Professional Documents

Culture Documents

Department of Labor: 2005 05 31 18 FLSA Reimbursement

Uploaded by

USA_DepartmentOfLaborOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Labor: 2005 05 31 18 FLSA Reimbursement

Uploaded by

USA_DepartmentOfLaborCopyright:

Available Formats

U.S.

Department of Labor

Employment Standards Administration

Wage and Hour Division

Washington, D.C. 20210

FLSA2005-18

May 31, 2005

Dear Name*,

This is in response to your letter requesting an opinion on the application of the Fair Labor Standards Act (FLSA) to

required reimbursements for internal training costs.

You state that a police officer employed by the City of Name* (the City) on May 16, 2000, left employment on

October 15, 2000, and has subsequently accepted a job with the City of the Name*. The officer attended required

CLEET training (the basic police course) from June 4, 2000, until August 4, 2000, and was paid $3,202.24 in wages

during the training period.

The applicable Oklahoma statute, Title 70 O.S., Section 3311(M) provides that if an employing law enforcement

agency has paid the salary of a person while attending a basic police course approved by the Council, and if that

person within (1) year after certification resigns and is hired by another law enforcement agency in the same state,

the second employing agency or the person who received the training must reimburse the original employment

agency for the salary paid to the person who completed the basic police course. You ask whether the second

employing agency or the officer is required to reimburse the City the full amount of the salary he received while in

training as required by state statute or only the amount of the salary in excess of the applicable minimum wage.

The FLSA is the Federal law of most general application concerning wages and hours of work. This law requires

that all covered and nonexempt employees be paid not less than the minimum wage for all hours worked and

overtime pay for all hours worked over 40 in a workweek. Hours worked under the FLSA include required basic

training time, such as the training hours in this case. See 29 CFR sections 785.27 through 785.32 and section

553.226 (copies enclosed).

Wages cannot be considered to have been paid by the employer and received by the employee unless they are paid

finally and unconditionally or “free and clear”. The wage requirements of the FLSA will not be met where the

employee “kicks-back” directly or indirectly to the employer or to another person for the employer’s benefit the

whole or part of the wage delivered to the employee, if such payments bring the employee’s pay below the required

minimum wage or overtime levels. See Section 531.35 of the enclosed 29 CFR Part 531.

The United States Supreme Court has held that an employee may not waive his or her rights to compensation due

under the FLSA. Brooklyn Savings Bank v. O’Neil, 328 U.S. 697 (1945). Similarly, in Barrentine v. Arkansas-Best

Freight System, 450 U.S. 728 (198l), the Supreme Court held that a labor organization may not negotiate a provision

that waives employees’ statutory rights under the FLSA. Consequently, the return from the employee to the

employer of compensation due an employee pursuant to the FLSA minimum wage and/or overtime requirements

would violate the statute.

It is thus our opinion that any reimbursement paid by the officer that will result in payment of less than the amount

required by the applicable minimum wage and/or overtime requirements will violate the “free and clear” provisions

of the FLSA. See opinion letters dated October 21, 1992 and September 30, 1999; Heder v. City of Two Rivers, 295

F.3d 777 (7th Cir. 2002). Because the FLSA establishes a floor for required compensation, state or local laws may

require greater amounts but, pursuant to the Supremacy Clause, may not diminish the protections of the Act. See 29

U.S.C. § 218 (a); U.S. Constitution, Art. VI, Cl. 2. You asked whether, in the alternative, the second employing

agency could be required to reimburse the City. The FLSA regulates employee wages, but it does not control this

arrangement under state law between the two cities. Thus, the FLSA does not affect any state law remedy the City

may have against the second agency. This opinion does not affect the ability of the City to pursue the recovery from

the other agency of any unpaid amounts due for such cost based upon a state statute.

