust receipt device should no longer be permitted in this day and age. DE CASTRO, J., dissenting: I regret to have to dissent from the majority opinion. The question is whether the violation of the terms of a trust receipt would constitute estafa. There is no more doubt that under P.D. 115, the violation is defined as estafa, but before the promulgation of said decree, I have entertained grave doubts to such an extent that I would acquit a person accused of the crime allegedly committed before said decree, the promulgation of which serves to confirm my doubts. For if there had been no such doubt, especially as some decisions had already been rendered by this Court holding that estafa is committed when there is a violation of a trust receipt, there would have been no need for P.D. 115.

One view is to consider the transaction as merely that of a security of a loan, and that the trust element is but an inherent feature of the security aspect of the arrangement where the goods are placed in the possession of the "entrustee," to use the term used in P.D. 115, violation of the element of trust not being intended to be in the same concept as how it is understood in the criminal sense. The other view is that the bank as the owner and "entrustor" delivers the goods to the "entrustee " with the authority to sell the goods, but with the obligation to give the proceeds to the "entrustor" or return the goods themselves if not sold, a trust being thus created in the full sense as contemplated by Art. 315, par. 1(b) I consider the view that the trust receipt arrangement gives rise only to civil liability as the more feasible, before the promulgation of P.D. 115. The transaction being contractual, the intent of the parties should govern. Since the trust receipt has, by its nature, to be executed upon the arrival of the goods imported, and acquires legal standing as such receipt only upon acceptance by the "entrustee," the trust receipt transaction itself, the antecedent acts consisting of the application of the L/C the approval of the L/C and the making of the marginal deposit and the effective importation of the goods, all through the efforts of the importer who has to find his supplier, arrange for the payment and shipment of the imported goods all these circumstances would negate any intent of subjecting the importer to criminal prosecution, which could possibly give rise to a case of imprisonment for non-payment of a debt. The parties, therefore, are deemed to have consciously entered into a purely commercial transaction that could give rise only to civil liability, never to subject the "entrustee" to criminal prosecution. Unlike, for instance, when several pieces of jewelry are received by a person from the owner for sale on commission, and the former misappropriates for his personal use and benefit, either the jewelries or the proceeds of the sale, instead of returning them to the owner as is his obligation, the bank is not in the same concept as the jewelry owner with full power of disposition of the goods, which the bank does not have, for the bank has previously extended a loan which the L/C represents to the importer, and by that loan, the importer should be the real owner of the goods. If under the trust receipt, the bank is made to appear as the owner, it was but an artificial expedient more of a legal fiction than fact, for if it were really so, it could dispose of the goods on any manner it wants, which is cannot do, just to give consistency with the purpose of the trust receipt of giving a stronger security for the loan obtained by the importer. To consider the bank as the true owner from the inception of the transaction would be to disregard the loan feature thereof, a feature totally absent in the case of the transaction between the jewel owner and his agent. Consequently, if only from the fact that the trust receipt transaction is susceptible to two (2) reasonable interpretations, one as giving rise only to civil liability for the violation of the condition thereof, and the other, as generating also criminal liability, the former should be adopted as more favorable to the supposed offender. (Duran vs. CA, L-

39758, May 7, 1976, 71 SCRA 68; People vs. Parayno L-24804, July 5, 1968, 24 SCRA 3; People vs. Abendan, L-1481, January 28, 1949, 82 Phil. 711; People vs. Bautista. L- 1502, May 24, 1948, 81 Phil. 78; People v . Abana, L-39, February 1, 1946, 76 Phil. 1.) Accordingly, I vote for the affirmance of the questioned order.

