Professional Documents

Culture Documents

Material Fact

Uploaded by

Klabin_RIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Material Fact

Uploaded by

Klabin_RICopyright:

Available Formats

KLABIN S.A. CNPJ/MF: No. 89.637.

490/0001-45 NIRE: 35300188349 Publicly-held Company

NOTICE OF MATERIAL FACT

Klabin S.A. (Company), in compliance with the provisions of Article 157, Paragraph Four, of Law No. 6,404, dated as of December 15th, 1976, and of CVM Rule No. 358, dated as of January 3rd, 2002, in addition to the information of the Notice of Material Fact dated as of June 11th, 2013, hereby informs its shareholders and the market that at meeting of the Companys Board of Directors held on this date it was resolved to continue the capitalization process to support the construction of a new short and long fiber pulp plant in the city of Ortigueira, in the State of Paran (Project Puma). Accordingly, the Board of Directors decided to call an Extraordinary Shareholders Meeting and Preferred Shareholders Special Meeting (Shareholders Meetings) in order to resolve on the proposal of the controlling shareholders to create a Units program and to list the Company in BM&FBovespas special listing segment Nvel 2 (Proposal), as described in the Notice of Material Fact dated as of June 11th, 2013. The Shareholders Meetings will be convened within fifteen (15) days from this date, and the effectiveness of the resolution that comes to approve the Proposal at the Shareholders Meetings will be subject to the successful fundraising by the Company through the issuance of shares or securities convertible into shares, or both, (Capitalization), in order to enable the Company to develop the Project Puma directly. Furthermore, the Company informs that, after an update on the scope, review of suppliers proposals and variation in the exchange rate, the industrial value of the investment was revised to a total of R$ 5.8 billion. In addition, the amount of R$ 0.8 billion will be spent in recoverable taxes for equipment and another R$ 0.6 billion will be spent in infrastructure, also recoverable by ICMS credits, as per an agreement entered into with the government of the State of Paran. Project Pumas funding includes, besides the Capitalization, financing from BNDES Banco Nacional de Desenvolvimento Econmico and BID - Banco Interamericano de Desenvolvimento, as well as from Export Credit Agencies. Recently, the Project Puma

was classified for funding in an amount estimated up to R$ 4 billion from BNDES in Finem Direto mode, and for US$ 300 million from BID, whose final approvals are also tied to the success of the Capitalization. Once the funds from the loans of BNDES and BID are engaged, they shall amount to the funds obtained from the Capitalization to be allocated in the implementation of the Project Puma. In due course, when of the calling of the Shareholders Meetings, the minutes of the Board of Directors meeting held on this date, the Call Notice of the Shareholders Meetings and the relevant documentation will be available on the Company website with details about the terms briefly described in this Notice of Material Fact. The Company will keep its shareholders and the market updated on new material information with respect to the Proposal and the Capitalization.

So Paulo, October 21st, 2013. Antonio Sergio Alfano Investor Relations Officer

You might also like

- Rating Klabin - Fitch RatingsDocument1 pageRating Klabin - Fitch RatingsKlabin_RINo ratings yet

- Press Klabin Downgrade Mai17Document5 pagesPress Klabin Downgrade Mai17Klabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Management Change (MATERIAL FACT)Document1 pageManagement Change (MATERIAL FACT)Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Itr 1Q17Document70 pagesItr 1Q17Klabin_RINo ratings yet

- Free Translation Klabin 31 03 2017 Arquivado Na CVMDocument70 pagesFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Recommedation To New Chief Executive OfficerDocument1 pageRecommedation To New Chief Executive OfficerKlabin_RINo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- DFP 2016Document87 pagesDFP 2016Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Notice To The Market - New Structure of The Executive BoardDocument2 pagesNotice To The Market - New Structure of The Executive BoardKlabin_RINo ratings yet

- Institutional Presentation 2016Document28 pagesInstitutional Presentation 2016Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Release 4Q16Document18 pagesRelease 4Q16Klabin_RINo ratings yet

- Presentation APIMEC 2016Document44 pagesPresentation APIMEC 2016Klabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Notice To Debenture HoldersDocument1 pageNotice To Debenture HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Release 3Q16Document19 pagesRelease 3Q16Klabin_RINo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Taxation: General PrinciplesDocument34 pagesTaxation: General PrinciplesKeziah A GicainNo ratings yet

