Professional Documents

Culture Documents

Bid Markup Methodologies Explained

Uploaded by

BTconcordOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bid Markup Methodologies Explained

Uploaded by

BTconcordCopyright:

Available Formats

T ECHNICAL A RTICLE

Bid Markup Methodologies

Dr. Kwaku A. Tenah and Dr. Carleton Coulter III, PE

ABSTRACT:

In todays environment of increased competition and decreased profit margins, markups for projects are more critical than ever, especially for competitively bid projects. This article defines markup and then explains and illustrates the basic markup approaches for different types of construction bids. The authors pinpoint why systematic markup is not used by small-to-medium sized contractors in the construction industry. Examples are cited from experience. Key Words: bids, markup, overhead, contractors, subcontractors, cost pools, profit, return on indirect costs (ROIC), indirect cost recovery factors (ICRF), profit recovery factors (PRF) n the construction industry, markup is defined as the amount added to the estimated direct costs to recover the firms indirect costs and profit for a project [2, 4, 5, 9, 10, 11]. Markup consists of both job and project overheads (or indirects), as well as project contingencies and profit. In todays environment of increased competition and decreased profit margins, markups for projects are more critical than ever, especially for competitively bid projects. During economic downturns, when more contractors are vying for a limited number of projects, contractors submit more bids to remain solvent. Some firms reported increasing the number of bid submissions ten-fold over the gravy years of the 1980s and early 1990s. If precise takeoffs and pricing reduce risk and provide a more accurate prediction of probable construction costs, then markup is the key to successful competitive bidding. Accurate quantity takeoffs and pricing do not guarantee that a contractor will have a successful or winning competitive bid, which is a bid that covers all of the costs, ensures the maximum profit, and has a high probability of being low. With all bidders obtaining quotes from the same pool of labor, subcontractors, and material suppliers, there is a high probability that every bidders direct costs are approximately

equal. Therefore, differences in bid amounts are caused by productivity on direct cost items, which are sometimes called construction means and methods, or strategy, indirect costs, and profit. Just as in the old saying, no two people can agree on color and taste, no two contractors can agree on how to mark up a bid. Markup based on cost engineering principles is common in the manufacturing and process industries, but these principles are not prevalent in construction. This article defines markup and then explains and illustrates the basic markup approaches for different types of construction bids. We pinpoint why systematic markup is not used by small-to-medium sized contractors in the construction industry. Examples are cited from experience.

bid. If there is a profit at the end of the year, regardless of the amount, the contractor may feel satisfied in having simply survived. The less profit added to a bid, the greater the chance is of being the successful bidder. Conversely, as more profit is added to a bid, the chance of being the successful bidder decreases. To be a successful bidder, the profit for one particular project may be too high for other projects, and that contractor would not win future work with the same markup. Bidding a job with an exorbitantly high markup does not mean that you will get the work in the future [5]. A contractor can go broke by not obtaining enough profitable work or by doing too much cheap work at the same time. Bidding a job below cost is also no guarantee of being the successful bidder. In our 15 years of experience in advising small-to-medium sized contractors with annual gross revenues of $5 to $50 million, no contractor systematically marked up the bid to ensure that the projects recovered their fair share of indirect costs and profits. Based upon our industrial and academic experience, the reasons why small-to-medium sized contractors in the construction industry dont use systematic markup are twofold: many managers do not know about state-of-the-art markup methodologies; and most estimating courses in US colleges and universities do not focus on the critical real-world bidding questionwhat is the correct markup?

JOB OVERHEAD Job overhead is a direct cost that can be directly estimated and traceable to the projects direct expenses. Job overhead is sometimes confused with indirect costs. Examples of job overhead are general condition expenses such as the trailer, onsite supervision, and insurance. While not strictly markup, markup for job overhead includes some cost engineering principles that help create a competitive bid. Accurate estimating of job overhead is difficult, especially on larger projects because of their vagueness and the variations

39

MARKUP CONUNDRUM Many contractors add a fixed (as large as possible) percentage to direct costs, hoping that this prophecy is sufficient to cover estimating errors, omissions, and contingencies, but low enough that they will be awarded the bid. The contractor trusts that this amount is sufficient to cover the indirect costs during the construction period until the next successful

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

between jobs. There are several estimating approaches that help to estimate job overhead and markup. In one known instance, a contractor reduced an annual $2.5 million job overhead cost by 10 percent, resulting in an increase of net profit (before taxes) of $250,000 by using the following cost engineering approaches.