Sia vs. People Post under case digests, Commercial Law at Monday, February 27, 2012 Posted by Schizophrenic Mind Facts: Jose Sia, president and GM of Metal ManufacturingCompany of the Phil., on behalf of said company, obtained delivery of 150 cold rolled steel sheets valued at P71,023.60 under a trust receipt agreement. Said sheets were consigned to the Continental Bank, under the express obligation on the part of Sia of holding the sheets in trust and selling them and turning over the proceeds to the bank. Sia, however, allegedly failed and refused to return the sheets or account for the proceeds thereof if sold, converting it to his own personal use and benefit. Continental Bank filed a complaint for estafa against Sia. The trial court and CA ruled against Sia. Issue: Whether or not Sia, acting as President of MMCP, may be held liable for estafa Held: Sia was acquitted. CA decision is reversed. An officer of a corporation can be held criminally liable for acts or omissions done in behalf of the corporation only where the law directly requires the corporation to do an act in a given manner. In he absence of a law making a corporate officer liable for a criminal offense committed by the corporation, the existence of the criminal liability of he former may not be said to be beyond doubt. Hence in the absence of an express provision of law making Sia liable for the offense done by MMCP of which he is President, as in fact there is no such provision under the Revised Penal Code, Sia cannot be said to be liable for estafa.

Lee v. Rodil, 1989 Facts: Petitioner Rosemarie M. Lee was charged with estafa.

The accused moved to quash the information on the ground that the facts charged do not constitute an offense. She alleges that the violation of a trust receipt agreement does not constitute estafa notwithstanding an express provision in the "Trust Receipts Law" (P.D. 115) characterizing such violation as estafa and therefore attacks P.D. 115 for being unconstitutional. Issue:Whether the violation of a trust receipt agreement constitutes the crime of estafa. Ruling: Yes. Acts involving the violation of trust receipt agreements occurring after 29 January 1973 would make the accused criminally liable for estafa under paragraph 1 (b), Article 315 of the Revised Penal Code, pursuant to the explicit provision in Sec. 13 of P.D. 115. The petitioner has failed to make out a strong case that P.D. 115 conflicts with the constitutional prohibition against imprisonment for non-payment of debt. The loan feature is separate and distinct from the trust receipt. The violation of a trust receipt committed by disposing of the goods covered thereby and failing to deliver the proceeds of such sale has been squarely made to fall under Art. 315 (1)(b) of the Revised Penal Code. P.D. 115 is a valid exercise of police power and is not repugnant to the constitutional provision on non- imprisonment for non-payment of debt.

ALLIED BANKING CORPORATION VS SECRETARY SEDFREY ORDOEZ AND ALFREDOCHING 192 SCRA 246 (1990) FACTS : Respondent Alfredo Ching duly authorized officer of Philippine Blooming Mills(PBM) applied for the issuance of commercial letters of credit with petitioner Allied banking Corporation. The latter issued an irrevocable letter of credit infavor of Nikko Industry wherein it drew four (4) drafts which were accepted by Blooming Mills and duly honored and paid by Allied Bank. In order to secure the payment of the loan, Blooming Mills as entrustee, executed four (4) Trust Receipt Agreements acknowledging Allied banks ownership of the goods and Blooming Mills obligation to turn over the proceeds of the sale of the goods if sold or to return the same within the stated period. Blooming Mills failed to pay itsobligation, thereby prompting petitioner bank to file a criminal complaint for violation of Presidential Decree 115. ISSUE: Whether or not the penal provision of Presidential decree 115 apply when the goods covered by a Trust Receipt do not form part of the finished

products which are ultimately sold but are instead, utilized in the operation of the equipment of entrustee-manufacturer? RULING: Yes. In trust receipts, there is an obligation to repay the entruster. The entrusteebinds himself to sell or otherwise dispose of the entrusted goods with the obligation to turn over to the entruster the proceeds if sold, or return the goods if unsold or not otherwise disposed of according to the terms and conditions of the trust receipt. Petition granted.

