Professional Documents

Culture Documents

Learner Guide HDB Resale Procedure and Financial Plan - V2

Uploaded by

wangks1980Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Learner Guide HDB Resale Procedure and Financial Plan - V2

Uploaded by

wangks1980Copyright:

Available Formats

Page | 0

( Version 2 )

Learners Guide

J anuary 2012

Organized By

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 1

Contents Page

Section 1 - Introduction

Type of HDB Flats 2 - 4

HDB Time Planning 5

Learner Activity 1 6 - 7

Learner Group Activity 1 8

Section 2 Resale Procedure

Resale Checklist Buyers & Sellers 9 - 12

Important notes on Option To Purchase 13 - 16

How to fill up the Option To Purchase 17 - 26

Documents for Registration 27

Learner Activity 2 28

HDB Eligibility Scheme and Conditions to Purchase 29

HDB Eligibility Checklist 30 - 31

Ethnic Integration Policy 32

Section 3 CPF Housing Grant

Types of Grants available 33

Family Grant 34 - 37

Additional CPF Housing Grant 38 - 39

Housing Grant for Singles 40 - 44

Use of Grant 45 - 46

Section 4 Financial Plan

HDB Loan 47

Bank Loan 48

Buying 49

Above valuation

Below valuation

At valuation

Example of HDB Loan 50

Example of Bank Loan 51

Learner Activity 3 52 - 53

Learner Group Activity 2 54

Learner Activity 4 55 - 56

Final Assessment 57 - 59

Annexes 60

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 2

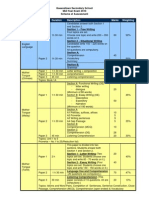

Types of HDB Flat

Conversion : 1 sq.m =10.76 sq.ft

TYPES

Floor Area (Approx.)

Sq. Meter Sq. Feet

2 'S' 42 452

3 'I' 60 646

3 S 65 700

3 'NG' 68.8 741

3 'A' 73 788

1/2 RM 82 883

'I' 82 883

'S' 85 915

4 'NG' / 4 A2 92.5 996

4 A1 100

1076

4 'A' 105 1130

'S' 110 1184

5 'I' 123 1324

5 'A' 135 1453

E.A / EM 145 1560

J umbo 180 1936

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 3

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 4

J umbo : Area ~158m

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 5

RESALE TIME PLANNING

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 6

After viewing a potential unit for the second time, your buyer decided to purchase the unit. The

buyer had a valid HLE from HDB and both the sellers and the buyer wanted to complete the

transaction as early as possible.

Please advise buyer accordingly using the resale time planning.

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 7

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 8

Discuss the individual answers that your group

have and select one representative to present your

best answer and the points to take note.

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 9

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 10

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 11

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 12

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 13

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 14

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 15

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 16

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 17

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 18

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 19

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 20

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 21

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 22

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 23

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 24

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 25

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 26

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 27

Documents For Registration (HDB/BANK)

SELLER :

RESALENET APPLICATION FORM

$80 REGISTRATION FEES

BUYER :

RESALENET APPLICATION FORM

$80 REGISTRATION FEES

BUYER CHECKLIST

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 28

After viewing a 4 room flat in J urong today, both the buyers and sellers of the unit agreed to

sell and purchase the unit at S$388,000. Your are the salesperson acting for the seller and you

are required to fill up the OTP (using the sample copy of OTP provided) based on the

following information :

Buyers :

Divorcee, Tan Chin Chuan, S1085677D

Daughter under his custody, Ong Bee Geok, S9900991A

Currently staying at Blk 123 Choa Chu Kang Ave 1

#03-90 Singapore 680123

Option Fee placed S$1000

Deposit agreed upon S$3000

Waiting for bank LO before exercise

Registration within 30 days

Sellers :

Lim Beng Ann, S1690001G

Koh Ai Min, S1890978F

Blk 101 J urong East Street 13 #08-818 Singapore 600101

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 29

Eligibility Schemes & Conditions to Purchase

* SC denotes Singapore Citizen ** SPR denotes Singapore Permanent Resident

Scheme

Citizenship

(Family Nucleus)

Min Age

(years)

(Owner)

Family Nucleus

Special Conditions

Public (PA)

2 SC; or

1 SC +1SPR;or

2 SPR

21 Applicant, spouse & children, if any; or

Applicant (single), parent & siblings; or

Applicant (widowed, divorced or

separated) and children legally under his

custody

Fiance/Fiancee

2 SC; or

1 SC +1SPR;or

2 SPR

21 Couple intending to get married Marriage certificate must be shown to HDB within 3 months

fromresale completion date. For couples applying for the CPF

Housing Grant, they must submit it on /before the resale

completion date.

Orphans

2 SC; or

1 SC +1SPR

21 A single orphan applicant and his siblings;

or two single orphans. Unrelated orphans

must buy as co-applicants and must be at

least 21 and are SCs (J SS).

Unrelated orphans must buy as co-applicants. Unmarried

siblings are not allowed to buy separate flats. If an orphan is

the only child and single, he can apply under the SSC scheme

if he is at least 21.

Single

Singapore

Citizen (SSC)

1 SC 35

21(orphan

s/widows)

Single person who is unmarried, divorced

or widowed.

You can buy a resale flat of any flat-type in any town/estate.

J oint Singles

(J SS)

2 SCs 35

21(orphan

s/widows)

Related or unrelated singles. Application must include at least 2 Sporean as owners.

Non-Citizen

Family

(NCF)

1 SC 21 1 SC applicant who is at least 21 and a

non-citizen family member as occupier

The non-citizen listed occupier must have at least a six-month

long-termsocial visit pass on the date of registration.

Non-Citizen

Spouse

(NCS)

1 SC 21

35

Married a non-citizen spouse with at least 6

months social visit pass.

Married a non-citizen spouse with less than

6 months social visit pass.

You can buy a resale flat of any flat type.