Cost Analysis The easiest and most effective method is a checklist of all possible job overhead items and their unit costs, based on past experience. Standard references that list typical job overhead items are a source of new items [9, 11]. With an itemized checklist, an estimator can more accurately identify job overhead for each new bid.

add 10 percent for indirect costs). Todays knowledgeable building owner requires the contractor to use indirect cost markup using indirect cost recovery factors. These will be explained below. Change orders, which make up an increasing amount of todays construction costs, also require markup. The method of change markup is part of contract negotiations and can be the same as the bids markup or some other mutually-agreedupon method. The following three-stepapproach explains how to develop indirect cost recovery factors that are useful for small-to-medium sized contractors with annual gross revenues of $5 to $50 million. This category includes 95 percent of the contractors in the US.

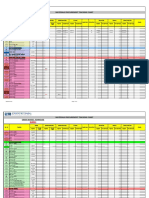

for chart of accounts and cost pools [1, 2, 7]. The major cost pools are equipment, the overhead pools of shop and yard, labor burden, vehicles, and marketing and estimating, as well as the general and administrative cost pools. A typical small-tomedium sized contractors chart of accounts arranged by cost pools is shown in figure 1.

Cost Control With the contractor described earlier, an analysis of past job overhead costs revealed opportunities for cost reduction, such as better controls for reducing recurring small tool expenses from loss and theft. Insurance costs, a big expense item, were reduced by shopping for better terms and premiums. Improved cost control led to better use of job trailers.

Principles Allocation methods are inherently inaccurate, but some principles apply [6]. All direct costs that can be identified should be estimated as direct costs. Indirect cost allocation methods should be rational, systematic, and consistently applied. The markup rates should be reviewed frequently and revised to ensure the full recovery of costs and a profit.

Cost Experience Curves Once job overhead costs were under control, the company developed cost experience curves for various jobs. AACEs Cost Engineers Notebook shows an example of estimating engineering indirect job costs by means of cost experience curves [1]. These curves indicate the indirect costs as a percent of project costs [1]. From past job cost reports, an estimator can quickly develop the markup percentage for classes of overhead items, such as support costs. For example, jobs in the $1 to $3 million range have 0.3 percent for housing, telecommunications, and transportation.

A contractor should have a written policy of indirect cost allocation. A spreadsheet can be developed that tracks each jobs contribution to indirect costs and indicates the necessary markup increases needed when work is not available.

Indirect Cost and Profit A contractor must forecast the expected annual indirect costs and profit. Each bids markup should recover its proportional share of indirect costs and provide for some level of profit. We have found that the best planning horizon is 3 years, so the indirect costs are sufficient for the companys future operations. The 3-year forecast should be updated quarterly. To be competitive, a companys indirect costs and profit should be close to industry norms, which are reported in several annual sources [3]. Of importance are the percentages reported over 20 years by Costonis on the percent of return on indirect costs investment (ROIC) [2]. The ROIC is calculated by dividing the annual net profit before taxes by the annual indirect costs. For example, a contractor with a $100,000 pretax profit and $300,000 of indirect costs has an ROIC of 33 percent. Costonis reported ROIC norms for various kinds of contractors, especially contractors that have experienced profit and remained in business for many years. These ROIC percentages are listed below: general contractor80 percent; heavy construction74 percent; mechanical contractor43 percent; electrical contractor34 percent; interior specialty49 percent; and exterior specialty47 percent.

INDIRECT COSTS ALLOCATION Indirect costs are costs that cannot be directly attributed to the project, such as home office expenses. Contrary to conventional practice, markup is not (or should not be) a fixed percentage (e.g.,

40

Chart of Accounts Correct markup is based on the companys chart of accounts for indirect costs. An account is a specific category for listing expenses, such as payroll taxes. To make markup easier, each account should be regrouped under an applicable cost pool. For example, the cost pool for equipment has separate accounts for fuels, oils and lubricants, insurance, maintenance, repair, and modifications. If no two contractors can agree on how to mark up an estimate, obviously no two contractors have the same chart of accounts or indirect costs items; however, most do have the same cost pools. There are several available accounting standards that can be used by contractors to guide them on accounting

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

MARKUP FACTORS Indirect cost recovery factors (ICRF) and profit recovery factors (PRF) are developed from the annual budget. These markup factors range from simple and straightforward markup based on labor hours to complex methodologies involving marking up the estimated direct costs for labor, materials, equipment, and subcontracts.