People vs. Nitafan G.R. Nos. 81559-60, 207 SCRA 726, April 06, 1992 PEOPLE OF THE PHILIPPINES, (public petitioner) and ALLIED BANKING CORPORATION (private petitioner), vs. HON. JUDGE DAVID G. NITAFAN (public respondent) and BETTY SIA ANG (private respondent). GUTIERREZ, JR., J.: This petition for certiorari involves an issue that has been raised before this Court several times in the past. The petitioner, in effect, is asking for a re-examination of our decisions on the issue of whether or not an entrustee in a trust receipt agreement who fails to deliver the proceeds of the sale or to return the goods if not sold to the entruster-bank is liable for the crime of estafa. Petitioner Allied Banking Corporation charged Betty Sia Ang with estafa in Criminal Case No. 87-53501 in an information which alleged: That on or about July 18, 1980, in the City of Manila, Philippines, the said accused, being then the proprietress of Eckart Enterprises, a business entity located at 756 Norberto Amoranto Avenue, Quezon City, did then and there wilfully, unlawfully and feloniously defraud the Allied Banking Corporation, a banking institution, represented by its Account Officer, Raymund S. Li, in the following manner, to wit: the said accused received in trust from the aforesaid bank Gordon Plastics, plastic sheeting and Hook Chromed, in the total amount of P398,000.00, specified in a trust receipt and covered by Domestic Letter of Credit No. DLC-002-801254, under the express obligation on the part of said accused to sell the same and account for the proceeds of the sale thereof, if sold, or to return said merchandise, if not sold, on or before October 16, 1980, or upon demand, but the said accused, once in possession of the said articles, far from complying with the aforesaid obligation, notwithstanding repeated demands made upon her to that effect, paid only the amount of P283,115.78, thereby leaving unaccounted for the amount of P114,884.22 which, once in her possession, with intent

to defraud, she misappropriated, misapplied and converted to her own personal use and benefit, to the damage and prejudice of said Allied Banking Corporation in the aforesaid sum of P114,884.22, Philippine Currency. (Rollo, pp. 13-14) The accused filed a motion to quash the information on the ground that the facts charged do not constitute an offense. On January 7, 1988, the respondent judge granted the motion to quash. The order was anchored on the premise that a trust receipt transaction is an evidence of a loan being secured so that there is, as between the parties to it, a creditor-debtor relationship. The court ruled that the penal clause of Presidential Decree No. 15 on the Trust Receipts Law is inoperative because it does not actually punish an offense mala prohibita. The law only refers to the relevant estafa provision in the Revised Penal Code. The Court relied on the judicial pronouncements inPeople v. Cuevo, 104 SCRA 312 [1981] where, for lack of the required number of votes, this Court upheld the dismissal of a charge for estafa for a violation of a trust receipt agreement; and in Sia v. People, 121 SCRA 655 [1983] where we held that the violation merely gives rise to a civil obligation. At the time the order to quash was issued or on January 7, 1988, these two decisions were the only most recent ones. Hence, this petition. The private respondent adopted practically the same stance of the lower court. She likewise asserts that P.D. 115 is unconstitutional as it violates the constitutional prohibition against imprisonment for non-payment of a debt. She argues that where no malice exists in a breach of a purely commercial undertaking, P.D. 115 imputes it. This Court notes that the petitioner bank brought a similar case before this Court in G.R. No. 82495, entitled Allied Banking Corporation v. Hon. Secretary Sedfrey Ordoez and Alfredo Ching which we decided on December 10, 1990 (192 SCRA 246). In that case, the petitioner additionally questioned, and we accordingly reversed, the pronouncement of the Secretary of Justice limiting the application of the penal provision of P.D. 115 only to goods intended to be sold to the exclusion of those still to be manufactured. As in G.R. No. 82495, we resolve the instant petition in the light of the Court's ruling in Lee v. Rodil, 175 SCRA 100 [1989] and Sia v. Court of Appeals, 166 SCRA 263 [1988]. We have held in the latter cases that acts involving the violation of trust receipt agreements occurring after 29 January 1973 (date of enactment of P.D. 115) would make the accused criminally liable for estafa under paragraph 1 (b), Article 315 of the Revised Penal Code (RPC) pursuant to the explicit provision in Section 13 of P.D. 115. The relevant penal provision of P.D. 115 provides: Sec. 13 of P.D. No. 115 provides: . . . Penalty clause. The failure of an entrustee to turn over the proceeds of the sale of the goods, documents or instruments covered by a trust receipt to the extent of the amount owing to the entruster or as appears in the trust receipt or to return said goods, documents or instruments if they were not sold or disposed of in accordance with the

