Professional Documents

Culture Documents

International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 3

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 3

Copyright:

Available Formats

I nternational J ournal of Scientific and I nnovative Mathematical Research (I J SI MR)

Volume I , I ssue I, August- 2013, PP 1-16

www.arcjournals.org

ARC Page | 1

Margrabe Formulas for a Simple Bivariate Exponential

Variance-Gamma Price Process (I) Theory

Werner Hrlimann

Wolters Kluwer Financial Services,

Seefeldstrasse 69,

CH-8008 Zrich, Switzerland.

werner.huerlimann@wolterskluwer.com

Received: 20-06-2013 Revised: 21-07-2013 Accepted: 24-07-2013

Abstract: For the purpose of simultaneous market consistent valuation of insurance liabilities and/or

asset prices from financial markets, an alternative to the Black-Scholes-Vasicek deflator is derived. It is

based on a simple multivariate exponential variance-gamma process associated to a multivariate Lvy

process, whose components are drifted Brownian motions time changed by a common independent gamma

subordinator. The logarithm of the multivariate variance-gamma deflator is linear in the variance-gamma

components. The practicability of the state-price deflator approach is demonstrated by determining the

price of the Margrabe exchange option with a bivariate exponential variance-gamma real-world or

deflated price process. Applications to both Insurance and Finance are mentioned. In a specialized

bivariate exponential variance-Erlang model, the formulas simplify to analytical closed-form expressions.

Keywords: Black-Scholes model, variance-gamma process, state-price deflator, market price of risk.

1. INTRODUCTION

It has long been observed that insurance liability data and financial returns exhibit non-zero

skewness, kurtosis and heavy tails, which cannot be captured by a Gaussian process. A typical

example is the Black-Scholes-Merton lognormal model used in option pricing. Modern Actuarial

Science and Finance is more and more focusing on alternative stochastic processes that enable the

modeling of non-Gaussian characteristics. However, the construction of multivariate non-

Gaussian processes for the simultaneous modeling of real-world insurance liabilities and/or asset

prices from financial markets is a complex topic, which seldom leads to simple analytical

formulas. Moreover, for market consistent valuation one needs to deflate these processes with so-

called state price deflators or use an equivalent martingale measure for deflated price processes as

argued in the Remarks 4.1. Though general frameworks for deriving state-price deflators exist

(e.g. [1], [2]), there are not many papers, which propose explicit expressions for them and their

corresponding distribution functions.

The goal of our contribution is two-fold. First, we propose an alternative to the multivariate

Black-Scholes-Vasicek (BSV) deflator introduced in [3] (see also [4]). For the interested reader

we remark that the article [5] contains an extension of the Black-Scholes deflator to a more

general version with interest rates as additional source of randomness. From a mathematical

viewpoint, it is natural to investigate other generalizations, namely the consideration of alternative

asset price processes for use in incomplete financial markets. Indeed, let us assume that asset

prices admit no arbitrage. Then, there exists a unique state-price deflator if, and only if, the

market is complete. Otherwise, if the market is incomplete, several state-price deflators exist and

pricing is not uniquely defined. Therefore, the study of state-price deflators is motivated by one of

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 2

the main problems of Modern Finance, which consists to understand the pricing of arbitrary

portfolios in incomplete markets.

A valuable and popular competitor to the ubiquitous multivariate exponential Gaussian process is

the multivariate exponential variance-gamma process presented in Section 2. It is obtained from a

multivariate Lvy process, whose components are drifted Brownian motions time changed by a

common independent gamma subordinator. This process has been previously considered in [6]

and [7]. For a better understanding of the state-price deflator approach, we recall briefly in

Section 3 the construction of the BSV deflator. Proceeding similarly, the logarithm of the

multivariate variance-gamma deflator is assumed to be linear in the variance-gamma components

and its coefficients are explicitly determined in Theorem 4.2.

As second goal, the practicability of the present state-price deflator approach is demonstrated by

pricing the Margrabe exchange option with a bivariate exponential variance-gamma real-world or

deflated price process. Theorem 5.1 displays Margrabe formulas for the bivariate exponential

variance-gamma real-world price process. Analytical closed-form expressions are obtained for the

bivariate exponential variance-Erlang special case. Based on the VG deflator, we derive in

Theorem 6.1 Margrabe formulas for the corresponding deflated price processes. Example 6.1

illustrates by comparing Margrabe option prices in the bivariate Black-Scholes model and the

bivariate variance-Erlang model. Section 7 is devoted to further discussion and conclusions.

Remaining technicalities are proved in Appendix 1 and 2. Statistical estimation of the multivariate

variance-gamma model and an application to stock market indices are presented in [8].

2. A SIMPLE MULTIVARIATE VARIANCE-GAMMA PROCESS

In its original representation, the univariate VG process is defined as a drifted Brownian motion

time changed by an independent gamma process. Viewed from the initial time 0 it is defined by

, 0 , > + = t W G X

t

G t t

t u (2.1)

where

t

W is a standard Wiener process and the independent subordinator (i.e. an increasing,

positive Lvy process) ) , ( ~

1 1

I v v t G

t

is a gamma process with unit mean rate and variance

rate v . Since

t

X is a Lvy process, the dynamics of the VG process is determined by its

distribution at unit time. In fact, the random variable ) , , ( ~ :

1

v t u VG X X

t=

= follows a three

parameter distribution with cumulant generating function (cgf)

< < > = =

u v t vt vu v , 0 , ), 1 ln( ] ) exp( [ ln ) (

2 2

2

1

1

u u uX E u C

X

. (2.2)

One notes that the cgf is only defined over the open interval

1 2 2 1 2 2

) 2 ) ( ( 2 ) 2 ) ( ( 2

+ + < < + vu vt vu vu vt vu u . (2.3)

The formula (2.2) is obtained from the cgf of the gamma random variable ) / 1 , / 1 ( ~ :

1

v v I =

= t

G G

by conditioning using that ) , ( ~

2

G G N G X t u is normally distributed. Since the distribution

of ) , , ( v t u VG is infinitely divisible, the VG process has independent and stationary increments,

which also follow a VG distribution, namely

. 0 ), / , , ( ~ t s t t t VG X X

s s t

< s

+

v t u (2.4)

The symmetric case 0 = u is used in the original model by [9] and [10]. The VG process has

been studied at many places (e.g. [11]-[14]). It is a special case of the bilateral gamma process

and other tempered stable processes considered in many recent papers (e.g. [15]-[19]).

Several multivariate versions of the VG process have been considered so far. Madan and Seneta

[9] first introduced a multivariate symmetric VG process by subordinating a multivariate

Brownian motion without drift by a common gamma process. The asymmetric version of this

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 3

model has been developed in Cont and Tankov [6] and Luciano and Schoutens [7]. Generalizing

(2.1) these authors consider multivariate Lvy processes with VG components of the type

, ,..., 2 , 1 ,

) ( ) (

n k W G X

k

G k t k

k

t

t

= + = t u (2.5)

where the

) (k

t

W s are correlated standard Wiener processes such that dt dW dW E

ij

j

t

i

t

= ] [

) ( ) (

.

More complex multivariate VG models have also been considered (e.g. [20]-[24]). Despite all its

shortcomings, the use of the model (2.5) is justified theoretically by looking at the variance of its

VG margins ) , , ( ~ :

) (

1

) (

v t u

k k

k

t

k

VG X X

=

= at unit time, namely

2 2 ) (

] [

k k

k

X Var u v t + = . (2.6)

Each variance decomposes into an idiosyncratic component

2

k

t , that is attributed to the Brownian

motion, and an exogenous component

2

k

v u , that is due to the gamma distributed time change of

the Brownian motion. The parameters

k

u govern the exposures of the margins to the global

market uncertainty measured by the common parameter v . Similarly, one notes that the skewness

and kurtosis are also affected by the single marginal settings and the common parameter v . On

the other hand, the statistical moment method developed in [8] and its successful application to

real-world data justifies its use in practical work. To fix ideas, and for the sake of simplicity, the

first focus is therefore on the model (2.5). The joint cgf of this multivariate process can be

expressed in closed-form.