EQUIPMENT POOL - Operations - Insurance - Maintenance - Repair - Modifications OVERHEAD POOLS Shop and Yard - Operations - Insurance - Equipment Vehicles - Auto and truck - Insurance - Fuels and lubricants - Maintenance - Repair - Modifications Labor Benefits - Insurance - Pension - Sick leave - Workers compensation Marketing and Estimating - Aircraft - Boat - Condominium - Contributions - Memberships - Entertainment - Gifts - Presentations - Computer

GENERAL and ADMINISTRATIVE Variable/Semivariable - Education and training - Legal - Mailing - Meals and lodging - Travel - Salaries: supervision - Supplies - Insurance Fixed - Accounting - Computer - Rents - Repairs - Telephone - Depreciation - Taxes - Reproduction - Temporary hires - Supervision - Office maintenance - Officers salaries - Mandated benefits - Social security - Workers compensation - Optional benefits - Dental - Health - Life insurance - Retirement - Vacation - Sick leave - Bonus

Equipmentequipment is prorated, based on the bids equipment hours. Shop and yardthis is usually concerned with materials storage and fabrication. It is allocated based on the bids material costs. If the shop and yard cost is related to equipment, its recovery is based on the bids equipment hours. Labor benefitsadditional labor benefits, such as vacation, sick leave, and group insurance, are allocated based on the bids labor hours. Vehiclesnonheavy equipment is allocated based on the bids direct costs, or labor hours for a labor-intensive contractor. Marketing and estimatingthese business development costs are allocated on the bids total direct costs. General and administrativethese necessary operational costs, which are usually divided into fixed and variable costs, are allocated based on the bids direct costs.

The indirect markup by cost pool is shown in figure 2.

PROFIT MARKUP After bid opening, contractors occasionally ask close competitors what percent they added for profit. Surprisingly, competitors are refreshingly candid in revealing the amount added for profit. This natural curiosity is related to the many kinds of profit. Contractors are intuitively trying to ascertain why competitor A, who lost the job, marked up 2 percent, while competitor B, who marked up 4 percent, was awarded the bid. Different kinds profit are related to several considerations, including the following. The firm must recoup sufficient profit for return on equity. The profit must be commensurate with industry averages. The profit must consider competitive bidding strategies. The profit must be as high as possible or what the competitive market will bear, while commensurate with the risk.

Figure 1Typical Chart of Accounts Allocated by Cost Pools Percent of Labor Hours Labor-intensive contractors are usually subcontractors. A bid with a markup based on the estimates labor hours is more competitive than simply adding 30 percent, regardless of the direct costs, because each bid has different labor hours. By adding a 30 percent markup, a contractor probably does not fully cover the indirect costs for large estimates and/or overprices bids for small projects. The labor markup, annual budget, and typical bid markup for a labor-intensive contractor are shown in table 1. This contractor has two types of labor, with the indirect costs markup for type I at $8/hour and type II at $4/hour. Profit is also marked up as a percent of labor hours. In the sample bid, there are 50,000 hours ($1,000,000/$20/hour) of type II labor marked up at $200,000 (50,000 hours x $4/hour). Profit is marked up as a percent of labor hours ($1,000,000/$10,000,000), or 10 percent.

Percent of Subcontract Costs General contractors and construction management firms usually produce subcontract-intensive bids. Markup is based on a percent of the estimates subcontract costs. The annual budget, markup recovery factors, and a typical bid markup are shown in table 2.

Allocation by Cost Pools Contractors with an annual gross revenue over $5 million should allocate the indirect costs in this bid by cost pool. The firm develops an indirect costs recovery factor for each cost pool every quarter.