terms of the trust receipt shall constitute the crime of estafa, punishable under the provisions of Article Three Hundred and Fifteen, paragraph one (b) of Act Numbered Three Thousand Eight Hundred and Fifteen, as amended, otherwise known as the Revised Penal Code. If the violation or offense is committed by a corporation, partnership, association or other juridical entities, the penalty provided for in this Decree shall be imposed upon the directors, officers, employees or other officials or persons therein responsible for the offense, without prejudice to the civil liabilities arising from the criminal offense. Section 1 (b), Article 315 of the RPC under which the violation is made to fall, states: . . . Swindling (estafa). Any person who shall defraud another by any of the means mentioned herein below . . . : xxx xxx xxx b. By misappropriating or converting, to the prejudice of another, money, goods, or any other personal property received by the offender in trust or on commission, or for administration, or under any other obligation involving the duty to make delivery of or to return the same, even though such obligation be totally or partially guaranteed by a bond; or by denying having received such money, good, or other property. The factual circumstances in the present case show that the alleged violation was committed sometime in 1980 or during the effectivity of P.D. 115. The failure, therefore, to account for the P114,884.22 balance is what makes the accused-respondent criminally liable for estafa. The Court reiterates its definitive ruling that, in the Cuevo and Sia(1983) cases relied upon by the accused, P.D. 115 was not applied because the questioned acts were committed before its effectivity. (Lee v. Rodil, supra, p. 108) At the time those cases were decided, the failure to comply with the obligations under the trust receipt was susceptible to two interpretations. The Court in Sia adopted the view that a violation gives rise only to a civil liability as the more feasible view "before the promulgation of P.D. 115," notwithstanding prior decisions where we ruled that a breach also gives rise to a liability for estafa. (People v. Yu Chai Ho, 53 Phil. 874 [1929]; Samo v. People, 115 Phil. 346 [1962]; Philippine National Bank v. Arrozal, 103 Phil. 213 [1958]; Philippine National Bank v. Viuda e Hijos de Angel Jose, 63 Phil. 814 [1936]). Contrary to the reasoning of the respondent court and the accused, a trust receipt arrangement does not involve a simple loan transaction between a creditor and debtorimporter. Apart from a loan feature, the trust receipt arrangement has a security feature that is covered by the trust receipt itself. (Vintola v. Insular Bank of Asia and America, 151 SCRA 578 [1987]) That second feature is what provides the much needed financial assistance to our traders in the importation or purchase of goods or merchandise through the use of those goods or merchandise as collateral for the advancements made by a bank. (Samo v. People, supra). The title of the bank to the security is the one sought to be protected and not the loan which is a separate and distinct agreement.