Source fromHDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 30

HDB RESALE BUYER'S ELIGIBILITY CHECK

1. HDB ELIGIBILITY SCHEME

Public Scheme (PA)

Non-Citizen Spouse Scheme (NCS)

Fianc/ Fiance Scheme

Non-Citizen Family Scheme (NCF)

Single Singapore Citizen Scheme (SSC)

Orphans Scheme

J oint Singles Scheme (J SS)

2. CPF GRANT FOR FAMILY $20K to $40K CPF GRANT FOR SINGLE $15K/$20K

Singaporean Singaporean

Age: 21 Age: 35

First timer Income ceiling $5k

Family nucleus 5 Room

Income ceiling $10k No private property last 30 months

$15k Stay same flat with parents Not bankrupt

No private property last 30 months

Not bankrupt

Buying Resale flat not affected by

SERS

Buying Resale flat not

affected by SERS

$15K or

$20K stay with Parents

$20K SC / SPR Household

$30K SC / SC Household

$40k near Parents /Married Child

ADDITIONAL CPF GRANT FOR FAMILY

$5K-$40K

CPF GRANT FOR NON-CITIZEN

SPOUSE $15K

At least one of the buyers working

continuously for past 1 years

One Singaporean ; One Non-citizen

Household Income $5K

Age: 21

HALF GRANT FOR FAMILY $15K/$20K

Income ceiling $10k

First timer ; Spouse Taken Grant

No private property last 30 months

Singaporean

Not bankrupt

$15K or

Buying Resale flat not affected by

SER

$20K near Parent /Married Child

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 31

HDB RESALE BUYER'S ELIGIBILITY CHECK

3. QUALIFY FOR HDB LOAN

At least one buyer is a Singaporean citizen

Household monthly income $10,000 (Family)

Household monthly income $5,000 (Single)

Have not previously taken two or more HDB concessionary interest rate loans

Do not own any private residential property ( include HUDC flat/Executive Condo) inside or

Out of Singapore

Have not disposed off any private residential property ( include HUDC flat/ Executive

Condo) within 30 months before the date of application for HDB Loan Eligibility (HLE) and

have never taken any HDB concessionary interest rate loan

Do not own more than one owner-operated market/hawker stalls or commercial/industrial

property in or overseas

Do not own any market/hawker stall or commercial/industrial property that is rented out

For single buyer under the Single Singapore Citizen (SSC) Scheme, gross monthly income

Does not exceed $5,000, resale flat size is 5 room or smaller

4. SECOND CONCESSIONARY HDB LOAN

HDB will reduce the quantum of the second concessionary loan by the full CPF proceeds

and part of the cash proceeds from the sale of the existing or immediate past HDB flats.

Flat buyers can keep the greater of $25,000 or half of the cash proceeds

REMARKS:

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 32

Ethnic Integration Policy & PR Quota

The Ethnic Integration Policy (EIP) is to promote racial integration and harmony and to

prevent the formation of racial enclaves, by ensuring a balanced ethnic mix among the various

ethnic communities living in public housing estates.

The EIP is applicable to the purchase of new flats, resale flats, SERS ( Selective En-bloc

Redevelopment Scheme) replacement flats and DBSS (Design, Build & Sell Scheme) flats as well

as the allocation of rental flats in all HDB estates.

Under the Policy,

Maximum proportions are set for all ethnic groups : Chinese, Malays and Indian/Others, in each

HDB block and neighbourhood. There is no restriction on the sale and purchase of an HDB flat if

the proportion of the buyer's ethnic group is within the prescribed block and neighbourhood

limits.

Once the block/neighbourhood limit for a particular ethnic group has been reached, no further

sale of HDB flats to that ethnic group will be allowed if it will lead to an increase of the

proportion beyond the limit.

There is no restriction if the buyer and seller are of the same ethnic group.

SPR Quota

For resale applications received on or after 5 March 2010, Singapore Permanent Resident (SPR)

families buying a resale flat will have to meet the SPR quota, in addition to the Ethnic Integration

Policy (EIP). The SPR quota ensures that SPR families can integrate into the local community for

social cohesion and to prevent enclaves forming in the public housing estates. The quota will

only apply on non-Malaysian SPRs. Malaysians are excluded because of our close historical and

cultural links.

Checklist for Buyers/Sellers:

You may check the eligibility of buyer's ethnic group and PR quota in any particular block using

the following channels :

www.hdb.gov.sg

Sale/Resale Customer Service Line (office hours): 1800-8663066

Important Notes:

The status of changes of ethnic proportions is updated on the first day of every month and is

applicable for resale applications submitted to HDB in the current month.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 33

Type of CPF Housing Grant Available

Source from HDB

Target Recipient Type of CPF Grant

For married couples who are

First-timer applicants

Family Grant

For married couples who are

First-timer applicants and

Buying a resale flat near their parents'/married child's HDB

flat or owner-occupied private residential property

Higher-tier Family Grant

Applicants of $30,000 Family Grant/$40,000 Higher-tier

Family Grant, if:

They have worked for at least 1 year and

Average monthly household income over the last 1 year does

not exceed $5,000

Additional CPF Housing Grant

(AHG)

For Single Citizens:

Single applicants aged 35 and above who buy the resale flat

to live on their own under Single Singapore Citizen (SSC)

Scheme, or

2-4 Single Citizens aged 35 and above who jointly buy a

resale flat under J oint Singles Scheme (J SS)

For Singapore Citizens above 21 years who are

Married to a non-citizen spouse who is holding a social visit

pass (including work permit) with a validity of at least 6

months under Non-Citizen Spouse Scheme

Singles Grant

For single citizens who are

Aged 35 years and above

Buying a resale flat to live with their parents

Higher-tier Singles Grant

For Singles Grant recipients who subsequently get married

Also applicable for Singles Grant recipients under the Non-

Citizen Spouse Scheme whose non-citizen spouse or child

subsequently obtained Singapore Citizenship or permanent

residence status.

Top-up Grant to the Family Grant

For a first-timer citizen with spouse who had previously

enjoyed a housing subsidy

Half-Housing Grant

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 34

Family Grant

Eligibility Conditions :

Criteria Detailed Description

Citizenship You are a Singapore Citizen. Your family nucleus must comprise of

at least another Singapore Permanent Resident or Singapore Citizen.

Age You must be at least 21 years old.

Family Nucleus You are applying with your:

Spouse and children (if any), or

Fianc/fiance (must be able to produce your marriage certificate,

latest by the date of resale completion), or

Children under your legal custody, care and control (if widowed or

divorced)

Income Ceiling Your average gross monthly household income must not exceed

$10,000

#

.

If applying with extended family, average gross monthly

household income must not exceed $15,000

#

.

Guidelines on assessment of household income.

#

For resale applications received on or after 15 Aug 2011.

If your average gross monthly household income over the past 12

months is $5,000 and below, you can also apply for the Additional

CPF Housing Grant (AHG) in addition to Family Grant.