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

41

Table 1Annual Budget and Bid Markup for a Labor-Intensive Contractor Labor Type I Type II Rate $40/hour $20/hour Hours 200,000 100,000 Budget $8,000,000 $2,000,000 Markup 0.8 x $2M/200,000 hours = $8/hour 0.2 x $2/100,000 hours = $4/hour Bid Markup $10,000,000 $4,000,000 $1,000,000 $5,000,000 $20,000,000 $2,000,000 $1,000,000 $23,000,000 1M/2M = 50% 1M/10M = 10% Labor Materials Equipment Subcontracts Direct costs Indirect costs Profit Bid price 50,000 hours x $4/hour = $200,000 0.10 x $1M = $100,000 $1,000,000 $200,000 $100,000 $800,000 $2,100,000 $200,000 $100,000 $2,400,000

Annual Budget Labor Materials Equipment Subcontracts Direct costs Indirect costs Net profit Revenue ROIC ICRF PRF

Table 2Annual Budget and Bid Markup for a Subcontract-Intensive Contractor Annual Budget Labor Materials Equipment Subcontracts Direct costs Indirect costs Net profit Revenue ROIC ICRF PRF $8,000,000 $8,000,000 $4,000,000 $10,000,000 $30,000,000 $3,000,000 $2,400,000 $35,400,000 2.4M/30M = 80% 3M/10M = 33.3% 2.4M/10M = 24% Labor Materials Equipment Subcontracts Direct costs Indirect costs Profit Bid price 0.333 x $1M = $333,000 0.240 x $1M = $240,000 Bid Markup $200,000 $200,000 $100,000 $1,000,000 $1,500,000 $333,000 $240,000 $2,073,000

The four general kinds of profit are return on equity, planned, optimum, and competitive bid. These are briefly described below.

exceed this profit percentage to remain in business.

Return on Equity Return on investment is the profit necessary to meet a percent return in equity commensurate with the contractors risk. A return of 20 to 40 percent is normal for construction risk.

Planned Profit Margin Planned profit is the profit that must be achieved over a certain period to meet the firms business goals. Again, financial surveys reveal what your competitors are achieving. An organization must meet or

42

Optimum Profit The optimum markup for profit is the one that yields the greatest total real profit the greatest expected profit. The expected profit is the total possible profit multiplied by the likelihood of being the low bidder. Lowering the profit provides a greater chance of being the successful bidder. However, if the profits are too low, a contractor can go broke because it does not perform enough highly profitable work and/or it does too much cheap work. Too low of a markup will not carry a contractor through dry bidding spells. In the US, optimum profit ranges average 8.0 percent.

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

Competitive Profit Competitive profit is the amount chosen that represents the intangibles of past bidding history and your competitors need for work. For example, in lean times, contractors might average a 0.5 to 1.5 percent profit to remain competitive in the bidding game.

Contingency Compounding bidding complexity is the need to add contingency. Contingency is the amount added to the final bid price to cover unforeseen or incalculable direct costs. This risk compensation is not marked up but is added to the final direct and indirect costs and profit. Depending on the type of contract and type of esti-

Annual Plan and Budget: Labor $300,000 (10,000 hours) Materials $300,000 Equipment $400,000 (10,000 hours) Subcontracts $3,000,000 ----------------------------------------------------------------------------------------Direct cost ..............$4,000,000 Indirect costs: Equipment $50,000 Shop and yard $50,000 Vehicles $50,000 Labor benefits $50,000 General and admin. $100,000 Profit ............................$50,000 ----------------------------------------------------------------------------------------Revenue ..................$4,350,000 Markup Factor: Indirect Cost Pool Amount/Direct Cost = Markup Factor --------------------------------------------------------------------------------------------------------------------------------------------Equipment 50,000/10,000 hours. = $5/equipment hour Shop and yard 50,000/300,000 = $0.167/material$ Vehicles 50,000/10,000 hours = $5/labor hour Labor benefits 50,000/10,000 hours = $5/labor hour General and admin. 100,000/4,000,000 = $0.025/direct cost$ Bid Markup: Labor (1,000 hours) $30,000 Materials $30,000 Equipment (1,000 hours) $40,000 Subcontracts $300,000 ------------------------------------------------------------------------------------------------------------------------------------------Direct costs ........................................................................................$400,000

phisticated bidding system that is based on accounting principles and cost engineering approaches.