Working to Improve the Lives of America's Workers Page 1 of 2

U.S. Department of Labor

Employment Standards Administration

Wage and Hour Division

Washington, D.C. 20210

This opinion is based exclusively on the facts and circumstances described in your request and is given on the basis

of your representation, express or implied, that you have provided a full and fair description of all the facts and

circumstances that would be pertinent to our consideration of the question presented. Existence of any other factual

or historical background not contained in your request might require a different conclusion than the one expressed

herein. You have represented that this opinion is not sought by a party to a pending private litigation concerning the

issue addressed herein. You have also represented that this opinion is not sought in connection with an investigation

or litigation between a client or firm and the Wage and Hour Division or the Department of Labor. This opinion

letter is issued as an official ruling of the Wage and Hour Division for purposes of the Portal-to Portal Act, 29

U.S.C. 259. See 29 C.F.R. 790.17(d), 790.19; Hultgren v. County of Lancaster, Nebraska, 913 F.2d 498, 507 (8th

Cir. 1990).

We trust that the above information is responsive to your inquiry.

Sincerely,

Alfred B. Robinson, Jr.

Deputy Administrator

Enclosures

Note: *The actual name(s) was removed to preserve privacy.

Working to Improve the Lives of America's Workers Page 2 of 2

You might also like

- CA-1032 RevisedDocument9 pagesCA-1032 RevisedSandy Zertuche50% (2)

- Spradling v. City of Tulsa, 198 F.3d 1219, 10th Cir. (2000)Document8 pagesSpradling v. City of Tulsa, 198 F.3d 1219, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- Chavez v. City of Albuquerque, 630 F.3d 1300, 10th Cir. (2011)Document26 pagesChavez v. City of Albuquerque, 630 F.3d 1300, 10th Cir. (2011)Scribd Government Docs100% (1)

- IRS Memorandum Determines Late Payment Penalties Are Not Subject to FICA, FUTA or Income Tax WithholdingDocument6 pagesIRS Memorandum Determines Late Payment Penalties Are Not Subject to FICA, FUTA or Income Tax WithholdingTheplaymaker508No ratings yet

- IRS Response Letter TemplateDocument4 pagesIRS Response Letter TemplateDiana86% (7)

- 2016 Commercial & Industrial Common Interest Development ActFrom Everand2016 Commercial & Industrial Common Interest Development ActNo ratings yet

- New Jersey Carpenters and Trus v. Tishman Construction Corp of N, 3rd Cir. (2014)Document13 pagesNew Jersey Carpenters and Trus v. Tishman Construction Corp of N, 3rd Cir. (2014)Scribd Government DocsNo ratings yet

- IRS Record CertificationDocument3 pagesIRS Record CertificationAlterick Davenport100% (1)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- NLRB v. Oklahoma Fixture Co., 295 F.3d 1143, 10th Cir. (2002)Document23 pagesNLRB v. Oklahoma Fixture Co., 295 F.3d 1143, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- Employment Laws Effective 1/01/2012 in CaliforniaDocument2 pagesEmployment Laws Effective 1/01/2012 in CaliforniaFrank PrayNo ratings yet

- Communist Party, USA v. Catherwood, 367 U.S. 389 (1961)Document5 pagesCommunist Party, USA v. Catherwood, 367 U.S. 389 (1961)Scribd Government DocsNo ratings yet

- OPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDocument77 pagesOPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDaily Caller News FoundationNo ratings yet

- Kendoll v. RosenblumDocument12 pagesKendoll v. RosenblumlanashadwickNo ratings yet

- Labor 2018 Bar Question and AnswerDocument14 pagesLabor 2018 Bar Question and AnswerTap cruz89% (18)

- United States Court of Appeals, Second Circuit.: No. 81, Docket 73-1667Document12 pagesUnited States Court of Appeals, Second Circuit.: No. 81, Docket 73-1667Scribd Government DocsNo ratings yet

- 997 F.2d 18 125 Lab - Cas. P 35,834, 1 Wage & Hour Cas.2d (BNA) 788Document17 pages997 F.2d 18 125 Lab - Cas. P 35,834, 1 Wage & Hour Cas.2d (BNA) 788Scribd Government DocsNo ratings yet

- Dol LetterDocument19 pagesDol LetterChris GothnerNo ratings yet

- John Keeley Timmie Orange Ariel Kilpatrick Charles Werdann, On Behalf of Themselves and All Others Similarly Situated v. Loomis Fargo & Co, 183 F.3d 257, 3rd Cir. (1999)Document23 pagesJohn Keeley Timmie Orange Ariel Kilpatrick Charles Werdann, On Behalf of Themselves and All Others Similarly Situated v. Loomis Fargo & Co, 183 F.3d 257, 3rd Cir. (1999)Scribd Government DocsNo ratings yet