Ownership/Interest in

Property

You(applicant), co-applicants and all persons listed in the application

for purchase of the flat must not

Own any of the following (local or overseas properties) or have

disposed of one within 30 months prior to the application:

- Private residential property (including HUDC flat, Executive

Condominium)

- House

- Building

- Land

Be buying a 1-room flat or a resale flat (of any flat type) that has been

announced for redevelopment under the Selective Enbloc

Redevelopment Scheme (SERS).

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 35

Type of Family Grant and Respective Grant Amount

Type of Grant Available Amount

SC / SC Household SC / SPR Household

CPF housing grant for family

Read more about Promoting

Citizenship in HDB Households

$30,000 $20,000

#

CPF housing grant for family (living

near parents/married child*):

Parents staying with you in the resale

flat, or

Your parents and married child are the

owner-occupant of property in the

same town or within 2 km

*At least one of the parents/married

child must be a Singapore Permanent

Resident or Singapore Citizen.

$40,000 $30,000

#

Half Housing Grant

If you are a first-timer citizen and your

spouse has previously enjoyed a

housing subsidy

$15,000

or

$20,000 (living near parents/married child)

#

If you are from an SC/SPR household, you can enjoy the full housing

subsidy by applying for the Citizen Top-Up when your SPR family member

takes up Singapore Citizenship or when you have an SC child.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 36

Higher-Tier Family Grant

Criteria Detailed Description

Citizenship You are a Singapore Citizen. Your family nucleus must comprise of

at least another Singapore Permanent Resident or Singapore Citizen.

Read more about Promoting Citizenship in HDB

Households

Age You must be at least 21 years old.

Family Nucleus You are applying with your:

Spouse and children (if any), or

Fianc/fiance (must be able to produce your marriage certificate,

latest by the date of resale completion), or

Children under your legal custody, care and control (if widowed or

divorced)

Income Ceiling Your average gross monthly household income must not exceed

$10,000

#

.

If applying with extended family, average gross monthly

household income must not exceed $15,000

#

.

If your average gross monthly household income over the past 12

months is $5,000 and below, you can also apply for the Additional

CPF Housing Grant (AHG) in addition to Family Grant.

Guidelines on assessment of household income for

AHG.

Ownership/Interest in

Property

You(applicant), co-applicants and all persons listed in the application

for purchase of the flat must not

Own any of the following (local or overseas properties) or have

disposed of one within 30 months prior to the application:

- Private residential property (including HUDC flat, Executive

Condominium)

- House

- Building

- Land

Be buying a 1-room flat or a resale flat (of any flat type) that has been

announced for redevelopment under the Selective Enbloc

Redevelopment Scheme (SERS).

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 37

Type of Family Grant and Respective Grant Amount

Type of Grant Available Amount

SC / SC Household SC / SPR Household

CPF housing grant for family

Read more about Promoting

Citizenship in HDB Households

$30,000 $20,000

#

CPF housing grant for family (living

near parents/married child*):

Parents staying with you in the resale

flat, or

Your parents and married child are the

owner-occupant of property in the

same town or within 2 km

*At least one of the parents/married

child must be a Singapore Permanent

Resident or Singapore Citizen.

$40,000 $30,000

#

Half Housing Grant

If you are a first-timer citizen and your

spouse has previously enjoyed a

housing subsidy

$15,000

or

$20,000 (living near parents/married child)

#

If you are from an SC/SPR household, you can enjoy the full housing

subsidy by applying for the Citizen Top-Up when your SPR family member

takes up Singapore Citizenship or when you have an SC child.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 38

Additional CPF Housing Grant (AHG)

Eligibility conditions:

Criteria Detailed Description

Meet eligibility

conditions and

are applying

for:

CPF

Housing Grant

for Family or

CPF

Housing Top-

Up Grant

AHG applicants must meet all eligibility conditions and must

be applying for any of the CPF Housing Grant below:

CPF Housing Grant for Family or

CPF Housing Top-Up Grant

Employment

Status

You or your co-applicant(s) must be in continuous

employment for one year before the flat application.

Income

Ceiling

Your average gross monthly household income for the

one-year period must not be more than $5,000.

Guidelines on assessment of household income for

AHG.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 39

Amount of Additional CPF Housing Grant (AHG)

The amount of AHG you will be eligible for is graded based on your average

gross monthly household income as follows:

Average Monthly

Gross Household

Income*

AHG prior to 6 Feb

2009**

AHG with effect from

6 Feb 2009**

$1,500 or less $30,000 $40,000

$1,501 - $2,000 $25,000 $35,000

$2,001 - $2,500 $20,000 $30,000

$2,501 - $3,000 $15,000 $25,000

$3,001 - $3,500 $10,000 $20,000

$3,501 - $4,000 $5,000 $15,000

$4,001 - $4,500 - $10,000

$4,501 - $5,000 - $ 5,000

*

Prior to 6 Feb 2009 : The average gross monthly household income was

assessed over a period of 2 years.

After 6 Feb 2009 : The average gross monthly household income is assessed

over a period of 1 year

**

Cut-Off Date is based on Resale Application received by HDB, i.e. on or

after 6 Feb 2009.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 40

Housing Grant for Singles

Eligibility Conditions :

Criteria Detailed Description

Citizenship You are a Singapore Citizen (SC).

Age At least 35 years old if you are single and

applying for resale flat under any of the following

schemes:

Single Singapore Citizen Scheme

Joint Singles Scheme

Orphans Scheme

Public Scheme (if parents are included in the

resale application as co-applicants or occupants)

Non-Citizen Family Scheme

OR

At least 21 years old if you are married and

applying for resale flat under the Non-Citizen Spouse

Scheme

Income Ceiling Average Gross Monthly Household Income must not

exceed $5,000

#

and buying a 2-, 3-, 4- or 5-room

resale flat under the Single Singapore Citizen

Scheme

OR

Average Gross Monthly Household Income must not

exceed $10,000

#

and below if:

buying a resale flat under the other eligibility

schemes

There is no flat type restriction for this group of

grant applicants.

#

For resale applications received on or after 15 Aug

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 41

2011.

Special Conditions For the Higher-Tier Singles Grant, the parents* must

be included in the application as the co-applicants or

occupants.

*At least one of the parents must be a Singapore

Permanent Resident or Singapore Citizen.

Ownership/Interest

in Property

You(applicant), co-applicants and all persons listed in

the application for purchase of the flat must not

Own any of the following (local or overseas

properties) or have disposed of one within 30

months prior to the application:

- Private residential property (including HUDC flat,

Executive Condominium)

- House

- Building

- Land

Be buying a 1-room flat or a resale flat (of any

flat type) that has been announced for

redevelopment under the Selective Enbloc

Redevelopment Scheme (SERS).