REFERENCES 1. AACE International. Cost Engineers Notebook. Morgantown, WV: AACE International, 1995. 2. Costonis, A.F. Overhead Relationships and Their Impact Are Important When Planning for Profit. Qualified Remodeler. Chicago, IL: 1990. 3. Dunn & Bradstreet. Cost of Doing Business. New York: Dunn & Bradstreet, 1992. 4. Fondahl, John. Construction Markup. Technical Report. Construction Management Institute, Stanford University, 1972. 5. Gates, M. Construction Cost Estimating and Bidding. Hartford, CT: Gates and Scarpa Associates, Inc., 1979. 6. Hickok, R.S, ed. Construction Accounting Manual. Boston, MA: Warren, Gorham & Lamont, 1985. 7. Lucas, P.D. Modern Construction Accounting Methods and Controls. Englewood Cliffs, NJ: Prentice-Hall, 1984. 8. Means Forms for Building Professionals. Kingston, MA: R.S. Means Co., 1986. 9. Neil, J.M. Construction Cost Estimating for Project Control. Englewood Cliffs, NJ: Prentice-Hall, 1982. 10. Park, W.E. Construction Bidding for Profit. New York: John Wiley & Sons, 1979. 11. Walkers Building Estimators Reference Book. 25th ed. Chicago, IL: Frank R. Walker Co., 1995.

Indirect Factor X Estimate ------------------------------------------------------------------------------------------------------------------------------------------Equipment $5/equip. hour x 1,000 hours 5,000 Shop and yard $0.167/material$ x $30,000 5,100 Vehicles $5/labor hour x 1,000 hours. 5,000 Labor benefit $5/labor hour x 1,000 hours 5,000 General and admin. $0.025/direct cost$ x $400,000 10,000 ------------------------------------------------------------------------------------------------------------------------------------------$30,100 ------------------------------------------------------------------------------------------------------------------------------------------Bid price ............................................................................................$430,100

Figure 2Indirect Markup by Cost Pool mate, the contingency can range from 0 to 20 percent. Successful contractors consider all four kinds of profit, as shown in figure 3. A comparison of the profits for a bid is shown in figure 4. cost engineer can make a significant contribution to profitability by understanding how to properly mark up bids. Calculating the correct markup is the key to a successful bid that includes all costs and sufficient profit to cover risk, while staying low enough to be the winning bid. We recommend that contractors operating in the 21st century use a more so-

Dr. Kwaku A. Tenah is an associate professor at the University of Floridas M.E. Rinker Sr. School of Building Construction in Gainesville, FL. He specializes in and consults on construction management.

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

43

Given: Planned Revenue = $5 million, Estimated Direct Costs = $4 million, Budgeted Indirect Costs = $800,000, Equity = $200,000 A. Return on Investment (@40%) Profit = percent ROI x equity = 0.4 x $200,000 = $80,000 Markup = profit/(direct + indirect) = $80,000/$4,800,000 = 0.0167 B. Planned Profit Margin (15%) Revenue = direct + indirect + profit = $4,880,000 Profit = profit margin x revenue = 0.15 x $4,880,000 = $720,000 Markup factor = $720,000/$4,800,000 = 0.15 C. Optimum Markup (@8%) Profit = optimum markup x (direct + indirect) = 0.08 x $4,880,000 = $384,000 D. Competitive Markup (@5%) Profit = competitive markup x (direct + indirect) = 0.05 x $4,880,000 = $240,000 (Note: contingency might be added to this amount.) Figure 3Sample Profit Markup Factors Given: Direct Costs = $1,000,000, Indirect Costs = $200,000, Direct + Indirect = $1,200,000 Markup Approach ROI Plan Optimum Competitive Expected Profit $80,000 $720,000 $384,000 $240,000 Markup Factor 0.0167 0.15 0.08 0.05 Bid Profit $20,040 $180,000 $96,000 $60,000

AACE Internationals Professional Practice Guide to Planning and Scheduling

Featuring articles covering a wide range of subjects, authored by industry experts and practitioners.

$38.50 members $53.50 nonmembers plus shipping & handling

Figure 4An Analysis of a Bid Profit Markup Dr. Carleton Coulter III, PE, is a former professor at the University of Floridas M.E. Rinker Sr. School of Building Construction in Gainesville, FL. He is currently a partner in JAC Ltd. Construction Consultants, of Palm Beach Gardens. He specializes in project controls.x

AACE MEMBER DISCOUNTS

Dont forget that one of the great benefits of AACE International membership is the money you can save on professional publicationsmembers receive substantial discounts on books from all of the leading publishers!

