Professional Documents

Culture Documents

Marketing BPS

Uploaded by

Cherine CherieOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing BPS

Uploaded by

Cherine CherieCopyright:

Available Formats

37000 Marketing Strategy Orhun

BPS Major Case Write-up

Barco Projection Systems (BPS): Worldwide Niche Marketing

We pledge our honor that we have not violated the Honor Code during this examination or case write-up.

Authors: Harvey, Suzanne Holt, Margaret Larson, Philip Villalon, Daniel Wilhite, Nathan

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 1

37000 Marketing Strategy Orhun

BPS Major Case Write-up Barco Projection Systems (BPS)

ISSUES AND RECOMMENDATIONS: BPS faces a significant threat to its current market share in both the mid- and high-end projector markets (i.e., the data and graphics projector markets) and has lost its position as the leader in innovative projector technology. This threat stems largely from Sonys introduction of the 1270 projector, which is superior to BPSs current product line in terms of both performance and price. Additionally, despite rapid growth in the high-end market segment,1 BPS has not released a new graphics projector in over two years. Further, by defining the market based on a single product feature, scan rate 2, rather than on the package of benefits consumers demand (e.g., ease of use and better overall picture quality), BPS has failed to protect its market position. BPSs near-term product options are to: 1) continue developing the BD700, an inferior product to the Sony 1270; 2) halt the production of the BD700 and develop the comparable but still inferior BG700; or 3) turn immediately to the development of the superior BG800. Regarding pricing, BPS can preemptively reduce prices on existing products to limit Sonys ability to capture market share or it can wait to adjust pricing until final 1270 pricing is announced. Given this competitive landscape, we recommend that BPS: 1) stop development of the BD700 and focus on developing the BG800 to reestablish its dominance at the high-end of the market; and 2) wait to adjust pricing on existing products until Sonys pricing is announced. BPS must recapture its position as the leading innovator in the industrial projector market because: 1) BPSs competitive advantages in R&D (electronics) and distribution network (established relationships with systems dealers) are only valued in the mid and high-end of the market; and 2) its current product and pricing strategies are not sustainable. If BPS does not offer a competitive product to the 1270, it stands to lose significant market share and profits, and its products will likely be rendered obsolete. Given BPSs size in comparison to Sony, BPS will not survive by competing purely on price. PRODUCT: Rolling out the BD700 as planned and introducing the BG800 in late 1990 is not a viable option because every BPS data and graphics projector would immediately become obsolete and uncompetitive against the 1270.

1 2

See Figures 1 and 2 in the Appendix showing expected growth of the worldwide projector market by segment. See Figure 3 in the Appendix suggesting that, historically, scan rate has been the best predictor of projector price.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 2

37000 Marketing Strategy Orhun

BPS Major Case Write-up

While this option poses the least execution risk because the R&D work and marketing efforts are already in progress, BPS would lose, at a minimum, 73% of its 1990-1993 forecast profits 3 and its position as a leading innovator. BPSs market share (and profits) would shrink drastically and it would no longer be able to invest in new technology that would allow it to charge premium prices. Additionally, BPS could face significant attrition in its distributor and dealer networks as resale and services revenue and margins for BPS product lines decrease. BPSs second product option (halt development on the BD700 and focus on the BG700) is also not viable. The BG700 would have the same basic functions as the BD700 and would not outperform the 1270 on any common industry measure (e.g. scan rate, resolution, lumens). As such, BPS would lose significant market share under this option. Further, without premium features, the BG700 would have to be priced to compete with the 1270. While this option poses minimal execution risk compared to option one (i.e., the BG700 could launch in 2-3 months), BPS would lose, at a minimum, 85% of its 1990-1993 forecast profits 4. This option would delay the launch of a competitive projector even further and would severely damage BPSs reputation for innovation. Consumers would likely purchase the Sony 1270 rather than wait to purchase an inferior product from BPS. BPSs only viable strategy is to suspend other projects and devote all resources to developing the BG800, which will command a price premium over the 1270 and reestablish BPS as the leading innovator in projector technology. Under this approach, BPS bears supplier risk (i.e., ability to source the necessary lenses), risk to company morale (e.g., R&D team and the overtime required), and risk related to the product launch (40% chance the BG800 will be ready for Infocomm); however, these risks are necessary for BPS to compete with Sony and save its position in the market. If the BG800 is launched by Infocomm, this approach will enable BPS to grow revenues and profit margins to $57M and 24.2%, respectively, by 1993. 5 This represents a 50% reduction to BPSs forecast profits from 1990-1994, however, this drop in profits is significantly less than the profit decline under the other product alternatives and provides the best potential for future growth. Furthermore, this strategy sends a positive signal to systems dealers who depend on BPSs high-end market leadership for their resale and services margins.