Amount of CPF Housing Grant for Singles

Singles Grant Higher-tier Singles Grant

$15,000

#

$20,000*

#

For resale applications received on or after 15 Aug 2011.

For the Higher-Tier Singles Grant, the parents* must be included in the

application as the co-applicants or occupants

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 42

Top-Up Grant to the Family Grant

The CPF Housing Top-Up Grant Scheme is a housing subsidy for those who

have taken a CPF Housing Grant for Singles previously in their purchase of a

resale flat

who subsequently marry a first-timer citizen spouse or another

Singles Grant recipient; or

whose non-citizen spouse or child have become a Singapore

Citizen or Singapore Permanent Resident (applicable for those who have

bought a resale flat under the Non-citizen Spouse Scheme).

They can apply for the Top-Up Grant for their existing flat or when they buy

another resale flat, if they meet the listed eligibility criteria.

The grant is only given to Singapore Citizen spouse (not Singapore

Permanent Resident spouse) who is listed as an owner or applicant of the

flat.

Eligibility Conditions:

Category Detailed Description

Citizenship You are a Singapore Citizen (SC).

Family Nucleus Your eligibility for Top-up will be assessed at the

point when your family nucleus first meets the

minimum citizenship requirement (i.e. 1 SC and 1

SPR in the family nucleus):

For Singles Grant recipients who bought resale flats

under SSC/JSS and subsequently get married

You are married to a Singapore Citizen (SC) or

Singapore Permanent Resident (SPR) on or after 1

Aug 2004.

Your application for the CPF Housing

Top-Up Grant must be submitted to the HDB within 6

months from the date of marriage registration

Your spouse must be a first-timer (i.e.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 43

have not enjoyed any housing subsidy before) or

another Singles Grant recipient

OR

For Singapore Citizens who had bought resale flats

under the Non-citizen Spouse Scheme and obtained

Singles Grant

You are married to a non-SC or non-SPR on or after

08 Mar 2005, and:

Your spouse or child(ren) later obtain SC or

SPR status, or

You and your spouse later give birth to an SC

or SPR child(ren)

Your application for the CPF Housing Top-Up Grant

must be submitted to the HDB within 6 months after

the spouse or child obtains Citizenship or Permanent

Resident status.

Average

Gross Monthly

Household Income

Must be $10,000 and below.

If the average gross monthly household

income over the past 12 months is $5,000 and

below, you may also apply for the Additional CPF

housing grant (AHG)

Ownership/Interest

in Property

You(applicant), co-applicants and all persons listed in

the application for purchase of the flat must not

Own any of the following (whether local or

overseas properties) or have disposed of one 30

months prior to the application:

- Private residential property (including HUDC flat,

Executive Condominium)

- House

- Building

- Land

Have bought or sold a flat purchased directly

from HDB or bought or sold a resale flat bought with

a Family Grant.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 44

Buy a 1-room flat or a resale flat (of any flat

type) that has been announced for redevelopment

under the Selective Enbloc Redevelopment Scheme

(SERS).

Amount of prevailing Family Grant:

Family Grant Family Grant (Living Near

Parents/Married Children)

SC / SC

Household

SC / SPR

Household

SC / SC

Household

SC / SPR

Household

$30,000 $20,000

#

$40,000 $30,000

#

#

If you are from an SC/SPR household, you can enjoy the full housing

subsidy by applying for the Citizen Top-Up when your SPR spouse takes up

Singapore Citizenship or when you have an SC child.

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 45

Use of Grant

The CPF Housing Grant will be credited into your CPF Ordinary

Account and treated as part of your CPF fund. It can be used to pay for

the CPF portion of the down-payment at the time of signing of the Sales

and Purchase Agreement after you have paid the cash payment (if

applicable) or to reduce the mortgage loan.

The CPF Housing Grant will be included in the computation of the CPF

withdrawal limit.

Conditions to comply with after getting the CPF housing grant

How it will impact you

SC/SPR Household getting Family Grant

If you are from an SC/SPR household, you can enjoy the full housing subsidy

by applying for the Citizen Top-Up when your SPR family member takes up

Singapore Citizenship or when you have a SC child.

Minimum Occupation Period (MOP)

You need to occupy the flat for a minimum period of 5 years before you are

allowed to:

Sell the flat in the open market

Invest in private residential property - both local and

overseas

Sublet the whole flat

The start date used to compute the occupation period is the date of purchase

of the flat.

Only for CPF Top-Up Grant

Waiver of MOP

If you and your spouse currently own a flat each and wish to dispose of both

flats to buy another resale flat with the Top-Up Grant:

HDB may grant waiver of MOP for 1 flat to be sold in the open

market

The other flat can be transferred to eligible family members or persons

under an approved housing scheme

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 46

Resale Levy

Resale Levy is payable when you buy or take over the ownership of another

subsidised flat. Read more on the Resale Levy and charges.

Refund of CPF Money

When you sell the flat bought with CPF Housing Grant, all the CPF money you

spent (including the housing grant) will be returned to your CPF account

according to the CPF Boards rules and regulations.

Disposal of Existing Flat

You have to dispose of your flat within six months of the date of taking

possession of the resale flat.

How it will impact your Parents/Married Child

If you are applying for a higher-tier grant, i.e. your flat is near your

parents'/married child's home, during the 5-year occupation period*, your

parents/married children must remain:

In the existing town, or

Within 2 km of the resale flat

* Your parents/married child must attend the first appointment with you and

sign an Undertaking for the above)

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 47

HDB RESALE BUYERS FINANCIAL PLAN

HDB Loan

Resale Price

HDB Valuation

COV (CASH ONLY)

<100%

10% Down Payment

( CPF / CASH )

Stamp +Legal Fee

~2% of Purchase Price or Valuation

(Whichever higher)

( CPF / CASH )

Loan Granted :

90% of Valuation

(Max)

Loan Quantum

(Age & Income)

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 48

HDB RESALE BUYERS FINANCIAL PLAN

Bank Loan

Resale Price

HDB Valuation

COV (CASH ONLY)

<100%

15% Down Payment

( CPF / CASH )

Stamp +Legal Fee

~2% of Purchase Price or Valuation

(Whichever higher)

( CPF / CASH )

Loan Granted :

80% of Valuation

(Max)

Loan Quantum

(Age & Income)

5% Minimum Cash Payment

(CASH ONLY)