1999 Transactions

Contains more than 70 presentations featured at the 1999 Annual Meeting in Denver, Colorado.

Call 800-858-COST or 304-296-8444

44

Hard Copy or CD-ROM Version $84.95 members $89.95 nonmembers plus shipping & handling

Cost Engineering Vol. 41/No. 11 NOVEMBER 1999

You might also like

- Conceptual Estimating for Steel FabricatorsDocument5 pagesConceptual Estimating for Steel FabricatorsRyan De Vera PagalNo ratings yet

- Calculate construction overhead and profit margins for business successDocument15 pagesCalculate construction overhead and profit margins for business successJaswin JonsonNo ratings yet

- Hewitt Estimating Infrastructure Cost DataDocument22 pagesHewitt Estimating Infrastructure Cost DataSudhaakar MN100% (1)

- Cost EstimatingDocument27 pagesCost EstimatingAndrew Ugoh100% (1)

- Procurement Tracking ChartDocument5 pagesProcurement Tracking ChartjayNo ratings yet

- Estimating Concrete Work II - Estimating Foundation Walls - tcm45-340150Document5 pagesEstimating Concrete Work II - Estimating Foundation Walls - tcm45-340150Tarun ChopraNo ratings yet

- 2017 Colorado Cost Data January - DecemberDocument533 pages2017 Colorado Cost Data January - Decemberhfenangad50% (2)

- Some Helpful Construction TechniquesDocument10 pagesSome Helpful Construction TechniquesNikulast KidsNo ratings yet

- Construction Cost Estimating: Section NineteenDocument16 pagesConstruction Cost Estimating: Section NineteenStephen Megs Booh MantizaNo ratings yet

- Cost Ch5 PDFDocument24 pagesCost Ch5 PDFJessica WardNo ratings yet

- Quantity Estimating: Indiana Department of Transportation-2013 Design ManualDocument137 pagesQuantity Estimating: Indiana Department of Transportation-2013 Design ManualjaveedNo ratings yet

- Back by Customer Demand!: Did You Know?Document5 pagesBack by Customer Demand!: Did You Know?markigldmm918No ratings yet

- Estimating Labor Unit Data For Concrete ConstructionDocument13 pagesEstimating Labor Unit Data For Concrete ConstructionsoparlNo ratings yet

- Estimating Labor Unit Data For Concrete Concrete Construction Unit Ratesconstruction - tcm45-344396Document13 pagesEstimating Labor Unit Data For Concrete Concrete Construction Unit Ratesconstruction - tcm45-344396tkarasonNo ratings yet

- 2012 National Construction EstimatorDocument765 pages2012 National Construction EstimatorMiguel DeLa Cruz SilveraNo ratings yet

- Constructing The Gold Standard FinalDocument135 pagesConstructing The Gold Standard FinalGMA16No ratings yet

- Building Progress ChecklistDocument1 pageBuilding Progress ChecklistRoskorossNo ratings yet

- Review Estimate Validation ProcessDocument6 pagesReview Estimate Validation ProcessB GirishNo ratings yet

- Estimation BookDocument127 pagesEstimation BookHariom Pandey100% (1)

- Accuracy in Estimating Project Cost Construction ContingencyDocument15 pagesAccuracy in Estimating Project Cost Construction ContingencyBspeedman17564No ratings yet

- WELCOME To Cost & Evaluation Workbook by Peters, Timmerhaus and West. Accompanying Plant Design and Economics For Chemical Engineers, 5th EditionDocument15 pagesWELCOME To Cost & Evaluation Workbook by Peters, Timmerhaus and West. Accompanying Plant Design and Economics For Chemical Engineers, 5th Editionxhche7No ratings yet

- Estimating Direct Costs of Welding EquationsDocument2 pagesEstimating Direct Costs of Welding EquationsGerson Suarez CastellonNo ratings yet

- PWD Schedule-Schedule of Rates of PWD (W.B) 2015 For Road Bridge Work (Vol-III) Wef 30.08.2018 PDFDocument367 pagesPWD Schedule-Schedule of Rates of PWD (W.B) 2015 For Road Bridge Work (Vol-III) Wef 30.08.2018 PDFAlipurNo ratings yet

- E0001 OverallDocument30 pagesE0001 OverallkamlNo ratings yet

- Unit 5 - CPM - Cost EstimationDocument42 pagesUnit 5 - CPM - Cost EstimationRT100% (1)