The Trust Receipts Law punishes the dishonesty and abuse of confidence in the handling of money or goods to the prejudice of another regardless of whether the latter is the owner or not. The law does not seek to enforce payment of the loan. Thus, there can be no violation of a right against imprisonment for non-payment of a debt. Trust receipts are indispensable contracts in international and domestic business transactions. The prevalent use of trust receipts, the danger of their misuse and/or misappropriation of the goods or proceeds realized from the sale of goods, documents or instruments held in trust for entruster-banks, and the need for regulation of trust receipt transactions to safeguard the rights and enforce the obligations of the parties involved are the main thrusts of P.D. 115. As correctly observed by the Solicitor General, P.D. 115, like Batas Pambansa Blg. 22, punishes the act "not as an offense against property, but as an offense against public order. . . ." The misuse of trust receipts therefore should be deterred to prevent any possible havoc in trade circles and the banking community (citing Lozano v. Martinez, 146 SCRA 323 [1986]; Rollo, p. 57) It is in the context of upholding public interest that the law now specifically designates a breach of a trust receipt agreement to be an act that "shall" make one liable for estafa. The offense is punished as a malum prohibitum regardless of the existence of intent or malice. A mere failure to deliver the proceeds of the sale or the goods if not sold, constitutes a criminal offense that causes prejudice not only to another, but more to the public interest. We are continually re-evaluating the opposite view which insists that the violation of a trust receipt agreement should result only in a civil action for collection. The respondent contends that there is no malice involved. She cites the dissent of the late Chief Justice Claudio Teehankee in Ong v. Court of Appeals, (124 SCRA 578 [1983]) to wit: The old capitalist orientation of putting importers in jail for supposed estafa or swindling for non-payment of the price of the imported goods released to them under trust receipts (a purely commercial transaction) under the fiction of the trust receipt device, should no longer be permitted in this day and age. As earlier stated, however, the law punishes the dishonesty and abuse of confidence in the handling of money or goods to the prejudice of the bank. The Court reiterates that the enactment of P.D. 115 is a valid exercise of the police power of the State and is, thus, constitutional. (Lee v. Rodil, supra; Lozano v. Martinez, supra) The arguments of the respondent are appropriate for a repeal or modification of the law and should be directed to Congress. But until the law is repealed, we are constrained to apply it. WHEREFORE, the petition is hereby GRANTED. The Order of the respondent Regional Trial Court of Manila, Branch 52 dated January 7, 1988 is SET ASIDE. Let this case be remanded to the said court for disposition in accordance with this decision. SO ORDERED. Feliciano, Bidin, Davide, Jr. and Romero, JJ., concur.

PRUDENTIAL BANK, petitioner, vs. NATIONAL LABOR RELATIONS COMMISSION, CECILIA ORQUELLO, et al., ZENAIDA UCHI, et al., ALU-INTERASIA CONTAINER INDUSTRIES, INC., and RAUL REMODO, respondents.

BELLOSILLO, J.: This petition for certiorari impugns the Resolutions of the National Labor Relations Commission (NLRC) dated 18 August and 12 November 1993 in NLRC Cases Nos. RAB-III580-82 (Orquillo v. Interasia Container Industries, Inc.), RAB-III-3-585-82, (Uchi v. Interasia Container Industries, Inc.) and RAB-III-08-0049-87, (ALU-Interasia Container Industries, Inc. v. Interasia Container Industries, Inc.) dismissing the appeal of petitioner from the order of the Labor Arbiter denying its third-party claim to the personal properties subject of levy on execution based on its trust receipts. The records show that Interasia Container Industries, Inc. (INTERASIA), was embroiled in three (3) labor cases which were eventually resolved against it. Thus in NLRC Cases Nos. RAB-III-03-580-82 and RAB-III-03-585-82 monetary awards consisting of 13th-month pay differentials and other benefits were granted to complainants. Subsequently the monetary award was recomputed to include separation pay in the total sum of P126,788.30 occasioned by the closure of operations of INTERASIA. In RAB-03-08-004987 the Labor Arbiter declared the closure or shutdown of operations effected by INTERASIA as illegal and awarded to complainants the sum of P1,188,466.32 as wage differentials, separation pay and other benefits. With the finality of the three (3) decisions, writs of execution were issued. The Sheriff levied on execution personal properties located in the factory of INTERASIA thus "For Case 580 and 585: One (1) lot-plastic sacks (scrap, one (1) lot sling sacks, one (1) lot plastic in spools; and, For Case 0049: Five hundred (500) bags plastic resins, one (1) lot plastic resins sweaping (scrap) and one (1) lot all plastic linings." Petitioner filed an Affidavit of Third-Party Claim asserting ownership over the seized properties on the strength of trust receipts executed by INTERASIA in its favor. As a result, the Sheriff suspended the public auction sale. But on 18 September 1992 the Labor Arbiter denied the claim of petitioner and directed the Sheriff to proceed with the levy of the properties. Petitioner then filed separate appeals to the NLRC.