Proposition 2.1 (cgf of the multivariate VG process) The joint cgf of the multivariate VG process

) / , , ( ~ ) ..., , (

) ( ) 2 ( ) 1 (

t t t VG X X X X

n

t t t t

v u E = with parameters ( )

n

u u u u ,..., ,

2 1

= , ( )

j i ij

t t = E , is

determined by

) ,..., , ( )}, ( 1 ln{ ) (

2 1 2

1

1

n

T T

X

u u u u u u u t u C

t

= E + =

u v v . (2.7)

Proof Since the conditional margins are normally distributed as ), , ( ~

2 ) (

t k t k t

k

t

G G N G X t u one

obtains the representation (2.7) from the following calculation

)]. ( [exp E ln ]] ) exp( [E[ E ln ] ) exp( [ ln ) (

2

1

G G

t t

t

T

t

T

t t

T

t

T

X

uG u uG G X u X u E u C

t

E + = = = u

Remarks 2.1 The random vector at unit time ) ,..., , (

) ( ) 2 ( ) 1 ( n

X X X X = of the special case 1 = v

has a so-called multivariate asymmetric Laplace distribution, denoted ) , ( ~ E u AL X , that has

been extensively studied in the monograph [26] (see also [27]). The parameter estimation of the

shifted version ) ,..., ( ), , , ( ~

1 n

AL X u = E + , has been discussed in [28] and [25]. The

method is extended in [8] to the statistical estimation of the shifted variance-gamma

model ) , , ( v u E +VG .

3. THE BLACK-SCHOLES-VASICEK DEFLATOR

Recall the Black-Scholes-Vasicek (BSV) deflator introduced in [3]. Consider a multiple risk

economy with 1 > n risky assets, whose real-world prices follow lognormal distributions. Given

the current prices of these risky assets at initial time 0 we assume that the future prices at time

0 > t are described by exponential Brownian motions of the type

n k W v t m S S

k

t

k

t k

k

t

k k

t

,..., 2 , 1 ), ) exp((

) ( ) ( 2

2

1

) ( ) (

0

) (

= + = o , (3.1)

where the

) (k

t

W s are correlated standard Wiener processes such that dt dW dW E

ij

j

t

i

t

= ] [

) ( ) (

.

We assume that the correlation matrix ) (

ij

= E is positive semi-definite with non-vanishing

determinant. The quantities

) (k

t

m and

) (k

t

v are interpreted as mean and standard deviation per

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 4

time unit of the k -th asset logarithmic return

) (k

t

r over the interval | | t , 0 , and

k

o is a constant

volatility parameter. The representation (3.1) includes two popular asset pricing models:

Black-Scholes model:

) ( ) ( k

t k k

k

t

dW dt dr o + = with

k

k

t

m =

) (

, .

) (

k

k

t

v o =

Vasicek (Ornstein-Uhlenbeck) model:

) ( ) ( ) (

) (

k

t k

k

t k k

k

t

dW dt r b a dr o + = with

t

e b

m

t a

k k

t

k

) 1 (

) (

= , .

2

1

2

) (

t a

e

v

k

t a

k

k

t

k

= o

The economic model contains also a risk-free asset, which is assumed (for simplicity) to

accumulate at a constant rate r per time unit. The BSV deflator of dimension n has the same

form as the price processes in (3.1), i.e.

, 0 ), exp( > = t W t D

t

T

t t t

| o (3.2)

for some time dependent parametric function

t

o and vectors , ) ..., , (

, 2 , 1 ,

T

n t t t t

| | | | =

) ..., , (

) ( ) 2 ( ) 1 ( n

t t t t

W W W W = . To define a state-price deflator the stochastic processes (3.1) and (3.2)

must satisfy the martingale conditions

, ,..., 2 , 1 , 0 , ] [ , ] [

) (

0

) (

n k t S S D E e D E

k k

t t

rt

t

= > = =

(3.3)

where ] [ E denotes conditional expectation with respect to the information at initial time 0.

Theorem 3.1 (BSV deflator of dimension n ) Given is a financial market with a risk-free asset

with constant rate of return r and 1 > n risky assets that have log-normal real-world prices

(3.1). Assume a non-singular positive semi-definite correlation matrix ) (

ij

= E . Then, the BSV

deflator (3.2) is determined by

, 0 ), exp( > = t W t D

t

T

t t t

| o with (3.4)

. ,..., 2 , 1 ), ] [ (

, ) ..., , ( , , ) (

2 ) ( 2

2

1

) ( ) (

,

, 2 , 1 ,

1

2

1

1

n k v r m v

r C r

k

t k

k

t

k

t k t

T

n t t t t t t t

T

t t W t

t

= =

= E = E + = + =

=

o

| | | | o

(3.5)

The quantity

k t ,

is called market price of the k -th risky asset at time t .

Proof The martingale conditions (3.3) are equivalent with the system of linear equations

0

2

1

= E + +

t

T

t t

r | | o and

t t

| = E (see [3], proof of Proposition 2).

4. A STATE-PRICE DEFLATOR FOR THE MULTIVARIATE EXPONENTIAL VG PROCESS

We begin with the construction of the univariate VG deflator. Consider the following asset

pricing model. Given the current price of a risky asset at time 0, its future price at time 0 > t is

described by an exponential VG process

, ), ) exp((

0

t

G t t t t

W G X X t S S t u e + = + = (4.1)

where represents the mean logarithmic rate of return of the risky asset per time unit and

0 )) ( 1 ln( ) 1 (

2

2

1

1

> + = =

t u v v e

X

C . (4.2)

To obtain (4.2) one uses the defining relationship ) exp( ] [

0

t S S E

t

= and the expression (2.7) for

the univariate cgf. The VG deflator has the same form as the price process in (4.1). For some

parameters | o, (to be determined) one sets

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 5

. 0 ), exp( > = t X t D

t t

| o (4.3)

Now, a simple cgf calculation shows that the state-price deflator martingale conditions

, 0 , ] [ , ] [

0

> = =

t S S D E e D E

t t

rt

t

(4.4)

are equivalent with the system of two non-linear equations in the three unknowns e | o , , :

. 0 ) ) 1 ( ) 1 ( 1 ln(

, 0 ) 1 ln(

2 2

2

1

1

2 2

2

1

1

= +

= + +

| vt | vu v e o

| vt vu| v o r

(4.5)

Inserting the first equation into the second one yields the necessary relationship

. 0 )} ) 1 ( ) 1 ( 1 ln( ) 1 {ln(

2 2

2

1

2 2

2

1

1

= + +

| vt | vu | vt vu| v e r (4.6)

As the system (4.5) has one degree of freedom, the unknown e can be chosen arbitrarily, say

r = e , (4.7)

which is interpreted as the (time-independent) VG market price of the risky asset. With the

restriction (4.2) on the VG parameters this value is always positive. Inserted into (4.6) and using

(4.2) shows that the parameter | is determined by the two alternate expressions

)). exp( 1 (

1 2

2

1

2

ve v t u |t = + =

(4.8)

In particular, comparing the first and third term in (4.8) shows that the parameter | is a simple

exponential transform of the market price, which is equivalent to the logarithmic relationship

). 1 ln(

2 1

v|t v e = =

r (4.9)

With the Mercator series for the logarithm, one sees that the VG market price of risk is given by

, ... ) ( ) (

2

2

1

2 2 2

2

1

2

1

2

1

1

t u |t |t v |t v|t v e + = ~ + + = = =

=

j

j

j

r (4.10)

where the last equality in the first order approximation follows from (4.8). Summarizing and

rearranging the above one obtains the following VG deflator representation.

