Professional Documents

Culture Documents

Emerson Electric Financial Statement Analysis

Uploaded by

mwillar08Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emerson Electric Financial Statement Analysis

Uploaded by

mwillar08Copyright:

Available Formats

Michael Willar (M.W.) and Taofeek Sowemimo (T.S.) Term Project: Emerson Electric (EMR: NYSE) 09-25-2013 Professor.

Kranisky

1. Industry Economics and Strategies: (M.W.) Emerson was incorporated in Missouri in 1890, and has grown from a regional manufacturer of electric motors and fans into a diversified global technology company. Having expanded its product lines through internal growth and acquisitions, Emerson today is designing and supplying products and technology, and delivering engineering services and solutions in a wide range of industrial, commercial and consumer markets around the world. 1 Emerson Electric operates in five main units, namely, Process Management (31% of sales), Industrial Automation (21%), Network Power (25%), Climate Technologies (15%) and Commercial & Residential Solutions (8%). Emersons sales by geographic location in 2012 were Unites States and Canada, 45%; Asia, 24%; Europe, 20%; Latin America, 6%; and Middle East/Africa, 5%. Porters 5 Forces Model: Rivalry Among existing Firms: Emerson operates in a highly competitive market. The main competitors include; Hitachi Ltd, Raytheon Co. Illinois Tool, ABB Ltd and General Electric. Threat of new entrants: Competitors are attempting to take advantage of the opportunities in emerging markets, namely, in Asia and parts of Europe. Emerson holds strong barriers to entry, with a well-fortified intellectual property portfolio including patents, licenses and trademarks. 2 Emersons continued number of acquisitions will ensure a reduced number of new entrants into the marketplace. Threat of Substitutes: Emersons principal competitive strategy is to deliver solutions/products to customers by manufacturing high quality products at the lowest cost compared to their peers within the industry. The low cost eliminates much of the propensity of customers to switch to alternative firms. Supplier Power: Emerson has multiple suppliers for each of its business units, and thus not significantly dependent on any one. This eliminates any one supplier demanding higher prices. Emerson exposes itself to market related risk relative to foreign currency, commodity prices and interest rates. Emerson uses financial derivative instruments such as swaps, forward contracts and options to hedge markets risks. Buyer Power: Buyers have the advantage that Emerson competes in a concentrated industry, whereby there is low product differentiation, although not all the firms compete in the same business units, and thus buyers can put firms under pressure to lower prices. Emersons market leadership in each individual product line makes it difficult for buyers to dictate terms and prices. Value Chain Analysis: The main basic raw materials that Emerson requires are steel, copper, cast iron and rare earth metals. Emerson has secured multiple sources of sources for each raw material, as to avoid any significance on any one supplier. 1 Emerson deploys various

1 Annual Report. Form 10-K 2 Emerson Electric Investor Relations. 1

production operations and methods mainly; electronics assembly, metal stamping, forming and heat treating. Emersons principal worldwide distribution for all business units is primarily through a direct sales force. In United States, approximately 50% of sales are conducted through a direct sales force, while the remainder are made through independent sales. In Asia and Europe, sales are predominately made through direct sales force. Emersons Competitive Strategy: The Industrial Equipment and Components industry is driven by continual technological advancements and innovation. Emersons success hinges upon their ability to identify key business opportunities that will increase energy efficiency and global presence. Emersons maintains their competitive advantage with four strategic initiatives, namely; Business without borders, Energy efficiency, Resources for the World and Communications Revolution. 1

2. Assessing Quality of Financial Statements. (M.W.) To assess Emersons quality of earnings I calculated the aggregate accruals with the Balance-Sheet and Cash-Flow based accrual ratio methods. I used aggregate accruals to assess whether management is manipulating accruals, and as a proxy for earnings

2

quality. In theory, the higher the total accruals as a percentage of assets, the greater the likelihood that earnings quality is low.

Balance-Sheet Based Accruals Ratio

Emersons Balance sheet-based accrual ratio decreased from 2.02% in 2011 to -2.45% in 2012, implying Emersons earnings were of higher quality than the year before. Emerson relied less on accruals to show a profit in 2012.

Cash-Flow-Statement-Based Accruals Ratio:

Emersons Cash-Flow-Statement Accrual Ratio decreased from .70 % in 2011 to -2.06% in 2012, suggesting that the cash flow component of the ratio was higher than net income. Emersons earnings were based more on cash items than non-cash items, such as the accrual items that are part of net income. Based on this assessment, Emersons earnings were of higher quality than the prior year, and exceedingly higher than that of the Industry average.