On 14 October 1992 the Sheriff posted Notices of levy and Sale of the seized properties on 21 October 1992. However, no bidder appeared on the scheduled date hence the public auction sale was postponed to 5 November 1992. At the rescheduled date the Sheriff declared Angel Peliglorio the highest bidder with an offer of P128,000.00 on the properties levied in Cases Nos. 580 (RAB-III-580-82) and 585 (RAB-III-3-585-82), and P1,191,110.00 in Case No. 0049 (RAB-111-08-0049-87). On 12 December 1992 the Labor Arbiter ordered the release of the properties to Peliglorio prompting INTERASIA to file a Motion to Set Aside and/or Declare Public Auction Sale Null and Void Ab Initio for non-compliance with legal requisites. On 23 December 1992 the Labor Arbiter denied the motion and directed the Sheriff to break open the plant of INTERASIA in order that Peliglorio could enter and take possession of the auctioned properties. INTERASIA moved to reconsider the order. On 12 January 1993 the Labor Arbiter inhibited himself from the case because of INTERASIAS's accusation of partiality. The records were then forwarded to the NLRC. On the other hand, petitioner filed a Third-Party Claimant's Appeal/Memorandum. On 18 August 1993 the NLRC dismissed petitioner's appeal as well as INTERASIA's Motion for Reconsideration of the resolution dated 23 December 1992. INTERASIA and petitioner separately moved to reconsider the ruling but on 12 November 1993 their motions were denied. 1 Hence petitioner brought this present recourse raising questions on the validity not only of the NLRC resolutions of 18 August and 12 November 1993 but also of the public auction sale. 2 Petitioner rails against the public auction of 5 November 1992 which was allegedly conducted without notice and in a place other than the premises of INTERASIA as required by the Manual of Instructions for Sheriffs. It also raises issue on the extent of its security title over the properties subject of the levy on execution, submitting that while it may not have absolute ownership over the properties, still it has right, interest and ownership consisting of a security title which attaches to the properties. Petitioner differentiates a trust receipt, which is a security for the payment of the obligations of the importer, from a real estate mortgage executed as security for the payment of an obligation of a borrower. Petitioner argues that in the latter the ownership of the mortgagor may not necessarily have any bearing on its acquisition, whereas in the case of a trust receipt the acquisition of the goods by the borrower results from the advances made by the bank. It concludes that the security title of the bank in a trust receipt must necessarily be of the same or greater extent than the nature of the security arising from a real estate mortgage. Petitioner maintains that it is a preferred claimant to the proceeds from the foreclosure to the extent of its security title in the goods which are valued at P46,100,253.92 otherwise its security title will become useless. 3 In their comment, private respondents support the findings of the NLRC. They submit that petitioner's negligence to immediately assert its right to cancel the Trust Receipt Agreements, upon INTERASIA's failure to comply with its obligation, is fatal to its claim.

For its part, the NLRC claims to rely on our pronouncement on trust receipts in Vintola v. Insular Bank of Asia and America. 4 It justifies the dismissal of petitioner's third-party claim on the ground that trust receipts are mere security transactions which do not vest upon petitioner any title of ownership, and that although the Trust Receipt Agreements described petitioner as owner of the goods, there was no showing that it canceled the trust receipts and took possession of the goods. 5 The petition is impressed with merit. We cannot subscribe to NLRC's simplistic interpretation of trust receipt arrangements. In effect, it has reduced the Trust Receipt Agreements to a pure and simple loan transaction. This perception was clearly dispelled in People v. Nitafan, 6 citing the Vintola and Samo cases, where we explained the nature of a trust receipt thus (A) trust receipt arrangement does not involve a simple loan transaction between a creditor and debtor-importer. Apart from a loan feature, the trust receipt arrangement has a security feature that is covered by the trust receipt itself. (Vintola v. Insular Bank of Asia and America, 150 SCRA 578 [1987] That second feature is what provides the much needed financial assistance to our traders in the importation or purchase of goods or merchandise through the use of those goods or merchandise as collateral for the advancements made by a bank (Samo v. People, 115 Phil 346 [1962]). The title of the bank to the security is the one sought to be protected and not the loan which is a separate and distinct agreement. Reliance cannot be placed upon the Vintola case as an excuse for the dismissal of petitioner's claim. For in that case we sustained, rather than frustrated, the claim of the bank for payment of the advances it had made to the purchaser of the goods, notwithstanding that it was not the factual owner thereof and that petitioners had already surrendered the goods to it due to their inability to sell them. We stated that the fact that the Vintolas were unable to sell the seashells in question did not affect IBAA's right to recover the advances it had made under the loan covered by the Letter of Credit, with the trust receipt as a security for the loan. Thus, except for our disquisition on the nature of a trust receipt as restated in Nitafan, Vintola hardly has any bearing on the case at bench since the issue here involves the effect and enforcement of the security aspect whereas the former case deals with the loan aspect of a trust receipt transaction. Apparently, the NLRC was confused about the nature of a trust receipt, specifically the security aspect thereof. The mechanics and effects flowing from a trust receipt transaction, particularly the importance given to the security held by the entruster, i.e., the person holding title over the goods, were fully discussed in earlier decisions, as follows