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 49

HDB LOAN - BUYERS FINANCIAL PLANNING

Purchase Price above Valuation

Purchase Price Below Valuation Purchase Price at Valuation

10% =$32,000

(CPF Down payment) +

2% Purchase Price

($6,400)

(Legal +Stamp)

Total CPF required =

$38,400

$300,000

(HDB Valuation)

$320,000

(Purchase Price)

$420,000

(HDB Valuation)

$400,000

(Purchase Price)

COV =

$20,000

10% =$30,000

(CPF Down payment) +

2% Purchase Price ($6,400)

(Legal +Stamp)

Total CPF required =$36,400

90% Loan =$270,000

COV =

$20000

10% =$40,000

(CPF Down payment) +

3% Purchase Price

($12,600)

(L l +St )

90% Loan =$360,000

<100%

90% Loan =$288,000

<100%

<100%

Note: e.g If HLE

approve is only

S$250,000

Buyer have to top up

S$20,000 CPF or Cash

Note: e.g If HLE approve is only

S$165,000

Buyer have to top up S$195,000

CPF or Cash

Note: e.g If HLE approve is only

S$165,000

Buyer have to top up S$123,000 CPF

or Cash

$320,000

(Purchase Price)

(HDB Valuation)

Estimated SF/LF :

Purchase Price <$360K : 2%, >$360K : 3%

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 50

EXAMPLE 1 : HDB LOAN - BUYERS FINANCIAL PLANNING

Step 1: Cash

Purchase Price : $ 350,000

HDB valuation : - $ 280,000

Cash 1 : $ 70,000

Step 2: CPF

CPF Ordinary AC Available $ 40,000

10% of VAL / PP (whichever lower) : - $ 28,000

2% of PP (Legal +Stamp Duty) : - $ 7,000

CPF Surplus / CPF Shortfall ( Cash 2 )) $ 5,000

Step 3: Loan

90% of VAL / PP (whichever lower) : $ 252,000

CPF Surplus : - $ 5,000

Loan needed : $ 247,000

Loan Qualified : $ 293,000

Cash 3 $ NIL .

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $ 70,000

2. Loan needed, Tenure ( ), Int. ( ) : $ 247,000

3. Monthly Installment : $ 1,012

4. 1% Agent commission (+7% GST) : $ 3,745

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 51

EXAMPLE 1 : BANK LOAN - BUYERS FINANCIAL PLANNING

Step 2: CPF

CPF Ordinary AC Available $ 40,000

15% of VAL / PP (whichever lower) : - $ 42,000

2% of PP (Legal +Stamp Duty) : - $ 7,000

CPF Surplus / CPF Shortfall ( Cash 2) $ 9,000

Step 3: Loan

80% of VAL / PP (whichever lower) : $ 224,000

CPF Surplus : - $ 0

Loan needed : $ 224,000

Loan Qualified : $ 300,000

Cash 3 $ NIL .

Step 1: Cash

Cash-Over-Valuation : $ 70,000

5% Minimum Cash Payment :+$ 14,000

Cash 1 $ 84,000

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $ 93,000

2. Loan needed, Tenure ( ), Int. ( ) : $ 224,000

3. Monthly Installment : $ 940

4. 1% Agent commission (+7% GST) : $ 3,745

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 52

CASE SCENARIO : Buy 1

st

Sell Later

Flat type Exec - Apt

Purchase Price $495,000

Market Valuation $450,000

Applicant (Husband) age, last birthday 44 yrs old

Co-applicant (Wife) age, last birthday 42 yrs old

Household Income $ 10,000

Total CPF ordinary A/C

Refer to Statement

Annex pages 67 & 70

HDB Loan, HLE Granted $ 800,000

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 53

HDB LOAN - BUYERS FINANCIAL PLANNING

Step 1: Cash

Purchase Price : $

HDB valuation : - $

Cash 1 : $

Step 2: CPF

CPF Ordinary AC Available $

10% of VAL / PP (whichever lower) : - $

2% of PP (Legal +Stamp Duty) : - $

CPF Surplus / CPF Shortfall ( Cash 2 )) $

Step 3: Loan

90% of VAL / PP (whichever lower) : $

CPF Surplus : - $

Loan needed : $

Loan Qualified : $

Cash 3 $ .

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $

2. Loan needed, Tenure ( ), Int. ( ) : $

3. Monthly Installment : $

4. 1% Agent commission (+7% GST) : $

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 54

Discuss in your group, the individual answers that you

have and get one representative to present the correct

answer and list out the mistakes that were made.

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 55

CASE SCENARIO : Flat sold already. Completion in 1 mths

Time

Flat type 5A

Purchase Price $530,000

Market Valuation $500,000

Applicant (Husband) age, last birthday 46 yrs old

Co-applicant (Wife) age, last birthday 42 yrs old

Household Income $ 8,000

Total CPF ordinary A/C

Refer to Statement

Annex pages 68 - 70

Bank Interest Rate 1.8%

Bank Approval in Principle 70% of Value

CPF to be fully utilized

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 56

BANK LOAN - BUYERS FINANCIAL PLANNING

Step 1: Cash

Cash-Over-Valuation : $

5% MinimumCash Payment : - $

Cash 1 : $

Step 2: CPF

CPF Ordinary AC Available $

10% of VAL / PP (whichever lower) : - $

2% of PP (Legal +Stamp Duty) : - $

CPF Surplus / CPF Shortfall ( Cash 2 )) $

Step 3: Loan

90% of VAL / PP (whichever lower) : $

CPF Surplus : - $

Loan needed : $

Loan Qualified : $

Cash 3 $ .

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $

2. Loan needed, Tenure ( ), Int. ( ) : $

3. Monthly Installment : $

4. 1% Agent commission (+7% GST) : $

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 57

CASE SCENARIO : Sell 1

st

Buy Later

Flat type 4A

Purchase Price $300,000

Market Valuation $260,000

Applicant (Husband) age, last birthday 44 yrs old

Co-applicant (Wife) age, last birthday 42 yrs old

Household Income $ 6,000

Total CPF ordinary A/C

Refer to Statement

Annex pages 69 & 70

HDB loan, HLE granted $200,000

Bank Interest Rate

Bank Approval in Principle

1.8%

80% of value

J ust sold there 3 room flat, completion in 1 months time

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 58

HDB LOAN - BUYERS FINANCIAL PLANNING

Step 1: Cash

Purchase Price : $

HDB valuation : - $

Cash 1 : $

Step 2: CPF

CPF Ordinary AC Available $

10% of VAL / PP (whichever lower) : - $

2% of PP (Legal +Stamp Duty) : - $

CPF Surplus / CPF Shortfall ( Cash 2 )) $

Step 3: Loan

90% of VAL / PP (whichever lower) : $

CPF Surplus : - $

Loan needed : $

Loan Qualified : $

Cash 3 $ .

