Professional Documents

Culture Documents

Quiz 2

Uploaded by

zainabcomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 2

Uploaded by

zainabcomCopyright:

Available Formats

VERSION 1

FAMILY NAME / INITIAL STUDENT ID #

S O L U T I

O N S

MIME 310 ENGINEERING ECONOMY QUIZ #2

May 8, 2008 8:30 to 9:15

Short Problems Circle the correct answer on this paper and record it on the computer answer sheet. All questions are worth 1.25 points each for a total of 10. Note: There are no penalties for incorrect answers.

1. A firm with sales of $1 million, a net after-tax income of $30 000, total assets of $1.5 million, total liabilities of $750 000 and no preferred equity has a return on equity of: A) 20 % B) 15 % Shareholders equity: 1 500 000 - 750 000 = 750 000 C) 4 % ROE: 30 000 / 750 000 = 0.04 or 4 % D) 3 % E) None of the choices listed above

Use the following information to answer questions 2 and 3.

The demand and supply functions for a particular product are: QD = 189 - 2.25 P QS = 124 + 1.5 P 2. The market equilibrium price and quantity are, respectively: A) $84.00 and 65 At market equilibrium, B) $82.67 and 150 189 - 2.25 P = 124 + 1.5 P C) $17.33 and 150 0.75 P = 65 D) $150.00 and 313 P=17.33 E) None of the choices listed above Q: 124 + 1.5 (17.33) = 150 At market equilibrium, the price elasticity of supply is: A) -2.25 B) 0.17 For supply, dQ/dP: 1.5 C) 0.26 ES: 1.5 / (150 / 17.33) = 0.17 D) 1.50 E) None of the choices listed above

3.

VERSION 1

4.

The total production cost function of a plant consists of the following: Fixed cost: $120 000 per year Constant variable cost: $50 per unit as long as the annual production does not exceed 5000 units $30 per unit for that part of production that exceeds 5000 units per year The marginal cost at a production rate of 7000 units per year is: A) $30 B) $50 The marginal cost is the slope of the cost function at a rate of 7000 units per year. C) $80 D) 7000 MC=30 E) None of the choices listed above

5.

An asset costs $60 000 and has a salvage value of $10 000 at the end of its 5-year life. Determine the assets accounting book value after two years of use using the sum-of-theyears-digits depreciation method. The corporate income tax rate is 34 %. A) $20 000 SOYD: 1 + 2 + 3 + 4 + 5 = 15 B) $16 000 DC1: (60 000 - 10 000) (5 / 15) = 16 667 C) $16 667 DC2: (60 000 - 10 000 (4 / 15) = 13 333 D) $40 000 BV2: 60 000 - 16 667 - 13 333 = 30 000 E) $30 000

VERSION 1

Use the following information to answer questions 6 to 8.

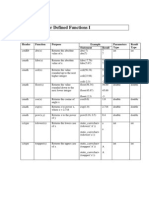

Cole Eagan Enterprise Inc. BALANCE SHEET December 31, 2002

Current Assets Cash Accounts receivable Inventories Total current assets Fixed Assets at Cost Less accumulated depreciation Net Fixed Assets 4 500 Current Liabilities Accounts payable Notes payable Accrued expenses Total current liabilities Long-term Debt Shareholders Equity Common Shares Retained Earnings Total Shareholders Equity Total Liab. & Shar. Equity 30 764 10 000 1 000

15 000

Total Assets

Information for 2002

Net sales (all credit sales) Gross profit margin* Inventory turnover ratio (360 days per year) Average collection period Current ratio Total asset turnover ratio Debt ratio

* (Net Sales - Cost of Goods Sold) / Net Sales

$110 000 0.25 3.0 65 days 2.4 1.13 0.538

6.

Accounts receivable for CEE Inc, in 2002 were: A) $14 056 B) $14 895 ACP: Accounts receivable (360) / Sales = 65 Receivables: 65 (110 000) / 360 = 19 861 C) $19 861 D) $18 333 Inventories for CEE Inc. in 2002 were: A) $9167 B) $36 667 C) $32 448 D) $27 500 Total assets for CEE Inc. in 2002 were: A) $45 895 B) $124 300 C) $97 345 D) $58 603

7.

Cost of goods sold: 110 000 (1 - 0.25) = 82 500 ITR: Cost of goods sold / Inventory = 3 Inventory: 82 500 / 3 = 27 500

8.