Theorem 4.1 (univariate VG deflator) Given is a risk-free asset with constant return r and a

risky asset with real-world price (4.1). Then, the VG deflator (4.3) is determined by

, 0 ), , ( ~ ), ) ( exp(

1 1 2

2

1

> I =

t t G W G t D

t G t t

t

v v |t t | | o with (4.11)

. ), ) 1 ( 1 ln( ) (

2

2

1

2 2

2

1

1

t u |t t | v| v | o + = = + =

r C r

X

(4.12)

Next, consider 2 > n risky assets. Given the current prices of these risky assets at initial time 0

their future prices at time 0 > t are described by exponential VG processes of the type

n k X t S S

k

t k k

k k

t

,..., 2 , 1 ), ) exp((

) ( ) (

0

) (

= + = e , (4.13)

where

k

represents the mean logarithmic rate of return of the k -th risky asset per time unit,

the random vector process ) ,.., ,. (

) ( ) 2 ( ) 1 ( n

t t t t

X X X X = follows a simple multivariate VG process

with cgf (2.7), and similarly to (4.2) one has

. 0 )) ( 1 ln(

2

2

1

1

> + =

k k k

t u v v e (4.14)

The VG deflator of dimension n has the same form as the price processes in (4.13). For some

parameter o and vector ) ,..., , (

2 1 n

| | | | = (both to be determined) one sets

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 6

. 0 ), exp( > = t X t D

t

T

t

| o (4.15)

In this situation, the martingale conditions, which define the state-price deflator, are equivalent

with the non-linear system of 1 + n equations in the 1 2 + n unknowns

k k

e | o , , (use the

explicit form of the cgf (2.7)):

, ,..., 2 , 1 , 0 )} ( 1 ln{

, 0 )} ( 1 ln{

) ( ) (

2

1

) ( 1

2

1

1

n k

r

k

T

k k T

k k

T T

= = E + +

= E + +

| | | u v v e o

| | | u v v o

(4.16)

with the vector notation n k j

j

k

j

k

j

k

n

k k k

,..., 2 , 1 , , ), ,..., , (

) ( ) ( ) (

2

) (

1

) (

= = = | o | | | | | . As the system

(4.16) has n degrees of freedom, the unknowns

k

e can be chosen arbitrarily. A convenient

appropriate choice, which leads to a simple solution of the system (4.16), consists to set

, r

k k

= e (4.17)

which is interpreted as the (time-independent) VG market price of the k -th risky asset. Now,

inserting the first equation of (4.16) into the second ones taking into account (4.17) yields

. ,..., 2 , 1 ), ( 1 ) ( 1

) ( ) (

2

1

) (

2

1

n k

k

T

k k T T T

= E + = E + | | | u v | | | u v (4.18)

A straightforward calculation shows that the components of the parameter vector | are

determined by the two alternate expressions (use (4.14) for the second one)

, ,..., 2 , 1 , , )) exp( 1 (

2 1 2 2

2

1

2

n k

k j

k

j

kj k k k k k k k k k k

= = + = + + =

=

t

t

t ve v t t u t | (4.19)

which generalize the relation (4.8). In particular, comparing the first and third term in (4.19)

shows that the parameters

k

| are simple exponential transforms of the market prices of risk,

which are equivalent to the logarithmic relationships

. ,..., 2 , 1 ), ) ( 1 ln(

2 1

n k

k k k k

= =

t | v v e (4.20)

Similarly to (4.10) one obtains the series expansions and the first order approximations for the VG

market prices of the risky assets

, ) (

... ] ) ( [ ) ( ] ) ( [

2

2

1

2

2 2

2

1

2

1

2

1

1

k k k k k

k k k k k k

j

j

k k k j k

t u t |

t | v t | t | v v e

+ = ~

+ + = =

=

(4.21)

where the last equality follows from (4.19). Summarizing and rearranging the above one obtains

the following multivariate VG deflator representation.

Theorem 4.2 (VG deflator of dimension n ) Given are 2 > n risky assets with real-world prices

(4.13), where the random vector process ) ,..., , (

) ( ) 2 ( ) 1 ( n

t t t t

X X X X = follows a multivariate VG

process. Then, the VG deflator (4.15) is determined by

, 0 ), exp(

) (

1

> =

=

t X t D

k

t

n

k

k t

| o with (4.22)

. ,..., 2 , 1 , , ) ( ), (

2

2

1

2

1

n k C r

k j

k

j

kj k k k k k k X

t

= = + + = + =

=

=

t

t

t u t | | o (4.23)

Remarks 4.1 It is instructive to note that (3.2) and (4.15) correspond to an Esscher transformed

measure that has long been used in option pricing (e.g. [29]). Moreover, an important connection

with the standard no-arbitrage framework of Mathematical Finance must be mentioned (e.g. [30],

Section 2.5, and [31], Chap. 2). By the Fundamental Theorem of Asset Pricing, the assumption of

no-arbitrage (weak form of the efficient market hypothesis) is equivalent with the existence of an

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 7

equivalent martingale measure for deflated price processes. In complete markets, the equivalent

martingale measure is unique, perfect replication of contingent claims holds, and straightforward

pricing applies. In incomplete markets, an economic model is required to decide upon which

equivalent martingale measure is appropriate. Now, let P denotes the real-world measure and

*

P an equivalent martingale measure. Then, one can either work under P , where the price

processes are deflated with a state-price deflator. Alternatively, one can work under

*

P by

discounting the price processes with the bank account numeraire. Working with financial

instruments only, one often works under

*

P . But, if additionally insurance liabilities are

considered, one works under P (see [30], Remark 2.13). A non-trivial example is pricing of the

guaranteed maximum inflation death benefit (GMIDB) option (equation (5.4) in [4]). In the

present paper, we demonstrate the practicability of the state-price deflator approach for

exponential variance-gamma price processes of Margrabe type used in insurance and financial

markets. In insurance, the Margrabe option has been discussed by [32], [33], [34], Sections V.4 to

V.6, [30], Section 4. On the other hand, [8] offers an alternative approach to calibration based on

a novel multivariate statistical moment method that uses besides means and covariances also the

coskewness and cokurtosis tensors. A real-world comparison of the exponential variance-gamma

model with the ubiquitous Black-Scholes model for pricing the Margrabe option is also made.

5. MARGRABE FORMULA FOR THE REAL-WORLD PRICE PROCESS

Given is the shifted version ) ,..., , ( ,

2 1 n t

X t = + , of the Lvy process induced by the unit

time shifted multivariate VG random vector ) , , , ( ~ v u E + VG X . We assume that future

values of financial entities at time 0 > t are described by exponential VG processes of the form

n k X t S

k

t k

k

t

,.., 2 ,. 1 ), exp(

) ( ) (

= + = . (5.1)

This general framework enables simultaneous modelling of real-world insurance liabilities and/or

asset prices from financial markets. For market consistent valuation one needs to deflate them

with so-called state price deflators, as explained in the Remarks 4.1, which will be done in the

next Sections. In both settings we derive integral and closed-form formulas for the two-

dimensional Margrabe exchange option, here of the real-world type

0 ], ) [(

) 2 ( ) 1 (

> =

+

t S S E M

t t

R

t

. (5.2)

Therefore, the bivariate case 2 = n in (5.1) is of interest and for this we set

12

= . For

simplicity and without loss of generality, it suffices to discuss the unit time case 1 = t . By abuse

of notation, the time index is removed from any stochastic process in the following. Conditioning

on the common gamma subordinator, one can write

. ), ( / ) ( ) ( ], ) [( ) (

, ) ( ) ( ] ) [(

1 1 ) 2 ( ) 1 (

0

) 2 ( ) 1 (

+

+

= I = = =

}

= =

v

w R

R R

e w w f w G S S E w M

dw w f w M S S E M

(5.3)

As usual ) (x u denotes the standard normal distribution, ) ( 1 ) ( x x u = u is the survival

function, and ) ( ' ) ( x x u = is the density. The bivariate standard normal density is denoted by

( ) { }

2 2

) 1 ( 2

1

) 1 ( 2

1

2

2 exp ) ; , (

2

2

y xy x y x + =

t

.