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $

2. Loan needed, Tenure ( ), Int. ( ) : $

3. Monthly Installment : $

4. 1% Agent commission (+7% GST) : $

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 59

BANK LOAN - BUYERS FINANCIAL PLANNING

Step 1: Cash

Cash-Over-Valuation : $

5% MinimumCash Payment : - $

Cash 1 : $

Step 2: CPF

CPF Ordinary AC Available $

10% of VAL / PP (whichever lower) : - $

2% of PP (Legal +Stamp Duty) : - $

CPF Surplus / CPF Shortfall ( Cash 2 )) $

Step 3: Loan

80% of VAL / PP (whichever lower) : $

CPF Surplus : - $

Loan needed : $

Loan Qualified : $

Cash 3 $ .

SUMMARY:

1. Total Cash Required

( Cash 1 +Cash 2 +Cash 3 )

: $

2. Loan needed, Tenure ( ), Int. ( ) : $

3. Monthly Installment : $

4. 1% Agent commission (+7% GST) : $

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 60

Annexes Pages

Sample of valuation report 61 - 66

Husbands CPF withdrawal statement 67 - 69

Wifes CPF withdrawal statement 70

Factors for Computation on Monthly Installment 71

Estimated Date of Completion for Resale of Flat 72

Loan Quantum Table for Purchase of HDB Flats 73 - 74

Bank Loan Table 75

Latest updates If Any

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 61

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 62

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 63

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 64

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 65

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 66

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 67

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 68

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 69

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 70

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 71

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 72

Source from HDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 73

Source fromHDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 74

Source fromHDB

HDB Resale Procedure & Financial Plan Property of Wild Wild West Properties Pte Ltd

Page | 75

Source fromHDB

You might also like

- Chhattisgarh Housing Board (CGHB) Chhattisgarh Housing Board (CGHB) Chhattisgarh Housing Board (CGHB)Document33 pagesChhattisgarh Housing Board (CGHB) Chhattisgarh Housing Board (CGHB) Chhattisgarh Housing Board (CGHB)KSOFTECHNo ratings yet

- Days of Our Life: " Talking Points " Your Housing OptionsDocument5 pagesDays of Our Life: " Talking Points " Your Housing OptionsXlnoz AngNo ratings yet

- Real Estate Brokerage Dec6Document60 pagesReal Estate Brokerage Dec6Law_Portal100% (3)

- Desk ReportDocument18 pagesDesk ReportRishikesh guptaNo ratings yet

- PGPM 2022-24 Fra Quiz 1 All Sections PGPM 2022-24 Fra Quiz 1 All SectionsDocument10 pagesPGPM 2022-24 Fra Quiz 1 All Sections PGPM 2022-24 Fra Quiz 1 All SectionsPrachiNo ratings yet

- GPF Kasi4Real Funding GuidelinesDocument2 pagesGPF Kasi4Real Funding GuidelinesKura ChihotaNo ratings yet

- DLF - Oct 22Document15 pagesDLF - Oct 22Vaishnavi SomaniNo ratings yet

- Godrej PropertiesDocument18 pagesGodrej PropertiesAnjali ShergilNo ratings yet

- Small Investors Nationwide: Can Now Provide Turnkey PropertiesDocument7 pagesSmall Investors Nationwide: Can Now Provide Turnkey Propertiesrnj1230No ratings yet

- H LoanDocument136 pagesH LoanElango PaulchamyNo ratings yet

- HDB Green Finance Framework SummaryDocument11 pagesHDB Green Finance Framework SummaryBharath Kumar Sudarsan100% (1)

- Acknowledgement: (Branch Head HDFC, Jaipur) For Giving Me An Opportunity ToDocument34 pagesAcknowledgement: (Branch Head HDFC, Jaipur) For Giving Me An Opportunity Toronypatel100% (5)

- Project ReportDocument48 pagesProject ReportNoman ParvezNo ratings yet

- Seven Figure Agency Roadmap Implementation Program Workbook-1Document147 pagesSeven Figure Agency Roadmap Implementation Program Workbook-1Waqas MukhtarNo ratings yet

- Industrial Services Capability StatementDocument20 pagesIndustrial Services Capability StatementDanny DoanNo ratings yet

- Underwriting and Financing Residential PropertiesDocument24 pagesUnderwriting and Financing Residential PropertiesmeraheNo ratings yet

- Management and Organization: Company OverviewDocument6 pagesManagement and Organization: Company Overviewbanti022No ratings yet

- Introducing Green Bond in BangladeshDocument19 pagesIntroducing Green Bond in BangladeshAshiq Rayhan0% (1)

- Credit Risk ManagementDocument63 pagesCredit Risk ManagementshuvossNo ratings yet

- Home Loan Process at Punjab & Sindh BankDocument105 pagesHome Loan Process at Punjab & Sindh Bankkaushal2442No ratings yet

- Buying A Resale Flat Plan For Leeying and Xinghong PDFDocument8 pagesBuying A Resale Flat Plan For Leeying and Xinghong PDFLim Xing HongNo ratings yet

- Bcom Y3 Acc3 12 August 2021 s1Document4 pagesBcom Y3 Acc3 12 August 2021 s1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Business Growth Through Sales and Service ExcellenceDocument90 pagesBusiness Growth Through Sales and Service Excellencepraveensingh04No ratings yet

- What Is A Capital Asset - Long Term and Short Term Capital AssetsDocument12 pagesWhat Is A Capital Asset - Long Term and Short Term Capital AssetsKapil SharmaNo ratings yet

- ChallanDocument1 pageChallanDawood KhanNo ratings yet

- Godo - 22!12!14 TOR For Business ConsultingDocument16 pagesGodo - 22!12!14 TOR For Business ConsultingRisaa TubeNo ratings yet

- Banking Working Capital & Term Loan Water Case StudyDocument2 pagesBanking Working Capital & Term Loan Water Case Studyanon_652192649No ratings yet

- Quiz Show-Sale of GoodsDocument53 pagesQuiz Show-Sale of GoodsVenkataramanan ThiruNo ratings yet

- Global Finance Group 7Document26 pagesGlobal Finance Group 7ThineshNo ratings yet