- Serrano Vs Gallant MaritimeDocument14 pagesSerrano Vs Gallant MaritimecharmssatellNo ratings yet

- Serrano Vs GallantDocument5 pagesSerrano Vs GallantAnonymous 5MiN6I78I0100% (1)

- Texas False ClaimsDocument4 pagesTexas False ClaimsShantel SchurmanNo ratings yet

- U.S. Customs Service, Region II v. Federal Labor Relations Authority, National Treasury Employees Union, Intervenor, 739 F.2d 829, 2d Cir. (1984)Document7 pagesU.S. Customs Service, Region II v. Federal Labor Relations Authority, National Treasury Employees Union, Intervenor, 739 F.2d 829, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- Challenge To IRS AuthorityDocument5 pagesChallenge To IRS Authorityapi-3744408100% (8)

- SC Declares Unconstitutional Provision Limiting OFW Money ClaimsDocument6 pagesSC Declares Unconstitutional Provision Limiting OFW Money ClaimsEmmanuel OrtegaNo ratings yet

- Disaster Business Loan ApplicationDocument4 pagesDisaster Business Loan ApplicationalexNo ratings yet

- Florida Afl-Cio v. State of Florida Department of Labor and Employment Security, 676 F.2d 513, 11th Cir. (1982)Document5 pagesFlorida Afl-Cio v. State of Florida Department of Labor and Employment Security, 676 F.2d 513, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Educational Films Corp. of America v. Ward, 282 U.S. 379 (1931)Document12 pagesEducational Films Corp. of America v. Ward, 282 U.S. 379 (1931)Scribd Government DocsNo ratings yet

- OSHA20212163 - Citations Copi3Document93 pagesOSHA20212163 - Citations Copi3Elieve GraphicsNo ratings yet

- Mazzant Overtime Pay Opinion, US District Court 112216Document20 pagesMazzant Overtime Pay Opinion, US District Court 112216BreitbartTexasNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument8 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Samuel M. Rizzitelli v. Federal Labor Relations Authority, 212 F.3d 710, 2d Cir. (2000)Document4 pagesSamuel M. Rizzitelli v. Federal Labor Relations Authority, 212 F.3d 710, 2d Cir. (2000)Scribd Government DocsNo ratings yet

- CNP CSX Transportation, Inc 1572262Document20 pagesCNP CSX Transportation, Inc 1572262Ryan D.No ratings yet

- Pomper v. United States, 196 F.2d 211, 2d Cir. (1952)Document5 pagesPomper v. United States, 196 F.2d 211, 2d Cir. (1952)Scribd Government DocsNo ratings yet

- Temple University - of The Commonwealth System of Higher Education v. United States, 769 F.2d 126, 3rd Cir. (1985)Document21 pagesTemple University - of The Commonwealth System of Higher Education v. United States, 769 F.2d 126, 3rd Cir. (1985)Scribd Government DocsNo ratings yet

- Serrano V GallantDocument5 pagesSerrano V GallantGerard Relucio OroNo ratings yet

- United States v. Jefferson-Pilot Life Insurance Company, 49 F.3d 1020, 4th Cir. (1995)Document6 pagesUnited States v. Jefferson-Pilot Life Insurance Company, 49 F.3d 1020, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- Criminal Law: ISSUE #2: Whether or Not They Are Entitled To Backwages. Held #2Document12 pagesCriminal Law: ISSUE #2: Whether or Not They Are Entitled To Backwages. Held #2Jyds NovaNo ratings yet

- Supreme Court Rules Against Limiting Back Wages for Illegally Dismissed SeafarerDocument6 pagesSupreme Court Rules Against Limiting Back Wages for Illegally Dismissed SeafarerMarianne Shen PetillaNo ratings yet

- Fort Halifax Packing Co. v. Coyne, 482 U.S. 1 (1987)Document21 pagesFort Halifax Packing Co. v. Coyne, 482 U.S. 1 (1987)Scribd Government DocsNo ratings yet