By definition (2.5) one obtains

} }

=

+

+ + + +

dxdy y x e e w M

y w w x w w R

) ; , ( ) ( ) (

2

2 2 2 1 1 1

t u t u

. (5.4)

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 8

The expression in the bracket of (5.4) is non-negative provided ) ( y x x >

with y w

w

y x

1

2

1

1 2

1

1 2

) (

) (

t

t

t

u u

t

+

= . Now, it is possible to separate the double integral as

}

=

dy y w y J w M

R R

) ( ) , ( ) ( , because

2 2

2

1 / ) 1 / ) (( ) ( ) ; , ( = y x y y x . With this

the inner integral reads

}

=

+ + + +

) (

2 2

) 1 / ) (( } { ) 1 / 1 ( ) , (

2 2 2 1 1 1

y x

y w w x w w R

dx y x e e w y J

t u t u

. (5.5)

A straightforward application of Lemma A1.1 in the Appendix 1 yields

) ( ) 1 ( ) , (

2

2 2 2

2

2

1

2

2

1

1 1 1

1

) (

1

2

1

) (

) 1 (

t u

t t u

t

+ +

+ + +

u + u =

y x y y w w y x y

w y w w

R

e w e w y J .

Taking into account the above definition of the auxiliary function ) ( y x , one rewrites the

arguments inside the normal distribution functions as

, , 1

2 2

1

) (

1

2

1

) (

cy b cy a w

y x y y x y

+ = + = +

t with

2

1

2 1

2

1

2 1 2 1

2

1

2 1

2

1

2

2 1

1 1

) (

1

) ) 1 ( (

, ,

t

t t

t

u u

t

t u u

+ +

= = = c b a

w

w

w

w

.

Furthermore, one notes that

) ( ) ( ), ( ) (

2 1

2

2

2

1

2

2

1

2

2

1

1

w y e y e w y e y e

w

y w

w

y w

t t

t

t

t

t

= = .

Now, using twice the Lemma A1.2 of the Appendix 1 one obtains

) ( ) ( ) (

2

2

2

2

2

1

2 2

2

1

2

1

2

1

1 1

1

) (

1

) (

c

w c b w

c

w c a w

R

e e w M

+

+ + +

+

+ + +

u u =

t t u t t u

.

An algebraic calculation based on the expressions for the coefficients c b a , , yields further

. , 2 , 1 ,

), ( ) ( ) (

2

2

2

1 2 1

2 2

) ( ) (

2 1

2

2 2 1

2

2

2

1

2 2 2 1

2

1 2 1

2

1

2

1

1 1

e e e t t t e

e

e

e u u t u

e

e

e u u t u

+ = = =

+ u + u =

+ + + + +

k

w e w e w M

k k

w

w

w

w

R

(5.6)

We are ready for the following result.

Theorem 5.1 (Margrabe formula for the real-world exponential shifted bivariate VG process)

Given is the bivariate process at unit time 2 , 1 ), exp(

) ( ) (

= + = k X S

k

k

k

, with

) , , , ( ~ v u E + VG X . With

1

12

,

= = v , , , 2 , 1 ,

2

2

2

1 2 1

2 2

e e e t t t e + = = = k

k k

one has

.

) (

, 2 , 1 ,

) 1 (

), (

, ) / ( ) ( / 1 ) , , , (

), , , , ( ) , , , ( ] ) [(

2 1

2 1

2 1 2

2

1

1

0

1

2 2 1 1

) 2 ( ) 1 (

2 1

e

e

e u u

t u

= =

+

= + =

}

+ u I = +

+ + = =

+

c k b a

dz z c z b e e z c b a

c b a e c b a e S S E M

k

k

k k k k

az z

R

(5.7)

Proof It remains to insert (5.6) into (5.3) and make the change of variables w z = .

Remark 5.1 One observes that the +-function in (5.7) is related to the one stated in [26], p.296

(European risk-neutral call-option price for an exponential VG price process).

A particular instance, for which the formula (5.7) simplifies considerably, is the special

case 0 = c , that is

2 1

= , which is analyzed into more details. In this situation, the +-function

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 9

simplifies to the calculation of the expression (make the change of variables ) 1 ( 2 /

2

a x z =

under the assumption 1 < a )

,

) 1 ( 2

) (

] ) 1 ( 2 [ 2

) , 0 , , (

-

|

|

.

|

\

|

I

= +

a

b

L

a

b a

(5.8)

with the integral function of normal type

dx x z x x z L

}

u =

0

1 2

) ( ) ( 2 ) ( t

. (5.9)

The assumption 1 < a in (5.8) means that (5.7) will be finite for 0 = c

provided 2 , 1 , 1 ) (

2

2

1

1

= < + =

k a

k k k

t u , a condition, which is equivalent with the existence of

the cgf ) 1 ln( ) (

k k SG

a a C = of a standard gamma random variable with shape parameter

and scale parameter 1. In case the gamma distributed subordinator ) , ( ~ t G

t

I reduces to an

Erlang distributed subordinator ) , ( ~ m t m Erlang G

t

with integer parameter ,... 2 , 1 = m , the

integral function (5.9) can be evaluated according to the following closed-form formula (proof in

Appendix 2):

,... 2 , 1 , )

) 1 ( ! 2

! )! 1 2 (

1 ( 1 )! 1 ( 2 ) (

1

1

2

1

2

2

=

|

|

.

|

\

|

+ + =

=

+

m

d k

k

m d L

m

k

k k

d

d

m

m

. (5.10)

6. MARGRABE FORMULA FOR THE DEFLATED PRICE PROCESS

Consider the Margrabe exchange option for the deflated price process in (5.1) such that

0 ], ) ( [

) 2 ( ) 1 (

> =

+

t S S D E M

t t t

D

t

. (6.1)

The state-price deflator is of the form (4.22) with 2 = n . As in Section 5, we set

12

= and

discuss the unit time case 1 = t . Conditioning on the common gamma subordinator, one writes

. ), ( / ) ( ) ( ], ) ( [ ) (

, ) ( ) ( ] ) ( [

1 1 ) 2 ( ) 1 (

0

) 2 ( ) 1 (

+

+

= I = = =

}

= =

v

w D

D D

e w w f w G S S D E w M

dw w f w M S S D E M

(6.2)

Similarly to (5.5) it is possible to separate the double integral as

}

=

dy y w y J w M

D D

) ( ) , ( ) (

with the inner integral

.