By this arrangement a banker advances money to an intending importer, and thereby lends the aid of capital, of credit, or of business facilities and agencies abroad, to the enterprise of foreign commerce. Much of this trade could hardly be carried on by any other means, and therefore it is of the first importance that the fundamental factor in the transaction, the banker's advance of money and credit, should receive the amplest protection. Accordingly, in order to secure that the banker shall be repaid at the critical point that is, when the imported goods finally reach the hands of the intended vendee the banker takes the full title to the goods at the very beginning; he takes it as soon as the goods are bought and settled for by his payments or acceptances in the foreign country, and he continues to hold that title as his indispensable security until the goods are sold in the United States and the vendee is called upon to pay for them. This security is not an ordinary pledge by the importer to the banker, for the importer has never owned the goods, and moreover, he is not able to deliver the possession; but the security is the complete title vested originally in the bankers, and this characteristic of the transaction has again and again been recognized and protected by the courts. Of course, the title is at bottom a security title, as it has sometimes been called, and the banker is always under the obligation to reconvey ; but only after his advances have been fully repaid and after the importer has fulfilled the other terms of the contract (emphasis supplied). 7 . . . . [I]n a certain manner, (trust receipt contracts) partake of the nature of a conditional sale as provided by the Chattel Mortgage Law, that is, the importer becomes absolute owner of the imported merchandise as soon as he has paid its price. The ownership of the merchandise continues to be vested in the owner thereof or in the person who has advanced payment, until he has been paid in full, or if the merchandise has already been sold, the proceeds of the sale should be turned over to him by the importer or by his representative or successor in interest (emphasis supplied). 8 More importantly, owing to the vital role trust receipts play in international and domestic commerce, Sec. 12 of P.D. No. 115 9 assures the entruster of the validity of his claim against all creditors Sec. 12. Validity of entruster's security interest as against creditors. The entruster's security interest in goods, documents, or instruments pursuant to the written terms of a trust receipt shall be valid as against all creditors of the entrustee for the duration of the trust receipt agreement.