3

This estimate assumes only market share declines and no prices are lowered. Hence, this is the minimum loss. See Figure 4 in the Appendix for further detail. 4 This estimate assumes only market share declines and no prices are lowered. Hence, this is the minimum loss. See Figure 4 in the Appendix for further detail. 5 This is a conservative estimate due to assumptions on market share loss in other sectors. See Figure 4 in the Appendix.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 3

37000 Marketing Strategy Orhun

BPS Major Case Write-up

In the long term, the 1270 is not BPSs only threat. Electrohome, a similarly sized company operating in the same high-end segment, will also need to position itself against the 1270. With similar positioning and a distribution channel matched well to that of BPS, Electrohome might be worth engaging in merger discussions.

PRICING:

BPS may either preemptively lower the price of existing products (e.g. BG400 and/or BD600) or wait to adjust prices until 1270 pricing is announced. A preemptive price drop has major risks and minimal upside. First, as shown in the Appendix 4, if BPS drops prices immediately, while assuming no change to the planned product rollout timeline, it will lose 83% of its projected profits over the 1990-1994 period. 6 Second, the effect of price cuts may be diluted by distributors and dealers and even price cuts that reached consumers would not substantially increase volume sold. Demand from consumers who need projectors immediately is fairly inelastic. Consumers without urgent needs, on the other hand, will likely hold off on purchasing a new projector until 1270 pricing becomes available. Therefore, a price drop will not substantially increase volume sales and will only erode BPSs premium pricing position. Third, preemptive price cuts might tempt Sony to price the 1270 even lower. This would further erode BPSs revenues and could trigger a prolonged price war that BPS cannot win as Sony has more engineers dedicated to projectors, a larger distribution network, a favorable source of raw materials and a strong reputation. Fourth, a preemptive price cut could trigger retaliatory action from Sony that would affect BPSs supply chain. Sony could refuse to provide the 8 tubes BPS needs or significantly increase their price, devastating BPSs ability to release a competitive projector in the near-term. Additionally, Sony could use its bargaining power to prevent their lens supplier from supplying lenses to BPS. Waiting to adjust prices in all geographic segments until the 1270 pricing is announced is a better strategy for BPS. At that time, BPS could cut prices on its old models without cannibalizing immediate sales and without triggering a potential price war. Additionally, avoiding a steep price cut for the BG400 will help preserve BPSs ability to price the BG800 at a premium above the 1270 when it is ready for release. Prior to the BG800 launch, BPS can then cut prices on its old models and communicate to the market that such price cuts are in anticipation of the BG800 launch (not in response to Sonys release of the 1270).