) (

) (

, ) 1 / ) (( 1 / 1 ) , (

1

2

1

1 2

1

1 2

) (

2

) )( 1 ( ) (

) ( ) )( 1 (

2

2 2 2 1 1 1 2

2 2 2 1 1 1 1

y w

w

y x

dx y x

e

e

w y J

y x

y w w x w w

y w w x w w

D

t

t

t

u u

t

t u | t u | o

t u | t u | o

+

=

}

=

+ + +

+ + +

(6.3)

A straightforward application of Lemma A1.1 in the Appendix 1 yields

). 1 (

) ) 1 ( 1 ( ) , (

1 1

2

1

) (

) 1 ( ) )( 1 (

1 1

2

1

) (

) 1 )( 1 ( ) 1 ( ) ( ) 1 (

2

2

1

2

1

2

2

1

1 1 2 2 2 1 1 2

2

2

1

2

1

2

2

1

1 1 2 2 2 1 1 1

w e

w e w y J

y x y

w y w y w w w

y x y

w y w y w w w

D

t |

t |

t | t | t u | u | o

t | t | t u | u | o

u

+ u =

+ + +

+ + + +

Taking into account the definition of the auxiliary function ) ( y x , one rewrites the arguments

inside the normal distribution functions as

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 10

, 1 , ) 1 ( 1

1 1

2

1

) (

1 1

2

1

) (

2 2

cy b w cy a w

y x y y x y

+ = + = +

t | t |

with

. , ,

2

1

2 1

2

1

2 1

2

1 1

2

2 1

2

1

2 1

2

1 1

2

2 1

1 1

) ) 1 ( (

1

) ) 1 )( 1 ( (

t

t t

t

t | u u

t

t | u u

+ +

= = = c b a

w

w

w

w

Furthermore, one notes that

{ }

{ }

{ }

{ }

{ }

{ } ). ) 1 ( ( ) (

), ) 1 ( ( ) (

1 1 2 2

) 1 (

) 1 (

2 2 1 1

) 1 (

) 1 (

2

1 1 2 2

2

1

1 1 2 2

2

2 2 1 1

2

1

2 2 1 1

w y e y e

w y e y e

w

y w

w

y w

t | t |

t | t |

t | t |

t | t |

t | t |

t | t |

=

=

Now, using twice the Lemma A1.2 of the Appendix 1 one obtains

{ } { }

{ } { }

). (

) ( ) (

2

1 1 2 2

2

1

2

1

2

1

2 1 2 1 1

2

2

2

2

2

1

2 2 2

2

2 2 1 1

2

2

2

2

2

1

2 1 1 2 2

2

1

2

1

2

1

1 1 1

1

) 1 ( ) ) 1 ( ( ) 1 ( ) 1 (

1

) 1 ( ) ) 1 ( ( ) 1 ( ) 1 (

c

w c b w

c

w c a w

D

e

e w M

+

+ + + + +

+

+ + + + +

u

u =

t | t | t | t t | u | t | t | o

t | t | t | t t | u | t | t | o

(6.4)

Repeated use of the following relationships for

2 1

, | | in (3.23) is made:

. 2 , 1 ,

2 1

2

2

1

2

= + + = k

k k k k

t t t u t | (6.5)

An algebraic calculation based on the expressions for the coefficients c b a , , yields

{ }

{ }

. , 2 , 1 ,

, ) ( ,

, ) ( ,

2

2

2

1 2 1

2 2

2 1 2

1

2 2

1

) 1 (

2 1 2

1

1 1

1

) 1 (

2 1 2 1

2

1 1 2 2

2 1 2 1

2

2 2 1 1

e e e t t t e

| | e

| | e

e

t t

e

t | t |

e

t t

e

t | t |

+ = = =

+ = + =

+ = + =

+

+

+

+

k

b w b

b w b

k k

w

c

w c b

w

c

w c a

(6.6)

Furthermore, the coefficients of w in the curly brackets of (6.4) are respectively equal to

. ) 1 ( , ) 1 (

2

1

2 1 1 2 2

1

2 1 2 1

| | | u t t | | | | u t t | E + = E + =

T T T T

a a (6.7)

We are ready for the following result.

Theorem 6.1 (Margrabe formula for the deflated exponential shifted bivariate VG process)

Given is the bivariate process at unit time 2 , 1 ), exp(

) ( ) (

= + = k X S

k

k

k

, with

) , , , ( ~ v u E + VG X , the bivariate deflator ) exp(

) 2 (

2

) 1 (

1

X X D | | o = of Theorem 4.2,

and set

1

12

,

= = v , . , 2 , 1 ,

2

2

2

1 2 1

2 2

e e e t t t e + = = = k

k k

Then one has

.

) (

, 2 , 1 ), ) ( ) 1 ( (

), ) 1 (( ), ) 1 ((

, ) / ( ) ( / 1 ) , , , (

), , , , ( ) , , , ( ] ) ( [

2 1 2 1

2 1

1

2

1

1

2

1

2 1 1

1

2 2

1

2 1 2

1

1

0

1

2 2 1 1

) 2 ( ) 1 (

2 1

e

e

t t

| | e

| | | u t t | | | | u t t |

o o

= = + =

E + = E + =

}

+ u I = +

+ + = =

+

c k b

a a

dz z c z b e e z c b a

c b a e c b a e S S D E M

k

k

T T T T

az z

D

(6.8)

Proof It remains to insert (6.4) into (6.2), make the necessary identifications based on (6.6) and

(6.7), and perform the change of variables w z = .

In the special case 0 = c , that is

2 1

= , and if 2 , 1 , 1 = < k a

k

, the expression (6.8) can be

evaluated using the formula (5.8) for the +-function. Specializing further to a shifted simple

bivariate variance-Erlang price process with integer parameter ,... 2 , 1 = = m , one obtains via

(5.10) closed-form Margrabe formulas.

Example 6.1 Bivariate Black-Scholes versus bivariate variance-Erlang models

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 11

It is interesting to compare the classical closed-form formula by Margrabe [35] with closed-form

variants obtained from (6.8). In the bivariate Black-Scholes model the future prices at unit time

1 = t are described by the equations (3.1), that is

, 2 , 1 ), exp(

2

2

1

) (

0

) (

1

= + = k Z S S

k k k k

k k

o o (6.9)

where the

k

Z s are correlated standard normal with correlation coefficient

BS

. The means and

variance-covariance characteristics of (6.9) are given by

. 2 , 1 , }, 1 ) {exp( ] , [

), exp( ] [

) (

1

) (

1

) (

0

) (

1

= = =

= =

j i E E S S Cov V

S S E E

j i

BS

ij

BS

j

BS

i

j i BS

ij

i

i i BS

i

o o

(6.10)

For illustration set 2 , 1 , 0 , 1

) (

0

= = = k S

k

k

. Applying the Black-Scholes deflator from Theorem

3.1 one obtains Margrabes classical exchange option price at initial time 0 = t (e.g. [3],

Theorem 2)

2 1

2

2

2

1 2

1

) 2 (

1

) 1 (

1 1

2 , 1 ) ( 2 ] ) ( [ o o o o o o

BS BS

S S D E M + = u = =

+

. (6.11)

In the bivariate variance-Erlang model (with closed-form exchange option price) the future prices

at unit time 1 = t are described by equations of the form (5.1) such that

2 , 1 , ), exp(

) (

1

= + = + = k Z W W X X S

k k k k k

k

t u , (6.12)

with ) ( ~ m Erlang W , and the

k

Z s are correlated standard normal with correlation coefficient

VE

. The corresponding means and variance-covariance characteristics are

. 2 , 1 , , } 2 1 ln( 2 exp{ ] , [

, )}, 1 ln( exp{ ] [

) (

1

) (

1

2

2

1

) (

1

= = =

+ = = =

j i E E m S S Cov V

m S E E

BS

j

BS

i j i

Ve

ij j i

j i VE

ij

i i i i

i VE

i

t t o o

t u o o

(6.13)

It is natural to compare both models under equal first and second order moments. In case

2 , 1 , 0 , 1

) (

0

= = = k S

k

k

, the equations of equal mean and variance-covariance, which consists to

equate (6.10) and (6.13), result into the following parameter constraints

.