- Cost Engineer Reference BookDocument13 pagesCost Engineer Reference Bookmosinqs100% (1)

- Sheetrock Bid Sheet for Home Renovation ProjectDocument26 pagesSheetrock Bid Sheet for Home Renovation ProjectAngelee BivinsNo ratings yet

- Cost EstimationDocument76 pagesCost EstimationsoxalNo ratings yet

- Bentley Construct Sim OverviewDocument55 pagesBentley Construct Sim OverviewlimresNo ratings yet

- RiskBasedConstructionCostEstimating 2 PDFDocument286 pagesRiskBasedConstructionCostEstimating 2 PDFthiruNo ratings yet

- Construction EstimatorDocument2 pagesConstruction Estimatorapi-76938856No ratings yet

- Cost Escalation and Delays in Construction Industry Using SPSSDocument11 pagesCost Escalation and Delays in Construction Industry Using SPSSInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- General Construction Estimate ReferenceDocument4 pagesGeneral Construction Estimate Reference?????No ratings yet

- Cost EstimatingDocument36 pagesCost EstimatingVisal ChengNo ratings yet

- Paper Contracting Book PreviewDocument28 pagesPaper Contracting Book PreviewClaudia Marcela Muñoz GonzalezNo ratings yet

- Pricing The Job-Mark-Up, Overhead & ProfitDocument6 pagesPricing The Job-Mark-Up, Overhead & Profitbeq97009No ratings yet

- Construction Claim Form TemplateDocument3 pagesConstruction Claim Form TemplateKevin KevinNo ratings yet

- Global SCANDocument187 pagesGlobal SCANLuis GonzalezNo ratings yet

- Cost Estimating SimplifiedDocument14 pagesCost Estimating SimplifiedsuperjerixNo ratings yet

- AIA-Design and Construction Delivery Methods For Public Projects PDFDocument1 pageAIA-Design and Construction Delivery Methods For Public Projects PDFGeorge AlexiadisNo ratings yet

- Progress Review Meeting-FormatDocument14 pagesProgress Review Meeting-FormatImalka KariyawasamNo ratings yet

- Overhead Cost Assessment Key for Gaza Construction ProjectsDocument7 pagesOverhead Cost Assessment Key for Gaza Construction ProjectsChristian Nicolaus MbiseNo ratings yet

- Cost Estimation Risk TechniquesDocument4 pagesCost Estimation Risk TechniquesV Suriya Raja G SNo ratings yet

- Labor Requirements For Construction M Aterials: Par T Il-Concrete Masonry UnitsDocument22 pagesLabor Requirements For Construction M Aterials: Par T Il-Concrete Masonry UnitsMohammed AffrozeNo ratings yet

- Estimating Steel Building Installation PDFDocument2 pagesEstimating Steel Building Installation PDFJurie_sk3608No ratings yet

- Rate of Shedule M - P - 2009Document393 pagesRate of Shedule M - P - 2009Er Tarun PalNo ratings yet

- Guidelines For Engineering CostDocument14 pagesGuidelines For Engineering CostMohamed Hareesh67% (3)

- Building Estimation2Document14 pagesBuilding Estimation2Ashley Farai MutangiriNo ratings yet

- Contractor Estimate WorksheetDocument3 pagesContractor Estimate WorksheetQi ZengNo ratings yet

- Construction and General Services Cost-Estimate by Alviar 2014Document16 pagesConstruction and General Services Cost-Estimate by Alviar 2014studio b2ze2No ratings yet

- Cost Estimation: 5.1 Costs Associated With Constructed FacilitiesDocument48 pagesCost Estimation: 5.1 Costs Associated With Constructed FacilitiesKabil Kumar100% (1)

- ESTIMATEDocument43 pagesESTIMATEJun Michael Artates VelascoNo ratings yet

- Construction Project Management A Complete Guide - 2021 EditionFrom EverandConstruction Project Management A Complete Guide - 2021 EditionNo ratings yet

- Book 1Document2 pagesBook 1BTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- A TestDocument7 pagesA TestBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Aspen Aerogels Pyrogel XT PDFDocument4 pagesAspen Aerogels Pyrogel XT PDFBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Eng TSTDocument3 pagesEng TSTBTconcordNo ratings yet