- Labor Case DigestsDocument302 pagesLabor Case DigestsKristine N.93% (15)

- Centre WISP OSHA FinesDocument14 pagesCentre WISP OSHA FinesRyan GraffiusNo ratings yet

- New California Employment Laws Present More ChallengesDocument3 pagesNew California Employment Laws Present More ChallengesSan Fernando Valley Bar AssociationNo ratings yet

- DD 2293Document2 pagesDD 2293klumer_xNo ratings yet

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- JMBrothercitationsDocument13 pagesJMBrothercitationsallmysubscriptionNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument4 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Davis v. Michigan Dept. of Treasury, 489 U.S. 803 (1989)Document22 pagesDavis v. Michigan Dept. of Treasury, 489 U.S. 803 (1989)Scribd Government DocsNo ratings yet

- FortStewart Schools v. FLRA, 495 U.S. 641 (1990)Document15 pagesFortStewart Schools v. FLRA, 495 U.S. 641 (1990)Scribd Government DocsNo ratings yet

- Serrano Vs Gallant MaritimeDocument5 pagesSerrano Vs Gallant MaritimeStacy OtazaNo ratings yet

- Radio Corporation of America v. Association of Professional Engineering Personnel Association of Professional Engineering Personnel Camden Area Chapter (And Charles M. Brindley,), 291 F.2d 105, 3rd Cir. (1961)Document7 pagesRadio Corporation of America v. Association of Professional Engineering Personnel Association of Professional Engineering Personnel Camden Area Chapter (And Charles M. Brindley,), 291 F.2d 105, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- Part-Time Lecturer Entitled to Retirement Benefits Despite Non-Permanent StatusDocument31 pagesPart-Time Lecturer Entitled to Retirement Benefits Despite Non-Permanent StatusPatrick SevenNo ratings yet

- U.S. Department of LaborDocument11 pagesU.S. Department of LaborRise Up Ocean CountyNo ratings yet

- Serrano v. Gallant Maritime, G.R. No. 167614, March 24, 2009Document3 pagesSerrano v. Gallant Maritime, G.R. No. 167614, March 24, 2009Mary LeandaNo ratings yet

- Department of Labor: Dst-Aces-Cps-V20040123Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040123USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Dst-Aces-Cps-V20040617Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040617USA_DepartmentOfLaborNo ratings yet

- Department of Labor: BookmarkDocument2 pagesDepartment of Labor: BookmarkUSA_DepartmentOfLaborNo ratings yet

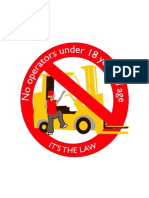

- Department of Labor: Stop1sticker6Document1 pageDepartment of Labor: Stop1sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- Department of Labor: Stop1stickerDocument1 pageDepartment of Labor: Stop1stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop2sticker6Document1 pageDepartment of Labor: Stop2sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop2stickerDocument1 pageDepartment of Labor: Stop2stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Forkliftsticker6Document1 pageDepartment of Labor: Forkliftsticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ForkliftstickerDocument1 pageDepartment of Labor: ForkliftstickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: LindseyDocument1 pageDepartment of Labor: LindseyUSA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: YouthConstructDocument1 pageDepartment of Labor: YouthConstructUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: KonstaDocument1 pageDepartment of Labor: KonstaUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 2Document1 pageDepartment of Labor: JYMP 8x11 2USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 3Document1 pageDepartment of Labor: JYMP 8x11 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 1Document1 pageDepartment of Labor: JYMP 8x11 1USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 2Document1 pageDepartment of Labor: JYMP 11x17 2USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 1Document1 pageDepartment of Labor: JYMP 11x17 1USA_DepartmentOfLaborNo ratings yet

- SAMPLE Flextime and Compressed Workweeks GuidanceDocument14 pagesSAMPLE Flextime and Compressed Workweeks GuidanceJamie Ying100% (1)

- Agreement Letter GaotekDocument2 pagesAgreement Letter Gaotekraghav jainNo ratings yet

- Department of Labor: PreambleDocument71 pagesDepartment of Labor: PreambleUSA_DepartmentOfLabor100% (1)

- Warren County Civil PetitionDocument6 pagesWarren County Civil PetitionLocal 5 News (WOI-TV)No ratings yet