- Procurement of Goods and Works - Jeff TaylorDocument42 pagesProcurement of Goods and Works - Jeff TaylorWalter Poick100% (1)

- Geetanjali Homestate PVT Ltd's (Notice)Document1 pageGeetanjali Homestate PVT Ltd's (Notice)yuktabb21045No ratings yet

- Real Estate Finance in BDDocument30 pagesReal Estate Finance in BDনাজমুস সাকিবNo ratings yet

- Homebuyers Advisory For Imperia StructuresDocument12 pagesHomebuyers Advisory For Imperia StructuresrahulNo ratings yet

- Real Estate Business Plan ExampleDocument25 pagesReal Estate Business Plan ExampleSyed Shafqat Shah50% (2)

- RossCF9ce PPT Ch24Document30 pagesRossCF9ce PPT Ch24js19imNo ratings yet

- Gold Loans: Quick Funds Against JewelryDocument5 pagesGold Loans: Quick Funds Against Jewelryhari1433No ratings yet

- Gold Loans: Quick Funds Against JewelryDocument5 pagesGold Loans: Quick Funds Against Jewelryhari1433No ratings yet

- Pakistan Pavilion RFP 2023 - 2024Document20 pagesPakistan Pavilion RFP 2023 - 2024Barun Kumar ChoubeyNo ratings yet

- Lakeport City Council - Council BusinessDocument40 pagesLakeport City Council - Council BusinessLakeCoNewsNo ratings yet

- Credit Policy GuidelinesDocument46 pagesCredit Policy GuidelinesRabi Shrestha100% (1)

- Investment in Real Estate: Samiho Dutta Snehashish Biswas Dipanjan de Dipak GandhiDocument12 pagesInvestment in Real Estate: Samiho Dutta Snehashish Biswas Dipanjan de Dipak GandhiSnehashish BiswasNo ratings yet

- Construction of HouseDocument11 pagesConstruction of Houseshivratan007No ratings yet

- Answers To The Respective Questions Are Given Below inDocument7 pagesAnswers To The Respective Questions Are Given Below inLakshmi NairNo ratings yet

- Depositary Receipts - The Indian PerspectiveDocument67 pagesDepositary Receipts - The Indian Perspectivesushantmallya100% (1)

- Credit Appraisal FOR Home LoanDocument68 pagesCredit Appraisal FOR Home LoanSamuel DavisNo ratings yet

- Business Income Very New-1Document85 pagesBusiness Income Very New-1King AndryNo ratings yet

- Lo Property Book Final New 2013Document118 pagesLo Property Book Final New 2013Jen TanNo ratings yet

- HDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndiaDocument40 pagesHDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndialavsamirNo ratings yet

- Capital Gains [Autosaved]Document50 pagesCapital Gains [Autosaved]Vikas WadmareNo ratings yet

- Statement of Additional InformationDocument110 pagesStatement of Additional Informationkirti MauryaNo ratings yet

- 02 - Siva ShankerDocument30 pages02 - Siva ShankerHafiz FadzilNo ratings yet

- World Bank Procurement Guidelines and Business 1 World Bank Procurement GuidelinesDocument31 pagesWorld Bank Procurement Guidelines and Business 1 World Bank Procurement GuidelinesEm FernandezNo ratings yet

- Stonewise Pitch Deck PDFDocument21 pagesStonewise Pitch Deck PDFJack SheehanNo ratings yet

- Project HelpdeskDocument295 pagesProject HelpdeskGoverdhan50% (2)

- Home Consulting Servic: Click To Edit Master Subtitle StyleDocument10 pagesHome Consulting Servic: Click To Edit Master Subtitle StyleRubina RizwanNo ratings yet

- Rural FinanceDocument2 pagesRural FinanceNaresh KumarNo ratings yet

- Rough CpyDocument84 pagesRough CpyKaran SonawaneNo ratings yet

- Sdas 1111Document6 pagesSdas 1111Jonas SarmientoNo ratings yet

- NRB Bank profile, products, SWOT analysisDocument10 pagesNRB Bank profile, products, SWOT analysisBiplobHasanNo ratings yet

- Mastering Rental Properties - How to Create Wealth and Passive Income Through Real Estate InvestingFrom EverandMastering Rental Properties - How to Create Wealth and Passive Income Through Real Estate InvestingRating: 5 out of 5 stars5/5 (1)

- Radioactivity 3Document4 pagesRadioactivity 3wangks1980No ratings yet

- Radioactivity 2Document2 pagesRadioactivity 2wangks1980No ratings yet

- Radioactivity 1: Symbol NameDocument4 pagesRadioactivity 1: Symbol Namewangks1980No ratings yet

- Ajc01 - Introduction To Volumetric Analysis & Mole ConceptDocument23 pagesAjc01 - Introduction To Volumetric Analysis & Mole Conceptwangks1980No ratings yet

- JC2 (05/06) Physics Common Test 2006 Suggested Answers: Paper 1Document13 pagesJC2 (05/06) Physics Common Test 2006 Suggested Answers: Paper 1wangks1980No ratings yet

- Untitled 0Document1 pageUntitled 0wangks1980No ratings yet

- How To Build Your Flying Star ChartDocument40 pagesHow To Build Your Flying Star Chartwangks1980No ratings yet

- Lower Sec Science Transport in Living ThingsDocument26 pagesLower Sec Science Transport in Living Thingswangks1980No ratings yet

- 3CC - Properties of Metals - Notes 13Document6 pages3CC - Properties of Metals - Notes 13wangks1980No ratings yet

- Physics 2204 Worksheet #4 - Advanced Kinematics: 1 of 2 14 Feb 07Document2 pagesPhysics 2204 Worksheet #4 - Advanced Kinematics: 1 of 2 14 Feb 07wangks1980No ratings yet

- A2 Electrochemistry TutorialDocument6 pagesA2 Electrochemistry Tutorialwangks1980No ratings yet

- Predicting Solubility of Simple Molecular CompoundsDocument2 pagesPredicting Solubility of Simple Molecular Compoundswangks1980No ratings yet

- Physics EquationsDocument5 pagesPhysics Equationsanon-992211100% (64)

- Chapter 5 AnswersDocument10 pagesChapter 5 Answerswangks1980No ratings yet

- Answer All Questions. Write Your Answers in The Spaces Provided in The Table BelowDocument4 pagesAnswer All Questions. Write Your Answers in The Spaces Provided in The Table Belowwangks1980No ratings yet