- Insurance ClaimsDocument4 pagesInsurance Claimsapi-121458059100% (1)

- Health Claim Form: Part A (To Be Filled by Insured)Document3 pagesHealth Claim Form: Part A (To Be Filled by Insured)Harshad DhodiNo ratings yet

- Philamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Document2 pagesPhilamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Ann Catalan100% (1)

- Mary Colete JohnDocument31 pagesMary Colete Johnthe PDNo ratings yet

- Welcome Package 42-14 The Indep.Document7 pagesWelcome Package 42-14 The Indep.Chris VisNo ratings yet

- 46-Emilio Tan vs. Court of Appeals, G.R. No. 48049, 29 June 1989Document5 pages46-Emilio Tan vs. Court of Appeals, G.R. No. 48049, 29 June 1989Jopan SJNo ratings yet

- Claim and SettlemenmtDocument14 pagesClaim and SettlemenmtThanga DuraiNo ratings yet

- EVENTS PLANNING BUSINESS MARKETING PLANDocument14 pagesEVENTS PLANNING BUSINESS MARKETING PLANwerewolf2010No ratings yet

- 4 Que vs. Law Union, G.R. No. L-4611Document4 pages4 Que vs. Law Union, G.R. No. L-4611thinkbeforeyoutalkNo ratings yet

- Study Material-Mba LLDocument216 pagesStudy Material-Mba LLsamrulezzzNo ratings yet

- Gratuity Trust RulesDocument6 pagesGratuity Trust RulesVIKASNo ratings yet

- Health Schemes and InsuranceDocument68 pagesHealth Schemes and InsurancePankaj Khatri88% (8)

- Business Finance: Introduction To InvestmentsDocument34 pagesBusiness Finance: Introduction To InvestmentsLala BubNo ratings yet

- Msih Student-To-Student Guide 2018 Section 1Document26 pagesMsih Student-To-Student Guide 2018 Section 1api-426256871No ratings yet

- PolicyDocument2 pagesPolicymalikdominik15No ratings yet

- Johnson v. Melton Truck Lines, Inc., 14-cv-07858 THIRD AMENDED COMPLAINT (PUBLIC NUISANCE) 050916Document207 pagesJohnson v. Melton Truck Lines, Inc., 14-cv-07858 THIRD AMENDED COMPLAINT (PUBLIC NUISANCE) 050916David JohnsonNo ratings yet

- Marketing Mix and Relationship Marketing@ Bec DomsDocument11 pagesMarketing Mix and Relationship Marketing@ Bec DomsBabasab Patil (Karrisatte)No ratings yet

- 25 2018 TT-BTC 382505Document6 pages25 2018 TT-BTC 382505LET LEARN ABCNo ratings yet

- SOBOTA, Katharina. Don't Mencion The Norm!Document16 pagesSOBOTA, Katharina. Don't Mencion The Norm!LeonardoNo ratings yet

- Asian Terminal Vs First Lepanto - BALLESTADocument1 pageAsian Terminal Vs First Lepanto - BALLESTAKim Kenneth PascuaNo ratings yet

- Compensation ManagementDocument78 pagesCompensation ManagementramkommuriNo ratings yet

- Release of Liability TransportationDocument1 pageRelease of Liability Transportationapi-248930594No ratings yet

- EAR Insurance PresentationDocument19 pagesEAR Insurance PresentationDonny WinardiNo ratings yet

- Risk Management - WikipediaDocument1 pageRisk Management - WikipediaLikeKangen LoveWaterNo ratings yet

- Rule Resolution Tech Note 54Document71 pagesRule Resolution Tech Note 54Svr RaviNo ratings yet

- TPA-1-2 and 5-12Document13 pagesTPA-1-2 and 5-12katts4uNo ratings yet

- Winter Intership ReportDocument25 pagesWinter Intership ReportHimanshu BhatiaNo ratings yet

- Module 9 Transport InsuranceDocument234 pagesModule 9 Transport InsuranceAung NaingNo ratings yet

- Gather Care ScenarioDocument4 pagesGather Care ScenarioAhmad Saiful Ridzwan JaharuddinNo ratings yet

- Cyber Insurance - Author Mansi ThaparDocument3 pagesCyber Insurance - Author Mansi Thaparaloksingh1980No ratings yet