Work-Citation: Emerson Electric. (2012, September 30). Annual Report. Form 10-K. Available from Mergent Online Database. Emerson Electric. (2012,November). Investor Relations. Retrieved from http://www.emerson.com/en-US/about/investor-relations/emerson-businesses/Pages/ default.aspx

You might also like

- The Fall of EnronDocument3 pagesThe Fall of Enrondonjony7No ratings yet

- Business Strategy - Sony Case Analysis - RestructuringDocument25 pagesBusiness Strategy - Sony Case Analysis - RestructuringRavi Jain50% (4)

- Sunrise Case StudyDocument4 pagesSunrise Case StudyShubhajit Nandi0% (1)

- Tpccaseanalysisver04 130720110742 Phpapp01Document17 pagesTpccaseanalysisver04 130720110742 Phpapp01yis_loveNo ratings yet

- Pest Analysis For RimDocument4 pagesPest Analysis For Rim傅可如100% (1)

- The Rise and Fall of Enron - A Case StudyDocument11 pagesThe Rise and Fall of Enron - A Case StudyAYUSH GUPTANo ratings yet

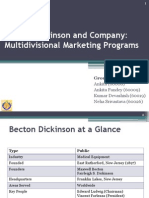

- Becton Dickinson and CompanyDocument19 pagesBecton Dickinson and CompanyAmitSinghNo ratings yet

- Cases CH 3Document2 pagesCases CH 3ejaaejoNo ratings yet

- New War of Currents Case Study SolutionDocument4 pagesNew War of Currents Case Study SolutionAkshat ChauhanNo ratings yet

- Fin Sony Corporation Financial AnalysisDocument13 pagesFin Sony Corporation Financial Analysisapi-356604698100% (1)

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]No ratings yet

- Porter's 5 Forces Analysis of GE's CompetitionDocument7 pagesPorter's 5 Forces Analysis of GE's CompetitionBvvss Ramanjaneyulu100% (1)

- EFE, IFE - Fall 19-20 - Student NoteDocument28 pagesEFE, IFE - Fall 19-20 - Student NoteAaaaaaNo ratings yet

- 1 Financial Detective Berau FinalDocument4 pages1 Financial Detective Berau Finalal ajiNo ratings yet

- Emerson Electric CompanyDocument32 pagesEmerson Electric CompanyJackie TorresNo ratings yet

- Example of Investment Analysis Paper PDFDocument24 pagesExample of Investment Analysis Paper PDFYoga Nurrahman AchfahaniNo ratings yet

- SAP Electric - Charges Group 4Document7 pagesSAP Electric - Charges Group 4Saunak SaikiaNo ratings yet

- SCM OF AppleDocument8 pagesSCM OF AppleSai VasudevanNo ratings yet

- Job-Order Costing Overhead Rate CalculationDocument2 pagesJob-Order Costing Overhead Rate CalculationAsmaNo ratings yet

- Xiaomi: Designing An Ecosystem For The "Internet of Things"Document5 pagesXiaomi: Designing An Ecosystem For The "Internet of Things"Shubham SinhaNo ratings yet

- Channel Conflict at Samsung IndiaDocument14 pagesChannel Conflict at Samsung IndiaAkash RanjanNo ratings yet

- Assessing The Goal of Sports ProductsDocument2 pagesAssessing The Goal of Sports ProductsSean Chris ConsonNo ratings yet

- Competing On Customer JourneysDocument10 pagesCompeting On Customer JourneysBhupesh NegiNo ratings yet

- Case 16-1 Jamie KincadeDocument7 pagesCase 16-1 Jamie Kincadejustabidin100% (1)

- Case Study4 - The Sharp Printing AGDocument10 pagesCase Study4 - The Sharp Printing AGdeepthi jacobNo ratings yet

- Private Fitness LLC Case: Controls for Small Business Revenue and TheftDocument3 pagesPrivate Fitness LLC Case: Controls for Small Business Revenue and TheftYayette BarimbadNo ratings yet

- Kota Fibres LTD: ASE NalysisDocument7 pagesKota Fibres LTD: ASE NalysisSuman MandalNo ratings yet

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- Blackberry CaseDocument20 pagesBlackberry CasePankhil ShikhaNo ratings yet

- Case 01 (DSP Final)Document46 pagesCase 01 (DSP Final)2rmj100% (5)