- 1Document1 page1wangks1980No ratings yet

- Chapter 5 Lesson PlanDocument17 pagesChapter 5 Lesson Planwangks1980No ratings yet

- PROGRAM PENINGKATAN KEBERKESANAN PELAKSANAAN KURIKULUM SAINS BAHAN SUMBER PENGAJARAN DAN PEMBELAJARAN KIMIADocument5 pagesPROGRAM PENINGKATAN KEBERKESANAN PELAKSANAAN KURIKULUM SAINS BAHAN SUMBER PENGAJARAN DAN PEMBELAJARAN KIMIANor Azrul IkwanNo ratings yet

- SAJC Prospectus 2014Document68 pagesSAJC Prospectus 2014wangks1980No ratings yet

- H2 Chemistry SummaryDocument16 pagesH2 Chemistry SummarySherman HoNo ratings yet

- Sec 2 Normal AcademicDocument2 pagesSec 2 Normal Academicwangks1980No ratings yet

- Untitled 0Document1 pageUntitled 0wangks1980No ratings yet

- Untitled 0Document1 pageUntitled 0wangks1980No ratings yet

- 2Document1 page2wangks1980No ratings yet

- Securities+Account+Info+Update Individual, JointDocument2 pagesSecurities+Account+Info+Update Individual, Jointwangks1980No ratings yet

- Untitled 0Document1 pageUntitled 0wangks1980No ratings yet

- Sec 2 Normal AcademicDocument2 pagesSec 2 Normal Academicwangks1980No ratings yet

- Geometrical Proof SolutionDocument1 pageGeometrical Proof Solutionwangks1980No ratings yet

- Physics 5058 2009Document23 pagesPhysics 5058 2009winwarrior100% (8)

- Entrepreneurship Reviewer FinalsDocument7 pagesEntrepreneurship Reviewer FinalsEricka Joy HermanoNo ratings yet

- Iles Greg - True EvilDocument317 pagesIles Greg - True Evilpunto198367% (3)

- Shipper Information - Not Part of This B/L ContractDocument1 pageShipper Information - Not Part of This B/L ContractMelíssa AlvaradoNo ratings yet

- Indian Penal Code MCQ SolvedDocument181 pagesIndian Penal Code MCQ Solvedcontactwitharun67% (12)

- Raymond ReddingtonDocument3 pagesRaymond Reddingtonapi-480760579No ratings yet

- Supreme Court of the Philippines upholds refusal to register corporation for unlawful purposeDocument3 pagesSupreme Court of the Philippines upholds refusal to register corporation for unlawful purposeRhoddickMagrataNo ratings yet

- The Hmong People's Sacrifice for US Freedom in the Secret War in LaosDocument3 pagesThe Hmong People's Sacrifice for US Freedom in the Secret War in Laosbabyboy1972No ratings yet

- HNLU Online Exam Legal AdviceDocument2 pagesHNLU Online Exam Legal AdviceHimanshuNo ratings yet

- (30.html) : Read and Listen To Sentences Using The WordDocument3 pages(30.html) : Read and Listen To Sentences Using The Wordshah_aditNo ratings yet

- Gregorio Araneta Inc. v Tuason de Paterno: Piercing Corporate Veil CaseDocument3 pagesGregorio Araneta Inc. v Tuason de Paterno: Piercing Corporate Veil CaseAlecParafinaNo ratings yet

- Democracy (Anup Shah) - Global IssuesDocument47 pagesDemocracy (Anup Shah) - Global IssuesjienlouNo ratings yet

- PHARMA0818 Davao PDFDocument22 pagesPHARMA0818 Davao PDFPhilBoardResultsNo ratings yet

- Connectors and Linkers b1Document1 pageConnectors and Linkers b1Anonymous 0NhiHAD100% (1)

- B215 AC08 Mochi Kochi 6th Presentation 19 June 2009Document46 pagesB215 AC08 Mochi Kochi 6th Presentation 19 June 2009tohqinzhiNo ratings yet

- FUNDAMENTAL of ManagementDocument100 pagesFUNDAMENTAL of ManagementEralisa Paden100% (1)

- Ilaw at Buklod Vs Director of Labor RelationsDocument3 pagesIlaw at Buklod Vs Director of Labor RelationsKaryl Eric BardelasNo ratings yet

- Searle & Brassell. Economic Approaches To IPDocument11 pagesSearle & Brassell. Economic Approaches To IPgongsilogNo ratings yet

- 40 Grey MarketDocument13 pages40 Grey MarketAani RashNo ratings yet

- Mac16Cm, Mac16Cn Triacs: Silicon Bidirectional ThyristorsDocument6 pagesMac16Cm, Mac16Cn Triacs: Silicon Bidirectional Thyristorsmauricio zamoraNo ratings yet

- Civility ReflectionDocument3 pagesCivility ReflectionChinedu KevinNo ratings yet

- Altair AcuFieldView 2021.1 User GuideDocument133 pagesAltair AcuFieldView 2021.1 User GuideakashthilakNo ratings yet

- Voluntarysm - The Political Thought of Auberon Herbert, Por Eric MackDocument11 pagesVoluntarysm - The Political Thought of Auberon Herbert, Por Eric Mackluizeduardo84No ratings yet

- Non Self-Executing Provisions in The ConstitutionDocument9 pagesNon Self-Executing Provisions in The Constitutiontequila0443No ratings yet

- 33 Dale Stricland Vs Ernst & Young 8 1 18 G.R. No. 193782Document3 pages33 Dale Stricland Vs Ernst & Young 8 1 18 G.R. No. 193782RubenNo ratings yet

- Sample Vaping Warning LetterDocument3 pagesSample Vaping Warning LetterStephen LoiaconiNo ratings yet

- Group Reflection Paper On EthicsDocument4 pagesGroup Reflection Paper On EthicsVan TisbeNo ratings yet

- Account StatementDocument1 pageAccount StatementBalaji ArumugamNo ratings yet

- SDS en-US SimpleGreenLimeScaleRemoverDocument5 pagesSDS en-US SimpleGreenLimeScaleRemoverjoelcarhuanchoNo ratings yet

- L'OREAL Social Audit ProgramDocument24 pagesL'OREAL Social Audit ProgramHanan Ahmed0% (1)

- Legal Research Step by Step, 5th EditionDocument346 pagesLegal Research Step by Step, 5th Editionderin100% (2)

![Capital Gains [Autosaved]](https://imgv2-1-f.scribdassets.com/img/document/719645194/149x198/aae11b711e/1712148777?v=1)