From the legal and jurisprudential standpoint it is clear that the security interest of the entruster is not merely an empty or idle title. To a certain extent, such interest, such interest becomes a "lien" on the goods because the entruster's advances will have to be settled first before the entrustee can consolidate his ownership over the goods. A contrary view would be disastrous. For to refuse to recognize the title of the banker under the trust receipt as security for the advance of the purchase price would be to strike down a bona fide and honest transaction of great commercial benefit and advantage founded upon a well-recognized custom by which banking credit is officially mobilized for manufacturers and importers of small means. 10 The NLRC argues that inasmuch as petitioner did not cancel the Trust Receipt Agreements and took possession of the properties it could not claim ownership of the properties. We do not agree. Significantly, the law uses the word "may" in granting to the entruster the right to cancel the trust and take possession of the goods. 11 Consequently, petitioner has the discretion to avail of such right or seek any alternative action, such as a third-party claim or a separate civil action which it deems best to protect its right, at anytime upon default or failure of the entrustee to comply with any of the terms and conditions of the trust agreement. Besides, as earlier stated, the law warrants the validity of petitioner's security interest in the goods pursuant to the written terms of the trust receipt as against all creditors of the trust receipt agreement. 12 The only exception to the rule is when the properties are in the hands of an innocent purchaser for value and in good faith. The records however do not show that the winning bidder is such purchaser. Neither can private respondents plead preferential claims to the properties as petitioner has the primary right to them until its advances are fully paid. In fine, we hold that under the law and jurisprudence the NLRC committed grave abuse of discretion in disregarding the third-party claim of petitioner. Necessarily the auction sale held on 5 November 1992 should be set aside. For there would be neither justice nor equity in taking the funds from the party whose means had purchased the property under the contract. 13 WHEREFORE, the petition for certiorari is GRANTED. The Resolutions of the National Labor Relations Commission dated 18 August and 12 November 1993 are SET ASIDE and a new judgment is entered GRANTING the Third-Party Claim and ORDERING the Sheriff or his representative to immediately deliver to petitioner PRUDENTIAL BANK the properties subject of the Trust Receipt Agreements. SO ORDERED. Padilla, Davide, Jr., Kapunan and Hermosisima, Jr., JJ., concur.

PHILIPPINE NATIONAL BANK, Plaintiff-Appellee, vs. DALMACIO CATIPON, DefendantAppellant. DECISION REYES, J. B. L., J.: This appeal is taken from the decision of the Court of First Instance of Manila in its Civil Case No. 15711 sentencing Dalmacio Catipon to pay the Philippine National Bank the principal sum of P3,050.83 with interest thereon from September 1, 1951 until full payment plus costs. The facts are set forth in the judgment appealed from to be as follows:chanroblesvirtuallawlibrary The parties stipulate, among other things, that Defendant affixed his signature on the Trust Receipt, Exhibit A because of his strong desire to get the onions purchased b y him from J. V. Ramirez & Co., Inc., and which were duly paid for to said J. V. Ramirez & Co., Inc., and not toPlaintiff Bank, as evidenced by receipts marked Exhibits 1, 2 and 3; chan roblesvirtualawlibrarythat his signature was affixed at the Divisoria Market when a son of J. V. Ramirez came to him and explained that the only way to get onions which he bought was to sign the said Trust Receipt Exhibit A; chan roblesvirtualawlibrarythat the signature of Dalmacio Catipon (Defendant) was affixed long after the trust receipt Exhibit A was signed by J. V. Ramirez; chan roblesvirtualawlibrarythat J. V. Ramirez, who is the President and General Manager of J. V. Ramirez & Co., Inc., is the indentor and importer and that Dalmacio Catipon is only a customer of J. V. Ramirez & Co., Inc.; chan roblesvirtualawlibrarythat Plaintiff filed a claim against J. V. Ramirez in the Insolvency Proceedings of J. V. Ramirez & Co., Inc. (Civil Case No. 3191 of the Court of First Instance of Manila) long before the present complaint was filed; chan roblesvirtualawlibraryand that Plaintiff did not realize any cent out of its claim filed in the insolvency proceedings as J. V. Ramirez & Co. has no sufficient assets to meet all claims of the creditors including that of the Plaintiff. (Rec. App. pp. 92-93.) It is also of record that at the instance of the bank, Catipon was charged with estafa (Criminal Case No. 8190) for having misappropriated, misapplied and converted the merchandise covered by the trust receipt; chan roblesvirtualawlibrarybut after due trial was acquitted from the charge. Shortly thereafter, the bank commenced the present action to recover the value of the goods. Dalmacio Catipon rests his present appeal on three points, the same ones invoked by him in the court below. They are:chanroblesvirtuallawlibrary (1) That his acquittal in the estafa case is a bar to the Banks instituting the present civil action, because the Bank