ATR: Sales / Total assets = 1.13 Total assets: 110 000 / 1.13 = 97 345

THIS IS THE LAST PAGE OF THE QUIZ PAPER

3

VERSION 1

Answer Key for Version 2

1. 2. 3. 4. 5. 6. 7. 8. B B D C B D B B

You might also like

- Seven Lamps of AdvocacyDocument4 pagesSeven Lamps of AdvocacyMagesh Vaiyapuri100% (1)

- 10 LasherIM Ch10Document30 pages10 LasherIM Ch10Erica Mae Vista100% (1)

- Uboot Rulebook v1.1 EN PDFDocument52 pagesUboot Rulebook v1.1 EN PDFUnai GomezNo ratings yet

- Are You ... Already?: BIM ReadyDocument8 pagesAre You ... Already?: BIM ReadyShakti NagrareNo ratings yet

- 3004 Home Office and BranchesDocument6 pages3004 Home Office and BranchesTatianaNo ratings yet

- Biopolitics and The Spectacle in Classic Hollywood CinemaDocument19 pagesBiopolitics and The Spectacle in Classic Hollywood CinemaAnastasiia SoloveiNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document89 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16Mckenzie100% (1)

- Case Study: Accounting Information SystemDocument9 pagesCase Study: Accounting Information SystemAlliah SomidoNo ratings yet

- Auditing-Review Questions Chapter 13Document2 pagesAuditing-Review Questions Chapter 13meiwin manihingNo ratings yet

- Philo Week 8Document4 pagesPhilo Week 8Emiel Magante100% (1)

- Module 1 - Introduction To Assurance Services PDFDocument10 pagesModule 1 - Introduction To Assurance Services PDFglobeth berbanoNo ratings yet

- Topic 3 Cash Flow Analysis Grand FinalsDocument20 pagesTopic 3 Cash Flow Analysis Grand FinalsA cNo ratings yet

- Homework CH 3Document12 pagesHomework CH 3LNo ratings yet

- Cost of Capital: By: Judy Ann G. Silva, MBADocument21 pagesCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- Master Budget-WPS OfficeDocument12 pagesMaster Budget-WPS OfficeRean Jane EscabarteNo ratings yet

- Academic Performance of BSA Students and Their Qualifying Examination Result Correlational StudyDocument17 pagesAcademic Performance of BSA Students and Their Qualifying Examination Result Correlational Studykarl cruzNo ratings yet

- Assignment 6Document2 pagesAssignment 6Janeth NavalesNo ratings yet

- Chapter 7 QuizDocument2 pagesChapter 7 QuizliviaNo ratings yet

- Dari GoogleDocument6 pagesDari Googleabc defNo ratings yet

- Nfjpia Region III Constitution & By-Laws - Final VersionDocument20 pagesNfjpia Region III Constitution & By-Laws - Final VersionAdrianneHarveNo ratings yet

- Prelim PartnershipFormationSampleProblemDocument4 pagesPrelim PartnershipFormationSampleProblemLee SuarezNo ratings yet

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- MS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingDocument4 pagesMS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingMarchelle CaelNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Audit ReviewDocument9 pagesAudit ReviewephraimNo ratings yet

- 03 Quiz 1Document9 pages03 Quiz 1Camille MadlangbayanNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Document1 page(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoNo ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- This Study Resource Was: Mr. X Has The Following Data On His Passive Income Earned During 2019Document1 pageThis Study Resource Was: Mr. X Has The Following Data On His Passive Income Earned During 2019Anne Marieline BuenaventuraNo ratings yet

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Chapter 14, Modern Advanced Accounting-Review Q & ExrDocument18 pagesChapter 14, Modern Advanced Accounting-Review Q & Exrrlg4814100% (4)

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Receipt and Disposition of InventoriesDocument5 pagesReceipt and Disposition of InventoriesWawex DavisNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- Module 1.a The Accountancy ProfessionDocument6 pagesModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Case 2 Assurance Vs Consulting ServicesDocument1 pageCase 2 Assurance Vs Consulting ServicesRose Medina BarondaNo ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- Diagnostic Test - Audit TheoryDocument13 pagesDiagnostic Test - Audit TheoryYenelyn Apistar CambarijanNo ratings yet

- Chapter Exercises DeductionsDocument11 pagesChapter Exercises DeductionsShaine KeefeNo ratings yet

- Final Exam: Question 1: Choose The Best Answer: (20 Marks)Document8 pagesFinal Exam: Question 1: Choose The Best Answer: (20 Marks)Faker PlaymakerNo ratings yet

- SA1 Submissions: Standalone AssessmentDocument11 pagesSA1 Submissions: Standalone AssessmentYenNo ratings yet

- Revision Questions - Q&ADocument3 pagesRevision Questions - Q&Arosario correiaNo ratings yet

- DocxDocument3 pagesDocxyvonneberdosNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) LawDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- Psa 550 PDFDocument9 pagesPsa 550 PDFLen AlairNo ratings yet

- Mansci - Chapter 3Document2 pagesMansci - Chapter 3Rae WorksNo ratings yet

- 1st Acctg8Document4 pages1st Acctg8John Bryan100% (1)

- Ia3 BSDocument5 pagesIa3 BSMary Joy CabilNo ratings yet

- Required: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToDocument2 pagesRequired: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToErica AbegoniaNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Practice Set Short Term Budgeting PDFDocument12 pagesPractice Set Short Term Budgeting PDFRujean Salar AltejarNo ratings yet

- Quiz 6 Market Value ApproachDocument4 pagesQuiz 6 Market Value ApproachRissa AgapeNo ratings yet

- SOLMANny 7Document15 pagesSOLMANny 7Zi Villar100% (1)