See Figure 4 in the Appendix.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 4

37000 Marketing Strategy Orhun PROMOTION / PLACE:

BPS Major Case Write-up

In addition to refocusing R&D efforts, this product strategy requires BPS to develop a promotional program to compete with the Sony 1270. Sonys massive investment in marketing and channel outreach creates brand challenges for BPS. To ensure the BG800 has a successful launch, BPS should: 1) promote the BG800 heavily in North America and the Far East; 2) reach out to existing customers to highlight the unique benefits of the BG800 (i.e., picture quality, digital technology and higher scan rate); and 3) offer financial incentives to dealers and distributors who convert BD700 orders, existing customers and Sony 1270 customers to the BG800. First, BPS should focus advertising and product rollout in North America and the Far East because the Sony 1270 will be heavily promoted in Europe. BPS will lose graphics market share in Europe but may be able to hold or increase share in North America and the Far East, which are expected to grow faster over the next five years. Second, to promote the BG800, BPS needs to communicate the benefits of the new BG800 to both existing customers and customers with BD700 orders. Customers regularly buy more advanced technology than currently required and BPS must communicate that the BG800 will be superior to the Sony 1270, making it worth the wait. Third, BPS needs to train and educate dealers many of whom also sell Sony products on the benefits of the BG800 and incentivize them with commissions and bonuses on each BG800 sold and on BD700 and Sony 1270 orders converted to the BG800. Sony has likely already begun accepting orders on the 1270, so these extra commissions and bonuses are critical to ensure messages regarding the BG800 are passed along by the dealers, many of whom may otherwise push the 1270 in the short term. If BPS fails to take these steps and communicate the superiority of the BG800, it is likely to lose significant market share and its position as a leading innovator, despite the accelerated roll-out of the BG800. CONCLUSION: BPS faces a significant threat to its current market share in both the mid- and high-end projector markets. With the introduction of the 1270, Sony has surpassed BPS as the leader in innovative projector technology. BPSs future depends on regaining that position because it cannot maintain profitability over the long-term in the low- to mid-market. To defend its position at the high end, BPS must introduce a superior product, the BG800, as

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 5

37000 Marketing Strategy Orhun

BPS Major Case Write-up

quickly as possible. While the execution and supply risks of this strategy are high, the risks of delay are even higher.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 6

37000 Marketing Strategy Orhun

BPS Major Case Write-up Appendix

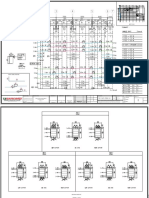

Figures1 and 2: Market for high-end projectors expected to grow rapidly while low-end decreases. BPS projects sales growth of 12.3% and 25% growth in the data and graphics market, respectively.

Figure 3: Scan rate is the best predictor of price in the projector market (R 2=.97 with reasonable standard error). This suggests that BPSs other technical differentiators are undervalued.

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 7

37000 Marketing Strategy Orhun

BPS Major Case Write-up

Suzanne Harvey, Margaret Holt, Philip Larson, Daniel Villalon, Nathan Wilhite

Page 8

You might also like

- Group 8 - GSK CaseDocument12 pagesGroup 8 - GSK CaseCherine CherieNo ratings yet

- 2011 Lecture 3 (HND) Hostile TakeoversDocument15 pages2011 Lecture 3 (HND) Hostile TakeoversCherine CherieNo ratings yet

- Barco 1Document5 pagesBarco 1Cherine CherieNo ratings yet

- 1 Financial Statement AnalysisDocument30 pages1 Financial Statement AnalysisCherine CherieNo ratings yet

- 1 Financial Statement AnalysisDocument30 pages1 Financial Statement AnalysisCherine CherieNo ratings yet

- Buffett CaseDocument15 pagesBuffett CaseElizabeth MillerNo ratings yet

- Barco 1Document5 pagesBarco 1Cherine CherieNo ratings yet

- Barco CaseDocument9 pagesBarco CaseMamud DakoNo ratings yet

- Red Dragon SolutionsDocument25 pagesRed Dragon SolutionsCherine CherieNo ratings yet

- Maccounting BridgetonDocument4 pagesMaccounting Bridgetonsufyanbutt007No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CH08 Location StrategyDocument45 pagesCH08 Location StrategyfatinS100% (5)

- Uppers Various Info DatabaseDocument54 pagesUppers Various Info DatabaseJason BexonNo ratings yet