2 1

) 1 (

ln ,

2 1

) 1 (

ln

), ( , ), 1 ln(

2 1 1

2

1

2 1

2

1

2

1 2

2

2

2

1

2

1

1 2

2

1

2

1

1 1 2 1

|

|

.

|

\

|

=

|

|

.

|

\

|

=

= + = = =

t t o

o

o o

t o

o

o

t t u u t u o o o

VE

BS

k

k

m m

m

(6.14)

Calculation of the deflated exchange option price (6.8) requires the parameters of the VG deflator

in (4.23), which are herewith determined by

2 , 1 , ), (

2 1

2

2

1

2

) , (

2 1

= + + = + = k C r

VE

k k k k X X

t t t u t | | o . (6.15)

For the bivariate symmetric Laplace special case 1 = m with the simple parameter choice

t t t u u = = = = =

1 2 1 2

, 0 , 0

VE

, one obtains (6.16)

2

1

2 1

2

4

1

) , (

), 1 ln( ) (

2 1

= = = + = | | t | o r C r

X X

. (6.17)

The remaining parameters in (6.8) take the values

t t t

2

2

2 2

2

1

2

4

1

1 2

, , = = = = b b a a . (6.18)

A straightforward calculation of (6.8) using (5.8) and (5.10) for 1 = m yields the symmetric

Laplace Margrabe option price

2

) 1 ( ] ) ( [

2

2

1

) 2 (

1

) 1 (

1 1

t

t = =

+

r SL

e S S D E M . (6.19)

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 12

Numerically, if 1 . 0 , 0 = = t r , then 0.14249 = o , and 5.67991% =

BS

M compares with

4.975% =

SL

M . The follow-up [8] provides some comparisons based on stock market indices.

7. RESULTS, FURTHER DISCUSSION AND CONCLUSIONS

First, it is useful to summarize what has been accomplished. The starting point is the wish to

enrich multidimensional option pricing with some multivariate non-Gaussian models able to

capture skewness, kurtosis and other stylized facts from observed insurance liability and financial

market data. It turns out that not much is known in this respect, especially when it comes to

market consistent valuation for use in the Basel III and Solvency II projects. To achieve this, one

can either work with an equivalent martingale measure for deflated price processes or use a state-

price deflator to discount insurance liabilities and asset prices under the real-world probability

measure. The second possible path has been followed. Since a multivariate exponential variance-

gamma process is one of the popular alternative choices to the multivariate exponential Gaussian

process, the construction of an explicit state-price deflator for it is a main first goal, which has

been achieved in Theorem 4.1. An application to bivariate option pricing has been undertaken.

Theorem 6.1, which displays a Margrabe formula for the deflated exponential shifted bivariate

variance-gamma process, is a main new contribution. Moreover, analytical closed-form

expressions for the bivariate exponential variance-Erlang special case are also obtained.

Second, it is important to remark that our simple model is easy to work with but has some serious

drawbacks. For example, linear correlation cannot be fitted once the margins are fixed. Moreover,

the choice of a single parameter v causes great difficulty in the joint calibration to option prices

on the margins, as observed in [21]. To overcome these difficulties there are at least two

possibilities at disposal. One can either apply an alternative estimation method, which does not

share some of the inconveniences (main purpose of the follow-up [8]), or consider more complex

multivariate variance-gamma models. Results on the latter proposal will be presented elsewhere.

APPENDIX 1: Integral identities of normal type

The crucial identities used in the derivation of Theorem 5.1 are stated and proved separately.

Lemma A1.1 For any real numbers , , c b and 0 > o one has the identity

( ) o o o

o

o

b e dx x e

c

b b

c

bx

+ u =

}

+

2 2

2

1

) / ) ((

1

. (A1.1)

Proof Consider first the case 1 , 0 = = o . From the relation ) ( ) (

2

2

1

b x e x e

b

bx

= one gets

( ) c b e dt t e dx x e

b

b c

b

c

bx

u =

}

=

}

2

2

1 2

2

1

) ( ) ( .

Using this one obtains by a change of variables

( ) o o o

o

o

o

o

b e dt t e dx x e

c

b b

c

t b b

c

bx

+ u =

}

=

}

+

2 2

2

1

/ ) (

1

) ( ) / ) (( .

Lemma A1.2 For any real numbers , , b a and 0 > o one has the identity

|

.

|

\

|

u =

}

+ u

+

+

2 2

1

1

) / ) (( ) (

o

o o

b

b a

dx x bx a . (A1.2)

Proof Consider the functions

}

+ u =

}

+ u =

dx x zx a z G dx x x z z F

a

) ( ) ( ) ( , ) ( ) ( ) ( . One notes

that

2

1

) ( ) ( ) 0 ( =

}

u =

dx x x F and ) ( ) ( ) ( ) ( '

2

2

2 z

dx x x z z F =

}

+ =

, from which one gets

) ( ) ( ' ) 0 ( ) (

2

0

a

a

dz z F F a F u =

}

+ = . On the other hand, one has ) ( ) ( ) 1 (

2

a

a

a F G u = = and

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 13

) ( ) ( ) ( ) (

2

2 / 3 2

1

) 1 (

'

z

a

z

z

a

dx x zx a z z G

+

+

=

}

+ = , hence ) ( ) ( ' ) 1 ( ) (

2

1

1

b

a

b

a a

dz z G G b G

+

u =

}

+ = . It

follows that |

.

|

\

|

u = =

}

+ u

+

+

+

2 2

1

1

) ( ) / ) (( ) (

o

o o o

b

b a

b a

b G dx x bx a .

APPENDIX 2: Closed-form evaluation of an integral function of normal type

In case ,... 2 , 1 = = m , is an integer parameter, the evaluation of the integral (5.9) is done through

partial integration by finding first a primitive integral for ) (

1 2

x x

m

of the form

) ( ) ( ) (

1 2

x x P dx x x

m

m

=

}

, (A2.1)

where ) (x P

m

is a polynomial of degree ) 1 ( 2 m with integer coefficients. The following

recursive relationship determines this polynomial completely.

Lemma A2.1 The polynomial ) (x P

m

defined by (A2.1) satisfies the following recursion

1 ) ( ,..., 3 , 2 ), ( ) 1 ( 2 ) (

1 1

) 1 ( 2

= = + =

x P m x P m x x P

m

m

m

. (A2.2)

Proof First of all, since ) ( ) ( ' x x x = it is immediate that ) (x is a primitive integral of

) (x x , hence 1 ) (

1

= x P . For 2 > m the recursion is shown by induction. For 2 = m one

proceeds as follows. Let ) (x H

k

be the (probabilistic) Hermite polynomial of order k ,

,... 2 , 1 , 0 = k , which satisfies the property ) ( ) ( ) 1 ( ) (

) (

x x H x

k

k k

= . In particular, one has

) ( ) 3 ( ) (

3 ) 3 (

x x x x = , hence ) ( ) ( ' 3 ) ( ) ( 3 ) (

) 3 ( ) 3 ( 3

x x x x x x x = = .

This leads to the primitive integral

) ( ) 2 ( ) ( )) ( 3 ( ) ( ' ' ) ( 3 ) (

2

2

3

x x x x H x x dx x x + = + = =

}

, hence

) ( 2 2 ) (

1

2 2

2

x P x x x P + = + = ,

which shows (A2.2) for 2 = m . The induction step from m to 1 + m is shown by performing

two successive partial integrations as follows:

( )

, ) ( 2 ) (

) ( ) 1 ( 2 ) ( ) 1 ( 2 ) ( 2

) ( ) 1 ( 2 ) (

] ) ( ) 1 ( 2 ) ( [ 2 ) ( ) 1 ( 2 ) (

] ) ( [ 2 ) ( ] ) ( [ ) (

1 2 2

1 2 3 2 2 1 2

3 2 2 2

3 2 1 2 3 2 ) 1 ( 2 2

1 2 1 2 2 2 1 2 1 2

}

+ =

}

+

}

}

+

}

+ =

} }

+

}

+ =

} }

}

=

}

=

}

+

dx x x m x x

dx x x m dx x x x m dx x x

dx x x x m x x

dx dx x x x m x x dx x x m x x x

dx dx x x x dx x x x dx x x x dx x x

m m

m m m

m m

m m m m

m m m m

which shows the recursion for the index 1 + m , namely ). ( 2 ) (

) 2

1

x mP x x P

m

m

m

+ =

+

A successive application of the recursion (A2.2) yields the following explicit formula.