- AFAR 2 SyllabusDocument11 pagesAFAR 2 SyllabusLawrence YusiNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- Practice FinalDocument13 pagesPractice FinalngStephanie26No ratings yet

- Wastewater Characteristics Physical ChemicalDocument31 pagesWastewater Characteristics Physical ChemicalzainabcomNo ratings yet

- Design of Members For Combined ForcesDocument27 pagesDesign of Members For Combined ForceszainabcomNo ratings yet

- 86841Document98 pages86841fandhiejavanov2009No ratings yet

- Applying VE ConceptDocument164 pagesApplying VE ConceptzainabcomNo ratings yet

- Ce470 Hw1 SolDocument8 pagesCe470 Hw1 SolzainabcomNo ratings yet

- Excercises - SolutionDocument2 pagesExcercises - SolutionzainabcomNo ratings yet

- Chapter 9 - Arrays - Handout 5Document5 pagesChapter 9 - Arrays - Handout 5zainabcomNo ratings yet

- General Equations of PlaneDocument2 pagesGeneral Equations of PlanezainabcomNo ratings yet

- Sample Mt2 KeyDocument10 pagesSample Mt2 KeyzainabcomNo ratings yet

- Chapter 6 - HandoutDocument5 pagesChapter 6 - HandoutzainabcomNo ratings yet

- 212-Chpt 8Document5 pages212-Chpt 8zainabcomNo ratings yet

- 212-Chpt 7Document6 pages212-Chpt 7zainabcomNo ratings yet

- 212-Chpt 4Document6 pages212-Chpt 4zainabcomNo ratings yet

- 212-Chpt 5Document8 pages212-Chpt 5zainabcomNo ratings yet

- Balkan Nationalism (Shodhangana Chapter) PDFDocument40 pagesBalkan Nationalism (Shodhangana Chapter) PDFsmrithiNo ratings yet

- A Repurchase AgreementDocument10 pagesA Repurchase AgreementIndu GadeNo ratings yet

- Islam and PatriarchyDocument21 pagesIslam and PatriarchycarolinasclifosNo ratings yet

- 202E13Document28 pages202E13Ashish BhallaNo ratings yet

- Session - 30 Sept Choosing Brand Elements To Build Brand EquityDocument12 pagesSession - 30 Sept Choosing Brand Elements To Build Brand EquityUmang ShahNo ratings yet

- Sample TosDocument7 pagesSample TosJenelin EneroNo ratings yet

- Blcok 5 MCO 7 Unit 2Document12 pagesBlcok 5 MCO 7 Unit 2Tushar SharmaNo ratings yet

- Youtube/Ydsatak Tense Ders 1Document9 pagesYoutube/Ydsatak Tense Ders 1ArasIlgazNo ratings yet

- EVNDocument180 pagesEVNMíša SteklNo ratings yet

- Simao Toko Reincarnated Black JesusDocument25 pagesSimao Toko Reincarnated Black JesusMartin konoNo ratings yet

- 10 Types of Innovation (Updated)Document4 pages10 Types of Innovation (Updated)Nur AprinaNo ratings yet

- Information Security NotesDocument15 pagesInformation Security NotesSulaimanNo ratings yet

- Day1 - Session4 - Water Supply and Sanitation Under AMRUTDocument30 pagesDay1 - Session4 - Water Supply and Sanitation Under AMRUTViral PatelNo ratings yet

- Modern Slavery TrainingDocument13 pagesModern Slavery TrainingRappler100% (1)

- War and Peace NTDocument2,882 pagesWar and Peace NTAMBNo ratings yet

- Chapter 8: ETHICS: Mores Laws Morality and EthicsDocument3 pagesChapter 8: ETHICS: Mores Laws Morality and EthicsJohn Rey BandongNo ratings yet

- Lesson 9 Government Programs and Suggestions in Addressing Social InequalitiesDocument25 pagesLesson 9 Government Programs and Suggestions in Addressing Social InequalitiesLeah Joy Valeriano-QuiñosNo ratings yet

- Visi Dan Misi Kementerian Keuangan:: ANTAM's Vision 2030Document5 pagesVisi Dan Misi Kementerian Keuangan:: ANTAM's Vision 2030Willy DavidNo ratings yet

- Greek Mythology ReviewerDocument12 pagesGreek Mythology ReviewerSyra JasmineNo ratings yet

- Supplier Claim Flow ChecklistDocument1 pageSupplier Claim Flow ChecklistChris GloverNo ratings yet

- Problem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationDocument15 pagesProblem 7 Bonds Payable - Straight Line Method Journal Entries Date Account Title & ExplanationLovely Anne Dela CruzNo ratings yet

- Assignment F225summer 20-21Document6 pagesAssignment F225summer 20-21Ali BasheerNo ratings yet

- Mt-Requirement-01 - Feu CalendarDocument18 pagesMt-Requirement-01 - Feu CalendarGreen ArcNo ratings yet

- Aims of The Big Three'Document10 pagesAims of The Big Three'SafaNo ratings yet