- English GradeDocument4 pagesEnglish GradeLloydDagsilNo ratings yet

- The First, First ResponderDocument26 pagesThe First, First ResponderJose Enrique Patron GonzalezNo ratings yet

- Selected Candidates For The Post of Stenotypist (BS-14), Open Merit QuotaDocument6 pagesSelected Candidates For The Post of Stenotypist (BS-14), Open Merit Quotaامین ثانیNo ratings yet

- Sto NinoDocument3 pagesSto NinoSalve Christine RequinaNo ratings yet

- Emergency Loan Pawnshop v. Court of Appeals, G.R. No. 129184, February 28Document3 pagesEmergency Loan Pawnshop v. Court of Appeals, G.R. No. 129184, February 28Alan Vincent FontanosaNo ratings yet

- Factors Affecting Exclusive BreastfeedingDocument7 pagesFactors Affecting Exclusive BreastfeedingPuput Dwi PuspitasariNo ratings yet

- Sources and Historiography of Kerala CoinageDocument68 pagesSources and Historiography of Kerala CoinageRenuNo ratings yet

- MNC diversity factors except expatriatesDocument12 pagesMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- Lord Subrahmanya Bhujangam StotramDocument31 pagesLord Subrahmanya Bhujangam StotramDhruv Giri100% (1)

- Ledford EPC Geothermal PresentationDocument27 pagesLedford EPC Geothermal PresentationgadisaNo ratings yet

- Division of WorkDocument19 pagesDivision of WorkBharadwaj KwcNo ratings yet

- System C Medway Proxima 0519Document4 pagesSystem C Medway Proxima 0519qy6jnrjzmcNo ratings yet

- Effectiveness of Environmental Impact Assessment Process in The MDocument136 pagesEffectiveness of Environmental Impact Assessment Process in The MJoel AntonyNo ratings yet

- OathDocument5 pagesOathRichard LazaroNo ratings yet

- 3 AL Banin 2021-2022Document20 pages3 AL Banin 2021-2022Haris HaqNo ratings yet

- Soil Color ChartDocument13 pagesSoil Color ChartIqbal AamerNo ratings yet

- 1964 Letter From El-Hajj Malik El-ShabazzDocument2 pages1964 Letter From El-Hajj Malik El-Shabazzkyo_9No ratings yet

- History of Brunei Empire and DeclineDocument4 pagesHistory of Brunei Empire and Declineたつき タイトーNo ratings yet

- PersonalEditionInstallation6 XDocument15 pagesPersonalEditionInstallation6 XarulmozhivarmanNo ratings yet

- International Conference GREDIT 2016Document1 pageInternational Conference GREDIT 2016Οδυσσεας ΚοψιδαςNo ratings yet

- Liberal Arts Reading ListDocument2 pagesLiberal Arts Reading ListAnonymous 7uD3SBhNo ratings yet

- Adventures in Antarctica: 12 Days / 9 Nights On BoardDocument2 pagesAdventures in Antarctica: 12 Days / 9 Nights On BoardVALENCIA TORENTHANo ratings yet

- Repair Almirah QuotationsDocument1 pageRepair Almirah QuotationsManoj Kumar BeheraNo ratings yet

- Wires and Cables: Dobaindustrial@ethionet - EtDocument2 pagesWires and Cables: Dobaindustrial@ethionet - EtCE CERTIFICATENo ratings yet

- Revised Y-Axis Beams PDFDocument28 pagesRevised Y-Axis Beams PDFPetreya UdtatNo ratings yet

- Understanding Risk and Risk ManagementDocument30 pagesUnderstanding Risk and Risk ManagementSemargarengpetrukbagNo ratings yet

- Helen Meekosha - Decolonising Disability - Thinking and Acting GloballyDocument17 pagesHelen Meekosha - Decolonising Disability - Thinking and Acting GloballyjonakiNo ratings yet

- Corporate Provisional Voter ListDocument28 pagesCorporate Provisional Voter ListtrueoflifeNo ratings yet