Lemma A2.2 The polynomial ) (x P

m

satisfies the explicit representation

,... 3 , 2 , 1 ,

2 !

1

)! 1 ( 2 ) (

2

1

0

1

=

|

|

.

|

\

|

=

=

m

x

k

m x P

k

m

k

m

m

. (A2.3)

Proof From Lemma A2.1 one knows that ) (x P

m

is a polynomial in even powers of x , say

=

=

1

0

2

,

) (

m

k

k

k m m

x a x P . With (A2.2) one obtains the recursive relationship

,... 4 , 3 , 2 , 1 , 2 ,..., 1 , 0 , ) 1 ( 2

1 , , 1 ,

= = = =

m a m k a m a

m m k m k m

,

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 14

which implies that ,... 3 , 2 , 1 , 1 ,..., 1 , 0 ,

! 2

1

)! 1 ( 2

1

,

= = =

m m k

k

m a

k

m

k m

.

Now, let us derive the formula (5.10). A partial integration of (5.9) using (A2.1) yields

. ) ( 2 ) 1 / (

1

) 0 (

2

1

) 1 ( ) ( ) 0 (

) ( ) ( ) ( ) ( ) ( ) ( 2 ) ( ) ( 2 ) (

0

2

2

0

2

2

1

0

0

0

1 2

|

|

.

|

\

|

}

+

+

+ =

}

+ + =

|

.

|

\

|

}

+ u =

}

u =

dt t d t P

d

d

P dx x d x P d P

dx dx x x P d dx x x P dx dx x x d L

m m m m

m m

m

m

t t

Using (A2.3) it follows that

,... 2 , 1 , ) ) ( 2

) 1 ( ! 2

1

1 (

1

1 )! 1 ( 2 ) (

1

1 0

2

2

2

2

=

|

|

.

|

\

|

}

+

+

+

+ =

=

m dt t t

d k

d

d

m d L

m

k

k

k k

m

m

.

Next, one observes that the function < s x x 0 ), ( 2 , is the probability density of the half-

normal distribution with moment generating function (e.g. [36], equation (9))

) ( ) exp( 2 ) (

2

2

1

t t t m u = .

Through induction one shows the recursive relation

,... 3 , 2 ), ( ) ( ) 1 ( ) (

) 1 ( ) 2 ( ) (

= + =

k t m t t m k t m

k k k

,

which shows that the moments

k

m of the half-normal distribution satisfy the recursion

,... 3 , 2 , ) 1 (

2

= =

k m k m

k k

. Since 1

0

= m one sees that

,... 3 , 2 , 1 , ) 1 2 ( ! )! 1 2 ( ) ( 2

1

2

0

2

= = = =

}

=

k j k m dt t t

k

j

k

k

,

The formula (5.10) is shown.

REFERENCES

[1] Milterssen K.R. and Persson S.A., Pricing rate of return guarantees in a Heath-Jarrow-

Morton framework, Insurance Math. Econom. 25(3), 307-325 (1999).

[2] Jeanblanc M., Yor M. and Chesney M., Mathematical Methods for Financial Markets,

Springer Finance, Springer-Verlag London Limited (2009).

[3] Hrlimann W., An extension of the Black-Scholes and Margrabe formulas to a multiple risk

economy, Appl. Math. 2(4), 137-142 (2011).

[4] Hrlimann W., The algebra of option pricing: theory and application, Int. J. of Algebra and

Statistics 1(2), 68-88 (2012).

[5] Hrlimann W., Option pricing in the multivariate Black-Scholes market with Vasicek

interest rates, Mathematical Finance Letters 2(1), 1-18 (2013).

[6] Cont R. and Tankov P., Financial Modelling with Jump Processes, CRC Financial

Mathematics Series, Chapman and Hall (2004).

[7] Luciano E. and Schoutens W., A multivariate jump-driven financial asset model,

Quantitative Finance 6(5), 385-402 (2006).

[8] Hrlimann W., Margrabe formulas for a simple bivariate exponential variance-gamma price

process (II) Statistical estimation and application, Appears in IJSIMR (2013).

[9] Madan D. and Seneta, E., The variance gamma model for share market returns, Journal of

Business 63, 511-524 (1990).

[10] Madan D. and Milne F., Option pricing with VG martingale components, Mathematical

Finance 1(4), 39-55 (1991).

[11] Madan D., Carr P. and Chang E., The variance gamma process and option pricing. European

Finance Review 2, 79-105 (1998).

Werner Hrlimann

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 15

[12] Madan D., Purely discontinuous asset pricing processes, In: Jouini E., Cvitanic J. and

Musiela M. (Eds.), Option Pricing, Interest Rates and Risk Management, Cambridge

University Press, Cambridge, 105-153 (2001).

[13] Carr P., Geman H., Madan D.B. and Yor M., The fine structure of asset returns: an empirical

investigation, Journal of Business 75(2), 305-332 (2002).

[14] Geman H., Pure jump Lvy processes for asset price modeling, J. of Banking and Finance

26, 1297-1316 (2002).

[15] Kchler U. and Tappe S., Bilateral gamma distributions and processes in financial

Mathematics, Stochastic Process. Appl. 118(2), 261-283 (2008).

[16] Kchler U. and Tappe S., Option pricing in bilateral gamma stock models, Statistics and

Decisions 27, 281-307 (2009).

[17] Kchler U. and Tappe S., Tempered stable distributions and applications to financial

mathematics, Preprint (2011),

URL: http://www.stochastik.uni-hannover.de/fileadmin/institut/pdf/TS_111114.pdf

[18] Kaishev V.K., Stochastic process induces by Dirichlet (B-) splines: modelling multivariate

asset price dynamics, Actuarial Research paper no. 195, Cass Business School, London

(2010).

[19] Bellini F. and Mercuri L., Option pricing in a conditional bilateral gamma model, Preprint

(2010), URL: http://ssrn.com/abstract=2046478

[20] Semeraro P., A multivariate variance gamma model for financial application, Int. J. of

Theoretical and Applied Finance 11(1), 1-18 (2008).

[21] Luciano E. and Semeraro P., Extending time-changed Lvy asset models through

multivariate subordinators, Collegio Carlo Alberto Working Paper Series, no. 42 (2007).

[22] Luciano E. and Semeraro P., Multivariate time changes for Lvy asset models:

characterization and calibration, J. Computational Appl. Math. 233, 1937-1953 (2010).

[23] Wang J., The multivariate variance gamma process and its applications in multi-asset option

pricing, Ph.D. Thesis, University of Maryland, College Park (2009).

[24] Hitaj A. and Mercuri L., Portfolio allocation using multivariate variance gamma, Capital

Markets: Asset Pricing & Valuation eJournal 4(4), (2012).

[25] Hrlimann W., A moment method for the multivariate asymmetric Laplace distribution,

Statistics & Probability Letters 83(4), 1247-1253 (2013).

[26] Kotz S., Kozubowski T.J. and Podgorski K., The Laplace distribution and generalizations: a

revisit with applications, Birkhuser, Boston (2001).

[27] Kotz S., Kozubowski T.J. and Podgorski K., An asymmetric multivariate Laplace

Distribution, TR 367, Dept. Stat. Appl. Probab., Univ. California at Santa Barbara (2003).