- Apples Business and Corporate StrategiesDocument18 pagesApples Business and Corporate StrategiesNadika Soysa50% (2)

- Lehman Brothers Corporate GovernanceDocument15 pagesLehman Brothers Corporate GovernanceAhmed AdelNo ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- JPL Case StudyDocument4 pagesJPL Case Studykoushik951100% (1)

- STRAMADocument6 pagesSTRAMAClaude PeñaNo ratings yet

- Sprint Nextel Merger AnalyzedDocument21 pagesSprint Nextel Merger Analyzedandryharyanto100% (9)

- Amaranth Disaster: How One Trader Lost $6B in 30 DaysDocument15 pagesAmaranth Disaster: How One Trader Lost $6B in 30 DaysRani ZahrNo ratings yet

- Management of Transaction ExposureDocument10 pagesManagement of Transaction ExposuredediismeNo ratings yet

- Case Study Erica CarsonDocument2 pagesCase Study Erica CarsonKeshav Chaudhari50% (2)

- Porter's Five Forces: A Model For Industry AnalysisDocument6 pagesPorter's Five Forces: A Model For Industry AnalysiskimsrNo ratings yet

- Apple AnalysisDocument10 pagesApple AnalysisLe NganNo ratings yet

- Dell's Strategic Management Accounting TechniquesDocument7 pagesDell's Strategic Management Accounting TechniquesJune SueNo ratings yet

- CISCO Case AnalysisDocument3 pagesCISCO Case AnalysisRaunak Doshi0% (1)

- XeroxDocument6 pagesXeroxirinaestefania100% (1)

- Naukri Employee Retention CaseDocument13 pagesNaukri Employee Retention CaseBhanu NirwanNo ratings yet

- Final Exam Review Questions - SolvedDocument6 pagesFinal Exam Review Questions - SolvedHemabhimanyu MaddineniNo ratings yet

- Vista LandDocument2 pagesVista LandDPS1911No ratings yet

- Group 1 Nguyễn Thị Thanh Thanh Nguyễn Thị Anh Thư Nguyễn Thị Yến Nhi Nguyễn Quang Lâm Hoàng Công Minh Lê Chăm Anh Lê Anh ThưDocument3 pagesGroup 1 Nguyễn Thị Thanh Thanh Nguyễn Thị Anh Thư Nguyễn Thị Yến Nhi Nguyễn Quang Lâm Hoàng Công Minh Lê Chăm Anh Lê Anh ThưThanh ThanhNo ratings yet

- Corporate Level Strategy - Types and ExamplesDocument21 pagesCorporate Level Strategy - Types and ExamplesSuraj RajbharNo ratings yet

- Case Study: The Knowledge Workers StrikeDocument3 pagesCase Study: The Knowledge Workers StrikeNarendra RamisettiNo ratings yet

- Executive Compensation at AquilaDocument9 pagesExecutive Compensation at AquilaAnkit SachdevaNo ratings yet

- Management Accounting Techniques Hero HondaDocument11 pagesManagement Accounting Techniques Hero HondaNavneet Lalit GoyalNo ratings yet

- Case StudyDocument4 pagesCase StudyArifNo ratings yet

- Analyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterDocument3 pagesAnalyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterRIJu KuNNo ratings yet

- Solved The Dijon Company S Total Variable Cost Function Is TVC 50qDocument1 pageSolved The Dijon Company S Total Variable Cost Function Is TVC 50qM Bilal SaleemNo ratings yet

- ISM Case Analysis (Cisco Systems) : Group 13 Section - ADocument6 pagesISM Case Analysis (Cisco Systems) : Group 13 Section - AManish Kumar BansalNo ratings yet

- Case StudyDocument3 pagesCase StudyArslan AshfaqNo ratings yet

- Chapter 2 + RM 5Document5 pagesChapter 2 + RM 5eshaeelelyeNo ratings yet

- Scotts Miracle-Gro Spreader Sourcing DecisionDocument10 pagesScotts Miracle-Gro Spreader Sourcing DecisionmsarojiniNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Shakes Beer: Specialty CocktailsDocument2 pagesShakes Beer: Specialty CocktailsGilberto Luiz MeleiroNo ratings yet

- LTE Speech Traffic Dimenshioning For VoipDocument6 pagesLTE Speech Traffic Dimenshioning For VoipRahul GuptaNo ratings yet

- 5.case Study: Effects of Homeopathic Medicines in AdultsDocument2 pages5.case Study: Effects of Homeopathic Medicines in AdultsAMEEN ARTSNo ratings yet