- 4th Circuit Bobby Paul Edward RulingDocument9 pages4th Circuit Bobby Paul Edward RulingLaw&CrimeNo ratings yet

- Module 11Document19 pagesModule 11Alyssa GuinoNo ratings yet

- Payroll Accounting 2014 24th Edition Bieg Test BankDocument20 pagesPayroll Accounting 2014 24th Edition Bieg Test BankMichaelWilliamscnot100% (42)

- Guide To Determining Employee ClassificationDocument8 pagesGuide To Determining Employee ClassificationylmalaverNo ratings yet

- Payroll Accounting 2017 3rd Edition Landin Solutions ManualDocument26 pagesPayroll Accounting 2017 3rd Edition Landin Solutions Manualcuclex61100% (32)

- MOTION - Pltf's 1st Mot. Compel and App.Document76 pagesMOTION - Pltf's 1st Mot. Compel and App.JUANITANo ratings yet

- HR Audit ChecklistDocument7 pagesHR Audit ChecklistPrabhu PrabhuNo ratings yet

- Dessler FHRM4ge PPT 010Document30 pagesDessler FHRM4ge PPT 010YasminlNo ratings yet

- Section 01 - Introduction and Course OverviewDocument5 pagesSection 01 - Introduction and Course OverviewJoaquim RaimundoNo ratings yet

- Lola v. Skadden ArpsDocument21 pagesLola v. Skadden ArpsStaci ZaretskyNo ratings yet

- Attorney Letter To City of Raleigh Calling COVID-19 Vaccine Mandate DiscriminatoryDocument14 pagesAttorney Letter To City of Raleigh Calling COVID-19 Vaccine Mandate DiscriminatoryAnna JohnsonNo ratings yet

- SA Farmworkers ComplaintDocument42 pagesSA Farmworkers ComplaintMail and GuardianNo ratings yet

- Federal Minimum Wage and State Rates in 2016/TITLEDocument8 pagesFederal Minimum Wage and State Rates in 2016/TITLEpatrixiaNo ratings yet

- KIPP DC Employee HandbookDocument52 pagesKIPP DC Employee HandbookIshmael OneyaNo ratings yet

- Mehta CaseDocument4 pagesMehta CaseUSA TODAY NetworkNo ratings yet

- Joint Case Management StatementDocument14 pagesJoint Case Management StatementyogaloyNo ratings yet

- Solicitation/Contract/Order For Commercial ItemsDocument17 pagesSolicitation/Contract/Order For Commercial ItemsPaul Dylan MendozaNo ratings yet

- 2019 US Teammate Handbook - 10.1.19 - EnglishDocument58 pages2019 US Teammate Handbook - 10.1.19 - EnglishShawnNo ratings yet

- Shannon O'Leary v. New York City Department of Education, Et Al.Document54 pagesShannon O'Leary v. New York City Department of Education, Et Al.Eric SandersNo ratings yet

- RFP For Airport Hotel Design Construction and Operation PDFDocument153 pagesRFP For Airport Hotel Design Construction and Operation PDFKatherine SayreNo ratings yet

- DOL Child Labor Law ResponseDocument3 pagesDOL Child Labor Law ResponseA.W. CarrosNo ratings yet

- Special Laws - Midterms (Leave, BMBE)Document3 pagesSpecial Laws - Midterms (Leave, BMBE)josiah9_5No ratings yet

- JULIE A. SU V SPARTY TACOS, LLC TC TACOS, LLC GR TACOS, LLC JACOB HAWLEY.Document14 pagesJULIE A. SU V SPARTY TACOS, LLC TC TACOS, LLC GR TACOS, LLC JACOB HAWLEY.Brandon ChewNo ratings yet

- Cep Exam Questions and AnswersDocument22 pagesCep Exam Questions and AnswersJohn HenryNo ratings yet

- Tabetha T. Tyndale v. Extended Managed Long Term Care, Et Al.Document23 pagesTabetha T. Tyndale v. Extended Managed Long Term Care, Et Al.Eric SandersNo ratings yet

- Employment Law Outline: Download NowDocument36 pagesEmployment Law Outline: Download NowseabreezeNo ratings yet