[28] Visk H., On the parameter estimation of the asymmetric multivariate Laplace Distribution,

Comm. Statist. Theory and Methods 38(4), 461-470 (2009).

[29] Gerber H.U. and Shiu E.S.W., Option pricing by Esscher transforms (with Discussions),

Transactions of the Society of Actuaries 46, 99-191 (1994).

[30] Wthrich M.V., Bhlmann H. and Furrer, H., Market-Consistent Actuarial Valuation, EAA

Lecture Notes, vol. 1 (2nd revised, and enlarged edition), Springer-Verlag (2010).

[31] Wthrich M.V. and Merz M., Financial Modeling, Actuarial Valuation and Solvency in

Insurance, Springer Finance (2013).

[32] Bhlmann H., Life insurance with stochastic interest rates, In: G. Ottaviani (Ed.), Financial

Risk in Insurance, Springer (1995).

[33] Hrlimann W., An elementary unified approach to loss variance bounds, Bulletin of the

Swiss Association of Actuaries, 73-88 (1997).

[34] Hrlimann W., Extremal Moment Methods and Stochastic Orders Application in Actuarial

Science, Research Monograph, 234p, In: BAMV - Boletn de la Asociacin Matemtica

Venezolana, Volume XV, num.1 & num. 2 (2008).

[35] Margrabe W., The value of an option to exchange one asset for another, Journal of Finance

33, 177-186 (1978).

[36] Pourahmadi M., Construction of skew-normal random variables: are they linear

combinations of normal and half-normal? J. Statist. Th. And Appl. 3, 314-328 (2007).

Margrabe Formulas for a Simple Bivariate Exponential Variance-Gamma Price Process (I) Theory

International J ournal of Scientific and Innovative Mathematical Research (IJ SIMR) Page | 16

AUTHORS BIOGRAPHY

Werner Hrlimann has studied mathematics and physics at ETHZ, where

he obtained his PhD in 1980 with a thesis in higher algebra. After

postdoctoral fellowships at Yale University and at the Max Planck

Institute in Bonn, he became 1984 an actuary at Winterthur Life and

Pensions, a senior actuary at Aon Re and IRMG Switzerland 2003-06, a

senior consultant at IRIS in Zrich 2006-2008, and is currently employed

at FRSGlobal Switzerland (a Wolters Kluwer Company). He has been

visiting associate professor in actuarial science at the University of

Toronto during the academic year 1988-89. More information is found at

his homepage https://sites.google.com/site/whurlimann/.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Civil EngineeringDocument3 pagesCivil EngineeringDhaked Shahab67% (3)

- International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 9Document15 pagesInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 9International Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 4Document7 pagesInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 4International Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 7Document9 pagesInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 7International Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- International Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 5Document9 pagesInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR) - 5International Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- Editoria LHTTP://WWW - Arcjournals.org/ijsimr Currentissue - PHPDocument1 pageEditoria LHTTP://WWW - Arcjournals.org/ijsimr Currentissue - PHPInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- Special Feature Http://arcjournals - Org/ijsimr - Editorialboard - PHPDocument2 pagesSpecial Feature Http://arcjournals - Org/ijsimr - Editorialboard - PHPInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- Special Feature Http://arcjournals - Org/ijsimr - Editorialboard - PHPDocument2 pagesSpecial Feature Http://arcjournals - Org/ijsimr - Editorialboard - PHPInternational Journal of Scientific and Innovative Mathematical Research (IJSIMR)No ratings yet

- Week 001 - Course Module RandomVariablesDocument44 pagesWeek 001 - Course Module RandomVariablesHikari AkariNo ratings yet

- Hen Eggs and Anatomical CanonDocument13 pagesHen Eggs and Anatomical CanonIgnacio Colmenero Vargas100% (1)

- Chapter 16 Matrices: Try These 16.1Document48 pagesChapter 16 Matrices: Try These 16.1Kenya LevyNo ratings yet

- Guide to Coding with Mata in StataDocument16 pagesGuide to Coding with Mata in Statache_wang_7No ratings yet

- Revised Computer Engineering Syllabus For Direct Second Year 2020 21 Sem IIIDocument4 pagesRevised Computer Engineering Syllabus For Direct Second Year 2020 21 Sem IIIMamta KolheNo ratings yet

- National Senior Certificate: Grade 11Document14 pagesNational Senior Certificate: Grade 11rowan chibiNo ratings yet

- UntitledDocument36 pagesUntitledCiana SacdalanNo ratings yet

- Real Life Exponential FunctionsDocument11 pagesReal Life Exponential FunctionsValentine DimitrovNo ratings yet

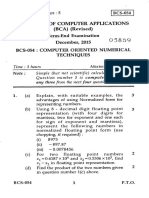

- Bachelor of Computer Applications (BCA) (Revised) Term-End Examination December, 2015 Bcs-054: Computer Oriented Numerical TechniquesDocument5 pagesBachelor of Computer Applications (BCA) (Revised) Term-End Examination December, 2015 Bcs-054: Computer Oriented Numerical TechniquesSebastianNo ratings yet

- Algebra 101 DDocument7 pagesAlgebra 101 DjohannyNo ratings yet

- Compound Interest Calculations ExplainedDocument4 pagesCompound Interest Calculations Explaineddev4c-1No ratings yet

- ERRATA LIST FOR SET THEORYDocument4 pagesERRATA LIST FOR SET THEORYKelvinNo ratings yet

- Solving fluid equations with Navier-StokesDocument3 pagesSolving fluid equations with Navier-StokesositisNo ratings yet

- Maths CH 2@2014Document33 pagesMaths CH 2@2014ALEMU TADESSENo ratings yet

- 10 Greens FunctionDocument9 pages10 Greens FunctionAnonymous j6r5KRtrH2No ratings yet

- Deriving CDF of Kolmogorov-Smirnov Test Statistic: Jan VrbikDocument20 pagesDeriving CDF of Kolmogorov-Smirnov Test Statistic: Jan VrbikPelajar JaliNo ratings yet

- Topic 6: Differentiation: Jacques Text Book (Edition 4)Document39 pagesTopic 6: Differentiation: Jacques Text Book (Edition 4)Anas AhmadNo ratings yet

- Statistics Cheat SheetDocument4 pagesStatistics Cheat SheetEvans Krypton SowahNo ratings yet

- Cuachy IntergalDocument7 pagesCuachy Intergalyaniv077No ratings yet

- Grade 12 Geometric SequencesDocument24 pagesGrade 12 Geometric SequencesSri Devi NagarjunaNo ratings yet

- Nucl - Phys.B v.603Document578 pagesNucl - Phys.B v.603buddy72No ratings yet

- Solving linear programming problems (Graphical, Simplex, Two phase and Big M methodDocument3 pagesSolving linear programming problems (Graphical, Simplex, Two phase and Big M methodG sai supreethNo ratings yet

- 4 2 OnlineDocument25 pages4 2 Onlineapi-234934912No ratings yet

- Differential Equations ElsgoltsDocument8 pagesDifferential Equations ElsgoltsAyeshaAmbreenNo ratings yet

- Class7 - Ode - MatlabDocument24 pagesClass7 - Ode - MatlabMohd Fauzi ZanilNo ratings yet

- Arithmetic Progression Assignment 15Document3 pagesArithmetic Progression Assignment 15Vishal Kumar SinghNo ratings yet

- Edexcel GCE MATHEMATICS CORE C1 To C4 Specimen QP + MSDocument57 pagesEdexcel GCE MATHEMATICS CORE C1 To C4 Specimen QP + MSrainman875No ratings yet

- ECSE343MidtermW2023 FinalDocument8 pagesECSE343MidtermW2023 FinalNoor JethaNo ratings yet