- Metric Heavy Hex Nuts: ASME B18.2.4.6M-2010Document16 pagesMetric Heavy Hex Nuts: ASME B18.2.4.6M-2010CarlitosNo ratings yet

- Assignment #1: 1 HgjyygbykvrfDocument1 pageAssignment #1: 1 HgjyygbykvrfJuan Sebastian ArangoNo ratings yet

- 1.1 Hardware and SoftwareDocument13 pages1.1 Hardware and SoftwareNurhanis SyazwaniNo ratings yet

- 322439480MVR Single Page Single Page Booklet - OPTDocument12 pages322439480MVR Single Page Single Page Booklet - OPTlarry vargas bautistaNo ratings yet

- M10 - Partial Replacement of Fine Aggregate Using Polystyrene in Lightweight CHB-CE-503Document19 pagesM10 - Partial Replacement of Fine Aggregate Using Polystyrene in Lightweight CHB-CE-503Michelle LeeNo ratings yet

- Exile 3 Hint BookDocument21 pagesExile 3 Hint BookLaura RoseNo ratings yet

- MSC Syllabus AllDocument13 pagesMSC Syllabus AllOmSilence2651No ratings yet

- Diff Types of Transmission Lines Used in CommsDocument9 pagesDiff Types of Transmission Lines Used in CommsLe AndroNo ratings yet

- Natural Law Theory ApproachDocument35 pagesNatural Law Theory ApproachseventhwitchNo ratings yet

- Orrick PostedbyrequestDocument4 pagesOrrick PostedbyrequestmungagungadinNo ratings yet

- LutensolxpDocument11 pagesLutensolxppkh29No ratings yet

- JMJ Marist Brothers Notre Dame of Marbel University Integrated Basic Education Department City of Koronadal, South CotabatoDocument13 pagesJMJ Marist Brothers Notre Dame of Marbel University Integrated Basic Education Department City of Koronadal, South CotabatoNestor Gerotape DiosanaNo ratings yet

- Hyundai Elevator Manual Helmon 2000 InstructionDocument27 pagesHyundai Elevator Manual Helmon 2000 InstructionReynold Suarez100% (1)

- HistorydylaneditDocument6 pagesHistorydylaneditapi-19858424No ratings yet

- Deam Edan M8 Monitor - User ManualDocument248 pagesDeam Edan M8 Monitor - User Manualvelasquez diazNo ratings yet

- Pd3c CV Swa (22kv)Document2 pagesPd3c CV Swa (22kv)เต่า วีไอNo ratings yet

- Steel PropertiesDocument26 pagesSteel PropertiesLutfy AzanNo ratings yet

- Mycotoxin Test ProcedureDocument3 pagesMycotoxin Test ProcedureKishenthi KerisnanNo ratings yet

- Answer Section B and C and Paper 3Document21 pagesAnswer Section B and C and Paper 3Adnan ShamsudinNo ratings yet

- Manoeuvrability Final EditedDocument12 pagesManoeuvrability Final EditedSaptarshi BasuNo ratings yet

- Syllabi - EE 5004 - Power ElectronicsDocument2 pagesSyllabi - EE 5004 - Power ElectronicsKalum ChandraNo ratings yet

- Fodor Hungary Between East and WestDocument22 pagesFodor Hungary Between East and WestFatih YucelNo ratings yet

- NQ-NQM Panelboards and Qonq Load Centers Information Manual 80043-712-06 Rev.02 06-2015 2 PiezasDocument144 pagesNQ-NQM Panelboards and Qonq Load Centers Information Manual 80043-712-06 Rev.02 06-2015 2 PiezasNadia EspinozaNo ratings yet

- Features General Description: 3A 24V 340Khz Synchronous Buck ConverterDocument18 pagesFeatures General Description: 3A 24V 340Khz Synchronous Buck ConverterAntonioNobregaNo ratings yet

- MATERIAL SAFETY DATA SHEET FOR PREVENTOL-D6 PRESERVATIVEDocument3 pagesMATERIAL SAFETY DATA SHEET FOR PREVENTOL-D6 PRESERVATIVEAkshay PushpanNo ratings yet

- The Karnataka Maternity Benefit (Amendment) Rules 2019Document30 pagesThe Karnataka Maternity Benefit (Amendment) Rules 2019Manisha SNo ratings yet

- Paradise Pools Flyer With Price ListDocument5 pagesParadise Pools Flyer With Price ListKhuzaima HussainNo ratings yet