- The Hidden History of The Second AmendmentDocument96 pagesThe Hidden History of The Second AmendmentAsanij100% (1)

- Labrel Module 3 DigestsDocument4 pagesLabrel Module 3 DigestsAdriannaNo ratings yet

- Nielson v. LepantoDocument2 pagesNielson v. LepantoHazel P.No ratings yet

- Corporate Governance Evolution and TheoriesDocument35 pagesCorporate Governance Evolution and TheoriesPRAKHAR GUPTA100% (1)

- An Assignment On The Bangladesh Studies: Submitted ToDocument16 pagesAn Assignment On The Bangladesh Studies: Submitted ToTarun Kr Das100% (1)

- Disability Discrimination Act 1992: Compilation No. 30Document84 pagesDisability Discrimination Act 1992: Compilation No. 30api-294360574No ratings yet

- GST ChallanDocument1 pageGST ChallanAshish VishnoiNo ratings yet

- Rules of EngagementDocument3 pagesRules of EngagementAlexandru Stroe100% (1)

- The Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To SuitsDocument13 pagesThe Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To Suitsnirav doshiNo ratings yet

- CARP Law Summary Philippines Land ReformDocument26 pagesCARP Law Summary Philippines Land ReformKatrina Issa A. GelagaNo ratings yet

- Omnibus Rules On Leave: Rule Xvi of The Omnibus Rules Implementing Book V of Eo 292Document2 pagesOmnibus Rules On Leave: Rule Xvi of The Omnibus Rules Implementing Book V of Eo 292Miguel GonzalesNo ratings yet

- Taxation and Government Intervention On The BusinessDocument33 pagesTaxation and Government Intervention On The Businessjosh mukwendaNo ratings yet

- AP Govt CH 8 Test Political Participationtest 8Document6 pagesAP Govt CH 8 Test Political Participationtest 8spatadia14No ratings yet

- Updated Bandolera Constitution Appendix A-General InfoDocument3 pagesUpdated Bandolera Constitution Appendix A-General Infoapi-327108361No ratings yet

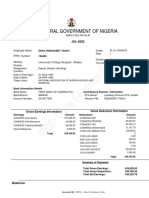

- Federal Pay Slip for Margaret Taiwo GiwaDocument1 pageFederal Pay Slip for Margaret Taiwo GiwaHalleluyah HalleluyahNo ratings yet

- Certificate of Candidacy SGODocument2 pagesCertificate of Candidacy SGObernardNo ratings yet

- Vakalatnama Supreme CourtDocument2 pagesVakalatnama Supreme CourtSiddharth Chitturi80% (5)

- Municipal Council of Iloilo v. EvangelistaDocument2 pagesMunicipal Council of Iloilo v. EvangelistaWinterBunBunNo ratings yet

- Twitter's Objection To Public AccommodationDocument10 pagesTwitter's Objection To Public AccommodationSensa VerognaNo ratings yet

- Family Law1Document406 pagesFamily Law1Cheezy ChinNo ratings yet

- CCXCXCXDocument9 pagesCCXCXCXJeffrey Constantino PatacsilNo ratings yet

- Act 658 Electronic Commerce Act 2006 MalaysiaDocument17 pagesAct 658 Electronic Commerce Act 2006 MalaysiaJunXuanLohNo ratings yet

- Decided-Date-1: 3 June 2010Document10 pagesDecided-Date-1: 3 June 2010Mohd Ubaidi Abdullah ZabirNo ratings yet

- IEI Is Statutory-Court JudgmentDocument8 pagesIEI Is Statutory-Court JudgmentErRajivAmieNo ratings yet

- Family Code of The PhilippinesDocument31 pagesFamily Code of The Philippinesautumn moon100% (1)

- Stat Con Nia v. GamitDocument1 pageStat Con Nia v. GamitRen Piñon100% (1)

- 35 Ton Spreader BeamDocument1 page35 Ton Spreader BeamMARMARCHONo ratings yet

- Hamer v. SidwayDocument3 pagesHamer v. SidwayAnonymous eJBhs9CgNo ratings yet

- Discuss The Different Modes of Filing Patent in Foreign CountriesDocument7 pagesDiscuss The Different Modes of Filing Patent in Foreign Countrieshariom bajpaiNo ratings yet